Home > Comparison > Industrials > UPS vs FDX

The strategic rivalry between United Parcel Service, Inc. (UPS) and FedEx Corporation shapes the competitive dynamics in the Industrials sector’s Integrated Freight & Logistics industry. UPS operates a vast capital-intensive global logistics network, while FedEx emphasizes a diversified transportation and e-commerce services model. This analysis contrasts their corporate strategies to identify which offers superior risk-adjusted returns for a diversified portfolio navigating evolving market demands.

Table of contents

Companies Overview

United Parcel Service and FedEx stand as pivotal players in the global logistics and freight sector.

United Parcel Service, Inc.: Global Logistics Powerhouse

United Parcel Service dominates as a leader in integrated freight and logistics. It generates revenue through U.S. Domestic and International Package delivery services, complemented by supply chain solutions and freight forwarding. In 2026, UPS sharpens its focus on expanding express international delivery, leveraging a fleet of 121K vehicles and 59K cargo containers to sustain its competitive advantage.

FedEx Corporation: Express Delivery Innovator

FedEx operates as a major provider of transportation and e-commerce services with diversified segments including FedEx Express, Ground, Freight, and Services. Its revenue engine hinges on time-critical express transport and day-certain ground delivery. In the current year, FedEx prioritizes technology-driven cross-border solutions and supply chain integration to enhance its market position across 400 service centers.

Strategic Collision: Similarities & Divergences

Both companies emphasize time-definite delivery and global reach but diverge in business philosophy; UPS leans on a vast asset base while FedEx integrates technology and e-commerce services. The primary battleground is express international and ground delivery, where efficiency determines market share. UPS offers a more asset-heavy profile, whereas FedEx presents a technology-enabled, service-diverse investment character.

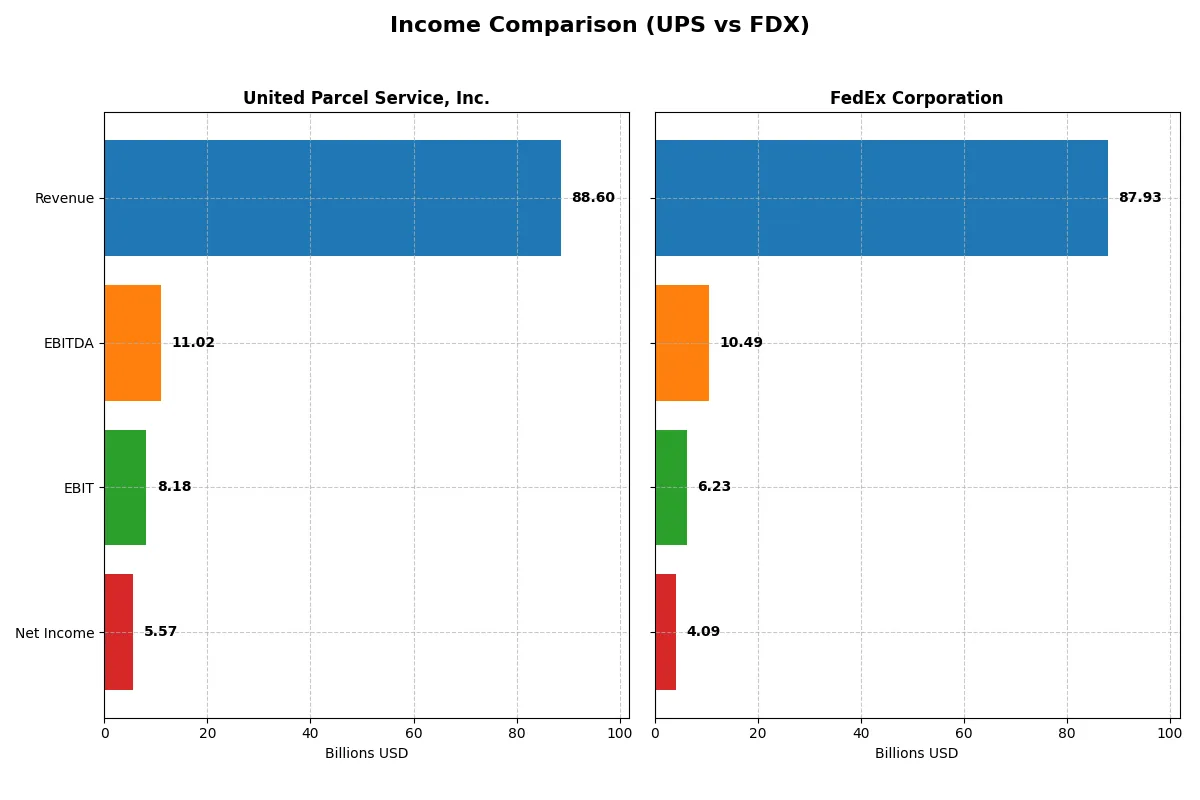

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | United Parcel Service, Inc. (UPS) | FedEx Corporation (FDX) |

|---|---|---|

| Revenue | 88.6B | 87.9B |

| Cost of Revenue | 53.2B | 68.9B |

| Operating Expenses | 27.5B | 12.9B |

| Gross Profit | 35.4B | 19.0B |

| EBITDA | 11.0B | 10.5B |

| EBIT | 8.2B | 6.2B |

| Interest Expense | 1.0B | 0.8B |

| Net Income | 5.6B | 4.1B |

| EPS | 6.57 | 16.96 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates more efficiently by dissecting their revenue and profit dynamics over recent years.

United Parcel Service, Inc. Analysis

UPS’s revenue declined by 2.5% in 2025, continuing a downward trend over five years. Its gross margin impressively rebounds to nearly 40%, showcasing strong cost control. However, net income slipped 3% last year, signaling margin pressure despite stable operating income near $7.9B. This mix highlights operational resilience amid top-line softness.

FedEx Corporation Analysis

FedEx’s revenue nudged up 0.3% in 2025, a mild improvement after fluctuating sales. Its gross margin stands at 21.6%, indicating tighter cost structure but lower profitability than UPS. Net income fell 5.8%, reflecting margin erosion combined with a 5.3% EBIT decline. FedEx struggles to convert slight revenue gains into sustained profit momentum.

Margin Strength vs. Revenue Stability

UPS leads with a stronger gross margin and higher net income despite shrinking revenue. FedEx’s modest top-line growth fails to translate into profit gains and reveals weaker margin control. For investors prioritizing efficiency and durable profitability, UPS’s profile aligns better with long-term value creation.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of these companies:

| Ratios | United Parcel Service, Inc. (UPS) | FedEx Corporation (FDX) |

|---|---|---|

| ROE | 34.34% | 14.58% |

| ROIC | 10.44% | 6.00% |

| P/E | 15.11 | 12.95 |

| P/B | 5.19 | 1.89 |

| Current Ratio | 1.22 | 1.19 |

| Quick Ratio | 1.22 | 1.15 |

| D/E | 1.53 | 1.33 |

| Debt-to-Assets | 34.05% | 42.70% |

| Interest Coverage | 7.78 | 7.71 |

| Asset Turnover | 1.21 | 1.00 |

| Fixed Asset Turnover | 2.11 | 1.51 |

| Payout Ratio | 96.88% | 32.72% |

| Dividend Yield | 6.41% | 2.53% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, revealing hidden risks and operational excellence that investors must decode carefully.

United Parcel Service, Inc.

UPS delivers strong profitability with a robust 34.34% ROE and favorable 10.44% ROIC, outperforming its 7.39% WACC comfortably. The stock trades at a neutral P/E of 15.11 but carries an unfavorable high P/B of 5.19, suggesting some valuation stretch. UPS rewards shareholders with a solid 6.41% dividend yield, balancing returns with steady capital discipline.

FedEx Corporation

FedEx shows moderate profitability, with a neutral 14.58% ROE and 6.0% ROIC, slightly below UPS’s efficiency. Its valuation appears attractive, trading at a favorable P/E of 12.95 and a neutral P/B of 1.89, indicating less valuation risk. FedEx offers a 2.53% dividend yield, favoring income but reflecting lower operational returns amid higher debt levels.

Premium Valuation vs. Operational Safety

UPS commands a premium valuation but delivers superior profitability and shareholder returns, signaling operational strength. FedEx trades cheaper but with lower returns and higher leverage, implying greater risk. Investors prioritizing stable profitability and income may lean toward UPS, while those seeking valuation bargains might find FedEx’s profile more fitting.

Which one offers the Superior Shareholder Reward?

I see UPS delivers a robust 6.4% dividend yield with a 97% payout ratio, nearly fully covering dividends with free cash flow. UPS also runs steady buybacks, supporting total returns. FedEx yields 2.5% with a 33% payout ratio, retaining more for growth and acquisitions but with weaker free cash flow coverage. FedEx’s buybacks are less intense, signaling a cautious capital return. Historically, UPS’s high payout and buyback blend offer more immediate and sustainable shareholder reward. I conclude UPS presents a superior total return profile for 2026 investors focused on income and capital return reliability.

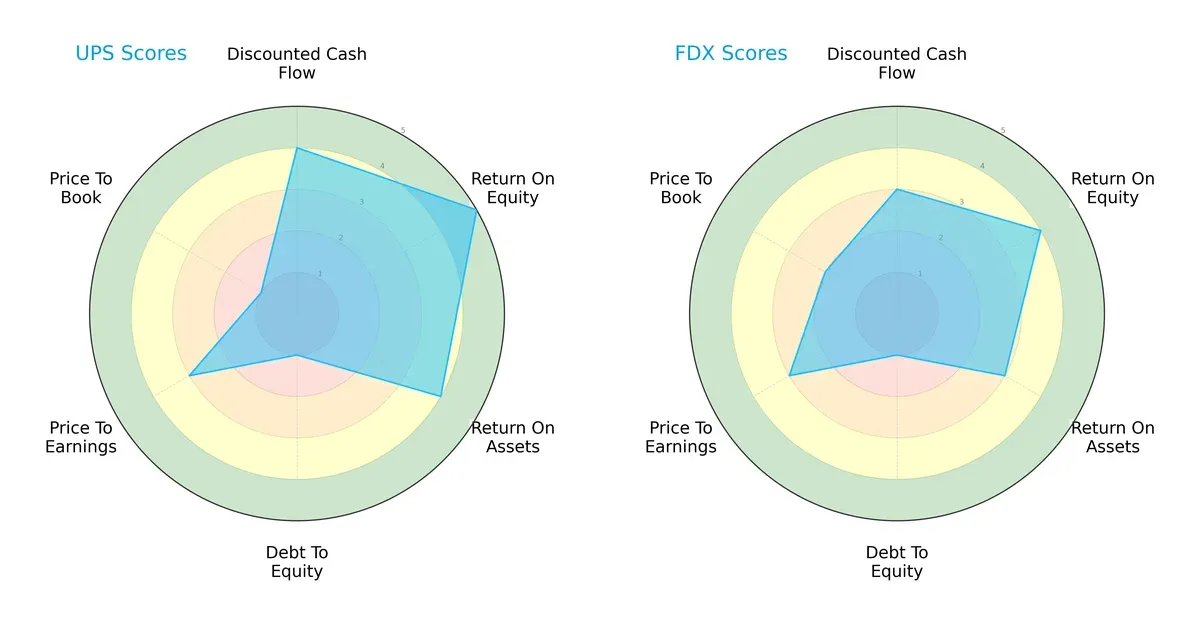

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of United Parcel Service, Inc. and FedEx Corporation, highlighting their financial strengths and vulnerabilities:

United Parcel Service (UPS) leads with superior returns on equity (5 vs. 4) and assets (4 vs. 3), showcasing operational efficiency. Both companies share moderate discounted cash flow (4 vs. 3) and price-to-earnings scores (3 each). However, UPS faces greater financial risk with a weaker debt-to-equity (1 vs. 1) and price-to-book score (1 vs. 2), indicating valuation concerns. FedEx presents a more balanced valuation profile but lags slightly in profitability metrics.

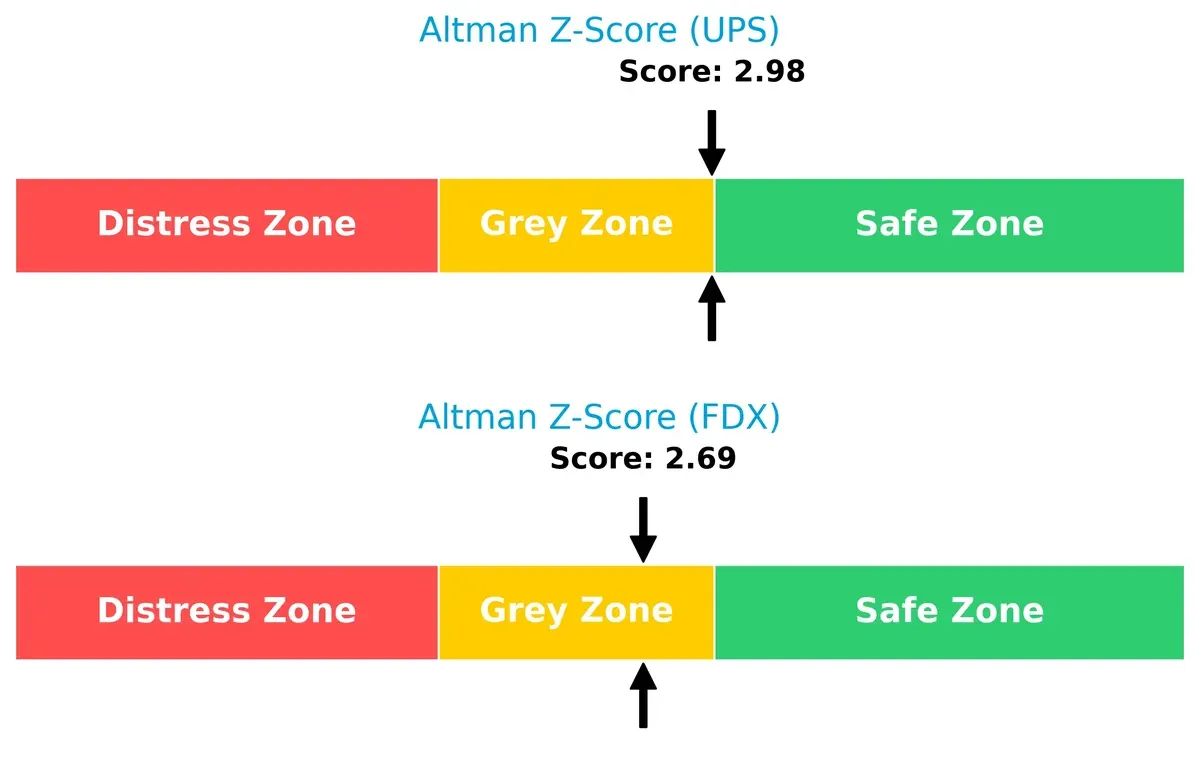

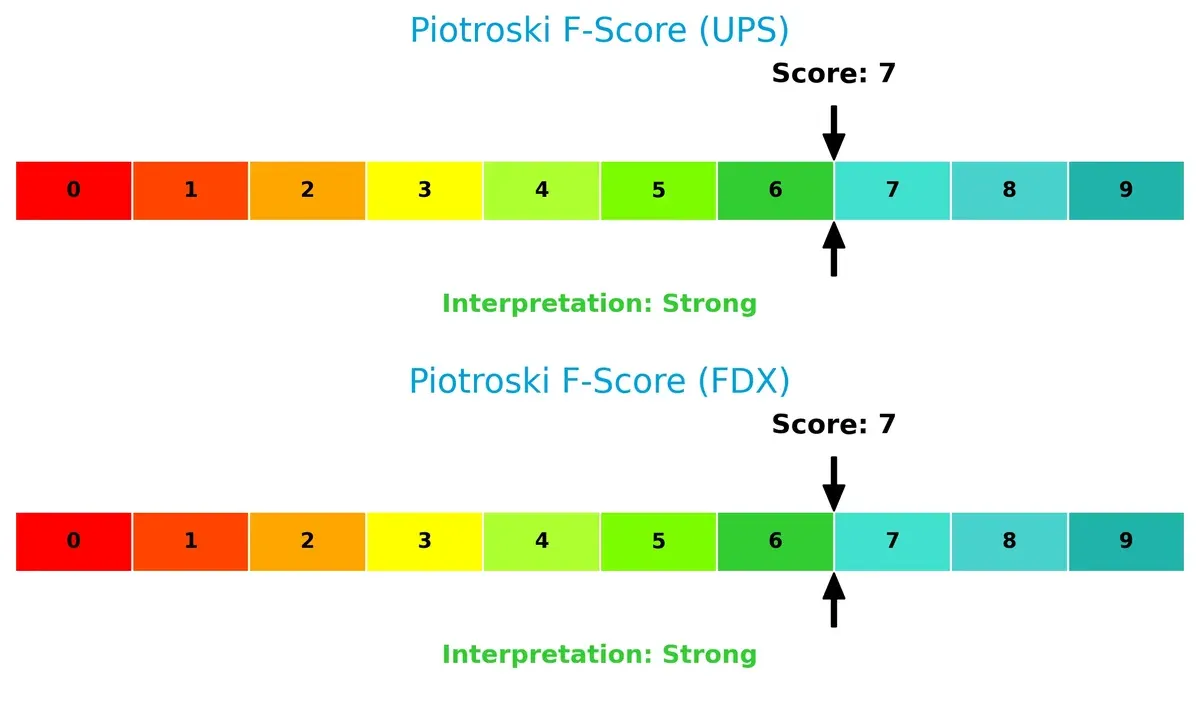

Bankruptcy Risk: Solvency Showdown

UPS’s Altman Z-Score of 2.98 slightly surpasses FedEx’s 2.69, placing both firms in the grey zone for bankruptcy risk. This suggests moderate survival prospects amid economic cycles:

Financial Health: Quality of Operations

Both UPS and FedEx score 7 on the Piotroski F-Score, indicating strong financial health. Neither company exhibits red flags in internal operations, supporting stable quality:

How are the two companies positioned?

This section dissects UPS and FDX’s operational DNA by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to reveal which model offers a more resilient, sustainable competitive advantage today.

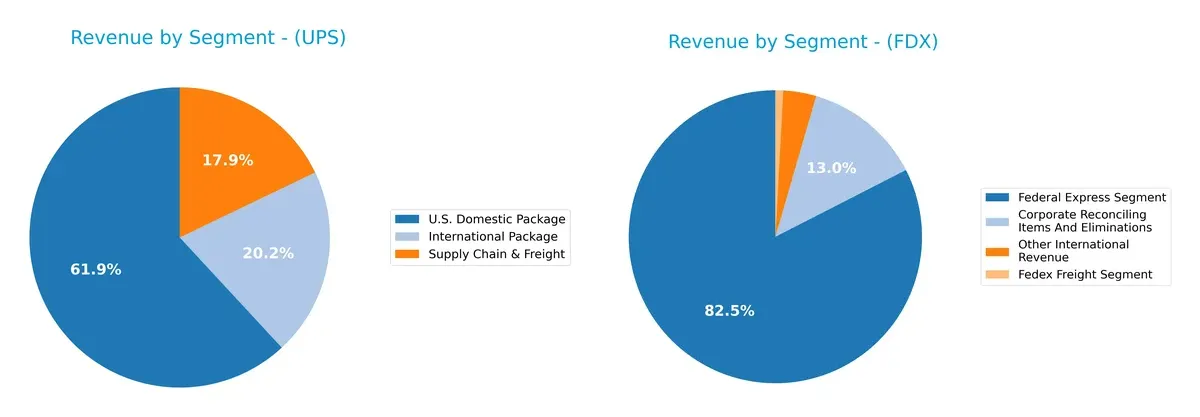

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how United Parcel Service and FedEx diversify their income streams and where their primary sector bets lie:

United Parcel Service anchors its revenue heavily in U.S. Domestic Package at $40.8B, with International Package and Supply Chain & Freight trailing at $13.3B and $11.8B respectively. FedEx presents a more fragmented mix, with FedEx Express dominating around $23.7B in 2025, but Ground and Freight segments adding meaningful scale. UPS’s concentration signals strong domestic market control, while FedEx’s diversification reduces risk but demands complex capital allocation.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of UPS and FDX based on diversification, profitability, financials, innovation, global presence, and market share:

UPS Strengths

- Diversified revenue streams across U.S. Domestic, International, and Supply Chain & Freight

- Strong ROE (34.34%) and ROIC (10.44%) above WACC (7.39%) indicate efficient capital use

- Favorable quick ratio (1.22) and interest coverage (8.05) reflect solid liquidity and debt servicing

- Large and growing U.S. and International revenue base with consistent scale

FDX Strengths

- Favorable P/E (12.95) and dividend yield (2.53%) support shareholder returns

- Favorable quick ratio (1.15) and interest coverage (7.9) indicate reasonable liquidity

- Diverse business segments including Express, Ground, Freight, and International

- Significant U.S. revenue scale with expanding Non-U.S. presence

UPS Weaknesses

- Unfavorable price-to-book (5.19) and debt-to-equity (1.53) suggest possible overvaluation and higher leverage

- Net margin (6.29%) neutral but lower than ROE might indicate operational inefficiencies

- Moderate current ratio (1.22) limits short-term flexibility

- Heavy reliance on U.S. Domestic Package segment

FDX Weaknesses

- Unfavorable net margin (4.65%) and moderate ROE (14.58%) indicate weaker profitability

- Higher debt-to-assets (42.7%) with unfavorable debt-to-equity (1.33) signals leverage risk

- Smaller scale in Supply Chain & Freight compared to UPS

- Corporate reconciling items and eliminations complicate revenue clarity

Both companies demonstrate strong liquidity and capital efficiency but face challenges in profitability and leverage management. UPS’s diversified segments and higher profitability contrast with FedEx’s valuation appeal and segment complexity, influencing their strategic priorities differently.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the critical barrier protecting long-term profits from relentless competition erosion. Let’s dissect these companies’ moats:

United Parcel Service, Inc. (UPS): Cost Advantage Fortress

UPS’s moat stems from its vast logistics network and scale-driven cost advantage. This translates into a ROIC exceeding WACC by 3%, signaling value creation despite a declining trend. New supply chain innovations could extend this advantage in 2026.

FedEx Corporation (FDX): Operational Scale Under Pressure

FedEx relies on integrated freight and global reach but struggles to generate ROIC above WACC, indicating value destruction. Its operational scale is challenged by margin compression and declining returns, though expansion into e-commerce logistics offers a growth lever.

Verdict: Scale-Driven Cost Advantage vs. Operational Strain

UPS holds a deeper moat with consistent value creation, while FedEx faces profitability erosion. UPS’s superior cost structure better equips it to defend market share amid intensifying logistics competition.

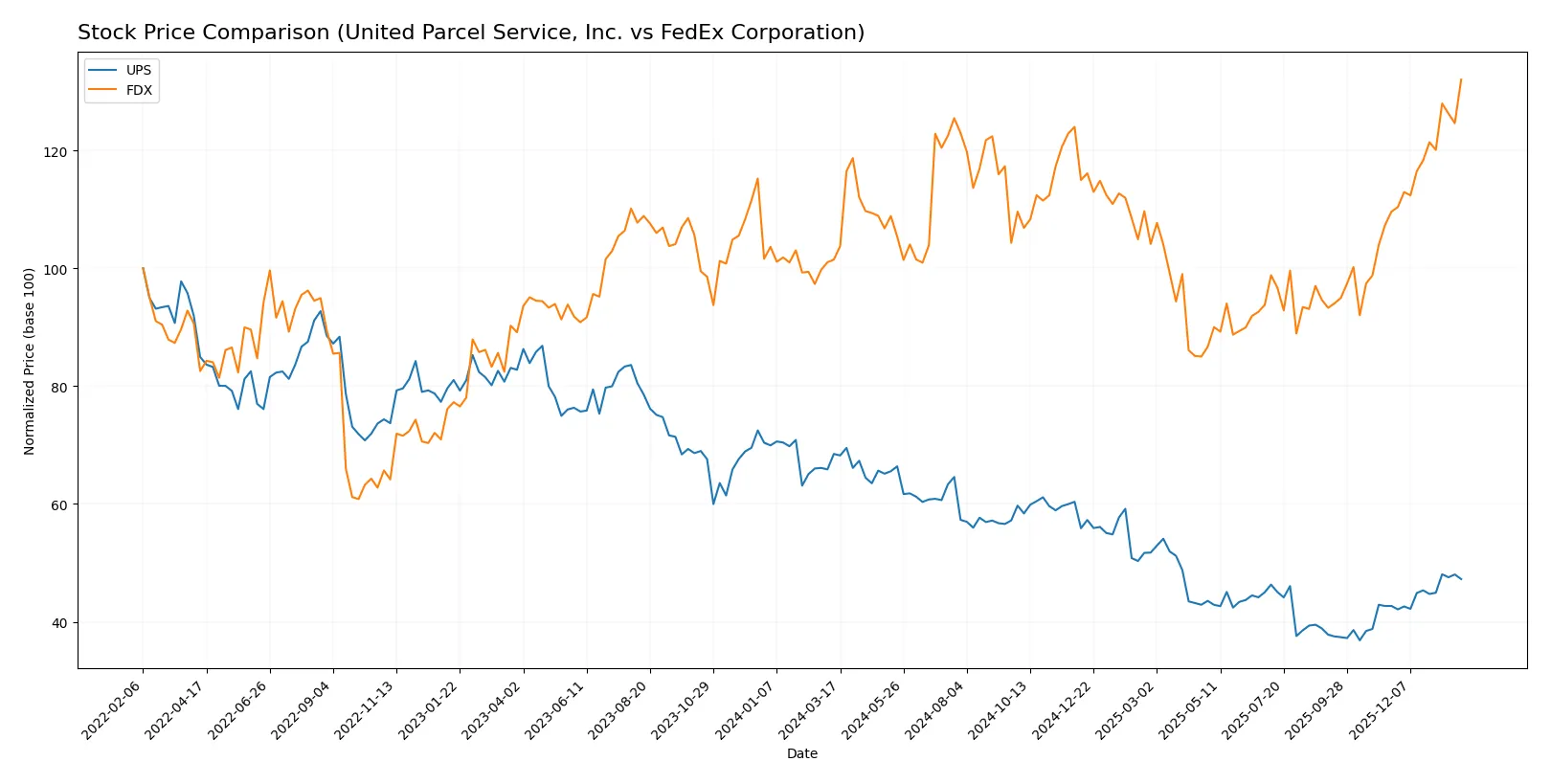

Which stock offers better returns?

The past year reveals contrasting price dynamics: UPS faces a sharp decline with recent recovery, while FedEx shows robust gains and accelerating momentum.

Trend Comparison

United Parcel Service’s stock fell 31.01% over the past 12 months, marking a bearish trend with accelerating decline and a high volatility of 20.85. Its price ranged between 82.87 and 156.27.

FedEx’s stock rose 30.11% in the last year, reflecting a bullish trend with accelerating gains and higher volatility at 28.04. The price fluctuated from 207.55 to 322.25.

FedEx outperformed UPS with a strong 30.11% gain versus UPS’s 31.01% loss, delivering the highest market performance in the comparison.

Target Prices

Analysts present a clear consensus on target prices for UPS and FedEx, reflecting measured optimism.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| United Parcel Service, Inc. | 85 | 128 | 110.6 |

| FedEx Corporation | 210 | 355 | 294.07 |

UPS’s consensus target of 110.6 suggests modest upside from its current 106.22 price, indicating steady growth expectations. FedEx’s 294.07 target sits below its 322.25 stock price, signaling cautious analyst sentiment despite recent strength.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

United Parcel Service, Inc. Grades

Here are the recent grades from major financial institutions for UPS:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stephens & Co. | Maintain | Equal Weight | 2026-01-28 |

| Jefferies | Maintain | Buy | 2026-01-28 |

| Oppenheimer | Maintain | Outperform | 2026-01-28 |

| Truist Securities | Maintain | Buy | 2026-01-28 |

| UBS | Maintain | Buy | 2026-01-28 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-28 |

| Citigroup | Maintain | Buy | 2026-01-28 |

| JP Morgan | Maintain | Neutral | 2026-01-28 |

| Stifel | Maintain | Buy | 2026-01-28 |

| Deutsche Bank | Maintain | Hold | 2026-01-28 |

FedEx Corporation Grades

Here are the recent grades from major financial institutions for FedEx:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rothschild & Co | Downgrade | Neutral | 2026-01-21 |

| Bernstein | Maintain | Market Perform | 2026-01-09 |

| Jefferies | Maintain | Buy | 2025-12-19 |

| Morgan Stanley | Maintain | Underweight | 2025-12-19 |

| JP Morgan | Maintain | Neutral | 2025-12-19 |

| BMO Capital | Maintain | Market Perform | 2025-12-19 |

| Truist Securities | Maintain | Buy | 2025-12-19 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-19 |

| Stephens & Co. | Maintain | Overweight | 2025-12-19 |

| B of A Securities | Maintain | Neutral | 2025-12-19 |

Which company has the best grades?

UPS consistently receives stronger grades, including multiple Buy and Outperform ratings. FedEx holds more neutral and mixed grades with a recent downgrade. This suggests UPS currently enjoys higher institutional confidence, which could influence investor sentiment.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing United Parcel Service, Inc. (UPS) and FedEx Corporation (FDX) in the 2026 market environment:

1. Market & Competition

United Parcel Service, Inc.

- UPS faces intense competition from global logistics firms and rising e-commerce demands increasing price pressure.

FedEx Corporation

- FDX contends with aggressive pricing and innovation from rivals, challenging its market share and growth prospects.

2. Capital Structure & Debt

United Parcel Service, Inc.

- UPS carries a debt-to-equity ratio of 1.53, flagged as unfavorable, raising financial risk concerns.

FedEx Corporation

- FDX’s debt-to-equity ratio at 1.33 is slightly lower but still unfavorable, indicating leverage risks.

3. Stock Volatility

United Parcel Service, Inc.

- UPS has a beta of 1.10, suggesting moderate stock volatility aligned with the industrial sector.

FedEx Corporation

- FDX’s beta is higher at 1.36, implying greater sensitivity to market swings and increased risk.

4. Regulatory & Legal

United Parcel Service, Inc.

- UPS faces regulatory scrutiny in cross-border logistics and environmental compliance, adding complexity.

FedEx Corporation

- FDX deals with similar legal challenges plus evolving trade policies impacting international operations.

5. Supply Chain & Operations

United Parcel Service, Inc.

- UPS’s vast fleet and global reach expose it to supply chain disruptions and rising fuel costs.

FedEx Corporation

- FDX’s smaller fleet and reliance on less-than-truckload freight increase operational vulnerabilities.

6. ESG & Climate Transition

United Parcel Service, Inc.

- UPS is investing in greener fleets but faces pressure to accelerate climate transition amid industry standards.

FedEx Corporation

- FDX also pursues sustainability but must balance cost controls with ESG commitments.

7. Geopolitical Exposure

United Parcel Service, Inc.

- UPS’s extensive global footprint exposes it to geopolitical tensions and trade disruptions worldwide.

FedEx Corporation

- FDX experiences similar geopolitical risks, with higher sensitivity due to concentrated operations in key regions.

Which company shows a better risk-adjusted profile?

UPS’s highest risk is its leveraged balance sheet, which may constrain flexibility amid rising interest rates. FDX’s greatest risk is its higher stock volatility, exposing investors to greater market uncertainty. Despite similar leverage concerns, UPS’s more diversified operations and slightly lower beta suggest a better risk-adjusted profile. Notably, UPS maintains a stronger return on invested capital (10.44% vs. 6.0%), underpinning operational resilience despite debt pressures.

Final Verdict: Which stock to choose?

United Parcel Service, Inc. (UPS) shines with its robust capital efficiency and strong return on equity. Its superpower lies in consistently creating value above its cost of capital. A point of vigilance is its declining profitability trend and high price-to-book ratio. UPS suits investors with an aggressive growth appetite who tolerate some margin pressure.

FedEx Corporation (FDX) leverages a strategic moat in diversified delivery networks and steady cash flow generation. It offers a more conservative risk profile than UPS but struggles to create value above its capital cost. FDX fits portfolios favoring growth at a reasonable price, seeking steadier income and lower valuation multiples.

If you prioritize superior capital returns and growth potential, UPS is the compelling choice due to its value-creation edge despite margin headwinds. However, if you seek stability and a more moderate valuation, FDX offers better downside protection and income consistency. Both carry risks, demanding careful alignment with your investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of United Parcel Service, Inc. and FedEx Corporation to enhance your investment decisions: