Investors seeking opportunities in the industrial machinery sector often face a choice between established giants and innovative disruptors. Emerson Electric Co. (EMR), with its extensive history and diversified product portfolio, contrasts sharply with Nano Nuclear Energy Inc. (NNE), a newcomer focused on cutting-edge microreactor technology. This comparison explores their market positions, innovation strategies, and growth potential to help you decide which company deserves a spot in your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Emerson Electric Co. and Nano Nuclear Energy Inc by providing an overview of these two companies and their main differences.

Emerson Electric Co. Overview

Emerson Electric Co. is a technology and engineering company focused on delivering solutions across industrial, commercial, and residential markets globally. It operates through Automation Solutions, offering instrumentation and process control systems, and Commercial & Residential Solutions, providing heating, air conditioning, and environmental control products. Founded in 1890 and headquartered in Saint Louis, MO, Emerson serves diverse sectors including oil and gas, power generation, and food and beverage.

Nano Nuclear Energy Inc Overview

Nano Nuclear Energy Inc. is a microreactor technology company developing advanced nuclear reactors like ZEUS and ODIN, along with a uranium fabrication facility. Founded in 2021 and based in New York City, it focuses on innovative nuclear energy solutions including fuel transportation and consultation services. Despite its recent establishment, NNE is active in the nuclear reactor industry with a concentrated workforce of 5 employees.

Key similarities and differences

Both companies operate within the industrial machinery sector but serve distinct markets and scales. Emerson is a well-established multinational with broad product lines in industrial and residential solutions, while Nano Nuclear Energy is a niche player specializing in microreactors and nuclear fuel technologies. Emerson’s large workforce and diversified offerings contrast with NNE’s focused, technology-driven approach and small team, reflecting different stages of company maturity and market presence.

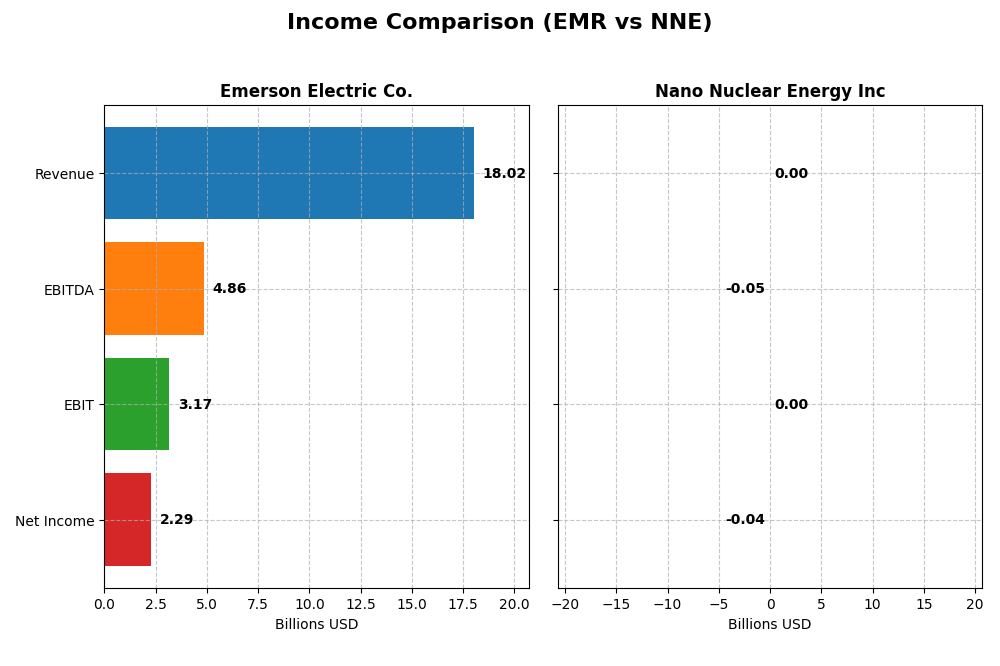

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Emerson Electric Co. and Nano Nuclear Energy Inc. for their latest fiscal year 2025.

| Metric | Emerson Electric Co. | Nano Nuclear Energy Inc |

|---|---|---|

| Market Cap | 81.0B | 1.33B |

| Revenue | 18.0B | 0 |

| EBITDA | 4.86B | -46.2M |

| EBIT | 3.17B | 0 |

| Net Income | 2.29B | -40.1M |

| EPS | 4.06 | -1.06 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Emerson Electric Co.

Emerson Electric Co. demonstrated steady revenue growth from $12.9B in 2021 to $18B in 2025, with net income fluctuating and ending at $2.29B in 2025. Margins showed mixed trends; gross margin was favorable at 52.84%, and net margin improved to 12.73%. The 2025 year saw modest revenue growth slow to 3%, but operating income and net margins improved significantly.

Nano Nuclear Energy Inc

Nano Nuclear Energy Inc reported zero revenue throughout 2022-2025, incurring increasing net losses, reaching -$40M in 2025. Margins remained unfavorable, with gross and net margins at zero, reflecting the company’s development stage and lack of commercial sales. Despite negative earnings, some growth metrics like EBIT and EPS improved due to controlled expenses and research investment.

Which one has the stronger fundamentals?

Emerson Electric Co. exhibits stronger fundamentals, supported by consistent revenue growth, positive net income, and favorable margins, including a solid gross margin above 50%. In contrast, Nano Nuclear Energy Inc operates with no revenue and persistent losses, reflecting early-stage development risks. Emerson’s stable profitability and margin improvements outweigh Nano Nuclear’s unfavorable income statement profile.

Financial Ratios Comparison

This table presents the most recent key financial ratios for Emerson Electric Co. (EMR) and Nano Nuclear Energy Inc (NNE) as of fiscal year 2025, allowing a direct comparison of their financial metrics.

| Ratios | Emerson Electric Co. (EMR) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| ROE | 11.30% | -18.00% |

| ROIC | 4.62% | -20.51% |

| P/E | 32.42 | -0.04 |

| P/B | 3.66 | 0.01 |

| Current Ratio | 0.88 | 53.48 |

| Quick Ratio | 0.65 | 53.48 |

| D/E (Debt-to-Equity) | 0.65 | 0.01 |

| Debt-to-Assets | 31.26% | 1.22% |

| Interest Coverage | 9.44 | 0 |

| Asset Turnover | 0.43 | 0 |

| Fixed Asset Turnover | 6.28 | 0 |

| Payout Ratio | 52.0% | 0 |

| Dividend Yield | 1.60% | 0 |

Interpretation of the Ratios

Emerson Electric Co.

Emerson Electric shows a mixed ratio profile with a favorable net margin of 12.73% and strong interest coverage at 13.38, but weaker liquidity indicated by a current ratio of 0.88 and quick ratio of 0.65. The company’s return on equity is neutral at 11.3%, while return on invested capital is unfavorable at 4.62%. Dividend yield stands at 1.6%, with stable payouts supported by cash flow, though some valuation metrics like P/E at 32.42 and P/B at 3.66 raise concerns.

Nano Nuclear Energy Inc

Nano Nuclear Energy exhibits several unfavorable profitability ratios, including a negative 18% return on equity and a net margin of zero. However, its valuation ratios such as price-to-book of 0.01 and price-to-earnings of -0.04 are favorable, reflecting a low market valuation. The company pays no dividend, likely due to its negative earnings and reinvestment focus, with a high current ratio of 53.48 reflecting substantial liquidity but operational inefficiency signs.

Which one has the best ratios?

Between the two, Emerson Electric presents a more balanced ratio set with some favorable profitability and coverage ratios despite liquidity challenges, while Nano Nuclear Energy suffers from deeper profitability issues and operational inefficiencies. Emerson’s dividend yield and interest coverage add to its relative strength, making its overall ratio evaluation slightly unfavorable but more stable compared to Nano Nuclear’s unfavorable profile.

Strategic Positioning

This section compares the strategic positioning of Emerson Electric Co. and Nano Nuclear Energy Inc., including Market position, Key segments, and exposure to technological disruption:

Emerson Electric Co.

- Large-cap industrial machinery firm facing typical competitive pressures in diverse markets globally.

- Operates Automation Solutions and Commercial & Residential Solutions, serving multiple industrial and commercial sectors.

- Exposure to technological disruption moderate, with established automation and control software segments.

Nano Nuclear Energy Inc

- Small-cap microreactor developer in early stage with high beta, facing emerging competitive dynamics.

- Focused on microreactor technology with products like ZEUS and ODIN, plus fuel fabrication and consulting.

- High exposure to disruption, developing advanced nuclear microreactors and new fuel technologies.

Emerson Electric Co. vs Nano Nuclear Energy Inc Positioning

Emerson Electric is a diversified industrial technology company with broad market exposure and established product lines, whereas Nano Nuclear Energy is concentrated on innovative microreactor technology, presenting different risk and growth profiles based on scale and business focus.

Which has the best competitive advantage?

Both companies show value destruction relative to cost of capital, but Nano Nuclear Energy’s improving ROIC trend indicates potential for future profitability, while Emerson’s declining ROIC suggests current challenges in sustaining competitive advantage.

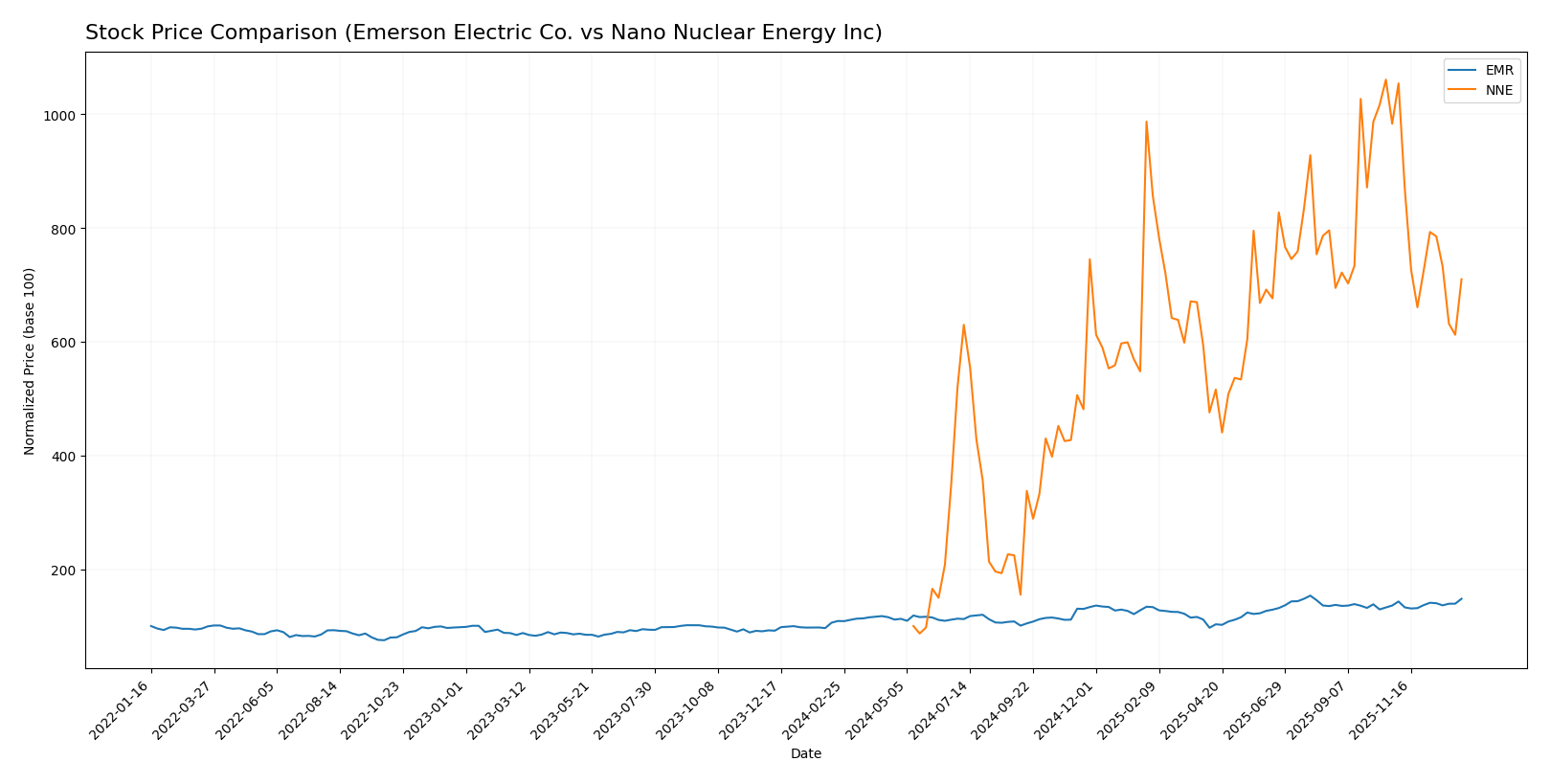

Stock Comparison

The stock price movements of Emerson Electric Co. (EMR) and Nano Nuclear Energy Inc (NNE) over the past 12 months reveal contrasting dynamics, with EMR showing steady gains and NNE experiencing significant volatility and recent declines.

Trend Analysis

Emerson Electric Co. exhibited a 35.86% price increase over the past year, indicating a bullish trend with accelerating momentum and a notable price range between 94.57 and 149.63. Recent months continued this positive slope with an 8.7% gain.

Nano Nuclear Energy Inc posted a substantial 609.76% increase over the year, signaling a strong bullish trend but with deceleration. Its price ranged widely from 3.92 to 47.84. However, the recent period saw a sharp 27.81% decline, reflecting short-term weakness.

Comparing both stocks, NNE delivered the highest overall market performance during the year, despite its recent downturn, while EMR maintained a more consistent and steadily accelerating upward trend.

Target Prices

The current analyst consensus presents a clear outlook on target prices for both Emerson Electric Co. and Nano Nuclear Energy Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Emerson Electric Co. | 170 | 125 | 149.67 |

| Nano Nuclear Energy Inc | 50 | 50 | 50 |

Analysts expect Emerson Electric’s stock to trade modestly above its current price of $144.2, indicating moderate upside potential. Nano Nuclear Energy’s consensus target of $50 suggests significant growth compared to its current price near $32.01.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Emerson Electric Co. and Nano Nuclear Energy Inc:

Rating Comparison

EMR Rating

- Rated B, indicating a very favorable overall evaluation by analysts.

- Discounted Cash Flow Score of 3, reflecting moderate valuation based on future cash flows.

- Return on Equity Score of 3, indicating moderate efficiency in generating profit from equity.

- Return on Assets Score of 4, favorable use of assets to generate earnings.

- Debt To Equity Score of 2, moderate financial risk with some reliance on debt.

- Overall Score of 3, reflecting a moderate overall financial standing.

NNE Rating

- Rated C with a very favorable status despite a lower rating grade.

- Discounted Cash Flow Score of 2, showing moderate caution on valuation.

- Return on Equity Score of 1, considered very unfavorable showing weak profit generation.

- Return on Assets Score of 1, very unfavorable, indicating poor asset utilization.

- Debt To Equity Score of 5, very favorable, indicating strong balance sheet and low financial risk.

- Overall Score of 2, showing moderate overall financial health but weaker than EMR.

Which one is the best rated?

Based strictly on the provided data, Emerson Electric Co. holds a higher rating (B vs. C) and better overall and profitability scores. Nano Nuclear Energy shows strength in debt management but lags significantly in profit generation and asset use scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Emerson Electric Co. and Nano Nuclear Energy Inc.:

EMR Scores

- Altman Z-Score: 2.68, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

NNE Scores

- Altman Z-Score: 143.56, in the safe zone indicating very low bankruptcy risk.

- Piotroski Score: 2, classified as very weak financial health.

Which company has the best scores?

Nano Nuclear Energy Inc. shows a much higher Altman Z-Score, placing it clearly in the safe zone, while Emerson Electric Co. has a stronger Piotroski Score, reflecting better financial health. The scores demonstrate contrasting strengths.

Grades Comparison

Here is a comparison of the recent grades assigned to Emerson Electric Co. and Nano Nuclear Energy Inc:

Emerson Electric Co. Grades

The table below summarizes recent grades from reputable grading companies for Emerson Electric Co.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-07 |

| Barclays | Maintain | Equal Weight | 2026-01-07 |

| UBS | Upgrade | Buy | 2026-01-05 |

| Jefferies | Downgrade | Hold | 2025-12-10 |

| JP Morgan | Maintain | Neutral | 2025-11-10 |

| RBC Capital | Maintain | Outperform | 2025-11-06 |

| Barclays | Maintain | Equal Weight | 2025-11-06 |

| RBC Capital | Maintain | Outperform | 2025-10-16 |

| JP Morgan | Maintain | Neutral | 2025-10-15 |

| Wells Fargo | Downgrade | Equal Weight | 2025-10-06 |

Emerson Electric Co.’s grades show a mixed trend with multiple “Equal Weight” and “Neutral” ratings, occasional upgrades to “Buy,” and consistent “Outperform” ratings by RBC Capital.

Nano Nuclear Energy Inc Grades

The table below presents recent grades from known grading companies for Nano Nuclear Energy Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-08-19 |

| Ladenburg Thalmann | Downgrade | Sell | 2025-08-18 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-15 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-31 |

| HC Wainwright & Co. | Maintain | Buy | 2025-01-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-11-27 |

| Benchmark | Maintain | Buy | 2024-11-07 |

| Benchmark | Maintain | Buy | 2024-07-15 |

| Benchmark | Maintain | Buy | 2024-06-25 |

Nano Nuclear Energy Inc maintains predominantly “Buy” ratings, with one notable downgrade to “Sell” by Ladenburg Thalmann.

Which company has the best grades?

Both companies have consensus ratings of “Buy,” but Emerson Electric Co.’s grades are more mixed with several “Hold” and “Neutral” ratings, whereas Nano Nuclear Energy Inc. shows predominantly “Buy” ratings despite one “Sell.” Nano Nuclear Energy’s stronger buy consensus may suggest higher confidence by some analysts, potentially providing more optimistic investment signals.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Emerson Electric Co. (EMR) and Nano Nuclear Energy Inc (NNE) based on the latest financial and operational data.

| Criterion | Emerson Electric Co. (EMR) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| Diversification | Broad product portfolio including Intelligent Devices and Software & Control with multi-sector exposure | Limited diversification; primarily focused on nuclear energy technology |

| Profitability | Moderate net margin (12.7%) but declining ROIC, indicating weakening profitability | Negative net margin and ROIC, currently unprofitable but improving ROIC trend |

| Innovation | Established company with steady innovation in automation and control solutions | Emerging player with high innovation potential in nuclear tech but unproven profitability |

| Global presence | Strong global presence with extensive international operations | Limited global footprint as a smaller, newer company |

| Market Share | Significant market share in automation and industrial devices | Small market share, niche player in nuclear energy |

Key takeaways: Emerson Electric offers diversification and stable profitability but faces challenges with declining capital efficiency. Nano Nuclear Energy shows promise with improving profitability trends and innovation but remains unprofitable and less diversified. Investors should weigh established stability against growth potential and risk tolerance.

Risk Analysis

Below is a comparative risk analysis for Emerson Electric Co. (EMR) and Nano Nuclear Energy Inc. (NNE) based on the latest 2025 data.

| Metric | Emerson Electric Co. (EMR) | Nano Nuclear Energy Inc. (NNE) |

|---|---|---|

| Market Risk | Beta 1.25, moderate market volatility | Beta 7.49, very high market volatility |

| Debt level | Debt-to-equity 0.65 (neutral) | Debt-to-equity 0.01 (very low, favorable) |

| Regulatory Risk | Moderate, industrial sector compliance | High, nuclear energy is heavily regulated |

| Operational Risk | Moderate, diversified industrial ops | High, early-stage microreactor tech |

| Environmental Risk | Moderate, energy and machinery impact | High, nuclear safety and waste concerns |

| Geopolitical Risk | Moderate, global operations exposure | Elevated, nuclear tech sensitive to geopolitics |

Synthesizing these risks, NNE exhibits significantly higher market, regulatory, operational, and environmental risks due to its pioneering nuclear technology and regulatory environment. EMR’s risks are more moderate and diversified, with its debt level and operational scale providing some stability. Investors should be cautious with NNE given its volatility and regulatory challenges, while EMR presents a more balanced risk profile with moderate market exposure.

Which Stock to Choose?

Emerson Electric Co. (EMR) shows a generally favorable income statement with stable profitability, a net margin of 12.73%, and moderate revenue growth of 3% in 2025. However, the company faces slightly unfavorable financial ratios, including a below-par current ratio of 0.88 and a net debt to EBITDA of 2.38, while maintaining a solid interest coverage ratio. Its rating is very favorable with a “B” grade, although its MOAT evaluation signals value destruction due to declining ROIC.

Nano Nuclear Energy Inc (NNE) displays an unfavorable income statement with zero net margin and negative returns on equity and invested capital. Despite a very favorable rating of “C” mainly due to low debt and valuation ratios, its financial ratios reveal severe profitability challenges and a high net debt to EBITDA ratio of 4.34. The company’s MOAT is slightly unfavorable, showing value destruction but with a growing ROIC trend.

Investors focused on stable profitability and a favorable income profile may find EMR’s fundamentals more appealing, while those willing to accept higher risk for possible turnaround potential could interpret NNE’s improving ROIC as a sign of emerging value. The ratings and financial ratio evaluations suggest EMR offers a more balanced risk-return profile compared to NNE’s current financial instability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Emerson Electric Co. and Nano Nuclear Energy Inc to enhance your investment decisions: