Fox Corporation (FOXA) and TKO Group Holdings, Inc. (TKO) are two prominent players in the entertainment industry, each with a strong foothold in media and sports content. While Fox excels in cable networks and broadcast television, TKO focuses on live events, digital media, and consumer products. Both companies innovate to capture audience attention in a rapidly evolving market. In this article, I will analyze their strengths and risks to identify the more compelling investment option for you.

Table of contents

Companies Overview

I will begin the comparison between Fox Corporation and TKO Group Holdings, Inc. by providing an overview of these two companies and their main differences.

Fox Corporation Overview

Fox Corporation operates as a news, sports, and entertainment company primarily in the U.S. Its business includes cable network programming, national television broadcasting, and production services. Fox owns national channels such as FOX News, FOX Business, FS1, and the FOX Network, alongside digital platforms like Tubi. The company also manages production facilities in Los Angeles and focuses on content creation and distribution, including Web3 initiatives.

TKO Group Holdings Overview

TKO Group Holdings, Inc. is a sports and entertainment company operating globally across four segments: Media and Content, Live Events, Sponsorships, and Consumer Products Licensing. It produces live sports events, television programs, and digital content across multiple platforms in about 170 countries. TKO also generates revenue through merchandising, advertising, and sponsorships. It is a subsidiary of Endeavor Group Holdings and focuses on expanding its brand through diverse media and consumer products.

Key similarities and differences

Both companies operate in the entertainment sector with a strong emphasis on sports and media content. Fox Corporation focuses mainly on U.S.-based cable and broadcast television networks with complementary digital services, while TKO Group operates internationally with a broader portfolio including live events and consumer product licensing. Fox has a larger workforce and a longer market presence, whereas TKO emphasizes global reach and diversified revenue streams from sponsorships and merchandising.

Income Statement Comparison

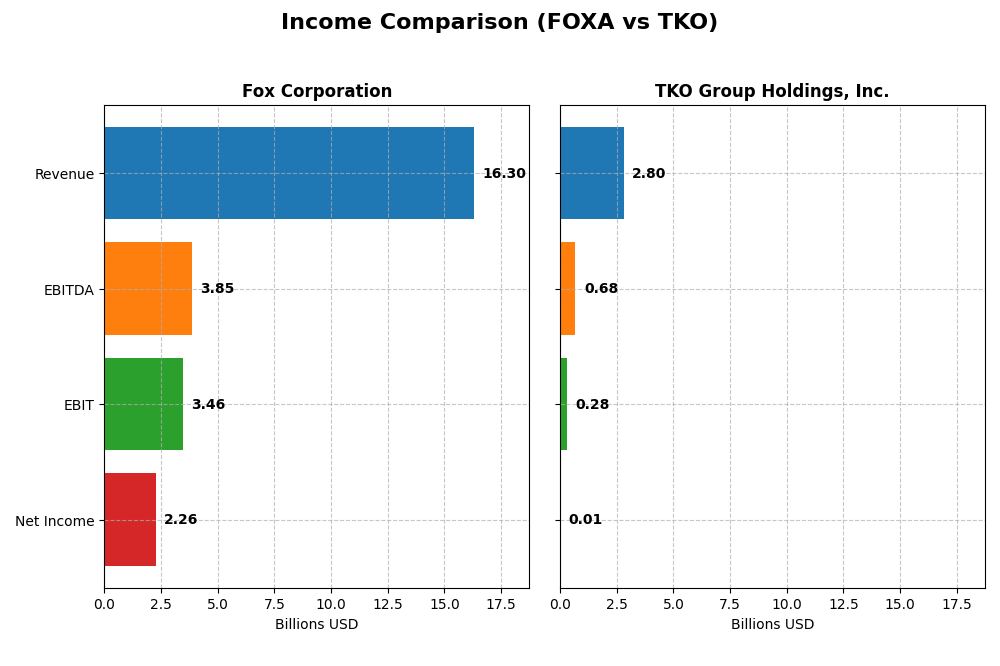

The table below presents a side-by-side comparison of key income statement metrics for Fox Corporation and TKO Group Holdings, Inc. for their most recent fiscal years.

| Metric | Fox Corporation | TKO Group Holdings, Inc. |

|---|---|---|

| Market Cap | 33.4B | 16.2B |

| Revenue | 16.3B | 2.8B |

| EBITDA | 3.85B | 676M |

| EBIT | 3.46B | 283M |

| Net Income | 2.26B | 9.41M |

| EPS | 4.97 | 0.12 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Fox Corporation

From 2021 to 2025, Fox Corporation’s revenue showed a positive trend, growing from $12.9B to $16.3B, with net income increasing from $2.15B to $2.26B. Margins generally remained stable and favorable, with a slight net margin dip overall but recent improvements. The 2025 fiscal year saw a 16.6% revenue increase and a 29.3% rise in net margin, indicating stronger profitability.

TKO Group Holdings, Inc.

TKO’s revenue increased significantly from $974M in 2020 to $2.8B in 2024, but net income was volatile, turning positive with $9.4M in 2024 after losses in 2023. Gross margin remained strong at 53.9%, yet EBIT margin and net margin were modest. The latest year showed revenue growth of 67.4%, but EBIT declined by 36.5%, reflecting operational challenges despite improved net margin.

Which one has the stronger fundamentals?

Fox Corporation demonstrates stronger fundamentals with consistent revenue and net income growth, favorable margins, and solid profitability metrics. TKO shows impressive revenue expansion but struggles with profitability and margin volatility, reflecting operational inefficiencies. Overall, Fox’s stable margins and earnings growth contrast with TKO’s fluctuating net income and weaker margins.

Financial Ratios Comparison

Below is a side-by-side comparison of key financial ratios for Fox Corporation (FOXA) and TKO Group Holdings, Inc. (TKO) based on the most recent fiscal year data.

| Ratios | Fox Corporation (2025) | TKO Group Holdings (2024) |

|---|---|---|

| ROE | 18.9% | 0.23% |

| ROIC | 11.9% | 1.28% |

| P/E | 11.42 | 1228.66 |

| P/B | 2.16 | 2.83 |

| Current Ratio | 2.91 | 1.30 |

| Quick Ratio | 2.76 | 1.30 |

| D/E (Debt to Equity) | 0.62 | 0.74 |

| Debt-to-Assets | 32.2% | 23.9% |

| Interest Coverage | 8.01 | 3.11 |

| Asset Turnover | 0.70 | 0.22 |

| Fixed Asset Turnover | 6.47 | 3.48 |

| Payout Ratio | 12.2% | 714.9% |

| Dividend Yield | 1.07% | 0.58% |

Interpretation of the Ratios

Fox Corporation

Fox Corporation’s financial ratios are generally strong, with favorable net margin (13.88%), ROE (18.92%), and ROIC (11.89%) reflecting solid profitability and efficient capital use. The company maintains a strong liquidity position with a current ratio of 2.91 and an interest coverage ratio of 8.6. Dividend yield is moderate at 1.07%, supported by a reasonable payout and coverage by free cash flow, suggesting sustainable shareholder returns.

TKO Group Holdings, Inc.

TKO Group Holdings shows weaker financial ratios, including a very low net margin (0.34%) and ROE (0.23%), indicating minimal profitability. The high PE ratio (1228.66) points to potential overvaluation or inconsistent earnings. Liquidity ratios are neutral to favorable, but interest coverage is low at 1.14, signaling risk in meeting interest obligations. Dividend yield is low at 0.58%, which may reflect the company’s reinvestment strategy amid limited free cash flow.

Which one has the best ratios?

Fox Corporation clearly exhibits stronger and more favorable financial ratios compared to TKO Group Holdings. Fox’s profitability, liquidity, and coverage ratios demonstrate better operational efficiency and financial stability. In contrast, TKO faces significant challenges with profitability, high valuation multiples, and weaker interest coverage, leading to a slightly unfavorable overall ratio assessment.

Strategic Positioning

This section compares the strategic positioning of Fox Corporation and TKO Group Holdings, Inc., focusing on market position, key segments, and exposure to technological disruption:

Fox Corporation

- Established U.S. entertainment leader with strong cable and TV presence amid moderate competitive pressure.

- Key segments include Cable Network Programming and Television, driving revenues via multiple national networks and digital platforms.

- Invests in Web3 content creation via Blockchain Creative Labs, signaling some exposure to technological innovation.

TKO Group Holdings, Inc.

- Smaller market cap, focused on sports and entertainment with less competitive intensity.

- Operates four segments: Media and Content, Live Events, Sponsorships, and Consumer Products Licensing.

- No explicit mention of technological disruption exposure in provided data.

Fox Corporation vs TKO Group Holdings, Inc. Positioning

Fox Corporation exhibits a diversified strategy with multiple content segments and digital ventures, while TKO concentrates on sports and entertainment events and licensing. Fox’s broader portfolio may offer resilience; TKO’s focused approach could limit diversification benefits.

Which has the best competitive advantage?

Fox Corporation shows a very favorable moat with growing ROIC, indicating durable competitive advantage and value creation, whereas TKO has a very unfavorable moat with declining ROIC, reflecting value destruction and weakening profitability.

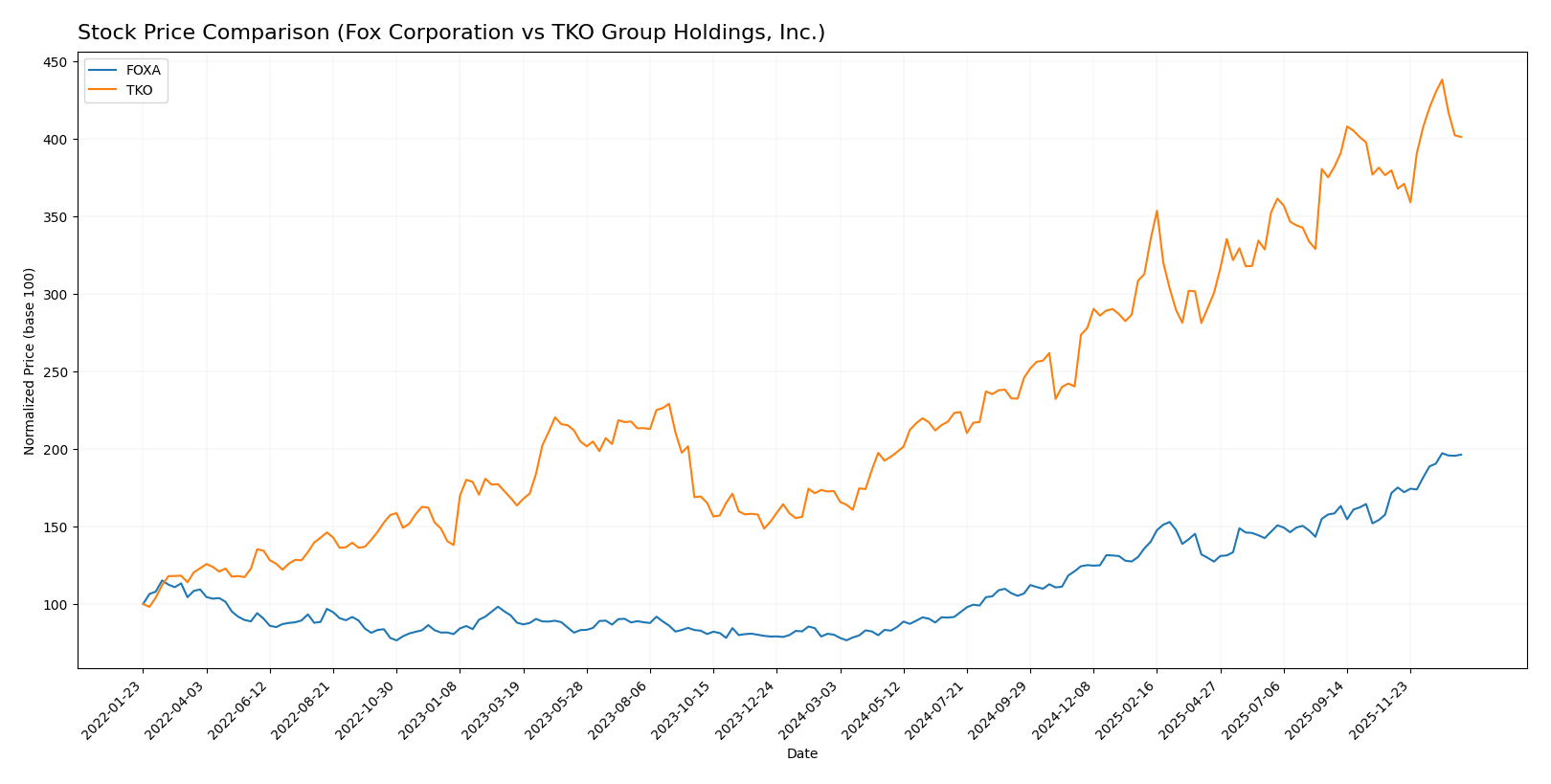

Stock Comparison

The stock price movements over the past 12 months reveal strong bullish trends for both Fox Corporation and TKO Group Holdings, Inc., with notable acceleration in price gains and distinct trading volume dynamics.

Trend Analysis

Fox Corporation’s stock shows a robust bullish trend with a 144.66% price increase over the past year, accompanied by acceleration and moderate volatility (std deviation 12.1). The recent three-month period also reflects continued positive momentum with a 14.4% gain.

TKO Group Holdings, Inc. exhibits a similarly bullish trend, rising 132.01% over the past year with acceleration and higher volatility (std deviation 36.57). Its recent price increase is 5.67%, showing slower but steady upward movement.

Comparing both, Fox Corporation delivered the higher market performance over the 12-month span, outperforming TKO Group Holdings by over 12 percentage points in total price appreciation.

Target Prices

Analysts present a clear consensus on the target prices for Fox Corporation and TKO Group Holdings, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Fox Corporation | 97 | 64 | 76.63 |

| TKO Group Holdings, Inc. | 250 | 210 | 228.1 |

The target consensus for Fox Corporation at 76.63 slightly exceeds its current price of 73.96, indicating moderate upside potential. For TKO Group Holdings, the consensus target of 228.1 is well above its current price of 199.09, suggesting stronger expected growth according to analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial grades for Fox Corporation and TKO Group Holdings, Inc.:

Rating Comparison

Fox Corporation Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating favorable valuation.

- ROE Score: 4, reflecting favorable profit generation efficiency.

- ROA Score: 5, very favorable asset utilization.

- Debt To Equity Score: 2, moderate financial risk level.

- Overall Score: 3, moderate overall financial standing.

TKO Group Holdings, Inc. Rating

- Rating: B-, also considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating favorable valuation.

- ROE Score: 3, showing moderate profit generation efficiency.

- ROA Score: 3, moderate asset utilization efficiency.

- Debt To Equity Score: 2, moderate financial risk level.

- Overall Score: 2, moderate overall financial standing.

Which one is the best rated?

Fox Corporation holds a higher rating (B+) compared to TKO’s B-, with stronger scores in ROE, ROA, and overall financial standing. Both share the same discounted cash flow and debt to equity scores.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score of Fox Corporation and TKO Group Holdings, Inc.:

Fox Corporation Scores

- Altman Z-Score of 3.42 places Fox in the safe zone.

- Piotroski Score of 8 indicates very strong financial health.

TKO Group Holdings, Inc. Scores

- Altman Z-Score of 2.17 places TKO in the grey zone.

- Piotroski Score of 6 indicates average financial health.

Which company has the best scores?

Fox Corporation has a higher Altman Z-Score and a stronger Piotroski Score compared to TKO Group Holdings, Inc., indicating better financial stability and strength based on the provided data.

Grades Comparison

Here is a comparison of the recent grades assigned to Fox Corporation and TKO Group Holdings, Inc.:

Fox Corporation Grades

The following table summarizes Fox Corporation’s latest grades from reputable grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Maintain | Buy | 2025-12-22 |

| B of A Securities | Maintain | Buy | 2025-12-19 |

| Goldman Sachs | Maintain | Buy | 2025-12-19 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-10-31 |

| TD Cowen | Maintain | Hold | 2025-10-31 |

| Barclays | Maintain | Equal Weight | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| JP Morgan | Maintain | Neutral | 2025-10-31 |

Fox Corporation’s grades show a general trend of Buy and Overweight ratings, with several Hold and Neutral assessments, indicating a moderately positive consensus.

TKO Group Holdings, Inc. Grades

The table below presents the latest grades for TKO Group Holdings, Inc. from established grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2025-12-31 |

| Susquehanna | Maintain | Positive | 2025-12-10 |

| TD Cowen | Maintain | Buy | 2025-12-08 |

| JP Morgan | Maintain | Overweight | 2025-12-02 |

| BTIG | Maintain | Buy | 2025-11-18 |

| Seaport Global | Upgrade | Buy | 2025-10-15 |

| BTIG | Maintain | Buy | 2025-10-10 |

| Bernstein | Maintain | Outperform | 2025-10-06 |

| Guggenheim | Maintain | Buy | 2025-10-03 |

| Morgan Stanley | Maintain | Equal Weight | 2025-09-25 |

TKO Group Holdings, Inc. displays a strong positive trend with multiple Buy ratings and an Outperform, reflecting a bullish sentiment among analysts.

Which company has the best grades?

TKO Group Holdings, Inc. has received comparatively stronger and more consistent Buy and Outperform grades than Fox Corporation, whose ratings are more mixed with several Hold and Neutral assessments. This suggests TKO may be viewed more favorably by analysts, potentially impacting investor confidence and portfolio decisions.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Fox Corporation (FOXA) and TKO Group Holdings, Inc. (TKO) based on the latest financial and operational data.

| Criterion | Fox Corporation (FOXA) | TKO Group Holdings, Inc. (TKO) |

|---|---|---|

| Diversification | Moderate diversification with strong Cable Network and Television segments | Limited diversification; primarily focused on core media |

| Profitability | Strong profitability with net margin 13.88% and ROIC 11.89% | Very low profitability; net margin 0.34%, ROIC 1.28% |

| Innovation | Consistent investment in content and digital platforms; growing ROIC indicates efficient capital use | Struggling innovation; declining ROIC and unfavorable profitability ratios |

| Global presence | Established presence with significant U.S. market share and content distribution | Limited global footprint; regional focus limits scale |

| Market Share | Solid market share in cable and television programming segments | Small market share with declining financial performance |

Fox Corporation demonstrates a strong and growing profitability profile supported by diversified media segments and efficient capital management. In contrast, TKO Group Holdings faces significant challenges with declining returns and weak profitability, raising caution for investors.

Risk Analysis

Below is a comparative table summarizing key risks for Fox Corporation (FOXA) and TKO Group Holdings, Inc. (TKO) based on the most recent data from 2025 and 2024 respectively:

| Metric | Fox Corporation (FOXA) | TKO Group Holdings, Inc. (TKO) |

|---|---|---|

| Market Risk | Moderate (Beta 0.505) | Low (Beta 0.225) |

| Debt level | Moderate (D/E 0.62) | Moderate (D/E 0.74) |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate (US-focused) | Moderate (Global events impact) |

Fox Corporation shows a moderate beta indicating average market volatility exposure. Its debt level is moderate with adequate interest coverage (8.6x), suggesting manageable financial risk. TKO has a lower market risk but weaker profitability metrics and interest coverage (1.14x), indicating higher financial vulnerability. Both face moderate regulatory and operational risks typical for entertainment firms. FOX’s Altman Z-score places it safely away from bankruptcy risk, whereas TKO is in a grey zone, signaling caution. The most impactful risks for TKO are low profitability and financial stability, while FOX’s primary risk stems from market and moderate leverage exposure.

Which Stock to Choose?

Fox Corporation (FOXA) shows a favorable income evolution with 16.6% revenue growth in 2025, strong profitability, and a solid balance sheet highlighted by a 2.91 current ratio. Its financial ratios are predominantly favorable, with ROE at 18.92% and a net debt to EBITDA of 0.55, supported by a very favorable rating (B+) and a very strong Altman Z-Score of 3.42.

TKO Group Holdings, Inc. (TKO) exhibits rapid revenue growth of 67.43% in 2024 but suffers from weak profitability metrics, including a 0.34% net margin and elevated net debt to EBITDA of 3.71. Its financial ratios are mostly unfavorable or neutral, reflected in a moderate rating (B-) and an Altman Z-Score in the grey zone at 2.17, indicating higher financial risk.

Considering ratings and comprehensive financial analysis, FOXA could appear more favorable for risk-averse or quality-oriented investors due to its durable competitive advantage and stable profitability, while TKO might appeal to growth-tolerant investors willing to accept higher risk for potential expansion.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Fox Corporation and TKO Group Holdings, Inc. to enhance your investment decisions: