In the dynamic energy sector, Occidental Petroleum Corporation (OXY) and Expand Energy Corporation (EXE) stand out as influential players in oil and gas exploration and production. Both companies focus on U.S. energy resources but differ in scale and strategic approaches, with Occidental boasting a diversified portfolio and Expand Energy specializing in unconventional natural gas. This article will help you decide which company presents a more compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Occidental Petroleum Corporation and Expand Energy Corporation by providing an overview of these two companies and their main differences.

Occidental Petroleum Corporation Overview

Occidental Petroleum Corporation focuses on the acquisition, exploration, and development of oil and gas properties across the US, Middle East, Africa, and Latin America. Operating through segments like Oil and Gas, Chemical, and Midstream and Marketing, it produces oil, natural gas, and chemicals while handling transportation and trading. Founded in 1920, it is headquartered in Houston, Texas, and has a market cap of 42.2B USD.

Expand Energy Corporation Overview

Expand Energy Corporation is an independent oil and gas exploration and production company operating in the US. It specializes in unconventional natural gas assets in the Marcellus and Haynesville/Bossier Shales, holding interests in about 5,000 natural gas wells. Founded in 1989 and based in Oklahoma City, Oklahoma, the company has a market cap of 24.2B USD and was renamed from Chesapeake Energy in 2024.

Key similarities and differences

Both companies operate in the oil and gas exploration and production sector within the US energy industry. Occidental has a broader geographic presence and diversified segments including chemicals and midstream operations, while Expand Energy focuses solely on unconventional natural gas production in specific US shale plays. Occidental employs over 13,000 staff, contrasting with Expand’s 1,500, reflecting differences in scale and operational scope.

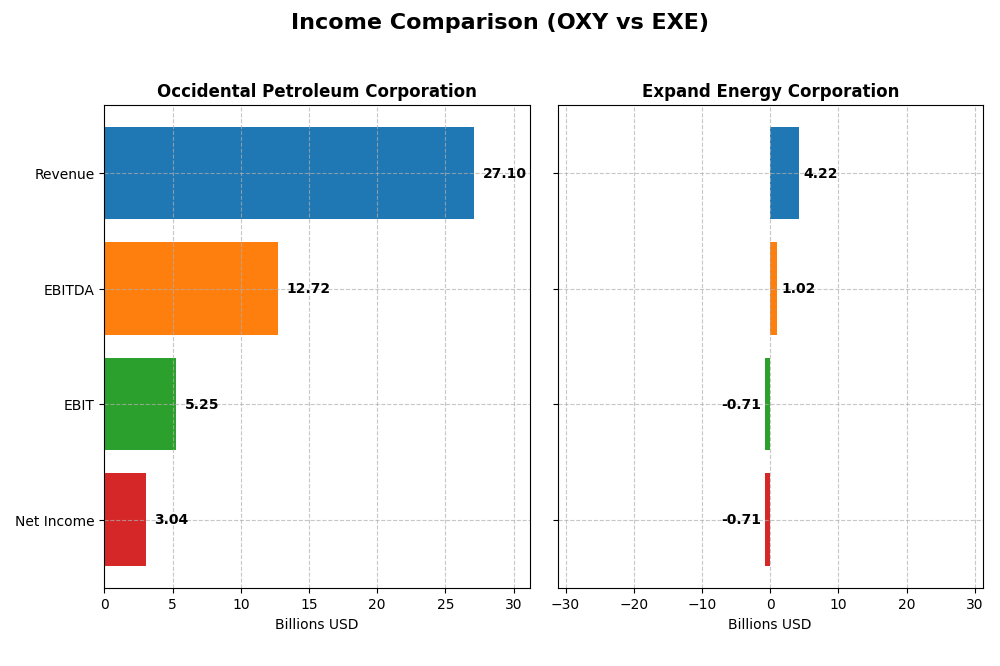

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Occidental Petroleum Corporation and Expand Energy Corporation for the fiscal year 2024.

| Metric | Occidental Petroleum Corporation | Expand Energy Corporation |

|---|---|---|

| Market Cap | 42.2B | 24.2B |

| Revenue | 27.1B | 4.2B |

| EBITDA | 12.7B | 1.0B |

| EBIT | 5.2B | -0.7B |

| Net Income | 3.0B | -0.7B |

| EPS | 2.59 | -4.55 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Occidental Petroleum Corporation

Occidental Petroleum’s revenue increased by 58.12% over 2020-2024, with net income rising 120.52%, reflecting strong growth. Margins remain favorable, with a gross margin of 35.61% and net margin of 11.23%. However, in 2024, revenue dropped 4.35%, and net margin declined 31.92%, signaling a slowing growth phase despite solid overall fundamentals.

Expand Energy Corporation

Expand Energy’s revenue declined 18.98% over the period, while net income showed a 92.66% increase, indicating mixed trends. Gross margin stands at a favorable 27.03%, but EBIT and net margins are negative (-16.84% and -16.92%). The recent year saw sharp declines, with revenue down 45.71% and net margin worsening by 154.37%, highlighting operational challenges.

Which one has the stronger fundamentals?

Occidental Petroleum exhibits stronger fundamentals with consistent favorable margins, positive net income growth, and better overall income statement metrics despite recent headwinds. In contrast, Expand Energy faces significant margin pressures and a steep revenue decline, reflected in an unfavorable global income statement evaluation, suggesting greater risk in its income performance.

Financial Ratios Comparison

The table below provides a side-by-side comparison of key financial ratios for Occidental Petroleum Corporation (OXY) and Expand Energy Corporation (EXE) based on the latest fiscal year 2024 data.

| Ratios | Occidental Petroleum Corporation (OXY) | Expand Energy Corporation (EXE) |

|---|---|---|

| ROE | 8.91% | -4.06% |

| ROIC | 5.48% | -2.70% |

| P/E | 14.81 | -21.89 |

| P/B | 1.32 | 0.89 |

| Current Ratio | 0.95 | 0.64 |

| Quick Ratio | 0.73 | 0.64 |

| D/E (Debt-to-Equity) | 0.79 | 0.33 |

| Debt-to-Assets | 31.7% | 20.9% |

| Interest Coverage | 5.08 | -6.53 |

| Asset Turnover | 0.32 | 0.15 |

| Fixed Asset Turnover | 0.39 | 0.17 |

| Payout Ratio | 47.5% | -54.3% |

| Dividend Yield | 3.21% | 2.48% |

Interpretation of the Ratios

Occidental Petroleum Corporation

Occidental Petroleum shows a mixed ratio profile with favorable net margin (11.23%) and dividend yield (3.21%), but weaker return on equity (8.91%) and liquidity ratios below 1, indicating potential short-term risk. Its dividend payout appears sustainable, supported by positive free cash flow yield, yet cautious monitoring of debt and asset turnover is advisable.

Expand Energy Corporation

Expand Energy’s ratios reveal challenges with negative profitability metrics such as net margin (-16.92%) and return on equity (-4.06%), alongside worrying negative interest coverage. The company pays dividends with a 2.48% yield despite losses, possibly indicating reliance on cash reserves or financing. Liquidity ratios are below 1, signaling potential short-term funding constraints.

Which one has the best ratios?

Occidental Petroleum maintains a more balanced ratio profile with favorable profitability and dividend metrics despite some liquidity concerns. Expand Energy faces significant profitability and coverage weaknesses, reflected in an unfavorable global ratio opinion. Overall, Occidental’s ratios present a comparatively stronger financial position based on the 2024 fiscal year data.

Strategic Positioning

This section compares the strategic positioning of Occidental Petroleum Corporation (OXY) and Expand Energy Corporation (EXE) across Market position, Key segments, and Exposure to technological disruption:

Occidental Petroleum Corporation (OXY)

- Large market cap of $42B with diversified operations facing moderate pressure

- Diversified segments: Oil & Gas, Chemicals, Midstream; strong oil & gas focus

- Exposure to disruption not explicitly detailed, but diversified segments may reduce risk

Expand Energy Corporation (EXE)

- Mid-size market cap of $24B focused on U.S. unconventional natural gas

- Concentrated on natural gas, liquids, and related gathering and marketing

- Focused on shale gas plays, potentially sensitive to energy transition disruptions

Occidental Petroleum Corporation vs Expand Energy Corporation Positioning

OXY follows a diversified strategy across chemicals, midstream, and oil & gas, offering revenue stability but complexity. EXE concentrates on unconventional gas production, which may yield growth but carries higher segment risk.

Which has the best competitive advantage?

Based on MOAT evaluation, OXY shows a slightly favorable moat with growing profitability despite shedding value, while EXE has a slightly unfavorable moat but also improving profitability. OXY currently has a better competitive advantage.

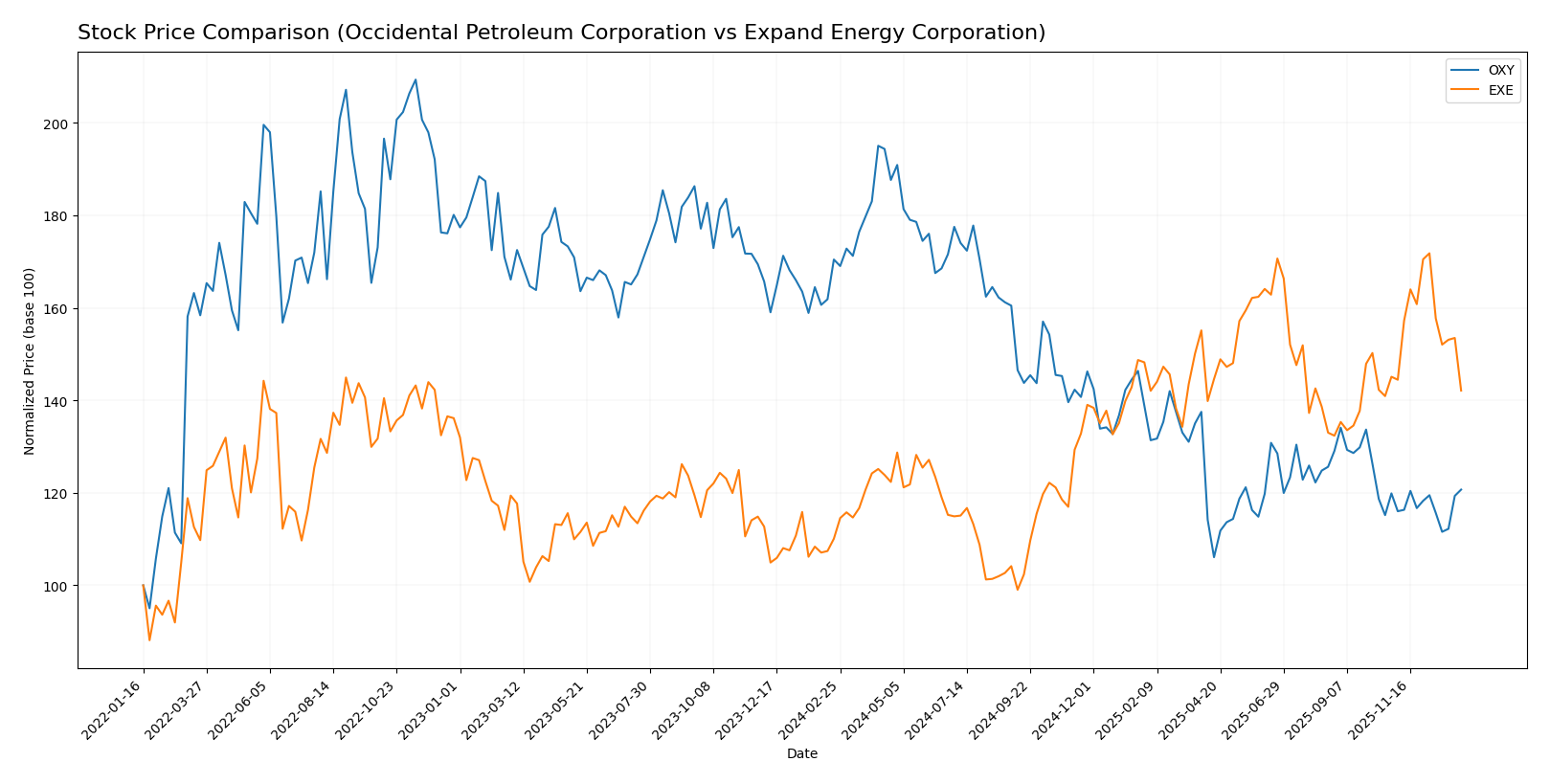

Stock Comparison

The stock price chart illustrates marked divergence in performance over the past 12 months, with Occidental Petroleum Corporation (OXY) experiencing a significant decline, while Expand Energy Corporation (EXE) has shown a substantial rise, reflecting contrasting market dynamics.

Trend Analysis

Occidental Petroleum Corporation’s stock shows a bearish trend over the past year with a -29.18% price change, accompanied by accelerating decline and notable volatility (8.33 std deviation), hitting a low of 37.67. Expand Energy Corporation’s stock displays a bullish trend with a 29.09% gain over the same period, though momentum is decelerating; volatility is higher at 12.95 std deviation, with a peak price of 122.86. Comparing both, EXE has delivered the highest market performance with a strong positive trend, whereas OXY’s stock has significantly underperformed, reflecting a clear divergence in investor sentiment.

Target Prices

The current analyst consensus presents a positive outlook for both Occidental Petroleum Corporation and Expand Energy Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Occidental Petroleum Corporation | 64 | 38 | 49.36 |

| Expand Energy Corporation | 150 | 125 | 140.63 |

Analysts expect Occidental Petroleum’s price to rise modestly above its current 42.86 USD, while Expand Energy shows a stronger upside from its 101.63 USD price, reflecting higher growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Occidental Petroleum Corporation (OXY) and Expand Energy Corporation (EXE):

Rating Comparison

OXY Rating

- Rating: B+ indicating a very favorable assessment of the company’s financials.

- Discounted Cash Flow Score: 5, very favorable, suggesting strong future cash flow projections.

- ROE Score: 3, moderate efficiency in generating profit from shareholders’ equity.

- ROA Score: 4, favorable asset utilization to generate earnings.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk.

- Overall Score: 3, moderate overall financial standing.

EXE Rating

- Rating: B, also considered very favorable by analysts.

- Discounted Cash Flow Score: 4, favorable but lower than OXY’s score.

- ROE Score: 3, similarly moderate efficiency in profit generation.

- ROA Score: 4, same favorable rating for asset use effectiveness.

- Debt To Equity Score: 2, moderate level of financial risk, better than OXY.

- Overall Score: 3, also moderate overall rating matching OXY’s score.

Which one is the best rated?

Based strictly on the provided data, OXY holds a slightly higher rating (B+ vs. B) and a stronger discounted cash flow score, while EXE has a better debt-to-equity score. Both have equal overall scores and similar ROE and ROA ratings.

Scores Comparison

Here is a comparison of the financial scores for Occidental Petroleum Corporation and Expand Energy Corporation:

OXY Scores

- Altman Z-Score: 1.39, indicating financial distress risk.

- Piotroski Score: 5, reflecting average financial strength.

EXE Scores

- Altman Z-Score: 2.43, indicating moderate bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength.

Which company has the best scores?

EXE shows a higher Altman Z-Score in the grey zone, suggesting lower bankruptcy risk than OXY in the distress zone. EXE also has a slightly better Piotroski Score, indicating marginally stronger financial health.

Grades Comparison

Here is the comparison of grades from reputable grading companies for Occidental Petroleum Corporation and Expand Energy Corporation:

Occidental Petroleum Corporation Grades

The following table presents recent ratings and grade updates for Occidental Petroleum Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-12-12 |

| B of A Securities | Maintain | Neutral | 2025-12-11 |

| JP Morgan | Downgrade | Underweight | 2025-12-08 |

| Citigroup | Maintain | Neutral | 2025-11-19 |

| Piper Sandler | Maintain | Neutral | 2025-11-18 |

| Susquehanna | Maintain | Positive | 2025-11-13 |

| Wells Fargo | Maintain | Underweight | 2025-11-12 |

| Mizuho | Maintain | Outperform | 2025-11-11 |

| Piper Sandler | Maintain | Neutral | 2025-10-21 |

| Susquehanna | Maintain | Positive | 2025-10-20 |

Occidental’s grades show a predominance of neutral ratings with some variation including underweight and positive grades, indicating a cautious outlook among analysts.

Expand Energy Corporation Grades

Below is the table of recent grades and rating actions for Expand Energy Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-08 |

| Bernstein | Maintain | Outperform | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-19 |

| Mizuho | Maintain | Outperform | 2025-12-12 |

| UBS | Maintain | Buy | 2025-12-12 |

| Piper Sandler | Maintain | Overweight | 2025-11-18 |

| Morgan Stanley | Maintain | Overweight | 2025-10-30 |

| UBS | Maintain | Buy | 2025-10-30 |

| Morgan Stanley | Maintain | Overweight | 2025-10-14 |

Expand Energy has consistently received buy and outperform grades, reflecting a positive consensus from multiple analysts.

Which company has the best grades?

Expand Energy Corporation holds stronger analyst grades than Occidental Petroleum Corporation, with numerous buy and outperform ratings versus Occidental’s neutral and mixed grades. This disparity may influence investor sentiment by indicating greater confidence in Expand Energy’s prospects.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Occidental Petroleum Corporation (OXY) and Expand Energy Corporation (EXE) based on their latest financial and operational data.

| Criterion | Occidental Petroleum Corporation (OXY) | Expand Energy Corporation (EXE) |

|---|---|---|

| Diversification | Strong diversification with revenues from Chemicals (4.92B), Midstream (1.65B), and Oil & Gas (21.7B) segments | Moderate diversification focused on Natural Gas, Oil, and related services with total Oil & Gas sales of 3B and gathering/transportation revenue of 1.29B |

| Profitability | Net margin 11.23% (favorable), ROIC 5.48% (neutral), growing ROIC trend | Negative net margin -16.92% and ROIC -2.7% (both unfavorable), but ROIC trend improving |

| Innovation | Moderate innovation with consistent operational improvements reflected in growing ROIC | Limited innovation evidence, profitability challenges persist despite improving ROIC |

| Global presence | Established global operations, evident from broad upstream and chemical segments | Primarily regional with focus on natural gas liquids and gathering in North America |

| Market Share | Large market share in oil & gas with 21.7B revenue in 2024 | Smaller market share with 3B in oil & gas sales, but niche in natural gas services |

Key takeaways: Occidental Petroleum demonstrates stronger diversification and profitability with a positive ROIC trend, suggesting cautious optimism for value creation. Expand Energy shows improving profitability trends but remains challenged by negative margins and smaller scale, indicating higher risk for investors.

Risk Analysis

Below is a comparison of key risks for Occidental Petroleum Corporation (OXY) and Expand Energy Corporation (EXE) based on the most recent data from 2024-2026.

| Metric | Occidental Petroleum Corporation (OXY) | Expand Energy Corporation (EXE) |

|---|---|---|

| Market Risk | Moderate (Beta 0.38, stable oil prices) | Moderate (Beta 0.45, volatile gas markets) |

| Debt Level | Neutral (Debt to Equity 0.79, manageable) | Favorable (Debt to Equity 0.33, low leverage) |

| Regulatory Risk | High (Exposure in US, Middle East, Africa) | Moderate (US-focused, shale gas regulations) |

| Operational Risk | Moderate (Large scale, complex operations) | Moderate (Focused on unconventional gas assets) |

| Environmental Risk | High (Oil & gas industry scrutiny, chemical segment) | Moderate (Natural gas focus, lower emissions profile) |

| Geopolitical Risk | High (Global operations including Middle East, Latin America) | Low (Primarily US domestic operations) |

The most impactful risks are Occidental’s geopolitical exposure and environmental scrutiny due to its global footprint and diverse operations. Expand Energy faces significant market and regulatory risks from shale gas volatility and evolving US energy policies. Both companies have moderate operational risks, but Occidental’s higher debt and geopolitical complexity warrant closer monitoring.

Which Stock to Choose?

Occidental Petroleum Corporation (OXY) shows a favorable income statement overall with strong gross and EBIT margins, though recent revenue and net margin growth are negative. Financial ratios are mixed with solid net margin and P/E but weaker liquidity. Debt levels are moderate, and the company holds a very favorable B+ rating.

Expand Energy Corporation (EXE) displays an unfavorable income statement recently, marked by negative net and EBIT margins and steep revenue decline, despite some overall net income growth. Financial ratios are mostly unfavorable, especially profitability and interest coverage, but debt metrics appear favorable. Its overall rating is very favorable at B.

For investors, OXY’s slightly favorable moat and stable rating may appeal to those favoring quality and moderate risk, while EXE’s unfavorable ratios and income suggest higher risk, possibly suiting risk-tolerant profiles seeking growth potential despite volatility. The choice could depend significantly on individual risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Occidental Petroleum Corporation and Expand Energy Corporation to enhance your investment decisions: