In the dynamic world of software applications, Elastic N.V. and SoundHound AI, Inc. stand out with distinct innovation strategies and market focuses. Elastic specializes in real-time search and data analytics across multi-cloud environments, while SoundHound pioneers conversational AI platforms for voice interaction. Both companies operate within the technology sector, targeting overlapping but unique niches. This article will help you decide which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Elastic N.V. and SoundHound AI, Inc. by providing an overview of these two companies and their main differences.

Elastic N.V. Overview

Elastic N.V. is a search technology company specializing in solutions that operate in public or private multi-cloud environments. Its core product, the Elastic Stack, includes Elasticsearch for real-time search and analytics, Kibana for user interface management, Beats and Logstash for data ingestion, and Elastic Agent for host protection. Founded in 2012 and based in Mountain View, California, Elastic serves diverse use cases such as app search, logging, and application performance management.

SoundHound AI, Inc. Overview

SoundHound AI, Inc. focuses on developing an independent voice AI platform designed to create conversational experiences for a variety of industries. Its flagship Houndify platform provides tools including speech recognition, natural language understanding, wake words, and text-to-speech services to help brands build voice assistants. Headquartered in Santa Clara, California, SoundHound AI went public in 2022 and employs fewer staff compared to Elastic.

Key similarities and differences

Both Elastic and SoundHound operate in the software application industry within the technology sector, providing specialized platforms to enhance user interaction with data. Elastic’s business centers on search and analytics software, while SoundHound focuses on voice AI and conversational interfaces. Elastic is the larger company by market cap and employee count, whereas SoundHound exhibits higher stock volatility, reflecting different operational scales and risk profiles.

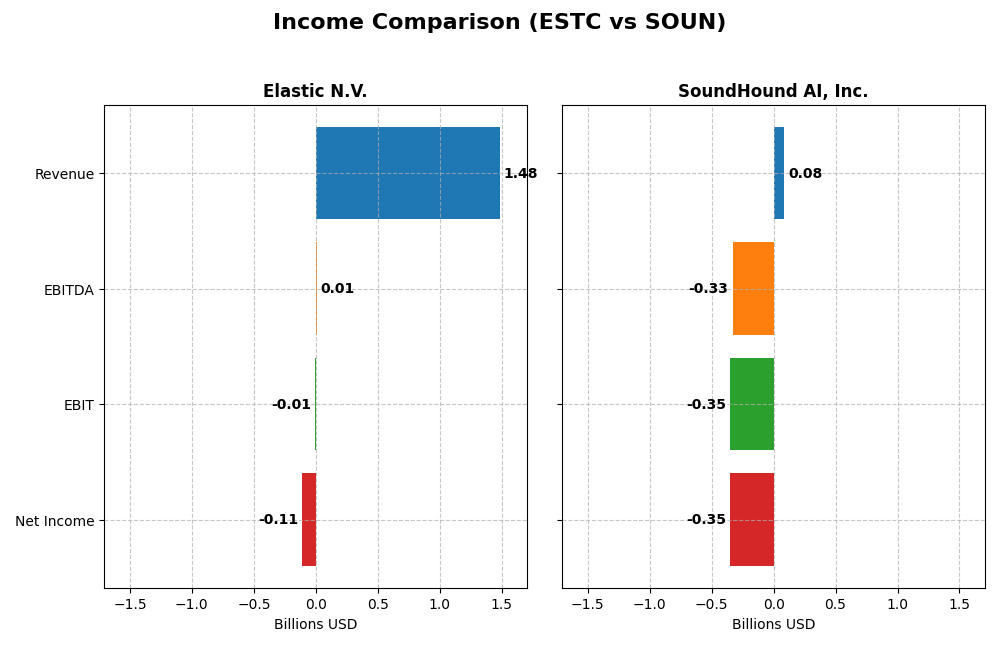

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Elastic N.V. and SoundHound AI, Inc. for their most recent fiscal years.

| Metric | Elastic N.V. (ESTC) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Cap | 7.5B | 4.7B |

| Revenue | 1.48B | 85M |

| EBITDA | 6M | -329M |

| EBIT | -6.3M | -348M |

| Net Income | -108M | -351M |

| EPS | -1.04 | -1.04 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Elastic N.V.

Elastic N.V. showed strong revenue growth over 2021-2025, increasing 144% overall and 17% in the latest year. Gross margins remained healthy at 74.4%, reflecting efficiency in core operations. However, net income fluctuated with a recent loss of $108M in 2025, despite a favorable 16% net income growth overall, indicating margin pressures and ongoing investments.

SoundHound AI, Inc.

SoundHound AI demonstrated rapid revenue expansion, surging 551% over the period and 85% year-on-year to $85M in 2024. Gross margin of 48.9% was solid but significantly lower than Elastic’s. The company faced substantial losses, with a net loss of $351M in 2024 and negative net margins, reflecting high operating expenses and unfavorable interest costs impacting profitability.

Which one has the stronger fundamentals?

Elastic N.V. exhibits stronger fundamentals with consistent revenue and net income growth, superior gross margins, and better cost control indicated by lower interest expenses. SoundHound AI’s impressive top-line growth is overshadowed by deep losses, poor net margins, and high financial costs. Elastic’s income statement profile is more favorable overall, suggesting a more stable financial foundation.

Financial Ratios Comparison

The table below presents the most recent fiscal year financial ratios for Elastic N.V. (ESTC) and SoundHound AI, Inc. (SOUN), providing a side-by-side comparison of key performance metrics.

| Ratios | Elastic N.V. (ESTC) 2025 | SoundHound AI, Inc. (SOUN) 2024 |

|---|---|---|

| ROE | -11.66% | -191.99% |

| ROIC | -3.45% | -68.13% |

| P/E | -82.65 | -19.15 |

| P/B | 9.64 | 36.76 |

| Current Ratio | 1.92 | 3.77 |

| Quick Ratio | 1.92 | 3.77 |

| D/E | 0.64 | 0.02 |

| Debt-to-Assets | 23% | 1% |

| Interest Coverage | -2.17 | -28.05 |

| Asset Turnover | 0.57 | 0.15 |

| Fixed Asset Turnover | 51.28 | 14.28 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Elastic N.V.

Elastic N.V. shows a mixed financial profile with favorable liquidity ratios (current and quick ratios at 1.92) and manageable debt levels (debt to assets at 22.95%). However, profitability indicators such as net margin (-7.29%), ROE (-11.66%), and ROIC (-3.45%) are unfavorable, signaling operational challenges. The company does not pay dividends, likely prioritizing reinvestment or growth, with no dividend yield or payout risks.

SoundHound AI, Inc.

SoundHound AI, Inc. presents predominantly unfavorable ratios including severe negative net margin (-414.06%), ROE (-191.99%), and ROIC (-68.13%), alongside a high WACC (17.71%). The current ratio is high but flagged unfavorable, possibly due to operational inefficiencies. SoundHound also does not issue dividends, reflecting its developmental phase and focus on research and development rather than shareholder returns.

Which one has the best ratios?

Between the two, Elastic N.V. exhibits a more balanced ratio profile with several favorable liquidity and debt metrics, despite some profitability weaknesses. SoundHound AI shows more pronounced financial distress and operational inefficiency, reflected in its unfavorable overall evaluation. Thus, Elastic N.V. holds a relatively stronger ratio standing based on the available data.

Strategic Positioning

This section compares the strategic positioning of Elastic N.V. and SoundHound AI, Inc. based on Market position, Key segments, and Exposure to technological disruption:

Elastic N.V.

- Larger market cap of 7.5B USD with moderate beta 0.93, facing competitive pressure in software applications.

- Key segments include Subscription (1.38B USD) and Professional Services (98.8M USD) focusing on data search and analytics.

- Exposure to technological disruption through multi-cloud data ingestion, real-time search, and analytics platform.

SoundHound AI, Inc.

- Smaller market cap of 4.7B USD with high beta 2.88, facing intense volatility in voice AI software.

- Key segments include Hosted Services (57.2M USD), Licensing (17.6M USD), and Professional Services (9.5M USD) focused on voice AI platforms.

- Exposure centered on voice AI, conversational interfaces, and embedded voice solutions disrupting customer experience.

Elastic N.V. vs SoundHound AI, Inc. Positioning

Elastic N.V. pursues a diversified model emphasizing cloud-based data search and analytics with significant subscription revenues. SoundHound AI focuses on a concentrated voice AI platform with smaller scale but multiple revenue streams in hosted services and licensing.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC but show growing profitability trends. Neither exhibits a strong moat; their competitive advantage remains slightly unfavorable given current capital efficiency.

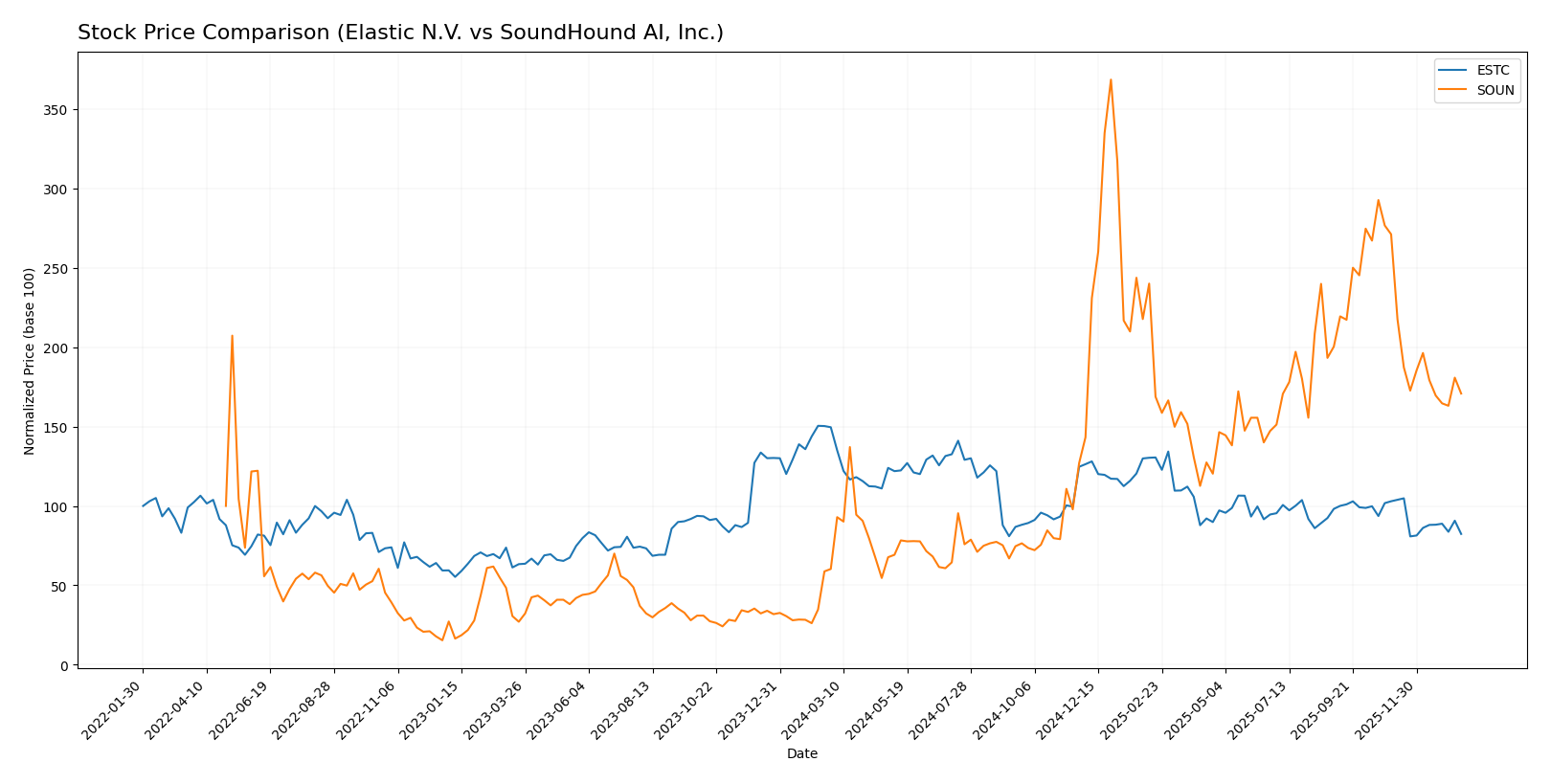

Stock Comparison

The stock price movements of Elastic N.V. (ESTC) and SoundHound AI, Inc. (SOUN) over the past 12 months reveal contrasting trends, with ESTC showing a significant decline and SOUN experiencing strong gains despite recent pullbacks.

Trend Analysis

Elastic N.V. (ESTC) recorded a bearish trend over the last 12 months with a price drop of 44.93%, showing deceleration in its decline and a volatility standard deviation of 14.08. The stock’s range fluctuated between 129.62 and 70.04.

SoundHound AI, Inc. (SOUN) exhibited a bullish trend over the past year, with an impressive 183.16% price increase, though it also faced a deceleration phase. Its volatility was lower at 4.66, with prices ranging from 3.55 to 23.95.

Comparing both stocks, SoundHound AI, Inc. delivered the highest market performance with a substantial positive return, while Elastic N.V. experienced a notable loss throughout the analyzed period.

Target Prices

The target price consensus reflects moderate growth expectations for both Elastic N.V. and SoundHound AI, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Elastic N.V. | 134 | 76 | 108 |

| SoundHound AI, Inc. | 15 | 11 | 13.33 |

Analysts anticipate Elastic N.V. shares could rise significantly from the current $71.38 price, while SoundHound AI’s consensus target price at $13.33 suggests modest upside from its $11.10 market value.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Elastic N.V. and SoundHound AI, Inc.:

Rating Comparison

Elastic N.V. Rating

- Rating: C- with a Very Favorable status

- Discounted Cash Flow Score: 3, Moderate status

- ROE Score: 1, Very Unfavorable status

- ROA Score: 1, Very Unfavorable status

- Debt To Equity Score: 1, Very Unfavorable status

- Overall Score: 1, Very Unfavorable status

SoundHound AI, Inc. Rating

- Rating: C- with a Very Favorable status

- Discounted Cash Flow Score: 1, Very Unfavorable status

- ROE Score: 1, Very Unfavorable status

- ROA Score: 1, Very Unfavorable status

- Debt To Equity Score: 4, Favorable status

- Overall Score: 1, Very Unfavorable status

Which one is the best rated?

Both companies share the same overall rating of C- and very unfavorable overall scores. Elastic N.V. has a better discounted cash flow score, while SoundHound AI shows a significantly stronger debt to equity score.

Scores Comparison

Here is a comparison of the financial scores for Elastic N.V. and SoundHound AI, Inc.:

Elastic N.V. Scores

- Altman Z-Score: 3.51, indicating a safe zone financial status.

- Piotroski Score: 4, categorized as average financial strength.

SoundHound AI Scores

- Altman Z-Score: 6.62, indicating a safe zone financial status.

- Piotroski Score: 3, categorized as very weak financial strength.

Which company has the best scores?

SoundHound AI has a higher Altman Z-Score, placing it more securely in the safe zone. However, Elastic N.V. shows a better Piotroski Score, indicating relatively stronger financial health.

Grades Comparison

Here is the recent grades comparison for Elastic N.V. and SoundHound AI, Inc.:

Elastic N.V. Grades

The following table summarizes recent grades assigned to Elastic N.V. by reputable financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-11-24 |

| Wedbush | Maintain | Outperform | 2025-11-21 |

| B of A Securities | Maintain | Neutral | 2025-11-21 |

| Guggenheim | Maintain | Buy | 2025-11-21 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-21 |

| RBC Capital | Maintain | Outperform | 2025-11-21 |

| Canaccord Genuity | Maintain | Buy | 2025-11-21 |

Elastic N.V. shows a strong bias toward positive ratings, primarily “Buy” and “Outperform,” with no downgrades, indicating sustained confidence.

SoundHound AI, Inc. Grades

The following table presents recent grades assigned to SoundHound AI, Inc. by established grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-11-18 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

SoundHound AI, Inc. displays a mix of “Buy,” “Outperform,” and “Neutral” ratings, with some upgrades, reflecting moderate upward momentum.

Which company has the best grades?

Elastic N.V. holds a stronger consensus with a higher number of consistent “Buy” and “Outperform” grades compared to SoundHound AI, Inc., which has more neutral ratings. This suggests Elastic N.V. currently enjoys broader analyst confidence, potentially impacting investor sentiment positively.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses of Elastic N.V. (ESTC) and SoundHound AI, Inc. (SOUN) based on the most recent data available.

| Criterion | Elastic N.V. (ESTC) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from Subscription (1.38B USD) and Professional Services (99M USD) | Moderate: Revenue from Hosted Services (57M USD), Licensing (18M USD), and Professional Services (9.5M USD) |

| Profitability | Unfavorable: Negative net margin (-7.29%) and ROIC (-3.45%); company shedding value but ROIC improving | Unfavorable: Deeply negative net margin (-414%) and ROIC (-68%); company shedding value but ROIC improving |

| Innovation | Strong: Growing ROIC trend (+85.8%) signals improving capital efficiency | Strong: Growing ROIC trend (+57.2%) despite current losses, indicating ongoing innovation efforts |

| Global presence | Established: Larger scale subscription business implies wider market reach | Emerging: Smaller scale and revenue suggest limited global footprint |

| Market Share | Significant in its segment with steady subscription growth over years | Smaller niche player with lower revenue and market penetration |

Key takeaways: Both companies are currently unprofitable and shedding value, yet they demonstrate improving profitability trends. Elastic N.V. shows stronger scale and market presence, while SoundHound AI is a smaller, innovative player with potential for growth but higher risk. Investors should weigh growth prospects against current financial challenges carefully.

Risk Analysis

Below is a comparative table summarizing key risks for Elastic N.V. (ESTC) and SoundHound AI, Inc. (SOUN) based on their latest financial and operational data:

| Metric | Elastic N.V. (ESTC) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Risk | Moderate (Beta 0.925, stable tech sector) | High (Beta 2.879, high volatility) |

| Debt Level | Moderate (Debt-to-Equity 0.64, neutral) | Low (Debt-to-Equity 0.02, favorable) |

| Regulatory Risk | Moderate (Tech industry compliance) | Moderate (AI voice tech regulatory scrutiny) |

| Operational Risk | Moderate (Negative margins, ROE -11.66%) | High (Severe negative margins, ROE -191.99%) |

| Environmental Risk | Low (Software sector, limited direct impact) | Low (Software sector, limited direct impact) |

| Geopolitical Risk | Moderate (US-based with global cloud operations) | Moderate (US-based, international clients) |

Elastic N.V. faces moderate market and operational risks, with relatively stable debt but negative profitability indicators. SoundHound AI encounters higher market volatility and operational risks, with extremely negative margins and profitability, despite a strong balance sheet. The most impactful risks are operational for both, especially SoundHound’s financial losses and Elastic’s profitability challenges. Caution is advised when considering exposure to either.

Which Stock to Choose?

Elastic N.V. (ESTC) shows a favorable income evolution with 17% revenue growth in 2025 and a 71% positive income statement rating. Its financial ratios are mixed: 43% favorable but also 43% unfavorable, reflecting weak profitability and moderate debt. The company is shedding value with a slightly unfavorable moat rating, despite a growing ROIC trend. The rating is very favorable overall, though key scores like ROE and P/E remain unfavorable.

SoundHound AI, Inc. (SOUN) exhibits strong revenue growth of 85% in 2024 but suffers from unfavorable income quality and profitability, with a 57% unfavorable income statement rating. Financial ratios are mostly unfavorable at 64%, indicating poor efficiency and weak asset turnover, though debt levels are low. SOUN is also shedding value with a slightly unfavorable moat rating and a very favorable rating classification, but with a very weak Piotroski score.

Considering the ratings and financial evaluations, investors prioritizing growth potential might view SoundHound’s rapid revenue expansion as attractive despite its risks. Conversely, those seeking a more balanced financial profile with improving profitability could find Elastic’s stronger income statement and moderate financial health more appealing. The choice could depend on the investor’s risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Elastic N.V. and SoundHound AI, Inc. to enhance your investment decisions: