Energy Fuels Inc. (UUUU) and Denison Mines Corp. (DNN) are two prominent players in the uranium industry, each driving innovation in uranium extraction and development across North America. While Energy Fuels focuses on U.S.-based projects with a broad portfolio, Denison Mines operates primarily in Canada’s rich Athabasca Basin. This comparison explores their market positions and growth strategies to help you identify which company could enhance your investment portfolio. Let’s dive into the details that matter most for investors.

Table of contents

Companies Overview

I will begin the comparison between Energy Fuels Inc. and Denison Mines Corp. by providing an overview of these two companies and their main differences.

Energy Fuels Inc. Overview

Energy Fuels Inc. focuses on the extraction, recovery, exploration, and sale of uranium within the United States. The company operates several uranium projects and a milling facility across multiple states including Wyoming, Texas, and Utah. With a market cap of approximately 4.3B USD and over 1,200 employees, it holds a significant position in the U.S. uranium industry, emphasizing conventional and in situ recovery methods.

Denison Mines Corp. Overview

Denison Mines Corp. is engaged in acquiring, exploring, developing, and processing uranium properties primarily in Canada. Its key asset is the Wheeler River project in Saskatchewan’s Athabasca Basin. The company has a market capitalization near 3B USD and a smaller workforce of 65 employees, reflecting a more focused operational scale compared to Energy Fuels. Denison’s activities center on Canadian uranium resources and project development.

Key similarities and differences

Both companies operate in the uranium industry and trade on the NYSE Arca exchange, targeting uranium extraction and development. Energy Fuels has a broader geographic footprint in the U.S. and a larger operational scale, while Denison Mines is concentrated on Canadian projects with fewer employees. Both have similar risk profiles indicated by their beta values (~1.85-1.89) but differ in size and market capitalization, with Energy Fuels being the larger entity.

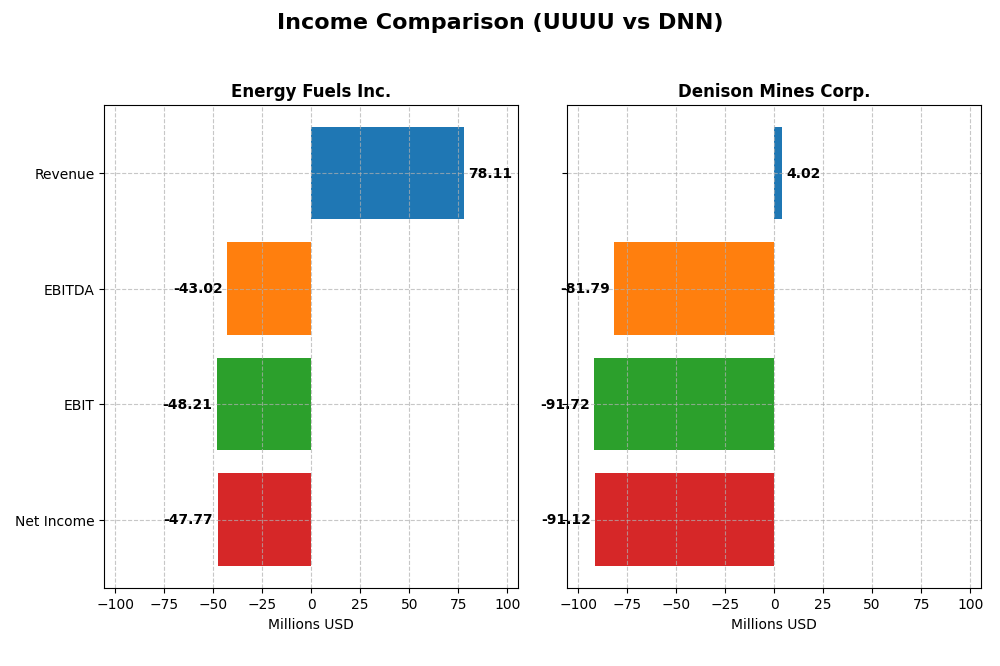

Income Statement Comparison

The table below summarizes the key income statement metrics for Energy Fuels Inc. and Denison Mines Corp. for the fiscal year 2024, providing a clear side-by-side financial snapshot.

| Metric | Energy Fuels Inc. (UUUU) | Denison Mines Corp. (DNN) |

|---|---|---|

| Market Cap | 4.31B USD | 2.97B CAD |

| Revenue | 78.1M USD | 4.02M CAD |

| EBITDA | -43.0M USD | -81.8M CAD |

| EBIT | -48.2M USD | -91.7M CAD |

| Net Income | -47.8M USD | -91.1M CAD |

| EPS | -0.28 USD | -0.10 CAD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Energy Fuels Inc.

Energy Fuels Inc. showed strong revenue growth, rising from 3.2M in 2020 to 78.1M in 2024, but net income remained negative at -47.8M in 2024. Gross margin improved to 21.8%, reflecting better core profitability, though EBIT and net margins stayed deeply negative. The latest year saw revenue double but EBIT margin deteriorated, signaling operational challenges.

Denison Mines Corp.

Denison Mines experienced fluctuating revenue, peaking at 20M in 2021, then falling to 4M in 2024, with net income turning sharply negative to -91.1M in 2024. Gross margins were negative at -19.7%, and EBIT and net margins were substantially unfavorable. The recent year featured a strong revenue rebound but worsening margins and large net losses, highlighting volatility.

Which one has the stronger fundamentals?

Energy Fuels Inc. presents a more favorable income statement profile with consistent revenue growth and positive gross margin trends despite net losses. Denison Mines struggles with negative margins across the board and steep net income decline. Overall, Energy Fuels’ income fundamentals appear relatively stronger, while Denison Mines faces significant profitability headwinds.

Financial Ratios Comparison

The table below presents the key financial ratios for Energy Fuels Inc. (UUUU) and Denison Mines Corp. (DNN) for the fiscal year 2024, enabling a straightforward performance comparison.

| Ratios | Energy Fuels Inc. (UUUU) | Denison Mines Corp. (DNN) |

|---|---|---|

| ROE | -9.05% | -16.15% |

| ROIC | -6.67% | -10.03% |

| P/E | -18.47 | -25.35 |

| P/B | 1.67 | 4.09 |

| Current Ratio | 3.88 | 3.65 |

| Quick Ratio | 2.76 | 3.54 |

| D/E | 0.0041 | 0 |

| Debt-to-Assets | 0.36% | 0 |

| Interest Coverage | 0 | -586.32 |

| Asset Turnover | 0.13 | 0.0061 |

| Fixed Asset Turnover | 1.42 | 0.0155 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Energy Fuels Inc.

Energy Fuels Inc. shows a mixed ratio profile with more unfavorable metrics, including a negative net margin of -61.15% and a negative return on equity at -9.05%, signaling profitability challenges. The company’s quick ratio of 2.76 and zero debt-to-equity ratio are favorable, but low asset turnover and interest coverage raise concerns. Energy Fuels does not pay dividends, likely reflecting reinvestment needs or a focus on operational recovery.

Denison Mines Corp.

Denison Mines Corp. also presents a challenging ratio set with a deeply negative net margin of -2264.95% and a return on equity of -16.15%, indicating significant losses and weak profitability. Although the quick ratio is strong at 3.54 and debt metrics are favorable, poor asset turnover and a negative interest coverage ratio highlight financial strain. Denison Mines does not pay dividends, which may relate to its reinvestment strategy or growth phase.

Which one has the best ratios?

Both companies have unfavorable overall ratio evaluations, but Energy Fuels Inc. has a slightly better balance with some neutral and favorable metrics, such as a better fixed asset turnover and manageable debt levels. Denison Mines exhibits a more severe profitability and efficiency weakness, reflected in a higher percentage of unfavorable ratios and greater financial stress indicators.

Strategic Positioning

This section compares the strategic positioning of Energy Fuels Inc. and Denison Mines Corp., including market position, key segments, and exposure to technological disruption:

Energy Fuels Inc.

- US uranium producer with diversified projects across multiple states facing competitive energy sector pressure.

- Extraction, recovery, and sale of conventional and in situ uranium; multiple projects and milling operations diversify revenue drivers.

- No explicit data on technological disruption exposure provided.

Denison Mines Corp.

- Canadian uranium company focused on the Athabasca Basin with a flagship project, under competitive mining pressures.

- Acquisition, exploration, development, and processing centered on uranium properties in Canada with emphasis on a single major project.

- No explicit data on technological disruption exposure provided.

Energy Fuels Inc. vs Denison Mines Corp. Positioning

Energy Fuels shows a diversified US project portfolio across several states, leveraging multiple operations including milling. Denison Mines is more concentrated geographically and project-wise in Canada, focusing heavily on the Wheeler River project. This reflects differing strategic breadth and operational approaches.

Which has the best competitive advantage?

Both companies are currently shedding value, with Energy Fuels showing a growing ROIC trend and Denison Mines a stable but unfavorable one. Energy Fuels has a slightly less unfavorable moat status, indicating a marginally better competitive position based on ROIC versus WACC.

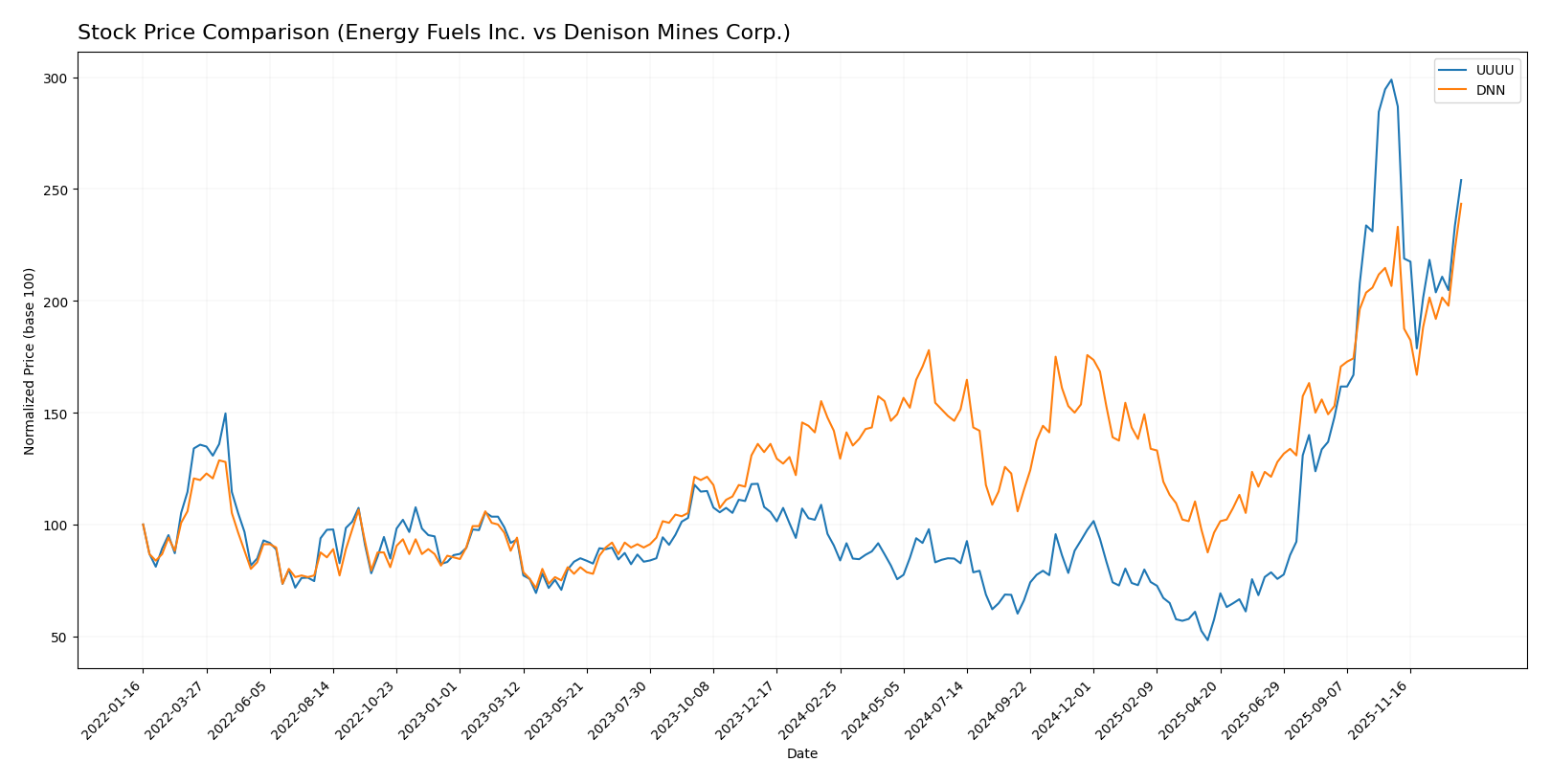

Stock Comparison

The stock price movements of Energy Fuels Inc. and Denison Mines Corp. over the past year reveal distinct bullish trends with varying acceleration patterns and recent shifts in trading dynamics.

Trend Analysis

Energy Fuels Inc. (UUUU) showed a strong bullish trend over the past 12 months with a 180.25% price increase, marked by deceleration and a standard deviation of 4.44. The price ranged from a low of 3.45 to a high of 21.37.

Denison Mines Corp. (DNN) also exhibited a bullish trend with a 71.5% gain over the same period, accompanied by acceleration and lower volatility at a 0.44 standard deviation. The stock price moved between 1.19 and 3.31.

Comparing the two, Energy Fuels Inc. delivered the highest market performance with a larger percentage increase, despite recent short-term weakness, while Denison Mines showed steady acceleration and moderate gains.

Target Prices

The current analyst consensus presents a clear outlook on target prices for these uranium sector companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Energy Fuels Inc. | 26.75 | 11.5 | 19.13 |

| Denison Mines Corp. | 2.6 | 2.6 | 2.6 |

Analysts expect Energy Fuels Inc. shares to appreciate from the current $18.16 price toward a consensus target of $19.13, indicating moderate upside. Denison Mines Corp. trades above its consensus target of $2.60 at $3.31, suggesting a more cautious outlook from analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Energy Fuels Inc. and Denison Mines Corp.:

Rating Comparison

Energy Fuels Inc. Rating

- Rating: D+, classified as Very Favorable

- Discounted Cash Flow Score: 1, Very Unfavorable

- ROE Score: 1, Very Unfavorable

- ROA Score: 1, Very Unfavorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 1, Very Unfavorable

Denison Mines Corp. Rating

- Rating: C-, classified as Very Favorable

- Discounted Cash Flow Score: 3, Moderate

- ROE Score: 1, Very Unfavorable

- ROA Score: 1, Very Unfavorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 1, Very Unfavorable

Which one is the best rated?

Denison Mines Corp. holds a higher rating at C- compared to Energy Fuels Inc.’s D+, primarily due to a moderately better discounted cash flow score. However, both have very unfavorable overall, ROE, ROA, and debt-to-equity scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Energy Fuels Inc. and Denison Mines Corp.:

Energy Fuels Inc. Scores

- Altman Z-Score: 40.34, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 1, classified as very weak financial health.

Denison Mines Corp. Scores

- Altman Z-Score: 0.73, indicating distress zone with high bankruptcy risk.

- Piotroski Score: 4, classified as average financial strength.

Which company has the best scores?

Energy Fuels Inc. has a much higher Altman Z-Score, placing it in the safe zone, while Denison Mines is in distress. However, Denison Mines has a stronger Piotroski Score than Energy Fuels, which is very weak.

Grades Comparison

The following presents a comparison of the recent grades assigned to Energy Fuels Inc. and Denison Mines Corp.:

Energy Fuels Inc. Grades

This table summarizes recent grades from verified grading companies for Energy Fuels Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2026-01-09 |

| Roth Capital | Downgrade | Sell | 2025-11-05 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-04 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-21 |

| B. Riley Securities | Maintain | Buy | 2025-10-08 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-08 |

| Canaccord Genuity | Maintain | Buy | 2025-07-02 |

| HC Wainwright & Co. | Maintain | Buy | 2025-05-09 |

| HC Wainwright & Co. | Maintain | Buy | 2025-02-28 |

Energy Fuels Inc. shows a strong predominance of Buy ratings, with one recent downgrade to Sell by Roth Capital.

Denison Mines Corp. Grades

This table summarizes recent grades from verified grading companies for Denison Mines Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth MKM | Maintain | Buy | 2024-10-23 |

| TD Securities | Maintain | Speculative Buy | 2023-06-27 |

| Raymond James | Maintain | Outperform | 2023-06-27 |

| TD Securities | Maintain | Speculative Buy | 2023-06-26 |

| Raymond James | Maintain | Outperform | 2023-06-26 |

| Credit Suisse | Downgrade | Underperform | 2017-07-18 |

| Credit Suisse | Downgrade | Underperform | 2017-07-17 |

| Roth Capital | Maintain | Buy | 2016-02-10 |

| Credit Suisse | Upgrade | Neutral | 2014-04-01 |

| Credit Suisse | Upgrade | Neutral | 2014-03-31 |

Denison Mines Corp. has maintained mostly positive ratings recently, including Buy, Speculative Buy, and Outperform, despite older downgrades.

Which company has the best grades?

Both Energy Fuels Inc. and Denison Mines Corp. hold a consensus rating of Buy, with Energy Fuels showing a consistent string of Buy ratings and one Sell from Roth Capital, while Denison maintains a mix of Buy, Speculative Buy, and Outperform from various firms. Investors may note Energy Fuels’ slightly more consistent Buy trend, whereas Denison displays a broader range of positive but varied ratings.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of Energy Fuels Inc. (UUUU) and Denison Mines Corp. (DNN) based on their latest financial and operational data.

| Criterion | Energy Fuels Inc. (UUUU) | Denison Mines Corp. (DNN) |

|---|---|---|

| Diversification | Limited product segmentation; focused on uranium | Limited product segmentation; focused on uranium |

| Profitability | Negative net margin (-61.15%), ROIC -6.67%, shedding value but improving ROIC trend | Significantly negative net margin (-2264.95%), ROIC -10.03%, stable but unfavorable profitability |

| Innovation | Moderate asset turnover (1.42 fixed asset turnover) | Very low asset turnover (0.02 fixed asset turnover), indicating inefficiency |

| Global presence | Presence primarily in North America, no significant expansion | Also primarily North American focus, limited global footprint |

| Market Share | Relatively small market share, niche uranium focus | Small market share, focused on uranium sector |

Key takeaways: Both companies are currently shedding value and face profitability challenges, with Energy Fuels showing a positive trend in ROIC improvement. Denison Mines struggles with very low operational efficiency and lacks diversification. Investors should be cautious and consider the companies’ improving or stable trends before investing.

Risk Analysis

Below is a comparison table of key risk factors affecting Energy Fuels Inc. (UUUU) and Denison Mines Corp. (DNN) for 2024:

| Metric | Energy Fuels Inc. (UUUU) | Denison Mines Corp. (DNN) |

|---|---|---|

| Market Risk | High beta (1.85), uranium price volatility | High beta (1.89), commodity exposure |

| Debt level | Very low debt, debt-to-assets 0.36% | No debt, debt-to-assets 0% |

| Regulatory Risk | US uranium regulatory environment, permitting delays | Canadian uranium mining permits, indigenous consultations |

| Operational Risk | Multiple sites, processing mill exposure | Concentrated in Wheeler River project |

| Environmental Risk | Uranium mining environmental impact, remediation costs | Same sector risks, stringent Canadian regulations |

| Geopolitical Risk | US energy policy shifts, trade tensions | Canadian-US cross-border trade and policy risks |

Energy Fuels shows moderate market and operational risks given its US operations and multiple sites but benefits from very low debt. Denison faces greater financial distress risk with a very low Altman Z-Score (0.73, distress zone) and extremely negative profitability, increasing bankruptcy concerns. Both companies have significant regulatory and environmental risks inherent to uranium mining, with Denison’s concentrated asset base adding operational risk. Investors should weigh Denison’s higher financial risk against Energy Fuels’ broader operational exposure.

Which Stock to Choose?

Energy Fuels Inc. (UUUU) shows strong revenue growth with a neutral overall income statement evaluation and slightly unfavorable MOAT due to value destruction despite improving profitability. Its financial ratios are mostly unfavorable, yet it maintains low debt and a favorable quick ratio, with a very favorable rating.

Denison Mines Corp. (DNN) exhibits unfavorable income statement and MOAT evaluations, with declining profitability and value destruction. Its financial ratios are predominantly unfavorable, burdened by weak asset turnover and interest coverage, but also display low debt levels. The company holds a very favorable rating despite challenges.

For investors prioritizing growth potential, Energy Fuels’ improving profitability and strong revenue expansion might appear attractive, whereas those seeking stability could see Denison Mines’ steady but challenged profile as more suitable. The ratings and overall financial health suggest that investor preference may vary according to risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Energy Fuels Inc. and Denison Mines Corp. to enhance your investment decisions: