Expand Energy Corporation (EXE) and Texas Pacific Land Corporation (TPL) are two prominent players in the U.S. oil and gas exploration and production sector, each with distinct operational focuses and asset portfolios. While EXE specializes in unconventional natural gas resources, TPL combines land management with water services in the Permian Basin. This comparison explores their strategies and market positions to help investors identify the most compelling opportunity for their portfolios.

Table of contents

Companies Overview

I will begin the comparison between Expand Energy Corporation and Texas Pacific Land Corporation by providing an overview of these two companies and their main differences.

Expand Energy Corporation Overview

Expand Energy Corporation operates as an independent exploration and production company in the U.S., focusing on oil, natural gas, and natural gas liquids extraction from underground reservoirs. It holds interests in unconventional natural gas assets across the Marcellus and Haynesville/Bossier Shales, with approximately 5,000 wells under management. Founded in 1989 and based in Oklahoma City, the company rebranded from Chesapeake Energy Corporation in 2024.

Texas Pacific Land Corporation Overview

Texas Pacific Land Corporation specializes in land and resource management and water services, managing around 880,000 acres primarily in Texas. Its operations include royalty interests in oil and gas, easements, leases, and water services such as sourcing, treatment, and disposal for Permian Basin operators. Founded in 1888 and headquartered in Dallas, it employs a smaller workforce with a focus on resource management rather than direct production.

Key similarities and differences

Both companies operate within the oil and gas sector in the U.S. but differ in business models. Expand Energy is primarily an exploration and production firm managing wells and extracting hydrocarbons. Texas Pacific Land focuses on land management, royalty interests, and water services, deriving revenue from leases and resource rights rather than direct extraction. Their asset bases and operational scales also vary significantly, reflecting distinct strategic approaches in the energy industry.

Income Statement Comparison

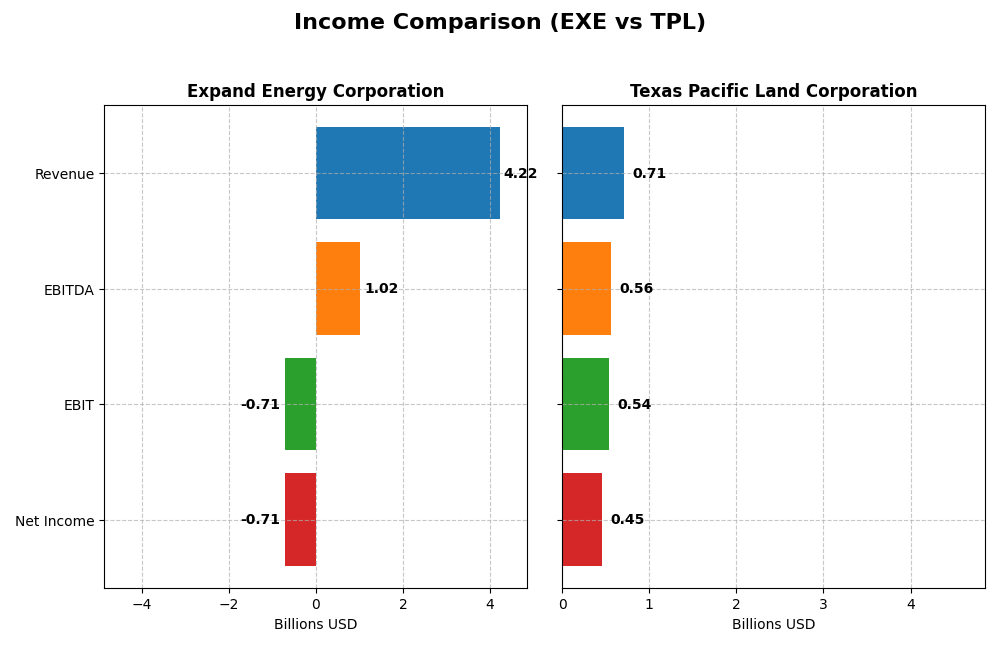

This table provides a clear comparison of key income statement metrics for Expand Energy Corporation and Texas Pacific Land Corporation, based on their most recent fiscal year data (2024).

| Metric | Expand Energy Corporation | Texas Pacific Land Corporation |

|---|---|---|

| Market Cap | 24.2B | 21.5B |

| Revenue | 4.22B | 706M |

| EBITDA | 1.02B | 564M |

| EBIT | -711M | 539M |

| Net Income | -714M | 454M |

| EPS | -4.55 | 6.58 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Expand Energy Corporation

Expand Energy Corporation experienced a significant decline in revenue from 11.44B in 2022 to 4.22B in 2024, with net income turning sharply negative to -714M in 2024. Gross margin remained relatively stable at 27.03% but operating and net margins deteriorated, reflecting operational challenges. The recent year showed marked contraction in revenue and profitability, with negative EBIT and net margins indicating worsening financial health.

Texas Pacific Land Corporation

Texas Pacific Land Corporation demonstrated steady revenue growth, increasing from 303M in 2020 to 706M in 2024. Net income followed a similar upward trend, reaching 454M in 2024. Margins are strong and stable, with gross margin near 90% and net margin above 64%. The most recent year showed continued margin strength and positive growth in revenue and earnings per share, indicating solid operational performance.

Which one has the stronger fundamentals?

Texas Pacific Land Corporation exhibits stronger fundamentals with consistent revenue and net income growth, high and stable margins, and favorable evaluations across all income statement metrics. In contrast, Expand Energy Corporation shows significant revenue decline, negative profitability, and mostly unfavorable margin trends, reflecting underlying financial and operational difficulties over the period analyzed.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Expand Energy Corporation (EXE) and Texas Pacific Land Corporation (TPL) based on their most recent fiscal year data (2024).

| Ratios | Expand Energy Corporation (EXE) | Texas Pacific Land Corporation (TPL) |

|---|---|---|

| ROE | -4.06% | 40.09% |

| ROIC | -2.70% | 35.60% |

| P/E | -21.89 | 18.67 |

| P/B | 0.89 | 7.48 |

| Current Ratio | 0.64 | 8.33 |

| Quick Ratio | 0.64 | 8.33 |

| D/E (Debt-to-Equity) | 0.33 | 0.0004 |

| Debt-to-Assets | 20.88% | 0.04% |

| Interest Coverage | -6.53 | 0 |

| Asset Turnover | 0.15 | 0.57 |

| Fixed Asset Turnover | 0.17 | 1.27 |

| Payout ratio | -54.34% | 76.51% |

| Dividend yield | 2.48% | 4.10% |

Interpretation of the Ratios

Expand Energy Corporation

Expand Energy shows mixed financial health with 57% unfavorable ratios, including negative net margin (-16.92%) and return on equity (-4.06%), indicating profitability challenges. The company’s low current and quick ratios (0.64) suggest liquidity concerns, while debt levels appear manageable. It pays a dividend with a 2.48% yield, supported by cautious payout coverage, though risks from negative free cash flow remain.

Texas Pacific Land Corporation

Texas Pacific Land exhibits strong profitability metrics, with a 64.32% net margin and 40.09% return on equity, reflecting efficient asset use and capital management. Most ratios are favorable, except a high price-to-book ratio (7.48) and an elevated current ratio (8.33) signaling potential overcapitalization. The company offers a 4.1% dividend yield, supported by ample free cash flow and no debt, enhancing shareholder returns.

Which one has the best ratios?

Texas Pacific Land Corporation holds the advantage with a predominantly favorable ratio profile, including robust profitability and excellent liquidity. Expand Energy’s financial ratios are more mixed, burdened by negative profitability and liquidity challenges. Overall, Texas Pacific Land’s stronger earnings performance and healthier balance sheet present a more favorable ratio assessment.

Strategic Positioning

This section compares the strategic positioning of Expand Energy Corporation and Texas Pacific Land Corporation, including Market position, Key segments, and disruption:

Expand Energy Corporation

- Independent exploration and production company with a large U.S. unconventional natural gas asset portfolio.

- Key segments include natural gas sales, gathering, transportation, marketing, and oil sales driving revenues.

- Exposure mainly to traditional oil and gas exploration with no explicit mention of technology disruption.

Texas Pacific Land Corporation

- Land and resource management focused on 880K acres, royalties, and water services in the Permian Basin.

- Revenue driven by easements, royalties from oil, gas, produced water, and land sales.

- Water services and land management segments involve resource and infrastructure management, with limited tech disruption indicated.

Expand Energy Corporation vs Texas Pacific Land Corporation Positioning

Expand Energy has a diversified energy production focus on natural gas and oil, while Texas Pacific Land concentrates on land management and royalties. Expand Energy’s broader operations contrast with Texas Pacific’s niche in land and water services, reflecting different business models and risk profiles.

Which has the best competitive advantage?

Texas Pacific Land shows a very favorable moat with ROIC above WACC and growing profitability, indicating a durable competitive advantage. Expand Energy is slightly unfavorable, shedding value despite improving ROIC trends.

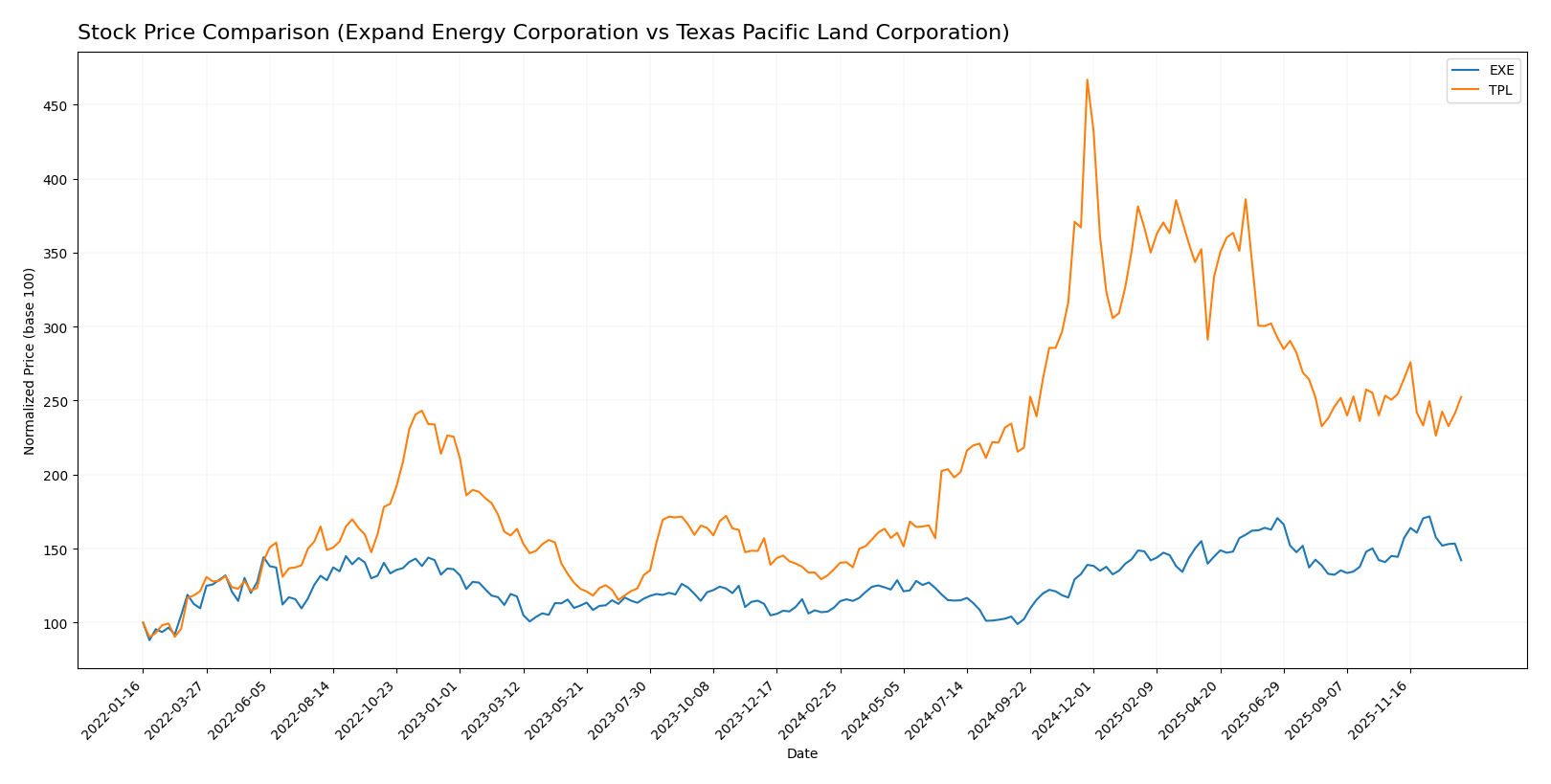

Stock Comparison

The stock price chart highlights significant bullish trends for both Expand Energy Corporation and Texas Pacific Land Corporation over the past year, with notable deceleration and varied recent trading dynamics.

Trend Analysis

Expand Energy Corporation’s stock rose 29.09% over the past year, indicating a bullish trend with deceleration. The price ranged from 70.84 to 122.86, showing moderate volatility (std dev 12.95).

Texas Pacific Land Corporation exhibited a stronger bullish trend with an 85.66% increase over the same period, also with deceleration. It showed higher volatility (std dev 91.94) and a price range from 167.98 to 576.67.

Comparing both, Texas Pacific Land Corporation delivered the highest market performance, outperforming Expand Energy Corporation significantly in price appreciation over the past year.

Target Prices

The current analyst consensus suggests significant upside potential for both Expand Energy Corporation and Texas Pacific Land Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Expand Energy Corporation | 150 | 125 | 140.63 |

| Texas Pacific Land Corporation | 1050 | 1050 | 1050 |

Analysts expect Expand Energy’s stock to rise from $101.63 to around $140.63, indicating strong growth prospects. Texas Pacific Land’s target of $1050 greatly exceeds its current price of $311.87, signaling very optimistic market expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Expand Energy Corporation and Texas Pacific Land Corporation:

Rating Comparison

Expand Energy Corporation Rating

- Rating: B, evaluated as Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating favorable valuation outlook.

- ROE Score: 3, reflecting moderate efficiency in profit generation.

- ROA Score: 4, showing favorable asset utilization effectiveness.

- Debt To Equity Score: 2, reflecting moderate financial risk management.

Texas Pacific Land Corporation Rating

- Rating: A-, also considered Very Favorable by analysts.

- Discounted Cash Flow Score: 4, similarly favorable valuation outlook.

- ROE Score: 5, indicating very favorable profit generation efficiency.

- ROA Score: 5, showing very favorable asset utilization effectiveness.

- Debt To Equity Score: 3, reflecting moderate financial risk management.

Which one is the best rated?

Texas Pacific Land Corporation holds higher overall and profitability scores compared to Expand Energy Corporation, indicating it is better rated. Both have favorable discounted cash flow scores, but Texas Pacific Land’s stronger ROE and ROA scores elevate its rating.

Scores Comparison

Here is a comparison of the financial scores for Expand Energy Corporation (EXE) and Texas Pacific Land Corporation (TPL):

EXE Scores

- Altman Z-Score of 2.43 places EXE in a grey zone of risk.

- Piotroski Score of 6 indicates average financial strength.

TPL Scores

- Altman Z-Score of 29.77 places TPL well within the safe zone.

- Piotroski Score of 4 also reflects average financial health.

Which company has the best scores?

Based strictly on the data, TPL has a significantly higher Altman Z-Score, indicating stronger financial stability. Both companies share average Piotroski Scores, with EXE slightly higher but still in the average range.

Grades Comparison

Here is a detailed comparison of recent grades assigned to Expand Energy Corporation and Texas Pacific Land Corporation:

Expand Energy Corporation Grades

This table lists the latest grades provided by recognized financial institutions for Expand Energy Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-08 |

| Bernstein | Maintain | Outperform | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-19 |

| Mizuho | Maintain | Outperform | 2025-12-12 |

| UBS | Maintain | Buy | 2025-12-12 |

| Piper Sandler | Maintain | Overweight | 2025-11-18 |

| Morgan Stanley | Maintain | Overweight | 2025-10-30 |

| UBS | Maintain | Buy | 2025-10-30 |

| Morgan Stanley | Maintain | Overweight | 2025-10-14 |

Expand Energy consistently receives positive grades, predominantly Buy, Outperform, and Overweight ratings, reflecting strong analyst confidence.

Texas Pacific Land Corporation Grades

This table shows the recent grades from financial firms for Texas Pacific Land Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BWS Financial | Maintain | Buy | 2024-08-12 |

| BWS Financial | Maintain | Buy | 2024-05-10 |

| BWS Financial | Maintain | Buy | 2024-04-02 |

| Stifel | Maintain | Hold | 2024-01-23 |

| Stifel | Maintain | Hold | 2023-11-30 |

| Stifel | Maintain | Hold | 2023-05-22 |

| Stifel | Maintain | Hold | 2023-05-21 |

| Stifel | Maintain | Hold | 2023-04-27 |

| Stifel | Maintain | Hold | 2023-04-26 |

| Stifel | Maintain | Hold | 2023-04-12 |

Texas Pacific Land’s grades largely range from Hold to Buy, indicating a more cautious outlook from analysts.

Which company has the best grades?

Expand Energy Corporation has received consistently stronger grades including multiple Buy and Outperform ratings, compared to Texas Pacific Land Corporation’s more mixed Buy and Hold ratings. This disparity suggests Expand Energy is viewed more favorably, potentially affecting investor confidence and portfolio decisions accordingly.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses of Expand Energy Corporation (EXE) and Texas Pacific Land Corporation (TPL) based on the most recent financial and operational data.

| Criterion | Expand Energy Corporation (EXE) | Texas Pacific Land Corporation (TPL) |

|---|---|---|

| Diversification | Moderate: Primarily oil & gas segments with natural gas liquids and gathering services | Limited: Focused on land royalties and easements with ancillary services |

| Profitability | Weak: Negative net margin (-16.92%) and ROIC (-2.7%), value destroying | Strong: High net margin (64.32%) and ROIC (35.6%), value creating |

| Innovation | Low: Limited evidence of innovation; ROIC is improving but still negative | Moderate: Stable growth with durable competitive advantage |

| Global presence | Moderate: Operations mainly in North America in oil and gas sectors | Limited: Concentrated in Texas land and mineral rights |

| Market Share | Significant in natural gas gathering and transportation | Niche market dominance in land and royalty management |

Key takeaways: TPL exhibits a robust profitability profile and a durable competitive advantage, making it a strong value creator with steady growth. In contrast, EXE is currently shedding value despite improving profitability and faces challenges in profitability and liquidity, indicating higher investment risk.

Risk Analysis

Below is a comparative table outlining key risk factors for Expand Energy Corporation (EXE) and Texas Pacific Land Corporation (TPL) as of 2024:

| Metric | Expand Energy Corporation (EXE) | Texas Pacific Land Corporation (TPL) |

|---|---|---|

| Market Risk | Low beta at 0.449 indicates lower volatility than the market. | Moderate beta at 0.935 suggests market sensitivity near average. |

| Debt level | Moderate debt-to-equity ratio of 0.33, manageable leverage. | Extremely low debt with a debt-to-equity ratio near zero. |

| Regulatory Risk | Potential exposure in U.S. unconventional gas sector, subject to environmental regulations. | Land and resource operations face regulatory scrutiny but less direct extraction risk. |

| Operational Risk | Operational challenges with 5,000 wells; negative returns and cash flow concerns. | Focus on land/resource management and water services reduces direct operational risks. |

| Environmental Risk | Moderate, given fossil fuel production and shale gas operations. | Lower environmental risk, primarily land and water management activities. |

| Geopolitical Risk | U.S.-based operations limit geopolitical exposure. | Similar U.S.-centric operations with limited geopolitical risk. |

In summary, the most impactful risks for EXE are operational and financial instability, highlighted by negative profitability and liquidity concerns despite moderate leverage. TPL presents lower financial and operational risks but has a higher market sensitivity and a notably high price-to-book ratio, signaling valuation risk. Investors should weigh EXE’s turnaround potential against its current financial distress, while TPL offers steadier performance with moderate market risk.

Which Stock to Choose?

Expand Energy Corporation (EXE) shows a declining income trend with a -45.71% revenue drop in 2024 and negative profitability ratios, including a -16.92% net margin and -4.06% ROE. Its debt metrics are favorable, but the overall financial ratios and income statement evaluations are unfavorable, reflected in a Very Favorable B rating yet moderate overall scores.

Texas Pacific Land Corporation (TPL) exhibits strong income growth with an 11.75% revenue increase in 2024 and robust profitability, including a 64.32% net margin and 40.09% ROE. It maintains low debt and favorable liquidity ratios, with mostly favorable financial ratios and income statement evaluations, earning a Very Favorable A- rating and strong scores, supported by a safe-zone Altman Z-Score.

Considering ratings and global financial evaluations, TPL might appear more favorable for investors seeking strong profitability and value creation, while EXE could be seen as riskier with improving but still unfavorable profitability metrics. Investors focused on quality and stable growth may find TPL more aligned with their profile, whereas those with higher risk tolerance interested in turnaround potential might consider EXE.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Expand Energy Corporation and Texas Pacific Land Corporation to enhance your investment decisions: