Home > Comparison > Utilities > GEV vs SMR

The strategic rivalry between GE Vernova Inc. and NuScale Power Corporation shapes the future of renewable utilities. GE Vernova operates as a capital-intensive powerhouse with diverse energy production across hydro, gas, nuclear, and wind segments. In contrast, NuScale Power focuses on innovative modular nuclear reactors, targeting niche energy solutions. This analysis evaluates which operational model offers superior risk-adjusted returns, guiding investors seeking durable exposure to the evolving utilities sector.

Table of contents

Companies Overview

GE Vernova Inc. and NuScale Power Corporation stand as pivotal players in the evolving renewable utilities market.

GE Vernova Inc.: Integrated Renewable Power Leader

GE Vernova dominates the renewable utilities sector by generating electricity across hydro, gas, nuclear, and steam power. Its revenue engine centers on diversified power generation and wind turbine blade manufacturing. In 2026, its strategic focus sharpens on expanding grid solutions and storage technologies within its Electrification segment to enhance energy integration.

NuScale Power Corporation: Modular Nuclear Innovator

NuScale Power carves a niche as a developer of modular light water reactor nuclear plants. It drives revenue by selling scalable nuclear modules designed for electricity generation and industrial applications. For 2026, the company prioritizes advancing its VOYGR series and expanding modular configurations to meet custom energy demands globally.

Strategic Collision: Similarities & Divergences

Both companies target the renewable utilities space but diverge in approach—GE Vernova emphasizes a broad energy portfolio blending traditional and renewable sources, while NuScale pursues cutting-edge modular nuclear technology. Their competitive battleground centers on clean energy generation capacity. Investors face contrasting profiles: GE Vernova offers scale and diversification, NuScale presents innovation with higher volatility.

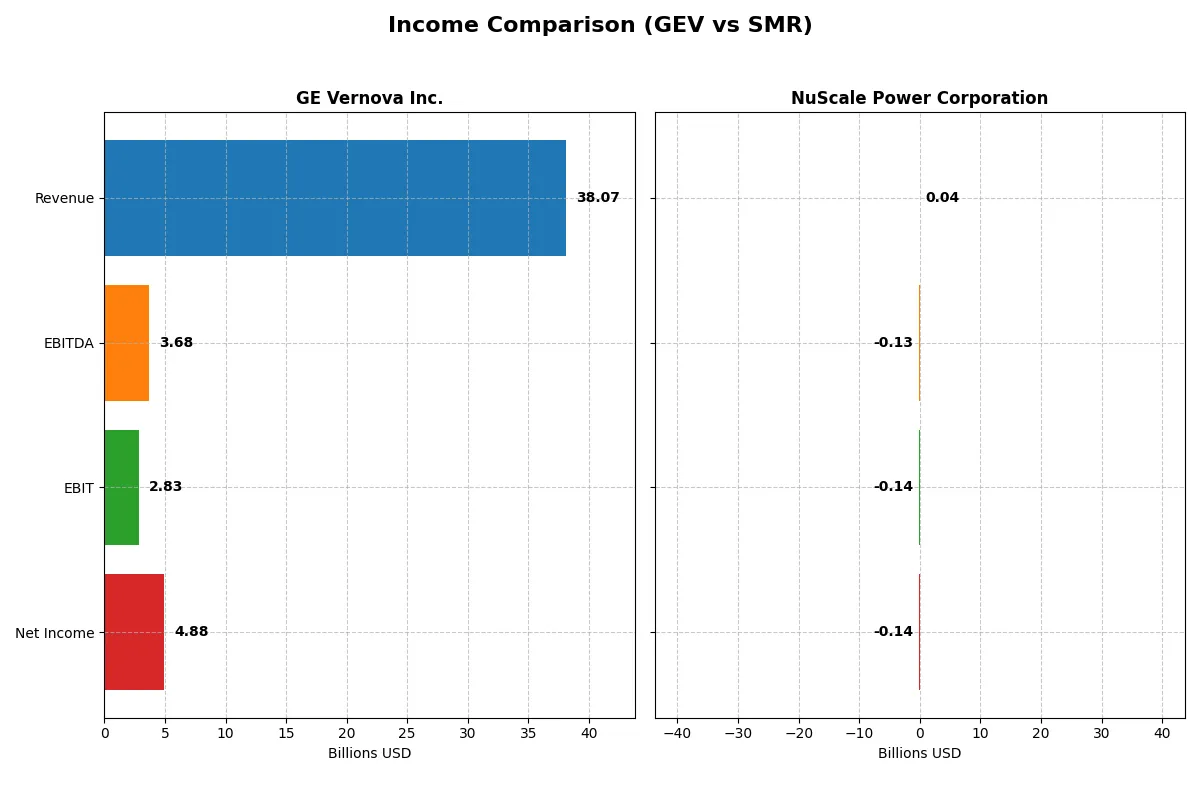

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | GE Vernova Inc. (GEV) | NuScale Power Corporation (SMR) |

|---|---|---|

| Revenue | 38B | 37M |

| Cost of Revenue | 30.5B | 5M |

| Operating Expenses | 6.15B | 171M |

| Gross Profit | 7.54B | 32M |

| EBITDA | 3.68B | -134M |

| EBIT | 2.83B | -135M |

| Interest Expense | 0 | 0 |

| Net Income | 4.88B | -137M |

| EPS | 17.92 | -1.47 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals how efficiently each company converts revenue into profit, exposing the strength and momentum of their corporate engines.

GE Vernova Inc. Analysis

GE Vernova’s revenue climbed steadily from 33B in 2021 to 38B in 2025, driving net income from a loss of 633M in 2021 to a robust 4.88B in 2025. Gross margins improved to nearly 20%, while net margins surged to 12.8%, signaling strengthened profitability. The latest year shows marked efficiency gains, with a 19% gross profit growth and a 217% EPS rise, illustrating strong operational momentum.

NuScale Power Corporation Analysis

NuScale Power’s revenue expanded sharply from 2.9M in 2020 to 37M in 2024, yet it remains unprofitable with a net loss of 137M in 2024. Despite an impressive gross margin of 87%, heavy operating expenses push EBIT and net margins deeply negative. The latest year’s 62% revenue growth contrasts with persistent large losses, reflecting a growth-focused but still immature business model.

Margin Strength vs. Growth Ambition

GE Vernova clearly outperforms NuScale in translating scale into profit, boasting positive and expanding margins alongside accelerating net income. NuScale excels in revenue growth and gross margin but struggles to control costs, resulting in significant losses. Investors prioritizing stable profitability may favor GE Vernova, while those seeking high growth at a higher risk might watch NuScale’s development carefully.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | GE Vernova Inc. (GEV) | NuScale Power Corporation (SMR) |

|---|---|---|

| ROE | 43.7% | -22.1% |

| ROIC | 6.3% | -30.5% |

| P/E | 36.4 | -12.2 |

| P/B | 15.9 | 2.7 |

| Current Ratio | 0.98 | 5.25 |

| Quick Ratio | 0.73 | 5.25 |

| D/E | 0 | 0 |

| Debt-to-Assets | 0 | 0 |

| Interest Coverage | 0 | 0 |

| Asset Turnover | 0.60 | 0.068 |

| Fixed Asset Turnover | 6.34 | 15.30 |

| Payout ratio | 5.6% | 0 |

| Dividend yield | 0.15% | 0 |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and operational strengths that raw numbers alone cannot reveal.

GE Vernova Inc.

GE Vernova posts a robust 43.7% ROE and a solid 12.8% net margin, demonstrating strong profitability. However, its P/E of 36.4 signals a stretched valuation relative to earnings. The company returns value through a modest 0.15% dividend yield, favoring operational reinvestment to sustain growth and efficiency.

NuScale Power Corporation

NuScale struggles with deeply negative profitability metrics, including a -22.1% ROE and a net margin of -368.8%. Despite an attractive P/E of -12.2 due to losses, its elevated current ratio of 5.25 flags potential inefficiency in asset utilization. The lack of dividends aligns with heavy R&D spending aimed at future scaling.

Premium Valuation vs. Operational Safety

GE Vernova balances profitability with a premium valuation, reflecting market confidence in its stable returns. NuScale’s metrics reveal high risk and ongoing investment needs, with weak operational returns. Investors seeking operational safety might prefer GE Vernova, while those tolerating high risk for growth could consider NuScale’s profile.

Which one offers the Superior Shareholder Reward?

I compare GE Vernova Inc. (GEV) and NuScale Power Corporation (SMR) on shareholder return. GEV pays a small dividend yield of 0.15% with a conservative payout ratio near 5.6%, backed by strong free cash flow coverage above 74%. It also executes meaningful buybacks, boosting total returns sustainably. SMR pays no dividend and burns cash with persistent negative margins and operating cash flow. Its reinvestment focuses on growth and R&D, but heavy losses and no buyback activity limit shareholder reward. I view GEV’s balanced income and buyback strategy as more sustainable and attractive for total return in 2026.

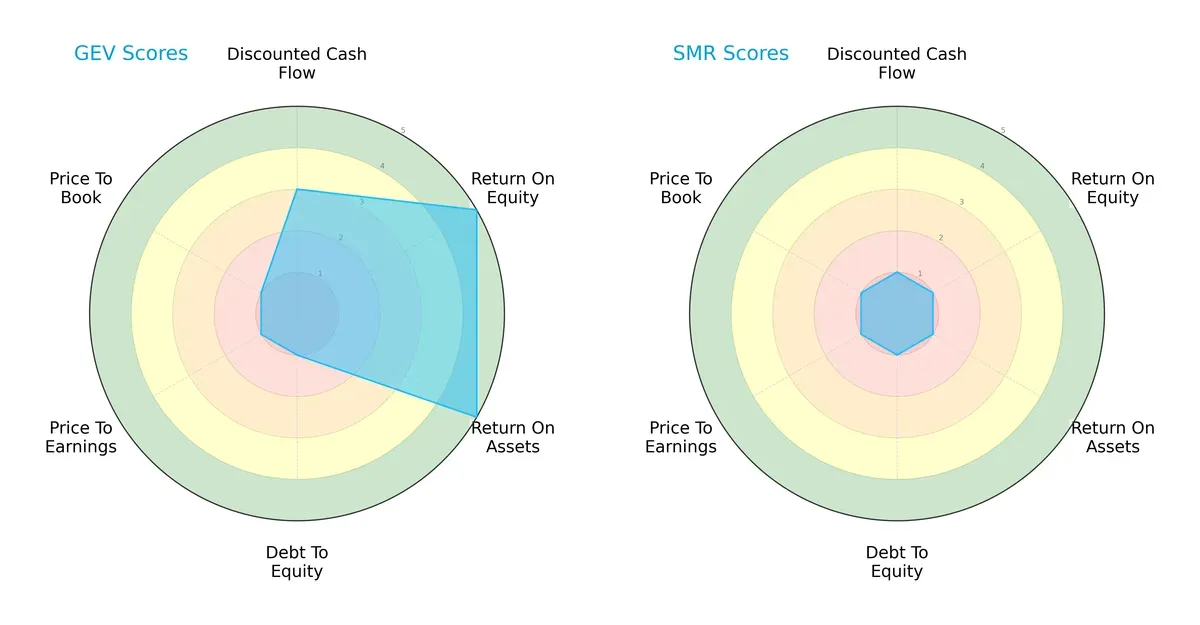

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their core financial strengths and vulnerabilities:

GE Vernova Inc. (GEV) shows strength in profitability metrics with very favorable ROE and ROA scores. However, it struggles with valuation and leverage, reflecting significant financial risk. NuScale Power Corporation (SMR) scores uniformly low, indicating a lack of operational efficiency and financial robustness. GEV presents a more balanced yet risky profile, while SMR relies on no clear competitive edge.

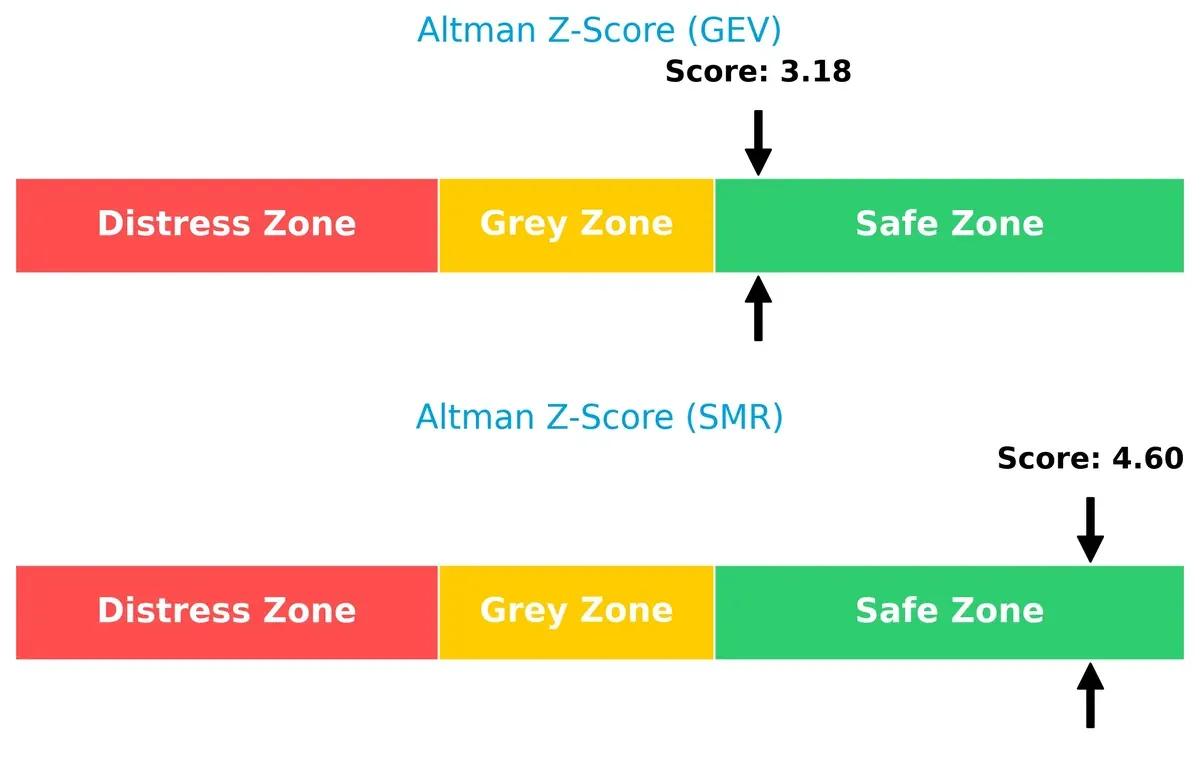

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap signals distinct solvency outlooks: GEV’s score near 3.18 indicates moderate safety, while SMR’s 4.60 places it firmly in a low bankruptcy risk zone:

Financial Health: Quality of Operations

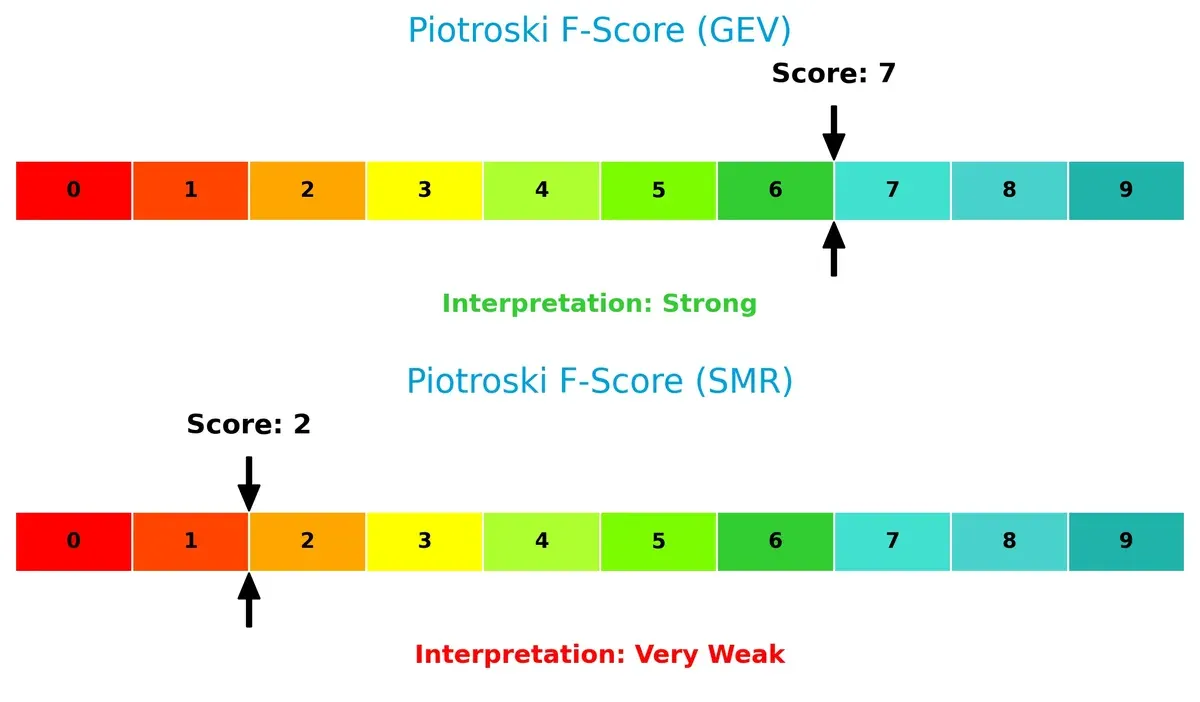

GEV’s Piotroski F-Score of 7 signals strong financial health and solid internal controls. SMR’s 2 reveals red flags, suggesting operational weaknesses and potential value traps:

How are the two companies positioned?

This section dissects the operational DNA of GE Vernova and NuScale Power by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

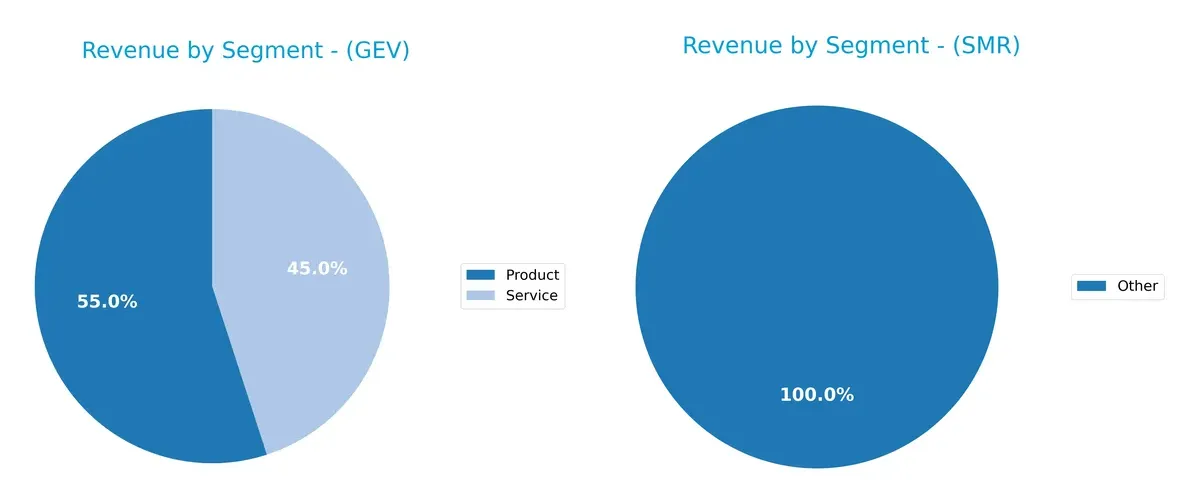

The following comparison dissects how GE Vernova Inc. and NuScale Power Corporation diversify income streams and where their primary sector bets lie:

GE Vernova shows a balanced revenue base with $20.9B from Products and $17.1B from Services, signaling strong diversification. NuScale Power, however, reports only $411K under Other, indicating minimal revenue breadth and heavy concentration risk. GE Vernova’s dual-segment focus anchors it in both product innovation and service ecosystems, while NuScale’s narrow base suggests vulnerability and limited market footprint.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of GE Vernova Inc. and NuScale Power Corporation:

GEV Strengths

- Diversified revenue streams with $20.9B products and $17.1B services

- Strong global presence across Americas, Europe, Asia, Middle East

- Favorable net margin at 12.8% and ROE 43.7%

- Zero debt and infinite interest coverage enhance financial stability

- High fixed asset turnover at 6.34

SMR Strengths

- Zero debt and favorable quick ratio at 5.25 indicate liquidity strength

- High fixed asset turnover at 15.3 suggests efficient asset use

- Favorable PE ratio despite negative earnings

GEV Weaknesses

- Unfavorable valuation multiples: PE 36.4, PB 15.9 indicate overvaluation

- Current and quick ratios below 1 pose liquidity concerns

- Dividend yield very low at 0.15%

- ROIC below WACC at 6.3% vs 9.9%

- Neutral asset turnover at 0.6

SMR Weaknesses

- Negative profitability metrics: net margin -368.8%, ROE -22.1%, ROIC -30.5%

- Unfavorable WACC at 13.85% exceeds returns

- Interest coverage at zero signals inability to cover interest expenses

- Extremely low asset turnover at 0.07

- No dividend yield

GEV exhibits diversified global revenues and strong profitability metrics with financial conservatism, but faces valuation and liquidity challenges. SMR shows liquidity and asset efficiency strengths but suffers from severe profitability and coverage weaknesses, reflecting early-stage or operational struggles. These factors shape each firm’s strategic focus on growth, risk management, and capital allocation.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only thing protecting long-term profits from the relentless erosion of competition. Let’s examine two utilities giants’ moats:

GE Vernova Inc.: Diversified Energy Infrastructure Moat

GE Vernova’s moat stems from its integrated energy platforms—power generation, wind manufacturing, and grid solutions. Its stable margins and positive revenue growth reflect steady operational leverage. However, its ROIC trails WACC, signaling value erosion. New green energy markets could deepen its moat if execution improves in 2026.

NuScale Power Corporation: Innovative Modular Nuclear Moat

NuScale’s core moat is its proprietary modular nuclear technology, differentiating it from GE Vernova’s diversified assets. Despite negative margins, its soaring revenue growth and improving ROIC trend indicate rising competitive strength. Its unique reactor designs promise expansion opportunities and potential market disruption in 2026.

Integrated Platforms vs. Disruptive Innovation

GE Vernova’s moat is broader due to scale and diversification, but NuScale’s improving ROIC and innovation-driven moat are deepening rapidly. I see NuScale as better positioned to defend and expand market share amid evolving energy demands.

Which stock offers better returns?

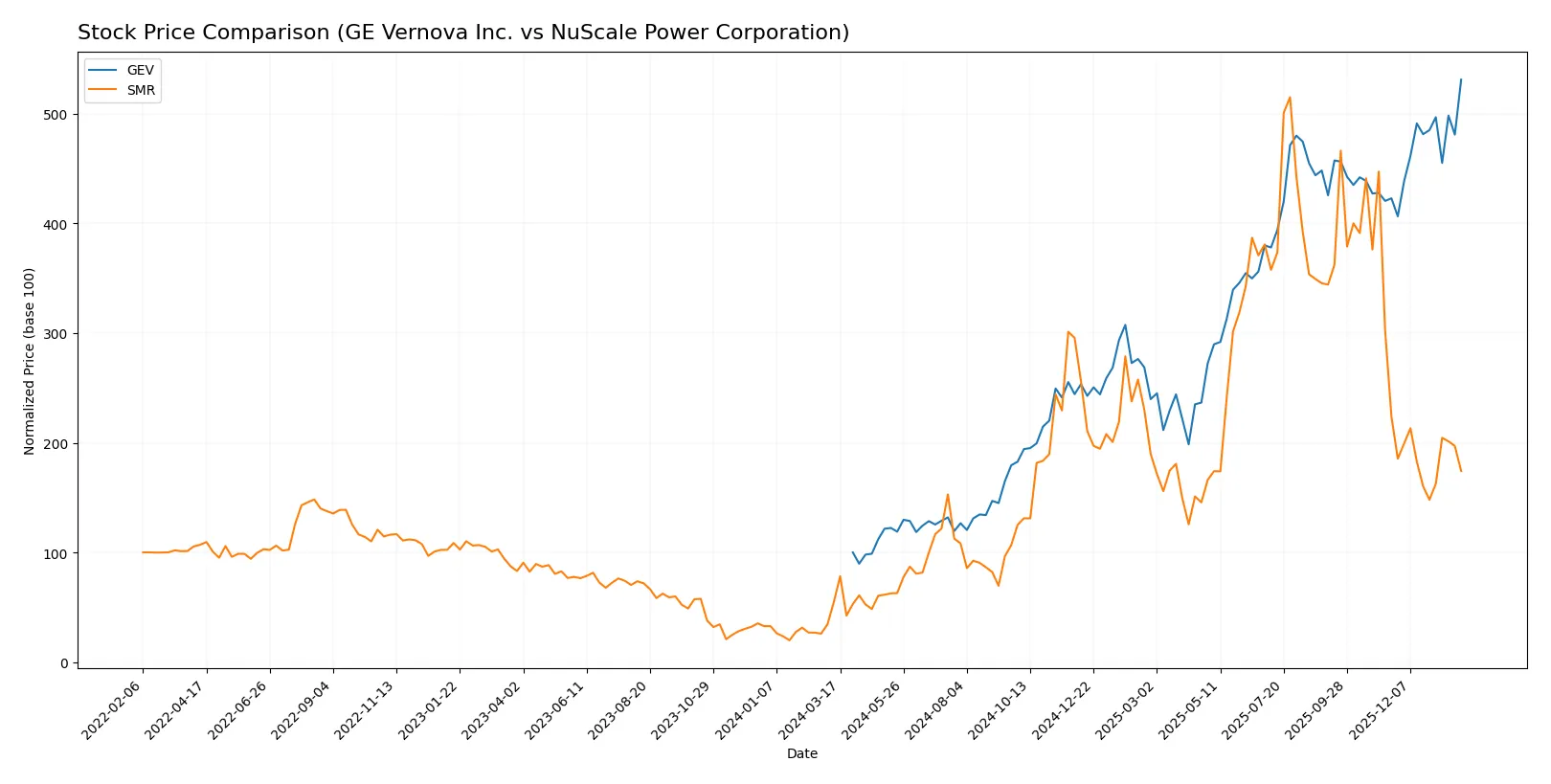

Over the past 12 months, GE Vernova Inc. and NuScale Power Corporation showed divergent price movements, with GE Vernova accelerating sharply while NuScale experienced recent deceleration and increased selling pressure.

Trend Comparison

GE Vernova Inc. posted a 431.17% price gain over the past year, signaling a strong bullish trend with accelerating momentum and high volatility, ranging from 122.7 to 726.37.

NuScale Power Corporation gained 218.4% over the same period, maintaining a bullish but decelerating trend, with lower volatility and a price range between 4.25 and 51.67.

GE Vernova’s stock outperformed NuScale’s by a wide margin, delivering significantly higher returns and stronger positive momentum over the past year.

Target Prices

The consensus target prices for GE Vernova Inc. and NuScale Power Corporation suggest varied upside potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| GE Vernova Inc. | 475 | 1,087 | 818.33 |

| NuScale Power Corporation | 20 | 55 | 31.5 |

Analysts expect GE Vernova’s stock to rise roughly 13% from the current 726.37, signaling confidence in its renewable utilities growth. NuScale Power’s consensus price of 31.5 implies an 80% upside from 17.48, reflecting high growth expectations amid nuclear innovation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here are the recent institutional grades for GE Vernova Inc. and NuScale Power Corporation:

GE Vernova Inc. Grades

This table summarizes the latest grades assigned to GE Vernova Inc. by various institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Outperform | 2026-01-30 |

| Goldman Sachs | Maintain | Buy | 2026-01-29 |

| Citigroup | Maintain | Neutral | 2026-01-29 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-29 |

| Susquehanna | Maintain | Positive | 2026-01-29 |

| Citigroup | Maintain | Neutral | 2026-01-12 |

| GLJ Research | Maintain | Buy | 2026-01-12 |

| Baird | Downgrade | Neutral | 2026-01-09 |

| Barclays | Maintain | Overweight | 2026-01-07 |

| RBC Capital | Maintain | Outperform | 2025-12-22 |

NuScale Power Corporation Grades

This table presents the most recent institutional grades for NuScale Power Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Buy | 2025-12-22 |

| Goldman Sachs | Maintain | Neutral | 2025-12-12 |

| UBS | Maintain | Neutral | 2025-11-25 |

| RBC Capital | Maintain | Sector Perform | 2025-11-10 |

| Citigroup | Downgrade | Sell | 2025-10-21 |

| B of A Securities | Downgrade | Underperform | 2025-09-30 |

| Canaccord Genuity | Maintain | Buy | 2025-09-03 |

| Canaccord Genuity | Maintain | Buy | 2025-08-11 |

| UBS | Maintain | Neutral | 2025-08-11 |

| BTIG | Downgrade | Neutral | 2025-06-25 |

Which company has the best grades?

GE Vernova Inc. consistently receives strong grades such as Outperform and Buy from several reputable firms. NuScale Power Corporation has a mix of Buy and Neutral ratings but also faces recent downgrades to Sell and Underperform. Investors may view GE Vernova’s steadier positive outlook as a sign of greater confidence by analysts.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

GE Vernova Inc.

- Established leader in renewable utilities with diverse segments. Faces intense competition in wind and electrification markets.

NuScale Power Corporation

- Emerging player focused on modular nuclear reactors. Faces high competition from established nuclear and alternative energy firms.

2. Capital Structure & Debt

GE Vernova Inc.

- Zero debt with strong interest coverage, signaling low financial risk.

NuScale Power Corporation

- Also debt-free but has zero interest coverage due to lack of earnings, implying liquidity risks.

3. Stock Volatility

GE Vernova Inc.

- Beta of 1.3 indicates moderate volatility, typical for utilities.

NuScale Power Corporation

- Beta above 2 signals high volatility and higher investor risk.

4. Regulatory & Legal

GE Vernova Inc.

- Operates in a regulated energy sector, subject to environmental policies and grid regulations.

NuScale Power Corporation

- Faces stringent nuclear regulatory hurdles, slowing commercialization and increasing costs.

5. Supply Chain & Operations

GE Vernova Inc.

- Large operational scale with 76,800 employees supports supply chain resilience.

NuScale Power Corporation

- Smaller workforce of 330 limits operational flexibility and scale advantages.

6. ESG & Climate Transition

GE Vernova Inc.

- Strong ESG profile with diversified renewable assets, supporting climate goals.

NuScale Power Corporation

- Nuclear focus offers low-carbon benefits but faces public perception and waste disposal challenges.

7. Geopolitical Exposure

GE Vernova Inc.

- US-based with limited direct foreign exposure, reducing geopolitical risks.

NuScale Power Corporation

- Also US-based but nuclear tech development could be impacted by international trade policies.

Which company shows a better risk-adjusted profile?

GE Vernova’s most impactful risk is its stretched valuation and weak liquidity ratios despite operational strength. NuScale’s biggest threat is its deep losses and operational infancy, amplified by extreme stock volatility. GE Vernova shows a better risk-adjusted profile, supported by a safe Altman Z-score and strong Piotroski score, while NuScale’s weak profitability and financial health raise caution.

Final Verdict: Which stock to choose?

GE Vernova Inc. (GEV) stands out as a powerhouse of operational efficiency and robust profitability. Its ability to generate strong returns on equity amid a challenging macro environment signals disciplined capital allocation. The point of vigilance remains its tight liquidity position, which could pressure short-term flexibility. GEV suits portfolios seeking aggressive growth with proven resilience.

NuScale Power Corporation (SMR) offers a compelling strategic moat in its emerging nuclear technology and innovation pipeline. Its abundant liquidity and minimal debt provide a safer financial profile relative to GEV. However, persistent negative returns and value destruction temper enthusiasm. SMR fits investors focused on growth at a reasonable price, willing to tolerate execution risks.

If you prioritize consistent profitability and operational strength, GEV is the compelling choice due to its superior return metrics and market momentum. However, if you seek exposure to cutting-edge technology with a stronger liquidity cushion, SMR offers better stability despite its current value challenges. Both present distinct analytical scenarios tailored to different risk appetites and investment horizons.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of GE Vernova Inc. and NuScale Power Corporation to enhance your investment decisions: