Choosing the right industrial machinery stock requires insight into companies that lead innovation and market presence. Emerson Electric Co. (EMR) and Generac Holdings Inc. (GNRC) both operate in the industrial machinery sector, yet they target distinct market segments with overlapping focus on power and automation solutions. This article will analyze their strategies and performance to help you decide which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Emerson Electric Co. and Generac Holdings Inc. by providing an overview of these two companies and their main differences.

Emerson Electric Co. Overview

Emerson Electric Co. is a technology and engineering company serving industrial, commercial, and residential markets globally. Its mission focuses on delivering automation and commercial solutions through two segments: Automation Solutions, which provides instrumentation, valves, and control systems for various industries; and Commercial & Residential Solutions, offering heating, air conditioning, and environmental control technologies. Founded in 1890 and headquartered in Saint Louis, MO, Emerson is a well-established leader in industrial machinery.

Generac Holdings Inc. Overview

Generac Holdings Inc. specializes in designing and manufacturing power generation equipment and energy storage systems for residential, light commercial, and industrial markets worldwide. Its product range includes standby generators, portable generators, outdoor power equipment, and clean energy solutions. Founded in 1959 and based in Waukesha, WI, Generac focuses on delivering reliable power solutions with a growing presence in clean energy technology.

Key similarities and differences

Both companies operate in the industrial machinery sector and serve residential and commercial markets, but Emerson has a broader global footprint and diversified product segments including automation technology. In contrast, Generac is more focused on power generation and energy storage solutions, with an emphasis on residential and light commercial applications. Emerson employs about 73K people, significantly more than Generac’s 5.4K, reflecting their different scales and market reach.

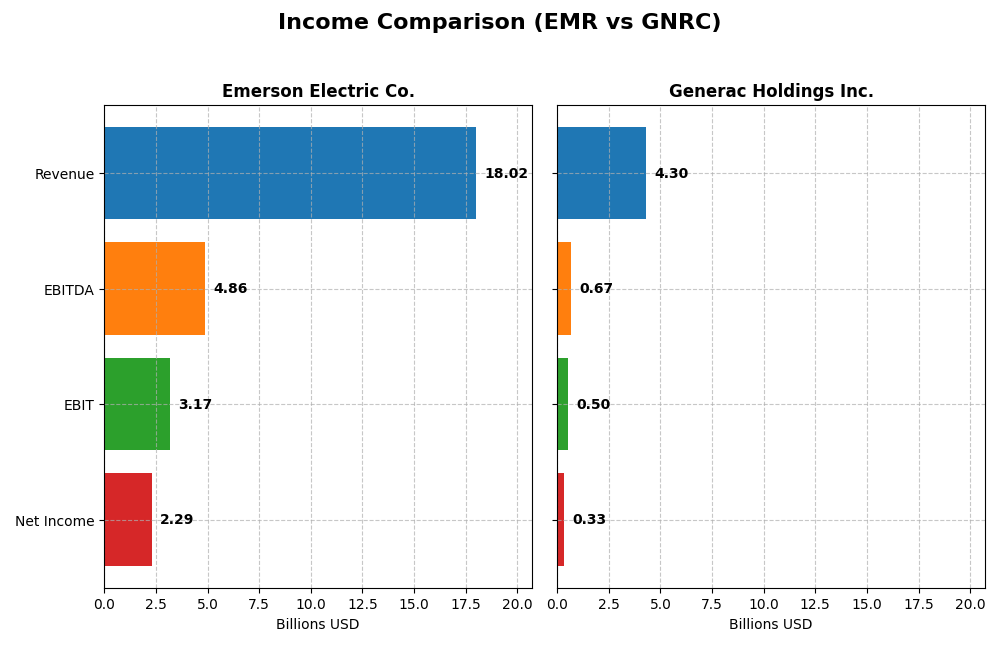

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Emerson Electric Co. and Generac Holdings Inc. for the most recent fiscal year available.

| Metric | Emerson Electric Co. | Generac Holdings Inc. |

|---|---|---|

| Market Cap | 81B | 9B |

| Revenue | 18.0B | 4.3B |

| EBITDA | 4.9B | 671M |

| EBIT | 3.2B | 499M |

| Net Income | 2.3B | 325M |

| EPS | 4.06 | 5.46 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Emerson Electric Co.

Emerson Electric Co. displayed steady revenue growth from $12.9B in 2021 to $18.0B in 2025, with net income fluctuating, peaking at $13.2B in 2023 mostly due to discontinued operations, then normalizing to $2.3B in 2025. Margins remained favorable, with gross margin at 52.8% and net margin at 12.7% in 2025. The latest year showed slower revenue growth at 3% but strong EBIT growth of 35%, reflecting improved profitability.

Generac Holdings Inc.

Generac’s revenue rose from $2.5B in 2020 to $4.3B in 2024, with net income peaking at $533M in 2021 before declining to $325M in 2024. Gross margin was solid at 38.8%, and net margin improved to 7.6% in 2024. The latest fiscal year saw moderate revenue growth of 6.8% and a 49.9% increase in net margin, driven by a 64.8% EPS growth, although operational expenses grew in line with revenue.

Which one has the stronger fundamentals?

Emerson Electric shows stronger absolute scale, higher margins, and consistent EBIT expansion despite slower revenue growth recently. Generac demonstrates faster revenue growth and marked improvements in net margin and EPS, but lower overall profitability and smaller scale. Both have favorable income statement evaluations, though Emerson’s higher margin stability and size suggest stronger fundamentals in absolute terms.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Emerson Electric Co. (EMR) and Generac Holdings Inc. (GNRC) based on the most recent full fiscal year data available.

| Ratios | Emerson Electric Co. (2025) | Generac Holdings Inc. (2024) |

|---|---|---|

| ROE | 11.3% | 13.0% |

| ROIC | 4.6% | 9.9% |

| P/E | 32.4 | 28.4 |

| P/B | 3.66 | 3.70 |

| Current Ratio | 0.88 | 1.97 |

| Quick Ratio | 0.65 | 0.97 |

| D/E (Debt-to-Equity) | 0.65 | 0.59 |

| Debt-to-Assets | 31.3% | 28.9% |

| Interest Coverage | 9.44 | 5.98 |

| Asset Turnover | 0.43 | 0.84 |

| Fixed Asset Turnover | 6.28 | 5.01 |

| Payout Ratio | 52.0% | 0.08% |

| Dividend Yield | 1.60% | 0.003% |

Interpretation of the Ratios

Emerson Electric Co.

Emerson Electric shows a mixed ratio profile with favorable net margin (12.73%) and strong interest coverage (13.38), but weak liquidity indicated by a current ratio below 1 (0.88) and unfavorable return on invested capital (4.62%). Its valuation multiples like P/E (32.42) and P/B (3.66) are also unfavorable. The company pays dividends with a stable yield of 1.6%, reflecting moderate shareholder returns without excessive payout risks.

Generac Holdings Inc.

Generac has a more balanced ratio set with favorable liquidity (current ratio 1.97) and interest coverage (5.56), alongside neutral profitability ratios such as net margin (7.57%) and ROE (13.04%). However, its cost of capital (WACC 11.3%) and valuation multiples remain unfavorable. It does not pay dividends, likely focusing on reinvestment and growth, which is common for companies in expansion phases.

Which one has the best ratios?

Generac’s ratios appear more balanced with fewer unfavorable metrics and stronger liquidity, while Emerson Electric faces notable liquidity and valuation challenges despite its dividend payments. Overall, Generac’s neutral global ratio opinion contrasts with Emerson’s slightly unfavorable profile, suggesting a more stable financial position at this time.

Strategic Positioning

This section compares the strategic positioning of Emerson Electric Co. and Generac Holdings Inc., including Market position, Key segments, and Exposure to technological disruption:

Emerson Electric Co.

- Large market cap ~81B, diversified industrial machinery with global presence, moderate competitive pressure.

- Key segments include Automation Solutions and Commercial & Residential Solutions, serving diverse industrial and residential markets.

- Exposure to technological disruption through automation, software, and control systems innovations in multiple sectors.

Generac Holdings Inc.

- Smaller market cap ~9B, focused on power generation equipment, facing higher competitive pressure.

- Specializes in residential, light commercial, and industrial power products with broad product range.

- Faces disruption risks in clean energy solutions and remote monitoring systems in power generation.

Emerson Electric Co. vs Generac Holdings Inc. Positioning

Emerson exhibits a diversified approach across industrial automation and residential solutions, providing broad market exposure. Generac concentrates on power generation and energy storage, offering focused product innovation but narrower market scope.

Which has the best competitive advantage?

Both companies show very unfavorable MOAT evaluations with declining ROIC below WACC, indicating value destruction and weakening competitive advantages despite their differing strategic focuses.

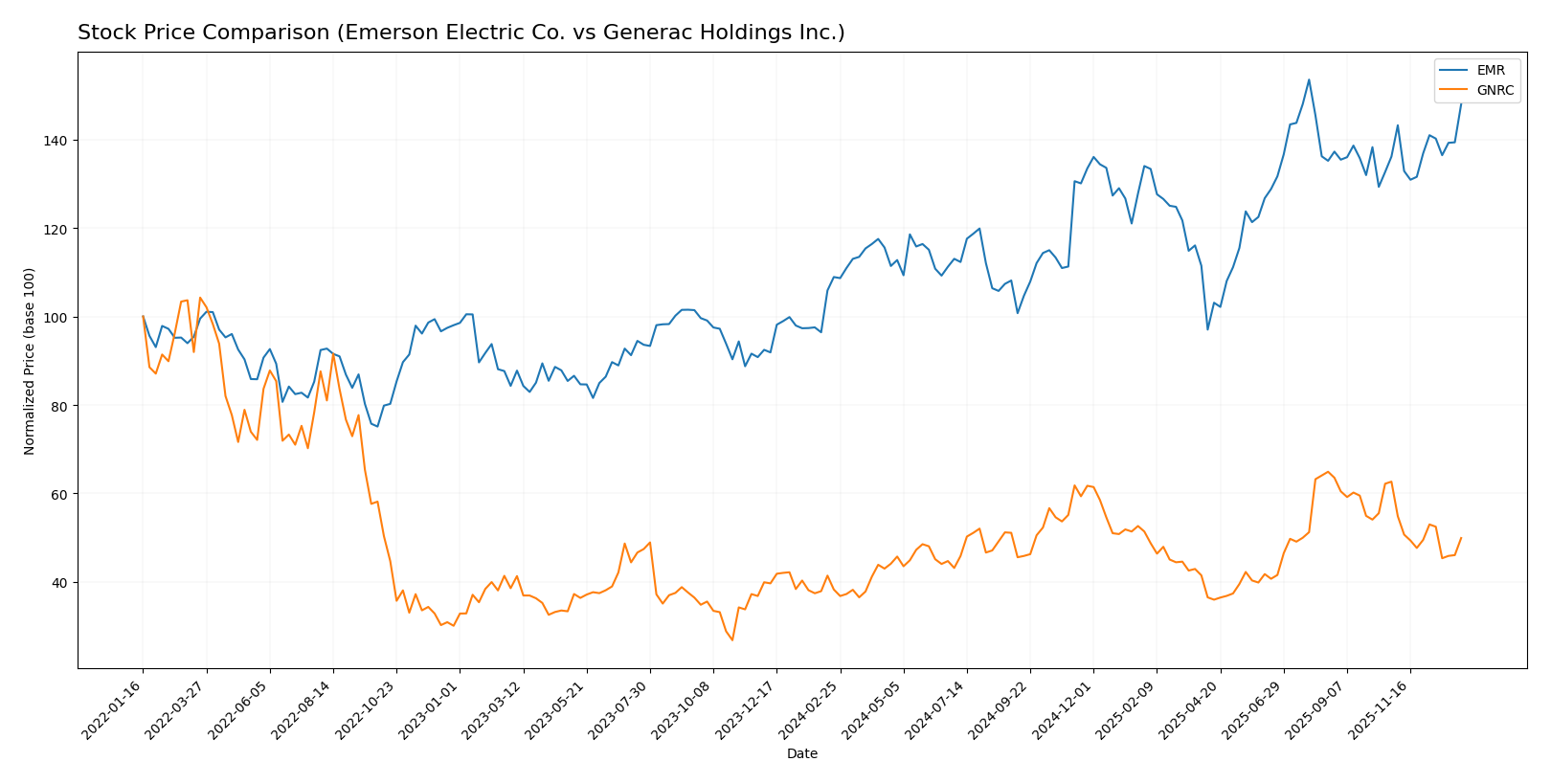

Stock Comparison

The stock price movements of Emerson Electric Co. and Generac Holdings Inc. over the past year reveal distinct trading dynamics, with Emerson displaying steady acceleration and Generac experiencing recent deceleration and increased volatility.

Trend Analysis

Emerson Electric Co. (EMR) shows a bullish trend with a 35.85% price increase over the past 12 months, marked by accelerating momentum and moderate volatility (std dev 12.39). The stock ranged from a low of 94.57 to a high of 149.63.

Generac Holdings Inc. (GNRC) also exhibits a bullish trend over the year with a 30.39% gain but with decelerating momentum and higher volatility (std dev 22.61). Recently, the stock trend turned bearish, declining 20.33% with increased volatility.

Comparing both, Emerson Electric delivered the highest market performance with stronger upward momentum and less recent volatility, outperforming Generac despite its earlier annual gains.

Target Prices

Analysts provide a moderately optimistic target price consensus for Emerson Electric Co. and Generac Holdings Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Emerson Electric Co. | 170 | 125 | 149.67 |

| Generac Holdings Inc. | 248 | 184 | 210 |

Consensus targets suggest Emerson’s stock price near current levels, while Generac shows potential upside from its current price of 152.68, reflecting stronger growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Emerson Electric Co. and Generac Holdings Inc.:

Rating Comparison

EMR Rating

- Rating: Both companies hold a “B” rating, considered very favorable by analysts.

- Discounted Cash Flow Score: EMR has a moderate score of 3, indicating average valuation.

- ROE Score: EMR’s return on equity score is moderate at 3, reflecting average profit efficiency.

- ROA Score: EMR’s return on assets score is favorable at 4, indicating effective asset use.

- Debt To Equity Score: EMR’s score is moderate at 2, signaling some financial leverage.

- Overall Score: EMR has a moderate overall score of 3 based on key financial metrics.

GNRC Rating

- Rating: Both companies hold a “B” rating, considered very favorable by analysts.

- Discounted Cash Flow Score: GNRC also scores 3, suggesting a similar moderate valuation level.

- ROE Score: GNRC’s ROE is favorable at 4, showing more efficient profit generation from equity.

- ROA Score: GNRC matches with a favorable score of 4, also utilizing assets effectively.

- Debt To Equity Score: GNRC shares the same moderate score of 2, indicating similar leverage.

- Overall Score: GNRC also holds a moderate overall score of 3, reflecting comparable performance.

Which one is the best rated?

Both Emerson Electric Co. and Generac Holdings Inc. share identical overall ratings and discounted cash flow scores. However, GNRC has a slight edge with a higher return on equity score, suggesting better efficiency in generating profits from shareholders’ equity.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Emerson Electric Co. and Generac Holdings Inc.:

EMR Scores

- Altman Z-Score: 2.68, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

GNRC Scores

- Altman Z-Score: 3.73, in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

Which company has the best scores?

Generac Holdings Inc. shows a stronger Altman Z-Score, placing it in the safe zone, while both companies share the same strong Piotroski Score of 7. Based strictly on these scores, Generac has a slight edge in financial stability.

Grades Comparison

A comparison of the recent grades assigned to Emerson Electric Co. and Generac Holdings Inc. by reputable grading companies:

Emerson Electric Co. Grades

The table below shows recent grades and rating actions from major financial institutions for Emerson Electric Co.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-07 |

| Barclays | Maintain | Equal Weight | 2026-01-07 |

| UBS | Upgrade | Buy | 2026-01-05 |

| Jefferies | Downgrade | Hold | 2025-12-10 |

| JP Morgan | Maintain | Neutral | 2025-11-10 |

| RBC Capital | Maintain | Outperform | 2025-11-06 |

| Barclays | Maintain | Equal Weight | 2025-11-06 |

| RBC Capital | Maintain | Outperform | 2025-10-16 |

| JP Morgan | Maintain | Neutral | 2025-10-15 |

| Wells Fargo | Downgrade | Equal Weight | 2025-10-06 |

Grades for Emerson Electric Co. show mixed signals, with most recent ratings clustering around “Equal Weight” and “Neutral,” and occasional upgrades and downgrades.

Generac Holdings Inc. Grades

The table below presents recent grades and rating changes from recognized grading firms for Generac Holdings Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | Upgrade | Outperform | 2026-01-09 |

| Citigroup | Upgrade | Buy | 2026-01-08 |

| B of A Securities | Maintain | Buy | 2026-01-07 |

| Wells Fargo | Upgrade | Overweight | 2025-12-19 |

| JP Morgan | Upgrade | Overweight | 2025-12-08 |

| Citigroup | Maintain | Neutral | 2025-11-03 |

| Barclays | Maintain | Equal Weight | 2025-10-31 |

| UBS | Maintain | Buy | 2025-10-30 |

| Canaccord Genuity | Maintain | Buy | 2025-10-30 |

| Citigroup | Maintain | Neutral | 2025-10-21 |

Generac Holdings Inc. has experienced several upgrades recently, with a majority of grades in the “Buy” or better categories, indicating positive analyst sentiment.

Which company has the best grades?

Generac Holdings Inc. has received more upgrades and higher ratings such as “Outperform” and “Overweight” compared to Emerson Electric Co., which mostly holds “Equal Weight” or “Neutral” grades. This suggests potentially stronger analyst confidence in Generac’s near-term performance, which may influence investor sentiment accordingly.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of Emerson Electric Co. (EMR) and Generac Holdings Inc. (GNRC) based on their recent financial and operational data.

| Criterion | Emerson Electric Co. (EMR) | Generac Holdings Inc. (GNRC) |

|---|---|---|

| Diversification | Strong diversification with multiple segments including Intelligent Devices and Software & Control generating over $18B combined in 2025 | Less diversified, focused primarily on power generation equipment |

| Profitability | Moderate net margin at 12.73%, but ROIC (4.62%) below WACC, indicating value destruction | Lower net margin at 7.57%, but ROIC (9.89%) closer to WACC, still shedding value |

| Innovation | Investment in software and control solutions shows innovation drive | Innovation focused on power solutions, but fewer segments |

| Global presence | Established global footprint with diverse product lines | More regional focus, less global reach |

| Market Share | Large presence in automation and control markets | Leading in residential and commercial backup power markets |

Key takeaways: Emerson Electric offers greater diversification and stronger profitability metrics but struggles with value creation as ROIC is below cost of capital. Generac has a more focused product line with improving efficiency but also faces challenges in sustaining profitability. Both companies show declining ROIC trends, signaling caution for investors.

Risk Analysis

Below is a comparison of key risks for Emerson Electric Co. (EMR) and Generac Holdings Inc. (GNRC) based on the most recent data.

| Metric | Emerson Electric Co. (EMR) | Generac Holdings Inc. (GNRC) |

|---|---|---|

| Market Risk | Beta 1.25, moderate volatility due to industrial sector cyclicality | Beta 1.83, higher volatility reflecting exposure to energy markets and residential demand |

| Debt Level | Debt-to-Equity 0.65, neutral risk with manageable leverage | Debt-to-Equity 0.59, favorable with conservative leverage position |

| Regulatory Risk | Moderate, operates globally with exposure to diverse regulations | Moderate, subject to U.S. energy and environmental regulations |

| Operational Risk | Medium, complexity from diverse product lines and global footprint | Medium, dependence on supply chain and manufacturing efficiency |

| Environmental Risk | Moderate, exposure to sustainability regulations but proactive in energy solutions | Moderate to high, increasing focus on clean energy may require investment |

| Geopolitical Risk | Moderate, global operations expose it to trade tensions | Lower, more focused on U.S. and North American markets |

Emerson faces moderate market and operational risks amplified by its global exposure and industrial diversification, while Generac’s higher beta signals greater sensitivity to market swings, especially in energy. Both maintain balanced debt levels, but Generac’s stronger liquidity ratios offer better short-term risk resilience. Environmental regulations represent a growing risk for both, with Generac potentially more impacted due to its clean energy product lines.

Which Stock to Choose?

Emerson Electric Co. (EMR) shows a mixed income evolution with favorable gross and EBIT margins but unfavorable revenue growth recently. Its profitability is moderate, with a net margin of 12.73% and ROE around 11.3%. Debt levels are neutral, but liquidity ratios are weak. The rating is very favorable, supported by a strong Altman Z-score in the grey zone and a solid Piotroski score.

Generac Holdings Inc. (GNRC) demonstrates favorable income metrics with solid gross and EBIT margins and moderate revenue growth. Profitability is decent, with a 7.57% net margin and slightly higher ROE near 13%. Debt metrics are generally favorable, and liquidity ratios are strong. The company holds a very favorable rating, with a safe zone Altman Z-score and a strong Piotroski score.

Considering the ratings and overall financial profiles, EMR might appear more attractive for investors focused on quality and moderate yield despite some liquidity concerns, while GNRC could be interpreted as suitable for those prioritizing stronger liquidity and moderate growth potential. Both companies show value destruction trends in MOAT evaluations, which might signal caution for risk-averse investors.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Emerson Electric Co. and Generac Holdings Inc. to enhance your investment decisions: