Howmet Aerospace Inc. (HWM) and Emerson Electric Co. (EMR) are two prominent players in the industrial machinery sector, each driving innovation in engineering solutions and automation technologies. Howmet focuses on advanced aerospace components, while Emerson specializes in automation and commercial systems. Their overlapping market presence and differing innovation strategies make them compelling candidates for comparison. In this article, I will help you identify which company holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Howmet Aerospace Inc. and Emerson Electric Co. by providing an overview of these two companies and their main differences.

Howmet Aerospace Inc. Overview

Howmet Aerospace Inc. specializes in advanced engineered solutions for aerospace and transportation industries globally. The company operates through four segments: Engine Products, Fastening Systems, Engineered Structures, and Forged Wheels. It focuses on manufacturing components such as airfoils, fastening systems, and forged aluminum wheels. Founded in 1888 and based in Pittsburgh, Pennsylvania, Howmet serves a broad international market with a workforce of 23,930 employees.

Emerson Electric Co. Overview

Emerson Electric Co. is a technology and engineering firm providing solutions for industrial, commercial, and residential markets worldwide. It operates in two main segments: Automation Solutions and Commercial & Residential Solutions. Emerson supplies products including instrumentation, valves, HVAC components, and control systems across diverse sectors such as oil and gas, life sciences, and residential heating. Founded in 1890 and headquartered in Saint Louis, Missouri, it employs approximately 73,000 people.

Key similarities and differences

Both Howmet Aerospace and Emerson Electric operate within the industrial machinery sector, serving global markets with specialized engineered products. Howmet’s focus is primarily on aerospace and transportation component manufacturing, while Emerson has a broader technological and engineering scope including automation and residential solutions. Emerson employs significantly more staff and offers a wider range of products catering to multiple industries beyond aerospace, highlighting differences in scale and diversification.

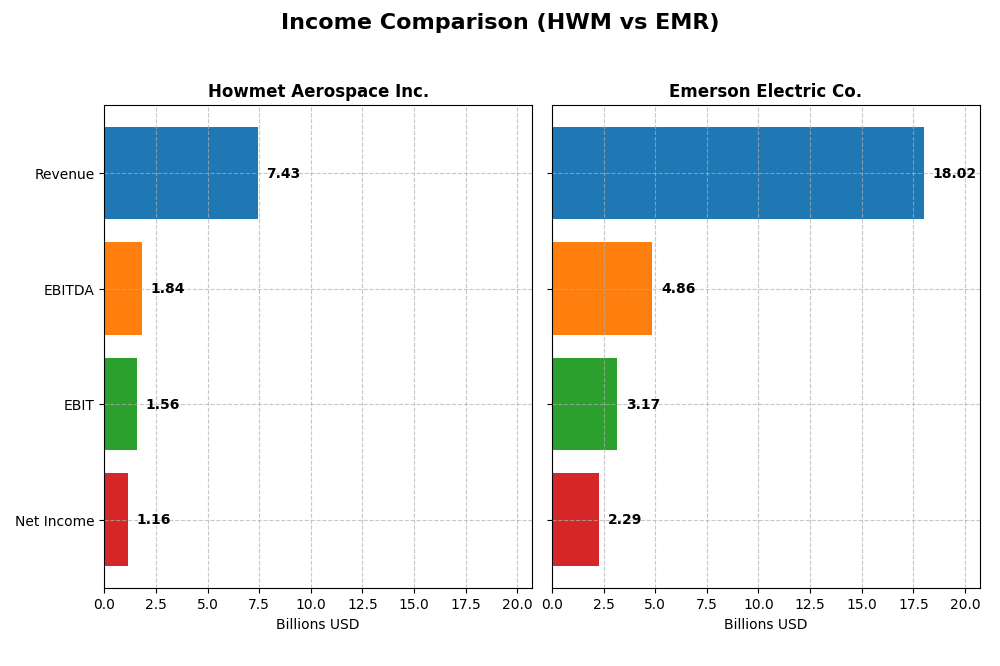

Income Statement Comparison

This table compares key income statement metrics for Howmet Aerospace Inc. and Emerson Electric Co. for their most recent fiscal year, providing a snapshot of their financial performance.

| Metric | Howmet Aerospace Inc. (HWM) | Emerson Electric Co. (EMR) |

|---|---|---|

| Market Cap | 87.99B | 81.00B |

| Revenue | 7.43B | 18.02B |

| EBITDA | 1.84B | 4.86B |

| EBIT | 1.57B | 3.17B |

| Net Income | 1.16B | 2.29B |

| EPS | 2.83 | 4.06 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Howmet Aerospace Inc.

Howmet Aerospace has shown strong revenue growth from 5.26B in 2020 to 7.43B in 2024, with net income rising impressively from 209M to 1.16B. Margins have consistently improved, with a gross margin of 27.62% and net margin of 15.55% in 2024, reflecting favorable cost control. The most recent year saw 11.9% revenue growth and a notable 34.93% increase in net margin, highlighting solid operational leverage.

Emerson Electric Co.

Emerson’s revenue expanded from 12.93B in 2021 to 18.02B in 2025, though net income fluctuated, peaking at 13.22B in 2023 then dropping to 2.29B in 2025. Gross margin is robust at 52.84%, but net margin stands lower at 12.73%. The latest fiscal year showed slower revenue growth at 3.0% and a mixed margin picture, with net margin growth favorable but revenue and operating expenses growth marked unfavorable.

Which one has the stronger fundamentals?

Howmet Aerospace demonstrates more consistent and robust growth in both revenue and net income, with steadily improving margins and favorable expense management. Emerson Electric posts higher absolute revenue and gross margins but faces volatility in net income and mixed growth signals. Both companies have favorable overall income statement evaluations, yet Howmet’s stronger margin expansion and earnings growth suggest more stable fundamentals.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Howmet Aerospace Inc. (HWM) and Emerson Electric Co. (EMR) based on their most recent fiscal data.

| Ratios | Howmet Aerospace Inc. (2024) | Emerson Electric Co. (2025) |

|---|---|---|

| ROE | 25.36% | 11.30% |

| ROIC | 15.49% | 4.62% |

| P/E | 38.63 | 32.42 |

| P/B | 9.80 | 3.66 |

| Current Ratio | 2.17 | 0.88 |

| Quick Ratio | 0.98 | 0.65 |

| D/E (Debt-to-Equity) | 0.76 | 0.65 |

| Debt-to-Assets | 33.00% | 31.26% |

| Interest Coverage | 9.19 | 9.44 |

| Asset Turnover | 0.71 | 0.43 |

| Fixed Asset Turnover | 2.92 | 6.28 |

| Payout Ratio | 9.44% | 51.98% |

| Dividend Yield | 0.24% | 1.60% |

Interpretation of the Ratios

Howmet Aerospace Inc.

Howmet Aerospace shows strong profitability ratios with a net margin of 15.55% and return on equity of 25.36%, indicating efficient profit generation. Liquidity is solid with a current ratio of 2.17, while leverage and coverage ratios are neutral to favorable. However, valuation ratios such as PE at 38.63 and PB at 9.8 are considered unfavorable. The company pays a modest dividend with a low yield of 0.24%, suggesting cautious distribution relative to earnings.

Emerson Electric Co.

Emerson Electric presents favorable net margin at 12.73% and strong interest coverage of 13.38, yet return on invested capital is weak at 4.62%, signaling less efficient capital use. Liquidity ratios are unfavorable, with current and quick ratios below 1. Valuation metrics like PE at 32.42 and PB at 3.66 also raise concerns. The dividend yield is moderate at 1.6%, supported by a neutral payout stance, reflecting steady shareholder returns.

Which one has the best ratios?

Howmet Aerospace exhibits a more favorable ratio profile overall, with higher profitability and liquidity metrics, despite some valuation concerns. Emerson Electric shows mixed results, with weaker capital efficiency and liquidity but stronger interest coverage. The global evaluation favors Howmet slightly, indicating it holds stronger financial ratios compared to Emerson under current conditions.

Strategic Positioning

This section compares the strategic positioning of Howmet Aerospace Inc. and Emerson Electric Co., focusing on Market position, Key segments, and exposure to Technological disruption:

Howmet Aerospace Inc.

- Positioned in aerospace and transportation sectors, facing industrial machinery competition.

- Key segments include Engine Products, Fastening Systems, and Engineered Structures driving aerospace solutions.

- Exposure to technological disruption is moderate, centered on advanced engineered aerospace and transportation components.

Emerson Electric Co.

- Operates in industrial, commercial, and residential markets with broad geographic presence.

- Key segments are Automation Solutions and Commercial & Residential Solutions driving diverse industrial technologies.

- Faces technological disruption in automation, software, and climate technologies sectors.

Howmet Aerospace Inc. vs Emerson Electric Co. Positioning

Howmet Aerospace shows a concentrated focus on aerospace and transportation with specialized engineered components, while Emerson Electric has a diversified portfolio across automation and residential technologies. Howmet’s niche segments may yield focused innovation; Emerson’s breadth provides market coverage but potentially dilutes focus.

Which has the best competitive advantage?

Howmet Aerospace demonstrates a very favorable moat with growing ROIC above WACC, indicating durable competitive advantage and increasing profitability. Emerson Electric shows a very unfavorable moat with declining ROIC below WACC, signaling value destruction and decreasing profitability.

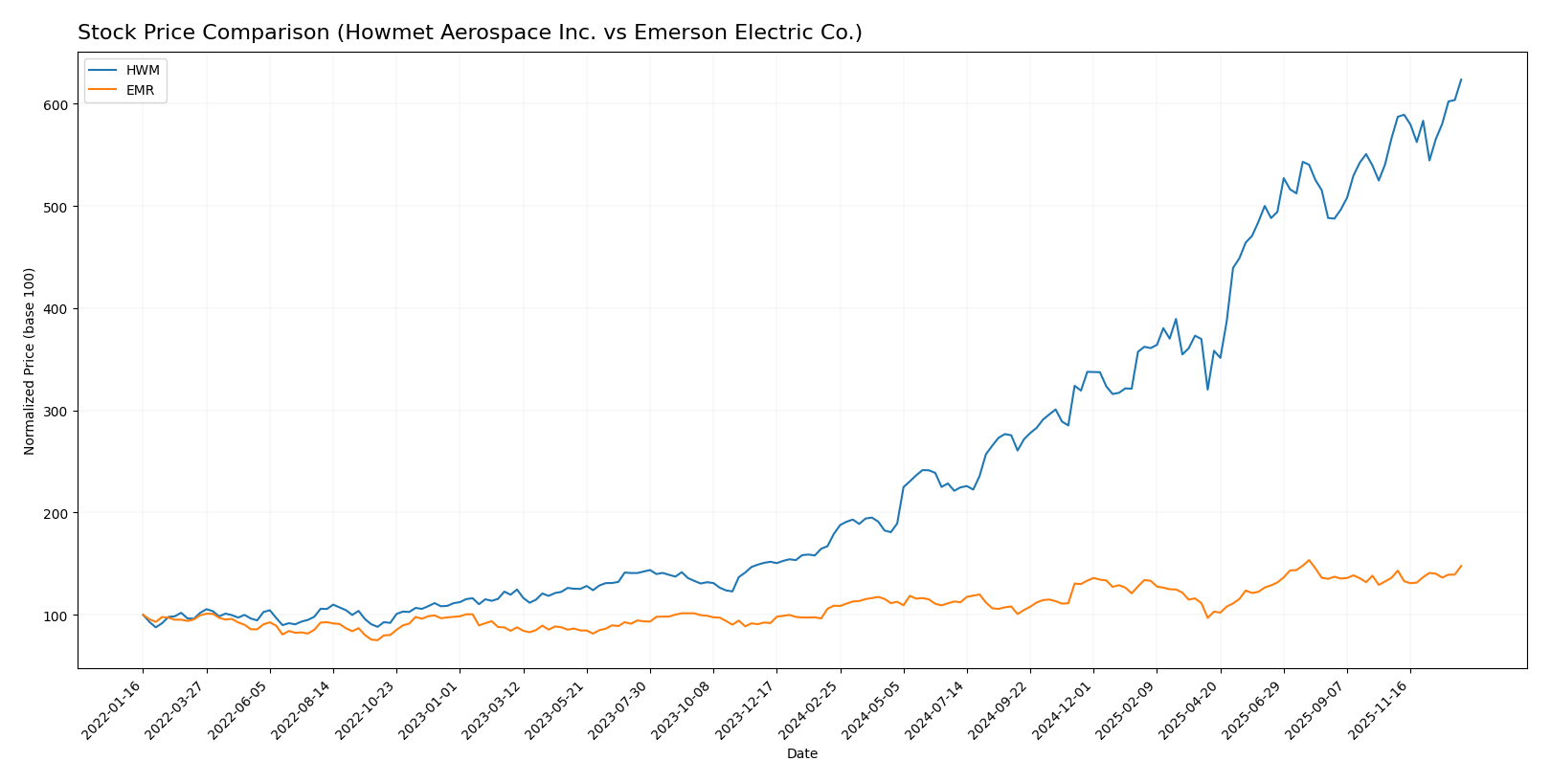

Stock Comparison

The stock price chart over the past 12 months reveals significant upward movements for both Howmet Aerospace Inc. and Emerson Electric Co., with Howmet showing stronger gains but signs of deceleration, while Emerson continues an accelerating bullish trend.

Trend Analysis

Howmet Aerospace Inc. (HWM) experienced a bullish trend with a 248.15% price increase over the past year, showing deceleration despite a high volatility level (47.01 std deviation) and a price range between 62.82 and 218.71.

Emerson Electric Co. (EMR) also exhibited a bullish trend with a 35.69% gain in the same period, marked by accelerating momentum and moderate volatility (12.39 std deviation) with prices fluctuating between 94.57 and 149.63.

Comparing both, Howmet Aerospace delivered the highest market performance with a significantly larger price increase than Emerson Electric.

Target Prices

Analysts present a clear consensus on target prices for Howmet Aerospace Inc. and Emerson Electric Co.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Howmet Aerospace Inc. | 258 | 205 | 231.75 |

| Emerson Electric Co. | 170 | 125 | 149.67 |

The consensus target prices suggest moderate upside potential for both stocks compared to their current prices of $218.61 for Howmet Aerospace and $144.17 for Emerson Electric. Analysts expect stable to positive performance in the near term.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Howmet Aerospace Inc. (HWM) and Emerson Electric Co. (EMR):

Rating Comparison

HWM Rating

- Rating: B, classified as Very Favorable overall by analysts.

- Discounted Cash Flow Score: Moderate at 2, indicating fair valuation concerns.

- ROE Score: Very Favorable at 5, showing strong profit generation efficiency.

- ROA Score: Very Favorable at 5, indicating excellent asset utilization.

- Debt To Equity Score: Moderate at 2, implying moderate financial risk.

- Overall Score: Moderate at 3, reflecting a balanced financial standing.

EMR Rating

- Rating: B, also regarded as Very Favorable overall by analysts.

- Discounted Cash Flow Score: Moderate at 3, suggesting slightly better valuation.

- ROE Score: Moderate at 3, reflecting average profit generation efficiency.

- ROA Score: Favorable at 4, showing good but lower asset utilization than HWM.

- Debt To Equity Score: Moderate at 2, indicating similar financial leverage.

- Overall Score: Moderate at 3, also indicating balanced financial standing.

Which one is the best rated?

Both HWM and EMR share the same overall rating of B and an overall score of 3, reflecting moderate financial standing. HWM scores higher in ROE and ROA, while EMR has a better discounted cash flow score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Howmet Aerospace Inc. and Emerson Electric Co.:

HWM Scores

- Altman Z-Score: 10.43, indicating a safe zone.

- Piotroski Score: 9, representing very strong health.

EMR Scores

- Altman Z-Score: 2.68, indicating a grey zone.

- Piotroski Score: 7, representing strong health.

Which company has the best scores?

Howmet Aerospace (HWM) shows stronger financial health with a much higher Altman Z-Score in the safe zone and a very strong Piotroski Score. Emerson Electric (EMR) has lower scores, indicating moderate risk and slightly less financial strength.

Grades Comparison

Here is a detailed comparison of the grading and rating trends for Howmet Aerospace Inc. and Emerson Electric Co.:

Howmet Aerospace Inc. Grades

The following table summarizes recent grades from reputable grading companies for Howmet Aerospace Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2025-11-14 |

| JP Morgan | Maintain | Overweight | 2025-11-10 |

| Goldman Sachs | Maintain | Buy | 2025-11-03 |

| BTIG | Maintain | Buy | 2025-11-03 |

| UBS | Maintain | Neutral | 2025-10-31 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

| TD Cowen | Maintain | Buy | 2025-10-31 |

| Truist Securities | Maintain | Buy | 2025-10-15 |

| Susquehanna | Maintain | Positive | 2025-10-09 |

| B of A Securities | Maintain | Buy | 2025-08-05 |

Howmet Aerospace’s grades show a consistent trend of buy and outperform ratings, with no downgrades reported in recent months.

Emerson Electric Co. Grades

The table below shows recent grades from recognized grading entities for Emerson Electric Co.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-07 |

| Barclays | Maintain | Equal Weight | 2026-01-07 |

| UBS | Upgrade | Buy | 2026-01-05 |

| Jefferies | Downgrade | Hold | 2025-12-10 |

| JP Morgan | Maintain | Neutral | 2025-11-10 |

| RBC Capital | Maintain | Outperform | 2025-11-06 |

| Barclays | Maintain | Equal Weight | 2025-11-06 |

| RBC Capital | Maintain | Outperform | 2025-10-16 |

| JP Morgan | Maintain | Neutral | 2025-10-15 |

| Wells Fargo | Downgrade | Equal Weight | 2025-10-06 |

Emerson Electric’s grades reveal more variability, with several hold and equal weight ratings and recent downgrades offset by a UBS upgrade to buy.

Which company has the best grades?

Howmet Aerospace has generally received stronger and more consistent buy and outperform grades compared to Emerson Electric, whose grades include multiple holds and downgrades. This difference may influence investors seeking more stable analyst confidence.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Howmet Aerospace Inc. (HWM) and Emerson Electric Co. (EMR), based on the most recent financial and operational data.

| Criterion | Howmet Aerospace Inc. (HWM) | Emerson Electric Co. (EMR) |

|---|---|---|

| Diversification | Moderate, with focus on aerospace engine products, fastening, and structure systems | Broad, spanning intelligent devices, software, control, and automation solutions |

| Profitability | High net margin (15.55%) and ROIC (15.49%), strong value creation | Moderate net margin (12.73%), low ROIC (4.62%), value destruction indicated |

| Innovation | Demonstrates growing ROIC indicating effective innovation and operational efficiency | Declining ROIC trend, suggesting challenges in sustaining innovation or competitive edge |

| Global presence | Strong in aerospace sectors, global market exposure | Extensive global footprint across multiple industrial segments |

| Market Share | Strong in aerospace components with increasing revenues | Leading in automation but facing profitability pressures |

Key takeaways: Howmet Aerospace shows a very favorable economic moat with strong profitability and growing returns, making it a solid value creator. Emerson Electric, despite its diversified portfolio and global presence, struggles with declining profitability and value destruction, signaling caution for investors.

Risk Analysis

Below is a comparison of key risk factors for Howmet Aerospace Inc. (HWM) and Emerson Electric Co. (EMR) as of the most recent fiscal years:

| Metric | Howmet Aerospace Inc. (HWM) | Emerson Electric Co. (EMR) |

|---|---|---|

| Market Risk | Beta 1.29, moderate volatility | Beta 1.25, moderate volatility |

| Debt level | Debt/Equity 0.76, neutral risk | Debt/Equity 0.65, neutral risk |

| Regulatory Risk | Aerospace industry regulations, moderate risk | Diverse industrial regulations, moderate risk |

| Operational Risk | Supply chain for aerospace components | Complex global operations, higher operational complexity |

| Environmental Risk | Exposure to emissions regulations, moderate | Moderate, with some focus on energy efficiency |

| Geopolitical Risk | Global aerospace exposure (US, Europe, Asia) | Broad global market exposure, moderate geopolitical risk |

The most impactful and likely risks for these companies include market volatility given their industrial sector exposure and operational risks tied to global supply chains. Howmet’s aerospace focus subjects it to stringent regulatory and geopolitical factors, while Emerson’s broader industrial portfolio faces operational complexity and moderate regulatory challenges. Both maintain manageable debt levels, indicating balanced financial risk.

Which Stock to Choose?

Howmet Aerospace Inc. (HWM) has shown strong income growth with a 41.3% revenue increase over five years and a consistently favorable income statement. Its profitability metrics, including a 25.4% ROE and 15.5% net margin, are favorable. Debt levels are moderate with a neutral debt-to-equity ratio and interest coverage rated favorable. The company holds a very favorable moat rating and a “B” overall rating.

Emerson Electric Co. (EMR) presents moderate income growth with a 39.3% revenue increase but mixed profitability trends, including a 12.7% net margin and 11.3% ROE rated neutral. Debt management is neutral with some unfavorable liquidity ratios. EMR’s moat rating is very unfavorable due to declining ROIC, yet it also has a “B” overall rating.

For investors prioritizing durable competitive advantages and strong profitability, Howmet Aerospace’s very favorable moat and income profile might appear more attractive. Conversely, those valuing moderate growth with a stable rating could find Emerson Electric’s profile acceptable despite its weaker moat and mixed financial ratios.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Howmet Aerospace Inc. and Emerson Electric Co. to enhance your investment decisions: