In the evolving uranium industry, Denison Mines Corp. and enCore Energy Corp. stand out as key players with distinct strategies and geographic focuses. Denison, based in Canada, centers on major projects in the Athabasca Basin, while enCore operates across several U.S. uranium properties. Comparing these companies offers insight into different approaches within the same sector. This article will help you decide which uranium stock presents the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Denison Mines Corp. and enCore Energy Corp. by providing an overview of these two companies and their main differences.

Denison Mines Corp. Overview

Denison Mines Corp. focuses on the acquisition, exploration, development, extraction, processing, and selling of uranium properties primarily in Canada. Its key asset is the Wheeler River uranium project in Saskatchewan’s Athabasca Basin. Founded in 1997 and headquartered in Toronto, Denison holds a leading position in the uranium mining sector, targeting the growing demand for nuclear energy resources.

enCore Energy Corp. Overview

enCore Energy Corp. is engaged in acquiring, exploring, and developing uranium resource properties across the United States. It owns multiple projects in New Mexico, South Dakota, Wyoming, and Utah, maintaining 100% interests in several significant uranium areas. Headquartered in Corpus Christi, Texas, and founded in 2011, enCore is a notable player in the U.S. uranium industry, positioning itself within the domestic energy supply chain.

Key similarities and differences

Both Denison and enCore operate in the uranium sector with an emphasis on exploration and development of uranium properties. Denison concentrates on Canadian assets with a flagship project, while enCore’s portfolio is diversified across several U.S. locations with full ownership of many sites. Each targets growing nuclear fuel demands but differs geographically and in project scale, with Denison having a larger market capitalization and a more concentrated asset base.

Income Statement Comparison

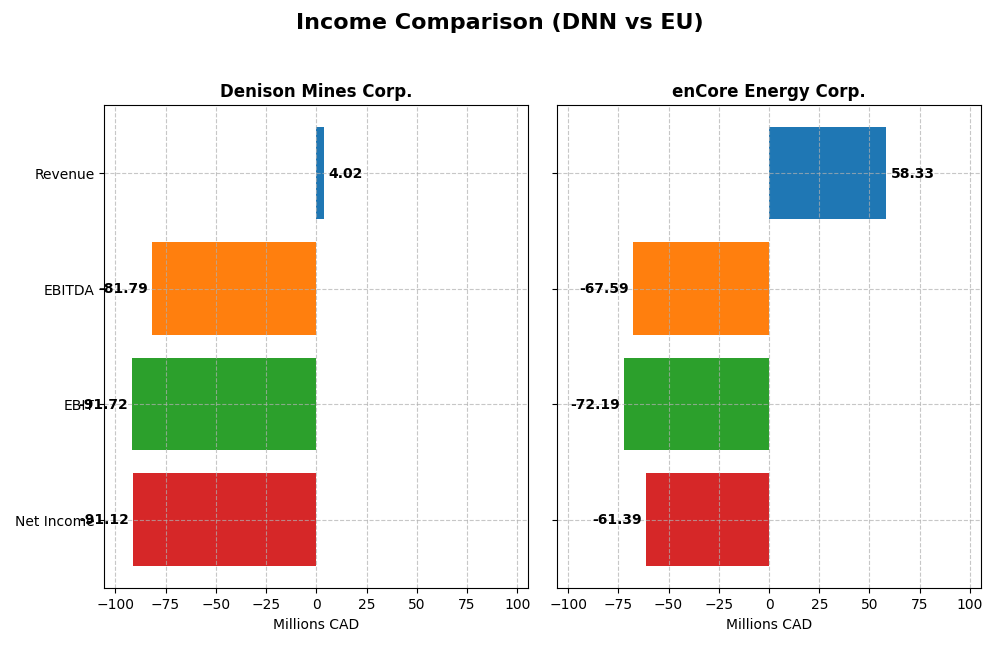

This table presents the key income statement metrics for Denison Mines Corp. and enCore Energy Corp. for the fiscal year 2024, enabling a straightforward financial comparison.

| Metric | Denison Mines Corp. (DNN) | enCore Energy Corp. (EU) |

|---|---|---|

| Market Cap | 2.97B CAD | 519M USD |

| Revenue | 4.02M CAD | 58.33M USD |

| EBITDA | -81.79M CAD | -67.59M USD |

| EBIT | -91.72M CAD | -72.19M USD |

| Net Income | -91.12M CAD | -61.39M USD |

| EPS | -0.10 CAD | -0.34 USD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Denison Mines Corp.

Denison Mines Corp. experienced fluctuating revenue from 2020 to 2024, peaking at 20M CAD in 2021 before declining to 4M CAD in 2024. Net income showed volatility, with a significant loss of -91.1M CAD in 2024 after a profit of 90.4M CAD in 2023. Margins deteriorated sharply in 2024, reflecting unfavorable gross and net margin trends, despite a 117% one-year revenue growth.

enCore Energy Corp.

enCore Energy Corp. saw revenue growth from 0 USD in 2020 to 58.3M USD in 2024, with net income remaining negative throughout, reaching -61.4M USD in 2024. Margins remained unfavorable, marked by negative gross and EBIT margins, though the net margin improved slightly in 2024. The company had a strong 163% revenue growth in the last year, but profitability remains elusive.

Which one has the stronger fundamentals?

Both Denison Mines and enCore Energy show overall unfavorable income statement fundamentals, with persistent losses and negative margins. Denison’s larger scale and recent sharp swings contrast with enCore’s consistent negative net income but higher revenue growth last year. Both companies face significant profitability challenges, reflected in their unfavorable global income statement evaluations.

Financial Ratios Comparison

The table below compares key financial ratios for Denison Mines Corp. (DNN) and enCore Energy Corp. (EU) based on their most recent fiscal year data ending in 2024.

| Ratios | Denison Mines Corp. (DNN) | enCore Energy Corp. (EU) |

|---|---|---|

| ROE | -16.15% | -21.49% |

| ROIC | -10.03% | -17.34% |

| P/E | -25.3 | -10.1 |

| P/B | 4.09 | 2.17 |

| Current Ratio | 3.65 | 2.91 |

| Quick Ratio | 3.54 | 2.21 |

| D/E | 0 | 0.072 |

| Debt-to-Assets | 0 | 5.20% |

| Interest Coverage | -586.3 | -41.6 |

| Asset Turnover | 0.0061 | 0.149 |

| Fixed Asset Turnover | 0.0155 | 0.197 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Denison Mines Corp.

Denison Mines shows mostly unfavorable financial ratios in 2024, with significant weaknesses in net margin (-2264.95%) and return on equity (-16.15%). The company has a strong quick ratio (3.54) and no debt, but concerns arise from poor asset turnover and negative interest coverage. It does not pay dividends, likely reflecting operational challenges or reinvestment priorities.

enCore Energy Corp.

enCore Energy’s 2024 ratios also lean unfavorable, with negative net margin (-105.24%) and return on equity (-21.49%). The liquidity position is relatively solid, with a current ratio of 2.91 and low debt levels. Like Denison, enCore pays no dividends, which may indicate a focus on growth, development, or ongoing investments rather than shareholder distributions.

Which one has the best ratios?

Both companies face significant challenges with negative profitability and returns, and neither pays dividends. enCore Energy exhibits a slightly better liquidity profile and lower debt risk, while Denison Mines has a marginally stronger quick ratio and no debt. However, both show unfavorable overall financial health, with no clear leader based on the provided ratios.

Strategic Positioning

This section compares the strategic positioning of Denison Mines Corp. and enCore Energy Corp., including market position, key segments, and exposure to disruption:

Denison Mines Corp.

- Larger market cap of 3B USD; faces competitive pressures in uranium exploration in Canada.

- Focused on uranium properties in Canada, notably the Wheeler River project in Saskatchewan.

- Operates in a traditional uranium industry with no explicit mention of technological disruption.

enCore Energy Corp.

- Smaller market cap of 519M USD; competes in U.S. uranium exploration and development markets.

- Concentrated on multiple uranium projects across New Mexico, South Dakota, Wyoming, and Utah in the U.S.

- Also in uranium industry with no stated exposure to technological disruption or innovation risks.

Denison Mines Corp. vs enCore Energy Corp. Positioning

Denison’s strategy is geographically concentrated in Canada with a flagship project, while enCore diversifies across several U.S. uranium properties. Denison benefits from scale but narrower regional focus, whereas enCore has broader asset spread but smaller market presence.

Which has the best competitive advantage?

Both companies are shedding value as their ROIC falls below WACC; Denison shows stable but unfavorable profitability, while enCore experiences declining returns and a very unfavorable moat status.

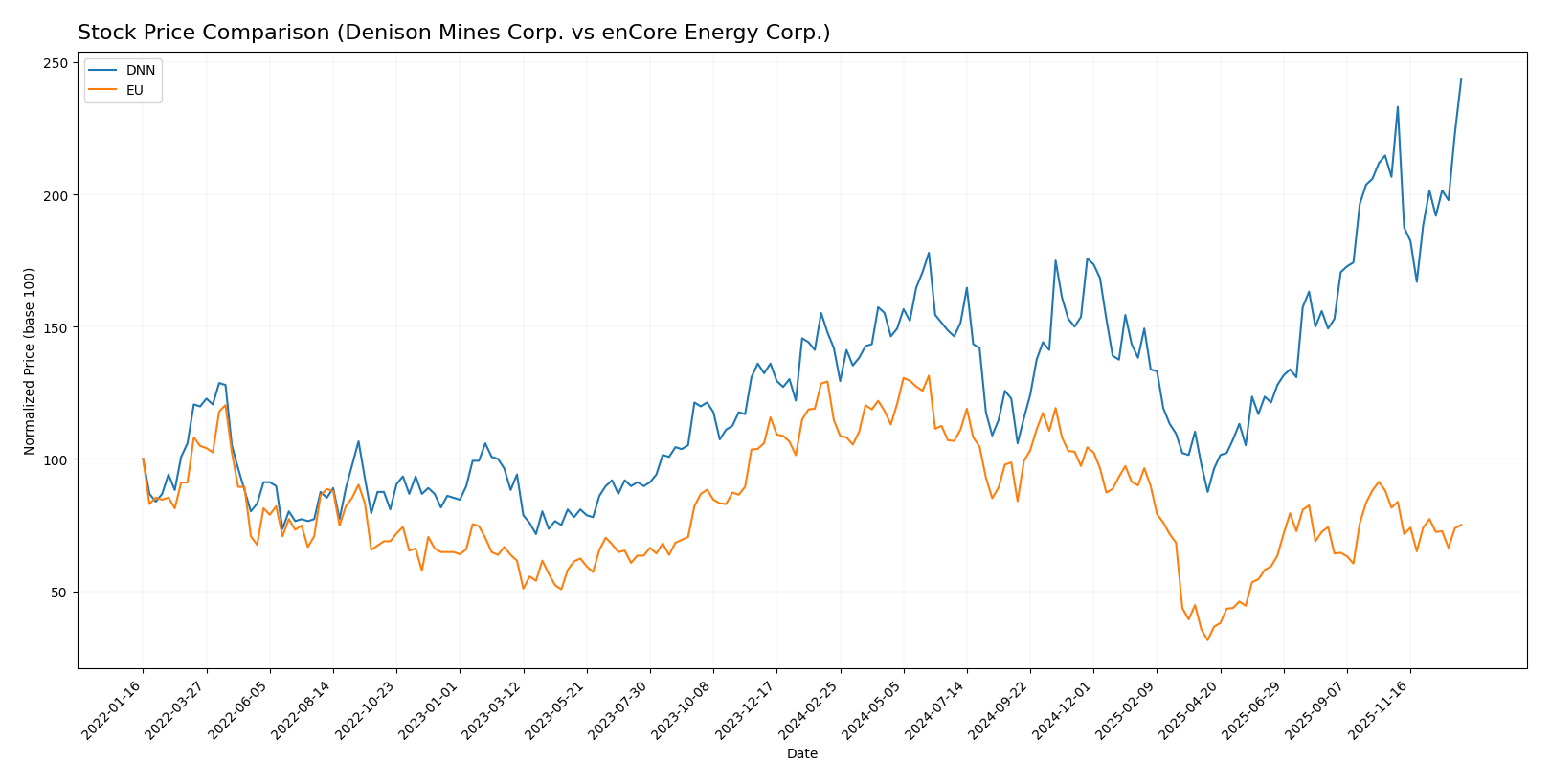

Stock Comparison

The stock price movements of Denison Mines Corp. (DNN) and enCore Energy Corp. (EU) over the past year reveal contrasting trading dynamics, with DNN showing strong gains and EU experiencing a significant decline.

Trend Analysis

Denison Mines Corp. (DNN) exhibited a bullish trend over the past 12 months, with a 71.5% price increase and accelerating momentum. The stock ranged from a low of 1.19 to a high of 3.31, showing moderate volatility (std deviation 0.44).

enCore Energy Corp. (EU) showed a bearish trend with a -34.52% price drop over the same period and decelerating decline. The price fluctuated between 1.16 and 4.85, with higher volatility (std deviation 0.92).

Comparing the two, DNN delivered the highest market performance with strong upward momentum, while EU faced a sustained and accelerating downturn.

Target Prices

Here is the current target price consensus from recognized analysts for the uranium sector.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Denison Mines Corp. | 2.6 | 2.6 | 2.6 |

| enCore Energy Corp. | 3.5 | 3.5 | 3.5 |

Analysts expect Denison Mines to trade below its current price of 3.31 USD, while enCore Energy’s consensus target of 3.5 USD suggests upside from its 2.77 USD market price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Denison Mines Corp. and enCore Energy Corp.:

Rating Comparison

DNN Rating

- Rating: Both companies share a “C-” rating, classified as Very Favorable.

- Discounted Cash Flow Score: DNN scores 3, indicating a Moderate valuation outlook.

- ROE Score: DNN has a 1 score, marked as Very Unfavorable for profitability efficiency.

- ROA Score: DNN records a 1, reflecting Very Unfavorable asset utilization.

- Debt To Equity Score: DNN scores 1, showing Very Unfavorable financial risk due to higher debt.

- Overall Score: DNN’s overall score is 1, categorized as Very Unfavorable financial standing.

EU Rating

- Rating: Both companies share a “C-” rating, classified as Very Favorable.

- Discounted Cash Flow Score: EU scores 1, signaling a Very Unfavorable valuation outlook.

- ROE Score: EU also scores 1, indicating Very Unfavorable profitability efficiency.

- ROA Score: EU matches with a 1 score, equally Very Unfavorable for asset utilization.

- Debt To Equity Score: EU scores 2, a Moderate level of financial risk.

- Overall Score: EU’s overall score is 1, also categorized as Very Unfavorable financial standing.

Which one is the best rated?

Both DNN and EU hold identical “C-” ratings with overall scores of 1, reflecting very unfavorable financial standings. DNN shows a better discounted cash flow score, while EU has a moderately better debt-to-equity score, indicating mixed strengths.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Denison Mines Corp. and enCore Energy Corp.:

Denison Mines Corp. Scores

- Altman Z-Score: 0.73, in distress zone, high risk of bankruptcy.

- Piotroski Score: 4, indicating average financial strength.

enCore Energy Corp. Scores

- Altman Z-Score: 1.17, also in distress zone, elevated bankruptcy risk.

- Piotroski Score: 4, indicating average financial strength.

Which company has the best scores?

Both Denison Mines and enCore Energy are in the Altman Z-Score distress zone, signaling financial risk. Their Piotroski Scores are identical at 4, reflecting average financial health. Neither distinctly outperforms the other based on these scores.

Grades Comparison

The grades given by recognized financial institutions for Denison Mines Corp. and enCore Energy Corp. are as follows:

Denison Mines Corp. Grades

This table summarizes recent grades from established grading companies for Denison Mines Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth MKM | Maintain | Buy | 2024-10-23 |

| TD Securities | Maintain | Speculative Buy | 2023-06-27 |

| Raymond James | Maintain | Outperform | 2023-06-27 |

| TD Securities | Maintain | Speculative Buy | 2023-06-26 |

| Raymond James | Maintain | Outperform | 2023-06-26 |

| Credit Suisse | Downgrade | Underperform | 2017-07-18 |

| Credit Suisse | Downgrade | Underperform | 2017-07-17 |

| Roth Capital | Maintain | Buy | 2016-02-10 |

| Credit Suisse | Upgrade | Neutral | 2014-04-01 |

| Credit Suisse | Upgrade | Neutral | 2014-03-31 |

Denison Mines Corp. has consistently maintained buy and outperform ratings from several reputable firms recently, showing a generally positive trend.

enCore Energy Corp. Grades

This table shows recent evaluations from recognized grading companies for enCore Energy Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-08-12 |

| HC Wainwright & Co. | Maintain | Buy | 2025-05-13 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-18 |

| HC Wainwright & Co. | Maintain | Buy | 2024-11-19 |

| HC Wainwright & Co. | Maintain | Buy | 2024-10-07 |

| HC Wainwright & Co. | Maintain | Buy | 2024-08-15 |

| HC Wainwright & Co. | Maintain | Buy | 2024-06-14 |

| B. Riley Securities | Maintain | Buy | 2024-05-15 |

enCore Energy Corp. has received consistent buy ratings from HC Wainwright & Co. and B. Riley Securities, indicating stable positive assessment.

Which company has the best grades?

Both Denison Mines Corp. and enCore Energy Corp. hold a consensus “Buy” rating. However, Denison Mines displays a broader range of grading companies and some higher ratings such as “Outperform,” while enCore Energy shows uniform buy grades from fewer sources. This diversity may impact investor confidence differently depending on preferences for breadth versus consistency.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of Denison Mines Corp. (DNN) and enCore Energy Corp. (EU) based on their diversification, profitability, innovation, global presence, and market share using the most recent data.

| Criterion | Denison Mines Corp. (DNN) | enCore Energy Corp. (EU) |

|---|---|---|

| Diversification | Limited product range, focused on mining | Focused on uranium energy, limited scope |

| Profitability | Negative net margin (-2264.95%), ROIC -10.03%, shedding value | Negative net margin (-105.24%), ROIC -17.34%, value destroying |

| Innovation | Moderate, no significant breakthroughs recently | Limited innovation, declining profitability |

| Global presence | Moderate, operating primarily in North America | Smaller footprint, mainly US-based |

| Market Share | Niche player in uranium mining | Smaller player, struggling market position |

Key takeaways: Both companies show unfavorable profitability and are currently destroying value with declining or stable negative returns on invested capital. Investors should be cautious due to limited diversification and weak innovation, with enCore Energy facing a more severe decline in profitability.

Risk Analysis

Below is a comparative table highlighting key risk factors for Denison Mines Corp. (DNN) and enCore Energy Corp. (EU) based on the latest 2024 data:

| Metric | Denison Mines Corp. (DNN) | enCore Energy Corp. (EU) |

|---|---|---|

| Market Risk | High beta at 1.89, volatile uranium sector | Moderate beta at 1.44, uranium market exposure |

| Debt Level | No reported debt (D/E = 0) | Low debt (D/E = 0.07) |

| Regulatory Risk | Moderate, Canadian uranium regulations | Moderate, US uranium mining regulations |

| Operational Risk | High, negative net margin and low asset turnover | High, negative net margin but better asset turnover |

| Environmental Risk | Significant due to uranium mining impact | Significant due to uranium mining impact |

| Geopolitical Risk | Moderate, Canadian base but global uranium market sensitive | Higher, US domestic focus with potential export restrictions |

In synthesis, both companies face considerable operational and market risks due to negative profitability and exposure to volatile uranium markets. Denison Mines shows no debt, which reduces financial risk, but its profitability metrics are worse. enCore has some debt but slightly better operational efficiency. Regulatory and environmental risks remain impactful for both, with geopolitical factors posing more uncertainty for the US-based enCore. Investors should weigh these risks carefully alongside potential uranium market recoveries.

Which Stock to Choose?

Denison Mines Corp. (DNN) shows a mixed income evolution with a 117% revenue growth in the last year but overall unfavorable profitability, marked by negative net margin and ROE. Its financial ratios reveal mostly unfavorable metrics, including a high EV to sales ratio and negative returns, though it maintains zero debt and a favorable quick ratio. The rating is very favorable overall, despite weak scores in key financial areas.

enCore Energy Corp. (EU) presents strong recent revenue growth but suffers from negative profitability and declining ROIC. Financial ratios are mostly unfavorable but include several favorable liquidity and leverage metrics, with low debt levels and a neutral price-to-book ratio. The company’s rating is also very favorable, yet financial stability concerns remain, reflected in distress zone scores.

For investors prioritizing growth potential, Denison Mines might appear more attractive given its positive revenue momentum and zero debt, while risk-averse or quality-focused investors may find enCore Energy’s better liquidity ratios and moderate leverage preferable despite its declining profitability. Both companies display unfavorable global financial and income evaluations, indicating high risk profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Denison Mines Corp. and enCore Energy Corp. to enhance your investment decisions: