Moody’s Corporation and FactSet Research Systems Inc. are two key players in the financial data and analytics industry, offering critical insights to investors and institutions worldwide. Both companies provide data-driven solutions but differ in scope and innovation strategies, with Moody’s focusing on credit risk assessment and FactSet excelling in integrated financial analytics. In this article, I will analyze their strengths and risks to help you decide which company holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Moody’s Corporation and FactSet Research Systems Inc. by providing an overview of these two companies and their main differences.

Moody’s Corporation Overview

Moody’s Corporation operates as a global integrated risk assessment firm with two main segments: Moody’s Investors Service, which publishes credit ratings across various debt obligations worldwide, and Moody’s Analytics, which offers subscription-based risk management products and services. Founded in 1900 and headquartered in New York City, Moody’s serves a broad range of clients in approximately 140 countries and employs about 15,795 people.

FactSet Research Systems Inc. Overview

FactSet Research Systems Inc. is a financial data and analytics provider offering integrated information and applications to the investment community globally. Founded in 1978 and based in Norwalk, Connecticut, FactSet serves portfolio managers, investment banks, asset managers, and wealth advisors through solutions in research, analytics, trading, content, and technology. The company employs approximately 12,598 people and operates across multiple regions worldwide.

Key similarities and differences

Both Moody’s and FactSet operate within the financial data and analytics sector, targeting institutional investors and financial services. Moody’s focuses significantly on credit ratings and risk assessment products, while FactSet emphasizes integrated financial information and workflow solutions for investment professionals. Moody’s has a broader global credit rating footprint, whereas FactSet concentrates on delivering technology-driven analytics and data applications to support investment decision-making.

Income Statement Comparison

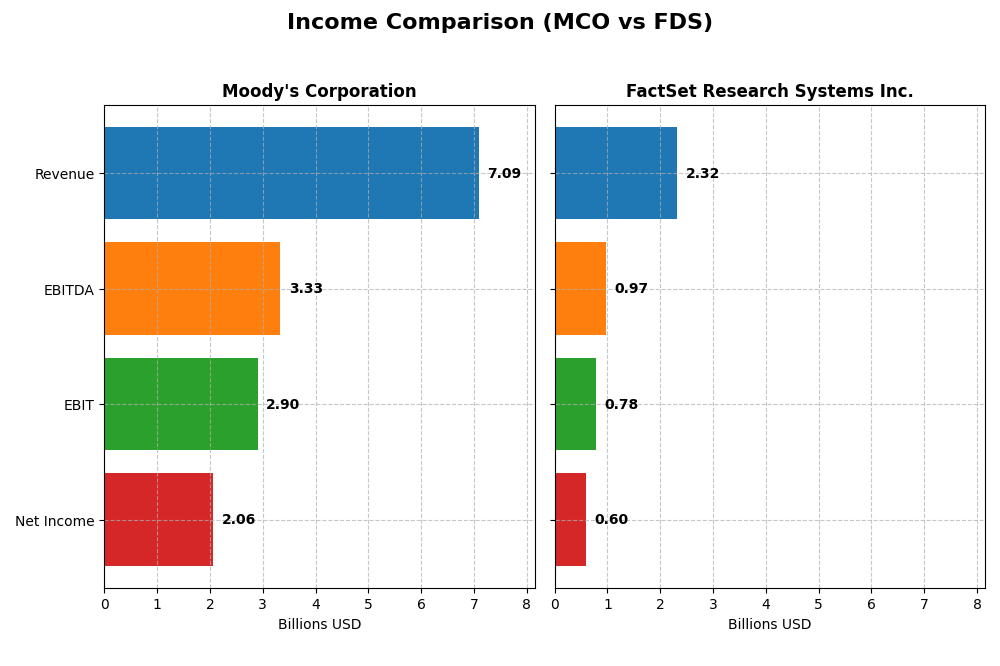

This table compares the most recent full fiscal year income statement figures for Moody’s Corporation and FactSet Research Systems Inc., highlighting key financial metrics.

| Metric | Moody’s Corporation (MCO) | FactSet Research Systems Inc. (FDS) |

|---|---|---|

| Market Cap | 95.4B | 11.2B |

| Revenue | 7.09B | 2.32B |

| EBITDA | 3.33B | 966M |

| EBIT | 2.90B | 777M |

| Net Income | 2.06B | 597M |

| EPS | 11.32 | 15.74 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Moody’s Corporation

Moody’s Corporation saw consistent revenue growth from 2020 to 2024, with a notable 19.8% increase in 2024 alone, reaching $7.1B. Net income also advanced steadily, hitting $2.1B in 2024. Margins largely remained favorable, with gross and EBIT margins at 66.4% and 41.0%, respectively. The latest year showed strong margin improvements and robust earnings per share growth of 29%.

FactSet Research Systems Inc.

FactSet’s revenue expanded by 45.9% over the 2021-2025 period, with a more modest 5.4% rise in 2025 to $2.3B. Net income grew significantly overall by 49.4%, reaching $597M in 2025. Margins were stable and healthy, with a gross margin of 52.7% and EBIT margin of 33.5%. The most recent year reflected steady margin improvement and an 11.8% EPS increase.

Which one has the stronger fundamentals?

Moody’s exhibits higher absolute revenue and net income figures with superior gross and EBIT margins, indicating strong profitability. Its recent rapid earnings growth and margin improvement are favorable. FactSet shows impressive relative growth rates and solid margins but at a smaller scale. Both companies have favorable income statement fundamentals, with Moody’s demonstrating greater scale and margin strength, while FactSet excels in growth rates.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Moody’s Corporation and FactSet Research Systems Inc., facilitating a straightforward comparison of their financial health and performance.

| Ratios | Moody’s Corporation (MCO) 2024 | FactSet Research Systems Inc. (FDS) 2025 |

|---|---|---|

| ROE | 57.7% | 27.3% |

| ROIC | 17.8% | 16.1% |

| P/E | 41.8 | 23.7 |

| P/B | 24.1 | 6.48 |

| Current Ratio | 1.43 | 1.40 |

| Quick Ratio | 1.43 | 1.40 |

| D/E (Debt to Equity) | 2.17 | 0.71 |

| Debt-to-Assets | 50.0% | 36.2% |

| Interest Coverage | 14.6 | 13.3 |

| Asset Turnover | 0.46 | 0.54 |

| Fixed Asset Turnover | 8.13 | 11.2 |

| Payout Ratio | 30.1% | 26.8% |

| Dividend Yield | 0.72% | 1.13% |

Interpretation of the Ratios

Moody’s Corporation

Moody’s shows strong profitability with a high net margin of 29.03% and an impressive return on equity at 57.73%, indicating efficient use of capital. However, concerns arise from an unfavorable price-to-earnings ratio of 41.82 and a high debt-to-equity ratio of 2.17. The company pays dividends, but the dividend yield is low at 0.72%, suggesting limited shareholder returns relative to its valuation.

FactSet Research Systems Inc.

FactSet presents a solid financial profile, with favorable net margin of 25.72% and return on invested capital at 16.1%. Its weighted average cost of capital is low at 6.76%, and debt levels are moderate, reflecting balanced leverage. FactSet also pays dividends, offering a neutral dividend yield of 1.13%, supported by stable cash flow and manageable payout ratios.

Which one has the best ratios?

FactSet’s ratios appear slightly more favorable overall, with half of its key metrics rated positively and fewer unfavorable signs compared to Moody’s. Moody’s exhibits impressive profitability but is burdened by high leverage and valuation concerns. FactSet’s more balanced capital structure and cost of capital contribute to a slightly better ratio profile.

Strategic Positioning

This section compares the strategic positioning of Moody’s Corporation and FactSet Research Systems Inc. regarding market position, key segments, and exposure to technological disruption:

Moody’s Corporation

- Leading global credit ratings firm with strong competitive pressure in risk assessment.

- Operates two segments: Moody’s Investors Service and Analytics, driving revenue growth.

- Exposure to disruption via evolving risk management and analytics software solutions.

FactSet Research Systems Inc.

- Financial data and analytics provider with competition in integrated information solutions.

- Focuses on financial information and analytical applications for investment community segments.

- Faces technological disruption in workflow, analytics, and content delivery platforms.

Moody’s Corporation vs FactSet Research Systems Inc. Positioning

Moody’s shows a diversified business model with two distinct segments, balancing credit ratings and analytics revenues. FactSet concentrates on integrated financial data and applications for investment professionals, implying a more focused but narrower market approach.

Which has the best competitive advantage?

Both companies create value with ROIC above WACC but face declining profitability trends. Moody’s and FactSet hold a slightly favorable moat status, indicating similar moderate competitive advantages based on efficient capital use and value creation.

Stock Comparison

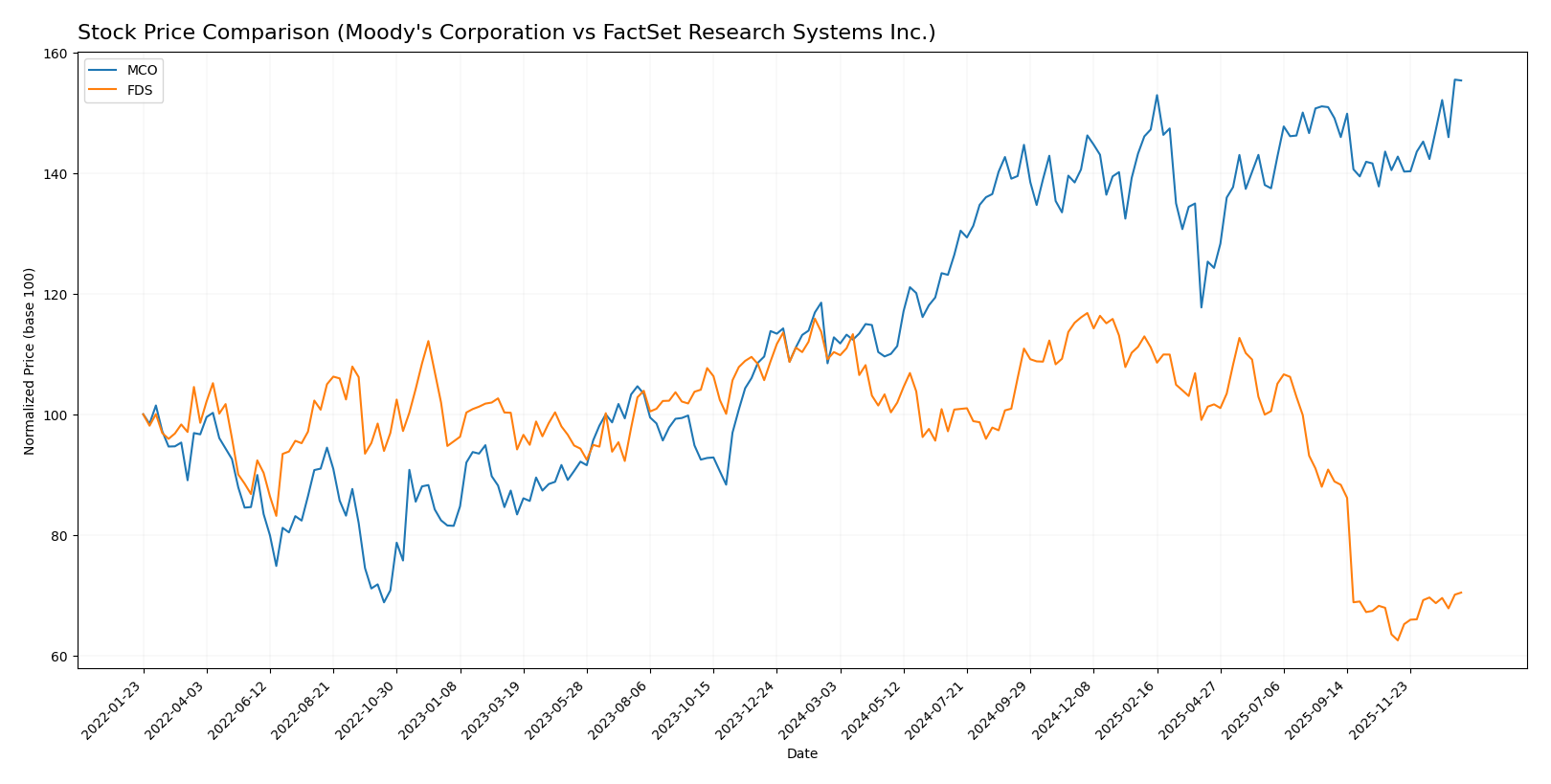

The past year displayed contrasting stock price movements between Moody’s Corporation and FactSet Research Systems Inc., with Moody’s showing a strong upward momentum while FactSet experienced a significant decline, both followed by recent positive shifts.

Trend Analysis

Over the past 12 months, Moody’s Corporation (MCO) exhibited a bullish trend with a 37.77% price increase, marked by acceleration and a high volatility level of 40.83. The stock reached a peak of 531.61 and a low of 374.67.

In the same period, FactSet Research Systems Inc. (FDS) showed a bearish trend with a 36.16% price decrease, despite recent acceleration. Its volatility was higher at 65.63, with the highest price at 490.67 and the lowest at 262.6.

Comparing the two, Moody’s Corporation delivered the highest market performance over the last year, outperforming FactSet by a wide margin in overall price appreciation.

Target Prices

The target price consensus reflects moderate optimism from analysts for both Moody’s Corporation and FactSet Research Systems Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Moody’s Corporation | 620 | 507 | 557.44 |

| FactSet Research Systems Inc. | 321 | 253 | 296.89 |

Analysts expect Moody’s stock to appreciate slightly above the current price of $530.89, while FactSet’s consensus target aligns closely with its current price of $295.63, indicating balanced market expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Moody’s Corporation and FactSet Research Systems Inc.:

Rating Comparison

Moody’s Corporation Rating

- Rating: B, classified as Very Favorable

- Discounted Cash Flow Score: 3, Moderate

- ROE Score: 5, Very Favorable

- ROA Score: 5, Very Favorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 3, Moderate

FactSet Research Systems Inc. Rating

- Rating: A-, classified as Very Favorable

- Discounted Cash Flow Score: 5, Very Favorable

- ROE Score: 5, Very Favorable

- ROA Score: 5, Very Favorable

- Debt To Equity Score: 2, Moderate

- Overall Score: 4, Favorable

Which one is the best rated?

FactSet holds a higher overall score (4 vs. 3) and a superior discounted cash flow score compared to Moody’s. Both share equally strong ROE and ROA scores, but FactSet’s debt-to-equity score is moderately better, indicating a stronger financial position.

Scores Comparison

Here is a comparison of Moody’s Corporation and FactSet Research Systems Inc. scores:

Moody’s Corporation Scores

- Altman Z-Score: 7.47, indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

FactSet Research Systems Inc. Scores

- Altman Z-Score: 5.20, indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 6, classified as average financial health.

Which company has the best scores?

Based on the provided data, Moody’s Corporation has higher scores in both the Altman Z-Score and Piotroski Score compared to FactSet, indicating stronger financial stability and health.

Grades Comparison

The following is a comparison of recent grades assigned to Moody’s Corporation and FactSet Research Systems Inc.:

Moody’s Corporation Grades

This table presents recent grades from notable grading firms for Moody’s Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | maintain | Outperform | 2026-01-08 |

| Stifel | upgrade | Buy | 2026-01-05 |

| Goldman Sachs | upgrade | Buy | 2025-12-16 |

| Mizuho | maintain | Neutral | 2025-10-28 |

| Stifel | maintain | Hold | 2025-10-23 |

| JP Morgan | maintain | Overweight | 2025-10-23 |

| Wells Fargo | maintain | Overweight | 2025-10-23 |

| BMO Capital | maintain | Market Perform | 2025-10-23 |

| Raymond James | upgrade | Market Perform | 2025-10-17 |

| BMO Capital | maintain | Market Perform | 2025-10-16 |

Overall, the grades for Moody’s Corporation show a positive trend, with multiple upgrades to Buy and Outperform ratings and several firms maintaining an overweight or market perform stance.

FactSet Research Systems Inc. Grades

This table displays recent grades given to FactSet Research Systems Inc. by various grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | maintain | In Line | 2026-01-08 |

| BMO Capital | maintain | Market Perform | 2025-12-22 |

| Goldman Sachs | maintain | Sell | 2025-12-19 |

| Stifel | maintain | Hold | 2025-12-19 |

| RBC Capital | maintain | Sector Perform | 2025-12-19 |

| Morgan Stanley | upgrade | Equal Weight | 2025-12-17 |

| Wells Fargo | maintain | Underweight | 2025-12-05 |

| UBS | upgrade | Buy | 2025-09-22 |

| BMO Capital | maintain | Market Perform | 2025-09-19 |

| Wells Fargo | maintain | Underweight | 2025-09-19 |

FactSet’s grades predominantly reflect a cautious outlook, with many hold, market perform, and underweight ratings, although there are some upgrades to Buy and Equal Weight.

Which company has the best grades?

Moody’s Corporation has received stronger and more positive grades overall, with a consensus rating of Buy supported by 17 Buy and 13 Hold recommendations. In contrast, FactSet holds a Hold consensus with more Hold and Sell opinions. This suggests Moody’s is viewed more favorably by analysts, potentially indicating greater confidence in its outlook for investors.

Strengths and Weaknesses

Below is a comparison table of key strengths and weaknesses for Moody’s Corporation (MCO) and FactSet Research Systems Inc. (FDS) based on their latest financial and strategic data.

| Criterion | Moody’s Corporation (MCO) | FactSet Research Systems Inc. (FDS) |

|---|---|---|

| Diversification | Moderate: Two main segments (Analytics & Investors Service) with growing Analytics revenue (4.41B in 2024) | Limited geographic diversification (mainly U.S. and UK) but focused product suite |

| Profitability | High profitability with net margin 29.03% and ROIC 17.84%, but declining ROIC trend | Strong profitability; net margin 25.72%, ROIC 16.1%, but also declining ROIC |

| Innovation | Strong in analytics with Moody’s Analytics growing significantly | Continuous innovation in financial data and analytics platforms |

| Global presence | Global footprint with diverse client base across sectors | Less global presence, mainly U.S. and UK markets |

| Market Share | Leading position in credit ratings and analytics | Niche leader in financial data and research systems |

Both companies are creating value with favorable ROIC above WACC, though their profitability shows a declining trend. Moody’s offers stronger global diversification and market presence, while FactSet maintains solid profitability with a slightly more focused geographic reach.

Risk Analysis

Below is a comparative table of key risks for Moody’s Corporation (MCO) and FactSet Research Systems Inc. (FDS) based on the latest available data from 2024 and 2025.

| Metric | Moody’s Corporation (MCO) | FactSet Research Systems Inc. (FDS) |

|---|---|---|

| Market Risk | High beta of 1.453 implies higher volatility versus the market | Lower beta of 0.743 suggests less volatility and market sensitivity |

| Debt Level | Elevated debt-to-equity ratio (2.17 – unfavorable) indicates higher leverage risk | Moderate debt-to-equity (0.71 – neutral) indicates manageable leverage |

| Regulatory Risk | Operates globally with exposure to varying regulations, credit rating scrutiny | Also global but with less regulatory complexity in credit ratings |

| Operational Risk | Large employee base (15,795) and complex services increase operational risk | Slightly smaller workforce (12,598) but similar operational complexity |

| Environmental Risk | Moderate, as a data and analytics firm with limited direct environmental impact | Similar profile with limited direct environmental exposure |

| Geopolitical Risk | Exposure to 140 countries’ credit markets entails geopolitical risk | Global presence but less exposure in sovereign credit ratings |

In synthesis, Moody’s faces higher market volatility and financial leverage risks, with a very unfavorable debt-to-equity position and high beta. FactSet shows stronger financial stability, lower market volatility, and moderate leverage. The most impactful risks for Moody’s are its leverage and market sensitivity, while FactSet’s risks are more moderate. Investors should weigh Moody’s growth potential against its leverage risk and consider FactSet for a more stable profile.

Which Stock to Choose?

Moody’s Corporation (MCO) shows a strong income evolution with a 19.81% revenue growth over one year and a 31.97% increase overall. Its profitability is high, with a 29.03% net margin and a 57.73% ROE, though its debt level and valuation ratios are unfavorable. The rating is very favorable with a moderate overall score, indicating solid financial health despite some leverage concerns.

FactSet Research Systems Inc. (FDS) presents steady income growth, with 5.39% revenue growth in the last year and 45.89% overall. Profitability metrics are favorable but lower than MCO’s, with a 25.72% net margin and 27.31% ROE. Debt ratios are more moderate, and the company holds a very favorable A- rating supported by favorable financial ratios and a slightly favorable moat evaluation.

Investors prioritizing high profitability and strong income growth might find Moody’s Corporation appealing due to its robust returns and value creation, although its leverage and valuation pose caution. Conversely, those favoring financial stability with moderate debt and a slightly favorable rating may view FactSet as a more balanced choice. The decision could depend on the investor’s tolerance for valuation risk versus preference for steadier financial leverage.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Moody’s Corporation and FactSet Research Systems Inc. to enhance your investment decisions: