In the dynamic world of software infrastructure, Gen Digital Inc. and Informatica Inc. stand out as prominent players shaping the future of technology. Gen Digital focuses on consumer cyber safety solutions, while Informatica leads in AI-powered data management platforms for enterprises. Both companies innovate within overlapping markets, making their comparison particularly insightful. This article will guide you through their strengths to identify which is the more compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Gen Digital and Informatica by providing an overview of these two companies and their main differences.

Gen Digital Overview

Gen Digital Inc. focuses on providing comprehensive cyber safety solutions to consumers across multiple regions including the US, Europe, and Asia Pacific. Its offerings include Norton 360, identity theft protection, secure VPN, and online privacy tools. With a market cap of 16.1B USD and 3,400 employees, the company operates in the software infrastructure industry, emphasizing consumer cybersecurity and privacy protection.

Informatica Overview

Informatica Inc. specializes in an AI-powered data management platform designed for enterprise-scale multi-cloud and hybrid environments. Its suite covers data integration, API management, data quality, master data management, and governance. The company, with a market cap of 7.5B USD and 5,200 employees, targets businesses seeking enhanced data accuracy, compliance, and unified data views in the software infrastructure sector.

Key similarities and differences

Both Gen Digital and Informatica operate in the software infrastructure industry and serve technology-driven markets. However, Gen Digital primarily addresses consumer cybersecurity and privacy, while Informatica focuses on enterprise data management and integration solutions. Their business models differ in customer base focus—consumer protection versus enterprise data orchestration—and in product offerings, with Gen Digital emphasizing security tools and Informatica delivering AI-powered data platforms.

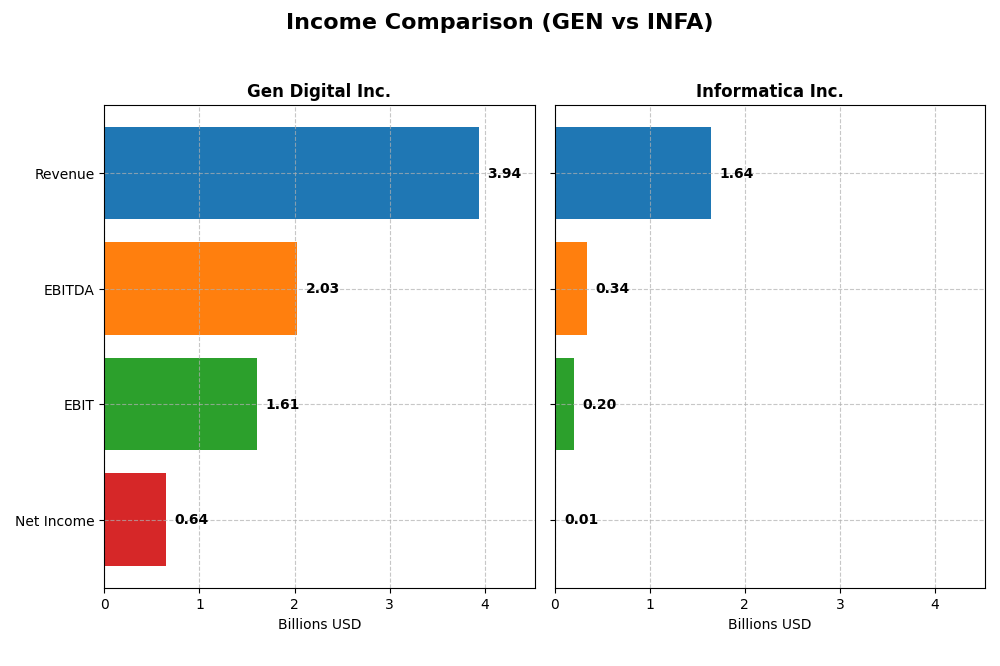

Income Statement Comparison

This table compares key income statement metrics for Gen Digital Inc. and Informatica Inc. for their most recent fiscal years, providing a clear snapshot of their financial performance.

| Metric | Gen Digital Inc. (2025) | Informatica Inc. (2024) |

|---|---|---|

| Market Cap | 16.1B | 7.54B |

| Revenue | 3.94B | 1.64B |

| EBITDA | 2.03B | 339M |

| EBIT | 1.61B | 199M |

| Net Income | 643M | 9.93M |

| EPS | 1.04 | 0.0329 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Gen Digital Inc.

Gen Digital Inc. exhibited steady revenue growth from 2.55B in 2021 to 3.94B in 2025, with net income rising from 554M to 643M over the same period, despite fluctuations. Gross and EBIT margins remained favorable around 80% and 41% respectively, though interest expenses were comparatively high. In 2025, revenue growth softened to 3.55%, EBIT surged 44%, and net margin held steady, signaling improved operational efficiency.

Informatica Inc.

Informatica Inc.’s revenue increased from 1.32B in 2020 to 1.64B in 2024, with net income recovering from losses to a modest 9.9M in 2024. Margins showed mixed trends; gross margin remained strong near 80%, EBIT margin improved to 12.15%, and net margin stayed low at 0.61%. The latest year showed slower revenue growth at 2.81%, but EBIT and net margin growth sharply accelerated, reflecting operational gains.

Which one has the stronger fundamentals?

Both companies present favorable income statement evaluations, with Informatica showing stronger net income and margin improvements, especially recently. Gen Digital boasts higher absolute revenues, more stable margins, and better overall profitability but faces higher interest expenses. Informatica’s rapid margin recovery contrasts with its lower net income scale. Investors should weigh scale versus margin momentum in assessing fundamentals.

Financial Ratios Comparison

The table below compares key financial ratios of Gen Digital Inc. (GEN) and Informatica Inc. (INFA) for their most recent fiscal years, providing an overview of profitability, liquidity, valuation, leverage, and efficiency metrics.

| Ratios | Gen Digital Inc. (2025) | Informatica Inc. (2024) |

|---|---|---|

| ROE | 28.3% | 0.43% |

| ROIC | 7.8% | 0.56% |

| P/E | 25.4 | 788 |

| P/B | 7.19 | 3.39 |

| Current Ratio | 0.51 | 1.82 |

| Quick Ratio | 0.51 | 1.82 |

| D/E (Debt-to-Equity) | 3.66 | 0.81 |

| Debt-to-Assets | 53.7% | 35.2% |

| Interest Coverage | 2.79 | 0.87 |

| Asset Turnover | 0.254 | 0.311 |

| Fixed Asset Turnover | 36.1 | 8.75 |

| Payout Ratio | 48.7% | 0.12% |

| Dividend Yield | 1.92% | 0.00015% |

Interpretation of the Ratios

Gen Digital Inc.

Gen Digital shows strength in profitability ratios such as net margin at 16.34% and ROE at 28.34%, which are favorable. However, liquidity ratios like the current and quick ratios are weak at 0.51, and leverage ratios are high, with debt-to-equity at 3.66 and debt-to-assets at 53.66%, raising concerns. The company pays a dividend with a 1.92% yield, indicating moderate shareholder returns.

Informatica Inc.

Financial ratio data for Informatica Inc. is unavailable, preventing a detailed analysis. Without key metrics such as profitability, liquidity, or leverage ratios, it is not possible to evaluate its financial health or dividend policy. This lack of information limits comparison and insight into shareholder returns or risk factors.

Which one has the best ratios?

Based on available data, Gen Digital presents a mixed profile with strong profitability but weak liquidity and high leverage, leading to a slightly unfavorable overall ratio evaluation. Informatica’s absence of ratio data means no informed comparison can be made, so Gen Digital stands as the only analyzable option here.

Strategic Positioning

This section compares the strategic positioning of Gen Digital Inc. and Informatica Inc. in terms of market position, key segments, and exposure to technological disruption:

Gen Digital Inc.

- Larger market cap at $16B with moderate competitive pressure.

- Focused on cyber safety solutions, identity theft protection, and privacy services.

- Faces moderate disruption risks linked to cybersecurity evolution and privacy demands.

Informatica Inc.

- Smaller market cap at $7.5B, operating in a competitive data management market.

- Concentrates on AI-powered data integration, quality, governance, and cloud platforms.

- Exposed to disruption from rapid AI and cloud data management technology changes.

Gen Digital Inc. vs Informatica Inc. Positioning

Gen Digital pursues a concentrated strategy centered on consumer cyber safety and privacy, while Informatica offers a diversified AI-driven data management suite. Gen Digital benefits from brand recognition; Informatica leverages enterprise cloud data integration scale but faces broader technology shifts.

Which has the best competitive advantage?

Gen Digital’s MOAT evaluation is very unfavorable with declining ROIC and value destruction from 2021 to 2025. Informatica’s MOAT data is unavailable, preventing a definitive competitive advantage comparison based on ROIC versus WACC.

Stock Comparison

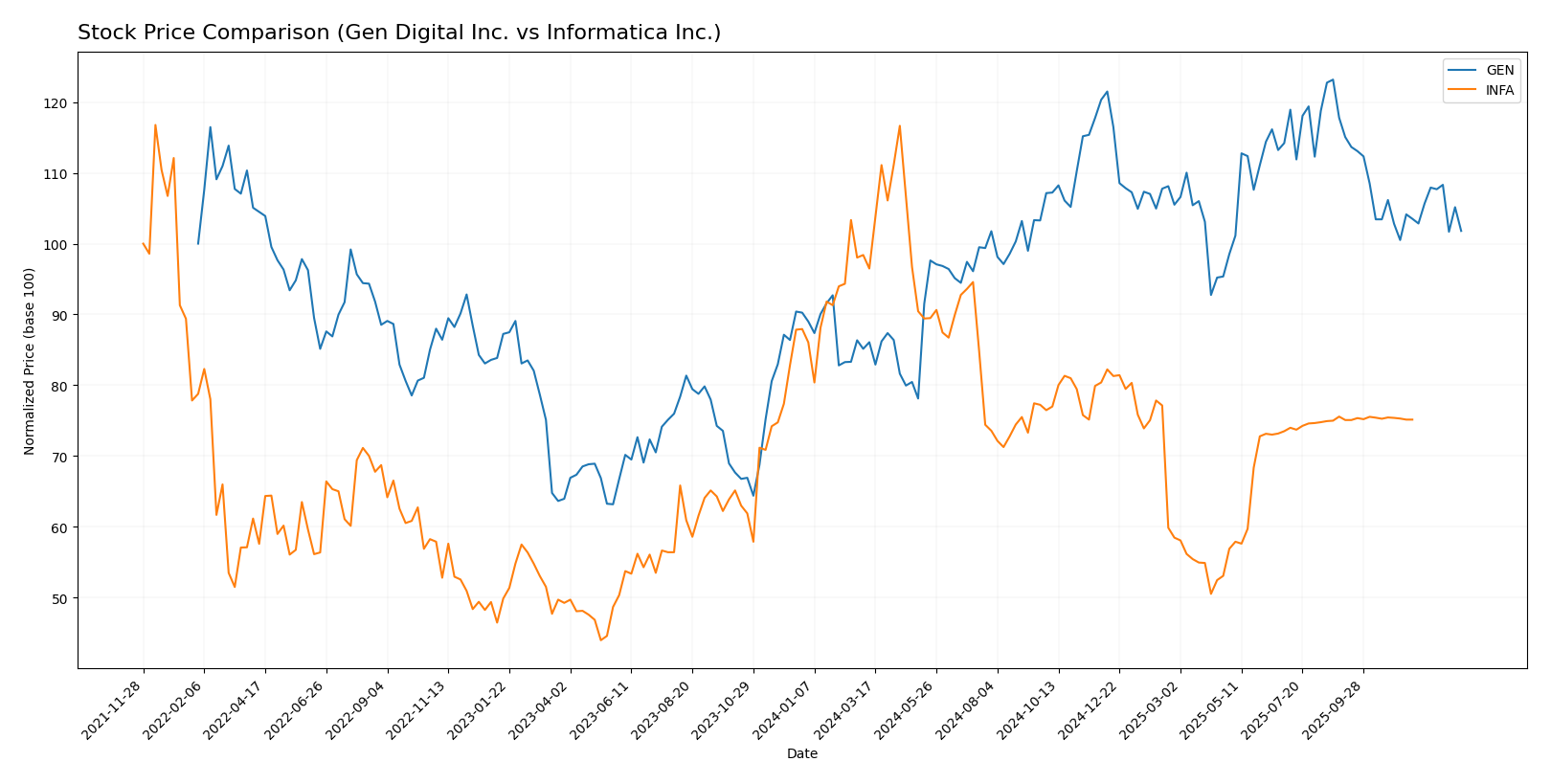

The stock price chart highlights significant divergence in trading dynamics over the past 12 months, with Gen Digital Inc. exhibiting a bullish trend despite recent deceleration, while Informatica Inc. shows a bearish trajectory coupled with accelerating decline.

Trend Analysis

Gen Digital Inc. (GEN) posted a 17.89% price increase over the past year, reflecting a bullish trend with deceleration. The stock ranged between $20.03 and $31.58, with moderate volatility (2.59 std deviation).

Informatica Inc. (INFA) experienced a 12.68% price decline over the same period, signifying a bearish trend with accelerating downward momentum. Its price fluctuated from $16.67 to $38.48, showing higher volatility (4.46 std deviation).

Comparing both, GEN delivered the highest market performance with positive gains, contrasting INFA’s negative trend and accelerating losses over the last year.

Target Prices

The current analyst consensus reveals moderately optimistic target prices for Gen Digital Inc. and Informatica Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Gen Digital Inc. | 32 | 31 | 31.5 |

| Informatica Inc. | 27 | 27 | 27 |

Gen Digital’s consensus target of 31.5 USD suggests a potential upside from its current price of 26.1 USD, indicating moderate growth expectations. Informatica’s target price of 27 USD also implies upside from the current price near 24.79 USD, reflecting cautious optimism among analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Gen Digital Inc. and Informatica Inc.:

Rating Comparison

Gen Digital Inc. Rating

- Rating: B, classified as Very Favorable.

- Discounted Cash Flow Score: 5, Very Favorable.

- ROE Score: 5, Very Favorable.

- ROA Score: 3, Moderate.

- Debt To Equity Score: 1, Very Unfavorable.

- Overall Score: 3, Moderate.

Informatica Inc. Rating

- No rating data available.

- No discounted cash flow score.

- No ROE score available.

- No ROA score available.

- No debt to equity score available.

- No overall score available.

Which one is the best rated?

Based strictly on the provided data, Gen Digital Inc. holds a clear advantage with a comprehensive rating and multiple favorable scores, while Informatica Inc. lacks any analyst rating or score data for comparison.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Gen Digital Inc. and Informatica Inc.:

Gen Digital Inc. Scores

- Altman Z-Score: 1.25, in the distress zone, high bankruptcy risk.

- Piotroski Score: 6, indicating average financial strength.

Informatica Inc. Scores

- Altman Z-Score: 1.94, in the grey zone, moderate bankruptcy risk.

- Piotroski Score: 6, indicating average financial strength.

Which company has the best scores?

Informatica Inc. shows a better Altman Z-Score, placing it in the grey zone versus Gen Digital’s distress zone. Both have the same average Piotroski Score of 6, indicating similar financial strength.

Grades Comparison

Here is a comparison of the latest reliable grades assigned to Gen Digital Inc. and Informatica Inc.:

Gen Digital Inc. Grades

The following table summarizes recent grades from well-known grading companies for Gen Digital Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2025-11-07 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-09-02 |

| Barclays | Maintain | Equal Weight | 2025-08-08 |

| Wells Fargo | Maintain | Overweight | 2025-08-08 |

| RBC Capital | Maintain | Sector Perform | 2025-08-08 |

| Barclays | Maintain | Equal Weight | 2025-07-14 |

| RBC Capital | Maintain | Sector Perform | 2025-05-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-04-16 |

| RBC Capital | Maintain | Sector Perform | 2025-01-31 |

Gen Digital shows mostly stable ratings, with a mix of “Sector Perform,” “Equal Weight,” and some “Overweight” or “Outperform” grades, indicating a generally positive but cautious view.

Informatica Inc. Grades

The following table shows recent grades from recognized grading companies for Informatica Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Downgrade | Neutral | 2025-08-07 |

| UBS | Maintain | Neutral | 2025-08-07 |

| Baird | Maintain | Neutral | 2025-05-28 |

| JP Morgan | Downgrade | Neutral | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | Downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | Maintain | Equal Weight | 2025-05-28 |

| Truist Securities | Downgrade | Hold | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-27 |

| UBS | Maintain | Neutral | 2025-05-16 |

Informatica’s grades suggest a recent trend of downgrades from “Buy” or “Overweight” to more cautious “Neutral,” “Hold,” or “Peer Perform” ratings, reflecting a more conservative outlook.

Which company has the best grades?

Gen Digital Inc. has received generally more favorable grades, including multiple “Buy” and “Outperform” ratings, while Informatica Inc. mostly holds “Neutral” and “Hold” grades. This indicates that investors may view Gen Digital as having stronger growth or performance potential compared to Informatica, which appears to be assessed with more caution.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses of Gen Digital Inc. (GEN) and Informatica Inc. (INFA) based on the most recent available data.

| Criterion | Gen Digital Inc. (GEN) | Informatica Inc. (INFA) |

|---|---|---|

| Diversification | Moderate: Primarily cybersecurity products, with some legacy | Moderate: Mix of subscription and license |

| products, limited product diversification. | revenues from professional services. | |

| Profitability | Mixed: Net margin 16.3% (favorable), ROE 28.3% (favorable), | Data unavailable for profitability metrics. |

| ROIC 7.8% slightly below WACC 7.8% (neutral). | ||

| Innovation | Moderate: Core in cyber safety with ongoing product updates, | Data unavailable; focus on cloud and |

| but ROIC trend declining, indicating challenges in value | subscription services suggests some | |

| creation over recent years. | innovation in cloud solutions. | |

| Global presence | Strong: Leading cybersecurity firm with a broad global | Moderate: Primarily North American and |

| customer base. | enterprise-focused. | |

| Market Share | Significant in cybersecurity segment, with $3.9B cyber safety | Solid presence in data management market, |

| revenues in FY 2025. | but exact market share data unavailable. |

Gen Digital shows strength in profitability and a strong global presence, but faces challenges with declining ROIC and high leverage. Informatica lacks recent financial ratio data but maintains a diversified revenue base with a growing subscription model. Investors should weigh Gen Digital’s value erosion risks against Informatica’s data gaps.

Risk Analysis

Below is a comparative table summarizing key risk factors for Gen Digital Inc. and Informatica Inc. based on the most recent 2025 data and financial health indicators:

| Metric | Gen Digital Inc. (GEN) | Informatica Inc. (INFA) |

|---|---|---|

| Market Risk | Moderate (Beta 1.08) | Moderate (Beta 1.13) |

| Debt Level | High (D/E 3.66; Debt/Assets 53.66%) | Data unavailable |

| Regulatory Risk | Moderate (Tech industry compliance) | Moderate (Data privacy regulations) |

| Operational Risk | Moderate (Cybersecurity product reliance) | Moderate (Cloud platform dependency) |

| Environmental Risk | Low (Software sector) | Low (Software sector) |

| Geopolitical Risk | Moderate (Global market exposure) | Moderate (Global enterprise clients) |

Gen Digital shows elevated financial risk due to high leverage and weak liquidity ratios, increasing vulnerability to interest rate changes and credit tightening. Informatica’s financial data gaps limit full risk assessment but its grey zone Altman Z-score suggests moderate financial uncertainty. Market and regulatory risks remain significant for both given their technology and data-sensitive sectors.

Which Stock to Choose?

Gen Digital Inc. (GEN) shows a generally favorable income evolution with steady revenue and net income growth over 2021-2025. Its profitability is strong, with a 16.34% net margin and 28.34% ROE, though some financial ratios like high debt levels (debt to equity 3.66) and low liquidity ratios appear unfavorable. The overall rating is very favorable with a B grade, despite concerns from a distress-zone Altman Z-score and value destruction indicated by declining ROIC.

Informatica Inc. (INFA) has favorable income statement metrics, including a solid gross margin of 80.11% and improving net margin growth over recent years. However, key financial ratios, debt metrics, and detailed rating evaluations are missing, limiting a full assessment. The Altman Z-score places INFA in the grey zone, suggesting moderate financial risk, and its Piotroski score is average, reflecting mixed financial strength.

For investors, GEN might appear more attractive for those prioritizing profitability and strong income growth, albeit with higher financial risk and value erosion concerns. INFA could be seen as a cautious choice, with positive income trends but incomplete financial data and moderate risk indicators. Ultimately, the preference might depend on whether an investor favors growth potential with financial leverage or a more uncertain profile with less comprehensive financial clarity.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Gen Digital Inc. and Informatica Inc. to enhance your investment decisions: