Home > Comparison > Technology > SNOW vs FICO

The strategic rivalry between Snowflake Inc. and Fair Isaac Corporation shapes the evolution of the technology sector. Snowflake operates a cloud-based data platform, emphasizing scalable data consolidation and analytics. In contrast, Fair Isaac delivers advanced decision-management software and scoring solutions focused on business automation. This head-to-head pits rapid cloud innovation against proven analytical expertise. This analysis will identify which company’s trajectory offers superior risk-adjusted returns for a well-diversified portfolio.

Table of contents

Companies Overview

Snowflake Inc. and Fair Isaac Corporation stand as pivotal players in the enterprise software landscape, shaping data-driven decision-making.

Snowflake Inc.: Cloud Data Platform Leader

Snowflake Inc. dominates as a cloud-based data platform provider, consolidating diverse datasets into a unified source for actionable insights. Its revenue hinges on scalable subscription fees for its Data Cloud services, which support data sharing and application development. In 2026, Snowflake sharpens its strategic focus on expanding customer adoption across industries and enhancing its platform’s data collaboration capabilities.

Fair Isaac Corporation: Analytics and Decision Automation Specialist

Fair Isaac Corporation commands the market with analytic software and scoring solutions, automating critical business decisions like fraud detection and customer management. Its revenue streams emerge from two core segments: Scores and Software, delivering modular decision management tools and consumer credit scores. The company’s 2026 strategy emphasizes broadening its decisioning software’s applicability and integrating advanced analytics to deepen client engagement.

Strategic Collision: Similarities & Divergences

Both firms leverage analytics software but diverge in approach: Snowflake offers an open, cloud-native data platform, while Fair Isaac delivers specialized decision automation within closed ecosystems. Their primary battleground lies in enabling smarter, faster business decisions through data, yet Snowflake targets broad data infrastructure, and Fair Isaac focuses on niche decision intelligence. These differences yield distinct investment profiles—Snowflake as a scalable platform play, Fair Isaac as a specialized analytics stalwart.

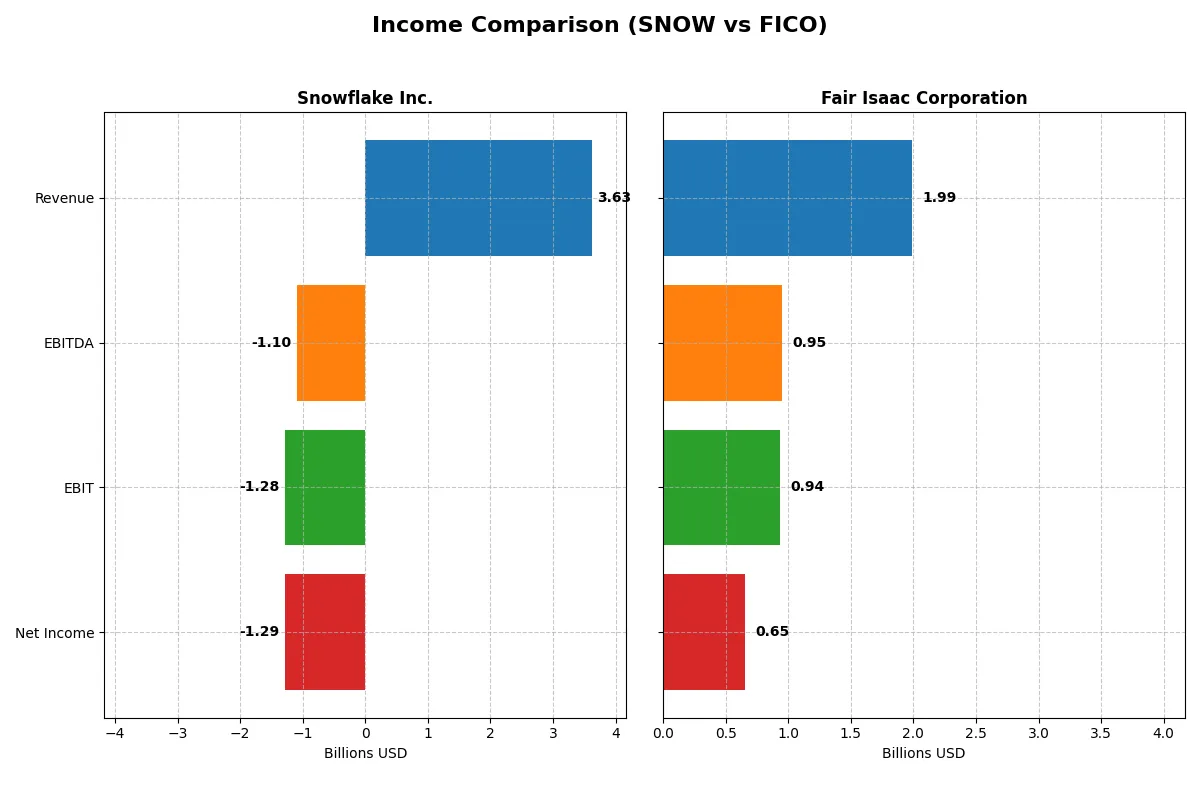

Income Statement Comparison

The following table dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Snowflake Inc. (SNOW) | Fair Isaac Corporation (FICO) |

|---|---|---|

| Revenue | 3.63B | 1.99B |

| Cost of Revenue | 1.21B | 354M |

| Operating Expenses | 3.87B | 712M |

| Gross Profit | 2.41B | 1.64B |

| EBITDA | -1.10B | 951M |

| EBIT | -1.28B | 936M |

| Interest Expense | 2.76M | 134M |

| Net Income | -1.29B | 652M |

| EPS | -3.86 | 26.9 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals each company’s true operational efficiency and profitability trajectory over recent years.

Snowflake Inc. Analysis

Snowflake’s revenue surged from 592M in 2021 to 3.63B in 2025, demonstrating robust top-line growth. However, persistent net losses, with a -1.29B net income in 2025, drag margins deep into negative territory. Despite a strong 66.5% gross margin, Snowflake’s -35.45% net margin and declining EBIT margin reveal ongoing challenges in converting sales into profits amid rising expenses.

Fair Isaac Corporation Analysis

Fair Isaac grew revenue steadily from 1.32B in 2021 to 1.99B in 2025, maintaining excellent profitability. Its gross margin of 82.23% and net margin of 32.75% highlight superior cost control and operational leverage. The company posted 652M net income in 2025, reflecting strong earnings momentum and consistent margin expansion, supported by a 25.22% EBIT growth year-over-year.

Margin Dominance vs. Growth Struggles

Fair Isaac clearly outperforms Snowflake in profitability and margin sustainability. While Snowflake impresses with rapid revenue growth, it still operates at significant losses. Fair Isaac’s healthy margins and consistent earnings growth make it the fundamental winner. Investors favoring stable, profitable cash flow will find Fair Isaac’s profile more attractive than Snowflake’s high-growth, high-burn model.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | Snowflake Inc. (SNOW) | Fair Isaac Corporation (FICO) |

|---|---|---|

| ROE | -42.9% | -37.3% |

| ROIC | -25.2% | 52.96% |

| P/E | -47 | 55.6 |

| P/B | 20.1 | -20.8 |

| Current Ratio | 1.75 | 0.83 |

| Quick Ratio | 1.75 | 0.83 |

| D/E (Debt-to-Equity) | 0.90 | -1.76 |

| Debt-to-Assets | 29.7% | 165% |

| Interest Coverage | -528 | 6.92 |

| Asset Turnover | 0.40 | 1.07 |

| Fixed Asset Turnover | 5.53 | 21.2 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering hidden risks and operational strengths that influence investor decisions.

Snowflake Inc.

Snowflake displays weak profitability with a -42.9% ROE and a -35.5% net margin, signaling operational challenges. Its P/E ratio is negative, reflecting losses, while its P/S ratio indicates a stretched valuation. Snowflake does not pay dividends, instead reinvesting heavily in R&D, which consumes nearly half its revenue for future growth.

Fair Isaac Corporation

Fair Isaac shows solid profitability with a 32.8% net margin and a strong 53.0% ROIC, despite a negative ROE at -37.3%. The stock trades at a high P/E of 55.6, suggesting it is expensive relative to earnings. It pays no dividend, focusing on efficient capital allocation and moderate R&D spending under 10% of revenue.

Premium Valuation vs. Operational Safety

Fair Isaac offers better profitability and operational efficiency but at a higher valuation and financial leverage risk. Snowflake’s valuation is less stretched but suffers from heavy losses and negative returns. Investors seeking growth with tolerance for risk may lean Snowflake; those favoring operational strength may prefer Fair Isaac.

Which one offers the Superior Shareholder Reward?

Snowflake Inc. (SNOW) pays no dividends and has no share buyback program, focusing instead on reinvesting heavily in growth and R&D, reflected in negative profit margins but strong gross margins and expanding free cash flow. Fair Isaac Corporation (FICO) also pays no dividends but actively returns capital through robust buyback activity, supported by a strong 33% net profit margin and solid free cash flow coverage. I see FICO’s distribution model as more sustainable and shareholder-friendly in 2026. Its consistent profitability and capital returns make it the superior choice for total shareholder reward.

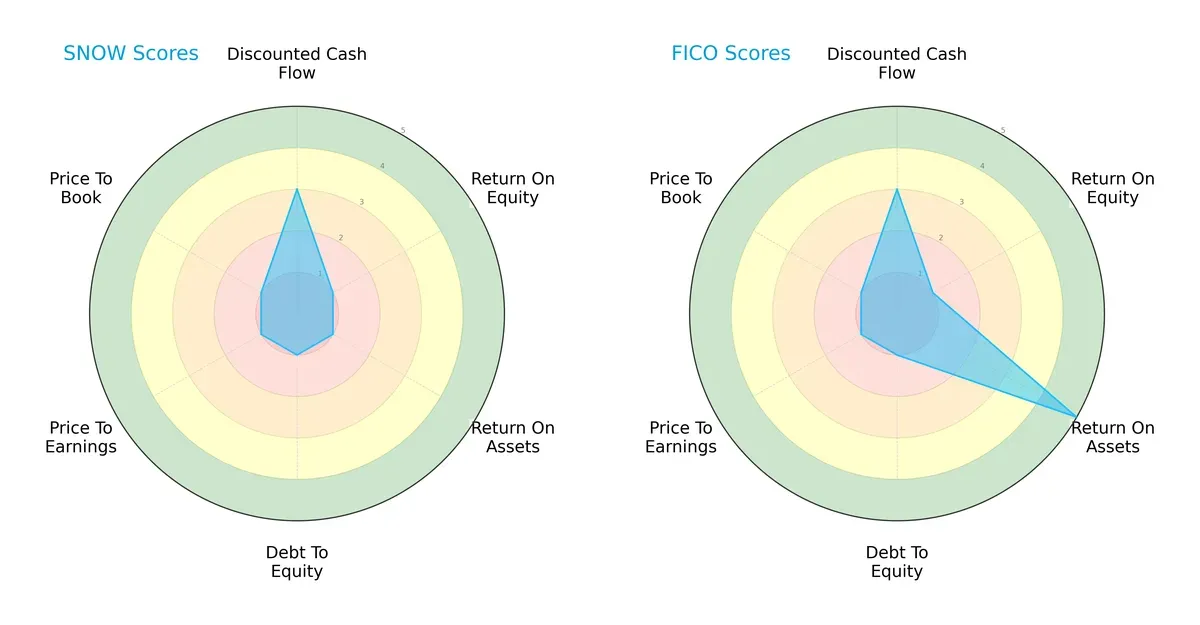

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Snowflake Inc. and Fair Isaac Corporation, highlighting their core financial strengths and weaknesses:

Snowflake shows a broadly weak profile, scoring very low on ROE, ROA, debt/equity, and valuation metrics. Fair Isaac presents a more balanced profile, notably excelling in return on assets, signaling more efficient asset use. Snowflake relies mostly on moderate DCF strength, while Fair Isaac leverages operational efficiency but shares valuation challenges.

Bankruptcy Risk: Solvency Showdown

Fair Isaac’s Altman Z-Score of 12.2 far exceeds Snowflake’s 5.3, both safely above distress levels, but Fair Isaac’s superior score indicates stronger solvency resilience in this cycle:

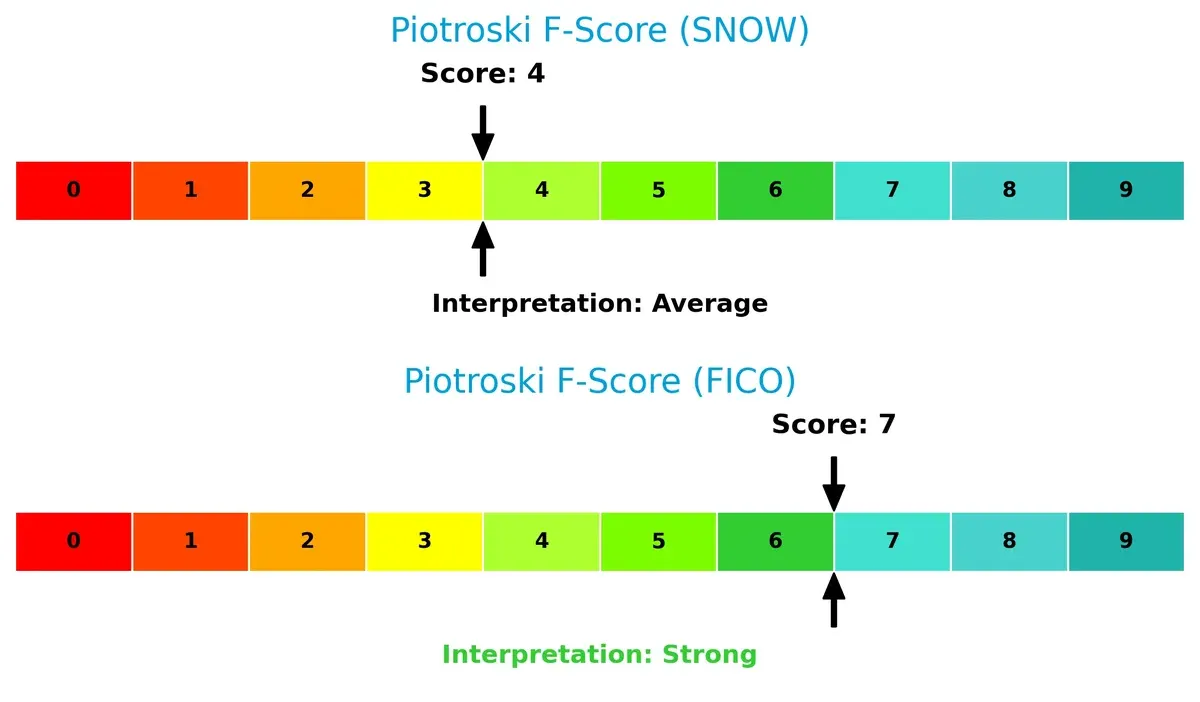

Financial Health: Quality of Operations

Fair Isaac’s Piotroski Score of 7 signals strong financial health, outperforming Snowflake’s average score of 4, which raises caution over internal operational metrics and potential red flags:

How are the two companies positioned?

This section dissects the operational DNA of Snowflake and Fair Isaac by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify which model offers a more resilient and sustainable advantage today.

Revenue Segmentation: The Strategic Mix

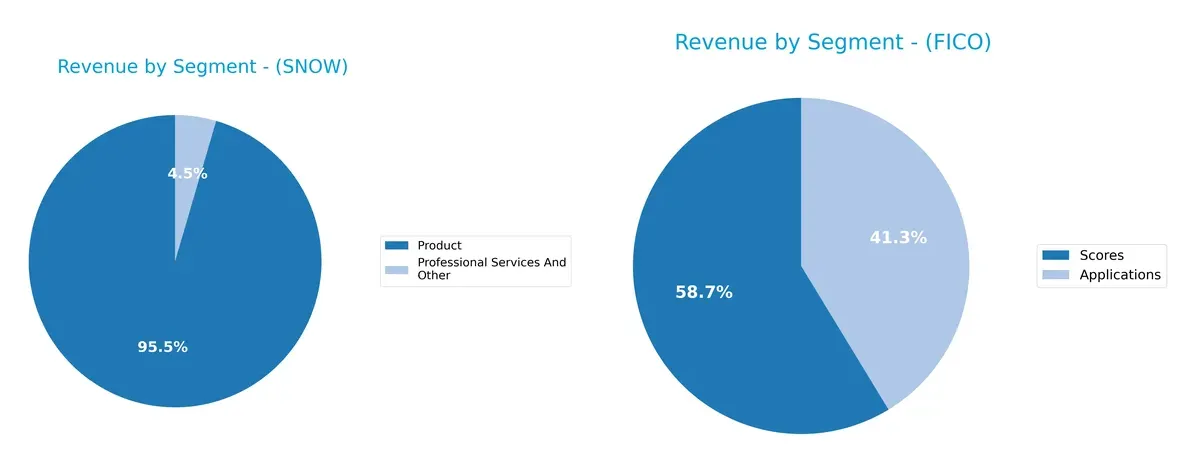

This visual comparison dissects how Snowflake Inc. and Fair Isaac Corporation diversify their income streams and highlights their primary sector bets:

Snowflake Inc. heavily anchors revenue in its Product segment with $3.46B in 2025, while its Professional Services generate a modest $164M. Fair Isaac Corporation shows a more balanced mix, with Scores at $1.17B and Applications or Software around $822M. Snowflake’s concentration signals strong cloud platform dominance but raises concentration risk. FICO’s split suggests more diversified client reliance, mitigating dependency on a single product ecosystem.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Snowflake Inc. and Fair Isaac Corporation:

Snowflake Inc. Strengths

- Strong revenue growth from products at 3.46B USD in 2025

- Solid global presence with 2.86B USD US revenue and expanding EMEA and Asia-Pacific sales

- Favorable liquidity ratios with current and quick ratio at 1.75

- Low debt-to-assets ratio at 29.72% indicating conservative leverage

- High fixed asset turnover at 5.53 showing efficient asset use

Fair Isaac Corporation Strengths

- Higher net margin at 32.75% reflecting profitability

- Robust ROIC at 52.96% outperforming cost of capital

- Favorable debt-to-equity at -1.76 and interest coverage at 7.01 indicating strong financial health

- Higher asset turnover at 1.07 and fixed asset turnover at 21.2 revealing operational efficiency

- Diversified revenue with 1.17B USD in Scores and 822M USD in Applications in 2025

Snowflake Inc. Weaknesses

- Negative net margin at -35.45% and ROE at -42.86% signal unprofitability

- Unfavorable interest coverage at -464.78 suggests financial strain

- High price-to-book ratio at 20.13 questions valuation

- Lower asset turnover at 0.4 indicating less efficient asset use

- No dividend yield potentially limiting income for investors

Fair Isaac Corporation Weaknesses

- Negative ROE at -37.34% despite profitability

- High debt-to-assets at 164.6% signals heavy leverage risk

- Low current ratio at 0.83 indicating liquidity concerns

- Unfavorable P/E at 55.64 reflecting expensive valuation

- No dividend yield reducing shareholder income potential

Both companies exhibit strengths in their core operations and global reach but face challenges in profitability and financial structure. Snowflake’s liquidity and asset efficiency contrast with Fair Isaac’s profitability and leverage profile, shaping distinct strategic priorities.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competition erosion. Here’s how two tech firms compare:

Snowflake Inc.: Network Effects and Data Consolidation Powerhouse

Snowflake’s moat stems from network effects in its cloud data platform, reflected in robust revenue growth (512% over five years). Yet, declining ROIC signals weakening capital efficiency. Expansion into global markets could deepen or strain this advantage in 2026.

Fair Isaac Corporation: Intangible Assets and Scoring Expertise

FICO’s moat relies on intangible assets—proprietary analytics and credit scoring. It consistently posts high ROIC well above WACC, showcasing durable value creation. Growing revenues and margins position FICO to capitalize on new decision management markets in 2026.

Network Effects vs. Intangible Asset Dominance

FICO possesses the deeper, more durable moat, evidenced by strong ROIC growth and margin expansion. Snowflake’s rapid growth is impressive but its declining profitability warns of moat erosion. FICO stands better poised to defend and expand its market share.

Which stock offers better returns?

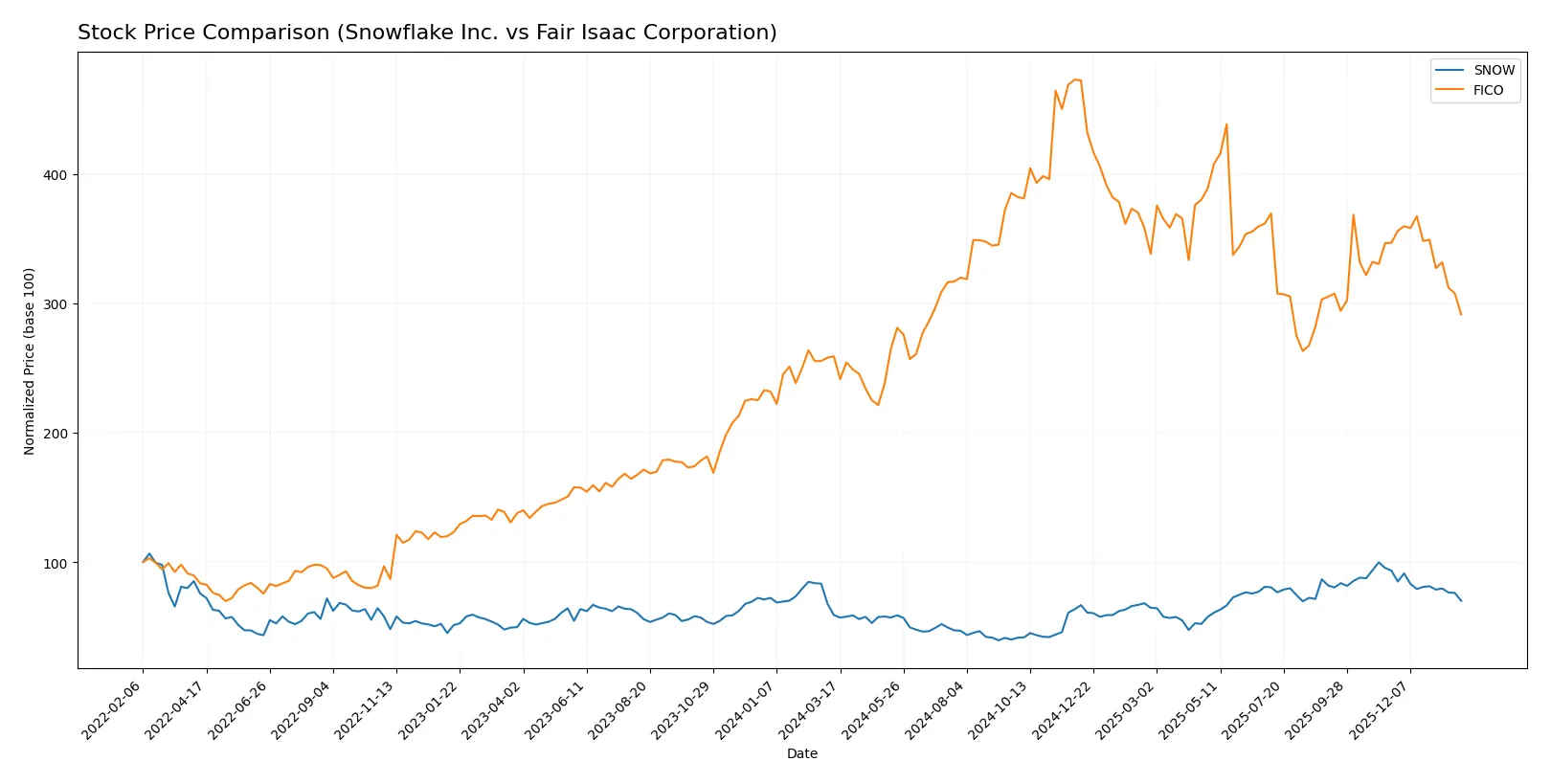

Snowflake Inc. and Fair Isaac Corporation show notable price dynamics over the past year, with both stocks exhibiting bullish trends but recent downward pressures.

Trend Comparison

Snowflake Inc. gained 18.66% over the past year, signaling a bullish trend with decelerating momentum. The stock ranged from a low of 108.56 to a high of 274.88, showing significant price volatility.

Fair Isaac Corporation rose 12.51% in the last 12 months, also bullish but with decelerating acceleration. Price fluctuated widely between 1110.85 and 2375.03, reflecting substantial volatility.

Comparing both, Snowflake delivered the stronger market performance with an 18.66% gain versus Fair Isaac’s 12.51%, despite recent declines in both stocks.

Target Prices

Analysts set clear target ranges for Snowflake Inc. and Fair Isaac Corporation, showing optimism above current prices.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Snowflake Inc. | 237 | 325 | 281.86 |

| Fair Isaac Corporation | 1640 | 2400 | 2115 |

Snowflake’s consensus target of $282 exceeds its $193 price, signaling upside potential. Fair Isaac’s $2,115 target also sits well above its $1,463 market price, reflecting strong analyst confidence.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for Snowflake Inc. and Fair Isaac Corporation:

Snowflake Inc. Grades

This table lists recent analyst ratings and grade changes for Snowflake Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Buy | 2026-01-30 |

| Morgan Stanley | Maintain | Overweight | 2026-01-27 |

| Barclays | Downgrade | Equal Weight | 2026-01-12 |

| Argus Research | Upgrade | Buy | 2026-01-08 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Evercore ISI Group | Maintain | Outperform | 2025-12-04 |

| Morgan Stanley | Maintain | Overweight | 2025-12-04 |

| Keybanc | Maintain | Overweight | 2025-12-04 |

| Rosenblatt | Maintain | Buy | 2025-12-04 |

| BTIG | Maintain | Buy | 2025-12-04 |

Fair Isaac Corporation Grades

This table lists recent analyst ratings and grade changes for Fair Isaac Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-29 |

| Jefferies | Maintain | Buy | 2026-01-16 |

| Wells Fargo | Maintain | Overweight | 2026-01-14 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Jefferies | Maintain | Buy | 2025-11-06 |

| BMO Capital | Maintain | Outperform | 2025-11-06 |

| Wells Fargo | Maintain | Overweight | 2025-10-14 |

| Barclays | Maintain | Overweight | 2025-10-02 |

| Needham | Maintain | Buy | 2025-10-02 |

Which company has the best grades?

Snowflake Inc. features multiple Buy and Overweight ratings, including recent upgrades, while Fair Isaac Corporation has consistent Buy and Outperform grades but one Neutral. Snowflake’s grades suggest stronger analyst conviction, possibly influencing investor confidence positively.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Snowflake Inc.

- Faces fierce competition in cloud data platforms with pressure on margins and innovation pace.

Fair Isaac Corporation

- Competes in analytics and scoring software with strong niche but faces disruption risks from AI entrants.

2. Capital Structure & Debt

Snowflake Inc.

- Maintains moderate debt-to-assets ratio at 29.7%, showing prudent leverage.

Fair Isaac Corporation

- Exhibits high debt-to-assets at 164.6%, signaling elevated financial risk and potential refinancing challenges.

3. Stock Volatility

Snowflake Inc.

- Beta of 1.14 indicates moderate market sensitivity, with a wide 52-week price range.

Fair Isaac Corporation

- Higher beta at 1.29 shows greater volatility; price range narrower but with sharper recent declines.

4. Regulatory & Legal

Snowflake Inc.

- Subject to data privacy regulations globally, which may increase compliance costs.

Fair Isaac Corporation

- Faces regulatory scrutiny in financial services and credit scoring accuracy standards.

5. Supply Chain & Operations

Snowflake Inc.

- Relies on cloud infrastructure providers; operational risk tied to third-party stability.

Fair Isaac Corporation

- Operations are service-heavy with less physical supply chain risk but sensitive to tech disruptions.

6. ESG & Climate Transition

Snowflake Inc.

- Invests in energy-efficient cloud solutions but faces scrutiny on data center carbon footprint.

Fair Isaac Corporation

- ESG risks lower but must address governance transparency and ethical use of AI analytics.

7. Geopolitical Exposure

Snowflake Inc.

- Global client base exposes it to geopolitical tensions affecting cloud data transfer and compliance.

Fair Isaac Corporation

- International operations face risks from trade policies and regulatory divergence across regions.

Which company shows a better risk-adjusted profile?

Snowflake’s largest risk is its negative profitability and cash flow, undermining financial stability despite moderate leverage. Fair Isaac’s most pressing concern is its high debt load, raising refinancing and solvency risks amid volatile markets. I judge Fair Isaac’s stronger profitability and liquidity scores afford it a better risk-adjusted profile, though elevated debt demands caution. Snowflake’s negative ROIC and interest coverage ratio reflect deeper financial strain, justifying investor vigilance.

Final Verdict: Which stock to choose?

Snowflake Inc. (SNOW) shines with its ability to drive rapid top-line growth and invest heavily in innovation, making it a cash-burning growth engine. Its declining profitability and negative returns on capital remain a point of vigilance. SNOW suits investors with a high tolerance for volatility and a focus on aggressive growth.

Fair Isaac Corporation (FICO) boasts a durable competitive moat supported by strong returns on invested capital and a consistent track record of profitability. Its financial stability and efficient capital use offer a safer profile relative to SNOW. FICO fits well in portfolios targeting growth at a reasonable price with moderate risk.

If you prioritize high-growth potential and are willing to accept profitability headwinds, SNOW is the compelling choice due to its innovation-driven expansion. However, if you seek durable competitive advantages and better financial stability, FICO outshines as a value creator with more consistent returns and a stronger balance sheet.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Snowflake Inc. and Fair Isaac Corporation to enhance your investment decisions: