As global demand for clean energy intensifies, the uranium sector is gaining traction, with companies such as Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU) emerging as key players. Both firms operate within the uranium industry, but they employ distinct strategies for extraction and exploration. UEC focuses on various projects across North America, while UUUU emphasizes its extensive processing capabilities and diverse properties. With their overlapping market presence, which company is better positioned to capitalize on the growing interest in nuclear energy?

Company Overview

Uranium Energy Corp. Overview

Uranium Energy Corp. (UEC) is a key player in the uranium sector, focusing on the exploration, extraction, and processing of uranium and titanium concentrates across the United States, Canada, and Paraguay. Founded in 2003 and headquartered in Corpus Christi, Texas, UEC operates several projects, including its notable Palangana mine and the Goliad project in Texas. With a market capitalization of approximately $5.73 billion, the company is well-positioned to capitalize on the growing demand for clean energy solutions. Under the leadership of CEO Amir Adnani, UEC is committed to sustainable practices while aiming to increase its production capabilities and project portfolio, responding effectively to global energy demands.

Energy Fuels Inc. Overview

Energy Fuels Inc. (UUUU), headquartered in Lakewood, Colorado, operates within the uranium industry, engaging in the extraction and recovery processes of uranium and vanadium. Established in 1987, the company has developed a robust portfolio, including the Nichols Ranch project in Wyoming and the White Mesa Mill in Utah. With a market capitalization of around $3.75 billion, Energy Fuels is recognized for its innovative approach to uranium production and environmental stewardship. CEO Mark S. Chalmers leads the company in exploring new opportunities for growth while ensuring compliance with regulatory standards, positioning Energy Fuels as a significant contributor to the renewable energy sector.

Key Similarities and Differences

Both Uranium Energy Corp. and Energy Fuels Inc. operate within the uranium mining industry, sharing a commitment to sustainable resource extraction and clean energy solutions. However, their business models differ in operational focus. UEC emphasizes a diverse range of projects across multiple countries, while Energy Fuels concentrates on the extraction and processing of uranium and vanadium primarily within the United States. Additionally, UEC appears to be more heavily involved in exploration. In contrast, Energy Fuels has established infrastructure for processing, such as its White Mesa Mill, which enhances its operational efficiency and potential profitability.

Income Statement Comparison

The table below provides a detailed comparison of the most recent income statements for Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU), highlighting key financial metrics.

| Metric | UEC | UUUU |

|---|---|---|

| Revenue | 67M | 78M |

| EBITDA | -85M | -43M |

| EBIT | -89M | -48M |

| Net Income | -88M | -48M |

| EPS | -0.20 | -0.28 |

In analyzing the most recent year’s performance, UEC reported a revenue of $67 million, a significant decline from previous years, while UUUU saw an increase to $78 million. However, both companies faced substantial net losses, with UEC at -$88 million and UUUU at -$48 million. UEC’s EBITDA and EBIT margins worsened, indicating operational challenges, while UUUU’s marginal improvements in revenue suggest a potential stabilization in their financials. Overall, both companies continue to struggle with profitability, underscoring the importance of careful evaluation and risk management in investment decisions.

Financial Ratios Comparison

Below is a comparative table showcasing the most recent financial ratios for Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU):

| Metric | UEC | UUUU |

|---|---|---|

| ROE | -8.93% | -5.32% |

| ROIC | -1.20% | -0.47% |

| P/E | -42.30 | -18.47 |

| P/B | 3.77 | 1.67 |

| Current Ratio | 8.85 | 3.88 |

| Quick Ratio | 5.85 | 2.76 |

| D/E | 0.002 | 0.004 |

| Debt-to-Assets | 0.002 | 0.003 |

| Interest Coverage | -50.71 | 0 |

| Asset Turnover | 0.060 | 0.128 |

| Fixed Asset Turnover | 0.086 | 1.415 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

Both companies exhibit negative profitability metrics, with UEC showing a higher P/E ratio compared to UUU, indicating greater investor pessimism about its future earnings. UEC’s current and quick ratios suggest strong liquidity, whereas UUU’s lower ratios indicate potential liquidity concerns. The debt ratios for both companies remain low, which reflects a conservative approach to leverage. However, UEC’s significantly negative interest coverage raises red flags regarding its ability to meet interest obligations. Overall, careful consideration is warranted before investing in either stock due to their financial challenges.

Dividend and Shareholder Returns

Neither Uranium Energy Corp. (UEC) nor Energy Fuels Inc. (UUUU) currently pays dividends, reflecting a focus on reinvestment and growth during their respective periods of high growth. UEC’s negative net income and reliance on share buybacks indicate a strategy to enhance shareholder value through potential future capital appreciation rather than immediate cash returns. UUUU, while not paying dividends, has recently shown positive operational metrics, suggesting a gradual path towards profitability. Overall, both companies prioritize long-term value creation, though risks remain due to their reliance on market conditions and operational efficiency.

Strategic Positioning

In the uranium sector, Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU) are prominent players. UEC holds a market cap of approximately $5.73 billion, with a significant focus on uranium extraction across various projects in the U.S. and Canada. In contrast, Energy Fuels, with a market cap of about $3.75 billion, emphasizes both uranium and uranium/vanadium recovery, operating multiple projects, including the White Mesa Mill in Utah. Competitive pressure remains high as both companies innovate and adapt to technological disruptions. Market fluctuations and geopolitical factors also play crucial roles in shaping their strategies and market shares.

Stock Comparison

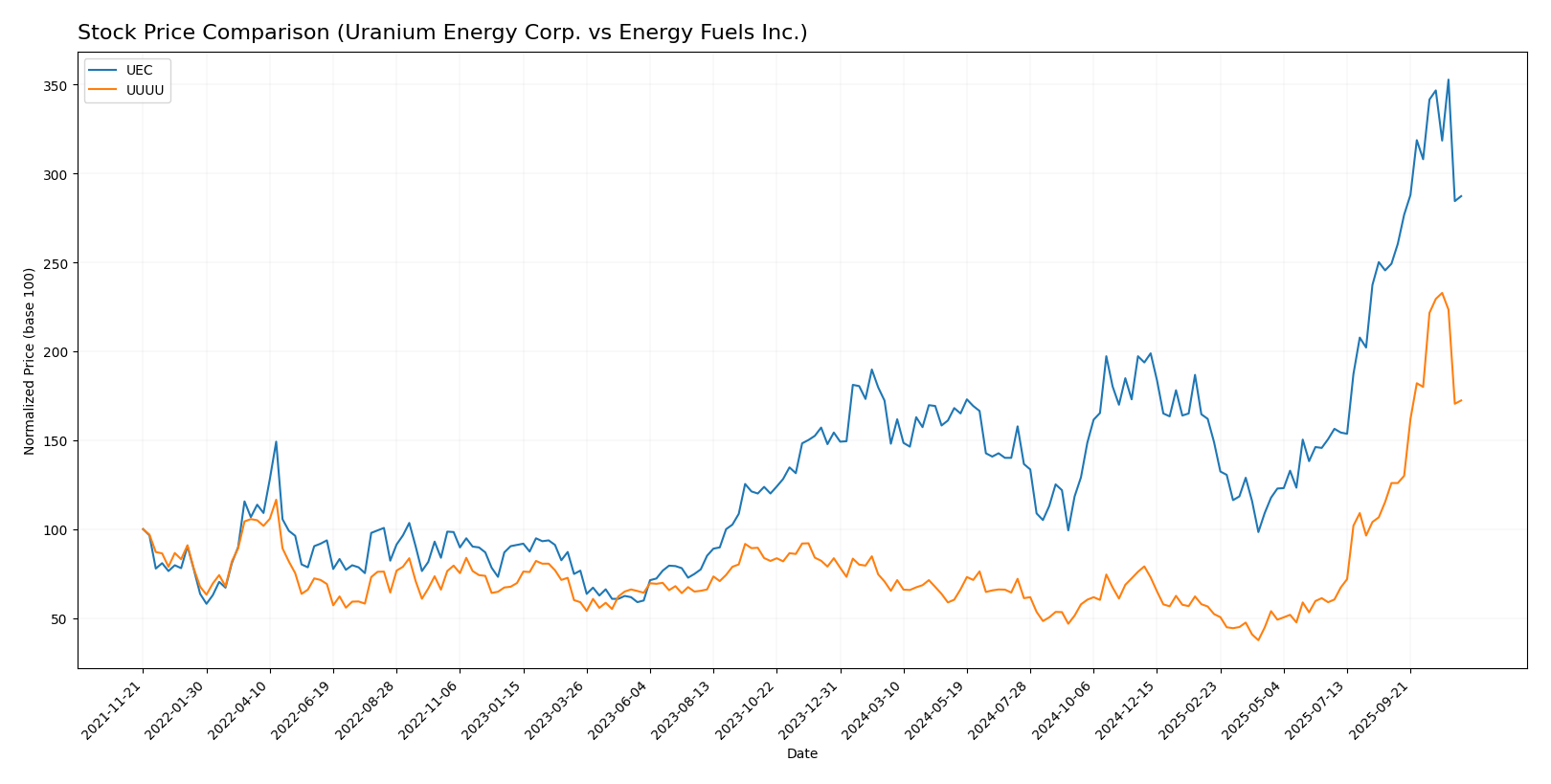

In the past year, both Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU) have demonstrated significant price movements, with UEC gaining 86.1% and UUUU increasing by 105.99%. The trading dynamics reveal a strong bullish trend for both companies, bolstered by notable price volatility.

Trend Analysis

Uranium Energy Corp. (UEC) has experienced a price change of 86.1% over the past year, indicating a bullish trend. The stock has shown acceleration, with its highest price reaching $15.13 and the lowest at $4.22. Between August 31 and November 16, 2025, the price increased by 15.25%. The average standard deviation during this period was 1.39, reflecting moderate volatility.

Energy Fuels Inc. (UUUU) similarly exhibited a bullish trend with a substantial price change of 105.99% over the past year. The trend is characterized by acceleration, with the stock achieving a peak price of $21.37 and a low of $3.45. In the recent analysis period from August 31 to November 16, 2025, UUUU’s price surged by 36.85%. The standard deviation of 3.52 suggests higher volatility compared to UEC, reflecting more significant price fluctuations.

Analyst Opinions

Recent analyst recommendations suggest a cautious outlook for both Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU). Analysts have rated UEC with a “C-” due to concerns over its financial metrics, particularly in debt management and profitability. On the other hand, UUUU has received a “D+” rating, indicating significant challenges in its operational performance and financial health. Given these ratings, the consensus for both companies leans towards a “sell” position for the current year, underscoring the importance of careful risk management in investment decisions.

Stock Grades

Recent evaluations from reputable analysts provide insights into two companies in the uranium sector: Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU). Here’s a closer look at their grades.

Uranium Energy Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | maintain | Buy | 2025-09-26 |

| BMO Capital | downgrade | Market Perform | 2025-09-25 |

| Roth Capital | maintain | Buy | 2025-09-25 |

| HC Wainwright & Co. | maintain | Buy | 2025-09-25 |

| Roth Capital | maintain | Buy | 2025-09-03 |

| HC Wainwright & Co. | maintain | Buy | 2025-08-06 |

| HC Wainwright & Co. | maintain | Buy | 2025-03-13 |

| HC Wainwright & Co. | maintain | Buy | 2024-12-09 |

| Roth MKM | maintain | Buy | 2024-10-23 |

| Roth MKM | maintain | Buy | 2024-09-25 |

Energy Fuels Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth Capital | downgrade | Sell | 2025-11-05 |

| HC Wainwright & Co. | maintain | Buy | 2025-11-04 |

| HC Wainwright & Co. | maintain | Buy | 2025-10-21 |

| B. Riley Securities | maintain | Buy | 2025-10-08 |

| HC Wainwright & Co. | maintain | Buy | 2025-09-17 |

| HC Wainwright & Co. | maintain | Buy | 2025-08-08 |

| Canaccord Genuity | maintain | Buy | 2025-07-02 |

| HC Wainwright & Co. | maintain | Buy | 2025-05-09 |

| HC Wainwright & Co. | maintain | Buy | 2025-02-28 |

| HC Wainwright & Co. | maintain | Buy | 2024-12-11 |

In summary, Uranium Energy Corp. maintains a generally positive outlook with a mix of “Buy” and a recent downgrade to “Market Perform,” while Energy Fuels Inc. has faced a more negative shift with a recent downgrade to “Sell,” despite several sustained “Buy” ratings from HC Wainwright & Co. This suggests a more cautious sentiment surrounding Energy Fuels. At the same time, Uranium Energy Corp. remains a solid option for investors.

Target Prices

The consensus target prices for Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU) indicate positive expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Uranium Energy Corp. | 19.75 | 14 | 17.08 |

| Energy Fuels Inc. | 26.75 | 11.5 | 19.13 |

For Uranium Energy Corp. (UEC), the consensus target price of $17.08 is significantly higher than the current market price of $12.32, indicating potential upside. Similarly, Energy Fuels Inc. (UUUU) has a consensus target price of $19.13, compared to its current price of $15.82, reflecting optimistic analyst sentiment.

Risk Analysis

In evaluating the investment potential for Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU), it’s essential to understand the various risks associated with both companies.

| Metric | Uranium Energy Corp. (UEC) | Energy Fuels Inc. (UUUU) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | High | Moderate |

| Operational Risk | High | High |

| Environmental Risk | Moderate | High |

| Geopolitical Risk | Moderate | Moderate |

Both companies face significant market and operational risks, with Energy Fuels Inc. exhibiting higher volatility. Recent regulatory changes and geopolitical tensions have added to the risks, particularly for UEC, which is heavily reliant on stable policy environments for uranium mining.

Which one to choose?

When comparing Uranium Energy Corp. (UEC) and Energy Fuels Inc. (UUUU), UEC appears to be the more favorable option for investors looking for growth potential. While both companies exhibit negative profit margins, UEC’s recent stock trend has shown an 86.1% price increase, with a bullish overall trend. Analysts have rated UEC with a C-, indicating a more positive outlook compared to UUU’s D+ rating. Additionally, UEC has a better current ratio and lower debt levels, suggesting a healthier financial position.

For investors focused on growth, UEC may be the preferred choice due to its upward price momentum and better financial ratios. However, potential risks include intense industry competition and market dependence that could impact both companies’ profitability.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

Discover my two complete analyses of Uranium Energy Corp and Energy Fuels Inc: