Home > Comparison > Technology > FTNT vs GDDY

The strategic rivalry between Fortinet, Inc. and GoDaddy Inc. shapes the evolving landscape of technology infrastructure. Fortinet operates as a capital-intensive cybersecurity hardware and software provider, delivering integrated security solutions worldwide. In contrast, GoDaddy focuses on cloud-based domain registration and hosting services, catering primarily to small businesses and individuals. This analysis compares their distinct operational models to determine which offers a superior risk-adjusted return for a diversified portfolio.

Table of contents

Companies Overview

Fortinet and GoDaddy stand as key players in the technology infrastructure sector, shaping digital security and presence.

Fortinet, Inc.: Cybersecurity Infrastructure Leader

Fortinet dominates the cybersecurity market with integrated hardware and software solutions like FortiGate firewalls and endpoint protection. Its revenue stems mainly from security subscriptions and technical services. In 2026, it sharpens its focus on expanding automated cybersecurity platforms across global industries, enhancing network defense and management capabilities.

GoDaddy Inc.: Digital Identity and Web Services Provider

GoDaddy leads in cloud-based digital identity and web hosting services. It generates revenue via domain registration, website hosting, and marketing tools aimed at small businesses and individuals. The company prioritizes enhancing its online marketing and e-commerce tools in 2026 to empower customers’ digital presence and seamless online transactions.

Strategic Collision: Similarities & Divergences

Both companies operate in technology infrastructure but diverge in strategy: Fortinet emphasizes closed, secure ecosystems, while GoDaddy offers open, scalable web solutions. Their primary battleground is the digital security and presence market, targeting overlapping customer bases. Fortinet appeals as a security infrastructure play, whereas GoDaddy profiles as a growth-oriented platform provider.

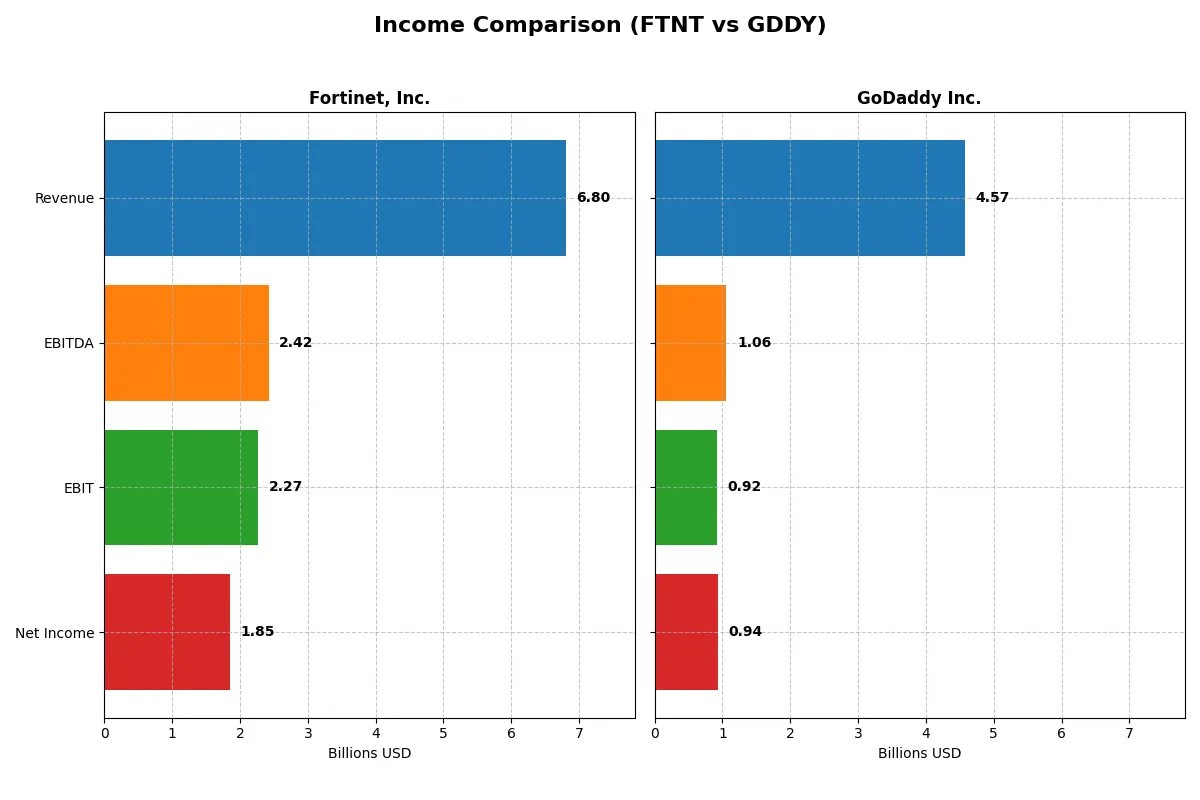

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Fortinet, Inc. (FTNT) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Revenue | 6.8B | 4.6B |

| Cost of Revenue | 1.3B | 1.7B |

| Operating Expenses | 3.4B | 2.0B |

| Gross Profit | 5.5B | 2.9B |

| EBITDA | 2.4B | 1.1B |

| EBIT | 2.3B | 924M |

| Interest Expense | 20M | 158M |

| Net Income | 1.9B | 937M |

| EPS | 2.44 | 6.63 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals how efficiently each company converts revenue into profit, highlighting operational strength and margin discipline.

Fortinet, Inc. Analysis

Fortinet’s revenue surged from 3.3B in 2021 to nearly 6.8B in 2025, more than doubling over five years. Net income followed suit, climbing to 1.85B in 2025. The company maintains robust gross (80.8%) and net margins (27.3%), signaling superior cost control. Its 2025 performance shows strong momentum with a 14% revenue increase and an expanding EBIT margin of 33.4%.

GoDaddy Inc. Analysis

GoDaddy grew revenue steadily from 3.3B in 2020 to 4.57B in 2024, a 38% rise. Net income ballooned even more impressively to 937M in 2024, despite a dip in EPS and net margin last year. Its gross margin sits at a solid 63.9%, while net margin hovers around 20.5%. Recent EBIT growth surged 58%, reflecting operational leverage despite mixed net margin trends.

Margin Dominance vs. Earnings Momentum

Fortinet leads in margin quality and scale, delivering over 27% net margin and substantial EBIT growth, reflecting tight expense management. GoDaddy shows impressive net income growth and a sharp EBIT rebound but operates with thinner margins and a recent net margin decline. For investors prioritizing margin sustainability and efficiency, Fortinet’s profile appears more attractive.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Fortinet, Inc. (FTNT) | GoDaddy Inc. (GDDY) |

|---|---|---|

| ROE | 150% | 135% |

| ROIC | 29% | 16% |

| P/E | 32.5 | 29.8 |

| P/B | 48.6 | 40.3 |

| Current Ratio | 1.17 | 0.72 |

| Quick Ratio | 1.09 | 0.72 |

| D/E | 0.81 | 5.63 |

| Debt-to-Assets | 9.6% | 47.3% |

| Interest Coverage | 104 | 5.64 |

| Asset Turnover | 0.65 | 0.56 |

| Fixed Asset Turnover | 4.20 | 22.22 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and operational strengths that shape investor confidence and valuation.

Fortinet, Inc.

Fortinet shows superior profitability with a ROE of 149.77% and a strong net margin of 27.26%. Despite this efficiency, its P/E ratio of 32.48 signals a stretched valuation. The company retains earnings for growth and R&D, foregoing dividends, reflecting a reinvestment strategy aimed at sustaining competitive edges and shareholder value.

GoDaddy Inc.

GoDaddy boasts a solid ROE of 135.37% and a respectable net margin of 20.49%, but a P/E of 29.76 also suggests premium pricing. The firm carries higher debt levels and a weak liquidity profile. Like Fortinet, GoDaddy reinvests profits rather than paying dividends, focusing on growth initiatives and operational improvements.

Premium Profitability vs. Liquidity Concerns

Fortinet offers a better balance of high returns and manageable debt, though at a premium valuation. GoDaddy’s risk profile is elevated by weaker liquidity and heavier leverage. Investors seeking operational efficiency with moderate risk may lean towards Fortinet’s profile, while those accepting higher financial risk might consider GoDaddy’s growth potential.

Which one offers the Superior Shareholder Reward?

Fortinet and GoDaddy both abstain from dividends, focusing on reinvestment and buybacks. Fortinet’s free cash flow per share stands at $2.9B, with no dividend payout but a steady buyback program enhancing shareholder value. GoDaddy boasts higher free cash flow per share at $8.9B but carries a heavier debt load, pressuring its leverage metrics. Fortinet’s conservative capital structure and superior operating margins support sustainable buybacks, while GoDaddy’s aggressive debt ratio raises risk. I conclude Fortinet offers a more attractive, sustainable total return profile for 2026 investors.

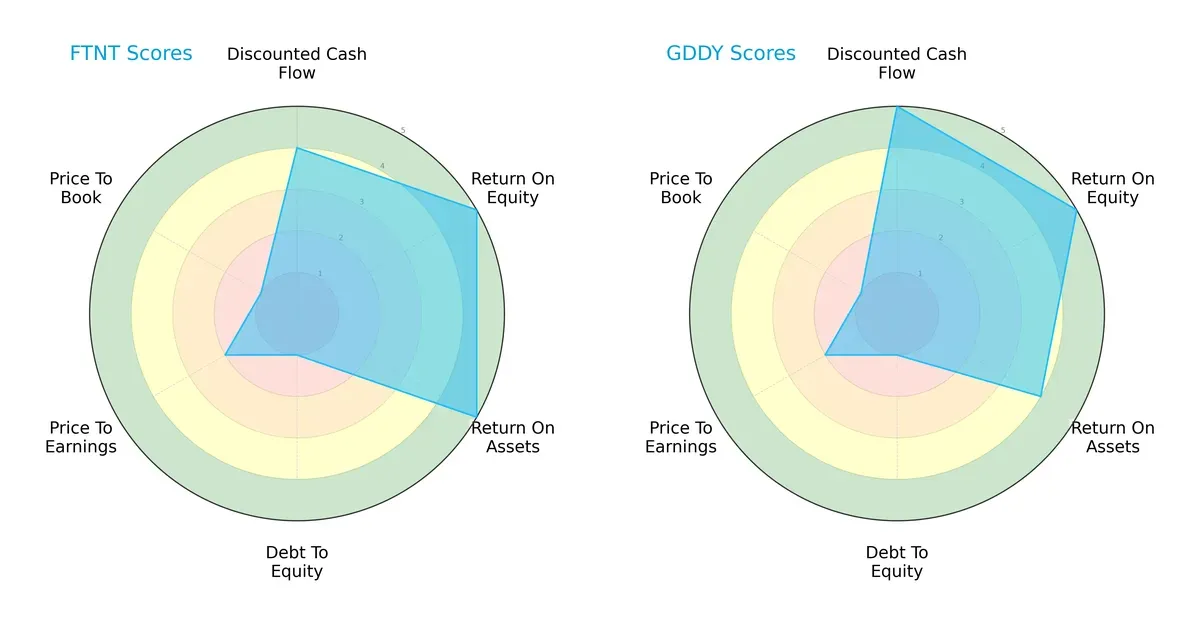

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Fortinet, Inc. and GoDaddy Inc., highlighting their financial strengths and valuation nuances:

Fortinet and GoDaddy share strong returns on equity (ROE) at top scores of 5, signaling efficient profit generation. Fortinet edges GoDaddy on return on assets (ROA) with a perfect 5 versus 4, indicating superior asset utilization. GoDaddy leads in discounted cash flow (DCF) with a 5 over Fortinet’s 4, suggesting better future cash flow prospects. Both struggle with debt-to-equity and valuation metrics (P/E and P/B), scoring low at 1 or 2, reflecting leverage risks and possible overvaluation. Overall, Fortinet’s profile balances operational efficiency and cash flow, while GoDaddy leans more on cash flow strength but shares leverage concerns.

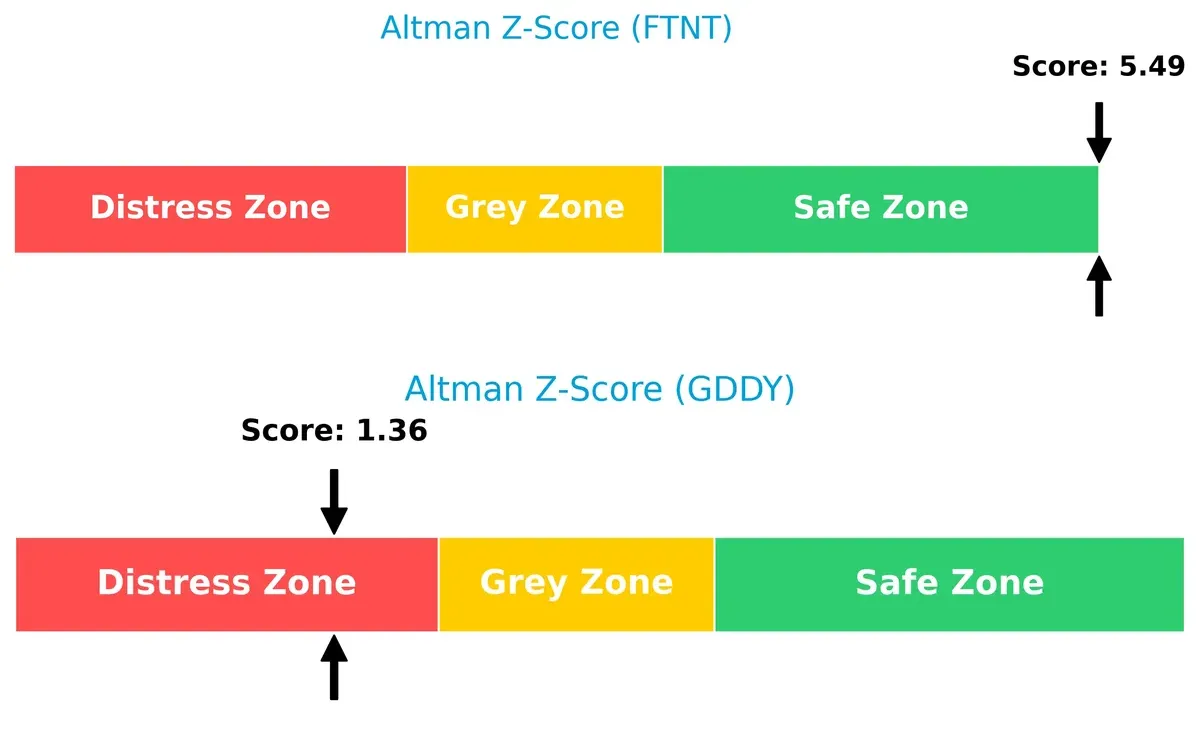

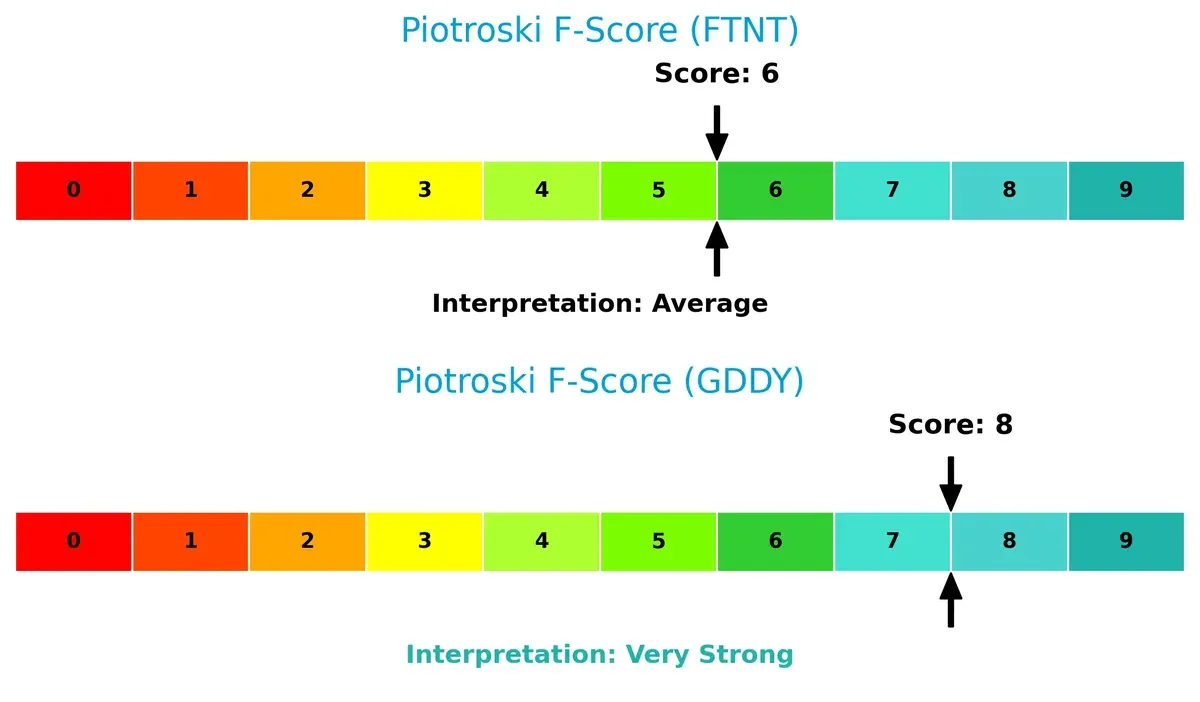

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score differential signals distinct solvency risks:

Fortinet’s score of 5.49 places it firmly in the safe zone, indicating robust financial health and low bankruptcy risk. Conversely, GoDaddy’s 1.36 score falls into the distress zone, signaling significant financial vulnerability and heightened bankruptcy risk in this cycle.

Financial Health: Quality of Operations

Piotroski F-Scores reveal operational quality and financial robustness:

GoDaddy scores an impressive 8, reflecting very strong financial health with solid profitability and efficient capital use. Fortinet’s 6 indicates average financial health, suggesting some caution. GoDaddy’s higher score points to fewer red flags and stronger internal metrics compared to Fortinet.

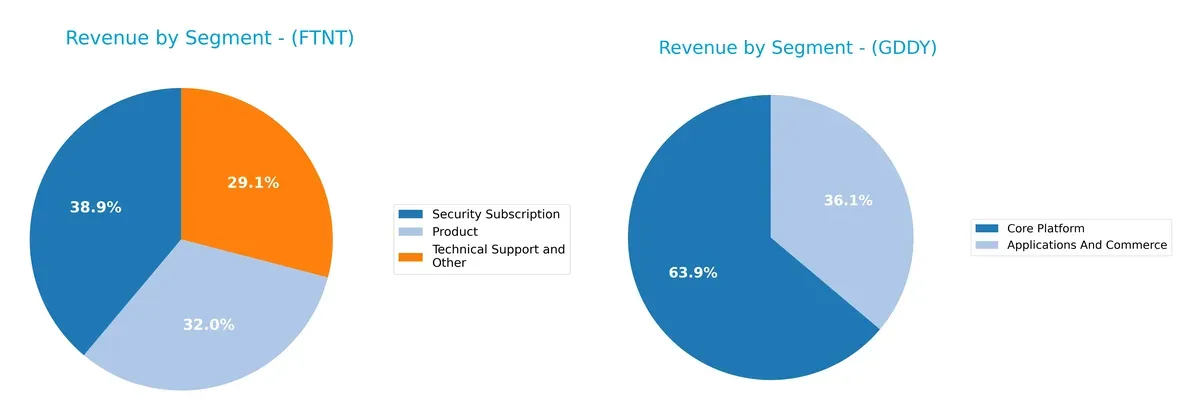

How are the two companies positioned?

This section dissects the operational DNA of Fortinet and GoDaddy by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify which offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Fortinet, Inc. and GoDaddy Inc. diversify their income streams and identifies their primary sector bets for 2024:

Fortinet anchors its revenue with a balanced mix: Security Subscription leads at 2.32B, followed by Product at 1.91B, and Technical Support at 1.73B. GoDaddy, however, pivots heavily on its Core Platform, generating 2.92B, dwarfing its Applications and Commerce segment at 1.65B. Fortinet’s diversified streams reduce concentration risk, while GoDaddy’s reliance on Core Platform reveals strong ecosystem lock-in but increased vulnerability to platform-specific disruptions.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Fortinet and GoDaddy:

Fortinet Strengths

- Strong profitability with 27.26% net margin

- High ROE of 149.77%

- Favorable ROIC at 28.76%

- Low debt-to-assets at 9.59%

- Solid global presence across Americas, EMEA, Asia Pacific

- Balanced product and service revenue streams

GoDaddy Strengths

- Favorable profitability with 20.49% net margin

- High ROE of 135.37%

- Favorable ROIC at 16.02%

- Low WACC at 7.27%

- Strong Core Platform revenue of 2.92B

- Dominant U.S. market presence with 3.11B revenue

Fortinet Weaknesses

- Unfavorable valuation metrics with PE at 32.48 and PB at 48.64

- Neutral current ratio at 1.17, slightly tight liquidity

- No dividend yield

- Moderate debt-to-equity at 0.81, neutral risk

GoDaddy Weaknesses

- Unfavorable liquidity with current and quick ratios at 0.72

- High debt-to-equity at 5.63

- Unfavorable PE at 29.76 and PB at 40.28

- No dividend yield

- Less diversified revenue, focused on U.S. market

Fortinet’s strengths highlight robust profitability and global diversification, though valuation and liquidity metrics warrant caution. GoDaddy shows strong U.S. market dominance and good profitability but faces liquidity and leverage concerns, emphasizing risks linked to its financial structure.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat alone protects long-term profits from relentless competition erosion and market pressures. Let’s examine the defensive strengths of two tech giants:

Fortinet, Inc.: Dominant Network Effects in Cybersecurity

Fortinet’s moat stems from its integrated cybersecurity ecosystem that creates high switching costs. This manifests in a robust 33% EBIT margin and sustained 20%+ ROIC above WACC. In 2026, expanding cloud security could deepen its moat despite rising competition.

GoDaddy Inc.: Strong Switching Costs via Digital Identity Services

GoDaddy’s moat relies on platform lock-in from domain registration and hosting services, locking millions of small businesses. Its 20% EBIT margin and steadily growing ROIC confirm value creation, yet its lower gross margin signals vulnerability. Future growth hinges on expanding marketing and e-commerce tools.

Network Effects vs. Platform Lock-In: The Moat Showdown

Fortinet’s wider moat, powered by superior ROIC and margin stability, outmatches GoDaddy’s narrower but growing competitive edge. Fortinet is better positioned to defend and expand market share amid intensifying digital threats.

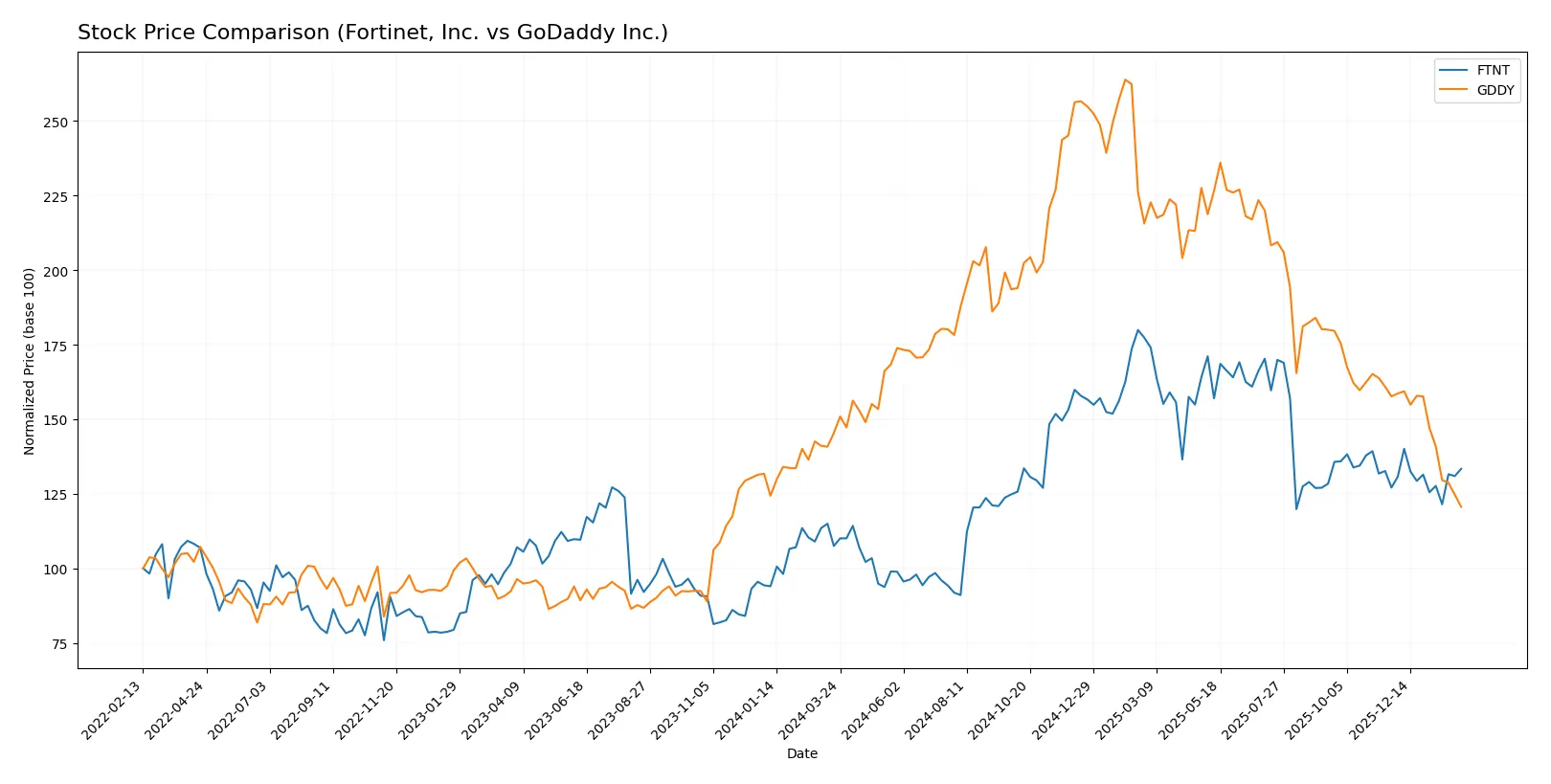

Which stock offers better returns?

The past year shows contrasting price movements for Fortinet and GoDaddy, with Fortinet’s stock rising steadily while GoDaddy’s declines amid increasing selling pressure.

Trend Comparison

Fortinet’s stock rose 24.04% over 12 months, signaling a bullish trend with decelerating momentum and a price range between 56.51 and 111.64. Recent months show a modest 4.95% gain but slight downward slope.

GoDaddy’s stock fell 17.04% over the year, confirming a bearish trend with deceleration. Volatility is high, with prices spanning 97.22 to 212.65. Recent losses accelerated to -23.48%, reflecting increased selling pressure.

Fortinet delivered the strongest market performance with sustained gains. GoDaddy’s stock declined sharply, showing weaker investor demand and negative momentum.

Target Prices

Analysts present a bullish consensus for Fortinet and GoDaddy, reflecting confidence in their growth prospects.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Fortinet, Inc. | 70 | 90 | 85 |

| GoDaddy Inc. | 70 | 173 | 138.5 |

Fortinet’s consensus target of 85 slightly exceeds its current price of 82.76, suggesting moderate upside. GoDaddy’s consensus target of 138.5 far surpasses its 97.22 price, indicating strong expected appreciation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a summary of the latest institutional grades assigned to Fortinet, Inc. and GoDaddy Inc.:

Fortinet, Inc. Grades

The following table lists recent grades from reputable financial institutions for Fortinet, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Buy | 2026-02-06 |

| Mizuho | Maintain | Underperform | 2026-02-06 |

| JP Morgan | Maintain | Underweight | 2026-02-06 |

| RBC Capital | Maintain | Sector Perform | 2026-02-06 |

| Wedbush | Maintain | Outperform | 2026-02-06 |

| Scotiabank | Downgrade | Sector Perform | 2026-02-02 |

| JP Morgan | Maintain | Underweight | 2026-01-30 |

| Rosenblatt | Upgrade | Buy | 2026-01-29 |

| TD Cowen | Upgrade | Buy | 2026-01-23 |

| Citigroup | Maintain | Neutral | 2026-01-13 |

GoDaddy Inc. Grades

The following table shows recent grades from reliable institutions for GoDaddy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

Which company has the best grades?

GoDaddy Inc. generally receives more favorable grades with multiple “Buy” and “Overweight” ratings. Fortinet shows mixed opinions, ranging from “Buy” to “Underperform.” Investors may interpret GoDaddy’s stronger consensus as greater institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Fortinet, Inc.

- Operates in a highly competitive cybersecurity sector with rapid innovation and strong rivals like Palo Alto Networks.

GoDaddy Inc.

- Faces intense competition in web hosting and domain registration, with pressure from cloud giants and specialized startups.

2. Capital Structure & Debt

Fortinet, Inc.

- Maintains a low debt-to-assets ratio (9.6%) and strong interest coverage (113x), indicating financial resilience.

GoDaddy Inc.

- Carries high debt relative to equity (D/E 5.63) and moderate interest coverage (5.8x), increasing financial risk.

3. Stock Volatility

Fortinet, Inc.

- Beta around 1.05 signals average market volatility, typical for tech infrastructure stocks.

GoDaddy Inc.

- Slightly lower beta of 0.93 indicates marginally less sensitivity to market swings.

4. Regulatory & Legal

Fortinet, Inc.

- Cybersecurity sector faces evolving data privacy and national security regulations globally, raising compliance costs.

GoDaddy Inc.

- Subject to data protection and e-commerce regulations, with risks from changes in internet governance policies.

5. Supply Chain & Operations

Fortinet, Inc.

- Relies on hardware components and software licensing, sensitive to semiconductor supply constraints and software development cycles.

GoDaddy Inc.

- Depends on cloud infrastructure providers and data centers, vulnerable to outages and service disruptions.

6. ESG & Climate Transition

Fortinet, Inc.

- Increasing pressure to reduce energy consumption of data centers and secure supply chain sustainability.

GoDaddy Inc.

- Faces scrutiny on data center emissions and responsible sourcing for hardware and software services.

7. Geopolitical Exposure

Fortinet, Inc.

- Global footprint exposes it to geopolitical tensions affecting cybersecurity demands and technology exports.

GoDaddy Inc.

- Primarily US-focused but with international customers, exposed to trade policies and cross-border data flow restrictions.

Which company shows a better risk-adjusted profile?

Fortinet’s strongest concern is competitive pressure in a fast-evolving cybersecurity market but benefits from a robust balance sheet and financial stability. GoDaddy’s most impactful risk lies in its leveraged capital structure, which elevates financial vulnerability despite strong operational execution. Fortinet’s Altman Z-score (5.49) places it safely above distress levels, while GoDaddy’s 1.36 signals financial distress risk. Thus, Fortinet presents a more favorable risk-adjusted profile supported by solid liquidity and lower debt risk.

Final Verdict: Which stock to choose?

Fortinet, Inc. wields unmatched efficiency in capital allocation, consistently generating returns well above its cost of capital. Its superpower lies in sustaining robust profitability through a widening economic moat. A point of vigilance remains its stretched valuation metrics, which could pressure near-term upside. It fits well in aggressive growth portfolios seeking strong capital creators.

GoDaddy Inc. defends a strategic moat with its entrenched subscription model and broad digital services portfolio. While not as capital-efficient as Fortinet, it offers a comparatively safer profile with solid cash flow generation. This makes it suitable for GARP portfolios prioritizing growth tempered by relative stability.

If you prioritize high returns on invested capital and aggressive growth, Fortinet outshines with its proven value creation and operational excellence. However, if you seek growth with better balance sheet safety and recurring revenue resilience, GoDaddy offers superior stability despite recent price weakness. Each suits distinct investor profiles balancing risk and growth differently.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Fortinet, Inc. and GoDaddy Inc. to enhance your investment decisions: