Home > Comparison > Financial Services > FITB vs KEY

The strategic rivalry between Fifth Third Bancorp and KeyCorp shapes the competitive landscape of regional banking. Fifth Third Bancorp operates a diversified financial services model with a strong commercial and consumer lending focus. KeyCorp emphasizes integrated retail and commercial banking with a broad suite of capital market solutions. This analysis evaluates which company’s operational strategy and market positioning offer a superior risk-adjusted return for a diversified portfolio.

Table of contents

Companies Overview

Fifth Third Bancorp and KeyCorp stand as pivotal players in the U.S. regional banking sector.

Fifth Third Bancorp: Diversified Financial Services Leader

Fifth Third Bancorp operates as a diversified financial services company, generating revenue primarily through commercial banking, branch banking, consumer lending, and wealth management. Its commercial banking segment drives core earnings via credit intermediation, capital markets, and asset-based lending. In 2021, the company emphasized expanding its loan portfolio and enhancing wealth management offerings across its 1,117 branches and 2,322 ATMs.

KeyCorp: Comprehensive Regional Banking Provider

KeyCorp serves as a holding company for KeyBank, focusing on retail and commercial banking. It earns revenue from deposits, lending, wealth management, and capital market services. The firm’s 2021 strategy concentrated on broadening its commercial banking footprint and deepening client relationships through diversified financial products across nearly 1,000 branches and 1,317 ATMs in 15 states.

Strategic Collision: Similarities & Divergences

Both banks pursue regional market dominance through expansive branch networks and diversified financial services. Fifth Third leans on commercial lending and wealth management as revenue engines, while KeyCorp emphasizes integrated banking and capital markets. Their battle for middle-market business clients remains intense. These distinctions reflect contrasting risk profiles and growth trajectories within the regional banking landscape.

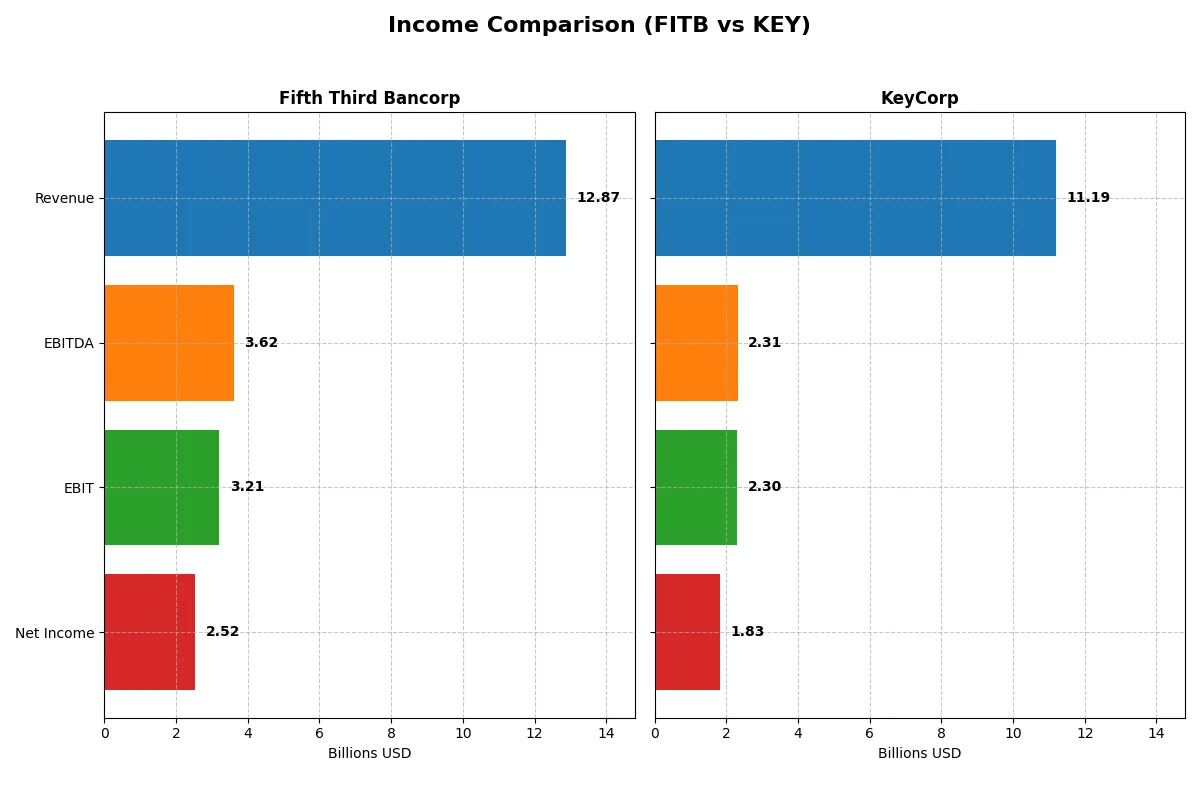

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Fifth Third Bancorp (FITB) | KeyCorp (KEY) |

|---|---|---|

| Revenue | 12.87B | 11.19B |

| Cost of Revenue | 4.47B | 4.22B |

| Operating Expenses | 5.19B | 4.66B |

| Gross Profit | 8.40B | 6.97B |

| EBITDA | 3.62B | 2.32B |

| EBIT | 3.21B | 2.30B |

| Interest Expense | 3.92B | 3.75B |

| Net Income | 2.52B | 1.83B |

| EPS | 3.55 | 1.66 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which bank operates more efficiently and sustains healthier profitability amid shifting market conditions.

Fifth Third Bancorp Analysis

Fifth Third Bancorp’s revenue grew 62% from 2021 to 2025 but declined slightly by 1.4% last year to $12.9B. Net income shows mixed signals, falling nearly 9% over five years but rising 10.6% in 2025 to $2.5B. Gross and net margins remain robust at 65.3% and 19.6%, respectively, reflecting strong cost control despite a high 30.5% interest expense ratio.

KeyCorp Analysis

KeyCorp posted solid revenue growth of 53% over five years, accelerating 23.6% in 2025 to $11.2B. Net income, however, fell 30% over the period but surged 10-fold last year to $1.8B, supported by a remarkable 1020% net margin improvement. Margins are healthy with a 62.3% gross and 16.4% net margin, though interest expense burden at 33.5% remains a pressure point.

Margin Strength vs. Revenue Momentum

Fifth Third Bancorp delivers steadier profit margins and a higher net income base, signaling operational efficiency and resilience. KeyCorp impresses with rapid top-line and earnings momentum but lags in absolute profitability and faces elevated interest costs. Investors prioritizing stable returns may favor Fifth Third’s profile, while growth seekers might note KeyCorp’s accelerating recovery.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | Fifth Third Bancorp (FITB) | KeyCorp (KEY) |

|---|---|---|

| ROE | 11.6% | 8.97% |

| ROIC | 8.9% | 5.8% |

| P/E | 12.3 | 12.4 |

| P/B | 1.43 | 1.11 |

| Current Ratio | 0.82 | 0.77 |

| Quick Ratio | 0.82 | 0.77 |

| D/E | 0.67 | 0.54 |

| Debt-to-Assets | 6.8% | 6.0% |

| Interest Coverage | 0.82 | 0.61 |

| Asset Turnover | 0.060 | 0.061 |

| Fixed Asset Turnover | 4.14 | 17.82 |

| Payout Ratio | 39.8% | 49.1% |

| Dividend Yield | 3.23% | 3.97% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, unveiling operational strengths and hidden risks vital for informed investing decisions.

Fifth Third Bancorp

Fifth Third Bancorp shows solid net margin at 19.61%, signaling strong profitability. Its ROE of 11.61% is neutral, while P/E at 12.33x and P/B at 1.43x suggest a fairly valued stock. The 3.23% dividend yield rewards shareholders, balancing between income and reinvestment in operational efficiency.

KeyCorp

KeyCorp posts a favorable net margin of 16.35%, though its ROE at 8.97% is unfavorable, indicating weaker profitability. The valuation remains reasonable with a P/E of 12.36x and a lower P/B of 1.11x. KeyCorp offers a higher 3.97% dividend yield but shows more unfavorable ratios, reflecting cautious operational risk.

Profitability Meets Valuation: Balanced Income vs. Operational Risk

Fifth Third Bancorp delivers a slightly better profitability and valuation balance with solid margins and a stable dividend. KeyCorp offers higher dividend income but shows greater operational weakness. Investors prioritizing stable returns may prefer Fifth Third, while income-focused profiles might consider KeyCorp’s yield despite higher risks.

Which one offers the Superior Shareholder Reward?

I compare Fifth Third Bancorp (FITB) and KeyCorp (KEY) on dividends and buybacks. FITB yields 3.23% with a 40% payout in 2025, supported by stable free cash flow. KEY offers a slightly lower 3.97% yield but with a higher 49% payout ratio. FITB’s dividend payout is more conservative and sustainable, given its stronger free cash flow coverage and capital expenditure support. Both companies engage in share buybacks, but FITB’s lower financial leverage and healthier coverage ratios suggest it balances buybacks prudently. KEY’s higher payout and recent earnings volatility raise sustainability concerns. I conclude FITB offers the superior total shareholder return profile for 2026 investors, blending steady dividends with disciplined buybacks underpinned by solid cash flow.

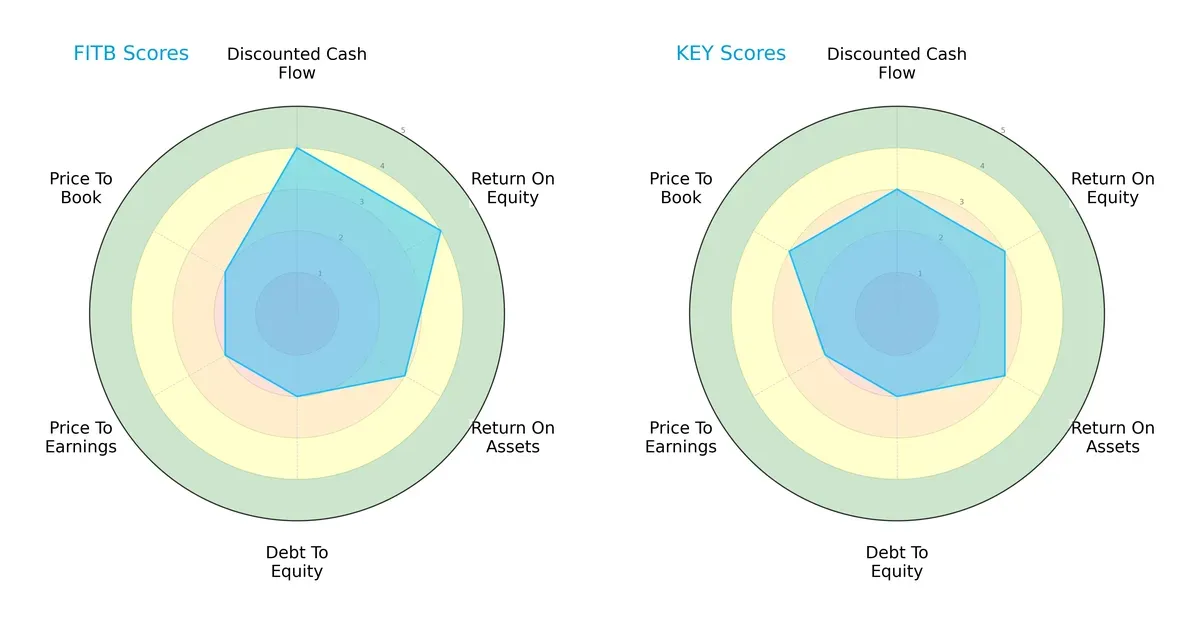

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Fifth Third Bancorp and KeyCorp’s financial profiles:

Fifth Third Bancorp leads with stronger discounted cash flow and return on equity scores, signaling efficient capital use and valuation upside. KeyCorp shows a slightly better price-to-book ratio, suggesting relative market undervaluation. Both share moderate debt-to-equity and price-to-earnings scores. Fifth Third presents a more balanced strength across cash flow and profitability metrics, whereas KeyCorp relies on valuation metrics for its appeal.

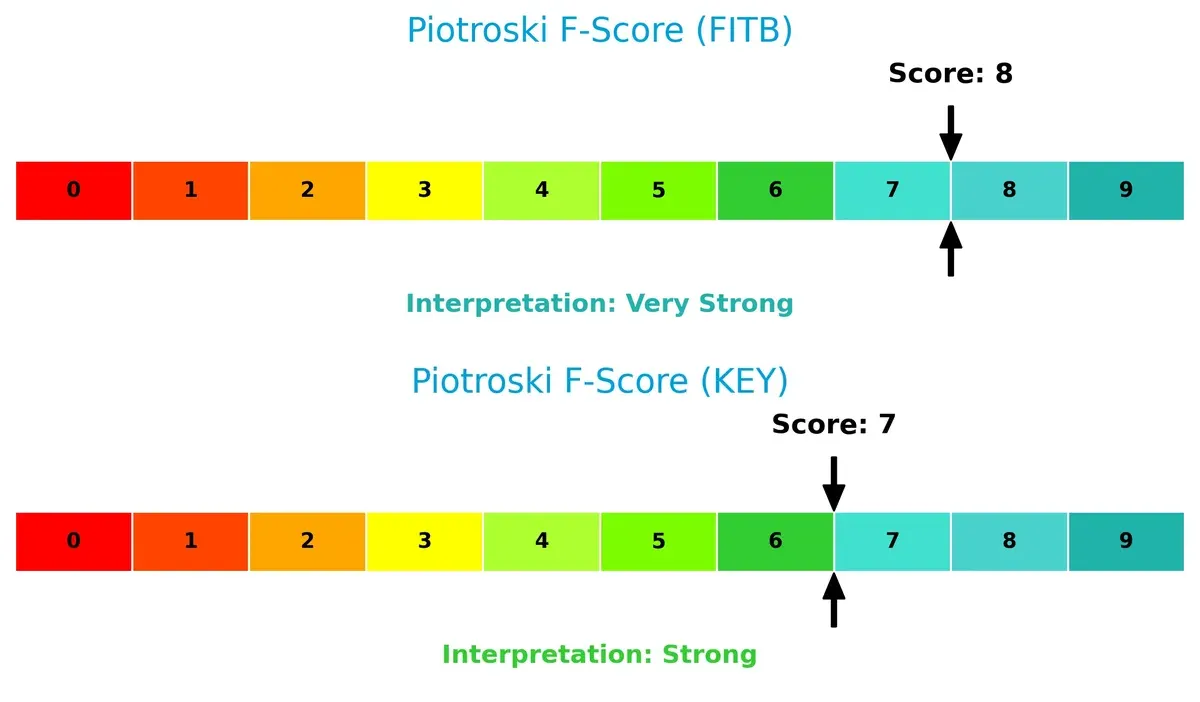

Bankruptcy Risk: Solvency Showdown

The Altman Z-Scores place both firms deep in the distress zone, indicating elevated bankruptcy risk and caution in this cycle’s uncertain environment:

Financial Health: Quality of Operations

Fifth Third Bancorp’s Piotroski score of 8 edges out KeyCorp’s 7, reflecting stronger financial health and operational quality. KeyCorp’s slightly lower score suggests minor red flags in internal metrics compared to Fifth Third:

How are the two companies positioned?

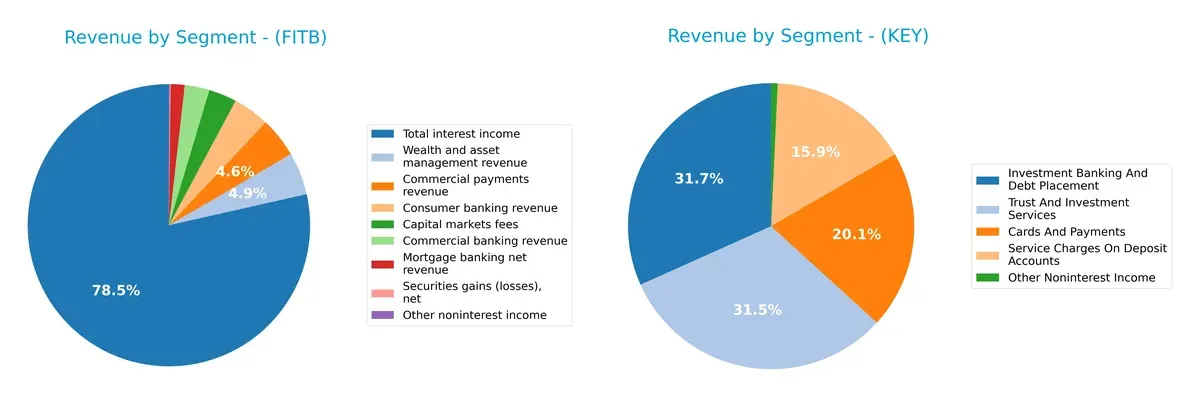

This section dissects the operational DNA of FITB and KEY by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats and identify the more resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Fifth Third Bancorp and KeyCorp diversify their income streams and where their primary sector bets lie:

Fifth Third Bancorp anchors revenue in Total Interest Income at $10.4B, dwarfing other segments like Wealth Management ($647M) and Commercial Payments ($608M). This signals a heavy reliance on interest-driven banking. KeyCorp exhibits a more balanced mix with Investment Banking ($521M), Trust Services ($518M), and Cards & Payments ($331M), reflecting a diversified revenue base that mitigates concentration risk and supports ecosystem lock-in.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Fifth Third Bancorp and KeyCorp:

Fifth Third Bancorp Strengths

- Favorable net margin at 19.61%

- Favorable P/E at 12.33

- Low debt-to-assets at 6.77%

- Strong fixed asset turnover at 4.14

- Diverse revenue streams including wealth and asset management

- Dividend yield at 3.23%

KeyCorp Strengths

- Favorable net margin at 16.35%

- Favorable P/E at 12.36

- Low debt-to-assets at 5.97%

- Very high fixed asset turnover at 17.82

- Diverse segments including investment banking and trust services

- Dividend yield at 3.97%

Fifth Third Bancorp Weaknesses

- Current ratio at 0.82 signals liquidity concerns

- Interest coverage below 1.0 indicates risk in covering debt

- Asset turnover at 0.06 is low

- WACC at 12.33% exceeds ROIC

- Neutral ROE and ROIC suggest moderate profitability

KeyCorp Weaknesses

- Current and quick ratios at 0.77 highlight liquidity risk

- Interest coverage at 0.61 is weaker than FITB

- Asset turnover equally low at 0.06

- WACC at 14.27% exceeds ROIC

- Unfavorable ROE at 8.97% limits returns

Both companies show solid profitability with favorable net margins and attractive valuations. However, liquidity and asset utilization remain challenges. FITB’s slightly better interest coverage and dividend yield contrast with KEY’s stronger fixed asset turnover and higher dividend yield, reflecting different operational focuses.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the single strongest shield protecting long-term profits from relentless competition erosion. Let’s break down the moat battle between two regional banks:

Fifth Third Bancorp: Growing Operational Efficiency Amid Value Challenges

Fifth Third’s moat centers on cost advantage and operational scale, reflected by improving ROIC trends despite negative spread versus WACC. Its stable margins and 2026 product expansion efforts could deepen this defensive edge.

KeyCorp: Struggling Profitability with Broad Service Offering

KeyCorp relies on diversified financial services and customer reach, yet suffers a declining ROIC and value destruction. Despite strong recent revenue growth, its shrinking profitability challenges moat durability in a competitive landscape.

Efficiency Improvement vs. Profitability Decline: Who Holds the Deeper Moat?

Fifth Third displays a wider moat with growing ROIC momentum, signaling improving capital allocation despite current value destruction. KeyCorp’s shrinking returns and declining ROIC trend mark a weaker moat. I see Fifth Third better equipped to defend its market share through operational gains and margin stability.

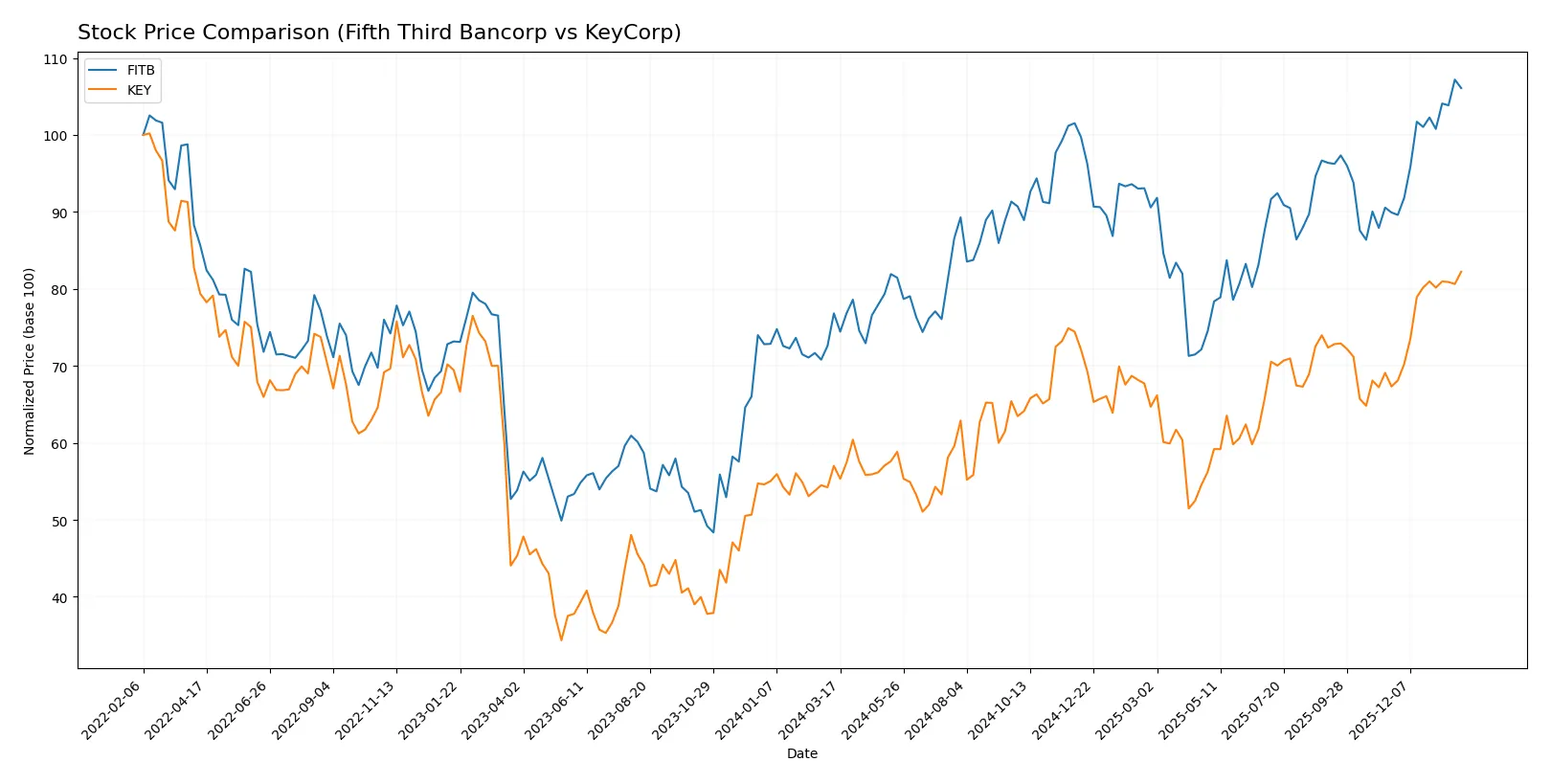

Which stock offers better returns?

The past year saw both Fifth Third Bancorp and KeyCorp exhibit strong upward momentum, with KeyCorp showing higher overall gains and more pronounced buyer dominance in recent trading.

Trend Comparison

Fifth Third Bancorp’s stock gained 38.08% over 12 months, signaling a bullish trend with accelerating price growth and a volatility level (std. dev.) of 4.08.

KeyCorp’s stock rose 44.24% over the same period, also bullish with acceleration, and lower volatility at 2.0 std. dev., indicating steadier gains.

KeyCorp outperformed Fifth Third Bancorp, delivering higher returns and stronger buyer dominance in recent months.

Target Prices

Analysts show a moderate upside for both Fifth Third Bancorp and KeyCorp, reflecting cautious optimism in regional banking.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Fifth Third Bancorp | 50 | 61 | 56.2 |

| KeyCorp | 18 | 25 | 23.38 |

Fifth Third Bancorp’s consensus target of 56.2 suggests roughly 12% upside from the current 50.22 price. KeyCorp’s 23.38 target implies nearly 9% growth above the 21.52 stock price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a detailed comparison of institutional grades for Fifth Third Bancorp and KeyCorp:

Fifth Third Bancorp Grades

The following table summarizes recent grades from established grading firms for Fifth Third Bancorp.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-01-26 |

| DA Davidson | Maintain | Buy | 2026-01-26 |

| Citigroup | Maintain | Neutral | 2026-01-23 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2026-01-21 |

| RBC Capital | Maintain | Outperform | 2026-01-21 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Barclays | Maintain | Overweight | 2026-01-05 |

| Truist Securities | Maintain | Buy | 2025-12-22 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2025-12-17 |

| Piper Sandler | Maintain | Overweight | 2025-12-10 |

KeyCorp Grades

The following table presents recent grades from reputable institutions for KeyCorp.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Hold | 2026-01-26 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Baird | Downgrade | Underperform | 2026-01-06 |

| Barclays | Maintain | Equal Weight | 2026-01-05 |

| Truist Securities | Maintain | Hold | 2025-12-22 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-12-17 |

| DA Davidson | Maintain | Buy | 2025-12-10 |

| DA Davidson | Maintain | Buy | 2025-10-17 |

| Truist Securities | Maintain | Hold | 2025-10-17 |

| UBS | Maintain | Buy | 2025-10-07 |

Which company has the best grades?

Fifth Third Bancorp consistently receives more favorable ratings, including multiple Buy and Outperform grades. KeyCorp shows a wider range, including a recent Underperform. This disparity may influence investor confidence and portfolio positioning.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Fifth Third Bancorp

- Operates in competitive regional banking with robust commercial and consumer segments. Faces pressure from fintech disruptors and regional peers.

KeyCorp

- Similar regional banking focus with broad consumer and commercial offerings. Slightly higher beta indicates marginally higher market risk.

2. Capital Structure & Debt

Fifth Third Bancorp

- Debt-to-equity moderate at 0.67; interest coverage weak at 0.82 signals debt servicing pressure. Current ratio low at 0.82 implies liquidity risk.

KeyCorp

- Lower debt-to-equity at 0.54 but weaker interest coverage at 0.61. Current ratio also low at 0.77, elevating short-term liquidity concerns.

3. Stock Volatility

Fifth Third Bancorp

- Beta near 1 (0.988) suggests stock volatility close to market average. Trading volume significantly above average, indicating active trading interest.

KeyCorp

- Slightly higher beta (1.082) signals above-market volatility. Volume below average may reflect less trading liquidity.

4. Regulatory & Legal

Fifth Third Bancorp

- As a large regional bank, faces ongoing regulatory scrutiny, especially in capital adequacy and lending practices. No recent legal flags noted.

KeyCorp

- Similar regulatory environment with intense oversight on consumer and commercial banking practices. No public legal controversies reported.

5. Supply Chain & Operations

Fifth Third Bancorp

- Operational risk moderate given extensive branch and ATM network. Asset turnover low at 0.06 suggests operational inefficiency.

KeyCorp

- Also faces operational challenges with low asset turnover at 0.06 but benefits from higher fixed asset turnover (17.82), indicating better use of fixed assets.

6. ESG & Climate Transition

Fifth Third Bancorp

- ESG risks include exposure to carbon-intensive sectors in commercial lending. No explicit climate transition strategy disclosed.

KeyCorp

- Similar ESG exposure; incremental efforts in sustainable finance reported but still early in transition efforts.

7. Geopolitical Exposure

Fifth Third Bancorp

- Primarily US-focused with no significant international exposure, reducing geopolitical risk.

KeyCorp

- Also primarily domestic, limiting geopolitical complications but vulnerable to US economic policy shifts.

Which company shows a better risk-adjusted profile?

Fifth Third Bancorp and KeyCorp both face notable liquidity and debt servicing risks, but Fifth Third shows a slightly more favorable capital structure with better interest coverage. KeyCorp’s higher stock volatility and weaker liquidity ratios elevate its risk profile. The Altman Z-scores place both firms in distress zones, yet Fifth Third’s stronger Piotroski score (8 vs. 7) signals better financial health and operational strength. I remain cautious given Fifth Third’s weak interest coverage and KeyCorp’s elevated volatility, but overall, Fifth Third presents a marginally better risk-adjusted profile due to stronger profitability metrics and operational efficiency trends observed in 2025.

Final Verdict: Which stock to choose?

Fifth Third Bancorp (FITB) showcases a superpower in steadily improving profitability despite a challenging macro environment. Its growing ROIC hints at operational progress, though its current liquidity profile signals a point of vigilance. FITB fits well in an aggressive growth portfolio seeking value uplift.

KeyCorp (KEY) leverages a strategic moat grounded in low valuation multiples and a solid dividend yield, supported by a stable asset base and strong cash flow generation. Relative to FITB, it offers a safer profile amid declining profitability trends. KEY aligns with GARP investors focused on measured growth with income.

If you prioritize operational momentum and improving profitability, FITB is the compelling choice due to its accelerating ROIC and favorable income trends. However, if you seek better stability and income consistency, KEY offers a more conservative stance with a stronger safety cushion despite its profitability headwinds. Both demand careful monitoring of their financial health given liquidity and value creation concerns.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Fifth Third Bancorp and KeyCorp to enhance your investment decisions: