Home > Comparison > Technology > RBRK vs FFIV

The strategic rivalry between Rubrik, Inc. and F5, Inc. shapes the evolving landscape of technology infrastructure. Rubrik operates as an innovative data security solutions provider, emphasizing cloud and SaaS protection. In contrast, F5 delivers multi-cloud application security with a hardware-software integrated approach. This analysis pits Rubrik’s growth-driven model against F5’s established enterprise footprint to identify which offers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

Rubrik and F5 stand as key players in the software infrastructure domain, shaping enterprise data and application security.

Rubrik, Inc.: Data Security Innovator

Rubrik leads in enterprise data protection, generating revenue by securing unstructured and cloud data worldwide. Its offerings span cyber recovery and data threat analytics, serving diverse sectors like finance and healthcare. In 2026, Rubrik’s strategic focus zeroes in on expanding SaaS data protection and enhancing its cyber resilience platforms.

F5, Inc.: Multi-Cloud Application Guardian

F5 dominates with application security and delivery solutions across multi-cloud environments. Its revenue stems from hardware and software products ensuring network application performance and security. F5’s 2026 strategy emphasizes integrating advanced firewall and DDoS protection with cloud partnerships, solidifying its role in hybrid and public cloud architectures.

Strategic Collision: Similarities & Divergences

Both firms emphasize security software, yet Rubrik targets data-focused protection, while F5 prioritizes application delivery and network defense. They compete chiefly in cloud security services, but Rubrik’s SaaS orientation contrasts with F5’s hybrid infrastructure approach. Investors face distinct profiles: Rubrik’s growth-driven innovation versus F5’s mature, diversified enterprise footprint.

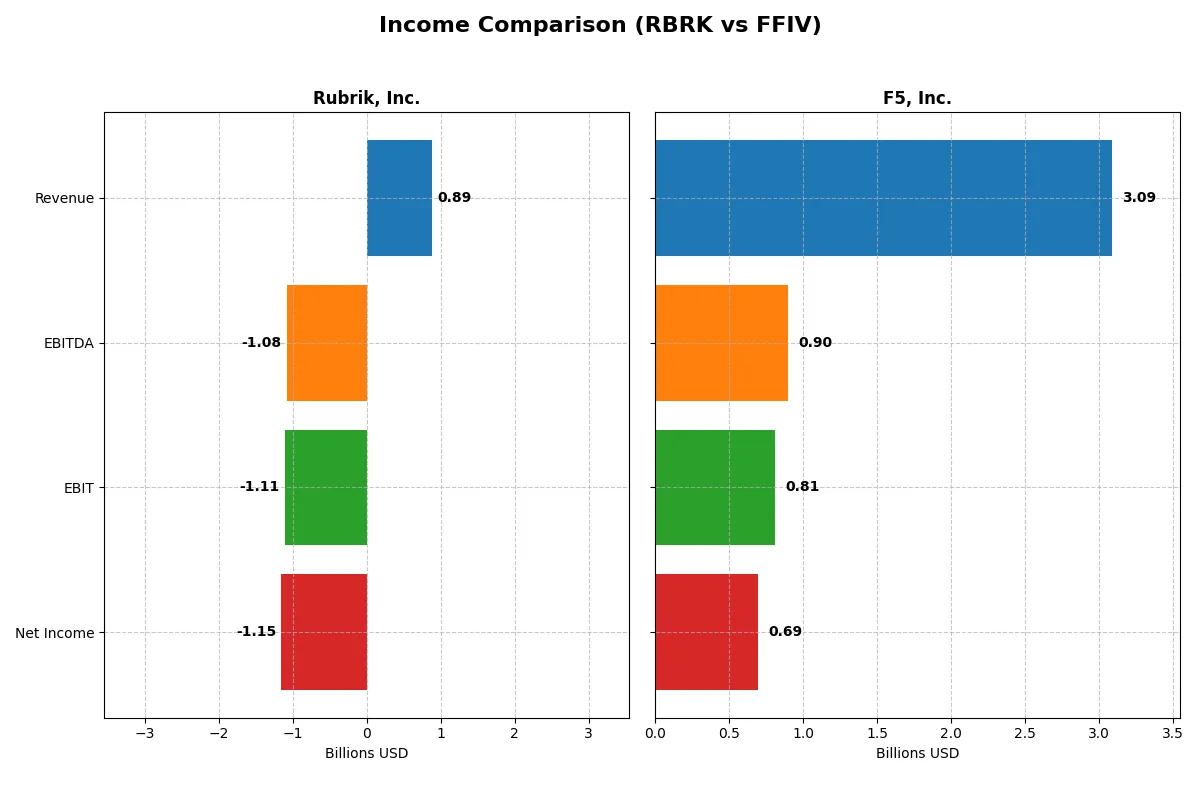

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Rubrik, Inc. (RBRK) | F5, Inc. (FFIV) |

|---|---|---|

| Revenue | 886.5M | 3.09B |

| Cost of Revenue | 265.7M | 563.7M |

| Operating Expenses | 1.75B | 1.76B |

| Gross Profit | 620.8M | 2.52B |

| EBITDA | -1.08B | 900.7M |

| EBIT | -1.11B | 808.3M |

| Interest Expense | 41.3M | 0 |

| Net Income | -1.15B | 692.4M |

| EPS | -7.48 | 11.95 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true operational efficiency and profitability trajectory of two distinct corporate engines.

Rubrik, Inc. Analysis

Rubrik’s revenue surged 41% in 2025 to $887M, reflecting strong top-line growth over five years (+129%). However, net income remains deeply negative at -$1.15B, signaling persistent losses. Despite a solid gross margin of 70%, heavy operating expenses erode profitability, driving a negative net margin of -130%. Momentum falters as EBIT and EPS deteriorate sharply.

F5, Inc. Analysis

F5’s revenue grew steadily by nearly 10% in 2025, reaching $3.09B, with a respectable five-year increase of 19%. It sustains robust profitability, boasting an 82% gross margin and a 22% net margin. Net income jumped to $692M, supported by efficient cost control and healthy EBIT growth (+21%). The company demonstrates consistent margin expansion and earnings momentum.

Margin Strength vs. Growth Struggles

F5 clearly outperforms Rubrik in profitability and margin quality, delivering consistent net income growth and superior operational leverage. Rubrik excels in rapid revenue expansion but suffers from chronic losses and negative earnings momentum. For investors, F5’s stable profit profile offers a lower-risk investment, while Rubrik’s profile reflects a high-growth, high-burn model requiring caution.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Rubrik, Inc. (RBRK) | F5, Inc. (FFIV) |

|---|---|---|

| ROE | 2.09% | 19.28% |

| ROIC | -2.35% | 13.99% |

| P/E | -9.79 | 26.91 |

| P/B | -20.42 | 5.19 |

| Current Ratio | 1.13 | 1.56 |

| Quick Ratio | 1.13 | 1.51 |

| D/E | -0.63 | 0.06 |

| Debt-to-Assets | 24.65% | 3.65% |

| Interest Coverage | -27.49 | 0 |

| Asset Turnover | 0.62 | 0.49 |

| Fixed Asset Turnover | 16.67 | 9.02 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, exposing hidden risks and operational excellence crucial for informed investment decisions.

Rubrik, Inc.

Rubrik posts a favorable 208.6% ROE despite a deeply negative net margin and ROIC, signaling profitability challenges. The stock’s valuation metrics (negative P/E and P/B) appear distorted, possibly reflecting losses. No dividends are paid; instead, Rubrik invests heavily in R&D (60% of revenue), focusing on growth and future innovation.

F5, Inc.

F5 achieves solid profitability with a 19.3% ROE and positive 22.4% net margin, demonstrating operational efficiency. However, its P/E of 26.9 and P/B of 5.2 mark the stock as relatively expensive versus peers. F5 offers no dividend but generates robust free cash flow, suggesting potential for shareholder returns or reinvestment.

Premium Valuation vs. Operational Safety

F5 balances healthy profitability with a premium valuation, while Rubrik shows volatile profitability masked by heavy growth investment. Investors prioritizing stable returns may favor F5’s operational safety; those seeking growth might consider Rubrik’s innovation-driven profile despite risks.

Which one offers the Superior Shareholder Reward?

I observe that Rubrik, Inc. (RBRK) pays no dividends and has no buyback program, reflecting a reinvestment strategy amid consistent net losses. In contrast, F5, Inc. (FFIV) also pays no dividend but generates strong free cash flow (~15.7/share in 2025) and maintains moderate buybacks, supporting shareholder returns. FFIV’s sustainable EBIT margin (~26%) and robust operating cash flow coverage (>4x) underpin a healthier distribution model. I conclude FFIV offers a superior total return profile in 2026 due to its cash-generative operations and disciplined capital allocation, unlike RBRK’s loss-heavy, non-distributive stance.

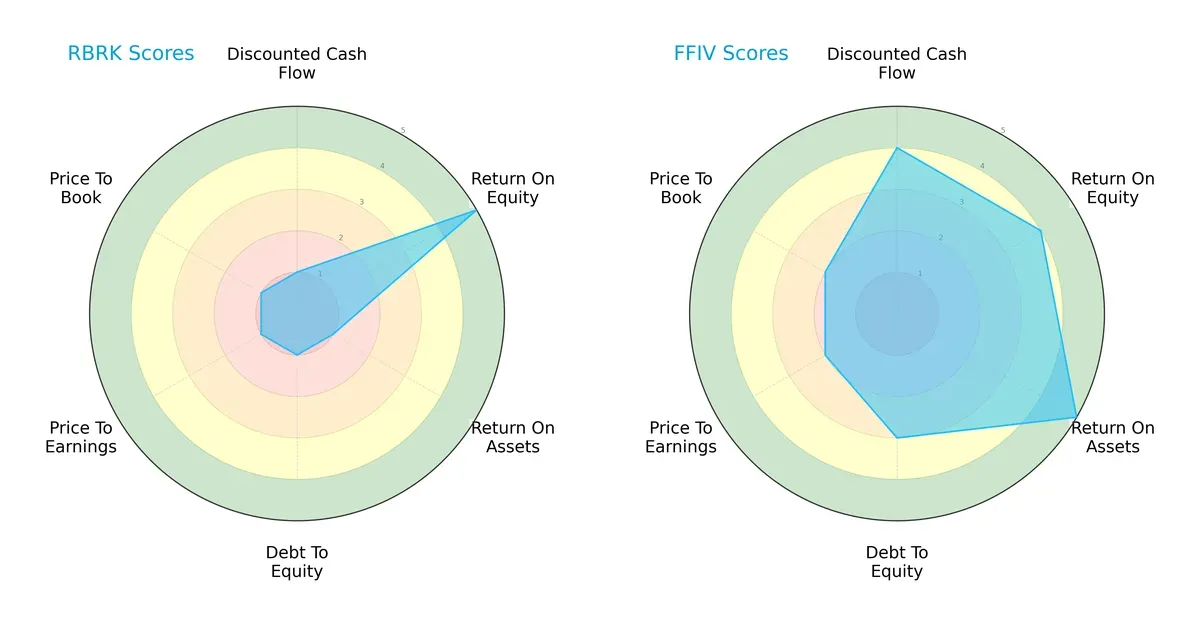

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Rubrik, Inc. and F5, Inc., showcasing their diverse financial strengths and valuation profiles:

F5, Inc. displays a more balanced profile with strong DCF (4), ROE (4), and ROA (5) scores, and moderate leverage and valuation metrics. Rubrik, Inc. relies heavily on ROE (5) but struggles with weak DCF (1), ROA (1), and debt-to-equity (1) scores, signaling financial instability and overvaluation risks.

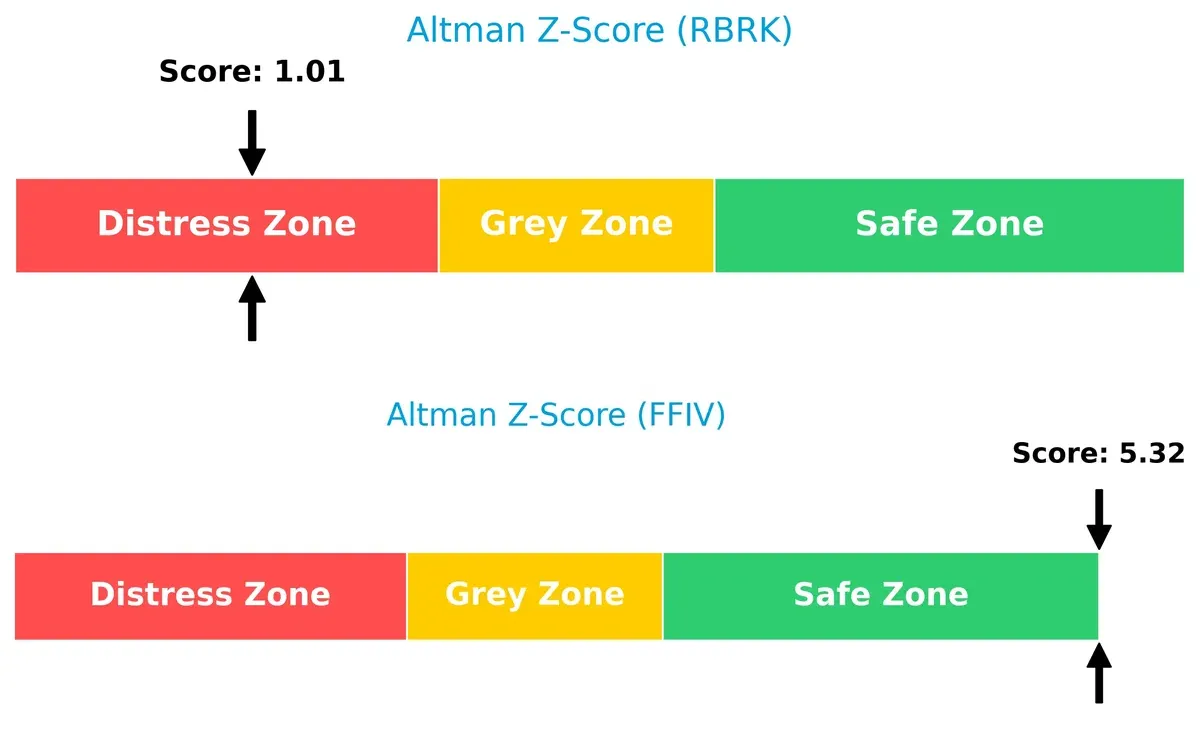

Bankruptcy Risk: Solvency Showdown

F5’s Altman Z-Score of 5.3 firmly places it in the safe zone, indicating robust solvency and low bankruptcy risk. Rubrik’s 1.0 score signals distress, reflecting high long-term survival risk in this cycle:

Financial Health: Quality of Operations

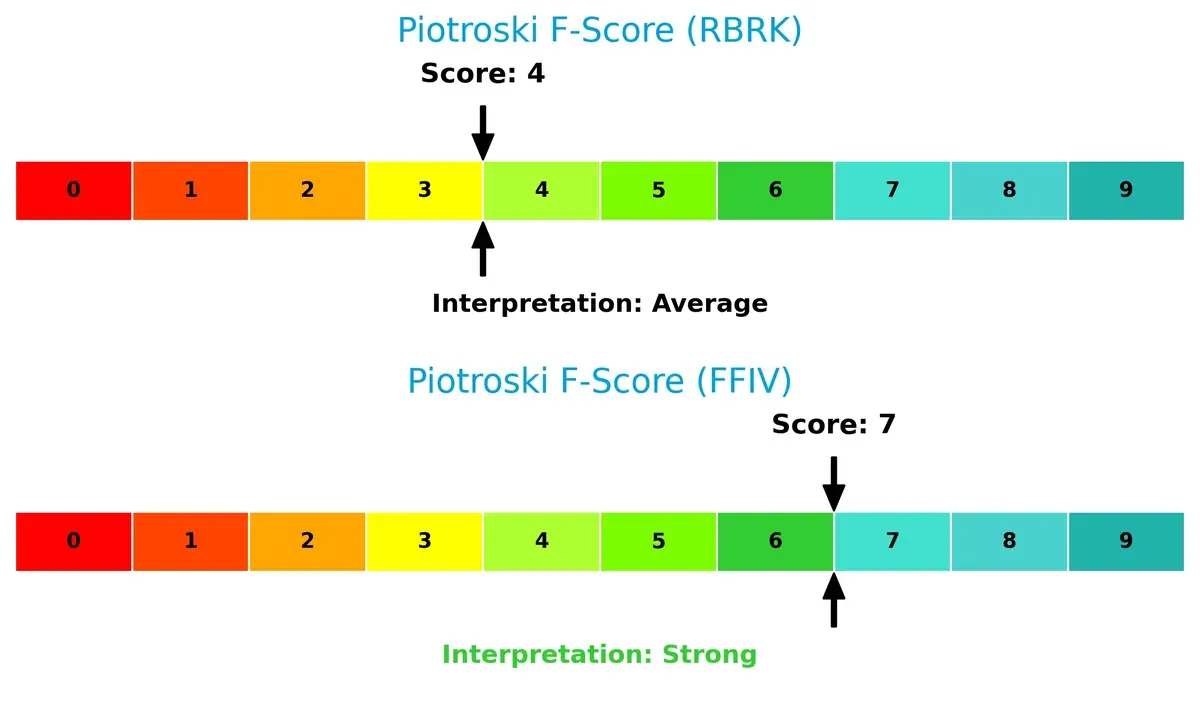

F5’s Piotroski score of 7 denotes strong financial health with solid internal metrics. Rubrik’s score of 4 suggests average operational quality, highlighting potential red flags in profitability or efficiency:

How are the two companies positioned?

This section dissects the operational DNA of Rubrik and F5 by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

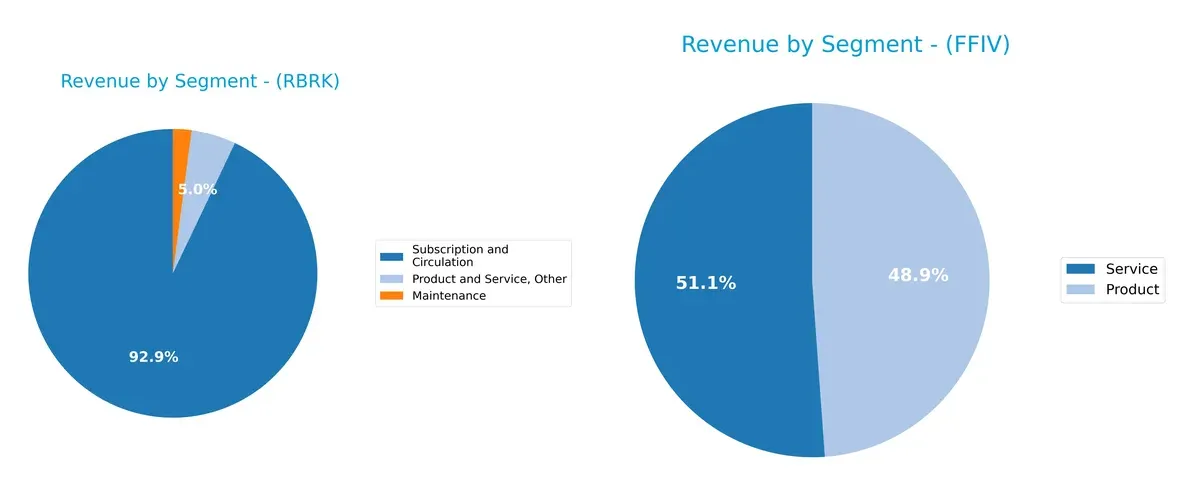

This comparison dissects how Rubrik, Inc. and F5, Inc. diversify income streams and where their primary sector bets lie:

Rubrik anchors 828.7M USD in Subscription and Circulation, dwarfing its 44.6M in Product and Service, Other, and 18.4M in Maintenance. F5 balances 1.51B USD in Product with a slightly higher 1.58B in Service. Rubrik’s heavy subscription focus signals ecosystem lock-in but raises concentration risk. F5’s dual-stream model pivots on infrastructure dominance, offering resilience through balanced product-service exposure.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Rubrik, Inc. and F5, Inc.:

Rubrik Strengths

- High return on equity at 208.55%

- Favorable weighted average cost of capital at 5.35%

- Strong quick ratio of 1.13

- Low debt-to-assets ratio at 24.65%

- High fixed asset turnover at 16.67

- Subscription revenue dominates at 828M USD

F5 Strengths

- Positive net margin at 22.42%

- Solid ROE of 19.28% and ROIC of 13.99%

- Strong liquidity with current ratio 1.56

- Minimal debt-to-assets at 3.65%

- Infinite interest coverage ratio

- Large product and service revenue base exceeding 3B USD

Rubrik Weaknesses

- Negative net margin at -130.26%

- Unfavorable ROIC at -234.85%

- Negative interest coverage ratio

- Negative price-to-earnings and price-to-book ratios

- Neutral asset turnover at 0.62

- Zero dividend yield

F5 Weaknesses

- Unfavorable price-to-earnings of 26.91 and price-to-book of 5.19

- Unfavorable asset turnover of 0.49

- Neutral weighted average cost of capital at 8.31%

- Zero dividend yield

Rubrik shows strengths in equity returns and asset efficiency but struggles with profitability and interest coverage. F5 demonstrates consistent profitability and strong liquidity but faces valuation and asset utilization challenges. These factors shape their strategic financial positioning differently.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competition erosion. Let’s dissect the moats of two industry players:

Rubrik, Inc.: Emerging Data Security Innovator

Rubrik’s primary moat lies in intangible assets—its proprietary data security software. Despite strong revenue growth, its negative ROIC signals value destruction. New cloud solutions could deepen the moat if profitability improves in 2026.

F5, Inc.: Established Multi-Cloud Security Leader

F5 leverages cost advantage and network effects through integrated multi-cloud application security. It sustains high ROIC above WACC with margin expansion. Its diverse product portfolio supports steady moat widening into new cloud markets.

Value Creation vs. Value Destruction: The Moat Battle

F5 boasts a wider, durable moat with growing profitability and efficient capital use. Rubrik’s shrinking ROIC and losses expose a fragile moat. F5 is clearly better positioned to defend and expand its market share.

Which stock offers better returns?

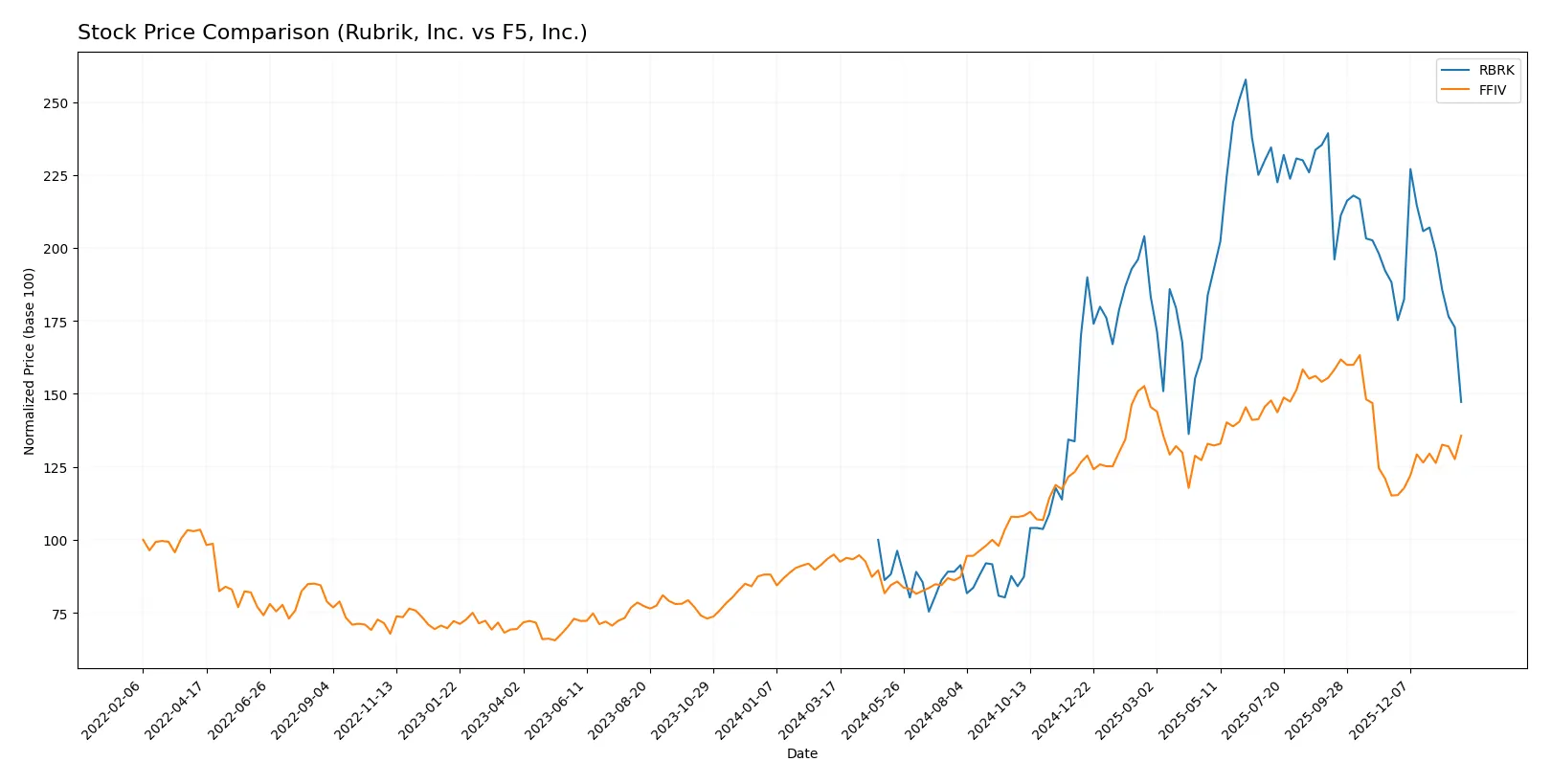

Over the past year, Rubrik, Inc. and F5, Inc. showed strong price appreciation with contrasting recent trading dynamics, highlighting shifting investor sentiment and momentum.

Trend Comparison

Rubrik, Inc. gained 47.24% over the past 12 months, indicating a bullish trend with decelerating momentum and a high volatility level (21.18% std deviation). The stock peaked at 97.91 and bottomed at 28.65.

F5, Inc. rose 42.85% over the same period, also bullish but with accelerating momentum and greater volatility (48.51% std deviation). Its price ranged between 165.57 and 331.75.

Comparing recent trends, F5 outperformed Rubrik with a 17.78% gain versus Rubrik’s 21.8% decline, making F5 the stronger market performer in the latest months.

Target Prices

Analysts set confident targets for both Rubrik, Inc. and F5, Inc., signaling bullish expectations ahead.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Rubrik, Inc. | 105 | 113 | 109.33 |

| F5, Inc. | 295 | 352 | 330.67 |

The consensus targets for Rubrik and F5 stand nearly double and 20% above current prices, respectively, indicating substantial upside potential according to market experts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Rubrik, Inc. Grades

The following table summarizes recent institutional grades for Rubrik, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

F5, Inc. Grades

This table presents recent institutional grades for F5, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Hold | 2026-01-28 |

| Piper Sandler | Maintain | Overweight | 2026-01-28 |

| Goldman Sachs | Maintain | Neutral | 2026-01-28 |

| Barclays | Maintain | Equal Weight | 2026-01-28 |

| RBC Capital | Maintain | Outperform | 2026-01-28 |

| JP Morgan | Upgrade | Overweight | 2026-01-15 |

| Piper Sandler | Upgrade | Overweight | 2026-01-05 |

| RBC Capital | Upgrade | Outperform | 2026-01-05 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-17 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-28 |

Which company has the best grades?

Rubrik, Inc. holds consistently higher ratings, including multiple “Buy” and “Outperform” grades. F5, Inc. features more neutral and hold ratings. Investors may see Rubrik as the stronger growth candidate based on these grades.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Rubrik, Inc.

- Faces intense competition in data security software with pressure on margins.

F5, Inc.

- Competes in multi-cloud application security with a solid enterprise client base but slower growth.

2. Capital Structure & Debt

Rubrik, Inc.

- Debt-to-assets at 24.65% is manageable, but negative interest coverage signals risk in servicing debt.

F5, Inc.

- Low debt-to-assets at 3.65%, strong interest coverage, reflecting conservative leverage and financial stability.

3. Stock Volatility

Rubrik, Inc.

- Low beta (0.28) indicates less market volatility but also lower liquidity and investor interest.

F5, Inc.

- Higher beta (0.98) implies greater price swings, reflecting sensitivity to market and sector trends.

4. Regulatory & Legal

Rubrik, Inc.

- Operates in data security, exposed to evolving privacy regulations and cybersecurity compliance risks.

F5, Inc.

- Faces regulatory scrutiny in multi-cloud environments, including data sovereignty and software export controls.

5. Supply Chain & Operations

Rubrik, Inc.

- Relies on cloud infrastructure partners, potential vulnerabilities in SaaS delivery and service uptime.

F5, Inc.

- Large global operations expose it to supply chain disruptions for hardware and software components.

6. ESG & Climate Transition

Rubrik, Inc.

- Emerging ESG policies; needs improvement in transparency and climate risk disclosures.

F5, Inc.

- More mature ESG programs with ongoing initiatives to reduce environmental footprint and improve governance.

7. Geopolitical Exposure

Rubrik, Inc.

- Primarily US-based but expanding internationally, vulnerable to trade tensions and data localization laws.

F5, Inc.

- Significant global footprint, higher geopolitical risk from exposure to EMEA and APAC markets.

Which company shows a better risk-adjusted profile?

F5, Inc. exhibits a stronger risk-adjusted profile, driven by stable capital structure and robust financial scores. Rubrik’s biggest risk is its negative profitability and distress-zone Altman Z-score, signaling financial fragility. F5’s main concern lies in geopolitical exposure, but its solid balance sheet and strong Piotroski score provide a buffer. The stark contrast in interest coverage and bankruptcy risk highlights my caution toward Rubrik despite its growth potential.

Final Verdict: Which stock to choose?

Rubrik, Inc. excels as a high-growth innovator with a robust revenue surge and a sharp focus on R&D. Its superpower lies in its potential to disrupt the data management space. However, its persistent value destruction and profitability challenges remain a point of vigilance. It suits aggressive growth portfolios willing to tolerate volatility.

F5, Inc. boasts a durable competitive moat through its cloud infrastructure dominance and consistent free cash flow generation. Its superior profitability and financial stability offer a safer profile compared to Rubrik. This makes it attractive for Growth at a Reasonable Price (GARP) investors seeking steady expansion with moderated risk.

If you prioritize rapid expansion and are comfortable with elevated risk, Rubrik might be the compelling choice due to its innovation potential and market dynamism. However, if you seek durable competitive advantage and better financial stability, F5 outshines with its proven profitability and stronger balance sheet. Both carry risks, so aligning with your risk tolerance and investment horizon is essential.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Rubrik, Inc. and F5, Inc. to enhance your investment decisions: