Home > Comparison > Utilities > NEE vs FE

The strategic rivalry between NextEra Energy, Inc. and FirstEnergy Corp. shapes the evolving utilities landscape in the U.S. NextEra operates as a capital-intensive clean energy leader with a diversified generation mix, while FirstEnergy focuses on regulated electric transmission and distribution with traditional power assets. This head-to-head highlights a battle between innovation-driven growth and stable regulated cash flows. This analysis will identify which trajectory offers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

NextEra Energy and FirstEnergy stand as pivotal players in the regulated electric utilities sector, shaping energy delivery across key U.S. regions.

NextEra Energy, Inc.: Clean Energy Powerhouse

NextEra Energy dominates as a regulated electric utility with a strong emphasis on clean energy. Its core revenue derives from generating and distributing electricity via wind, solar, nuclear, coal, and natural gas facilities. In 2026, the company strategically focuses on expanding renewable generation and battery storage projects, positioning itself as a leader in the clean energy transition.

FirstEnergy Corp.: Regional Utility Provider

FirstEnergy operates as a regulated electric utility serving around 6 million customers mainly in Ohio and neighboring states. It generates revenue through coal, nuclear, hydro, natural gas, wind, and solar power facilities. The company prioritizes maintaining and operating extensive transmission and distribution networks to ensure reliable service across its regional footprint.

Strategic Collision: Similarities & Divergences

Both firms generate electricity through diverse fuel sources and operate regulated transmission networks, but NextEra pursues an aggressive clean energy growth strategy, while FirstEnergy leans into regional service reliability. Their primary battleground lies in balancing traditional and renewable energy investments amid evolving regulatory pressures. NextEra offers a growth-oriented profile; FirstEnergy presents a more stable, income-focused investment case.

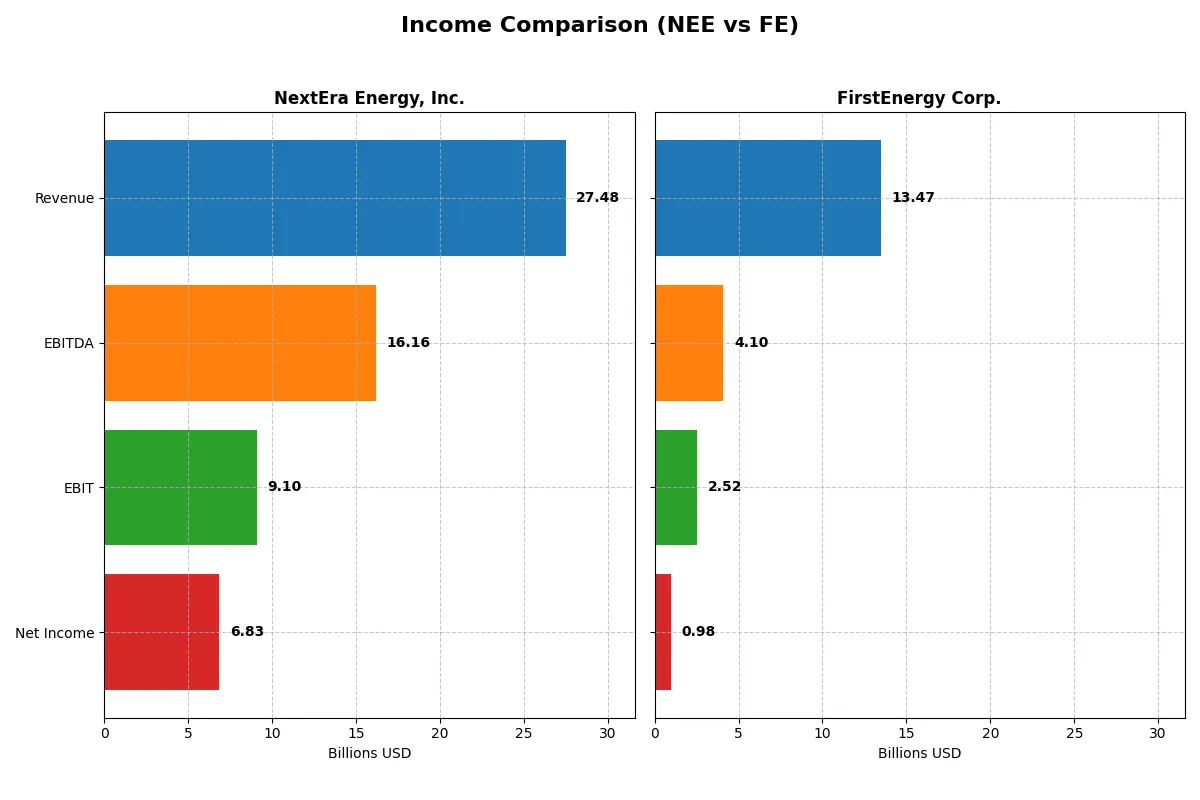

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | NextEra Energy, Inc. (NEE) | FirstEnergy Corp. (FE) |

|---|---|---|

| Revenue | 27.48B | 13.47B |

| Cost of Revenue | 10.22B | 4.38B |

| Operating Expenses | 8.98B | 6.72B |

| Gross Profit | 17.25B | 9.10B |

| EBITDA | 16.17B | 4.10B |

| EBIT | 9.10B | 2.52B |

| Interest Expense | 4.57B | 1.01B |

| Net Income | 6.83B | 978M |

| EPS | 3.31 | 1.70 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability dynamics of NextEra Energy and FirstEnergy’s corporate engines.

NextEra Energy, Inc. Analysis

NextEra Energy’s revenue climbed 11% in 2025 to $27.5B, driving a net income of $6.8B despite a slight EPS dip. Its gross margin remains robust at 62.8%, with net margin at 24.9%, signaling strong profitability. However, rising interest expenses at 16.6% weigh on overall earnings momentum.

FirstEnergy Corp. Analysis

FirstEnergy posted moderate 4.7% revenue growth to $13.5B in 2024 but saw net income decline to $978M. Its gross margin at 67.5% is healthy, yet net margin at just 7.3% highlights weaker bottom-line efficiency. EPS fell over 11%, reflecting challenges sustaining profitability amid stable operating income.

Margin Strength vs. Growth Resilience

NextEra Energy outpaces FirstEnergy with superior net margins and solid revenue growth, translating into stronger earnings expansion. FirstEnergy’s higher gross margin masks underlying net income and EPS weakness. For investors, NextEra’s profile offers a more attractive balance of profitability and growth momentum.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | NextEra Energy, Inc. (NEE) | FirstEnergy Corp. (FE) |

|---|---|---|

| ROE | 13.9% | 7.9% |

| ROIC | 4.0% | 3.7% |

| P/E | 21.2 | 23.4 |

| P/B | 2.94 | 1.84 |

| Current Ratio | 0.47 | 0.56 |

| Quick Ratio | 0.38 | 0.45 |

| D/E (Debt-to-Equity) | 1.64 | 1.95 |

| Debt-to-Assets | 43.3% | 46.6% |

| Interest Coverage | 3.35 | 2.35 |

| Asset Turnover | 0.13 | 0.26 |

| Fixed Asset Turnover | 0.18 | 0.33 |

| Payout Ratio | 61.0% | 99.2% |

| Dividend Yield | 2.87% | 4.24% |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, unveiling hidden risks and operational excellence essential for informed investment decisions.

NextEra Energy, Inc.

NextEra exhibits a strong net margin of 28.06%, signaling operational efficiency, while its ROE at 13.86% remains neutral. The stock’s P/E of 21.23 suggests fair valuation. Favorable dividend yield at 2.87% rewards shareholders, reflecting a balanced capital allocation approach amid somewhat unfavorable liquidity and leverage metrics.

FirstEnergy Corp.

FirstEnergy posts a modest net margin of 7.26% and a weaker ROE of 7.85%, indicating lower profitability. Its P/E ratio of 23.39 appears somewhat stretched relative to earnings. The higher dividend yield of 4.24% provides income appeal but coincides with unfavorable leverage and liquidity ratios, underscoring potential financial strain.

Balanced Yield vs. Operational Strength

NextEra offers a superior profitability profile with a solid dividend and reasonable valuation. FirstEnergy presents higher yield but weaker returns and similar financial risks. Investors prioritizing stable growth may lean toward NextEra; income-focused profiles might consider FirstEnergy’s yield despite its operational challenges.

Which one offers the Superior Shareholder Reward?

I compare NextEra Energy (NEE) and FirstEnergy (FE) focusing on dividends, payout ratios, and buybacks. NEE yields 2.87% with a 61% payout ratio, supported by strong free cash flow (2.3B FCF per share coverage). FE yields 4.24% but with almost 99% payout and negative free cash flow (-1.98B per share), signaling risk. NEE’s moderate payout and consistent buybacks suggest a sustainable, balanced return strategy. FE’s higher yield comes with heavy leverage and weak cash flow, threatening long-term value. I conclude NEE offers superior total shareholder reward in 2026.

Comparative Score Analysis: The Strategic Profile

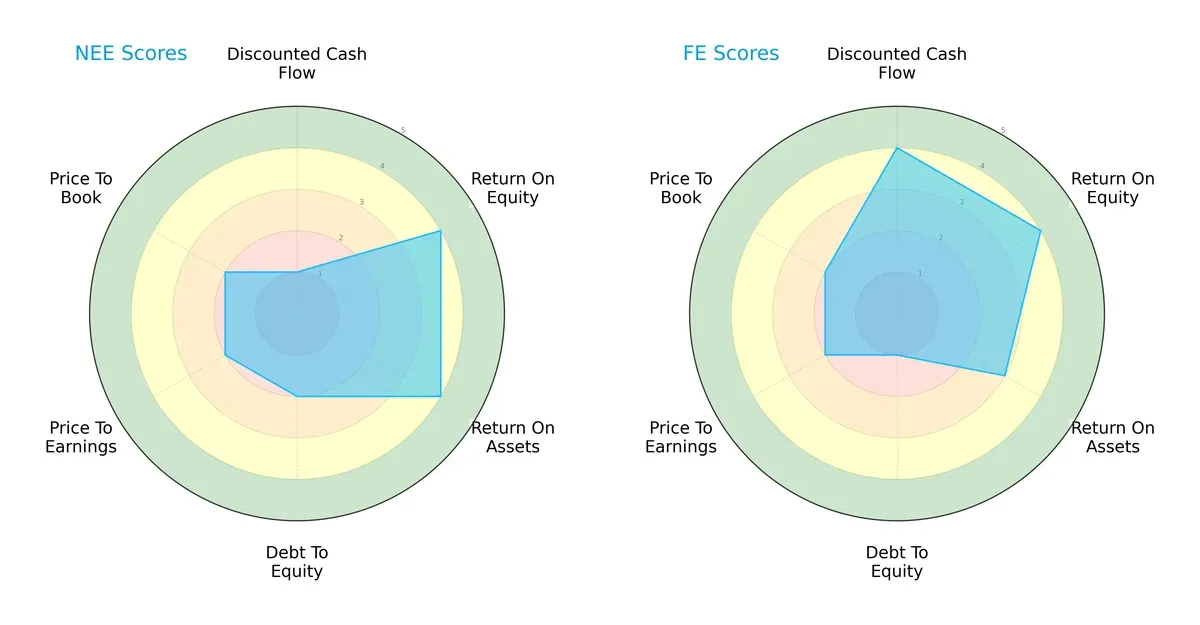

The radar chart reveals the fundamental DNA and trade-offs of NextEra Energy, Inc. and FirstEnergy Corp., highlighting their strategic financial strengths and weaknesses:

NextEra Energy shows strength in return on equity (4) and return on assets (4), indicating efficient profit generation and asset use. However, its discounted cash flow score is weak (1), signaling potential overvaluation risks. FirstEnergy excels in discounted cash flow (4) and matches NextEra in return on equity (4), but lags slightly in return on assets (3) and has a weaker debt-to-equity score (1), reflecting higher financial risk. Overall, FirstEnergy presents a more balanced profile, leveraging valuation advantages, while NextEra relies heavily on operational efficiency.

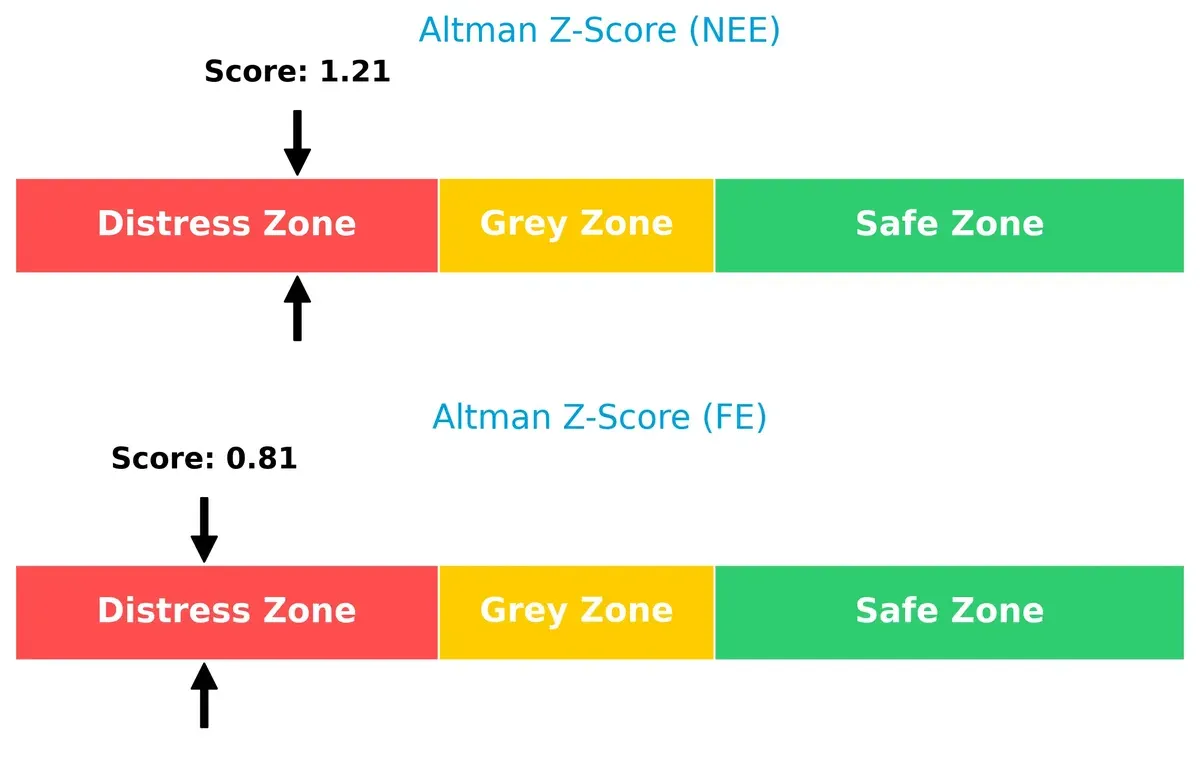

Bankruptcy Risk: Solvency Showdown

The Altman Z-Scores place both NextEra Energy (1.21) and FirstEnergy (0.81) in the distress zone, signaling elevated bankruptcy risk in this cycle:

Both companies face significant long-term survival challenges. NextEra’s marginally higher score suggests slightly better solvency, but neither is well-positioned to withstand severe financial shocks currently.

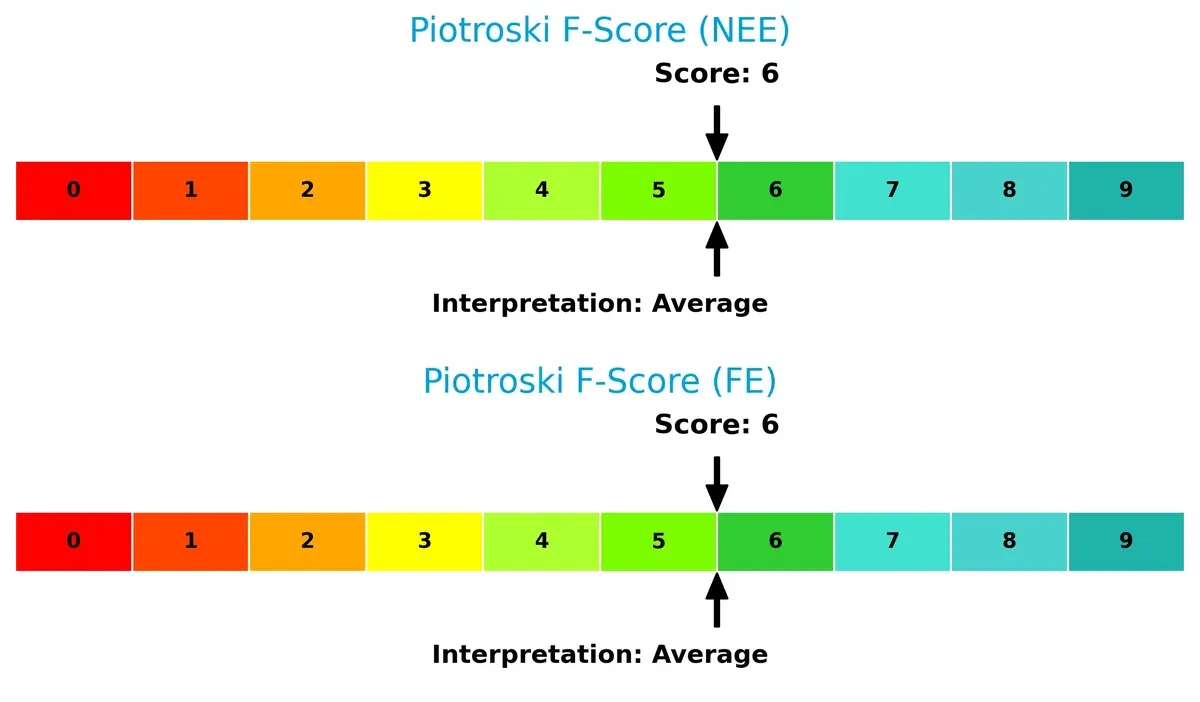

Financial Health: Quality of Operations

NextEra Energy and FirstEnergy both score a 6 on the Piotroski F-Score, indicating average financial health with no glaring red flags in internal metrics:

Neither firm demonstrates peak operational quality, but both maintain moderate financial strength. Investors should monitor for improvements or deterioration in these internal signals as the cycle progresses.

How are the two companies positioned?

This section dissects the operational DNA of NextEra Energy and FirstEnergy by comparing their revenue distribution and internal strengths and weaknesses. The final objective confronts their economic moats to identify which model offers the most resilient, sustainable competitive advantage today.

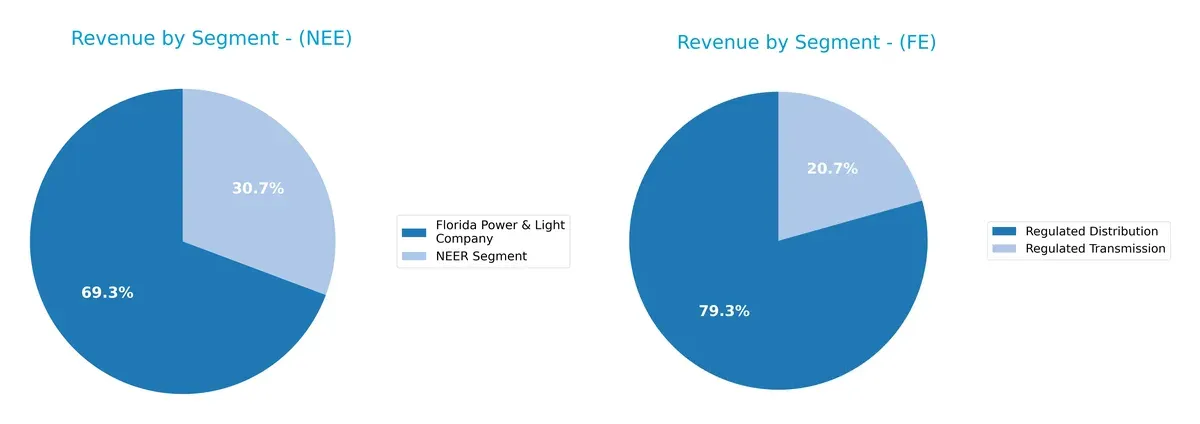

Revenue Segmentation: The Strategic Mix

This comparison dissects how NextEra Energy, Inc. and FirstEnergy Corp. diversify income streams and where their primary sector bets lie:

NextEra leans heavily on its Florida Power & Light segment with $17B in 2024, complemented by a $7.5B energy resources business. This mix suggests a balance between regulated utility cash flow and renewable infrastructure growth. FirstEnergy skews toward regulated distribution at $6.9B and transmission at $1.8B, showing a more concentrated reliance on traditional regulated assets. NextEra’s diversification mitigates risk, while FirstEnergy’s focus anchors it in stable, regulated returns but faces exposure to regulatory shifts.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of NextEra Energy, Inc. and FirstEnergy Corp.:

NextEra Energy Strengths

- Strong net margin of 28.06%

- Favorable WACC at 6.4%

- Robust dividend yield of 2.87%

- Large revenue from Florida Power & Light Company at 17B USD

- Significant diversification in energy resources

FirstEnergy Strengths

- Favorable WACC at 4.93%

- Higher dividend yield of 4.24%

- Neutral current ratio better than NEE

- Diverse revenue streams including regulated distribution and transmission

- Presence in Ohio market

NextEra Energy Weaknesses

- Unfavorable ROIC at 4.04% below WACC

- Low current and quick ratios (0.47, 0.38) indicating liquidity risk

- High debt/equity ratio at 1.64

- Weak interest coverage at 1.99 times

- Low asset turnover ratios

FirstEnergy Weaknesses

- Unfavorable ROE at 7.85% and ROIC at 3.66%

- Low liquidity ratios (current 0.56, quick 0.45)

- Higher debt/equity ratio at 1.95

- Neutral interest coverage at 2.49 times

- Lower net margin at 7.26%

NextEra Energy shows strong profitability and dividend strength but faces liquidity and capital efficiency challenges. FirstEnergy exhibits better WACC and dividend yield but struggles with lower profitability and liquidity, highlighting distinct strategic and financial challenges.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only thing protecting long-term profits from relentless competition erosion. Let’s examine how these two utilities defend their turf:

NextEra Energy, Inc.: Innovation-Driven Renewable Moat

NextEra relies on intangible assets and clean energy innovation. Its strong margins and 11% revenue growth reflect this advantage. Yet, declining ROIC signals rising competitive or capital costs in 2026.

FirstEnergy Corp.: Traditional Scale and Network Moat

FirstEnergy’s moat stems from extensive regulated transmission and distribution networks. Despite stable gross margins, slower growth and a steeper ROIC decline reveal vulnerability compared to NextEra’s innovation edge.

Innovation vs. Infrastructure: Which Moat Holds Stronger?

Both companies suffer declining ROIC, signaling value destruction. However, NextEra’s innovation-driven moat offers deeper growth potential and margin resilience. It is better positioned to defend market share amid evolving energy markets.

Which stock offers better returns?

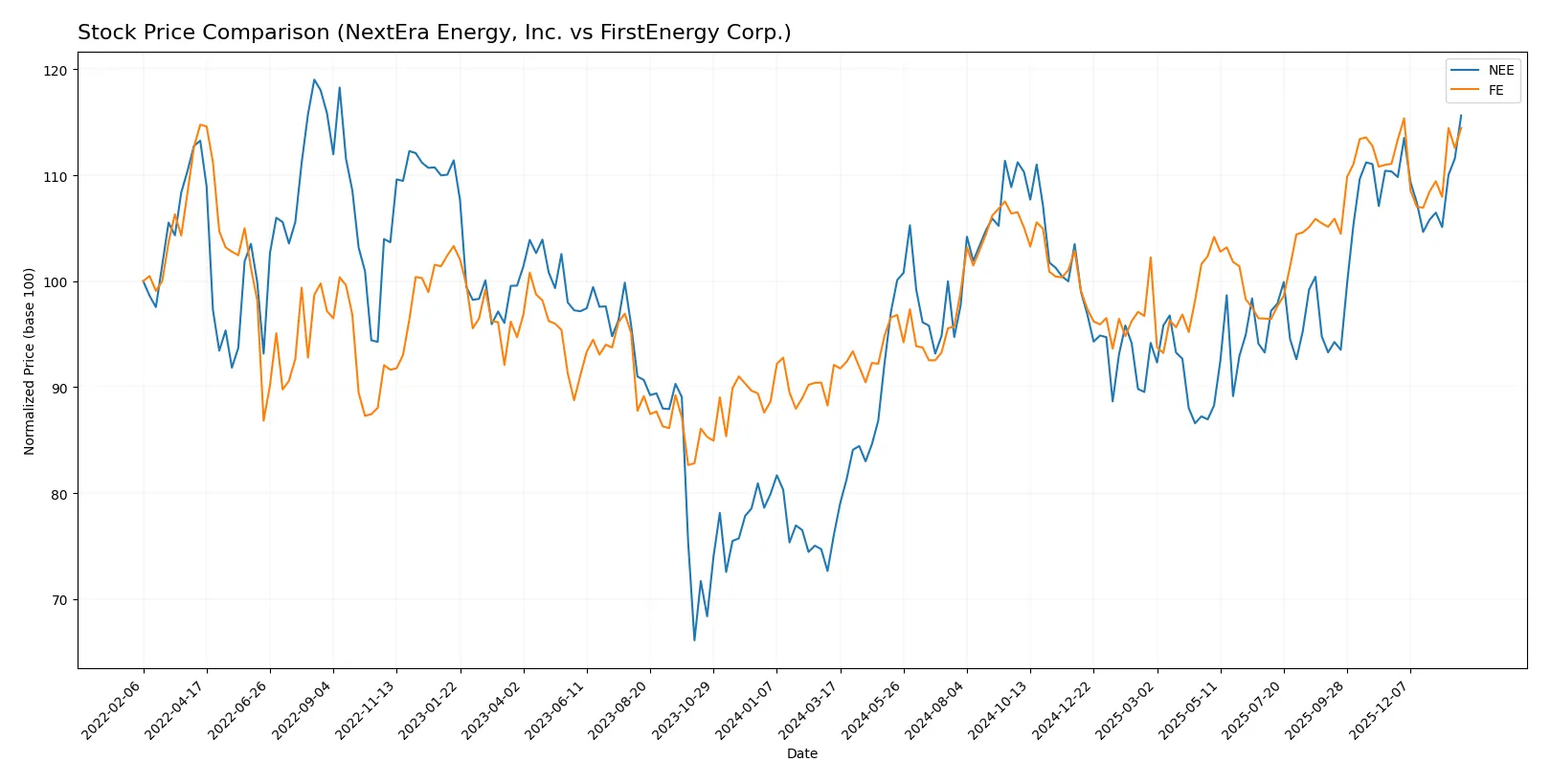

NextEra Energy and FirstEnergy displayed marked upward price movements over the past year, with distinct trading volume dynamics shaping their momentum.

Trend Comparison

NextEra Energy’s stock gained 52.05% over the past 12 months, showing a bullish trend with decelerating momentum. It reached a high of 87.9 and a low of 57.81, with notable volatility (6.42 std deviation).

FirstEnergy’s stock rose 24.28% in the same period, also bullish but with decelerating momentum. Its price ranged between 37.41 and 47.72, with lower volatility (2.68 std deviation) compared to NextEra.

NextEra Energy outperformed FirstEnergy with a stronger price gain and higher volatility, indicating greater market enthusiasm despite deceleration in trend acceleration.

Target Prices

Analysts present a measured target price consensus for NextEra Energy and FirstEnergy, reflecting cautious optimism in the regulated electric sector.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| NextEra Energy, Inc. | 84 | 104 | 93.09 |

| FirstEnergy Corp. | 46 | 54 | 49.5 |

NextEra’s consensus target of 93.09 sits modestly above the current price of 87.9, suggesting moderate upside. FirstEnergy’s target of 49.5 slightly exceeds its 47.34 price, indicating limited near-term appreciation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for NextEra Energy, Inc. and FirstEnergy Corp.:

NextEra Energy, Inc. Grades

This table shows the latest grades assigned by major financial institutions to NextEra Energy, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Neutral | 2026-01-28 |

| Argus Research | Maintain | Buy | 2026-01-28 |

| BMO Capital | Maintain | Outperform | 2026-01-27 |

| Wells Fargo | Maintain | Overweight | 2026-01-20 |

| Barclays | Maintain | Equal Weight | 2026-01-15 |

| Jefferies | Maintain | Hold | 2025-12-31 |

| UBS | Maintain | Buy | 2025-12-17 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| BMO Capital | Maintain | Outperform | 2025-12-10 |

| UBS | Maintain | Buy | 2025-12-10 |

FirstEnergy Corp. Grades

This table shows the latest grades assigned by major financial institutions to FirstEnergy Corp.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wolfe Research | Upgrade | Outperform | 2026-01-27 |

| Barclays | Maintain | Overweight | 2026-01-22 |

| Wells Fargo | Maintain | Overweight | 2026-01-20 |

| UBS | Maintain | Neutral | 2025-12-17 |

| UBS | Maintain | Neutral | 2025-10-24 |

| Mizuho | Maintain | Neutral | 2025-10-24 |

| Scotiabank | Maintain | Sector Outperform | 2025-10-24 |

| Morgan Stanley | Maintain | Overweight | 2025-10-21 |

| Jefferies | Maintain | Hold | 2025-10-21 |

| Keybanc | Downgrade | Sector Weight | 2025-10-15 |

Which company has the best grades?

NextEra Energy, Inc. consistently receives higher ratings such as Buy, Outperform, and Overweight. FirstEnergy Corp. has more mixed grades, including Neutral and Hold, despite some Outperform calls. Investors may interpret NextEra’s stronger consensus as a sign of higher confidence among analysts.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

NextEra Energy, Inc.

- Dominates renewable energy growth but faces intense competition in clean tech markets.

FirstEnergy Corp.

- Relies on legacy fossil and nuclear assets, challenged by shifting demand and decarbonization trends.

2. Capital Structure & Debt

NextEra Energy, Inc.

- High debt-to-equity ratio (1.64) and weak interest coverage (1.99) raise refinancing risks.

FirstEnergy Corp.

- Even higher leverage (1.95) with moderate interest coverage (2.49) signals financial strain.

3. Stock Volatility

NextEra Energy, Inc.

- Beta of 0.73 indicates moderate market sensitivity, typical for utilities in transition.

FirstEnergy Corp.

- Slightly lower beta (0.63) reflects stable investor sentiment but limited growth prospects.

4. Regulatory & Legal

NextEra Energy, Inc.

- Faces regulatory scrutiny on transmission expansions and renewable subsidies.

FirstEnergy Corp.

- Exposed to ongoing investigations related to past regulatory compliance and political risks.

5. Supply Chain & Operations

NextEra Energy, Inc.

- Benefits from vertically integrated operations but vulnerable to equipment supply delays.

FirstEnergy Corp.

- Large distribution network complexity increases operational risk and maintenance costs.

6. ESG & Climate Transition

NextEra Energy, Inc.

- Strong ESG profile with aggressive clean energy investments.

FirstEnergy Corp.

- Lagging on climate goals; dependence on coal and nuclear assets raises transition risk.

7. Geopolitical Exposure

NextEra Energy, Inc.

- Primarily US-focused, limiting direct geopolitical risk but subject to domestic policy shifts.

FirstEnergy Corp.

- Similar US concentration but higher exposure to regulatory changes in multiple states.

Which company shows a better risk-adjusted profile?

NextEra Energy faces its greatest risk in heavy leverage and weak liquidity metrics, despite strong market positioning and ESG. FirstEnergy’s main risk lies in legacy asset exposure and regulatory/legal pressures. Both firms are in financial distress zones per Altman Z-scores, but NextEra’s balanced growth strategy and better interest coverage suggest a relatively superior risk-adjusted profile in 2026.

Final Verdict: Which stock to choose?

NextEra Energy (NEE) boasts a superpower in its robust cash flow generation and impressive top-line growth, fueling expansion and shareholder returns. However, its declining ROIC below WACC and stretched liquidity ratios are points of vigilance. NEE suits portfolios aiming for aggressive growth with tolerance for operational risks.

FirstEnergy (FE) leverages a strategic moat rooted in steady dividend yield and lower valuation multiples, offering relative stability compared to NEE. Its weaker growth trajectory and value destruction via declining ROIC suggest a more conservative profile. FE fits well within GARP portfolios seeking income with moderate growth potential.

If you prioritize aggressive growth and can stomach short-term financial headwinds, NextEra Energy outshines with stronger revenue momentum and cash flow. However, if you seek income stability and a more defensive stance, FirstEnergy offers better safety despite slower growth. Both carry risks, and investors should weigh their appetite for volatility accordingly.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of NextEra Energy, Inc. and FirstEnergy Corp. to enhance your investment decisions: