Home > Comparison > Technology > KEYS vs FTV

The strategic rivalry between Keysight Technologies, Inc. and Fortive Corporation shapes the competitive landscape of the technology hardware sector. Keysight operates as a specialized electronic design and test solutions provider, while Fortive delivers diversified professional engineered products and software services. This head-to-head highlights a contest between niche innovation and broad industrial integration. This analysis aims to clarify which corporate trajectory offers superior risk-adjusted returns for a diversified investor portfolio.

Table of contents

Companies Overview

Keysight Technologies and Fortive Corporation stand as key players in the hardware and equipment sector, shaping technology markets worldwide.

Keysight Technologies, Inc.: Precision Test Solutions Leader

Keysight Technologies dominates the electronic design and test solutions market, generating revenue by selling advanced test instruments and software. Its strategic focus in 2026 centers on expanding its portfolio in communications and aerospace sectors, leveraging high-performance network test platforms and precision measurement tools to maintain a competitive edge.

Fortive Corporation: Diversified Industrial Tech Innovator

Fortive Corporation operates across multiple industries through professional engineered products and software. Its revenue engine relies on connected reliability tools and lifecycle software across manufacturing, healthcare, and energy markets. In 2026, Fortive emphasizes integrated software solutions and hardware innovation to enhance operational efficiency and expand its industrial software footprint.

Strategic Collision: Similarities & Divergences

Both companies excel in hardware and software integration but target distinct industries. Keysight focuses on high-precision test solutions for communications and defense, while Fortive serves broad industrial verticals with reliability and lifecycle tools. Their primary battleground lies in delivering value through innovation, yet their investment profiles diverge: Keysight is tech-centric with a narrower niche, Fortive is diversified with broader industrial exposure.

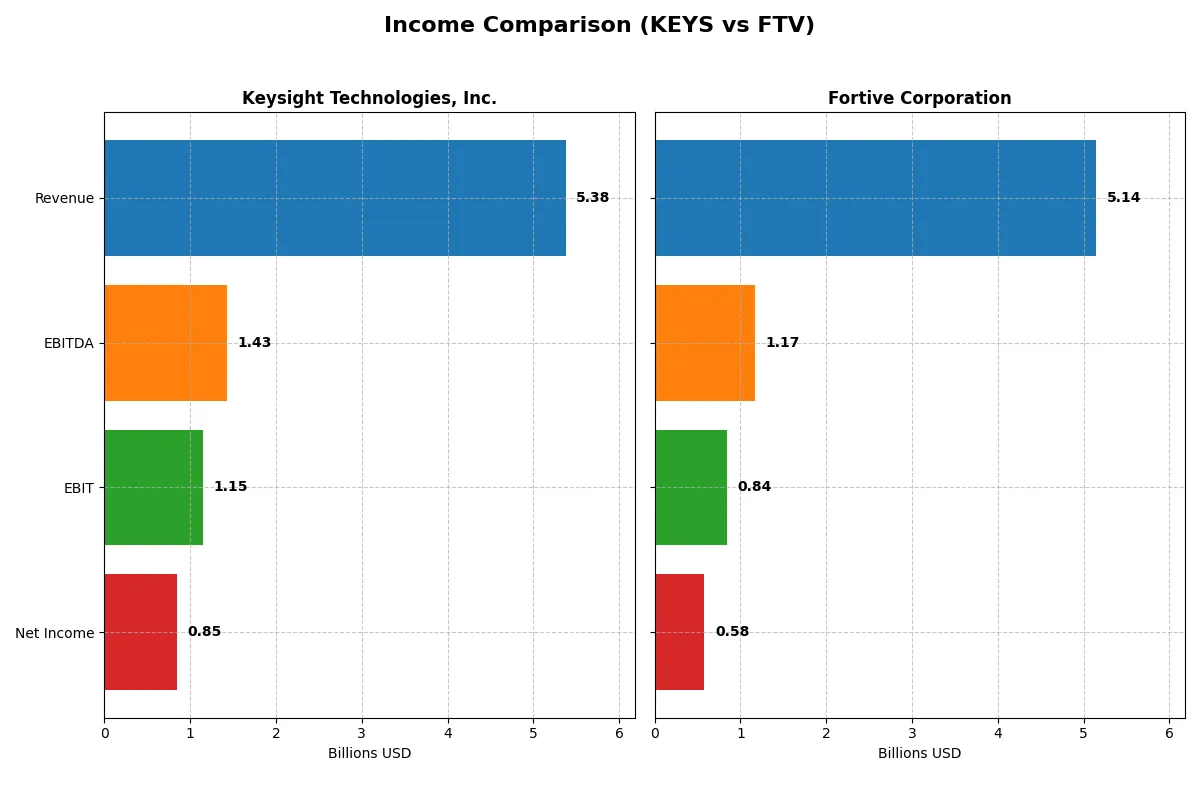

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Keysight Technologies, Inc. (KEYS) | Fortive Corporation (FTV) |

|---|---|---|

| Revenue | 5.38B | 5.14B |

| Cost of Revenue | 2.04B | 2.01B |

| Operating Expenses | 2.39B | 2.23B |

| Gross Profit | 3.34B | 3.13B |

| EBITDA | 1.43B | 1.17B |

| EBIT | 1.15B | 843M |

| Interest Expense | 96M | 121M |

| Net Income | 846M | 579M |

| EPS | 4.9 | 1.75 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs the most efficient and profitable corporate engine in recent years.

Keysight Technologies, Inc. Analysis

Keysight’s revenue rose steadily to $5.4B in 2025, with net income at $846M, reflecting strong operational discipline. Its gross margin of 62.1% and net margin of 15.7% remain robust. The 2025 figures show improved EBIT growth of 21%, signaling momentum and efficient cost management despite slight net income decline over five years.

Fortive Corporation Analysis

Fortive’s revenue declined 17.5% to $5.1B in 2025, with net income dropping to $579M. It maintains a solid gross margin near 61%, but net margin slipped to 11.3%. EBIT fell 25% year-over-year, reflecting weakening operational leverage. The overall trend shows deteriorating top-line and bottom-line results, despite a modest EPS gain over five years.

Margin Strength vs. Revenue Momentum

Keysight leads with superior margin expansion and EBIT growth, while Fortive struggles with shrinking revenue and earnings. Keysight’s operational efficiency and margin stability position it as the clear fundamental winner. Investors seeking reliable earnings momentum will find Keysight’s profile more compelling.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Keysight Technologies (KEYS) | Fortive Corporation (FTV) |

|---|---|---|

| ROE | 14.40% | 8.98% |

| ROIC | 8.02% | 7.44% |

| P/E | 37.41 | 30.16 |

| P/B | 5.39 | 2.71 |

| Current Ratio | 2.35 | 0.71 |

| Quick Ratio | 1.78 | 0.58 |

| D/E | 0.51 | 0.50 |

| Debt-to-Assets | 26.31% | 27.31% |

| Interest Coverage | 9.88 | 7.54 |

| Asset Turnover | 0.48 | 0.44 |

| Fixed Asset Turnover | 5.21 | 19.06 |

| Payout ratio | 0 | 15.9% |

| Dividend yield | 0 | 0.53% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering operational strength and hidden risks essential for investment insight.

Keysight Technologies, Inc.

Keysight shows solid profitability with a 14.4% ROE and a favorable 15.74% net margin, reflecting efficient core operations. However, its valuation appears stretched, with a high P/E of 37.41 and P/B of 5.39. The company pays no dividend, instead reinvesting heavily in R&D (18.7% of revenue), signaling a growth-focus strategy.

Fortive Corporation

Fortive posts a lower 8.98% ROE and an 11.26% net margin, suggesting less profitability but still favorable performance. Its valuation is relatively lower with a P/E of 30.16 and P/B at 2.71, though the current ratio of 0.71 flags liquidity risk. Fortive offers a modest 0.53% dividend yield, balancing shareholder returns with moderate debt levels.

Growth Ambition vs. Cash Yield: A Ratio Verdict

Keysight commands a premium valuation driven by robust profitability and aggressive R&D reinvestment, fitting growth-oriented investors. Fortive offers a more conservative valuation, weaker profitability, but provides some dividend income and carries liquidity risks. Investors seeking growth should lean toward Keysight; income-focused ones might prefer Fortive’s yield despite its operational challenges.

Which one offers the Superior Shareholder Reward?

I find Keysight Technologies (KEYS) follows a zero-dividend policy, reinvesting all free cash flow into growth, supported by a high FCF per share of 7.4 and a strong cash ratio above 1. Fortive (FTV) offers a modest 0.53% dividend yield, with a sustainable payout ratio around 13-16%, plus steady buybacks. KEYS’s aggressive reinvestment strategy and robust cash flow coverage suggest superior long-term value creation compared to FTV’s income-focused model. I conclude KEYS delivers a more attractive total return profile for 2026 investors aiming for growth and capital appreciation.

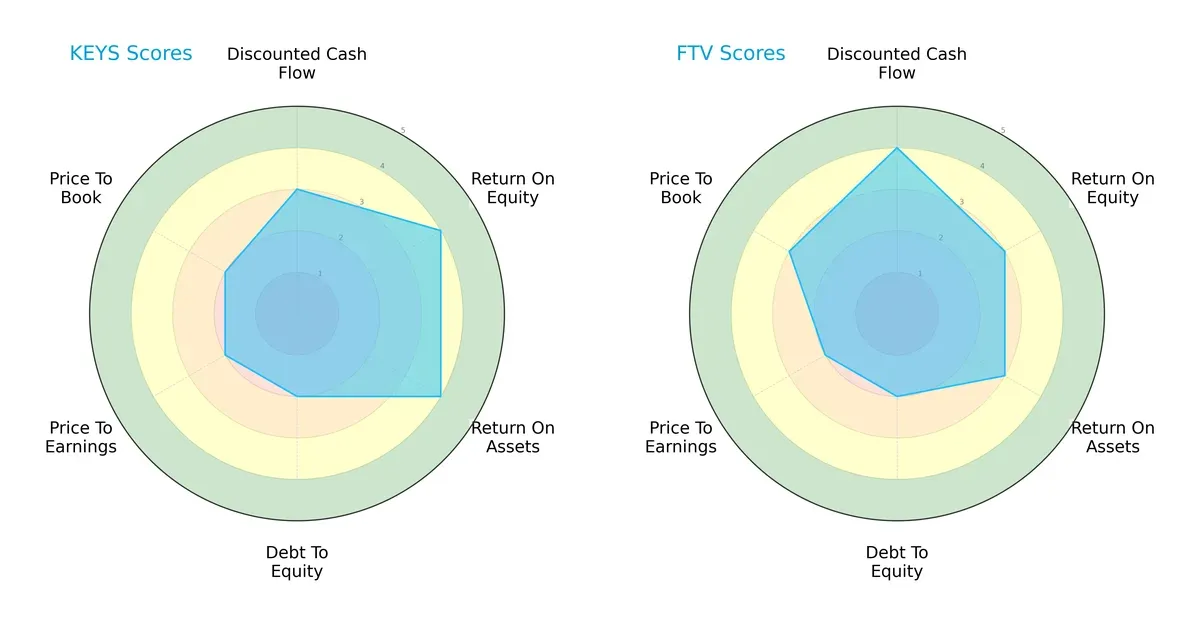

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Keysight Technologies, Inc. and Fortive Corporation in key financial dimensions:

Keysight shows higher efficiency with ROE and ROA scores at 4 versus Fortive’s 3, reflecting better asset and equity utilization. Fortive edges out in discounted cash flow with a 4, signaling stronger cash generation expectations. Both share weaknesses in debt management (score 2) and P/E valuation (score 2), but Fortive’s slightly better price-to-book score (3 vs. 2) suggests marginally more attractive valuation metrics. Overall, Keysight relies on operational efficiency, while Fortive presents a more balanced growth and valuation profile.

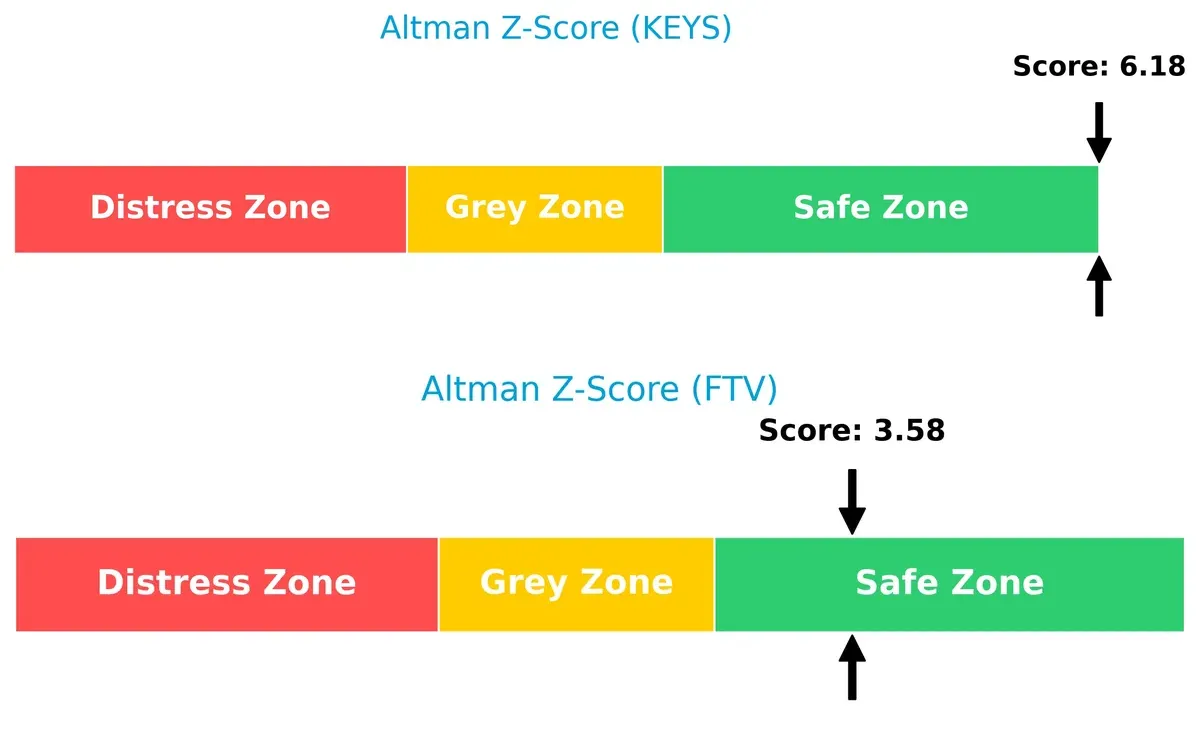

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score delta shows Keysight at 6.18 and Fortive at 3.58, both safely above distress thresholds, implying robust long-term survival prospects in this cycle:

Keysight’s superior score highlights a stronger buffer against financial distress, reflecting better solvency and operational stability. Fortive remains comfortably positioned but with less margin for economic shocks.

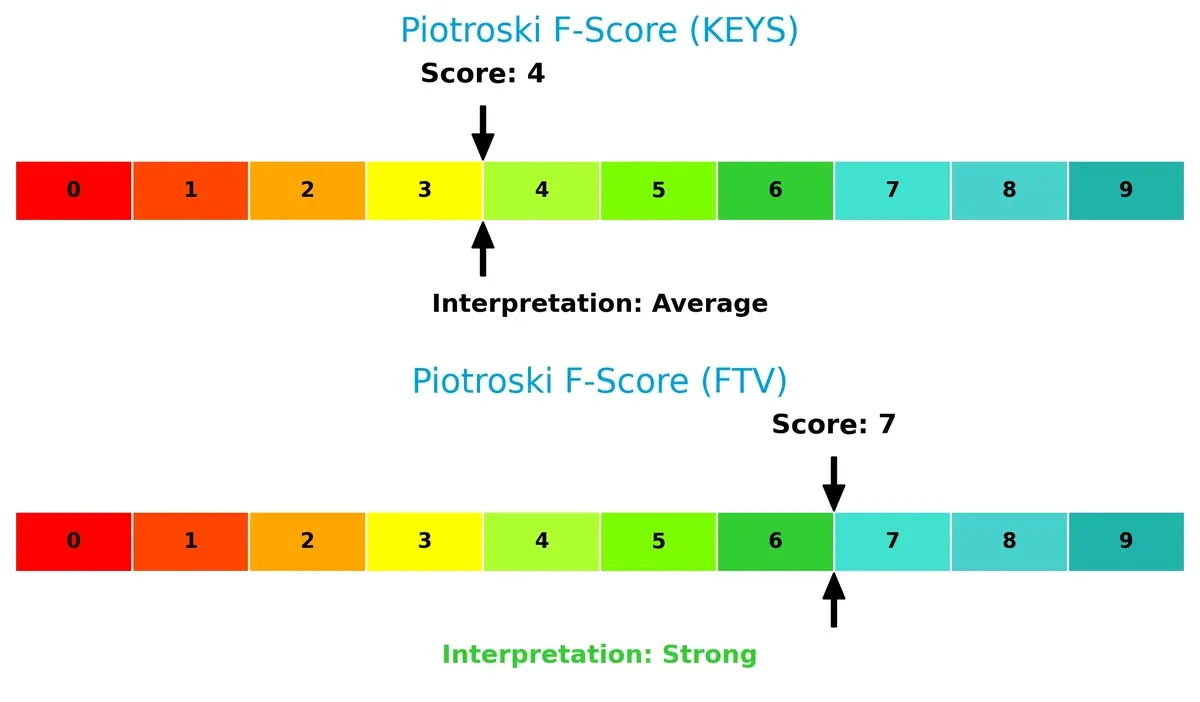

Financial Health: Quality of Operations

Keysight’s Piotroski F-Score of 4 versus Fortive’s 7 reveals a notable difference in internal financial quality and operational health:

Fortive demonstrates stronger fundamentals and fewer red flags, suggesting more reliable profitability, liquidity, and efficiency metrics. Keysight’s average score signals potential internal weaknesses that investors should monitor carefully.

How are the two companies positioned?

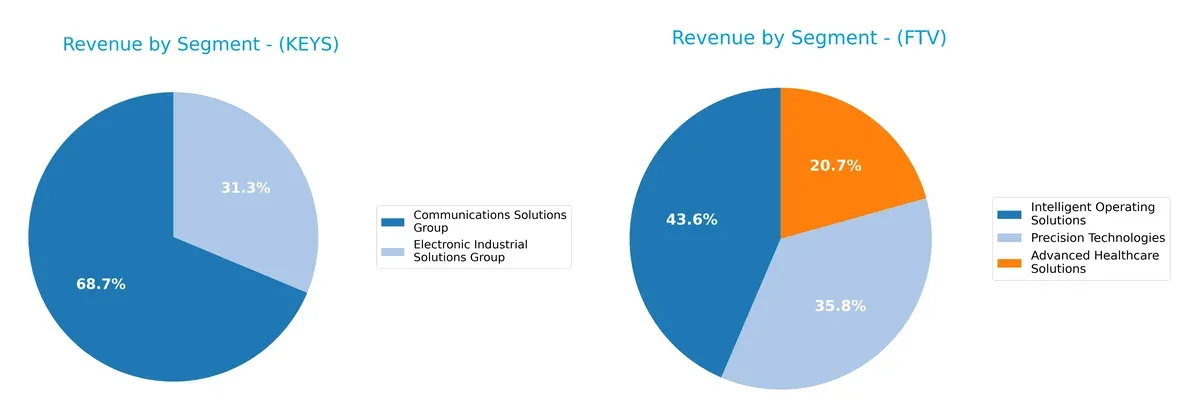

This section dissects the operational DNA of KEYS and FTV by comparing their revenue distribution and internal dynamics—strengths and weaknesses. The goal is to confront their economic moats to reveal which business model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following comparison dissects how Keysight Technologies and Fortive diversify their income streams and reveals their primary sector bets for strategic positioning:

Keysight relies heavily on its Communications Solutions Group, generating $3.42B in 2024, dwarfing its $1.56B Electronic Industrial Solutions revenue. This concentration anchors its market dominance but adds sector risk. Fortive displays a more balanced mix with $2.71B from Intelligent Operating Solutions, $2.23B from Precision Technologies, and $1.29B in Advanced Healthcare Solutions. Fortive’s diversification reduces dependence on any single segment, enhancing resilience amid market shifts.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Keysight Technologies, Inc. (KEYS) and Fortive Corporation (FTV):

KEYS Strengths

- Strong net margin at 15.74%

- Favorable liquidity ratios (current 2.35, quick 1.78)

- Low debt-to-assets at 26.31%

- High fixed asset turnover (5.21)

FTV Strengths

- Favorable net margin at 11.26%

- Low WACC (7.86%) supports capital efficiency

- Favorable debt-to-equity (0.5) and debt-to-assets (27.31%)

- Very high fixed asset turnover (19.06)

KEYS Weaknesses

- High valuation multiples (PE 37.41, PB 5.39)

- Unfavorable asset turnover (0.48)

- No dividend yield

- Neutral ROE (14.4%) below sector leaders

FTV Weaknesses

- Low current (0.71) and quick ratios (0.58) signal liquidity risks

- Unfavorable ROE (8.98%) below cost of capital

- Unfavorable PE ratio (30.16)

- Slightly unfavorable dividend yield (0.53%)

I observe that KEYS excels in profitability and liquidity, reflecting solid financial health but carries high valuation risks. FTV shows operational efficiency and capital cost advantages but faces liquidity constraints and weaker returns. Both companies must balance growth and financial prudence within their strategies.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only barrier protecting long-term profits from relentless competitive erosion. Let’s dissect the moats of Keysight Technologies and Fortive Corporation:

Keysight Technologies, Inc.: Intangible Asset Moat

Keysight leverages proprietary test solutions and software, creating high switching costs. This moat shows in stable 21.4% EBIT margins and 62% gross margins. However, declining ROIC signals pressure; new markets in 2026 must deepen its technological edge.

Fortive Corporation: Operational Efficiency Moat

Fortive’s moat stems from integrated software and hardware platforms optimizing industrial processes. Unlike Keysight, Fortive’s ROIC is rising despite value destruction, reflecting improving capital efficiency. Expansion in connected reliability tools could bolster its competitive position in 2026.

Verdict: Intangible Assets vs. Operational Efficiency

Keysight’s moat is deeper but weakening due to falling ROIC. Fortive’s operational moat is narrower yet improving, with a rising ROIC trend. Fortive appears better positioned to defend and grow its market share in the near term.

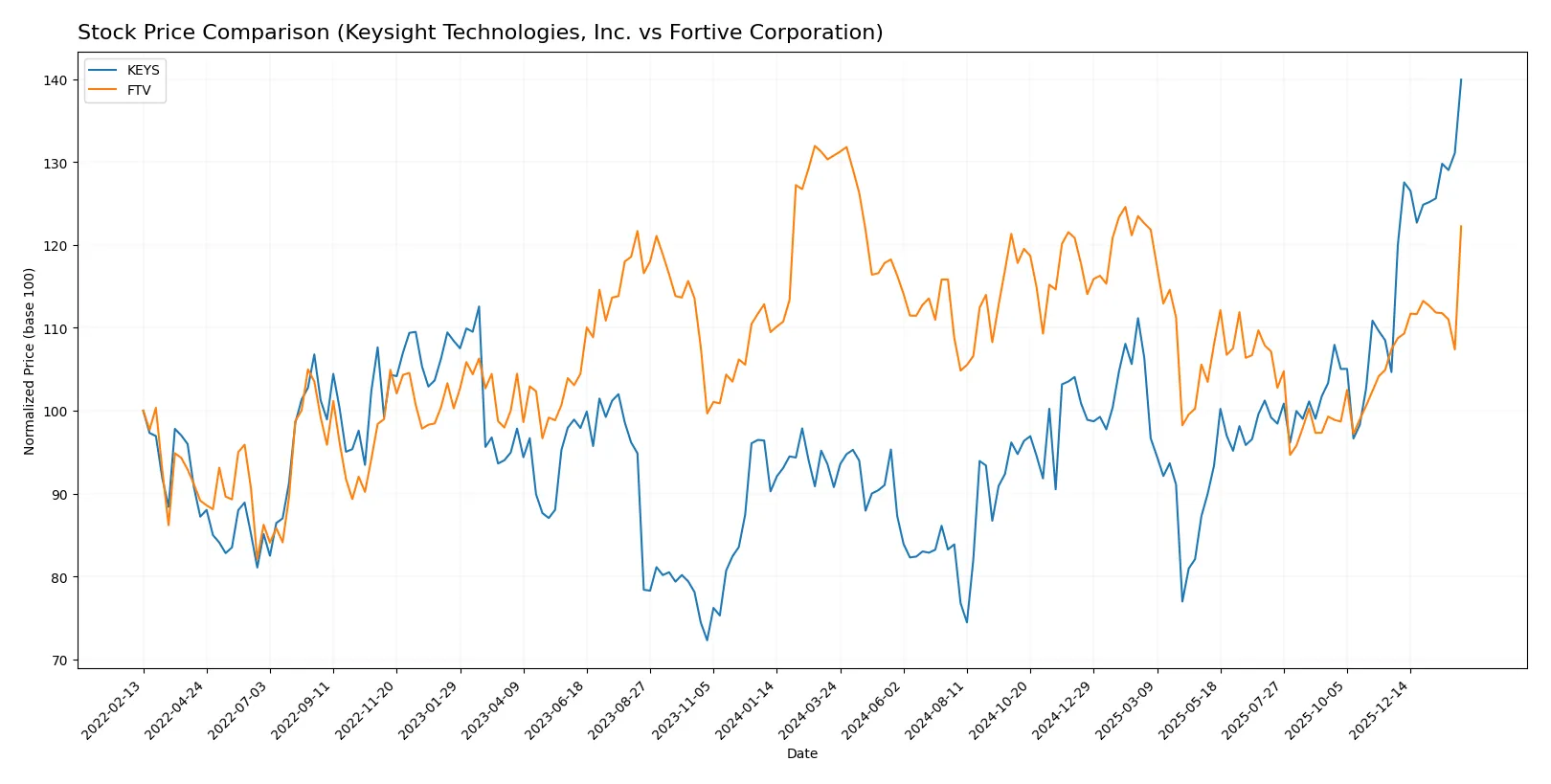

Which stock offers better returns?

The stock prices of Keysight Technologies, Inc. and Fortive Corporation show contrasting dynamics over the past year, with Keysight exhibiting significant gains and Fortive facing declines amid differing volume trends.

Trend Comparison

Keysight Technologies’ stock rose 54.17% over 12 months, signaling a bullish trend with accelerating momentum. It reached a high of 230.95 and a low of 122.87, showing notable volatility (std dev 21.19).

Fortive’s stock declined 6.53% in the same period, reflecting a bearish trend despite accelerating movement. Its price ranged between 46.55 and 64.82 with low volatility (std dev 4.16).

Keysight outperformed Fortive by a wide margin, delivering the highest market returns over the past year based on the provided data.

Target Prices

Analysts offer a cautiously optimistic target consensus for Keysight Technologies and Fortive Corporation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Keysight Technologies, Inc. | 220 | 243 | 229 |

| Fortive Corporation | 51 | 70 | 59.83 |

Keysight’s target consensus aligns closely with its current price of $230.95, suggesting limited upside. Fortive’s consensus target at $59.83 is just below its current price of $60.12, indicating a neutral near-term outlook.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Keysight Technologies, Inc. Grades

The following table summarizes recent institutional grades for Keysight Technologies, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2025-12-17 |

| Jefferies | Maintain | Hold | 2025-12-10 |

| Baird | Maintain | Outperform | 2025-11-26 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-25 |

| Jefferies | Maintain | Hold | 2025-11-25 |

| Wells Fargo | Maintain | Overweight | 2025-11-25 |

| UBS | Maintain | Buy | 2025-11-25 |

| JP Morgan | Maintain | Overweight | 2025-11-25 |

| Barclays | Maintain | Overweight | 2025-11-25 |

| Susquehanna | Maintain | Positive | 2025-11-25 |

Fortive Corporation Grades

The following table summarizes recent institutional grades for Fortive Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-02-05 |

| RBC Capital | Maintain | Sector Perform | 2026-02-05 |

| Citigroup | Maintain | Neutral | 2026-02-05 |

| JP Morgan | Downgrade | Underweight | 2026-01-16 |

| Mizuho | Downgrade | Underperform | 2026-01-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-22 |

| Citigroup | Maintain | Neutral | 2025-12-08 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-05 |

| Baird | Maintain | Outperform | 2025-11-04 |

| JP Morgan | Maintain | Neutral | 2025-10-30 |

Which company has the best grades?

Keysight Technologies consistently receives more favorable grades, including multiple Overweight and Buy ratings. Fortive’s recent downgrades to Underweight and Underperform highlight increased caution. Investors may perceive Keysight as having stronger institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Keysight Technologies, Inc.

- Faces high valuation multiples (PE 37.4) signaling pressure to justify growth; operates in competitive test equipment markets.

Fortive Corporation

- Trades at lower PE (30.2) but contends with diverse industrial segments and evolving software service demand.

2. Capital Structure & Debt

Keysight Technologies, Inc.

- Moderate debt-to-equity (0.51) with strong interest coverage (11.98) indicates prudent leverage control.

Fortive Corporation

- Similar debt-to-equity (0.50) but lower interest coverage (7.0) suggests tighter debt servicing capacity.

3. Stock Volatility

Keysight Technologies, Inc.

- Beta at 1.20 implies above-market volatility, raising sensitivity to sector swings.

Fortive Corporation

- Beta 1.03 shows volatility closer to market average, offering slightly less risk.

4. Regulatory & Legal

Keysight Technologies, Inc.

- Exposure to aerospace, defense, and government contracts may invite regulatory scrutiny and compliance risks.

Fortive Corporation

- Diverse industrial and healthcare verticals face complex regulatory environments, increasing compliance costs.

5. Supply Chain & Operations

Keysight Technologies, Inc.

- Complex global supply chains in semiconductors and hardware components create operational risks and potential bottlenecks.

Fortive Corporation

- Broad product portfolio across manufacturing and healthcare sectors may dilute operational focus amid supply disruptions.

6. ESG & Climate Transition

Keysight Technologies, Inc.

- Technology focus demands innovation in energy-efficient products; ESG pressure rising from enterprise customers.

Fortive Corporation

- Industrial exposure necessitates adaptation to stricter environmental regulations and sustainable practices.

7. Geopolitical Exposure

Keysight Technologies, Inc.

- Significant revenue from Americas, Europe, Asia-Pacific exposes it to trade tensions and geopolitical risks.

Fortive Corporation

- Global footprint in sensitive sectors like healthcare and industrial automation subjects it to geopolitical instability.

Which company shows a better risk-adjusted profile?

Keysight faces valuation and volatility risks but benefits from stronger liquidity and interest coverage. Fortive shows operational complexity and weaker liquidity ratios but a stronger Piotroski score and moderate volatility. Keysight’s Altman Z-Score of 6.18 versus Fortive’s 3.58 confirms superior financial safety. However, Fortive’s broader industrial base may cushion cyclical shocks. Overall, Keysight demonstrates a better risk-adjusted profile driven by robust balance sheet metrics and liquidity, despite higher valuation pressure.

Final Verdict: Which stock to choose?

Keysight Technologies, Inc. (KEYS) stands out as a cash-generating powerhouse with robust operational efficiency and a resilient balance sheet. Its challenge lies in a declining return on invested capital, signaling caution on long-term value creation. KEYS suits investors targeting aggressive growth with a tolerance for cyclical swings.

Fortive Corporation (FTV) leverages a strategic moat in operational diversification and growing profitability, despite recent revenue softness. Its stronger financial stability and improving returns make it a safer harbor relative to KEYS. FTV fits well in Growth at a Reasonable Price (GARP) portfolios seeking measured upside with lower volatility.

If you prioritize high growth and can weather value erosion risks, KEYS offers compelling upside through operational strength and cash flow. However, if you seek better stability and a gradually improving moat, FTV outshines with a balanced risk-reward profile. Both present distinct analytical scenarios depending on your investment strategy and risk appetite.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Keysight Technologies, Inc. and Fortive Corporation to enhance your investment decisions: