Home > Comparison > Healthcare > UNH vs ELV

The strategic rivalry between UnitedHealth Group Incorporated and Elevance Health Inc. shapes the healthcare plans sector’s evolution. UnitedHealth operates as a diversified healthcare giant with integrated care delivery and pharmacy services, while Elevance focuses on comprehensive health benefits and digital solutions across the care continuum. This head-to-head reflects a battle between scale-driven diversification and focused innovation. This analysis aims to identify which trajectory offers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

UnitedHealth Group and Elevance Health dominate the U.S. healthcare plans market with expansive service portfolios.

UnitedHealth Group: Diversified Healthcare Powerhouse

UnitedHealth Group leads as a diversified health care company with four segments driving revenue. Its core earnings stem from consumer health benefit plans and extensive service lines, including Optum’s healthcare delivery and pharmacy services. In 2026, its strategy centers on integrating care delivery with data-driven health management, reinforcing its competitive edge in both insurance and provider networks.

Elevance Health: Comprehensive Health Benefits Leader

Elevance Health operates as a health benefits company serving 118M people with medical, digital, pharmacy, and behavioral solutions. It generates revenue through a broad portfolio of clinical and care management services focused on supporting consumers across the care continuum. The company’s 2026 strategic priority emphasizes connecting care resources digitally to improve health outcomes and patient engagement.

Strategic Collision: Similarities & Divergences

Both firms emphasize comprehensive healthcare plans but differ in approach; UnitedHealth combines insurance with integrated care delivery, while Elevance prioritizes digital and clinical service connectivity. Their competition intensifies in managing chronic conditions and expanding consumer engagement. Investors face distinct profiles: UnitedHealth’s expansive ecosystem contrasts with Elevance’s digital-first, population health focus.

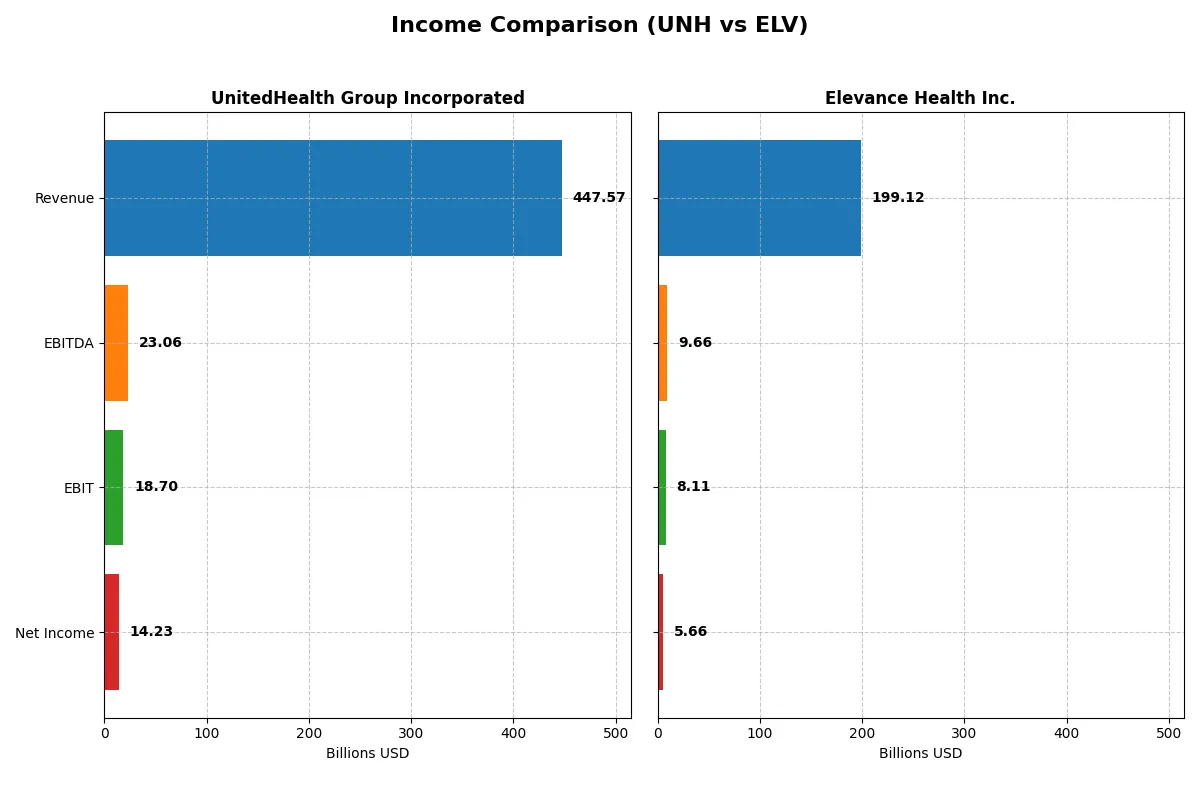

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | UnitedHealth Group Incorporated (UNH) | Elevance Health Inc. (ELV) |

|---|---|---|

| Revenue | 448B | 199B |

| Cost of Revenue | 365B | 148B |

| Operating Expenses | 64B | 43B |

| Gross Profit | 83B | 51B |

| EBITDA | 23B | 9.7B |

| EBIT | 19B | 8.1B |

| Interest Expense | 4.0B | 1.4B |

| Net Income | 14.2B | 5.7B |

| EPS | 15.66 | 25.18 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

The following income statement comparison reveals how efficiently each company converts revenue into profits, exposing operational strengths and weaknesses.

UnitedHealth Group Incorporated Analysis

UnitedHealth’s revenue climbed steadily from 287.6B in 2021 to 447.6B in 2025, a robust 56% growth over five years. However, net income declined from 17.3B to 14.2B, reflecting margin compression. Gross margin deteriorated to 18.5% in 2025, and net margin fell to 3.2%. The latest year shows revenue momentum but weaker profitability and efficiency.

Elevance Health Inc. Analysis

Elevance Health grew revenue from 138.6B in 2021 to 199.1B in 2025, a 44% increase. Net income dropped slightly from 6.1B to 5.7B, with gross margin improving to 25.6% in 2025. Net margin stood at 2.8%. Despite a small dip in net income, Elevance maintains stronger margin health and controls expenses well, signaling solid operational discipline.

Margin Efficiency vs. Revenue Scale

UnitedHealth achieves superior scale with higher revenue but suffers declining profitability and margins. Elevance posts healthier margins and steadier expense control but on a smaller revenue base. For investors, UnitedHealth’s growth profile suits those favoring scale, while Elevance appeals to margin-focused investors seeking operational efficiency.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | UnitedHealth Group Incorporated (UNH) | Elevance Health Inc. (ELV) |

|---|---|---|

| ROE | 14.21% (2025) | 12.90% (2025) |

| ROIC | 9.45% (2025) | 7.22% (2025) |

| P/E | 21.12 (2025) | 13.73 (2025) |

| P/B | 3.00 (2025) | 1.77 (2025) |

| Current Ratio | 0.79 (2025) | 1.54 (2025) |

| Quick Ratio | 0.79 (2025) | 1.54 (2025) |

| D/E | 0.78 (2025) | 0.73 (2025) |

| Debt-to-Assets | 25.32% (2025) | 26.38% (2025) |

| Interest Coverage | 4.74 (2025) | 4.99 (2025) |

| Asset Turnover | 1.45 (2025) | 1.64 (2025) |

| Fixed Asset Turnover | 0 (2025) Note: UNH fixed asset turnover reported as 0 | 42.46 (2025) |

| Payout ratio | 97.22% (2025) | 27.00% (2025) |

| Dividend yield | 4.60% (2025) | 1.97% (2025) |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as the company’s DNA, revealing hidden risks and operational excellence crucial to assessing investment quality.

UnitedHealth Group Incorporated

UnitedHealth shows neutral ROE at 14.2%, but its net margin is unfavorable at 3.18%, indicating thin profitability. The P/E of 21.1 signals a fairly valued stock, though the P/B of 3.0 suggests some premium. It rewards shareholders with a solid 4.6% dividend yield, balancing moderate returns with operational discipline.

Elevance Health Inc.

Elevance posts a neutral ROE of 12.9% and a slightly lower net margin of 2.85%. Its P/E ratio of 13.7 is favorable, indicating a more attractive valuation. The current ratio of 1.54 highlights strong liquidity. Dividend yield stands modest at 1.97%, pointing to retained earnings likely fueling growth or debt reduction.

Balanced Valuation Meets Operational Strength

Elevance Health offers a more favorable valuation and liquidity profile with fewer weak metrics. UnitedHealth balances shareholder returns via dividends but faces margin pressure and lower liquidity. Investors seeking value and operational safety may prefer Elevance, while those prioritizing income might lean toward UnitedHealth.

Which one offers the Superior Shareholder Reward?

I compare UnitedHealth Group (UNH) and Elevance Health (ELV) on dividends, payout ratios, and buybacks for 2026. UNH yields 4.6% with a payout ratio near 97%, indicating an aggressive dividend policy well-covered by free cash flow. ELV offers a lower yield of 1.97% and a 27% payout, prioritizing reinvestment. UNH’s buyback intensity appears moderate, supporting shareholder returns alongside dividends. ELV’s buybacks are less aggressive but complemented by strong free cash flow reinvestment in growth. Historically, UNH’s high payout risks sustainability, while ELV’s balanced approach aligns better with long-term value creation. I conclude UNH offers superior short-term yield, but ELV’s sustainable model favors total return in 2026.

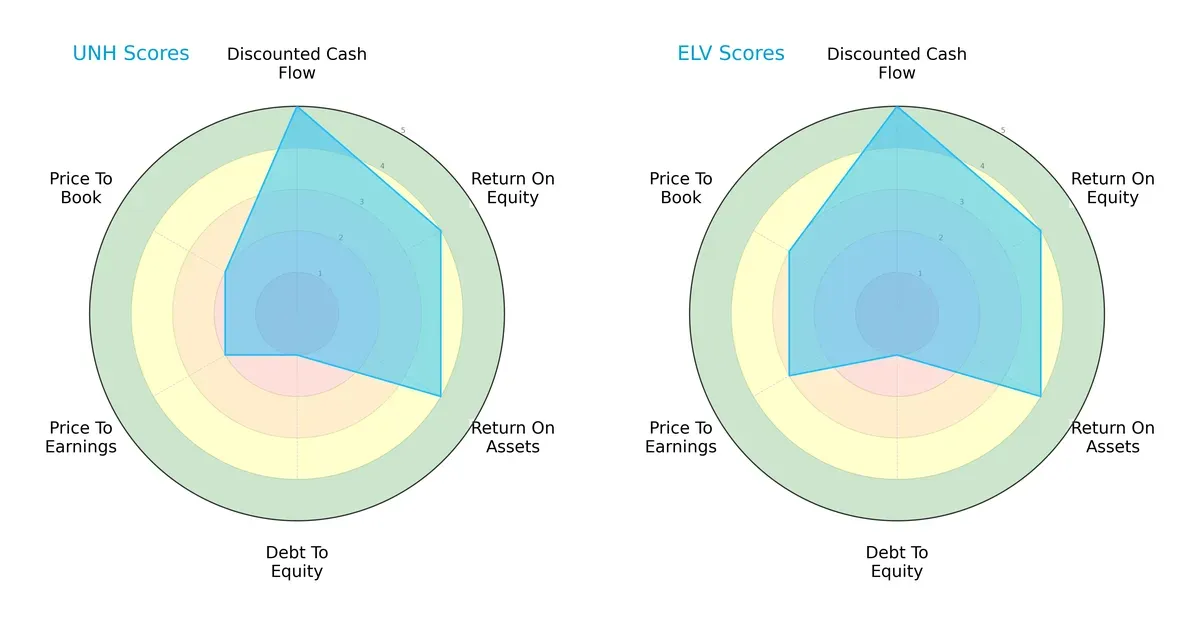

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of UnitedHealth Group and Elevance Health, spotlighting their core financial strengths and vulnerabilities:

Both firms excel in discounted cash flow and returns on equity and assets, signaling robust profitability and capital efficiency. UnitedHealth’s valuation scores lag with weaker P/E and P/B ratings, while Elevance enjoys a more favorable valuation profile. Despite identical low debt-to-equity scores signaling leverage risk, Elevance presents a more balanced and attractive overall financial profile, relying less on singular competitive advantages.

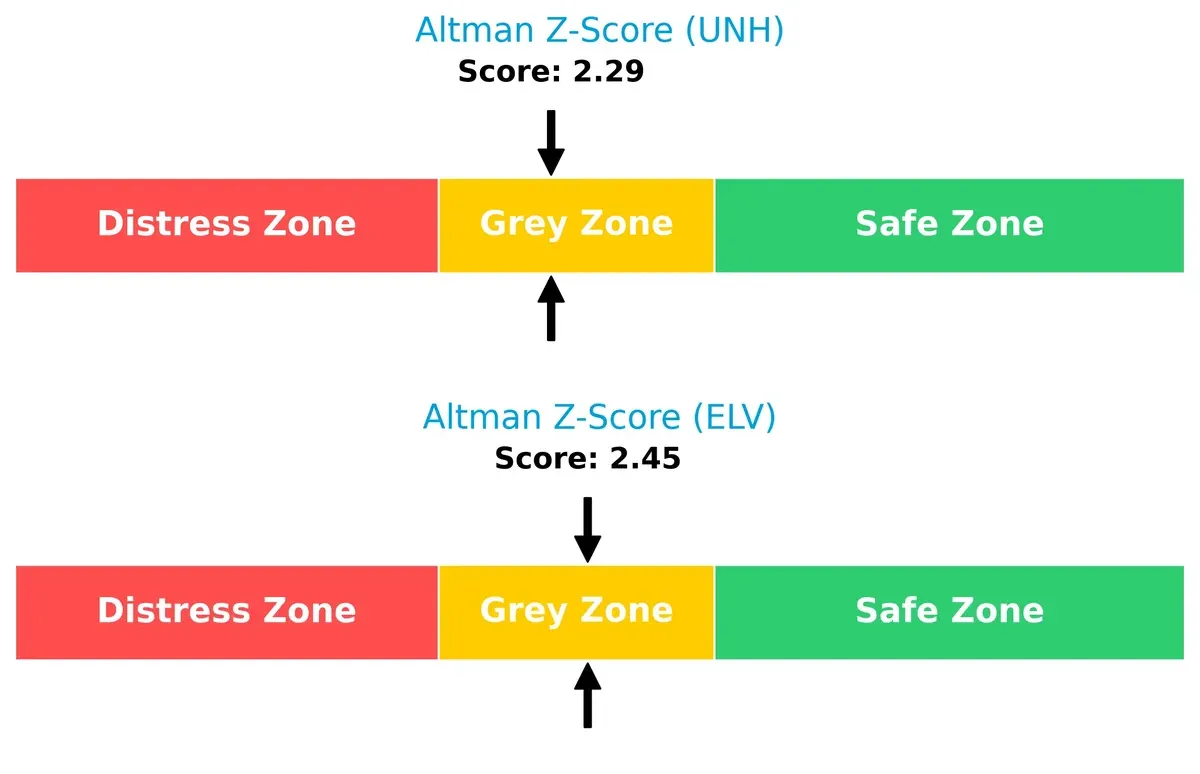

Bankruptcy Risk: Solvency Showdown

UnitedHealth and Elevance both occupy the Altman Z-Score grey zone, implying moderate bankruptcy risk but manageable financial stress in the current cycle:

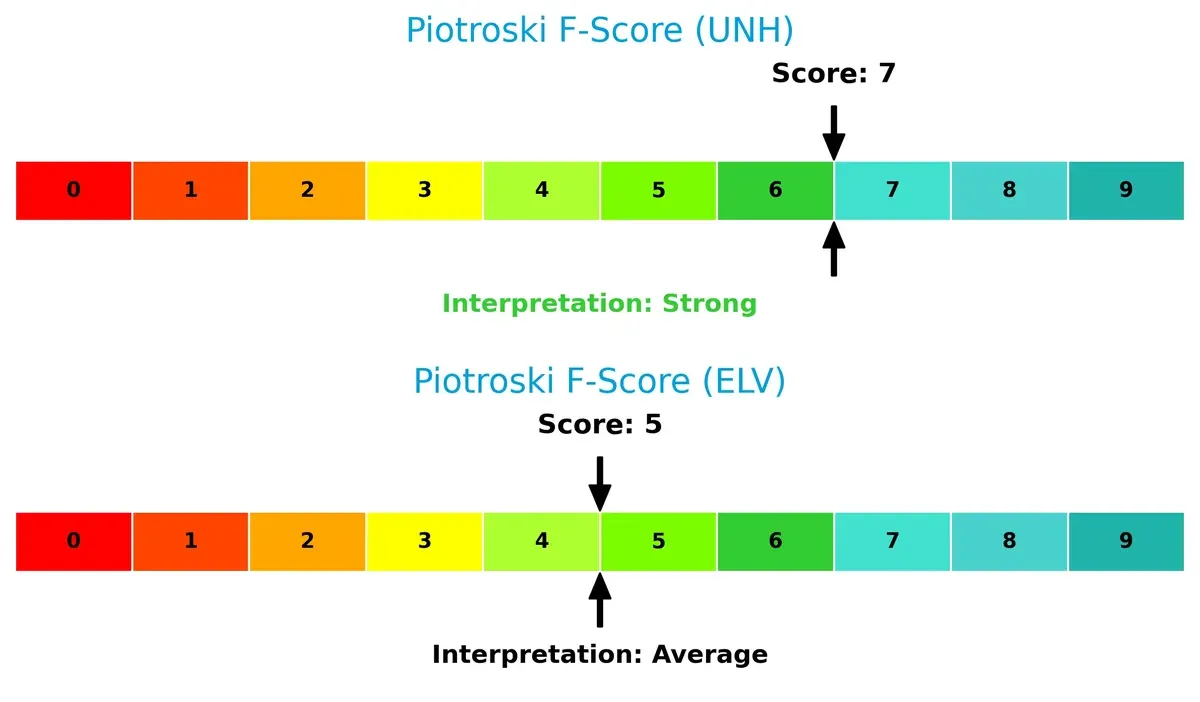

Financial Health: Quality of Operations

UnitedHealth’s Piotroski F-Score of 7 indicates strong operational health and internal financial quality. Elevance’s score of 5 flags some red flags in its fundamentals compared to UnitedHealth:

How are the two companies positioned?

This section dissects the operational DNA of UNH and ELV by comparing their revenue distribution and internal dynamics. The final objective is to confront their economic moats to identify the more resilient and sustainable competitive advantage in today’s market.

Revenue Segmentation: The Strategic Mix

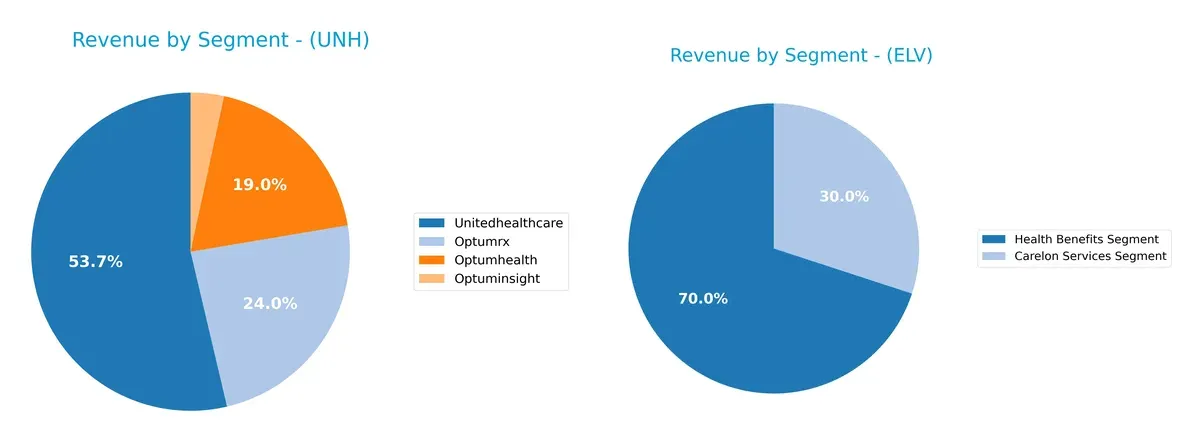

This visual comparison dissects how UnitedHealth Group and Elevance Health diversify their income streams and reveals where their primary sector bets lie:

UnitedHealth Group anchors revenue in its UnitedHealthcare segment with $298B in 2024, dwarfing other units like OptumHealth ($105B) and OptumRx ($133B). Elevance Health leans on two main pillars: Health Benefits ($167B) and Carelon Services ($72B), showing a more balanced spread. UnitedHealth’s concentration signals strong ecosystem lock-in but higher exposure risk, while Elevance’s mix suggests strategic diversification across health services and benefits.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of UnitedHealth Group Incorporated (UNH) and Elevance Health Inc. (ELV):

UNH Strengths

- Large diversified revenue streams across multiple Optum and UnitedHealthcare segments

- Favorable WACC and asset turnover ratios

- High dividend yield at 4.6%

- Moderate leverage with favorable debt-to-assets

ELV Strengths

- Favorable net margin and PE ratio compared to UNH

- Strong liquidity ratios with current and quick ratios at 1.54

- High fixed asset turnover ratio at 42.46

- Favorable interest coverage and asset turnover ratios

UNH Weaknesses

- Unfavorable net margin and PB ratio

- Low current and quick ratios at 0.79 indicate liquidity risks

- Fixed asset turnover at 0 is unfavorable

- Slightly unfavorable overall ratio profile

ELV Weaknesses

- Lower ROIC compared to UNH

- Net margin slightly unfavorable at 2.85%

- Dividend yield neutral and lower than UNH

- Neutral PB ratio indicates moderate valuation

UnitedHealth shows strength in diversified revenue and capital efficiency but faces liquidity concerns and weak profitability margins. Elevance maintains better liquidity and more favorable valuation metrics but has lower profitability returns. These contrasts highlight different financial strategies and operational focuses between the two firms.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield preserving long-term profits from relentless competition erosion. Let’s dissect the defensive strengths of two healthcare giants:

UnitedHealth Group Incorporated: Diversified Healthcare Ecosystem

UnitedHealth leverages a vast, integrated care network and data analytics, driving high ROIC above WACC by 4.1%. Margin pressures and declining ROIC signal challenges, but new service expansions could reinforce its moat in 2026.

Elevance Health Inc.: Focused Health Benefits Innovator

Elevance depends on cost advantages and digital health solutions. Unlike UnitedHealth’s broad ecosystem, Elevance’s ROIC lags slightly below WACC, reflecting inefficiencies. Ongoing digital investments may reverse profitability trends and deepen its moat.

Integrated Care Network vs. Digital Health Cost Advantage

UnitedHealth’s wider moat stems from its scale and ecosystem integration, yielding consistent value creation despite ROIC decline. Elevance’s narrower moat faces profitability headwinds but holds promise if digital innovation accelerates. UnitedHealth remains better positioned to defend market share today.

Which stock offers better returns?

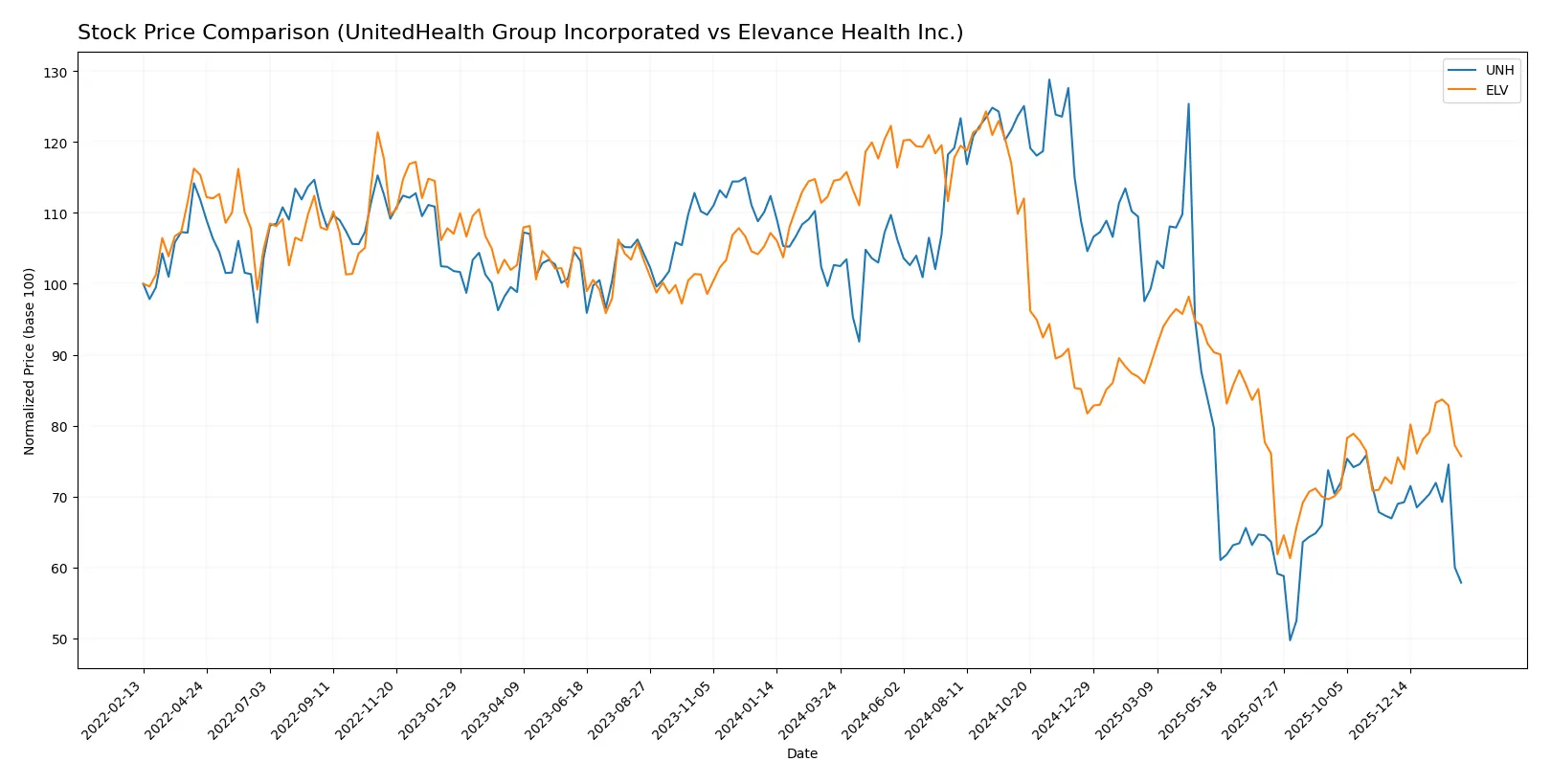

The past year shows significant price declines for both stocks, with UnitedHealth experiencing sharper losses and more pronounced trading volume shifts.

Trend Comparison

UnitedHealth Group’s stock fell 43.64% over the last 12 months, marking a bearish trend with accelerating decline and a high volatility of 110.79. The price ranged between 615.81 and 237.77.

Elevance Health’s stock declined 33.93% in the same period, also bearish but with lower volatility at 82.59 and accelerating losses. It traded between 556.89 and 274.66.

Comparing both, Elevance Health outperformed UnitedHealth, posting a smaller decline and showing recent positive momentum versus UnitedHealth’s continued downward slope.

Target Prices

Analysts present a bullish consensus for both UnitedHealth Group Incorporated and Elevance Health Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| UnitedHealth Group Incorporated | 327 | 444 | 385.38 |

| Elevance Health Inc. | 332 | 425 | 387.14 |

The target consensus for UnitedHealth and Elevance Health exceeds their current prices by 39% and 14% respectively, reflecting strong analyst confidence.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Below is a summary of the latest institutional grades for UnitedHealth Group Incorporated and Elevance Health Inc.:

UnitedHealth Group Incorporated Grades

This table shows recent grades from reputable financial institutions for UnitedHealth Group Incorporated.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | maintain | Outperform | 2026-02-05 |

| Truist Securities | maintain | Buy | 2026-02-02 |

| JP Morgan | maintain | Overweight | 2026-02-02 |

| Wells Fargo | maintain | Overweight | 2026-01-30 |

| Barclays | maintain | Overweight | 2026-01-30 |

| Oppenheimer | maintain | Outperform | 2026-01-28 |

| Leerink Partners | maintain | Outperform | 2026-01-28 |

| Jefferies | maintain | Buy | 2026-01-28 |

| UBS | maintain | Buy | 2026-01-28 |

| RBC Capital | maintain | Outperform | 2026-01-28 |

Elevance Health Inc. Grades

This table presents recent grades from verified grading companies for Elevance Health Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Overweight | 2026-02-02 |

| Truist Securities | maintain | Buy | 2026-02-02 |

| Barclays | maintain | Overweight | 2026-01-30 |

| Wells Fargo | maintain | Overweight | 2026-01-30 |

| Guggenheim | maintain | Buy | 2026-01-29 |

| Guggenheim | maintain | Buy | 2026-01-22 |

| Wolfe Research | upgrade | Outperform | 2026-01-08 |

| Wells Fargo | maintain | Overweight | 2026-01-07 |

| Barclays | maintain | Overweight | 2026-01-05 |

| Deutsche Bank | downgrade | Hold | 2025-12-19 |

Which company has the best grades?

UnitedHealth Group holds consistently strong grades, mostly Outperform and Buy, with no recent downgrades. Elevance Health shows solid grades but includes a recent downgrade to Hold. This suggests UnitedHealth Group currently enjoys more institutional confidence, potentially impacting investor sentiment positively.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing UnitedHealth Group Incorporated and Elevance Health Inc. in the 2026 market environment:

1. Market & Competition

UnitedHealth Group Incorporated

- Dominates with broad consumer health segments and diversified services across care delivery and pharmacy.

- Faces intense competition but benefits from scale and integrated care platforms.

Elevance Health Inc.

- Strong portfolio serving 118M people with integrated medical and digital care solutions.

- Competes aggressively with innovation in digital and behavioral health, expanding market share.

2. Capital Structure & Debt

UnitedHealth Group Incorporated

- Moderate debt-to-equity at 0.78; interest coverage neutral at 4.67x, signaling manageable leverage risk.

- Current ratio weak at 0.79, a liquidity red flag in volatile markets.

Elevance Health Inc.

- Slightly lower debt-to-equity at 0.73; stronger interest coverage at 5.79x, indicating better financial flexibility.

- Healthy current ratio of 1.54 supports operational liquidity and short-term obligations.

3. Stock Volatility

UnitedHealth Group Incorporated

- Low beta of 0.415 reflects defensive stock behavior and lower volatility.

- Trading range wide from 234.6 to 606.36, showing potential price swings.

Elevance Health Inc.

- Beta at 0.503, slightly higher but still indicates moderate volatility relative to market.

- Narrower trading range from 273.71 to 458.75 suggests more stable price movement.

4. Regulatory & Legal

UnitedHealth Group Incorporated

- Operating in complex healthcare regulatory environment with risks from policy shifts.

- Large scale may buffer regulatory costs but invites scrutiny.

Elevance Health Inc.

- Similarly exposed to healthcare regulation; name change reflects strategic repositioning to mitigate risks.

- Focus on digital health may face evolving compliance challenges.

5. Supply Chain & Operations

UnitedHealth Group Incorporated

- Extensive network across pharmacy, clinical, and care services; operational complexity is a risk.

- Employee base of 400K supports scale but adds operational cost pressure.

Elevance Health Inc.

- Integrated care solutions rely on robust supply chain; digital health expansion requires agile operations.

- Smaller workforce of 104K suggests leaner operations but potential capacity constraints.

6. ESG & Climate Transition

UnitedHealth Group Incorporated

- Increasing pressure to improve sustainability in healthcare delivery and supply chain.

- Transparency on ESG metrics critical to maintain investor trust amid sector scrutiny.

Elevance Health Inc.

- ESG initiatives advancing but must balance growth with environmental and social governance.

- Stronger emphasis on digital health aligns with lower carbon footprint potential.

7. Geopolitical Exposure

UnitedHealth Group Incorporated

- Primarily US-focused, limiting direct geopolitical risk but sensitive to domestic healthcare policy.

- Political climate on healthcare reform remains a persistent uncertainty.

Elevance Health Inc.

- Also US-centric but digital services may expand cross-border, exposing it to regulatory variability.

- Geopolitical tensions impact supply chain and digital health data governance risks.

Which company shows a better risk-adjusted profile?

Elevance Health’s stronger liquidity, higher interest coverage, and more favorable valuation ratios mitigate its risks better than UnitedHealth Group. UnitedHealth’s low current ratio and valuation multiples raise caution despite scale advantages. The most impactful risk for UnitedHealth is its weak liquidity amid complex operations. For Elevance, regulatory and operational agility amid growth pressures is key. Elevance’s favorable financial ratios and moderate stock volatility point to a superior risk-adjusted profile.

Final Verdict: Which stock to choose?

UnitedHealth Group’s superpower lies in its robust value creation, consistently delivering returns above its cost of capital. However, its declining profitability and weak liquidity remain points of vigilance. It suits portfolios focused on long-term value with a tolerance for cyclical earnings pressure.

Elevance Health benefits from a strategic moat grounded in operational efficiency and a favorable valuation relative to peers. It offers better liquidity and a steadier income profile than UnitedHealth, making it appealing for investors seeking more moderate risk with growth potential.

If you prioritize sustained economic value creation and can weather near-term margin pressures, UnitedHealth outshines as a compelling choice. However, if you seek a blend of operational safety and attractive valuation, Elevance Health offers better stability and a more favorable risk-return balance. Both present nuanced scenarios aligned with different investor profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of UnitedHealth Group Incorporated and Elevance Health Inc. to enhance your investment decisions: