In today’s fast-evolving technology landscape, choosing the right hardware and equipment company can be challenging yet rewarding. Trimble Inc. and Fabrinet both operate in the hardware, equipment, and parts industry, focusing on innovation and precision technology solutions. Trimble excels in geospatial and construction tech, while Fabrinet specializes in advanced optical and electro-mechanical manufacturing. This analysis will help you decide which company stands out as the more compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Trimble Inc. and Fabrinet by providing an overview of these two companies and their main differences.

Trimble Inc. Overview

Trimble Inc. provides technology solutions aimed at enhancing work processes for professionals and field mobile workers worldwide. Its offerings span field and office software for construction, geospatial products, precision agriculture, and transportation solutions, including asset management and route optimization. Founded in 1978 and headquartered in California, Trimble operates across multiple segments with a focus on integrating technology into hardware and software for various industries.

Fabrinet Overview

Fabrinet specializes in optical packaging and precision manufacturing services across North America, Asia-Pacific, and Europe. The company produces advanced optical and electro-mechanical components, including lasers, transceivers, and sensors for telecommunications, medical, automotive, and industrial markets. Incorporated in 1999 and based in the Cayman Islands, Fabrinet supports original equipment manufacturers with complex manufacturing, assembly, and testing capabilities.

Key similarities and differences

Both Trimble and Fabrinet operate in the technology sector within the hardware, equipment, and parts industry, providing specialized components and solutions. While Trimble focuses on software and hardware integration for construction, agriculture, and transportation, Fabrinet centers on precision manufacturing for optical and electro-mechanical products. Their geographic footprints and customer bases differ, reflecting distinct business models: technology integration versus advanced manufacturing services.

Income Statement Comparison

The table below compares the key income statement metrics for Trimble Inc. and Fabrinet for their most recent fiscal years, providing a snapshot of their financial performance.

| Metric | Trimble Inc. (TRMB) | Fabrinet (FN) |

|---|---|---|

| Market Cap | 18.9B | 17.5B |

| Revenue | 3.68B (FY 2024) | 3.42B (FY 2025) |

| EBITDA | 2.33B | 409M |

| EBIT | 2.10B | 355M |

| Net Income | 1.50B | 333M |

| EPS | 6.13 | 9.23 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Trimble Inc.

Trimble Inc. showed overall revenue growth of 17.02% from 2020 to 2024, with net income increasing by 285.84% in the same period. Margins improved significantly, with a gross margin of 65.06% and a net margin of 40.84% in 2024, both marked as favorable. Despite a slight revenue decline of 3.04% in 2024, EBIT and net margin growth surged, reflecting improved profitability and operational efficiency.

Fabrinet

Fabrinet’s revenue grew strongly by 81.94% over 2021-2025, supported by a net income growth of 124.16%. The company maintained favorable EBIT and net margins at 10.39% and 9.72%, respectively, though with a modest gross margin of 12.09%. The most recent year saw a 18.6% revenue increase and a 13.21% EPS growth, despite a slight 5.34% dip in net margin, indicating solid operational performance overall.

Which one has the stronger fundamentals?

Both companies present favorable income statements with robust growth, but Trimble’s significantly higher margins and explosive net income growth suggest stronger profitability fundamentals. Fabrinet excels in revenue expansion but operates with lower margins, which could indicate tighter cost structures or competitive pressure. Trimble’s margin improvements and earnings growth offer a more pronounced financial strength in this comparison.

Financial Ratios Comparison

This table presents a factual comparison of key financial ratios for Trimble Inc. and Fabrinet based on their most recent fiscal data, helping investors analyze their financial health and performance.

| Ratios | Trimble Inc. (TRMB) 2024 | Fabrinet (FN) 2025 |

|---|---|---|

| ROE | 26.18% | 16.78% |

| ROIC | 4.49% | 15.01% |

| P/E | 11.52 | 32.02 |

| P/B | 3.02 | 5.37 |

| Current Ratio | 1.27 | 3.00 |

| Quick Ratio | 1.16 | 2.28 |

| D/E (Debt to Equity) | 0.26 | 0.003 |

| Debt-to-Assets | 15.96% | 0.19% |

| Interest Coverage | 5.08 | 0 |

| Asset Turnover | 0.39 | 1.21 |

| Fixed Asset Turnover | 11.81 | 8.85 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Trimble Inc.

Trimble shows a majority of favorable ratios including a strong net margin of 40.84% and a robust return on equity at 26.18%, but its return on invested capital (4.49%) and weighted average cost of capital (10.81%) raise concerns. The company has no dividend payouts, signaling a possible reinvestment strategy or focus on growth rather than shareholder distributions.

Fabrinet

Fabrinet’s ratios are mostly favorable with a solid return on equity of 16.78% and return on invested capital of 15.01%. Its current and quick ratios are strong at 3.0 and 2.28 respectively, indicating good liquidity. The stock pays no dividends, likely prioritizing reinvestment or operational expansion over direct shareholder returns.

Which one has the best ratios?

Fabrinet edges out Trimble in ratio strength with 64.29% favorable ratios compared to Trimble’s 57.14%, highlighted by superior liquidity, asset turnover, and capital efficiency metrics. However, both companies are assessed as having a favorable overall ratio profile, with Trimble showing notable strengths in profitability but some concerns in capital returns.

Strategic Positioning

This section compares the strategic positioning of Trimble Inc. and Fabrinet, focusing on Market position, Key segments, and Exposure to technological disruption:

Trimble Inc.

- Market position and competitive pressure: Technology sector leader with diversified segments facing competition in hardware and software solutions.

- Key segments and business drivers: Diverse markets including Buildings and Infrastructure, Geospatial, Resources and Utilities, and Transportation.

- Exposure to technological disruption: Engages with evolving technologies in construction, agriculture, and transportation sectors.

Fabrinet

- Operates in hardware and precision manufacturing with a focus on optical and electro-mechanical products, facing industry competition.

- Concentrated on Optical Communications and Lasers, Sensors, and other precision manufacturing products.

- Involved in advanced optical and electronic manufacturing, sensitive to innovation in communications and sensor technologies.

Trimble Inc. vs Fabrinet Positioning

Trimble Inc. pursues a diversified strategy across multiple technology-driven sectors, offering broad market exposure. Fabrinet is more concentrated, specializing in optical communications and precision manufacturing, which may focus risk and opportunity in narrower fields.

Which has the best competitive advantage?

Fabrinet exhibits a very favorable moat with growing ROIC and increasing profitability, indicating a durable competitive advantage. Trimble shows a very unfavorable moat with declining ROIC, signaling value destruction and weaker competitive positioning.

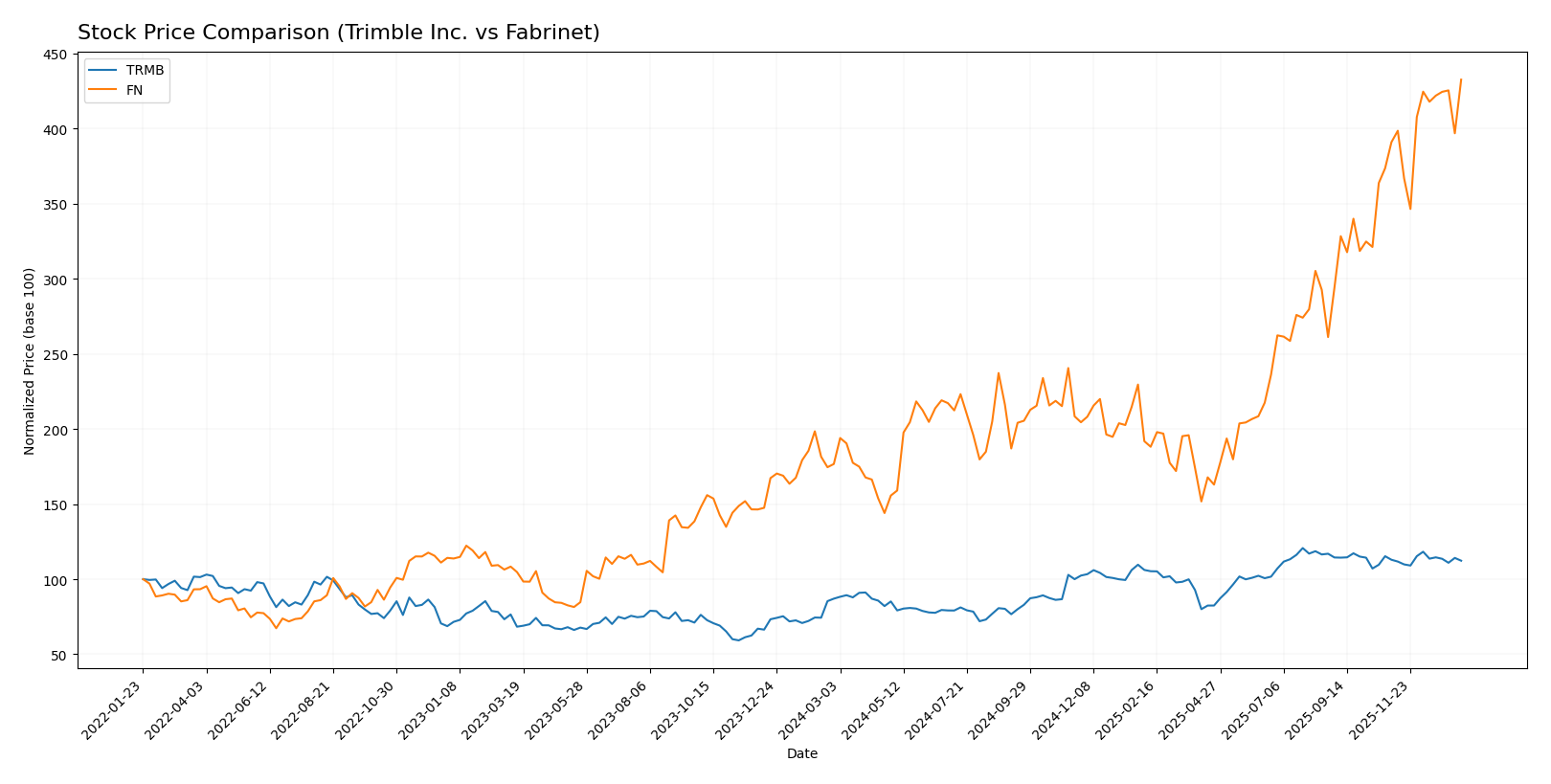

Stock Comparison

The stock price movements of Trimble Inc. (TRMB) and Fabrinet (FN) over the past year reveal contrasting dynamics, with TRMB showing a solid overall gain but recent slight pullback, while FN exhibits strong growth acceleration and higher volatility.

Trend Analysis

Trimble Inc. (TRMB) posted a bullish trend with a 29.04% price increase over the past 12 months, though the upward momentum shows deceleration. The stock fluctuated between $50.86 and $85.24, with moderate volatility (std deviation 9.79).

Fabrinet (FN) experienced a pronounced bullish trend, soaring 144.81% in one year with accelerating momentum. Its price ranged widely from $162.32 to $487.47, reflecting high volatility (std deviation 85.91). Recent gains remain strong at +10.65%.

Comparing both stocks, Fabrinet delivered the highest market performance with a significantly larger price increase and accelerating trend, outpacing Trimble’s more moderate and decelerating gains.

Target Prices

Analysts present a clear target price consensus for both Trimble Inc. and Fabrinet, indicating growth potential from current levels.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Trimble Inc. | 102 | 94 | 98.2 |

| Fabrinet | 600 | 537 | 568.5 |

The target consensus for Trimble Inc. is about 24% above its current price of $79.28, while Fabrinet’s consensus is roughly 17% higher than its current $487.64 price, reflecting moderate upside expectations from analysts.

Analyst Opinions Comparison

This section compares the analysts’ ratings and financial scores for Trimble Inc. and Fabrinet:

Rating Comparison

Trimble Inc. Rating

- Rating: B-, considered very favorable overall.

- Discounted Cash Flow Score: Moderate at 3 out of 5.

- Return on Equity Score: Moderate at 3 out of 5.

- Return on Assets Score: Moderate at 3 out of 5.

- Debt To Equity Score: Moderate at 2 out of 5.

- Overall Score: Moderate at 2 out of 5.

Fabrinet Rating

- Rating: A-, considered very favorable overall.

- Discounted Cash Flow Score: Moderate at 3 out of 5.

- Return on Equity Score: Favorable at 4 out of 5.

- Return on Assets Score: Very favorable at 5 out of 5.

- Debt To Equity Score: Very favorable at 5 out of 5.

- Overall Score: Favorable at 4 out of 5.

Which one is the best rated?

Based strictly on the data, Fabrinet holds higher ratings and scores across most metrics, including overall score, ROE, ROA, and debt-to-equity, indicating a more favorable analyst view compared to Trimble Inc.

Scores Comparison

The following table presents a comparison of Trimble Inc. and Fabrinet based on their financial scores:

Trimble Inc. Scores

- Altman Z-Score: 4.56, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength.

Fabrinet Scores

- Altman Z-Score: 13.79, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

Which company has the best scores?

Fabrinet has a higher Altman Z-Score than Trimble Inc., suggesting stronger bankruptcy safety. However, Trimble Inc. holds a better Piotroski Score, indicating relatively stronger financial health. Both companies have average Piotroski scores.

Grades Comparison

Here is a comparison of the recent grades assigned to Trimble Inc. and Fabrinet by recognized grading companies:

Trimble Inc. Grades

This table shows the latest grades and actions from verified grading companies for Trimble Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| Keybanc | Upgrade | Overweight | 2025-12-16 |

| Piper Sandler | Maintain | Overweight | 2025-11-07 |

| JP Morgan | Maintain | Overweight | 2025-09-19 |

| JP Morgan | Maintain | Overweight | 2025-08-07 |

| Oppenheimer | Maintain | Outperform | 2025-08-07 |

| Raymond James | Maintain | Outperform | 2025-08-07 |

| Oppenheimer | Maintain | Outperform | 2025-07-17 |

| JP Morgan | Maintain | Overweight | 2025-07-10 |

| JP Morgan | Maintain | Overweight | 2025-05-14 |

The overall trend for Trimble Inc. shows consistent overweight and outperform ratings, indicating a generally positive outlook from major analysts.

Fabrinet Grades

This table presents the latest verified grades and actions for Fabrinet:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Needham | Maintain | Buy | 2025-11-04 |

| JP Morgan | Maintain | Overweight | 2025-11-04 |

| Rosenblatt | Maintain | Buy | 2025-11-04 |

| JP Morgan | Maintain | Overweight | 2025-10-16 |

| Rosenblatt | Maintain | Buy | 2025-10-02 |

| JP Morgan | Upgrade | Overweight | 2025-08-25 |

| B. Riley Securities | Maintain | Neutral | 2025-08-19 |

| Needham | Maintain | Buy | 2025-08-19 |

| Rosenblatt | Maintain | Buy | 2025-08-19 |

Fabrinet’s grades reflect a mix of buy and overweight ratings, with some neutral and equal weight assessments, showing a positive but somewhat more varied analyst sentiment.

Which company has the best grades?

Both Trimble Inc. and Fabrinet have a consensus “Buy” rating, but Trimble Inc. has a more uniform pattern of overweight and outperform grades. Fabrinet shows more variation, including some neutral ratings. Investors might interpret Trimble’s steadier and more bullish analyst sentiment as indicative of stronger confidence in its near-term prospects.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Trimble Inc. (TRMB) and Fabrinet (FN), based on the most recent financial and operational data.

| Criterion | Trimble Inc. (TRMB) | Fabrinet (FN) |

|---|---|---|

| Diversification | Moderately diversified across Products and Services; multiple industry segments like Buildings, Geospatial, Transport | Focused primarily on Optical Communications; less diversified |

| Profitability | High net margin (40.8%) and ROE (26.2%), but ROIC (4.5%) below WACC indicates value destruction | Moderate net margin (9.7%), favorable ROIC (15.0%) and ROE (16.8%) reflecting value creation |

| Innovation | Strong in geospatial and engineering tech, but ROIC trend declining, signaling challenges in sustaining innovation returns | Growing ROIC and high asset turnover suggest effective innovation and capital use |

| Global presence | Broad global operations with presence in infrastructure, utilities, and transportation sectors | Strong global supply chain in optical components, but more niche market focus |

| Market Share | Established player in multiple sectors but facing profitability decline | Leading in optical communications manufacturing with durable competitive advantage |

Key takeaways: Fabrinet demonstrates a stronger economic moat with growing profitability and efficient capital use, while Trimble shows high profitability margins but struggles with declining return on invested capital, signaling caution for investors despite diversified operations.

Risk Analysis

Below is a comparative risk table for Trimble Inc. (TRMB) and Fabrinet (FN) based on the most recent data available for 2025-2026:

| Metric | Trimble Inc. (TRMB) | Fabrinet (FN) |

|---|---|---|

| Market Risk | High beta (1.59) indicates higher volatility and sensitivity to market swings | Moderate beta (1.04), less volatile but still exposed to market fluctuations |

| Debt level | Low debt-to-equity (0.26) and debt-to-assets (16%) reflect manageable leverage | Virtually no debt (D/E = 0), very low financial risk from leverage |

| Regulatory Risk | Moderate, with exposure to US and global tech regulations | Moderate, with manufacturing facilities and clients worldwide, including Asia-Pacific |

| Operational Risk | Diversified segments reduce risk; supply chain disruptions remain a concern | Complex supply chain and reliance on advanced manufacturing processes increase risk |

| Environmental Risk | Moderate, given hardware production and resource use | Moderate, due to manufacturing processes and global footprint |

| Geopolitical Risk | US-based but with international operations, impacted by trade policies | Cayman Islands-based with global operations; sensitive to geopolitical tensions in Asia-Pacific |

The most likely and impactful risks for Trimble involve market volatility amplified by its higher beta and potential supply chain challenges. Fabrinet’s key risk is operational, given its advanced manufacturing reliance and geopolitical exposure in Asia-Pacific. Both companies maintain favorable financial health, but vigilance on global trade and regulatory changes remains crucial.

Which Stock to Choose?

Trimble Inc. (TRMB) shows a generally favorable income evolution with strong net margin growth of 229.74% over 2020-2024, a robust 26.18% ROE, manageable debt levels, and a solid B- rating. However, its ROIC is below WACC, signaling value destruction.

Fabrinet (FN) demonstrates consistent income growth with 81.94% revenue increase over 2021-2025, favorable profitability ratios including a 16.78% ROE, negligible debt, and an A- rating. Its ROIC exceeds WACC, indicating value creation and rising profitability.

For risk-tolerant investors favoring growth, Fabrinet’s accelerating income and strong moat might appear more attractive. Conversely, risk-averse or quality-focused investors might view Trimble’s stable margins and moderate ratings as a sign of relative resilience despite its weaker capital efficiency.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Trimble Inc. and Fabrinet to enhance your investment decisions: