In the competitive world of self-storage real estate investment trusts (REITs), Public Storage (PSA) and Extra Space Storage Inc. (EXR) stand out as industry leaders. Both companies operate extensive networks of storage facilities across the United States, leveraging scale and innovation to capture market share. This comparison explores their strategies, market positions, and growth prospects to help you identify which stock might best enhance your investment portfolio. Let’s dive in and find the most compelling opportunity for your capital.

Table of contents

Companies Overview

I will begin the comparison between Public Storage and Extra Space Storage Inc. by providing an overview of these two companies and their main differences.

Public Storage Overview

Public Storage is a REIT focused on acquiring, developing, owning, and operating self-storage facilities. It holds interests in 2,504 facilities across 38 US states, with around 171M net rentable square feet. The company also has significant equity stakes in Shurgard Self Storage and PS Business Parks, offering diversified commercial real estate exposure. Headquartered in Glendale, California, Public Storage is a member of the S&P 500 and FT Global 500.

Extra Space Storage Inc. Overview

Extra Space Storage Inc. is a self-administered, self-managed REIT and S&P 500 member headquartered in Salt Lake City, Utah. It owns or operates 1,906 self-storage stores in 40 states, Washington, D.C., and Puerto Rico, totaling about 147.5M rentable square feet and 1.4M units. The company offers diverse storage options including boat, RV, and business storage. It is the second largest US self-storage owner and the largest self-storage management company.

Key similarities and differences

Both companies operate as REITs specializing in self-storage facilities and are listed on the NYSE. Public Storage has a larger footprint by facility count and rentable area, while Extra Space Storage manages more units and focuses on a broader range of storage types. Public Storage also holds equity stakes in related real estate businesses, whereas Extra Space Storage is self-managed and emphasizes its management scale. Their geographic presence is broadly similar across the US.

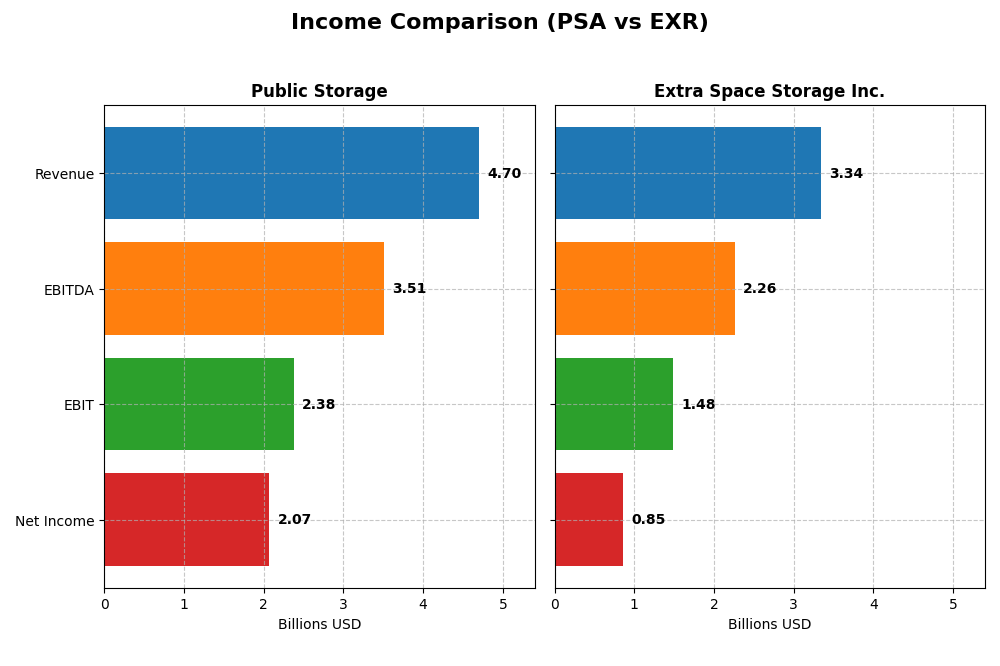

Income Statement Comparison

The following table compares key income statement metrics for Public Storage and Extra Space Storage Inc. for the fiscal year 2024.

| Metric | Public Storage (PSA) | Extra Space Storage Inc. (EXR) |

|---|---|---|

| Market Cap | 47.6B | 28.9B |

| Revenue | 4.70B | 3.34B |

| EBITDA | 3.51B | 2.26B |

| EBIT | 2.38B | 1.48B |

| Net Income | 2.07B | 855M |

| EPS | 10.68 | 4.03 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Public Storage

Public Storage (PSA) showed steady revenue growth from 2020 to 2024, increasing from $2.92B to $4.70B, with net income rising from $1.36B to $2.07B. Margins remained strong, with a gross margin of 73.21% and net margin at 44.13% in 2024. However, the latest year saw slower net margin and EPS growth, indicating some margin pressure despite stable revenues.

Extra Space Storage Inc.

Extra Space Storage (EXR) experienced significant revenue growth, from $1.38B in 2020 to $3.34B in 2024, and net income increased from $518M to $855M. Margins were favorable with a gross margin of 76.31%, but net margin was lower at 25.61%, partly due to higher interest expenses. Revenue and EBIT growth accelerated in 2024, although net margin and EPS declined year-over-year.

Which one has the stronger fundamentals?

Both companies exhibit favorable income statement trends with solid revenue and net income growth. PSA offers higher profitability with superior net margins and more stable interest expenses, while EXR shows faster revenue and EBIT growth but faces higher interest costs and margin declines. PSA’s margin stability contrasts with EXR’s greater top-line expansion but more volatile profitability metrics.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Public Storage (PSA) and Extra Space Storage Inc. (EXR) based on their latest fiscal year data ending 2024.

| Ratios | Public Storage (PSA) | Extra Space Storage Inc. (EXR) |

|---|---|---|

| ROE | 21.3% | 6.1% |

| ROIC | 11.5% | 4.5% |

| P/E | 25.3 | 37.0 |

| P/B | 5.4 | 2.3 |

| Current Ratio | 0.76 | 0.93 |

| Quick Ratio | 0.76 | 0.93 |

| D/E | 0.96 | 0.93 |

| Debt-to-Assets | 47.3% | 45.2% |

| Interest Coverage | 7.7 | 2.2 |

| Asset Turnover | 0.24 | 0.12 |

| Fixed Asset Turnover | 15.2 | 4.5 |

| Payout Ratio | 111.1% | 160.9% |

| Dividend Yield | 4.38% | 4.34% |

Interpretation of the Ratios

Public Storage

Public Storage shows a mixed but generally positive ratio profile. It has strong net margin (44.13%) and return on equity (21.33%), with favorable interest coverage (8.27) and fixed asset turnover (15.24). However, concerns arise from a low current ratio (0.76) and high price-to-book (5.41) and price-to-earnings (25.34) ratios. The company pays dividends with a solid 4.38% yield, supported by stable payout ratios and coverage from free cash flow, though careful monitoring of payout sustainability is warranted.

Extra Space Storage Inc.

Extra Space Storage exhibits some financial weaknesses, including a low return on equity (6.13%) and return on invested capital (4.49%), with a modest net margin (25.61%). Its interest coverage (2.49) and current ratio (0.93) are less favorable, reflecting potential liquidity and debt service challenges. The dividend yield is competitive at 4.34%, but the payout must be evaluated carefully against free cash flow and debt levels to avoid risks from over-distribution.

Which one has the best ratios?

Public Storage’s ratios are overall more favorable, with stronger profitability and coverage metrics despite some liquidity concerns. Extra Space Storage shows weaker returns and coverage ratios, alongside a less favorable global evaluation. Therefore, Public Storage demonstrates a slightly more robust ratio profile based on the available metrics.

Strategic Positioning

This section compares the strategic positioning of Public Storage and Extra Space Storage Inc. regarding market position, key segments, and exposure to technological disruption:

Public Storage

- Leading REIT with 2,504 facilities across 38 states; faces competition in self-storage sector.

- Revenue primarily from self-storage ($4.4B in 2024) and ancillary operations; diversified with equity stakes in European and commercial space.

- Limited explicit information on technological disruption exposure; operates traditional self-storage facilities.

Extra Space Storage Inc.

- Second largest US owner/operator with 1,906 stores in 40 states, DC, and Puerto Rico; strong market presence.

- Revenue mainly from self-storage ($2.8B in 2024) and tenant reinsurance; focused on US self-storage segments.

- No explicit data on technological disruption; operates self-administered, self-managed facilities emphasizing operational control.

Public Storage vs Extra Space Storage Inc. Positioning

Public Storage exhibits a more diversified approach with international equity interests and commercial real estate exposure, while Extra Space Storage concentrates on US self-storage and tenant reinsurance. Diversification may spread risk, but concentration allows focused operational management.

Which has the best competitive advantage?

Based on MOAT evaluation, Public Storage shows a slightly favorable status with value creation despite declining profitability, whereas Extra Space Storage has a very unfavorable status, destroying value with sharply declining returns. Public Storage holds the stronger competitive advantage.

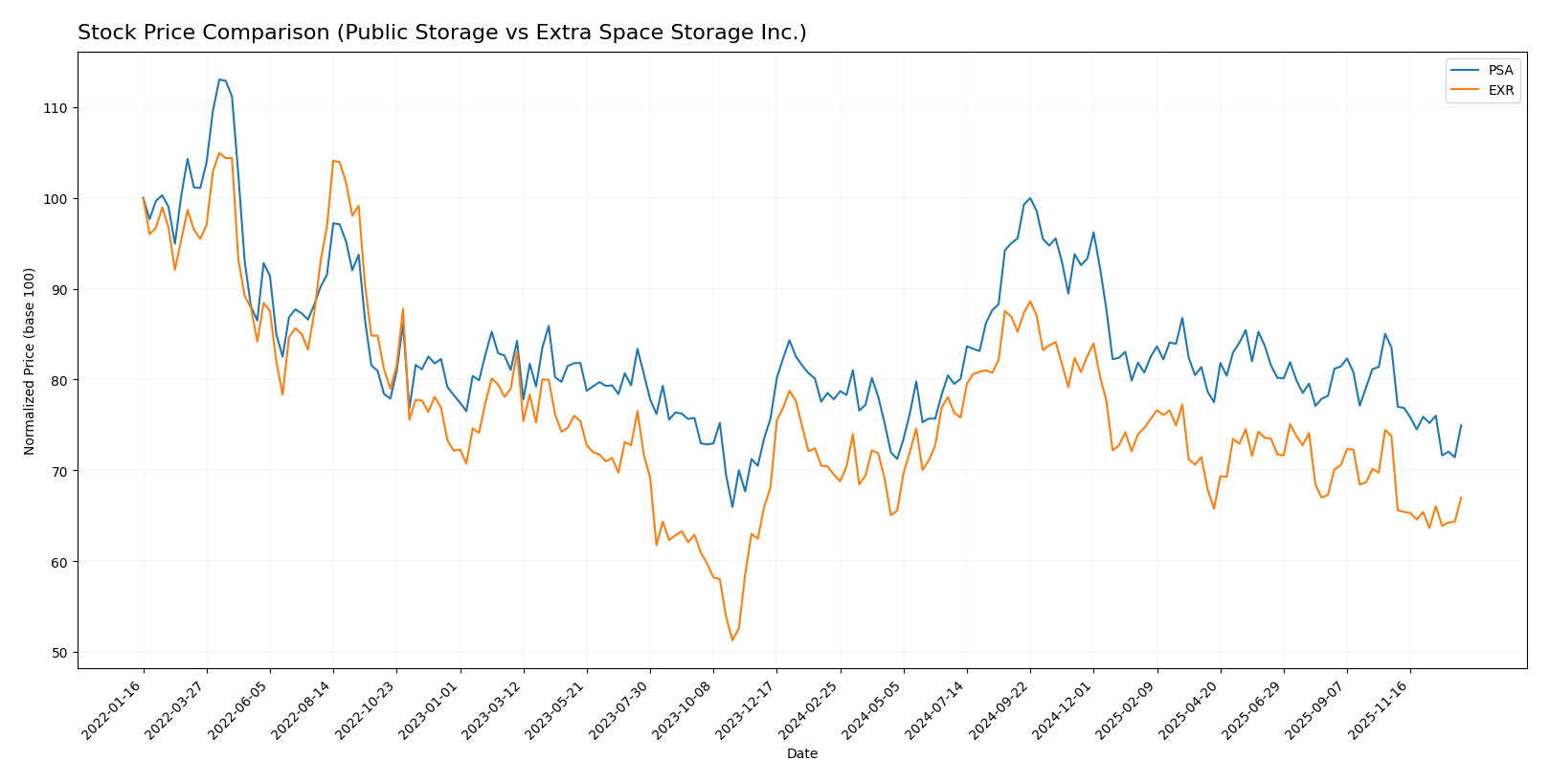

Stock Comparison

The stock prices of Public Storage (PSA) and Extra Space Storage Inc. (EXR) have both experienced bearish trends over the past 12 months, with notable price declines and decelerating momentum, reflecting challenges in the storage sector.

Trend Analysis

Public Storage’s stock showed a -3.69% decline over the past year, indicating a bearish trend with price deceleration. It traded between a high of 361.72 and a low of 257.73, exhibiting significant volatility (24.06 std deviation).

Extra Space Storage also faced a -3.69% price drop over the last 12 months, marking a bearish trend with decelerating decline. Price ranged from 180.41 to 129.56 with moderate volatility (12.53 std deviation).

Comparing the two, both stocks delivered identical overall market performance with a -3.69% decline, although PSA showed higher volatility and a sharper recent downward trend than EXR.

Target Prices

Here is the current consensus target price outlook from reliable analysts for Public Storage and Extra Space Storage Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Public Storage | 330 | 276 | 304.29 |

| Extra Space Storage Inc. | 152 | 137 | 145.86 |

Analysts expect Public Storage’s price to rise above its current $271.12, with consensus near $304, signaling moderate upside potential. Extra Space Storage’s consensus of $145.86 also suggests a modest increase from the current $136.35.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Public Storage and Extra Space Storage Inc.:

Rating Comparison

PSA Rating

- Rating: B+ indicating a very favorable overall rating.

- Discounted Cash Flow Score: 4, showing a favorable valuation based on cash flow.

- ROE Score: 5, very favorable efficiency in generating profit from equity.

- ROA Score: 5, very favorable asset utilization for earnings.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk.

- Overall Score: 3, moderate overall financial standing.

EXR Rating

- Rating: B indicating a very favorable overall rating.

- Discounted Cash Flow Score: 4, also favorable for valuation based on cash flow.

- ROE Score: 3, moderate efficiency in generating profit from equity.

- ROA Score: 4, favorable asset utilization for earnings.

- Debt To Equity Score: 2, moderate financial risk with better balance sheet.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

Based strictly on provided data, PSA holds a higher rating (B+) with stronger ROE and ROA scores, but weaker debt-to-equity compared to EXR’s moderate rating (B) and more balanced financial risk profile. Overall scores are equal.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Public Storage and Extra Space Storage Inc.:

PSA Scores

- Altman Z-Score: 3.24, in the safe zone, indicating low bankruptcy risk.

- Piotroski Score: 6, average financial strength.

EXR Scores

- Altman Z-Score: 1.34, in the distress zone, indicating higher bankruptcy risk.

- Piotroski Score: 4, average financial strength.

Which company has the best scores?

Based on the provided data, PSA exhibits a stronger financial position with a safe zone Altman Z-Score and a higher Piotroski Score than EXR, which is in the distress zone with a lower Piotroski Score.

Grades Comparison

The following presents a detailed comparison of the recent grades for Public Storage and Extra Space Storage Inc.:

Public Storage Grades

This table summarizes the latest grades assigned by recognized grading companies for Public Storage.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Downgrade | Neutral | 2025-12-18 |

| Mizuho | Maintain | Neutral | 2025-12-05 |

| Evercore ISI Group | Maintain | In Line | 2025-12-01 |

| Truist Securities | Maintain | Buy | 2025-11-25 |

| Evercore ISI Group | Maintain | In Line | 2025-11-03 |

| RBC Capital | Maintain | Sector Perform | 2025-10-31 |

| Wells Fargo | Maintain | Overweight | 2025-10-27 |

| Evercore ISI Group | Maintain | In Line | 2025-10-03 |

| UBS | Maintain | Neutral | 2025-09-16 |

| Evercore ISI Group | Maintain | In Line | 2025-09-15 |

Overall, Public Storage’s grades show a stable to slightly cautious trend, with several firms maintaining neutral or in-line ratings and only one recent downgrade.

Extra Space Storage Inc. Grades

Below is a summary of the recent grades from established grading companies for Extra Space Storage Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Hold | 2025-12-16 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-05 |

| Mizuho | Maintain | Outperform | 2025-12-05 |

| RBC Capital | Maintain | Sector Perform | 2025-11-07 |

| Evercore ISI Group | Maintain | In Line | 2025-11-03 |

| Evercore ISI Group | Maintain | In Line | 2025-10-03 |

| UBS | Maintain | Buy | 2025-09-16 |

| Evercore ISI Group | Maintain | In Line | 2025-09-15 |

| Scotiabank | Maintain | Sector Outperform | 2025-08-28 |

| Wells Fargo | Upgrade | Overweight | 2025-08-26 |

Extra Space Storage Inc. benefits from a generally positive outlook, with several firms assigning outperform and buy ratings, alongside recent upgrades.

Which company has the best grades?

Extra Space Storage Inc. has received comparatively stronger grades, including outperform and buy recommendations, whereas Public Storage’s ratings cluster around neutral and in-line. This difference may influence investor sentiment and portfolio positioning based on perceived growth potential and risk.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses of Public Storage (PSA) and Extra Space Storage Inc. (EXR) based on the most recent financial and operational data.

| Criterion | Public Storage (PSA) | Extra Space Storage Inc. (EXR) |

|---|---|---|

| Diversification | Moderate: Primarily self storage with ancillary ops $3.7B revenue in 2024 | Limited: Mainly self storage, some tenant reinsurance $3.1B revenue in 2024 |

| Profitability | High net margin 44.13%, ROIC 11.46%, creating value with declining ROIC | Moderate net margin 25.61%, ROIC 4.49%, value destroying with steep declining ROIC |

| Innovation | Stable operational efficiency, less focus on innovation | Some innovation in tenant insurance products, limited overall |

| Global presence | Primarily U.S.-focused, well-established | Also U.S.-focused, smaller scale |

| Market Share | Largest in sector with $4.4B self storage revenue | Smaller player with $2.8B self storage revenue |

Key takeaways: PSA demonstrates stronger profitability and market leadership with a solid though slightly declining ROIC, indicating ongoing value creation despite some risks. EXR shows weaker profitability and declining returns, signaling caution for investors despite some niche diversification.

Risk Analysis

Below is a comparison of key risks for Public Storage (PSA) and Extra Space Storage Inc. (EXR) based on the most recent data from 2024.

| Metric | Public Storage (PSA) | Extra Space Storage Inc. (EXR) |

|---|---|---|

| Market Risk | Moderate (beta 0.99, stable sector) | Higher (beta 1.27, more volatile) |

| Debt level | Moderate (D/E ~0.96, neutral) | Moderate (D/E ~0.93, neutral) |

| Regulatory Risk | Low (US-focused, stable REIT rules) | Low (similar US REIT environment) |

| Operational Risk | Moderate (large footprint, 2,500+ facilities) | Moderate (1,900+ facilities, nationwide) |

| Environmental Risk | Low (industrial REIT, limited impact) | Low (similar industry exposure) |

| Geopolitical Risk | Low (primarily US operations) | Low (primarily US operations) |

The most impactful and likely risks relate to market volatility and operational scale. EXR’s higher beta suggests more sensitivity to market swings, while PSA’s larger facility base adds operational complexity. Both maintain moderate debt levels but should monitor interest coverage closely, especially EXR, which has a lower coverage ratio.

Which Stock to Choose?

Public Storage (PSA) shows a favorable income evolution with a 61% revenue growth over five years and solid profitability metrics, including a 44.13% net margin and 21.33% ROE. Its debt level is moderate, with neutral debt-to-equity ratios, supported by a strong B+ rating and a slightly favorable moat indicating value creation despite a declining ROIC trend.

Extra Space Storage Inc. (EXR) exhibits a strong income growth of 142% over five years but lower profitability, with a 25.61% net margin and 6.13% ROE. The company carries higher debt, reflected in a moderate debt-to-equity score, and holds a B rating. Its very unfavorable moat signals value destruction and declining profitability.

Investors focused on quality and stable profitability might find PSA’s financial ratios and rating more favorable, while those prioritizing high growth potential could consider EXR’s robust income expansion despite its weaker profitability and financial stress indicators. The choice may depend on an investor’s risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Public Storage and Extra Space Storage Inc. to enhance your investment decisions: