Home > Comparison > Technology > SHOP vs FICO

The strategic rivalry between Shopify Inc. and Fair Isaac Corporation shapes the future of the technology software application sector. Shopify operates a capital-intensive commerce platform enabling merchants worldwide, while Fair Isaac focuses on high-margin analytic and decision software solutions. This analysis contrasts their operational models to identify which offers superior risk-adjusted returns. Investors will gain clarity on the optimal corporate trajectory for a diversified portfolio within this dynamic industry landscape.

Table of contents

Companies Overview

Shopify and Fair Isaac Corporation each hold critical roles in software application markets with distinct value propositions.

Shopify Inc.: Global Commerce Platform Leader

Shopify dominates as a commerce platform enabling merchants to sell through web, mobile, and physical channels globally. Its core revenue stems from subscription solutions and merchant services like payments and shipping. In 2026, Shopify focuses strategically on expanding omnichannel capabilities and merchant financing to deepen customer relationships and increase platform dependency.

Fair Isaac Corporation: Analytics and Decision Software Pioneer

Fair Isaac thrives as a software and analytics provider specializing in decision management and scoring solutions. It generates revenue through its Scores segment and modular software offerings supporting marketing, fraud detection, and compliance. The company’s 2026 strategy emphasizes enhancing AI-driven decision platforms and expanding its global footprint through direct and indirect sales channels.

Strategic Collision: Similarities & Divergences

Both firms operate in technology-driven software markets but diverge significantly in business philosophy. Shopify builds a broad commerce ecosystem, while Fair Isaac focuses on specialized analytic software for decision automation. Their main battleground lies in serving business clients’ operational efficiency, but Shopify targets merchants, and Fair Isaac targets financial and risk management sectors. This divergence creates distinct investment profiles rooted in platform scale versus specialized expertise.

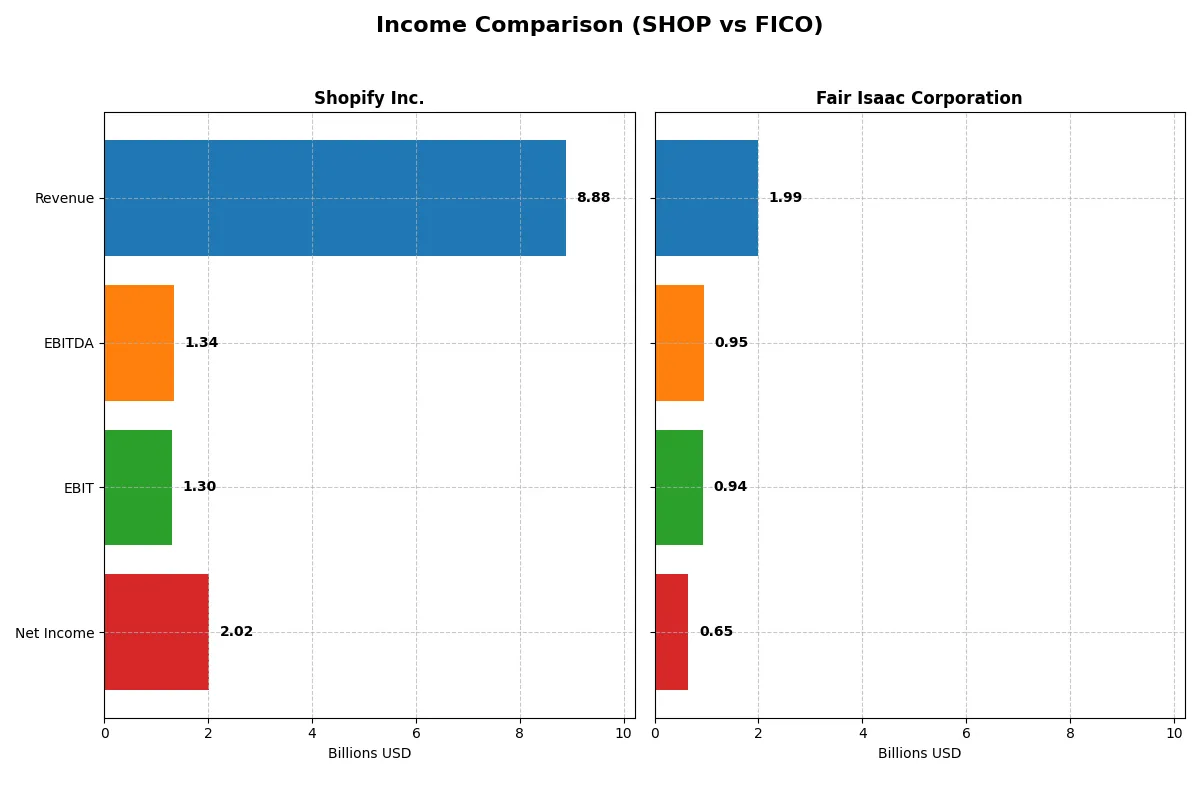

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Shopify Inc. (SHOP) | Fair Isaac Corporation (FICO) |

|---|---|---|

| Revenue | 8.88B | 1.99B |

| Cost of Revenue | 4.41B | 354M |

| Operating Expenses | 3.40B | 712M |

| Gross Profit | 4.47B | 1.64B |

| EBITDA | 1.34B | 951M |

| EBIT | 1.30B | 936M |

| Interest Expense | 0 | 134M |

| Net Income | 2.02B | 652M |

| EPS | 1.56 | 26.9 |

| Fiscal Year | 2024 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates its business more efficiently and translates sales into profits.

Shopify Inc. Analysis

Shopify’s revenue surged from 4.6B in 2021 to 8.9B in 2024, showing strong momentum. Net income recovered dramatically from a 3.5B loss in 2022 to 2B profit in 2024. Its gross margin holds at a favorable 50.4%, while net margin expanded to 22.7%, indicating improving cost control and operational leverage.

Fair Isaac Corporation Analysis

Fair Isaac’s revenue grew steadily from 1.3B in 2021 to 2B in 2025. Net income increased from 392M to 652M, supported by a robust gross margin of 82.2% and a strong net margin of 32.8%. EBIT margin at 47% reflects highly efficient operations, though interest expense at 6.7% slightly tempers overall profitability.

Margin Power vs. Revenue Scale

Shopify outpaces Fair Isaac in revenue growth and margin improvement, turning losses into substantial profits. Fair Isaac maintains superior margins and operational efficiency but grows more modestly. Shopify’s sharp turnaround appeals to growth-focused investors, while Fair Isaac suits those prioritizing consistent profitability and margin strength.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | Shopify Inc. (SHOP) | Fair Isaac Corporation (FICO) |

|---|---|---|

| ROE | 17.47% | -37.34% |

| ROIC | 7.55% | 52.96% |

| P/E | 68.18 | 55.64 |

| P/B | 11.91 | -20.78 |

| Current Ratio | 3.71 | 0.83 |

| Quick Ratio | 3.70 | 0.83 |

| D/E (Debt-to-Equity) | 0.10 | -1.76 |

| Debt-to-Assets | 8.09% | 164.60% |

| Interest Coverage | 0 | 6.92 |

| Asset Turnover | 0.64 | 1.07 |

| Fixed Asset Turnover | 63.43 | 21.20 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering hidden risks and signaling operational prowess essential for sound investment decisions.

Shopify Inc.

Shopify posts a robust 17.5% ROE and a strong 22.7% net margin, signaling solid profitability. However, its valuation appears stretched, with a high P/E of 68.2 and P/B of 11.9. The company doesn’t pay dividends but reinvests heavily in R&D, fueling growth and innovation.

Fair Isaac Corporation

Fair Isaac delivers an impressive 32.8% net margin and outstanding 53.0% ROIC, reflecting operational efficiency. Its P/E of 55.6 is elevated but more moderate than Shopify’s. Despite no dividends, Fair Isaac manages debt well and invests strategically, balancing growth with financial discipline.

Premium Valuation vs. Operational Strength

Both companies show slightly favorable ratios but differ in risk profiles. Shopify’s high valuation demands caution despite solid returns. Fair Isaac offers a better operational yield but carries debt risks. Growth investors might prefer Shopify’s reinvestment; value-focused investors could lean toward Fair Isaac’s efficiency.

Which one offers the Superior Shareholder Reward?

I observe Shopify Inc. (SHOP) and Fair Isaac Corporation (FICO) both eschew dividends, focusing on reinvestment and buybacks. Shopify’s free cash flow per share stands at $1.23 with no dividend payout, signaling reinvestment in growth and R&D. Its buyback program remains moderate but steady, supporting shareholder value. FICO, with a robust $31.76 free cash flow per share and similarly no dividends, demonstrates a more aggressive buyback profile, reflecting confidence in capital allocation. While Shopify’s distribution model bets on long-term innovation, FICO’s strategy leans on strong cash returns via buybacks. Given FICO’s higher free cash flow yield and sustained buybacks, I conclude FICO offers a more attractive total return profile for investors in 2026.

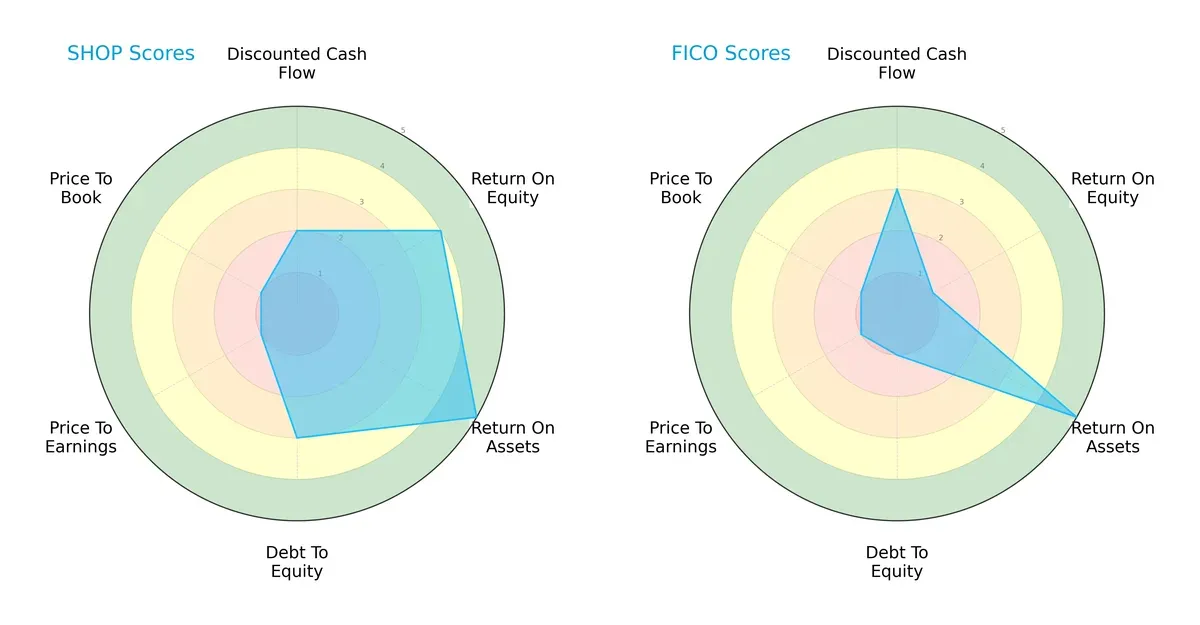

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Shopify Inc. and Fair Isaac Corporation, highlighting their financial strengths and valuation profiles:

Shopify boasts a more balanced profile with strengths in ROE (4) and ROA (5), reflecting efficient profit and asset utilization. Fair Isaac excels in discounted cash flow (3) and ROA (5) but suffers from poor debt-to-equity (1) and valuation scores (P/E and P/B at 1 each). Shopify’s moderate debt management contrasts with Fair Isaac’s financial risk, showing Shopify relies on operational efficiency, while Fair Isaac depends on asset productivity.

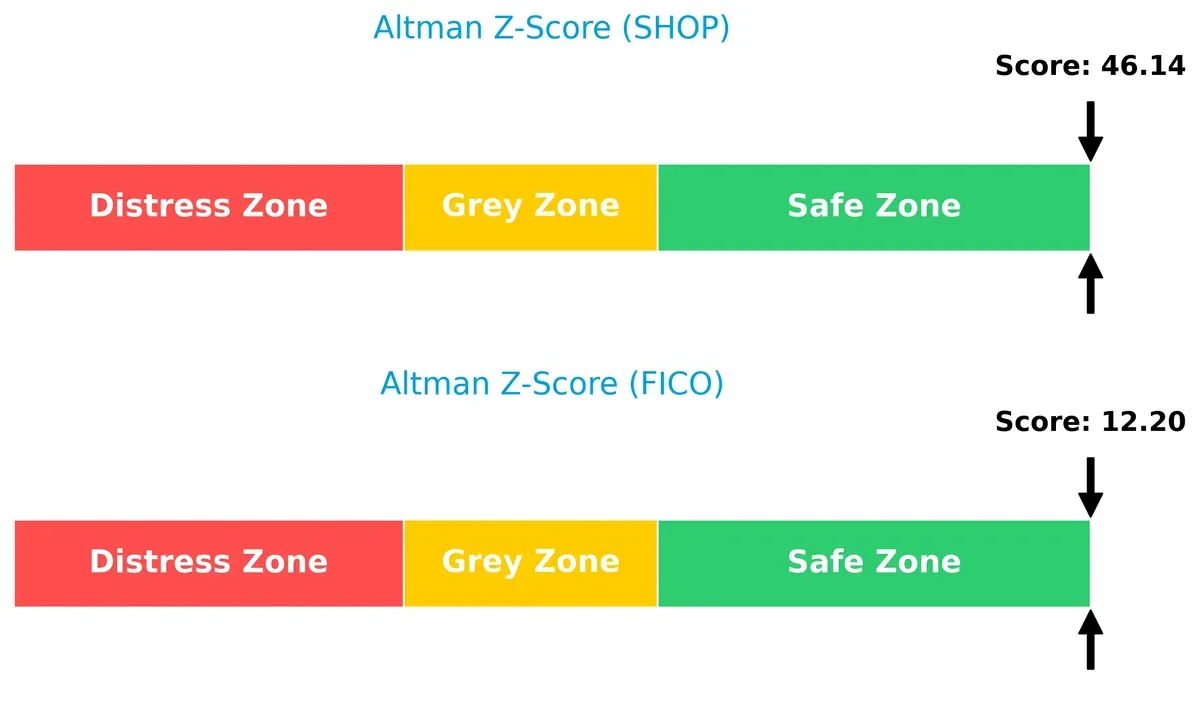

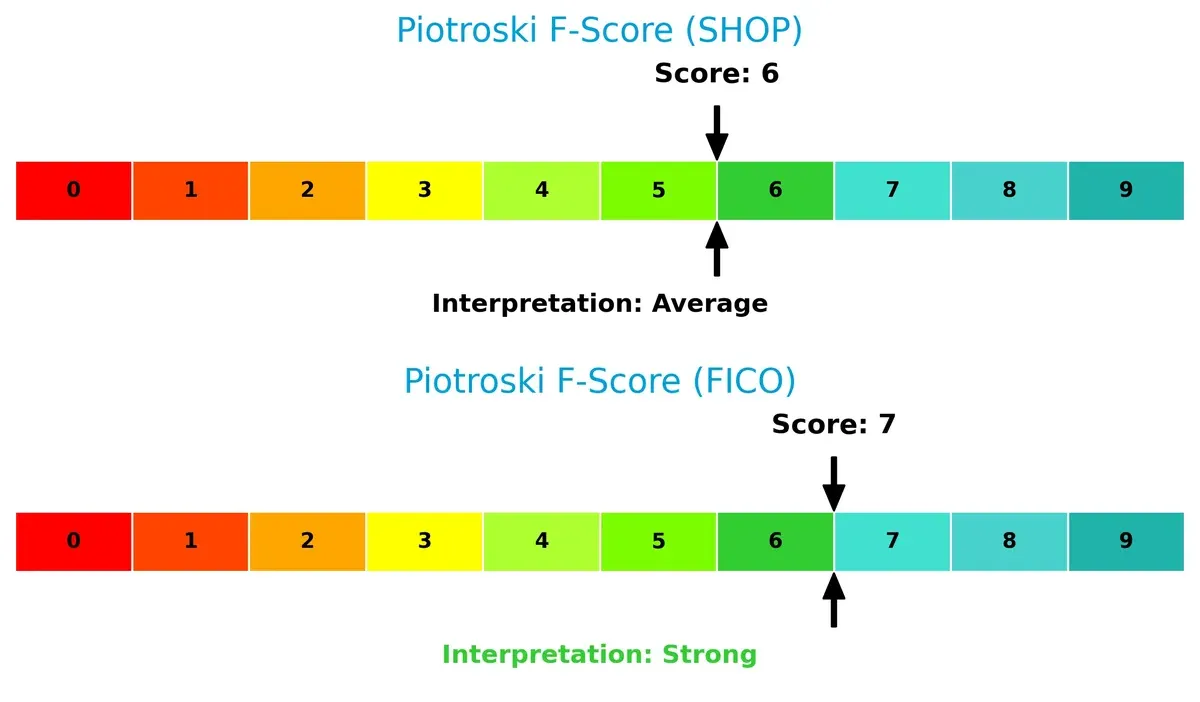

Bankruptcy Risk: Solvency Showdown

Shopify’s Altman Z-Score of 46.1 substantially outpaces Fair Isaac’s 12.2, confirming both firms sit safely above distress thresholds, but Shopify’s margin signals extraordinary solvency and resilience in this cycle:

Financial Health: Quality of Operations

Fair Isaac edges Shopify in Piotroski F-Score, posting a strong 7 against Shopify’s average 6. This suggests Fair Isaac holds a slight advantage in internal financial quality and operational health, with Shopify showing no immediate red flags but room for improvement:

How are the two companies positioned?

This section dissects the operational DNA of Shopify and Fair Isaac by comparing revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to identify which model delivers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

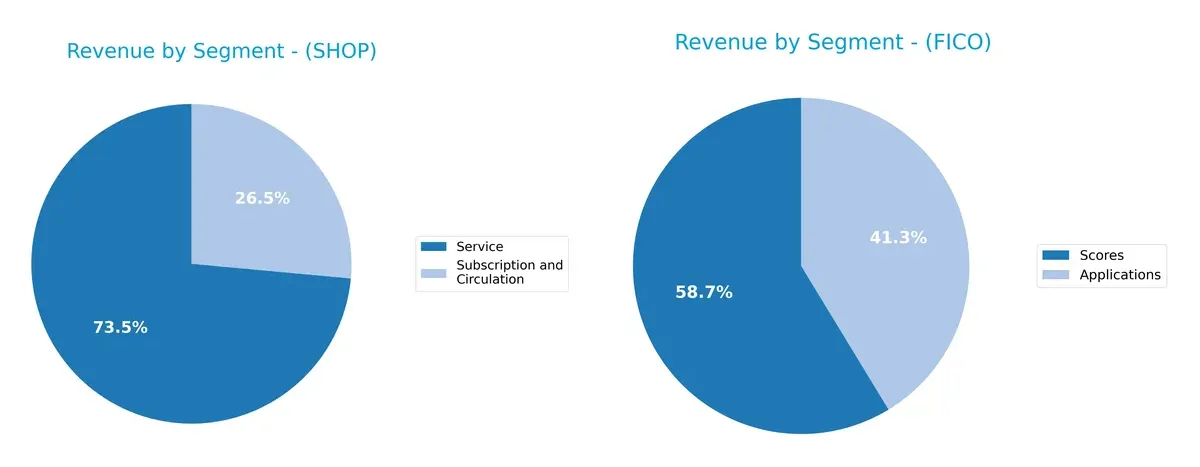

The following visual comparison dissects how Shopify Inc. and Fair Isaac Corporation diversify their income streams and where their primary sector bets lie:

Shopify’s revenue pivots mainly on Merchant Solutions at $6.53B, complemented by Subscription Solutions at $2.35B, showing moderate diversification. Fair Isaac relies heavily on Scores ($1.17B) and Software/Applications (~$820M), reflecting a more balanced split. Shopify’s dominance in merchant services signals ecosystem lock-in risk, while Fair Isaac’s mix suggests steady software infrastructure reliance with less concentration risk. Both strategies align with their sector moats.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Shopify Inc. and Fair Isaac Corporation:

Shopify Inc. Strengths

- Strong net margin of 22.74%

- High ROE at 17.47%

- Low debt-to-assets at 8.09%

- High quick ratio at 3.7

- Large US revenue base of $5.4B

- Diverse revenue streams including services and subscriptions

Fair Isaac Corporation Strengths

- Highest net margin at 32.75%

- Exceptional ROIC of 52.96%

- Favorable PB despite negative value

- Solid interest coverage at 7.01

- Higher asset turnover of 1.07

- Steady revenue from Americas at $1.7B

Shopify Inc. Weaknesses

- WACC surpasses ROIC at 17.1% vs. 7.55%

- Unfavorable P/E at 68.18

- Unfavorable P/B at 11.91

- Current ratio high at 3.71 may indicate inefficient working capital

- Zero dividend yield

- Moderate asset turnover at 0.64

Fair Isaac Corporation Weaknesses

- Negative ROE at -37.34%

- High debt-to-assets at 164.6%

- Low current ratio at 0.83

- Unfavorable P/E at 55.64

- Zero dividend yield

- Negative debt-to-equity ratio of -1.76

Shopify’s strengths lie in profitability and liquidity with a broad US market and diversified products. Fair Isaac excels in operational efficiency and margin but shows financial leverage and profitability risks. These contrasts suggest differing strategic focuses and risk profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole protector of long-term profits against relentless competitive pressures. Let’s dissect how these two firms defend their turf:

Shopify Inc.: Network Effects and Platform Ecosystem

Shopify’s moat stems from powerful network effects and its integrated commerce platform. This drives high revenue growth and margin stability despite a negative ROIC vs. WACC. Expansion into new markets in 2026 could deepen this ecosystem but capital efficiency remains a challenge.

Fair Isaac Corporation: Intangible Assets and Data Analytics Dominance

FICO’s moat relies on proprietary analytics, deep data assets, and entrenched client relationships. Its ROIC far exceeds WACC, signaling strong value creation. With growing profitability and scalable solutions, FICO is primed to expand its decision management footprint globally in 2026.

Moat Strength: Platform Network vs. Data Analytics Fortress

FICO holds a wider and deeper moat, evidenced by a 44% ROIC premium over WACC and consistent profit growth. Shopify’s platform shows promise but is currently value destructive despite rising profitability. FICO is better equipped to defend and grow its market share long term.

Which stock offers better returns?

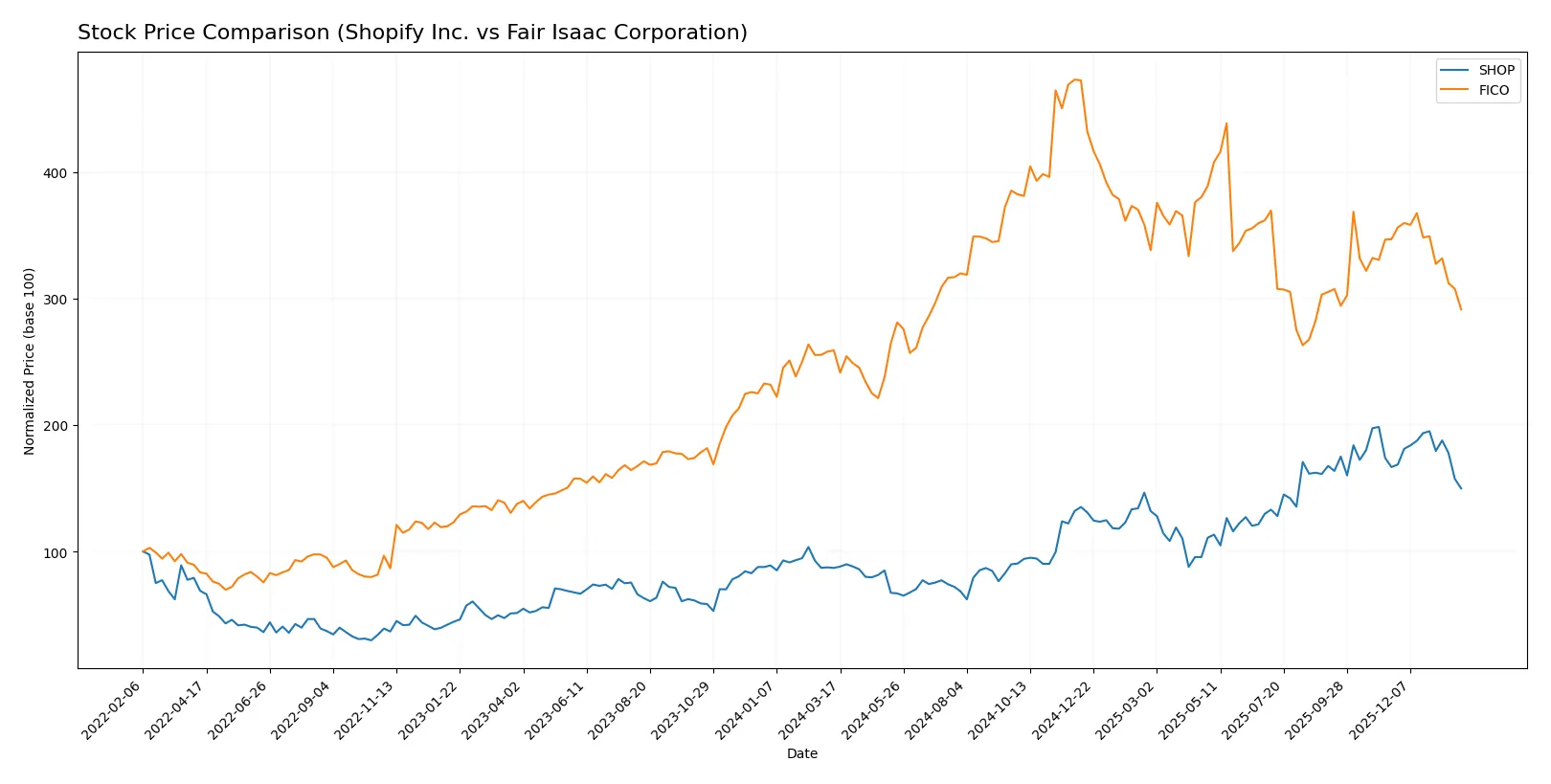

The past year shows divergent price movements for Shopify Inc. and Fair Isaac Corporation, with Shopify’s strong overall gains contrasting with recent pullbacks in both stocks.

Trend Comparison

Shopify Inc. displays a bullish trend over the past 12 months, gaining 72.31%. The price trend shows deceleration despite high volatility, with a peak at 173.86 and a low at 54.43.

Fair Isaac Corporation also trends bullish with a 12.51% rise in the same period. The stock experiences significant volatility and deceleration, hitting a high of 2375.03 and a low of 1110.85.

Shopify’s performance outpaces Fair Isaac significantly, delivering the highest market return over the past year despite recent short-term declines in both stocks.

Target Prices

Analysts set a bullish consensus for both Shopify Inc. and Fair Isaac Corporation, signaling strong upside potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Shopify Inc. | 140 | 200 | 186.24 |

| Fair Isaac Corp. | 1640 | 2400 | 2115 |

The target consensus for Shopify sits about 42% above its current price of 131.23, reflecting robust growth expectations. Fair Isaac’s consensus target exceeds its current price by approximately 44%, indicating solid confidence in its business outlook.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Shopify Inc. Grades

The following table summarizes recent institutional grades for Shopify Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Scotiabank | Upgrade | Sector Outperform | 2026-01-08 |

| Wolfe Research | Downgrade | Peer Perform | 2026-01-06 |

| Wells Fargo | Maintain | Overweight | 2025-12-17 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-11-05 |

| CIBC | Maintain | Outperform | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

| DA Davidson | Maintain | Buy | 2025-11-05 |

| Needham | Maintain | Buy | 2025-11-05 |

| Scotiabank | Maintain | Sector Perform | 2025-11-05 |

Fair Isaac Corporation Grades

The following table summarizes recent institutional grades for Fair Isaac Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-29 |

| Jefferies | Maintain | Buy | 2026-01-16 |

| Wells Fargo | Maintain | Overweight | 2026-01-14 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Jefferies | Maintain | Buy | 2025-11-06 |

| BMO Capital | Maintain | Outperform | 2025-11-06 |

| Wells Fargo | Maintain | Overweight | 2025-10-14 |

| Barclays | Maintain | Overweight | 2025-10-02 |

| Needham | Maintain | Buy | 2025-10-02 |

Which company has the best grades?

Fair Isaac Corporation consistently receives “Buy” and “Overweight” ratings, indicating strong institutional confidence. Shopify Inc. shows more mixed grades, including downgrades and neutral ratings. Investors might perceive Fair Isaac as a more favored stock based on these grades.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both Shopify Inc. and Fair Isaac Corporation in the 2026 market environment:

1. Market & Competition

Shopify Inc.

- Faces intense competition in the commerce platform space, requiring constant innovation to maintain growth.

Fair Isaac Corporation

- Operates in a niche analytics market but faces pressure from emerging AI and fintech competitors.

2. Capital Structure & Debt

Shopify Inc.

- Maintains low debt levels (D/E 0.1), signaling financial prudence and strong balance sheet.

Fair Isaac Corporation

- High debt-to-assets ratio (165%) raises red flags about leverage and financial risk.

3. Stock Volatility

Shopify Inc.

- Exhibits high beta (2.84), indicating significant stock price swings and investor risk.

Fair Isaac Corporation

- Lower beta (1.29) reflects more moderate stock volatility and steadier investor sentiment.

4. Regulatory & Legal

Shopify Inc.

- Subject to evolving e-commerce regulations globally, with risks in data privacy and payment compliance.

Fair Isaac Corporation

- Faces regulatory scrutiny in financial services and data governance, especially in credit scoring.

5. Supply Chain & Operations

Shopify Inc.

- Relies on a broad network of merchant integrations; supply chain disruptions could impact service delivery.

Fair Isaac Corporation

- Primarily software-based, so operational risks focus on platform reliability and data security.

6. ESG & Climate Transition

Shopify Inc.

- Increasing ESG pressures to reduce carbon footprint amid global commerce expansion.

Fair Isaac Corporation

- ESG risks stem mainly from data ethics and transparent algorithm governance.

7. Geopolitical Exposure

Shopify Inc.

- Global presence exposes it to trade tensions and currency fluctuations.

Fair Isaac Corporation

- Also global but with concentrated exposure in financial sectors sensitive to geopolitical shifts.

Which company shows a better risk-adjusted profile?

Shopify’s highest risk lies in its volatile stock price and high valuation multiples, which amplify market swings. Fair Isaac faces critical leverage risk from its elevated debt-to-assets ratio, threatening financial stability. Despite Shopify’s market volatility, its strong balance sheet and liquidity provide a safer cushion. Fair Isaac’s leverage and poor ROE pose deeper structural concerns. I see Shopify as having a more balanced risk-adjusted profile, supported by its robust liquidity ratios and Altman Z-Score safety margin.

Final Verdict: Which stock to choose?

Shopify Inc. showcases a superpower in rapid revenue and earnings growth, driven by its scalable e-commerce platform. Its main point of vigilance lies in its current capital efficiency, where ROIC trails WACC, signaling value destruction despite improving trends. Shopify suits aggressive growth portfolios willing to embrace cyclical execution risks.

Fair Isaac Corporation’s strategic moat is its durable competitive advantage through data-driven credit scoring and analytics, delivering robust ROIC well above WACC. It offers a more stable cash flow profile compared to Shopify but carries noticeable leverage risks. FICO fits well within GARP portfolios seeking quality growth with a margin of safety.

If you prioritize high-growth exposure with a tolerance for capital inefficiencies and market volatility, Shopify outshines as the compelling choice. However, if you seek superior capital efficiency and more consistent profitability, FICO offers better stability and a durable moat, though it commands a premium and bears financial leverage concerns.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Shopify Inc. and Fair Isaac Corporation to enhance your investment decisions: