Home > Comparison > Real Estate > PLD vs EXR

The strategic rivalry between Prologis, Inc. and Extra Space Storage Inc. defines leadership in the Real Estate sector’s industrial REIT space. Prologis operates as a global logistics real estate powerhouse focused on high-growth markets, while Extra Space Storage commands the domestic self-storage industry with a vast network of facilities. This analysis explores their divergent capital allocation and growth models to determine which offers superior risk-adjusted returns for a diversified portfolio in 2026.

Table of contents

Companies Overview

Two dominant REITs shape industrial and storage real estate markets in the US today.

Prologis, Inc.: Global Logistics Real Estate Leader

Prologis dominates the logistics real estate sector with 984M sqft across 19 countries. It generates revenue by leasing modern logistics facilities to 5,500 customers in B2B and retail/online fulfillment. In 2020, its strategic focus remained on expanding in high-barrier, high-growth markets to sustain competitive advantage.

Extra Space Storage Inc.: Premier Self-Storage Operator

Extra Space Storage leads as the second largest US self-storage REIT, managing 1,906 stores and 147.5M sqft of rentable space. It earns primarily through rental fees on units for personal, boat, RV, and business storage. The company’s 2020 strategy centers on nationwide footprint expansion and enhancing unit security and convenience.

Strategic Collision: Similarities & Divergences

Prologis and Extra Space both target real estate niches but adopt different philosophies: Prologis invests in global logistics infrastructure, while Extra Space focuses on self-managed, customer-centric storage. Their battle for market share centers on real estate specialization and operational scale. Investors face contrasting profiles: Prologis offers global logistics exposure, whereas Extra Space delivers growth through self-storage dominance.

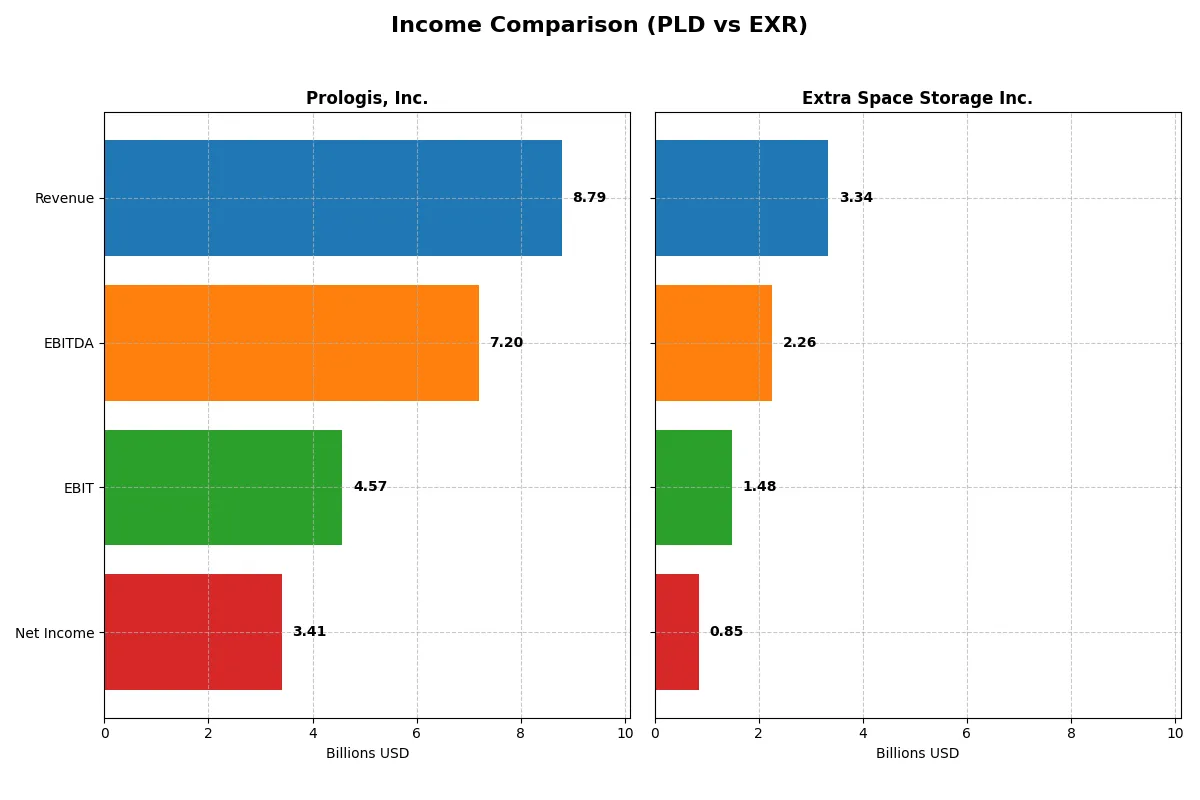

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Prologis, Inc. (PLD) | Extra Space Storage Inc. (EXR) |

|---|---|---|

| Revenue | 8.79B | 3.34B |

| Cost of Revenue | 3.55B | 791M |

| Operating Expenses | 1.70B | 1.22B |

| Gross Profit | 5.24B | 2.55B |

| EBITDA | 7.20B | 2.26B |

| EBIT | 4.57B | 1.48B |

| Interest Expense | 1.00B | 595M |

| Net Income | 3.41B | 855M |

| EPS | 3.57 | 4.03 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates their business with greater efficiency and stronger profit dynamics.

Prologis, Inc. Analysis

Prologis grew revenue by 7.2% in 2025 to 8.8B, but net income declined 11.7% to 3.4B, reflecting margin pressures. Its gross margin contracted notably, signaling cost challenges despite stable operating expenses. The 2025 EBIT margin of 52% remains robust, yet rising interest expenses erode net margins, showing limits to operational momentum.

Extra Space Storage Inc. Analysis

Extra Space Storage surged revenue 27.6% to 3.3B in 2024, with net income slipping 15% to 854M, driven by margin compression. Gross margin stays strong above 76%, though operating expenses grew faster than revenue. EBIT margin at 44% is healthy, supported by solid revenue expansion, but higher interest costs and falling net margin highlight emerging risks.

Margin Strength vs. Growth Velocity

Prologis delivers superior margins with a 38.8% net margin, outperforming Extra Space’s 25.6%, but struggles with declining profitability and rising interest burdens. Extra Space boasts faster revenue and net income growth, yet margin erosion and cost control issues temper its momentum. Investors favoring stable high margins may lean toward Prologis, while growth seekers might consider Extra Space’s top-line acceleration.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Prologis, Inc. (PLD) | Extra Space Storage Inc. (EXR) |

|---|---|---|

| ROE | 6.4% | 6.1% |

| ROIC | 3.6% | 4.5% |

| P/E | 35.1 | 37.0 |

| P/B | 2.25 | 2.27 |

| Current Ratio | 0.23 | 0.93 |

| Quick Ratio | 0.23 | 0.93 |

| D/E | 0.66 | 0.93 |

| Debt-to-Assets | 35.5% | 45.2% |

| Interest Coverage | 3.53 | 2.22 |

| Asset Turnover | 0.089 | 0.116 |

| Fixed Asset Turnover | 0.11 | 4.51 |

| Payout ratio | 111% | 161% |

| Dividend yield | 3.16% | 4.34% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and operational strengths critical for investment decisions.

Prologis, Inc.

Prologis delivers a strong net margin of 38.8% but suffers from weak ROE at 6.41% and ROIC at 3.6%, both below WACC of 8.93%. The stock trades at a stretched P/E of 35.12, indicating expensive valuation. A 3.16% dividend yield offers steady shareholder returns amid limited reinvestment.

Extra Space Storage Inc.

Extra Space Storage posts a solid net margin of 25.61%, with ROE and ROIC also below WACC at 6.13% and 4.49%, respectively. Its valuation appears expensive with a P/E of 37.03. The company supports shareholders with a higher 4.34% dividend yield, reflecting a focus on income distribution over growth.

Premium Valuation vs. Operational Safety

Both companies exhibit slightly unfavorable ratios, but Prologis shows stronger profitability margins while Extra Space Storage offers higher dividend yield and better fixed asset turnover. Risk-averse investors may prefer Extra Space’s income profile, while growth-oriented investors might find Prologis’s operational scale more appealing.

Which one offers the Superior Shareholder Reward?

I compare Prologis, Inc. (PLD) and Extra Space Storage Inc. (EXR) on dividend yields, payout ratios, and share buybacks. PLD yields ~3.6% with a near 96% payout ratio, showing moderate dividend sustainability but a high payout. EXR offers a higher yield near 4.3%, but with a payout ratio exceeding 160%, signaling potential risk to dividend stability. Both deploy strong buyback programs, but PLD’s capital allocation balances dividends with buybacks better, supporting long-term value. EXR’s heavy leverage and payout ratio pose risks despite its higher yield. I conclude PLD offers a more attractive, sustainable total return profile in 2026.

Comparative Score Analysis: The Strategic Profile

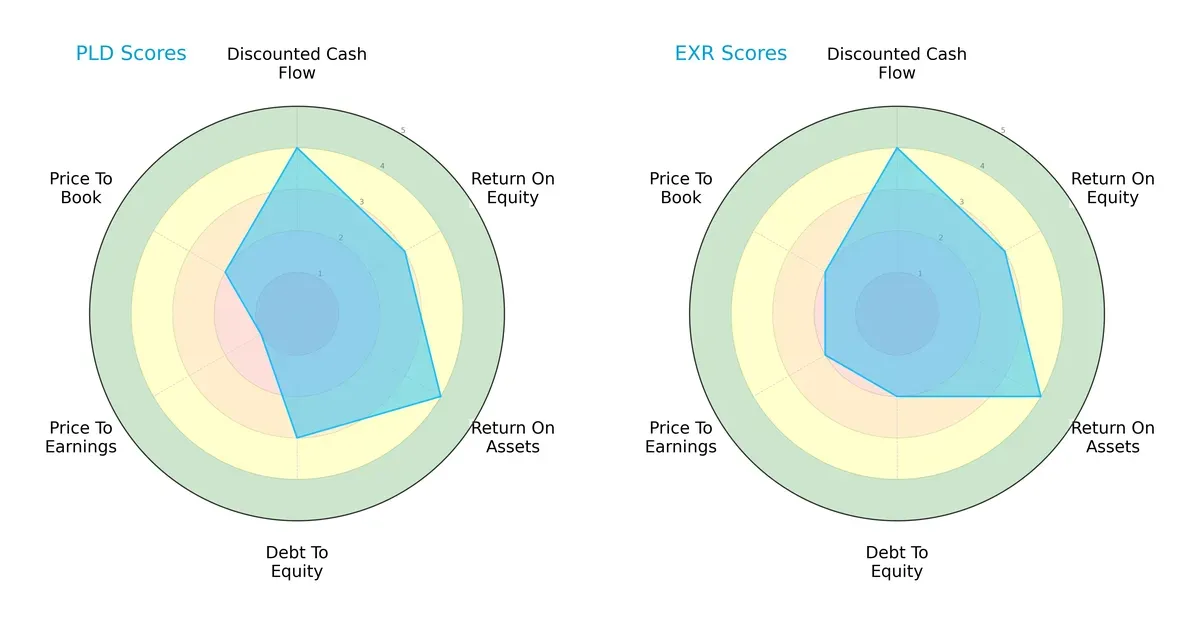

The radar chart reveals the fundamental DNA and trade-offs of Prologis, Inc. and Extra Space Storage Inc., highlighting their financial strengths and valuation nuances:

Both firms show strong DCF and ROA scores at 4, indicating efficient asset use and future cash flow potential. Prologis has a moderate Debt/Equity score of 3, slightly better than Extra Space’s 2, suggesting a stronger balance sheet. However, Extra Space edges out Prologis on Price-to-Earnings with a 2 versus 1, signaling a relatively more attractive valuation. Prologis’ overall profile is slightly more balanced, while Extra Space leans on valuation strengths amid higher leverage risk.

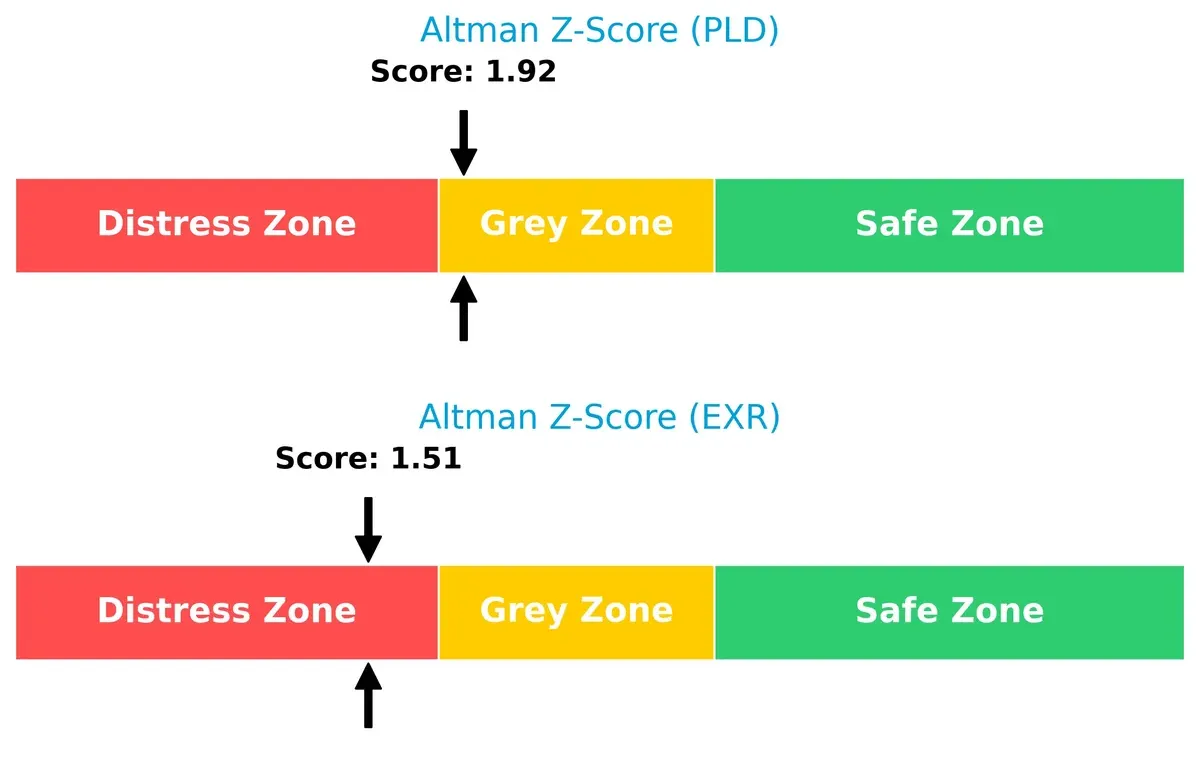

Bankruptcy Risk: Solvency Showdown

Prologis’ Altman Z-Score of 1.92 places it in the grey zone, while Extra Space’s 1.51 signals distress:

This gap warns that Extra Space faces a higher bankruptcy risk in this cycle. Prologis, while not fully safe, demonstrates better solvency resilience.

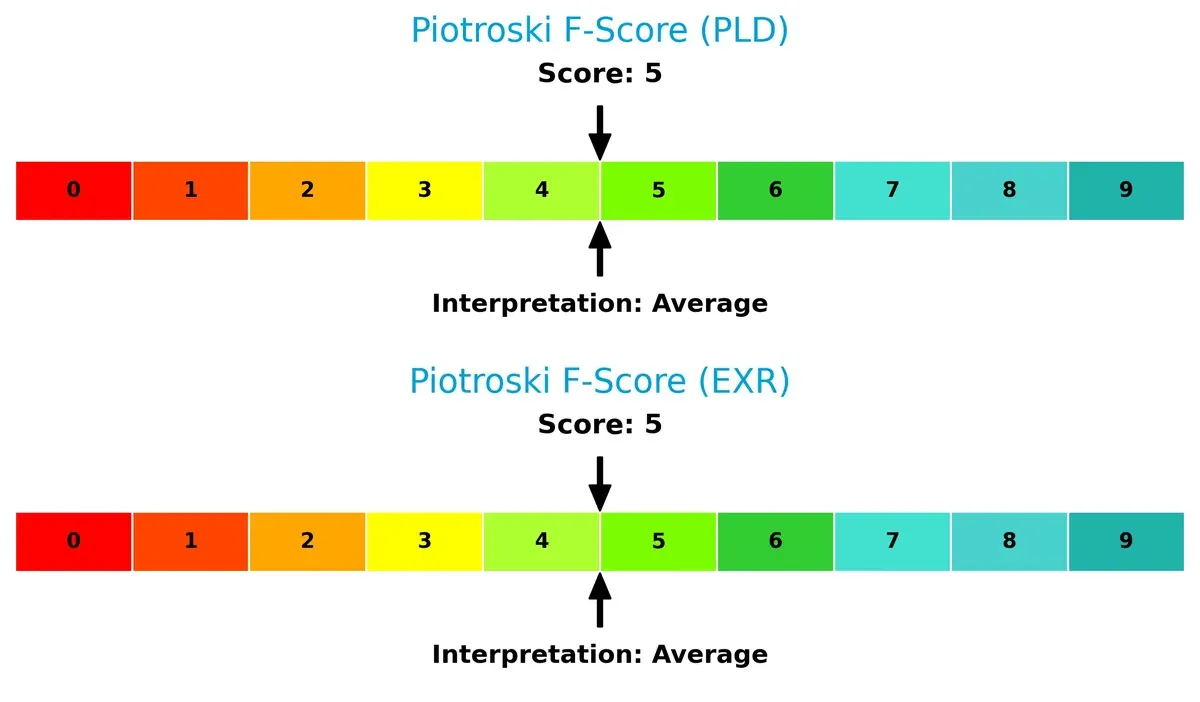

Financial Health: Quality of Operations

Both companies share a Piotroski F-Score of 5, reflecting average financial health without pronounced red flags:

Neither firm currently excels in operational quality, which implies caution despite stable metrics. Investors should watch for improvements in profitability and leverage management.

How are the two companies positioned?

This section dissects Prologis and Extra Space Storage’s operational DNA by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model delivers the most resilient competitive advantage today.

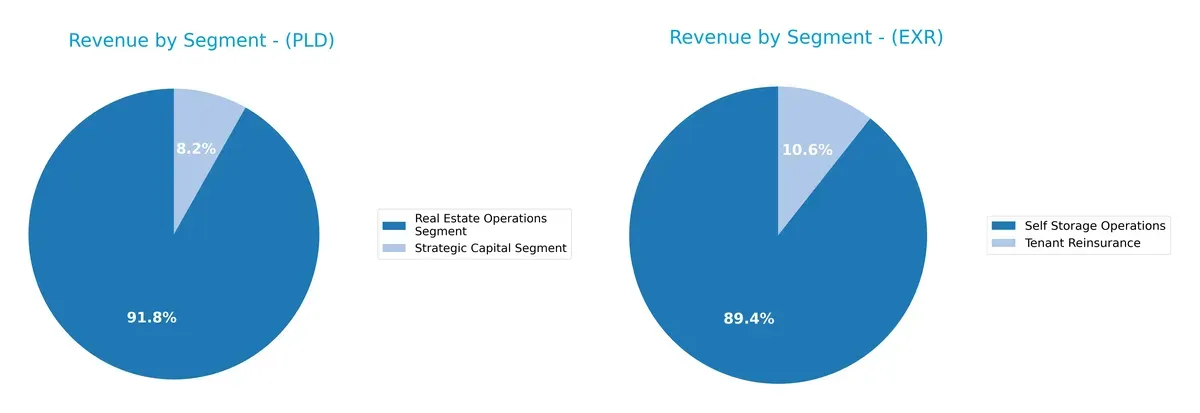

Revenue Segmentation: The Strategic Mix

This comparison dissects how Prologis, Inc. and Extra Space Storage Inc. diversify income streams and where their primary sector bets lie:

Prologis anchors its revenue heavily in Real Estate Operations, generating $7.53B in 2024, with a smaller $672M Strategic Capital segment. Extra Space Storage, with $2.8B from Self Storage Operations and $333M Tenant Reinsurance, shows more balance but still relies on one dominant area. Prologis’ concentration signals infrastructure dominance, while Extra Space Storage’s split reduces segment risk but relies on niche ecosystem lock-in.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Prologis, Inc. (PLD) and Extra Space Storage Inc. (EXR):

PLD Strengths

- Strong net margin of 38.8%

- Favorable dividend yield at 3.16%

- Large global presence with diversified geographic revenue

- Balanced debt-to-assets ratio at 35.49%

EXR Strengths

- Favorable net margin at 25.61%

- High fixed asset turnover at 4.51

- Higher dividend yield of 4.34%

- Neutral current and quick ratios indicate liquidity management

PLD Weaknesses

- Low current and quick ratios at 0.23 signal liquidity risk

- Unfavorable ROE and ROIC below WACC

- High P/E ratio at 35.12 may reflect valuation concerns

- Low asset and fixed asset turnover ratios

EXR Weaknesses

- Current ratio below 1 at 0.93 suggests liquidity risk

- ROE and ROIC below WACC indicate weak capital returns

- Elevated debt-to-assets at 45.16%

- High P/E ratio of 37.03 could imply overvaluation

Both companies show favorable profitability and dividend yields but face liquidity and capital efficiency challenges. PLD’s global diversification contrasts with EXR’s operational efficiency in asset turnover. These factors shape each firm’s strategic priorities.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole shield protecting long-term profits from relentless competition erosion. Let’s dissect the moat dynamics of two REIT giants:

Prologis, Inc.: Global Logistics Scale and High-Barrier Market Access

Prologis exploits scale and strategic locations as its moat, reflected in stable EBIT margins near 52%. Yet, declining ROIC signals rising capital costs that may erode this advantage in 2026.

Extra Space Storage Inc.: National Market Penetration and Operational Efficiency

Extra Space’s moat hinges on dense U.S. self-storage footprint and strong margin expansion. Despite a shrinking ROIC trend, its superior revenue growth and margin resilience outperform Prologis’s industrial focus.

Verdict: Scale and Location vs. Market Density and Growth

Both firms face declining ROICs, signaling value erosion. However, Extra Space’s faster growth and higher gross margin suggest a wider moat. It appears better positioned to defend market share in 2026.

Which stock offers better returns?

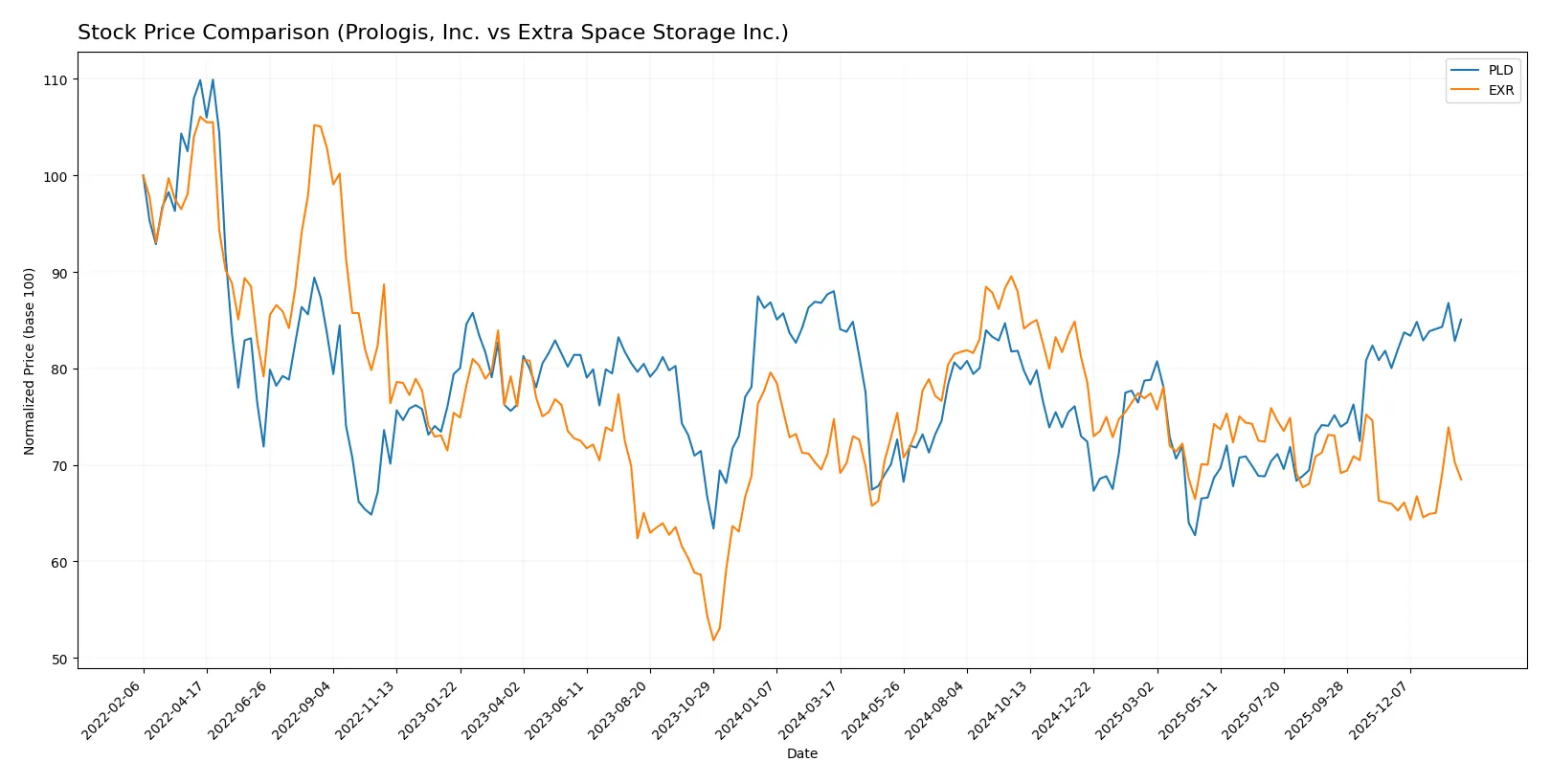

Both Prologis, Inc. (PLD) and Extra Space Storage Inc. (EXR) underwent bearish trends over the past year, with recent signs of upward momentum beginning in late 2025.

Trend Comparison

Prologis (PLD) shows a 3.34% price decline over the past 12 months, indicating a bearish trend with accelerating downward pressure despite a recent 6.29% rebound starting November 2025.

Extra Space Storage (EXR) experienced a steeper 8.39% price drop for the year, marking a bearish trend with accelerating losses, though it posted a 3.81% gain since November 2025.

PLD outperformed EXR in annual price retention, with a smaller decline and a stronger recent recovery, indicating better market performance over the past year.

Target Prices

Analysts present a solid target price consensus for Prologis, Inc. and Extra Space Storage Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Prologis, Inc. | 119 | 155 | 136.08 |

| Extra Space Storage Inc. | 143 | 164 | 149.38 |

The target consensus for Prologis suggests modest upside from its current price of $130.56. Extra Space Storage’s targets imply a stronger price appreciation potential from $137.97 today.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here are the latest institutional grades for Prologis, Inc. and Extra Space Storage Inc.:

Prologis, Inc. Grades

The following table shows recent grades from reliable grading companies for Prologis, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | maintain | Outperform | 2026-01-26 |

| Truist Securities | maintain | Buy | 2026-01-26 |

| Freedom Capital Markets | downgrade | Hold | 2026-01-23 |

| UBS | maintain | Buy | 2026-01-22 |

| Argus Research | maintain | Buy | 2026-01-22 |

| Evercore ISI Group | maintain | In Line | 2026-01-22 |

| Truist Securities | maintain | Buy | 2026-01-20 |

| Scotiabank | upgrade | Sector Outperform | 2026-01-14 |

| Baird | downgrade | Neutral | 2026-01-08 |

| UBS | maintain | Buy | 2026-01-08 |

Extra Space Storage Inc. Grades

The following table shows recent grades from reliable grading companies for Extra Space Storage Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | maintain | Hold | 2026-01-20 |

| Mizuho | maintain | Outperform | 2026-01-12 |

| Scotiabank | downgrade | Sector Perform | 2026-01-08 |

| UBS | maintain | Buy | 2026-01-08 |

| Truist Securities | maintain | Hold | 2025-12-16 |

| Mizuho | maintain | Outperform | 2025-12-05 |

| Morgan Stanley | maintain | Equal Weight | 2025-12-05 |

| RBC Capital | maintain | Sector Perform | 2025-11-07 |

| Evercore ISI Group | maintain | In Line | 2025-11-03 |

| Evercore ISI Group | maintain | In Line | 2025-10-03 |

Which company has the best grades?

Prologis, Inc. holds stronger grades overall, with multiple Buy and Outperform ratings, including recent upgrades. Extra Space Storage’s grades feature more Hold and Sector Perform ratings. Investors may view Prologis as having more institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Prologis, Inc. (PLD)

- Dominates global logistics real estate with a broad customer base but faces high competition in high-growth markets.

Extra Space Storage Inc. (EXR)

- Leading self-storage operator in the U.S. with scale advantages but competitive pressures in mature markets.

2. Capital Structure & Debt

Prologis, Inc. (PLD)

- Moderate debt-to-equity ratio (0.66) with neutral interest coverage but low liquidity ratios raise caution.

Extra Space Storage Inc. (EXR)

- Higher leverage (0.93 D/E) and weaker interest coverage, indicating elevated refinancing and financial risk.

3. Stock Volatility

Prologis, Inc. (PLD)

- Beta of 1.42 suggests above-market volatility, reflecting sensitivity to industrial real estate cycles.

Extra Space Storage Inc. (EXR)

- Beta of 1.27 indicates slightly less volatility but still exposed to market fluctuations in real estate sector.

4. Regulatory & Legal

Prologis, Inc. (PLD)

- Operating globally incurs complex regulations and zoning challenges, increasing compliance costs.

Extra Space Storage Inc. (EXR)

- Primarily U.S.-focused with risks from evolving storage regulations and tenant protection laws.

5. Supply Chain & Operations

Prologis, Inc. (PLD)

- Leases modern logistics facilities; supply chain disruptions could impact tenant demand and occupancy.

Extra Space Storage Inc. (EXR)

- Operates 1,906 stores; operational risks tied to property maintenance and regional economic cycles.

6. ESG & Climate Transition

Prologis, Inc. (PLD)

- Global footprint demands proactive climate risk management and sustainability integration.

Extra Space Storage Inc. (EXR)

- Faces pressure to improve energy efficiency and environmental impact in self-storage operations.

7. Geopolitical Exposure

Prologis, Inc. (PLD)

- Exposure to 19 countries introduces risks from trade tensions and geopolitical instability.

Extra Space Storage Inc. (EXR)

- Concentrated in the U.S., limiting geopolitical risk but increasing sensitivity to domestic policy shifts.

Which company shows a better risk-adjusted profile?

Prologis’s most impactful risk is its low liquidity amid moderate leverage, posing refinancing challenges in tighter credit markets. Extra Space Storage faces higher financial risk from elevated debt and weaker interest coverage. Despite Prologis’s greater market volatility and geopolitical exposure, it shows a marginally better risk-adjusted profile, supported by its global diversification and stronger interest coverage. Recent ratio data reveal Prologis’s current ratio at 0.23, a red flag for short-term financial flexibility that investors must monitor closely.

Final Verdict: Which stock to choose?

Prologis, Inc. (PLD) stands out as a cash-generating industrial real estate powerhouse with a robust dividend yield that appeals to income-focused investors. Its main caution is a notably weak liquidity position, which demands close monitoring. PLD suits portfolios targeting aggressive growth with income stability.

Extra Space Storage Inc. (EXR) offers a strategic moat through its recurring revenue model and operational efficiency in self-storage. It presents a safer balance sheet than PLD but carries elevated debt levels and interest burdens. EXR fits well with GARP portfolios seeking steady growth and moderate risk.

If you prioritize income and industrial real estate exposure with a high dividend, Prologis is the compelling choice despite liquidity concerns. However, if your focus is on recurring revenue stability and operational efficiency with better downside protection, Extra Space Storage offers better stability. Both stocks show declining profitability trends, so risk management is critical.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Prologis, Inc. and Extra Space Storage Inc. to enhance your investment decisions: