Equity Residential (EQR) and Invitation Homes Inc. (INVH) are two leading players in the residential real estate investment trust (REIT) sector, each with distinct approaches to serving housing markets. Equity Residential focuses on urban apartment communities in dynamic cities, while Invitation Homes specializes in single-family home leasing across high-demand suburban areas. This comparison explores their market strategies and growth potential to help you identify the more attractive investment opportunity. Let’s determine which company aligns best with your portfolio goals.

Table of contents

Companies Overview

I will begin the comparison between Equity Residential and Invitation Homes by providing an overview of these two companies and their main differences.

Equity Residential Overview

Equity Residential is a member of the S&P 500 focused on acquiring, developing, and managing residential properties in dynamic urban areas. The company owns or invests in 305 properties with 78,568 apartment units across cities such as Boston, New York, and San Francisco. Its mission centers on creating communities where people thrive, targeting high-quality, long-term renters in key metropolitan markets.

Invitation Homes Overview

Invitation Homes is the leading single-family home leasing company in the US, dedicated to offering high-quality, updated homes in locations with good schools and job access. Its mission emphasizes making houses into homes and providing high-touch service to enhance residents’ living experiences. Invitation Homes operates primarily in the residential REIT sector and focuses on meeting evolving lifestyle demands of individuals and families.

Key similarities and differences

Both companies operate in the residential REIT sector, focusing on providing quality housing solutions to renters. Equity Residential primarily manages multi-family apartment units in urban centers, while Invitation Homes specializes in single-family home leasing. Both emphasize tenant satisfaction but differ in property type and geographic focus, with Equity Residential concentrated in major cities and Invitation Homes targeting suburban areas with family-oriented amenities.

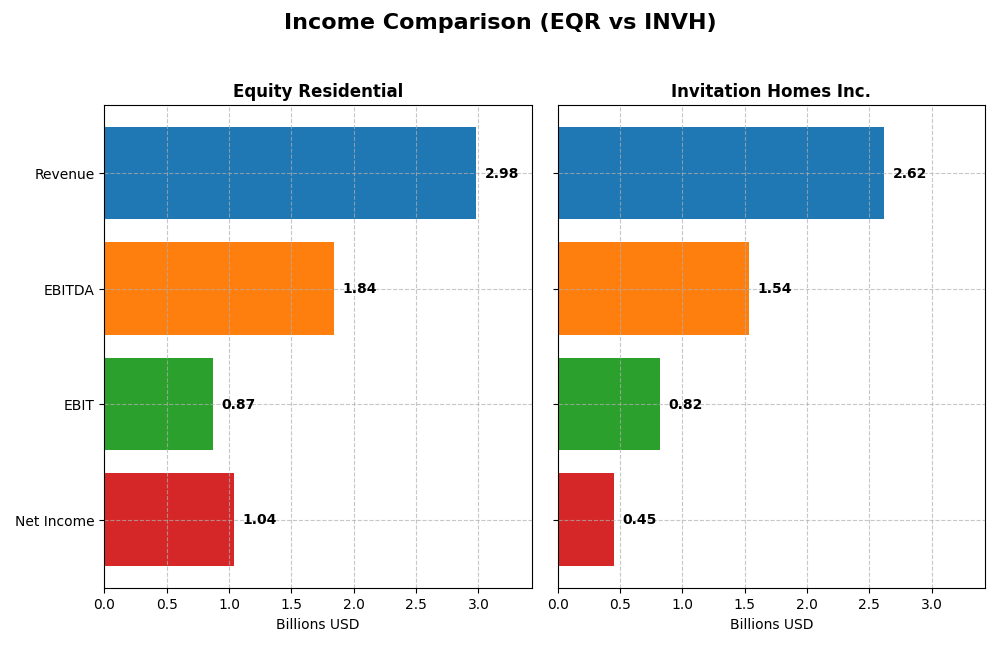

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Equity Residential (EQR) and Invitation Homes Inc. (INVH) for the fiscal year 2024.

| Metric | Equity Residential (EQR) | Invitation Homes Inc. (INVH) |

|---|---|---|

| Market Cap | 23.9B | 16.3B |

| Revenue | 2.98B | 2.62B |

| EBITDA | 1.84B | 1.54B |

| EBIT | 872M | 821M |

| Net Income | 1.04B | 454M |

| EPS | 2.73 | 0.74 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Equity Residential

Equity Residential’s revenue increased steadily from $2.46B in 2021 to $2.98B in 2024, with net income growing from $1.33B to $1.04B in the same period, showing a slight dip in 2024. Margins remained strong, with a favorable gross margin of 63.27% and net margin of 34.76%. The latest year showed neutral revenue growth at 3.69%, while net margin improved significantly by 19.57%.

Invitation Homes Inc.

Invitation Homes saw revenue rise from $1.99B in 2021 to $2.62B in 2024, with net income climbing from $261M to $454M but declining slightly last year. Margins are favorable, with a gross margin of 59.04% and an EBIT margin of 31.37%. The most recent year displayed neutral revenue growth of 7.67%, though net margin and EPS contracted by 18.85% and 12.94%, respectively.

Which one has the stronger fundamentals?

Both companies show favorable overall income statement evaluations, but Equity Residential has more stability in margins and stronger net margin growth recently. Invitation Homes exhibits higher revenue and net income growth over the longer term but faces unfavorable interest expense and recent margin contractions. The fundamentals suggest Equity Residential maintains steadier profitability, while Invitation Homes shows more volatility despite growth.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Equity Residential (EQR) and Invitation Homes Inc. (INVH) based on their 2024 fiscal year-end data, offering a snapshot of their operational and financial metrics.

| Ratios | Equity Residential (EQR) | Invitation Homes Inc. (INVH) |

|---|---|---|

| ROE | 9.38% | 4.65% |

| ROIC | 8.93% | 4.02% |

| P/E | 26.24 | 43.14 |

| P/B | 2.46 | 2.01 |

| Current Ratio | 0.16 | 0.82 |

| Quick Ratio | 0.16 | 0.82 |

| D/E (Debt-to-Equity) | 0.76 | 0.84 |

| Debt-to-Assets | 40.45% | 43.86% |

| Interest Coverage | 6.38 | 2.02 |

| Asset Turnover | 0.14 | 0.14 |

| Fixed Asset Turnover | 6.54 | 36.61 |

| Payout Ratio | 98.61% | 151.84% |

| Dividend Yield | 3.76% | 3.52% |

Interpretation of the Ratios

Equity Residential

Equity Residential shows a mixed ratio profile with a strong net margin of 34.76% and a favorable dividend yield of 3.76%, indicating decent profitability and shareholder returns. However, the company faces concerns with a low current ratio of 0.16 and an unfavorable ROE of 9.38%, suggesting liquidity risks and moderate equity returns. The dividend payments appear sustainable given the positive free cash flow coverage, but caution is warranted due to some unfavorable operational metrics.

Invitation Homes Inc.

Invitation Homes displays similarly mixed financial ratios, with a favorable net margin of 17.33% and a dividend yield of 3.52%, reflecting reasonable profitability and shareholder income. However, weak returns on equity and invested capital (4.65% and 4.02%, respectively) and a modest current ratio of 0.82 highlight potential liquidity and efficiency challenges. Dividend distributions are supported but could be under pressure if operating performance does not improve.

Which one has the best ratios?

Both companies exhibit a comparable balance of favorable and unfavorable ratios, each with a 28.57% share of positive indicators and 35.71% unfavorable metrics, leading to a slightly unfavorable overall rating. Equity Residential has a higher net margin and dividend yield, while Invitation Homes shows a better current ratio but weaker returns. Neither clearly outperforms the other in all key metrics.

Strategic Positioning

This section compares the strategic positioning of Equity Residential and Invitation Homes Inc. regarding market position, key segments, and exposure to technological disruption:

Equity Residential

- Large market cap of 23.9B USD; operates in competitive urban apartment markets.

- Focuses on acquisition, development, and management of urban apartments in major U.S. cities.

- No explicit exposure to technological disruption mentioned.

Invitation Homes Inc.

- Market cap of 16.3B USD; focuses on single-family home leasing nationwide.

- Concentrated on single-family home rentals with emphasis on location and resident experience.

- No explicit exposure to technological disruption mentioned.

Equity Residential vs Invitation Homes Inc. Positioning

Equity Residential operates a diversified portfolio of urban apartments across several U.S. cities, while Invitation Homes concentrates on single-family homes nationwide. Equity Residential’s broad geographic presence contrasts with Invitation Homes’ focused segment, reflecting different market approaches and business drivers.

Which has the best competitive advantage?

Equity Residential shows a very favorable moat with ROIC exceeding WACC by 2.57%, indicating value creation and durable competitive advantage. Invitation Homes has a slightly unfavorable moat with ROIC below WACC, reflecting value destruction despite improving profitability.

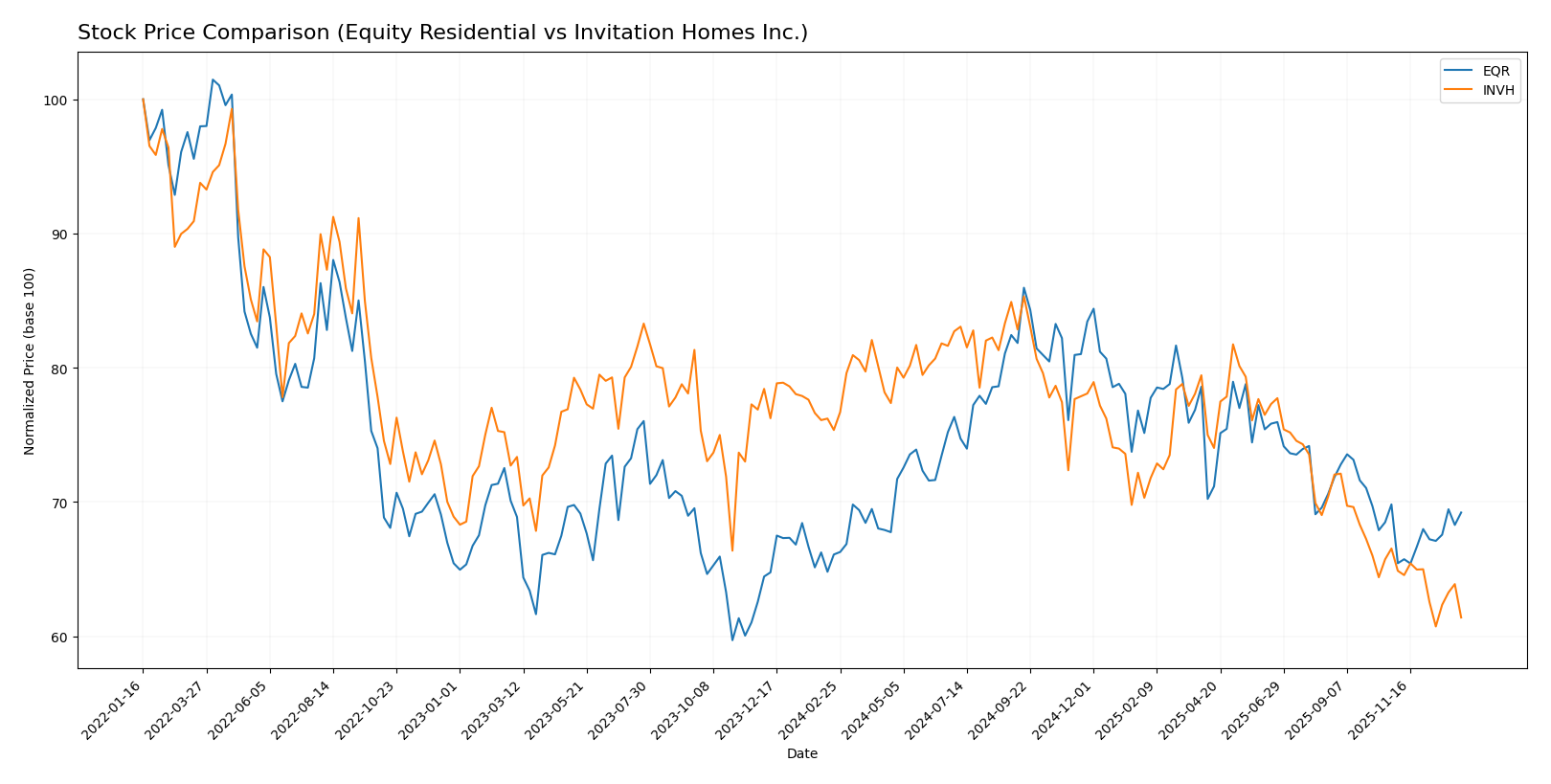

Stock Comparison

The stock price chart highlights distinct price movements and trading dynamics over the past 12 months, with Equity Residential showing moderate gains and Invitation Homes Inc. facing notable declines.

Trend Analysis

Equity Residential’s stock exhibited a bullish trend over the past year with a 4.73% price increase, accelerating upward from a low of 59.42 to a high of 78.08, supported by a 4.68 standard deviation.

Invitation Homes Inc. displayed a bearish trend with an 18.53% price decline over the same period, marked by deceleration and a lower volatility of 2.66, falling from 37.02 to 26.35.

Comparing both, Equity Residential delivered the highest market performance, showing a positive price trend, while Invitation Homes Inc. experienced significant losses.

Target Prices

Analysts provide a clear target price consensus for both Equity Residential and Invitation Homes Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Equity Residential | 79.75 | 35 | 69.19 |

| Invitation Homes Inc. | 38 | 27 | 32.71 |

The consensus target for Equity Residential at 69.19 suggests upside potential compared to its current price of 62.87. Invitation Homes’ consensus target of 32.71 also indicates expected growth above the current price of 26.64.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Equity Residential and Invitation Homes Inc.:

Rating Comparison

EQR Rating

- Rating: B+, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation based on cash flow projections.

- ROE Score: 4, showing good profit generation efficiency from equity.

- ROA Score: 5, demonstrating very effective asset utilization.

- Debt To Equity Score: 2, reflecting moderate financial risk.

- Overall Score: 3, indicating a Moderate overall financial standing.

INVH Rating

- Rating: B+, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 5, indicating a Very Favorable valuation based on cash flow projections.

- ROE Score: 3, showing moderate profit generation efficiency from equity.

- ROA Score: 4, demonstrating favorable asset utilization.

- Debt To Equity Score: 2, reflecting moderate financial risk.

- Overall Score: 3, indicating a Moderate overall financial standing.

Which one is the best rated?

Both Equity Residential and Invitation Homes Inc. share the same overall rating of B+ and an identical Moderate overall score. However, INVH scores higher on discounted cash flow, while EQR leads on return on equity and assets, showing a mixed rating comparison.

Scores Comparison

Here is a comparison of the key financial scores for Equity Residential and Invitation Homes Inc.:

Equity Residential Scores

- Altman Z-Score: 1.84, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength.

Invitation Homes Inc. Scores

- Altman Z-Score: 1.31, in the distress zone indicating high bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial strength.

Which company has the best scores?

Invitation Homes has a lower Altman Z-Score indicating higher bankruptcy risk but a stronger Piotroski Score compared to Equity Residential. Equity Residential shows moderate bankruptcy risk but only average financial strength.

Grades Comparison

Here is a comparison of the latest reliable grades for Equity Residential and Invitation Homes Inc.:

Equity Residential Grades

The following table shows recent grades assigned by major financial institutions for Equity Residential:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-25 |

| Mizuho | Maintain | Neutral | 2025-11-24 |

| Truist Securities | Maintain | Buy | 2025-11-17 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-13 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-10 |

| UBS | Maintain | Buy | 2025-11-10 |

| Scotiabank | Maintain | Sector Perform | 2025-11-04 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-03 |

| RBC Capital | Maintain | Outperform | 2025-10-30 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-13 |

Equity Residential’s grades predominantly reflect a positive to neutral outlook, with several “Outperform” and “Buy” ratings balanced by some “Neutral” and “Equal Weight” assessments.

Invitation Homes Inc. Grades

The following table presents recent grades for Invitation Homes Inc. from recognized financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-25 |

| JP Morgan | Maintain | Overweight | 2025-11-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-13 |

| B of A Securities | Maintain | Neutral | 2025-11-12 |

| Scotiabank | Maintain | Sector Perform | 2025-11-10 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-31 |

| RBC Capital | Maintain | Sector Perform | 2025-10-31 |

| Mizuho | Maintain | Outperform | 2025-10-21 |

| JP Morgan | Upgrade | Overweight | 2025-10-17 |

Invitation Homes shows a generally favorable outlook with multiple “Overweight” and “Outperform” ratings, alongside some “Neutral” and “Sector Perform” grades, indicating a balanced but positive sentiment.

Which company has the best grades?

Invitation Homes has received somewhat stronger grades overall, with a higher proportion of “Overweight” and “Outperform” ratings compared to Equity Residential’s mix of “Buy” and “Outperform” but also several “Neutral” and “Equal Weight” grades. This difference may influence investor sentiment and portfolio positioning by signaling a slightly higher confidence in Invitation Homes’ near-term performance.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Equity Residential (EQR) and Invitation Homes Inc. (INVH) based on their latest financial and operational data.

| Criterion | Equity Residential (EQR) | Invitation Homes Inc. (INVH) |

|---|---|---|

| Diversification | Moderate geographic diversification across US regions (Northeast, Northwest, Southeast, Southwest) | Limited diversification data; primarily U.S. single-family rental focus |

| Profitability | High net margin (34.76%), ROIC slightly above cost of capital | Moderate net margin (17.33%), ROIC below cost of capital but improving |

| Innovation | Steady innovation reflected in fixed asset turnover (6.54 favorable) | High fixed asset turnover (36.61 favorable), indicating efficient asset use |

| Global presence | Primarily US market presence, no global footprint | Primarily US market presence, no global footprint |

| Market Share | Strong presence in multi-family residential segment | Leading in single-family rental market |

Key takeaways: Equity Residential demonstrates a durable competitive advantage with solid profitability and efficient asset management but moderate diversification. Invitation Homes shows improving profitability and strong asset efficiency, yet it is currently value-destructive and less diversified. Both companies have room for improvement in liquidity and financial leverage ratios.

Risk Analysis

Below is an overview of key risks for Equity Residential (EQR) and Invitation Homes Inc. (INVH) based on the most recent data from 2024.

| Metric | Equity Residential (EQR) | Invitation Homes Inc. (INVH) |

|---|---|---|

| Market Risk | Moderate beta 0.756; sensitive to real estate cycles | Moderate beta 0.83; exposed to housing market fluctuations |

| Debt level | Debt-to-assets 40.45%; interest coverage 3.05x (neutral) | Debt-to-assets 43.86%; interest coverage 2.24x (neutral) |

| Regulatory Risk | Moderate; subject to US real estate regulations | Moderate; compliance with residential leasing laws |

| Operational Risk | Exposure to property management efficiency and vacancy rates | Risks from property maintenance and tenant turnover |

| Environmental Risk | Potential impact from climate regulations on coastal properties | Risk related to suburban developments and environmental compliance |

| Geopolitical Risk | Low; primarily US-focused portfolio | Low; US market concentration |

The most impactful risks for both companies stem from market volatility and elevated debt levels, which impact financial flexibility. INVH’s lower interest coverage and Altman Z-score in the distress zone indicate higher bankruptcy risk compared to EQR’s grey zone status. Both face operational challenges in managing large residential portfolios amid changing housing demands.

Which Stock to Choose?

Equity Residential (EQR) shows steady income growth with a favorable net margin of 34.76% and a strong gross margin of 63.27%. Its return on invested capital (8.93%) surpasses WACC, indicating value creation, despite moderate debt levels and a current ratio of 0.16. The company holds a very favorable B+ rating and demonstrates a bullish stock trend.

Invitation Homes Inc. (INVH) exhibits higher overall revenue growth but with a lower net margin of 17.33% and less efficient returns on equity (4.65%) and invested capital (4.02%). It is shedding value as ROIC is below WACC, and although it has moderate debt and a better current ratio of 0.82, the stock trend is bearish. INVH also holds a very favorable B+ rating.

For investors emphasizing durable competitive advantage and strong income quality, EQR could appear more favorable due to its value-creating moat and stable profitability. Conversely, those focused on growth potential may find INVH’s higher revenue and net income growth over the period attractive, despite its current challenges. Risk-averse profiles might lean towards EQR’s financial stability, while risk-tolerant investors could see potential in INVH’s improving profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Equity Residential and Invitation Homes Inc. to enhance your investment decisions: