In the evolving landscape of digital infrastructure and wireless communication, Equinix, Inc. and SBA Communications Corporation stand out as key players. Both operate as specialty REITs with overlapping interests in enabling connectivity—Equinix through data centers and SBA via wireless communication towers. Their innovation strategies focus on expanding critical infrastructure to meet growing digital demands. This article will help you decide which company presents a more compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Equinix and SBA Communications by providing an overview of these two companies and their main differences.

Equinix Overview

Equinix, Inc. is a global digital infrastructure company focused on enabling digital leaders to interconnect the foundational infrastructure powering their businesses. Positioned in the specialty REIT sector, Equinix provides a trusted platform that helps clients scale with agility, accelerate digital service launches, and enhance user experiences. The company operates from Redwood City, CA, with over 13,600 employees and a market cap of approximately 76.3B USD.

SBA Communications Overview

SBA Communications Corporation is a leading owner and operator of wireless communications infrastructure across the Americas and South Africa. As a specialty REIT, SBA focuses primarily on leasing antenna space on multi-tenant sites to wireless service providers under long-term contracts, generating revenue from site leasing and development services. Headquartered in Boca Raton, FL, it employs about 1,720 people and has a market cap near 19.5B USD.

Key similarities and differences

Both companies operate as specialty REITs within the real estate sector, specializing in infrastructure essential to communication and digital services. Equinix concentrates on digital infrastructure interconnection, while SBA Communications focuses on wireless infrastructure site leasing and development. Equinix is significantly larger in market capitalization and workforce size, reflecting its broader global digital platform compared to SBA’s more regionally focused wireless site operations.

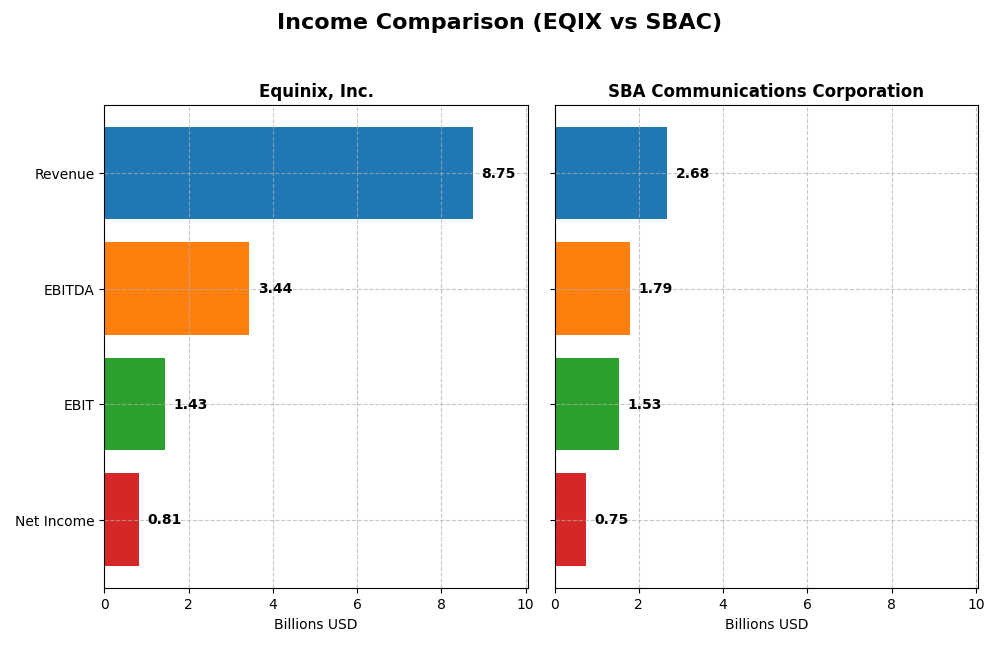

Income Statement Comparison

The following table presents a factual comparison of the latest available income statement metrics for Equinix, Inc. and SBA Communications Corporation based on their 2024 fiscal year data.

| Metric | Equinix, Inc. (EQIX) | SBA Communications Corporation (SBAC) |

|---|---|---|

| Market Cap | 76.3B | 19.5B |

| Revenue | 8.75B | 2.68B |

| EBITDA | 3.44B | 1.79B |

| EBIT | 1.43B | 1.53B |

| Net Income | 815M | 750M |

| EPS | 8.54 | 6.96 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Equinix, Inc.

Equinix’s revenue rose steadily from $6.0B in 2020 to $8.7B in 2024, a 45.8% increase over five years. Net income more than doubled, reaching $815M in 2024. Gross and net margins improved over the period, with 2024 showing solid profitability despite a slight decline in EBIT and net income margins, indicating some pressure on efficiency and earnings quality.

SBA Communications Corporation

SBA Communications reported revenue growth from $2.1B in 2020 to $2.7B in 2024 but faced a slight revenue decline in 2024. Net income surged dramatically to $750M in 2024, reflecting strong margin expansion. The company’s gross margin remained robust above 77%, and EBIT margin increased significantly, with 2024 showing strong earnings growth and improved profitability metrics across the board.

Which one has the stronger fundamentals?

SBA Communications demonstrates stronger fundamentals with superior gross and EBIT margins, higher net margin, and remarkable net income growth exceeding 3000% over five years. Equinix shows consistent revenue growth and solid margins but experienced recent margin compression and earnings decline. SBA’s more favorable margin profile and earnings acceleration suggest stronger income statement fundamentals.

Financial Ratios Comparison

Below is a comparison of the most recent key financial ratios for Equinix, Inc. (EQIX) and SBA Communications Corporation (SBAC) for the fiscal year 2024.

| Ratios | Equinix, Inc. (EQIX) | SBA Communications Corporation (SBAC) |

|---|---|---|

| ROE | 6.02% | -14.67% |

| ROIC | 3.33% | 12.57% |

| P/E | 110.44 | 29.37 |

| P/B | 6.65 | -4.31 |

| Current Ratio | 1.63 | 1.10 |

| Quick Ratio | 1.63 | 1.10 |

| D/E | 1.40 | -3.08 |

| Debt-to-Assets | 54.04% | 138.00% |

| Interest Coverage | 2.91 | 0 |

| Asset Turnover | 0.25 | 0.23 |

| Fixed Asset Turnover | 0.42 | 0.42 |

| Payout ratio | 201.60% | 56.59% |

| Dividend yield | 1.83% | 1.93% |

Interpretation of the Ratios

Equinix, Inc.

Equinix shows a mixed ratio profile with favorable liquidity (current and quick ratios at 1.63) but unfavorable profitability and valuation metrics, such as a low ROE of 6.02% and a high P/E of 110.44. Its debt levels and asset turnover also raise concerns. Dividend yield is modest at 1.83%, supported by stable payouts, but free cash flow coverage is weak, indicating potential sustainability risks.

SBA Communications Corporation

SBA Communications presents stronger profitability ratios, including a high net margin of 27.97% and ROIC at 12.57%, though its negative return on equity (-14.67%) signals losses or equity issues. Debt measures show mixed signals with a negative debt-to-equity ratio but a concerning 138% debt-to-assets. Dividend yield is 1.93%, balanced with favorable interest coverage and some liquidity caution.

Which one has the best ratios?

SBA Communications displays a more favorable overall ratio outlook, with half of its key ratios positive and better profitability metrics, despite some debt and equity concerns. Equinix has fewer favorable ratios and faces challenges with profitability and leverage. Therefore, SBA’s ratios appear slightly more robust compared to Equinix’s more unfavorable profile.

Strategic Positioning

This section compares the strategic positioning of Equinix and SBA Communications, focusing on Market position, Key segments, and Exposure to technological disruption:

Equinix, Inc.

- Leading global digital infrastructure provider with broad market reach and competitive NASDAQ presence.

- Key segments include Co-Location, Interconnection, and Managed Infrastructure, driving recurring revenues.

- Exposed to digital infrastructure trends; focuses on enabling digital service scalability and agility.

SBA Communications Corporation

- Leading owner/operator of wireless infrastructure across Americas and South Africa with strong market presence.

- Revenue driven by Domestic and International Site Leasing and Site Development Construction services.

- Exposed to wireless communications evolution; focuses on multi-tenant antenna leasing and infrastructure buildout.

Equinix vs SBA Communications Positioning

Equinix adopts a diversified digital infrastructure focus with multiple service segments, while SBA concentrates on wireless communications infrastructure and site leasing. Equinix benefits from broad digital interconnectivity, whereas SBA leverages geographic and service specialization.

Which has the best competitive advantage?

SBA Communications shows a very favorable moat with ROIC well above WACC and strong growth, indicating durable competitive advantage. Equinix exhibits a slightly unfavorable moat, shedding value despite improving ROIC trends.

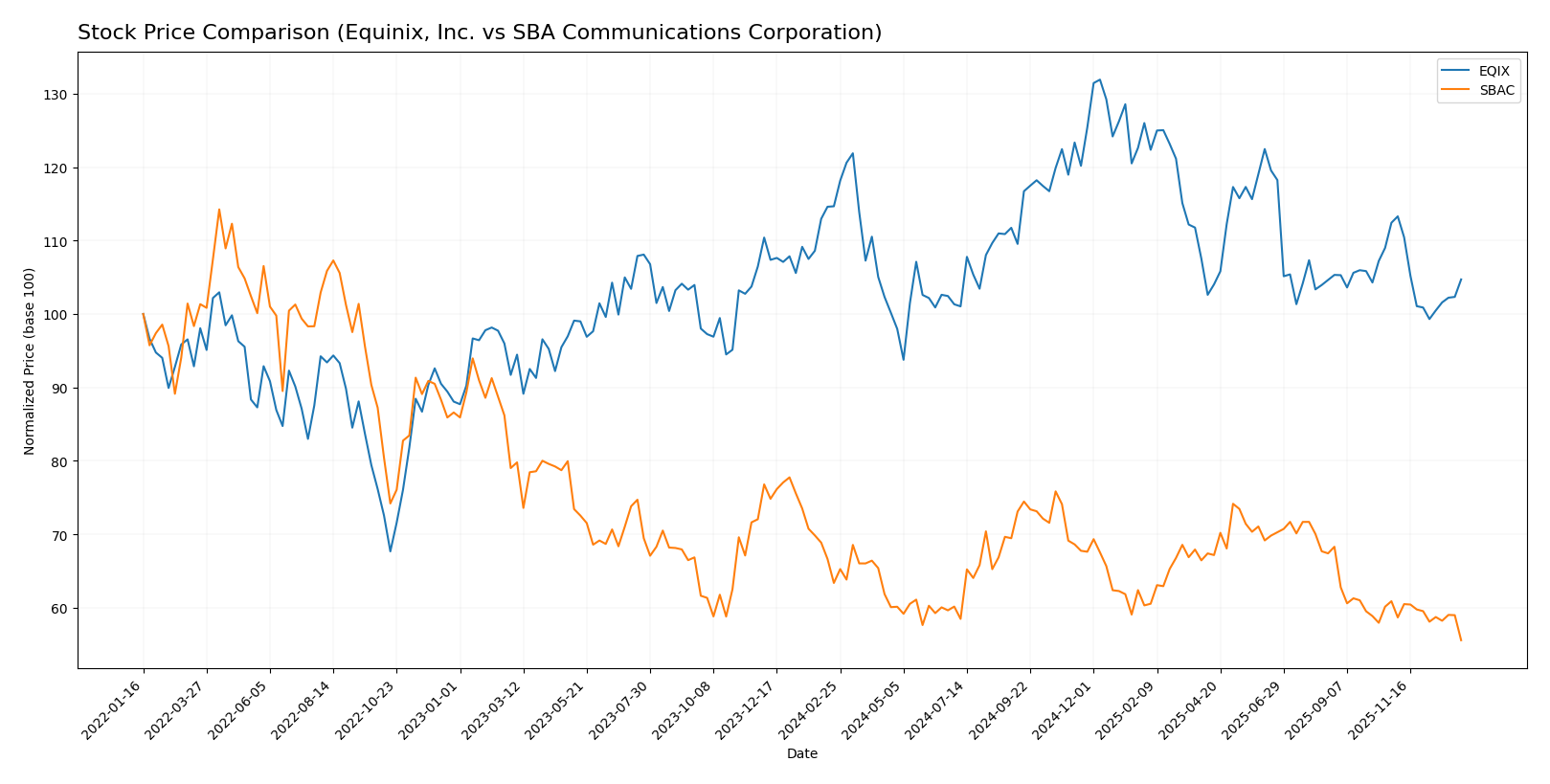

Stock Comparison

The stock price chart over the past 12 months highlights notable bearish trends for both Equinix, Inc. and SBA Communications Corporation, with significant price declines and decelerating downward momentum.

Trend Analysis

Equinix, Inc. (EQIX) exhibited a bearish trend with a price decrease of -8.68% over the past year, showing deceleration in its decline. The stock fluctuated between a high of 985.0 and a low of 700.18, with a volatility measure of 66.16.

SBA Communications Corporation (SBAC) also followed a bearish trajectory, declining -12.3% over the same period. This trend decelerated as well, with prices ranging from 247.47 to 181.36 and lower volatility at 16.35.

Comparing the two, Equinix’s stock outperformed SBA Communications by delivering a smaller percentage loss, indicating a less severe market downturn over the past year.

Target Prices

Analysts provide a generally optimistic target consensus for Equinix, Inc. and SBA Communications Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Equinix, Inc. | 973 | 795 | 900 |

| SBA Communications Corporation | 280 | 205 | 240.57 |

The target consensus for Equinix, Inc. at 900 suggests upside potential from the current price of 781.88 USD, while SBA Communications Corporation’s consensus target of 240.57 also indicates expected growth from its current 181.36 USD price. Both stocks are viewed favorably by analysts relative to their current valuations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Equinix, Inc. and SBA Communications Corporation:

Rating Comparison

Equinix, Inc. Rating

- Rating: C, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 1, considered Very Unfavorable.

- ROE Score: 4, assessed as Favorable for profit efficiency.

- ROA Score: 3, with a Moderate status on asset utilization.

- Debt To Equity Score: 1, seen as Very Unfavorable indicating risk.

- Overall Score: 2, categorized as Moderate overall financial standing.

SBA Communications Rating

- Rating: B-, also rated Very Favorable by analysts.

- Discounted Cash Flow Score: 5, deemed Very Favorable.

- ROE Score: 1, marked Very Unfavorable for profitability.

- ROA Score: 5, rated Very Favorable for effective asset use.

- Debt To Equity Score: 1, also Very Unfavorable showing financial risk.

- Overall Score: 3, indicating a Moderate overall financial standing.

Which one is the best rated?

Based strictly on the provided data, SBA Communications holds a higher rating (B-) than Equinix (C) and scores better in discounted cash flow and asset utilization, while Equinix outperforms SBA in return on equity. Both share similar debt risk and moderate overall scores.

Scores Comparison

The comparison of Altman Z-Score and Piotroski Score for Equinix, Inc. and SBA Communications Corporation is as follows:

Equinix, Inc. Scores

- Altman Z-Score: 2.12, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

SBA Communications Corporation Scores

- Altman Z-Score: 0.49, in the distress zone indicating high bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

Which company has the best scores?

Equinix shows a better Altman Z-Score, positioned in the grey zone versus SBA’s distress zone, while both share an average Piotroski Score of 6. Thus, Equinix presents a relatively stronger financial stability based on these metrics.

Grades Comparison

Here is a detailed comparison of the recent grades and ratings for Equinix, Inc. and SBA Communications Corporation:

Equinix, Inc. Grades

The following table summarizes the latest grades from reputable financial institutions for Equinix, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BMO Capital | Upgrade | Outperform | 2025-12-03 |

| Truist Securities | Maintain | Buy | 2025-11-18 |

| JP Morgan | Maintain | Overweight | 2025-10-30 |

| TD Cowen | Maintain | Buy | 2025-10-30 |

| Barclays | Maintain | Equal Weight | 2025-08-20 |

| Truist Securities | Maintain | Buy | 2025-08-07 |

| JP Morgan | Maintain | Overweight | 2025-07-31 |

| JMP Securities | Maintain | Market Outperform | 2025-07-22 |

| Barclays | Maintain | Equal Weight | 2025-07-11 |

| UBS | Maintain | Buy | 2025-07-11 |

Equinix’s grades predominantly show a “Buy” consensus with some “Overweight” and “Outperform” ratings, indicating a generally positive outlook from analysts.

SBA Communications Corporation Grades

The following table shows the latest grades from recognized grading companies for SBA Communications Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2025-12-16 |

| Barclays | Maintain | Overweight | 2025-12-01 |

| Barclays | Maintain | Overweight | 2025-11-17 |

| RBC Capital | Maintain | Outperform | 2025-11-10 |

| BMO Capital | Maintain | Market Perform | 2025-11-04 |

| TD Cowen | Maintain | Buy | 2025-11-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-20 |

| Citigroup | Maintain | Buy | 2025-10-16 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-16 |

| UBS | Maintain | Buy | 2025-10-14 |

SBA Communications shows a mix of “Buy,” “Overweight,” “Outperform,” and “Equal Weight” ratings, reflecting a moderately positive but somewhat more cautious analyst sentiment.

Which company has the best grades?

Equinix, Inc. has received a stronger overall grade profile with numerous “Buy” and “Outperform” ratings compared to SBA Communications, which features more “Equal Weight” and “Market Perform” grades. This suggests that investors might perceive Equinix as having a higher growth or value potential relative to SBA Communications, potentially influencing portfolio decisions.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses of Equinix, Inc. (EQIX) and SBA Communications Corporation (SBAC) based on the most recent financial and operational data.

| Criterion | Equinix, Inc. (EQIX) | SBA Communications Corporation (SBAC) |

|---|---|---|

| Diversification | Focused on data center services with strong recurring revenue (8.18B USD in 2024), moderate product range | Mainly site leasing and site development, with growing international segment (2.53B USD total in 2024) |

| Profitability | Net margin 9.3%, ROIC 3.3%, but ROIC below WACC indicates value destruction | Net margin 28%, ROIC 12.6%, ROIC well above WACC showing value creation |

| Innovation | Steady growth in interconnection and managed infrastructure services, but slower asset turnover | Solid infrastructure expansion, growing site development, but asset turnover remains low |

| Global presence | Strong global data center footprint supporting colocation and interconnection | Expanding international site leasing revenue, significant domestic market share |

| Market Share | Leading in data center colocation with steady revenue growth | Large market share in wireless infrastructure leasing, aggressive international growth |

Key takeaways: SBA Communications demonstrates a more favorable profitability profile with a durable competitive advantage and growing returns on capital. Equinix shows steady revenue growth but currently struggles with value creation and higher leverage, reflecting cautious risk considerations for investors.

Risk Analysis

Below is a comparative table of key risks for Equinix, Inc. (EQIX) and SBA Communications Corporation (SBAC) based on the latest 2024 data:

| Metric | Equinix, Inc. (EQIX) | SBA Communications (SBAC) |

|---|---|---|

| Market Risk | Beta 1.04 indicates moderate market sensitivity | Beta 0.87 suggests lower volatility |

| Debt level | Debt-to-Equity 1.4 (unfavorable), Debt-to-Assets 54% | Debt-to-Equity -3.08 (favorable, possibly due to accounting), Debt-to-Assets 138% (unfavorable) |

| Regulatory Risk | Moderate, operates in digital infrastructure with some regulatory oversight | Moderate, subject to telecommunications and infrastructure regulations |

| Operational Risk | Medium, complex global data center operations | Medium, wireless infrastructure maintenance and development |

| Environmental Risk | Increasing focus on energy efficiency but substantial data center power use | Potential environmental impact from tower construction and maintenance |

| Geopolitical Risk | Exposure to US and international markets with some geopolitical uncertainty | Presence in Americas and South Africa exposes to regional political risks |

Synthesis: SBAC’s extremely high debt-to-assets ratio and distress zone Altman Z-score highlight significant financial risk, despite favorable operational scores. EQIX shows moderate market risk and leverage with a grey zone Altman Z-score, indicating caution. Both face regulatory and geopolitical uncertainties, but SBAC’s financial distress is the most impactful immediate risk.

Which Stock to Choose?

Equinix, Inc. (EQIX) shows a favorable income statement with a 45.84% revenue growth and 120.4% net income growth over 2020-2024. However, its financial ratios are mostly unfavorable, including a high debt-to-assets ratio of 54%, and the company is rated “Very Favorable” overall but with moderate scores in key valuation metrics.

SBA Communications Corporation (SBAC) presents a very favorable income statement with strong net margin growth of 2317.39% and positive EBIT margin of 56.91%. Its financial ratios are more balanced with 50% favorable metrics despite high debt-to-assets at 138%, and it holds a “Very Favorable” rating with moderate overall scores but better discounted cash flow metrics.

For investors focused on growth and value creation, SBAC’s strong income growth and durable competitive advantage might appear more attractive, while those prioritizing stability and moderate valuation might find EQIX’s improving profitability and moderate rating more suitable. Each stock’s appeal could vary depending on risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Equinix, Inc. and SBA Communications Corporation to enhance your investment decisions: