Fox Corporation (FOXA) and News Corporation (NWSA) are two influential players in the entertainment and media industry, both headquartered in New York City. While Fox focuses on cable networks, broadcast television, and emerging Web3 content, News Corp offers a diverse portfolio including news media, digital real estate, and subscription services. This comparison will help investors identify which company presents the most compelling opportunity in today’s dynamic media landscape.

Table of contents

Companies Overview

I will begin the comparison between Fox Corporation and News Corporation by providing an overview of these two companies and their main differences.

Fox Corporation Overview

Fox Corporation is a U.S.-based entertainment company operating in news, sports, and general entertainment. It runs multiple cable networks including FOX News and FS1, a national broadcast network, and offers digital services like Tubi. Fox also owns 29 television stations and provides production facilities through its FOX Studios Lot. The company focuses on content creation, licensing, and distribution primarily within the U.S. market.

News Corporation Overview

News Corporation is a global media and information services company with diversified operations across six segments such as Digital Real Estate, Subscription Video, and News Media. It owns major newspapers including The Wall Street Journal and The Times, and offers content via print, digital platforms, and broadcasts. Founded in 2012, News Corp also provides publishing, financial data, and online advertising services worldwide, employing a broader workforce.

Key similarities and differences

Both companies operate in the communication services sector, focusing on content creation and distribution. Fox Corporation emphasizes U.S. cable networks, broadcast television, and sports programming, while News Corporation has a wider global reach with diversified media segments including newspapers and digital real estate. Fox is more centered on entertainment and broadcast infrastructure, whereas News Corp integrates publishing, financial information, and real estate services.

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Fox Corporation and News Corporation for the fiscal year 2025.

| Metric | Fox Corporation (FOXA) | News Corporation (NWSA) |

|---|---|---|

| Market Cap | 33.4B | 15.0B |

| Revenue | 16.3B | 8.45B |

| EBITDA | 3.85B | 1.42B |

| EBIT | 3.46B | 956M |

| Net Income | 2.26B | 1.18B |

| EPS | 4.97 | 2.08 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Fox Corporation

Fox Corporation’s revenue increased steadily from 12.9B in 2021 to 16.3B in 2025, with net income rising from 2.15B to 2.26B over the same period. Margins showed some variability, with a slight decline in net margin growth overall. The most recent year saw favorable revenue growth of 16.6% and a 29.3% improvement in net margin, indicating strengthened profitability.

News Corporation

News Corporation experienced fluctuating revenue, peaking at 10.39B in 2022 before declining to 8.45B in 2025. Net income surged from 330M in 2021 to 1.18B in 2025, driven by significant improvements in margins. The latest fiscal year saw modest revenue growth of 2.4% but a strong net margin increase of 333%, reflecting notable earnings efficiency gains.

Which one has the stronger fundamentals?

Both companies demonstrate favorable fundamentals, with Fox showing consistent revenue growth and stable margins, while News exhibits more volatile revenue but exceptional net income and margin expansion. Fox’s wide margin stability contrasts with News’s dramatic margin growth, suggesting differing strengths in operational efficiency and growth trajectories. Overall, each displays solid but distinct financial characteristics.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Fox Corporation (FOXA) and News Corporation (NWSA) for the fiscal year 2025, illustrating profitability, liquidity, leverage, and market valuation metrics.

| Ratios | Fox Corporation (FOXA) | News Corporation (NWSA) |

|---|---|---|

| ROE | 18.9% | 13.4% |

| ROIC | 11.9% | 5.2% |

| P/E | 11.4 | 14.3 |

| P/B | 2.16 | 1.92 |

| Current Ratio | 2.91 | 1.84 |

| Quick Ratio | 2.76 | 1.72 |

| D/E (Debt-to-Equity) | 0.62 | 0.34 |

| Debt-to-Assets | 32.2% | 18.9% |

| Interest Coverage | 8.0 | 95.6 |

| Asset Turnover | 0.70 | 0.55 |

| Fixed Asset Turnover | 6.47 | 3.99 |

| Payout Ratio | 12.2% | 15.7% |

| Dividend Yield | 1.07% | 1.10% |

Interpretation of the Ratios

Fox Corporation

Fox Corporation shows a generally favorable ratio profile with a strong net margin of 13.88% and a high return on equity at 18.92%. Its current and quick ratios indicate good liquidity, while debt levels are moderate. Dividend yield is modest at 1.07%, reflecting a balanced payout supported by stable free cash flow, though share repurchases and payout sustainability warrant monitoring.

News Corporation

News Corporation exhibits a favorable net margin of 13.96%, but its return on equity and invested capital are neutral, indicating moderate profitability. Liquidity ratios are adequate, and leverage is lower than Fox’s, enhancing financial stability. The dividend yield stands at 1.1%, with coverage supported by free cash flow; however, its capital returns are less robust compared to Fox Corporation.

Which one has the best ratios?

Both companies have 64.29% of their ratios rated favorable and no unfavorable ratios. Fox Corporation leads with higher returns on equity and capital employed, while News Corporation has lower debt and stronger interest coverage. Overall, their ratio profiles are comparable, each showing strengths in different financial aspects.

Strategic Positioning

This section compares the strategic positioning of Fox Corporation (FOXA) and News Corporation (NWSA), focusing on market position, key segments, and exposure to technological disruption:

Fox Corporation (FOXA)

- Larger market cap of 33.4B with moderate competitive pressure in U.S. entertainment and media sectors.

- Key segments include Cable Network Programming and Television, driven by news, sports, entertainment, and digital platforms.

- Moderate exposure through digital platforms and Blockchain Creative Labs focused on Web3 content creation and monetization.

News Corporation (NWSA)

- Smaller market cap of 15.0B, facing competitive pressure in global media and information services.

- Diversified segments across Digital Real Estate, Dow Jones, News Media, Book Publishing, and Subscription Video Services.

- Exposure to digital transformation via subscription video and digital real estate services, plus traditional media channels.

Fox Corporation vs News Corporation Positioning

Fox Corporation concentrates on U.S.-based cable and television programming with a strong focus on sports and news, offering moderate digital innovation. News Corporation is more diversified globally across media, publishing, and digital real estate, balancing traditional and digital services with broader segment exposure.

Which has the best competitive advantage?

Fox Corporation demonstrates a very favorable moat with ROIC exceeding WACC by over 6%, signaling durable value creation and efficient capital use. News Corporation has a slightly unfavorable moat, shedding value despite growing ROIC, indicating weaker competitive advantage.

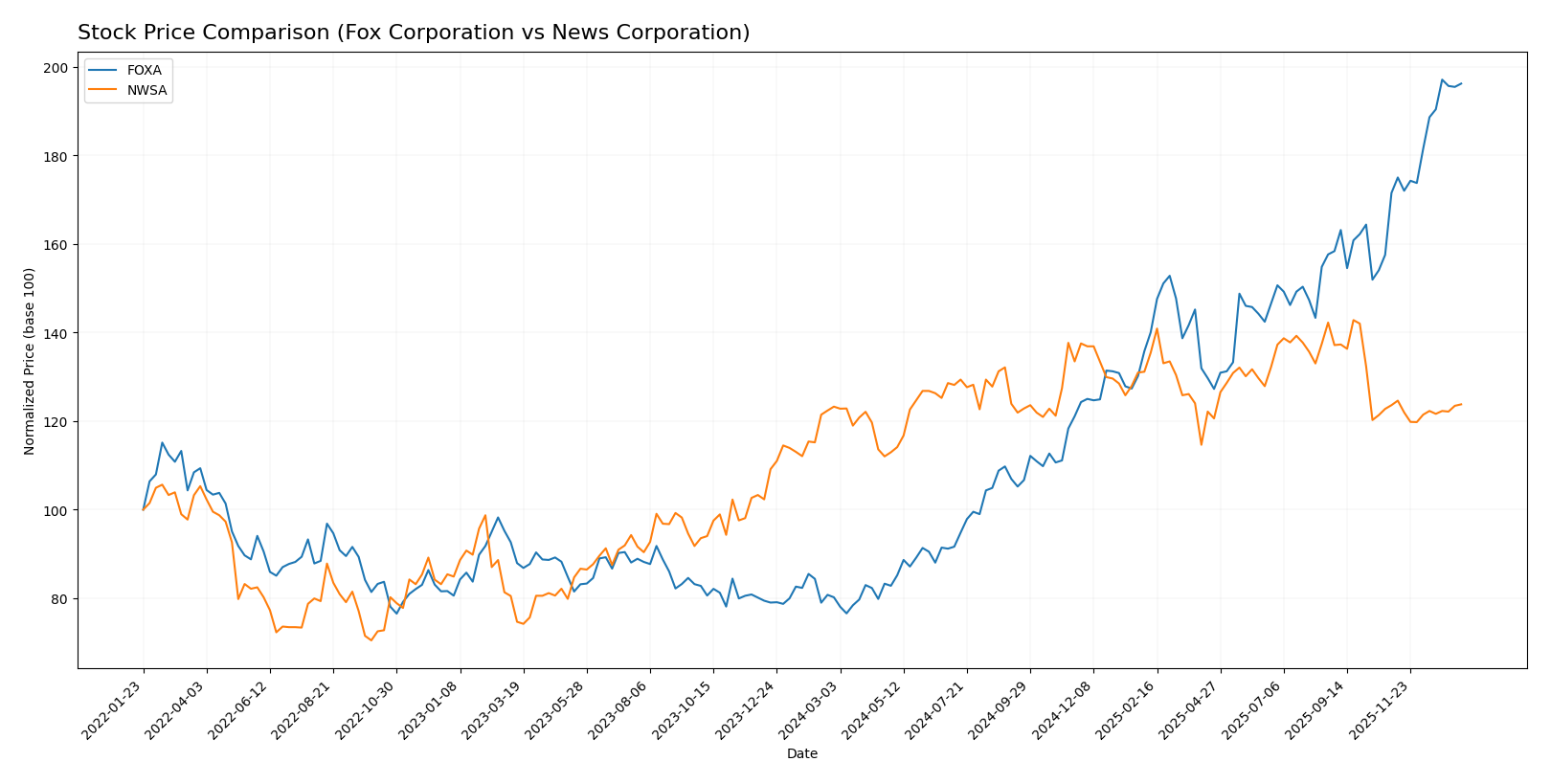

Stock Comparison

The stock price movements of Fox Corporation and News Corporation over the past year reveal distinct trading dynamics, with Fox exhibiting strong gains and accelerating momentum, while News shows marginal growth with signs of deceleration.

Trend Analysis

Fox Corporation’s stock showed a marked bullish trend over the past 12 months with a 144.66% price increase, significant acceleration, and a volatility level indicated by a 12.1 standard deviation. The price ranged between 28.86 and 74.3 during this period.

News Corporation’s stock trend is neutral to mildly bullish with a 0.42% price increase over the same 12-month span, deceleration in trend growth, and low volatility with a 1.5 standard deviation. The price fluctuated between 24.02 and 30.62.

Comparing both stocks, Fox Corporation delivered the highest market performance with a substantially larger price appreciation and stronger trading momentum than News Corporation over the past year.

Target Prices

The current analyst consensus for Fox Corporation and News Corporation shows a moderate upside potential based on verified target prices.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Fox Corporation | 97 | 64 | 76.63 |

| News Corporation | 45 | 16 | 33.33 |

Analysts expect Fox Corporation’s stock to appreciate slightly above the current price of $73.96, while News Corporation shows a wider target range with consensus above its current $26.54 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Fox Corporation and News Corporation:

Rating Comparison

Fox Corporation Rating

- Rating: B+ with a Very Favorable status.

- Discounted Cash Flow Score: 4, indicating Favorable valuation based on future cash flows.

- ROE Score: 4, showing Favorable profit generation from equity.

- ROA Score: 5, reflecting Very Favorable asset utilization.

- Debt To Equity Score: 2, representing Moderate financial risk.

- Overall Score: 3, categorized as Moderate overall performance.

News Corporation Rating

- Rating: B+ with a Very Favorable status.

- Discounted Cash Flow Score: 3, indicating Moderate valuation based on future cash flows.

- ROE Score: 4, showing Favorable profit generation from equity.

- ROA Score: 5, reflecting Very Favorable asset utilization.

- Debt To Equity Score: 2, representing Moderate financial risk.

- Overall Score: 3, categorized as Moderate overall performance.

Which one is the best rated?

Both Fox Corporation and News Corporation share the same overall rating of B+ and identical scores in ROE, ROA, debt-to-equity, and overall categories. Fox Corporation edges slightly ahead with a higher Discounted Cash Flow score, indicating a more favorable valuation on projected cash flows compared to News Corporation.

Scores Comparison

Here is a comparison of the financial scores for Fox Corporation and News Corporation:

Fox Corporation Scores

- Altman Z-Score: 3.42, indicating financial safety

- Piotroski Score: 8, categorized as very strong

News Corporation Scores

- Altman Z-Score: 2.35, placing company in grey zone

- Piotroski Score: 7, rated as strong

Which company has the best scores?

Fox Corporation shows a higher Altman Z-Score, indicating lower bankruptcy risk, and a stronger Piotroski Score compared to News Corporation. Based strictly on these scores, Fox Corporation has the better financial strength indicators.

Grades Comparison

The grades for Fox Corporation and News Corporation from recognized grading companies are as follows:

Fox Corporation Grades

This table summarizes recent grades assigned by reputable firms for Fox Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Maintain | Buy | 2025-12-22 |

| B of A Securities | Maintain | Buy | 2025-12-19 |

| Goldman Sachs | Maintain | Buy | 2025-12-19 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-10-31 |

| TD Cowen | Maintain | Hold | 2025-10-31 |

| Barclays | Maintain | Equal Weight | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| JP Morgan | Maintain | Neutral | 2025-10-31 |

Fox Corporation’s grades predominantly indicate a buy or equivalent rating, with some hold and neutral opinions maintained consistently.

News Corporation Grades

Below is a summary of recent grades assigned by recognized firms for News Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-11-25 |

| Guggenheim | Maintain | Buy | 2025-11-13 |

| JP Morgan | Maintain | Overweight | 2025-08-20 |

| Macquarie | Downgrade | Neutral | 2025-08-06 |

| Morgan Stanley | Maintain | Overweight | 2025-04-11 |

| UBS | Upgrade | Buy | 2025-02-04 |

| Guggenheim | Maintain | Buy | 2025-01-22 |

| Loop Capital | Maintain | Buy | 2024-12-23 |

| Loop Capital | Maintain | Buy | 2024-12-09 |

| Guggenheim | Maintain | Buy | 2024-11-12 |

News Corporation’s grades mainly reflect buy and overweight ratings with a single recent downgrade to neutral.

Which company has the best grades?

Both Fox Corporation and News Corporation hold a consensus “Buy” rating. Fox’s grades show a balance between buy and hold ratings, while News Corporation has more consistent buy and overweight grades with fewer neutral ratings. This suggests News Corporation may have a slightly stronger positive analyst sentiment, potentially influencing investor confidence differently in their portfolio positioning.

Strengths and Weaknesses

Below is a comparison table summarizing the key strengths and weaknesses of Fox Corporation (FOXA) and News Corporation (NWSA) based on their latest financial and operational data.

| Criterion | Fox Corporation (FOXA) | News Corporation (NWSA) |

|---|---|---|

| Diversification | Focused on Cable Network and Television segments; moderate diversification within media | More diversified across Digital Real Estate, Dow Jones, News Services, and Book Publishing |

| Profitability | High profitability with 13.88% net margin and 18.92% ROE; ROIC well above WACC, creating value | Similar net margin (13.96%) but lower ROE (13.45%) and ROIC below WACC, indicating value erosion |

| Innovation | Demonstrates growing ROIC trend (+18.4%), signaling effective innovation and capital use | Also shows growing ROIC trend (+38.4%) but still shedding value overall; innovation improving but results lag |

| Global presence | Strong U.S.-centric media presence; less global diversification | Broader international footprint with diversified businesses |

| Market Share | Large share in cable and television programming markets | Strong presence in news and digital real estate, but more fragmented market share |

In summary, Fox Corporation exhibits a durable competitive advantage with strong profitability and efficient capital use, making it a more favorable investment. News Corporation, while diversified and improving profitability, still faces challenges in value creation despite a positive ROIC trend. Investors should weigh Fox’s focused strength against News’ broader but less efficient portfolio.

Risk Analysis

Below is a comparative table of key risks for Fox Corporation (FOXA) and News Corporation (NWSA) based on their latest 2025 data:

| Metric | Fox Corporation (FOXA) | News Corporation (NWSA) |

|---|---|---|

| Market Risk | Moderate (Beta 0.51) | Moderate-High (Beta 0.97) |

| Debt level | Moderate (D/E 0.62) | Low (D/E 0.34) |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | Moderate |

Fox Corporation shows a moderate market risk with a low beta, suggesting less volatility relative to the market, whereas News Corporation’s higher beta implies greater sensitivity to market swings. Fox has a higher debt level, indicating more leverage risk compared to News Corp. Both face typical regulatory and operational risks inherent in the media sector. Environmental risks are low for both, reflecting limited exposure. Geopolitical tensions could impact international content distribution for both, a notable consideration for investors. Fox’s safer Altman Z-score and very strong Piotroski score reflect sound financial health, while News Corp’s moderate Z-score signals caution despite strong fundamentals.

Which Stock to Choose?

Fox Corporation (FOXA) shows strong income growth with a 16.6% revenue increase in 2025 and favorable profitability metrics, including an 18.9% ROE and a net margin of 13.88%. The company maintains moderate debt levels and a very favorable rating of B+, supported by a very favorable moat status indicating durable competitive advantage.

News Corporation (NWSA) exhibits slower revenue growth at 2.4% but impressive net income and margin expansions over the long term. Its financial ratios are mostly favorable or neutral, with a moderate debt profile and a B+ rating. However, its slightly unfavorable moat status suggests the company is currently shedding value despite growing profitability.

Investors seeking growth and durable competitive advantage might find Fox Corporation appealing given its robust income evolution and very favorable moat. Conversely, those who prioritize stable profitability improvements despite some value erosion could see News Corporation as a potential fit, reflecting different risk tolerances and investment strategies.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Fox Corporation and News Corporation to enhance your investment decisions: