Investors seeking growth in the technology sector often face tough choices between innovative companies with overlapping markets. Tyler Technologies, Inc. (TYL) and Elastic N.V. (ESTC) both operate in the software application industry, yet they serve distinct niches—public sector management versus data search and analytics. This comparison explores their industry positioning, innovation strategies, and market potential to help you decide which stock might best enhance your portfolio. Let’s uncover which company stands out as the smarter investment in 2026.

Table of contents

Companies Overview

I will begin the comparison between Tyler Technologies, Inc. and Elastic N.V. by providing an overview of these two companies and their main differences.

Tyler Technologies Overview

Tyler Technologies, Inc. focuses on providing integrated information management solutions and services specifically for the public sector. With a diverse product range spanning financial management, judicial systems, public safety, and property tax software, Tyler serves government agencies and educational institutions. Founded in 1966 and headquartered in Plano, Texas, the company operates across multiple segments and maintains a strategic cloud hosting partnership with Amazon Web Services.

Elastic N.V. Overview

Elastic N.V. specializes in search technology designed for multi-cloud environments, offering the Elastic Stack suite which includes Elasticsearch, Kibana, Beats, and Logstash. These products enable data ingestion, search, analysis, and visualization across various data types. Incorporated in 2012 and based in Mountain View, California, Elastic targets diverse use cases such as application search, logging, metrics, and performance monitoring with a platform designed to enhance data management capabilities.

Key similarities and differences

Both Tyler Technologies and Elastic operate within the software application industry and serve enterprise clients with technology solutions. Tyler’s business model centers on public sector software management with a focus on government and education, while Elastic provides cloud-based search and data analytics tools applicable across multiple industries. Tyler has a longer market presence and broader governmental scope, whereas Elastic’s offerings emphasize real-time data search and multi-cloud deployment flexibility.

Income Statement Comparison

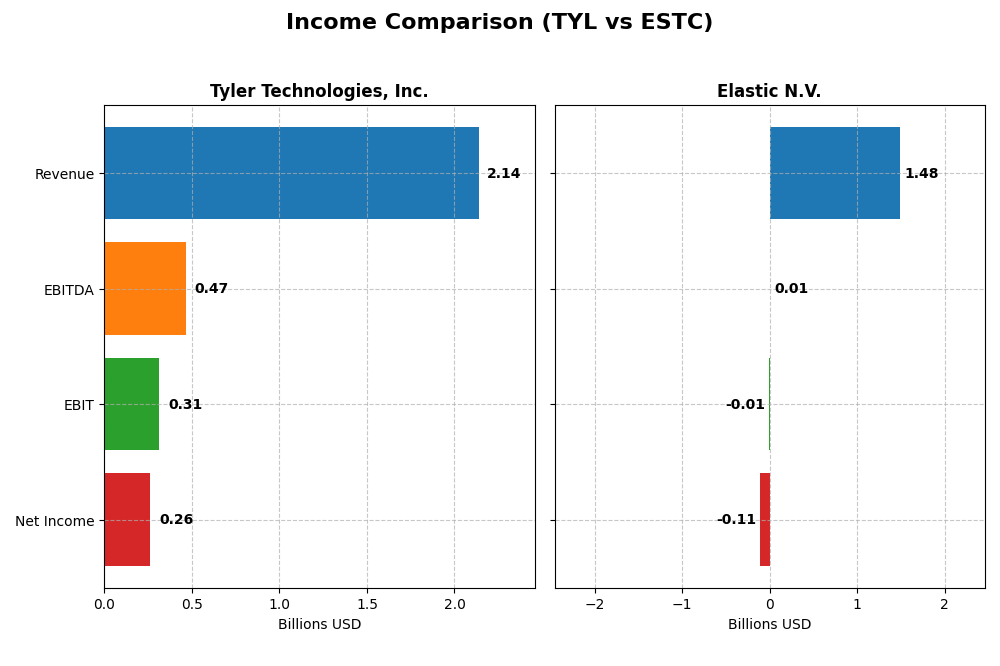

The table below presents a side-by-side comparison of the most recent full fiscal year income statement metrics for Tyler Technologies, Inc. and Elastic N.V.

| Metric | Tyler Technologies, Inc. (TYL) | Elastic N.V. (ESTC) |

|---|---|---|

| Market Cap | 18.9B | 7.5B |

| Revenue | 2.14B | 1.48B |

| EBITDA | 466M | 6M |

| EBIT | 314M | -6.3M |

| Net Income | 263M | -108M |

| EPS | 6.17 | -1.04 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Tyler Technologies, Inc.

Tyler Technologies exhibited a steady revenue growth of 91.45% from 2020 to 2024, reaching $2.14B in 2024. Net income also increased by 35.01% over this period, with a favorable 12.3% net margin in 2024 despite a slight overall net margin decline. The 2024 year showed strong profitability improvements, including a 41.57% EBIT growth and a 55.93% EPS increase.

Elastic N.V.

Elastic’s revenue expanded 143.77% over 2021–2025, hitting $1.48B in 2025, supported by a 17.04% rise in the latest year. However, net income remained negative at -$108M in 2025, with a net margin of -7.29%. Despite strong revenue and gross profit growth, EBIT margins stayed negative, reflecting ongoing operating losses in the most recent fiscal year.

Which one has the stronger fundamentals?

Tyler Technologies presents stronger fundamentals with consistent profitability, favorable margins, and robust net income growth, reflecting operational efficiency. Elastic shows impressive revenue expansion but continues to face challenges in achieving profitability, with negative EBIT and net margins. Tyler’s stable margins and positive net income contrast with Elastic’s losses, indicating more solid income statement fundamentals for Tyler.

Financial Ratios Comparison

This table presents the most recent key financial ratios for Tyler Technologies, Inc. (TYL) and Elastic N.V. (ESTC) as of their latest fiscal year-end, offering a side-by-side view of profitability, liquidity, valuation, and leverage metrics.

| Ratios | Tyler Technologies, Inc. (TYL) 2024 | Elastic N.V. (ESTC) 2025 |

|---|---|---|

| ROE | 7.76% | -11.66% |

| ROIC | 6.20% | -3.45% |

| P/E | 93.42 | -82.65 |

| P/B | 7.25 | 9.64 |

| Current Ratio | 1.35 | 1.92 |

| Quick Ratio | 1.35 | 1.92 |

| D/E (Debt-to-Equity) | 0.19 | 0.64 |

| Debt-to-Assets | 12.32% | 22.95% |

| Interest Coverage | 50.50 | -2.17 |

| Asset Turnover | 0.41 | 0.57 |

| Fixed Asset Turnover | 10.95 | 51.28 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Tyler Technologies, Inc.

Tyler Technologies shows a mixed ratio profile with 50% favorable and 35.7% unfavorable metrics, resulting in a slightly favorable overall opinion. Key strengths include low debt levels, strong interest coverage at 52.96, and a favorable quick ratio of 1.35. Concerns arise from a high price-to-earnings ratio of 93.42 and weak return on equity at 7.76%. The company does not pay dividends, reflecting a possible reinvestment strategy or growth focus.

Elastic N.V.

Elastic presents a balanced but cautious ratio assessment with 42.9% favorable and 42.9% unfavorable metrics, leading to a neutral global view. The firm benefits from a solid current and quick ratio of 1.92, a favorable weighted average cost of capital at 7.83%, and a high fixed asset turnover of 51.28. However, negative net margin, return on equity, and interest coverage raise concerns. Like Tyler, Elastic does not offer dividends, likely prioritizing reinvestment and development.

Which one has the best ratios?

Tyler Technologies holds a slightly favorable overall ratio profile, supported by strong solvency and coverage ratios, despite valuation concerns. Elastic’s neutral stance is weighed down by losses and weak profitability indicators, despite robust liquidity and asset use. Based strictly on ratio evaluations, Tyler shows a marginally stronger financial position for investors to consider.

Strategic Positioning

This section compares the strategic positioning of Tyler Technologies and Elastic N.V., including market position, key segments, and exposure to technological disruption:

Tyler Technologies

- Strong public sector focus with integrated management software; faces moderate competition in government software.

- Key segments include Enterprise Software, Appraisal and Tax, SaaS, and transaction-based fees driving revenues.

- Collaboration with AWS for cloud hosting; technology disruption risk managed via cloud-based service offerings.

Elastic N.V.

- Specializes in multi-cloud search and analytics software; operates in a competitive cloud technology market.

- Revenue driven mainly by Subscription and Professional Services centered on Elastic Stack platform.

- Focus on cloud-native Elastic Stack products; positioned to leverage multi-cloud technological trends.

Tyler Technologies vs Elastic N.V. Positioning

Tyler Technologies adopts a diversified approach targeting public sector software needs across multiple segments, whereas Elastic N.V. concentrates on cloud-based search and analytics solutions. Tyler’s broad government focus contrasts with Elastic’s specialized multi-cloud platform emphasis.

Which has the best competitive advantage?

Both companies are currently shedding value as ROIC remains below WACC, but Elastic shows improving profitability trends, suggesting a slightly more favorable competitive advantage despite ongoing challenges. Tyler faces more significant value destruction with declining returns.

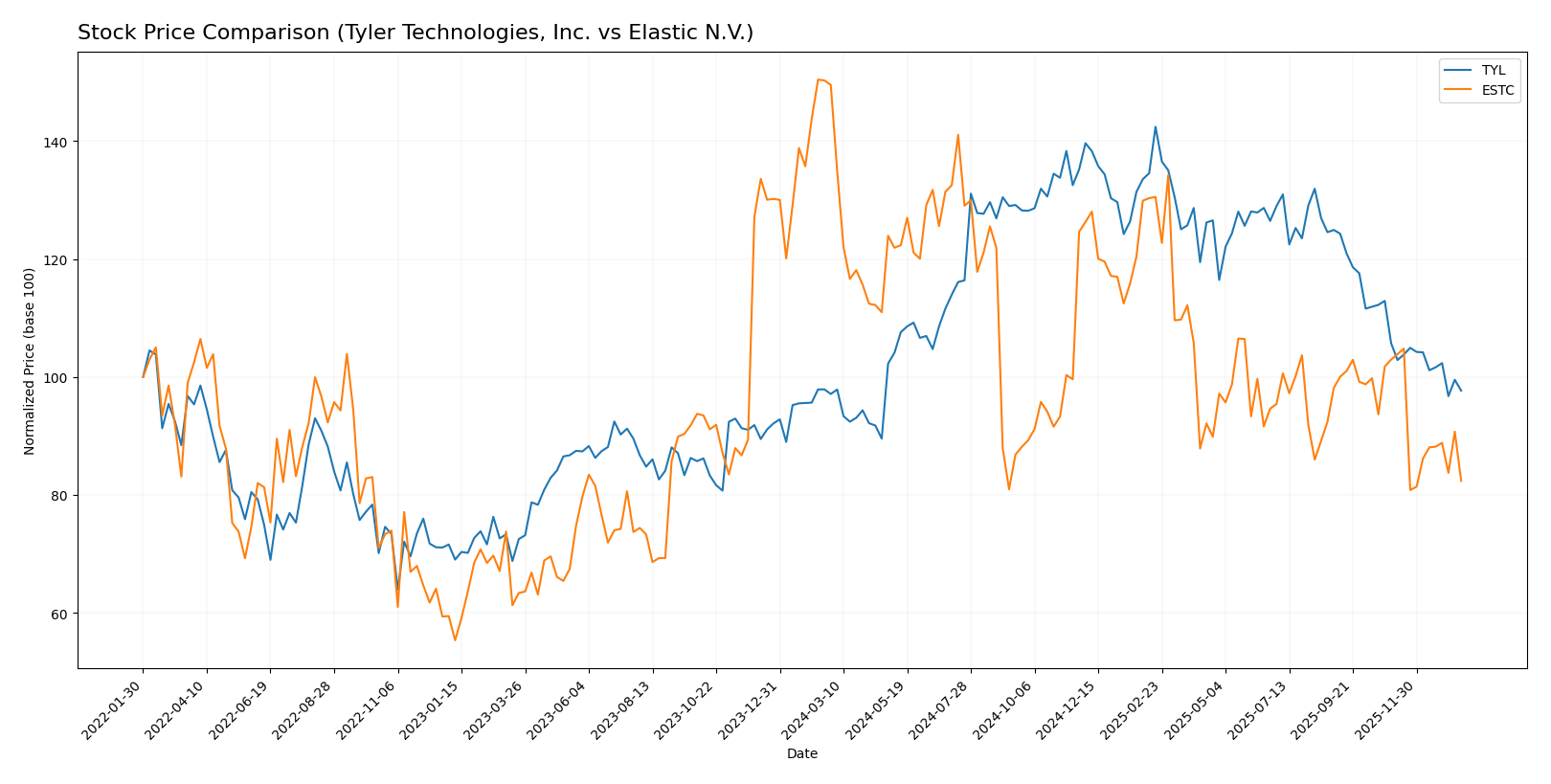

Stock Comparison

The stock prices of Tyler Technologies, Inc. (TYL) and Elastic N.V. (ESTC) over the past 12 months reveal contrasting dynamics, with TYL showing a mild bullish trend despite recent decline, while ESTC exhibits a pronounced bearish trajectory marked by significant price drops.

Trend Analysis

Tyler Technologies, Inc. (TYL) experienced a 0.58% price increase over the past year, indicating a neutral-to-bullish trend with decelerating momentum and a high volatility level (std deviation 61.82). The stock peaked at 641.7 and bottomed at 403.35, though recent weeks saw a -7.61% decline.

Elastic N.V. (ESTC) displayed a -44.93% price change over the same period, confirming a clear bearish trend with deceleration. Its volatility is moderate (std deviation 14.08), with a high of 129.62 and a low of 70.04. The recent trend remained negative with a -20.0% drop.

Comparing both, Tyler Technologies outperformed Elastic over the last 12 months, delivering the highest market performance despite recent downward pressure, whereas Elastic faced sustained and sharper losses.

Target Prices

Analysts present a clear target consensus for Tyler Technologies, Inc. and Elastic N.V., reflecting optimistic outlooks.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Tyler Technologies, Inc. | 675 | 470 | 584 |

| Elastic N.V. | 134 | 76 | 108 |

Tyler Technologies’ consensus target of 584 is notably above its current price of 440.01, suggesting potential upside. Elastic’s consensus target of 108 likewise exceeds its current price of 71.38, indicating expected growth.

Analyst Opinions Comparison

This section compares the analysts’ ratings and grades for Tyler Technologies, Inc. (TYL) and Elastic N.V. (ESTC):

Rating Comparison

TYL Rating

- Rating: B, considered Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation based on cash flow projections.

- ROE Score: 3, reflecting Moderate efficiency in generating profit from equity.

- ROA Score: 4, Favorable use of assets to generate earnings.

- Debt To Equity Score: 3, Moderate financial risk with balanced debt levels.

- Overall Score: 3, a Moderate summary assessment of financial health.

ESTC Rating

- Rating: C-, with a Very Unfavorable overall assessment from analysts.

- Discounted Cash Flow Score: 3, showing a Moderate valuation on future cash flows.

- ROE Score: 1, indicating Very Unfavorable efficiency in equity profit generation.

- ROA Score: 1, Very Unfavorable asset utilization for earnings.

- Debt To Equity Score: 1, Very Unfavorable financial risk due to high debt.

- Overall Score: 1, Very Unfavorable overall financial standing.

Which one is the best rated?

Based strictly on the provided data, Tyler Technologies (TYL) holds a significantly better rating and scores across key financial metrics than Elastic (ESTC), reflecting stronger financial health and lower risk.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Tyler Technologies, Inc. (TYL) and Elastic N.V. (ESTC):

TYL Scores

- Altman Z-Score: 7.42, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 6, categorized as average financial strength.

ESTC Scores

- Altman Z-Score: 3.51, also in the safe zone with moderate safety.

- Piotroski Score: 4, categorized as average financial strength.

Which company has the best scores?

TYL shows a higher Altman Z-Score (7.42) than ESTC (3.51), indicating stronger financial stability. Both companies have average Piotroski Scores, but TYL’s score is slightly higher at 6 versus ESTC’s 4.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to Tyler Technologies, Inc. and Elastic N.V.:

Tyler Technologies, Inc. Grades

The following table summarizes recent grades from established financial institutions for Tyler Technologies, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Overweight | 2026-01-13 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-08 |

| DA Davidson | Maintain | Neutral | 2025-12-09 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| DA Davidson | Maintain | Neutral | 2025-10-31 |

| DA Davidson | Maintain | Neutral | 2025-10-10 |

| DA Davidson | Maintain | Neutral | 2025-08-05 |

| Barclays | Maintain | Overweight | 2025-07-31 |

| Needham | Maintain | Buy | 2025-05-13 |

| Barclays | Maintain | Overweight | 2025-04-25 |

Overall, Tyler Technologies has mostly maintained a neutral to overweight stance, with no recent downgrades.

Elastic N.V. Grades

The following table summarizes recent grades from established financial institutions for Elastic N.V.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-11-24 |

| Wedbush | Maintain | Outperform | 2025-11-21 |

| B of A Securities | Maintain | Neutral | 2025-11-21 |

| Guggenheim | Maintain | Buy | 2025-11-21 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-21 |

| RBC Capital | Maintain | Outperform | 2025-11-21 |

| Canaccord Genuity | Maintain | Buy | 2025-11-21 |

Elastic N.V. consistently holds buy or outperform ratings with no downgrades, reflecting generally positive analyst sentiment.

Which company has the best grades?

Both Tyler Technologies and Elastic N.V. have buy consensus ratings, but Elastic N.V. shows a stronger trend with multiple “Outperform” and “Buy” grades from top-tier firms, while Tyler Technologies mainly holds neutral to overweight ratings. This difference may influence investors seeking more bullish analyst views.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Tyler Technologies, Inc. (TYL) and Elastic N.V. (ESTC) based on recent financial and strategic data.

| Criterion | Tyler Technologies, Inc. (TYL) | Elastic N.V. (ESTC) |

|---|---|---|

| Diversification | Strong product mix with Transaction Based Fees (698M), SaaS Arrangements (645M), and Maintenance (463M) revenue streams. | Revenue mainly from Subscription (1.38B) and Professional Services (98.8M), showing focus on SaaS model. |

| Profitability | Net margin positive at 12.3%, but ROIC is slightly below WACC; company is shedding value with declining profitability. | Negative net margin (-7.3%) and ROIC (-3.5%), indicating current unprofitability but with improving ROIC trend. |

| Innovation | Moderate innovation as indicated by stable product segments but limited ROIC growth. | High innovation potential with growing ROIC trend (+85.8%) despite current losses. |

| Global presence | Established presence with broad product offerings tailored to government sectors. | Growing global SaaS footprint but financials reflect early growth stage challenges. |

| Market Share | Solid position in public sector software with consistent revenue streams. | Expanding market share in cloud search and analytics, driven by subscription growth. |

In summary, Tyler Technologies exhibits diversified revenue and steady profitability but struggles with declining returns and value destruction. Elastic shows promising innovation and ROIC growth but faces profitability challenges typical of a rapidly growing SaaS company. Investors should weigh stability against growth potential carefully.

Risk Analysis

Below is a comparative table highlighting key risks for Tyler Technologies, Inc. (TYL) and Elastic N.V. (ESTC) based on the most recent data from 2025-2026.

| Metric | Tyler Technologies, Inc. (TYL) | Elastic N.V. (ESTC) |

|---|---|---|

| Market Risk | Moderate beta (0.916), stable public sector demand but high P/E (93.42) suggests valuation risk | Moderate beta (0.925), negative margins and volatile growth increase market sensitivity |

| Debt Level | Low debt-to-equity (0.19), strong interest coverage (52.96) | Moderate debt-to-equity (0.64), negative interest coverage (-0.25) indicates financial stress |

| Regulatory Risk | Moderate, software compliance in public sector contracts | Moderate, data privacy and cloud regulations affect operations |

| Operational Risk | Moderate, reliant on government contracts and cloud hosting partnerships | Higher, given negative profitability and operational losses reported |

| Environmental Risk | Low, software company with minimal direct environmental impact | Low, similar software profile with limited environmental footprint |

| Geopolitical Risk | Moderate, US-focused government contracts may face policy shifts | Moderate, global cloud infrastructure exposed to geopolitical tensions |

Tyler Technologies shows lower financial risk with strong balance sheet metrics and stable market positioning but faces valuation pressure. Elastic struggles with profitability and debt service, making operational and financial risks more pronounced. Investors should weigh Tyler’s market valuation risks against Elastic’s turnaround potential and higher financial vulnerability.

Which Stock to Choose?

Tyler Technologies, Inc. (TYL) shows favorable income growth with a 9.53% revenue increase in 2024 and strong profitability, including a 12.3% net margin. Its financial ratios are slightly favorable, supported by low debt levels and robust interest coverage, although ROE and valuation metrics appear less attractive. The company’s credit rating is very favorable despite a declining ROIC trend indicating value destruction.

Elastic N.V. (ESTC) exhibits higher overall revenue growth of 17.04% in 2025 but suffers from negative profitability metrics, including a -7.29% net margin and unfavorable ROE and ROIC ratios. Its financial ratios are neutral overall, with mixed debt metrics and a very favorable credit rating, reflecting improving profitability despite ongoing value shedding.

Investors with a risk-tolerant profile seeking growth might find Elastic’s improving income and ROIC trend indicative of potential upside, while those favoring stability and consistent profitability could view Tyler’s favorable income and stronger financial footing as more reassuring, despite its value erosion. The choice depends on one’s tolerance for risk and preference for growth versus quality metrics.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Tyler Technologies, Inc. and Elastic N.V. to enhance your investment decisions: