Live Nation Entertainment, Inc. (LYV) and Fox Corporation (FOXA) are two giants in the entertainment sector, each shaping how audiences engage with live events and media content. LYV dominates live music experiences and ticketing, while FOXA excels in news, sports broadcasting, and digital streaming innovation. Their overlapping market presence and distinct innovation strategies make them compelling choices for investors. In this article, I will help you identify which company offers the most intriguing investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Live Nation Entertainment, Inc. and Fox Corporation by providing an overview of these two companies and their main differences.

Live Nation Entertainment, Inc. Overview

Live Nation operates as a live entertainment company, focusing on concerts, ticketing, and sponsorship & advertising. It promotes live music events, manages venues, produces festivals, and offers artist services. The company also manages ticketing operations and sells sponsorships and advertising across its venues and digital platforms. Headquartered in Beverly Hills, CA, it owns or operates 259 entertainment venues globally.

Fox Corporation Overview

Fox Corporation is a U.S.-based news, sports, and entertainment company operating through cable network programming, television, and production services. It owns major cable channels like FOX News and FS1 and runs the FOX Network broadcast and various digital platforms including Tubi. The company also manages production facilities in Los Angeles and owns 29 broadcast stations. Fox is headquartered in New York City, NY.

Key similarities and differences

Both companies operate in the communication services sector with a focus on entertainment but differ in their core activities. Live Nation centers on live events and ticketing services, while Fox emphasizes content creation, broadcasting, and digital media distribution. Live Nation’s revenue is driven by event promotion and ticket sales, whereas Fox’s derives from programming, advertising, and media licensing. Each maintains a significant portfolio of venues or stations complementing their distinct business models.

Income Statement Comparison

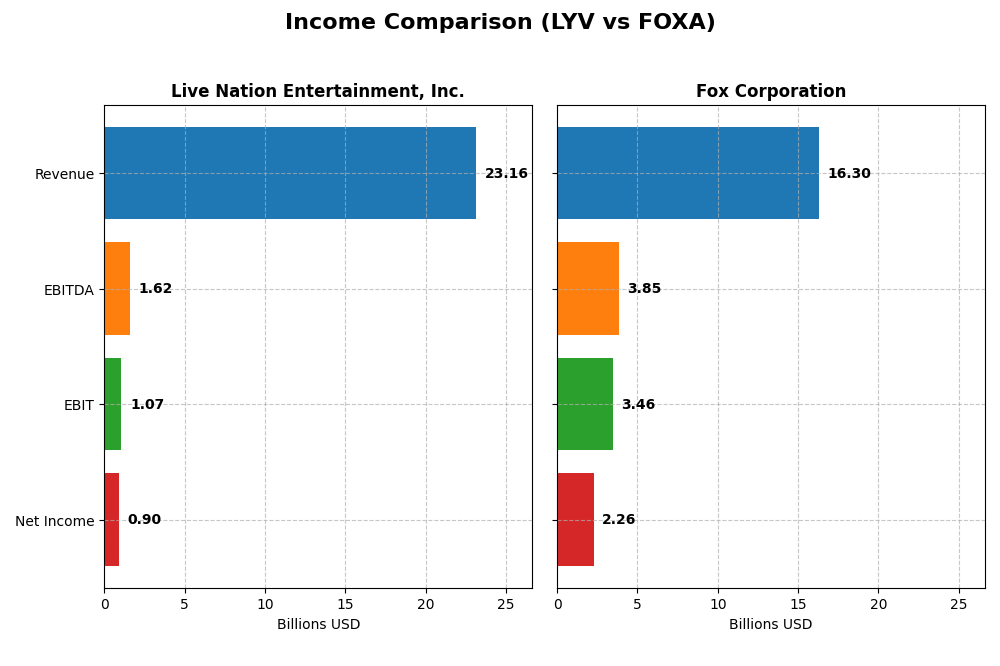

The table below presents a side-by-side comparison of key income statement metrics for Live Nation Entertainment, Inc. and Fox Corporation for their most recent fiscal years.

| Metric | Live Nation Entertainment, Inc. (LYV) | Fox Corporation (FOXA) |

|---|---|---|

| Market Cap | 34.6B | 33.4B |

| Revenue | 23.2B (2024) | 16.3B (2025) |

| EBITDA | 1.62B (2024) | 3.85B (2025) |

| EBIT | 1.07B (2024) | 3.46B (2025) |

| Net Income | 896M (2024) | 2.26B (2025) |

| EPS | 2.77 (2024) | 4.97 (2025) |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Live Nation Entertainment, Inc.

Live Nation’s revenue grew significantly from 2020 to 2024, reaching $23.16B in 2024, with net income improving from a loss in 2020 to $896M in 2024. Gross margins were favorable at 25.17%, while EBIT and net margins remained neutral. In 2024, revenue growth slowed to 1.89%, but net margin and EPS growth showed strong improvement.

Fox Corporation

Fox’s revenue steadily increased to $16.3B by mid-2025, with net income rising to $2.26B. Margins were generally favorable, including a 33.11% gross margin and 21.25% EBIT margin. The most recent year saw a notable 16.6% revenue growth and 38.06% EBIT growth, despite a significant decline in gross profit, indicating operational leverage and margin improvement.

Which one has the stronger fundamentals?

Fox Corporation demonstrates stronger fundamentals with higher and more stable margins, significant recent revenue and EBIT growth, and a favorable overall income statement evaluation. Live Nation shows robust long-term revenue and net income growth but faces margin pressures and slower recent revenue gains, resulting in a more mixed financial profile compared to Fox.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Live Nation Entertainment, Inc. (LYV) and Fox Corporation (FOXA) to facilitate a side-by-side analysis of their financial health and performance as of fiscal year 2024 and mid-2025 respectively.

| Ratios | Live Nation Entertainment, Inc. (2024) | Fox Corporation (2025) |

|---|---|---|

| ROE | 5.17% | 18.92% |

| ROIC | 7.71% | 11.89% |

| P/E | 33.25 | 11.42 |

| P/B | 172.00 | 2.16 |

| Current Ratio | 0.99 | 2.91 |

| Quick Ratio | 0.99 | 2.76 |

| D/E (Debt-to-Equity) | 47.74 | 0.62 |

| Debt-to-Assets | 42.12% | 32.18% |

| Interest Coverage | 2.53 | 8.01 |

| Asset Turnover | 1.18 | 0.70 |

| Fixed Asset Turnover | 5.70 | 6.47 |

| Payout ratio | 0% | 12.24% |

| Dividend yield | 0% | 1.07% |

Interpretation of the Ratios

Live Nation Entertainment, Inc.

Live Nation’s ratios reveal a mixed picture with several unfavorable metrics such as a low current ratio of 0.99 and high price-to-book ratio at 172.0, indicating potential liquidity and valuation concerns. Its return on equity is notably strong at 517.3%, but net margin remains low at 3.87%. The company does not pay dividends, likely due to a reinvestment strategy or growth focus, as free cash flow to equity is negative.

Fox Corporation

Fox Corporation displays generally favorable ratios, including a net margin of 13.88% and a return on equity of 18.92%, reflecting solid profitability and efficient capital use. The company maintains strong liquidity with a current ratio of 2.91 and reasonable debt levels. It pays dividends with a 1.07% yield, supported by stable free cash flow, presenting a balanced shareholder return profile without excessive financial risk.

Which one has the best ratios?

Fox Corporation shows a more favorable ratio profile overall, with a majority of metrics rated positively and no unfavorable flags. In contrast, Live Nation struggles with liquidity and valuation concerns despite strong equity returns. The disparity in dividend policy and free cash flow further underscores Fox’s stronger financial footing relative to Live Nation in this comparison.

Strategic Positioning

This section compares the strategic positioning of Live Nation Entertainment, Inc. (LYV) and Fox Corporation (FOXA) in terms of market position, key segments, and exposure to technological disruption:

Live Nation Entertainment, Inc. (LYV)

- Leading live entertainment company focused on concerts and venues; faces competition in live events and ticketing industries.

- Revenue driven by Concerts ($19B), Ticketing ($3B), and Sponsorship & Advertising (~$1.2B) segments emphasizing live events and related services.

- Exposure to digital disruption through ticketing software and streaming advertising but primarily dependent on physical live events and traditional media.

Fox Corporation (FOXA)

- Major U.S. news, sports, and entertainment provider with strong cable and broadcast presence; competitive in media and content distribution.

- Key segments include Cable Network Programming (~$6.9B) and Television (~$9.3B), focusing on news, sports, and digital content platforms.

- Engages in Web3 content creation and digital platforms like Tubi, indicating active adaptation to technological shifts in media consumption.

LYV vs FOXA Positioning

LYV’s strategy centers on live events and venue operations, creating a concentrated portfolio reliant on physical and ticketing services. FOXA offers a more diversified media approach, combining cable, broadcast, and digital content, balancing traditional and emerging platforms with broader revenue streams.

Which has the best competitive advantage?

FOXA holds a stronger competitive advantage with a very favorable MOAT, generating value and demonstrating durable profitability. LYV shows slightly unfavorable MOAT status, destroying value despite growing profitability, indicating weaker capital efficiency.

Stock Comparison

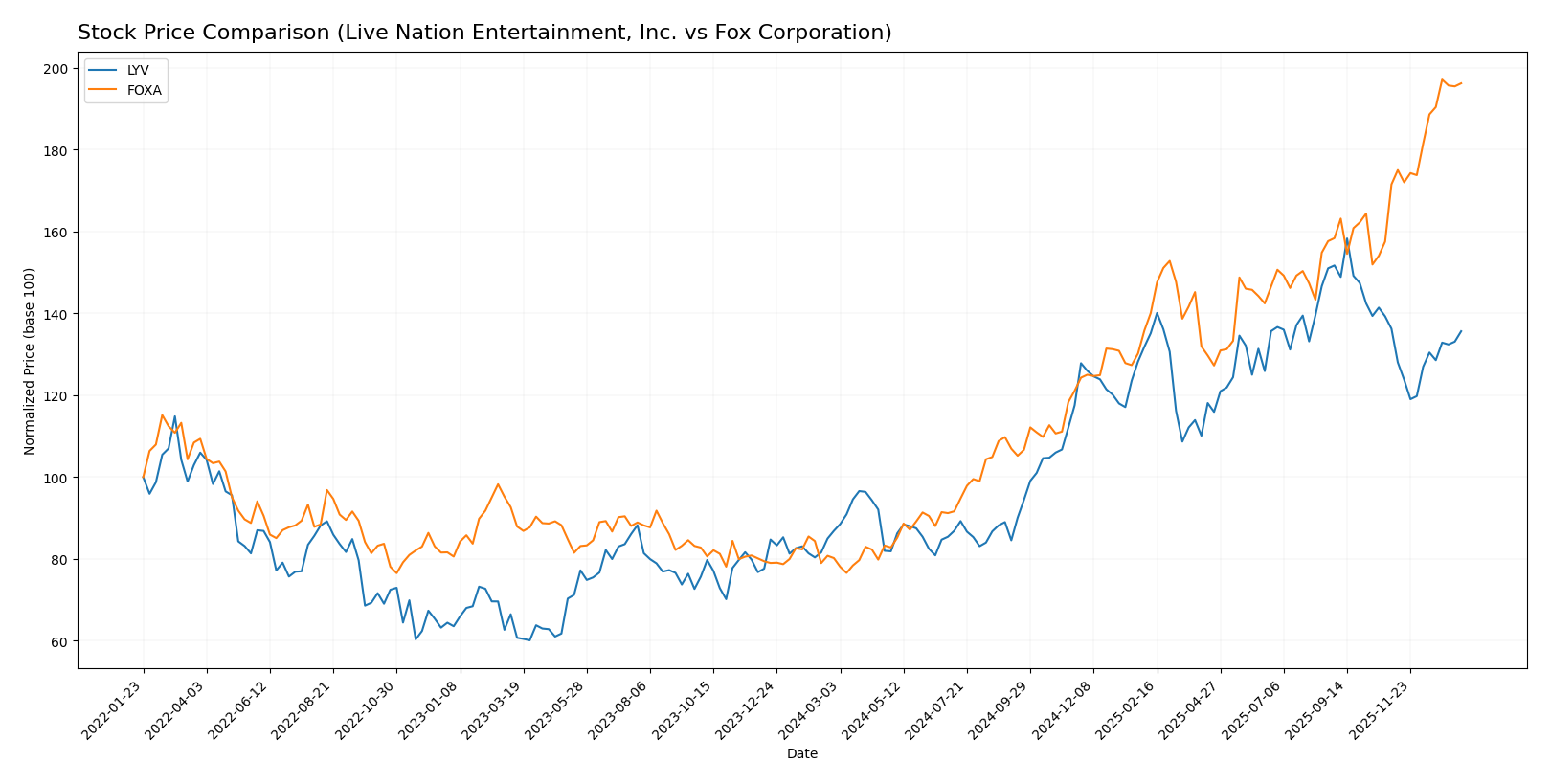

The stock price chart highlights significant bullish trends for both Live Nation Entertainment, Inc. (LYV) and Fox Corporation (FOXA) over the past 12 months, with FOXA showing notably stronger price appreciation and trading volume dynamics.

Trend Analysis

Live Nation Entertainment, Inc. (LYV) experienced a 56.16% price increase over the past 12 months, indicating a bullish trend with acceleration. The stock hit a high of 173.73 and a low of 88.75, with notable volatility (std deviation 23.63).

Fox Corporation (FOXA) showed a stronger bullish trend with a 144.66% price increase over the same period, also accelerating. The stock ranged from 28.86 to 74.3, with moderate volatility (std deviation 12.1).

Comparing both, FOXA delivered higher market performance than LYV, driven by a larger price increase and stronger buyer dominance in recent trading volumes.

Target Prices

Analysts provide a clear target price consensus for Live Nation Entertainment, Inc. and Fox Corporation, reflecting moderate upside potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Live Nation Entertainment, Inc. | 195 | 164 | 180.13 |

| Fox Corporation | 97 | 64 | 76.63 |

The target consensus prices suggest that both stocks have room to grow from their current prices of $148.85 for Live Nation and $73.96 for Fox Corporation, indicating generally positive analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Live Nation Entertainment, Inc. (LYV) and Fox Corporation (FOXA):

Rating Comparison

LYV Rating

- Rating: C+, considered very favorable overall.

- Discounted Cash Flow Score: 1, very unfavorable indicating possible overvaluation.

- ROE Score: 5, very favorable, showing strong profit generation from equity.

- ROA Score: 4, favorable, reflecting effective asset utilization.

- Debt To Equity Score: 1, very unfavorable, implying higher financial risk.

- Overall Score: 2, moderate, summarizing mixed financial strengths and risks.

FOXA Rating

- Rating: B+, also very favorable overall.

- Discounted Cash Flow Score: 4, favorable suggesting better valuation.

- ROE Score: 4, favorable, indicating efficient use of shareholders’ equity.

- ROA Score: 5, very favorable, demonstrating excellent asset efficiency.

- Debt To Equity Score: 2, moderate, indicating lower financial risk.

- Overall Score: 3, moderate, reflecting comparatively better financial health.

Which one is the best rated?

Based strictly on the provided data, FOXA holds a better rating with a B+ compared to LYV’s C+. FOXA also outperforms LYV in discounted cash flow, ROA, and debt-to-equity scores, indicating stronger financial metrics overall.

Scores Comparison

Here is a comparison of the key financial scores for Live Nation Entertainment, Inc. and Fox Corporation:

Live Nation Scores

- Altman Z-Score: 2.12, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 5, considered average financial strength.

Fox Scores

- Altman Z-Score: 3.42, in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 8, considered very strong financial strength.

Which company has the best scores?

Based strictly on the provided data, Fox demonstrates stronger financial health with a safe zone Altman Z-Score and a very strong Piotroski Score. Live Nation’s scores indicate moderate risk and average financial strength.

Grades Comparison

The following is a comparison of the recent grades assigned to Live Nation Entertainment, Inc. and Fox Corporation by established grading companies:

Live Nation Entertainment, Inc. Grades

This table summarizes recent grades from reputable financial institutions for Live Nation Entertainment, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | Maintain | Outperform | 2025-12-23 |

| Guggenheim | Maintain | Buy | 2025-11-18 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| Guggenheim | Maintain | Buy | 2025-11-05 |

| Roth Capital | Maintain | Buy | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-11-05 |

| Susquehanna | Maintain | Positive | 2025-11-03 |

| Deutsche Bank | Maintain | Buy | 2025-10-23 |

| Citigroup | Maintain | Buy | 2025-10-23 |

Overall, Live Nation maintains a strong consensus with consistent “Buy” and “Outperform” grades, indicating positive analyst sentiment.

Fox Corporation Grades

This table summarizes recent grades from reputable financial institutions for Fox Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Maintain | Buy | 2025-12-22 |

| B of A Securities | Maintain | Buy | 2025-12-19 |

| Goldman Sachs | Maintain | Buy | 2025-12-19 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-10-31 |

| TD Cowen | Maintain | Hold | 2025-10-31 |

| Barclays | Maintain | Equal Weight | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| JP Morgan | Maintain | Neutral | 2025-10-31 |

Fox Corporation shows a mixed but generally positive trend with multiple “Buy” ratings balanced by neutral and hold opinions.

Which company has the best grades?

Live Nation Entertainment, Inc. has received predominantly buy and outperform grades from analysts, reflecting stronger confidence compared to Fox Corporation’s more mixed ratings with several hold and neutral opinions. Investors may perceive Live Nation as having clearer upside potential based on these grades.

Strengths and Weaknesses

Below is a comparison of Live Nation Entertainment, Inc. (LYV) and Fox Corporation (FOXA) based on key investment criteria:

| Criterion | Live Nation Entertainment, Inc. (LYV) | Fox Corporation (FOXA) |

|---|---|---|

| Diversification | Focused on concerts (19B in 2024), ticketing, and sponsorship; limited diversification outside live events | Diversified media segments including cable programming (6.9B) and television (9.3B) in 2025 |

| Profitability | Low net margin (3.87%), high ROE (517%), neutral ROIC (7.7%); overall slightly unfavorable financial ratios | Strong profitability with 13.9% net margin, 18.9% ROE, 11.9% ROIC; overall favorable financial ratios |

| Innovation | Moderate, with growing ROIC trend but currently shedding value (ROIC vs. WACC -0.53%) | High, with very favorable moat status and growing ROIC trend (+6.14% vs. WACC) |

| Global presence | Large global concert presence, but revenue concentrated in live events | Broad U.S.-based media reach, less global but strong domestic footprint |

| Market Share | Leader in live entertainment and ticketing markets | Significant share in cable and broadcast television sectors |

Key takeaways: Fox Corporation shows stronger profitability, financial stability, and a durable competitive advantage compared to Live Nation. LYV’s revenue heavily depends on live concerts, which poses concentration risk despite improving profitability trends. Investors should weigh FOXA’s diversified media assets and favorable financials against LYV’s growth potential but current value destruction.

Risk Analysis

Below is a comparative table highlighting key risks for Live Nation Entertainment, Inc. (LYV) and Fox Corporation (FOXA) based on the most recent data available:

| Metric | Live Nation Entertainment, Inc. (LYV) | Fox Corporation (FOXA) |

|---|---|---|

| Market Risk | Beta 1.20, higher volatility | Beta 0.51, lower volatility |

| Debt level | Debt-to-Equity 47.74%, unfavorable | Debt-to-Equity 0.62%, moderate risk |

| Regulatory Risk | Moderate, entertainment industry regulations | Moderate, media and broadcasting regulations |

| Operational Risk | Venue and event disruptions possible | Content production and distribution challenges |

| Environmental Risk | Moderate, event-related environmental impact | Moderate, studio and facility operations impact |

| Geopolitical Risk | Moderate, international venue exposure | Moderate, primarily US-focused but sensitive to global content trends |

Live Nation shows higher financial leverage and market volatility, increasing financial and market risks. Fox boasts stronger financial stability and profitability, making its risks more operational and regulatory in nature. Investors should weigh Live Nation’s higher debt and event-related uncertainties against Fox’s steadier financials and content-driven challenges.

Which Stock to Choose?

Live Nation Entertainment, Inc. (LYV) shows a favorable income statement with strong revenue and net income growth, yet its financial ratios are slightly unfavorable due to high debt and low liquidity. Profitability is improving but remains moderate, reflected in a very favorable ROE and a slightly unfavorable overall rating.

Fox Corporation (FOXA) exhibits a favorable income statement with solid revenue growth and strong profitability metrics, supported by favorable financial ratios including low debt and high liquidity. Its profitability and rating are very favorable, with a durable competitive advantage indicated by a growing ROIC above WACC.

For investors prioritizing stable profitability and strong financial health, FOXA might appear more favorable, while those focusing on significant growth potential amid higher leverage could see LYV as an opportunity. The choice could depend on the investor’s risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Live Nation Entertainment, Inc. and Fox Corporation to enhance your investment decisions: