In the dynamic world of technology, Elastic N.V. (ESTC) and Perfect Corp. (PERF) stand out as innovators in software applications, each carving a distinct niche while sharing a market focus on cutting-edge solutions. Elastic excels in data search and analytics across multi-cloud environments, whereas Perfect Corp. leads in AI-driven augmented reality for beauty and fashion tech. This comparison will help investors identify which company offers the most compelling growth and value potential in 2026.

Table of contents

Companies Overview

I will begin the comparison between Elastic N.V. and Perfect Corp. by providing an overview of these two companies and their main differences.

Elastic N.V. Overview

Elastic N.V. is a search technology company that provides solutions designed to operate in public or private clouds across multi-cloud environments. Its flagship Elastic Stack includes products such as Elasticsearch, Kibana, Beats, Elastic Agent, and Logstash, which enable data ingestion, storage, search, analysis, and visualization. Founded in 2012 and headquartered in Mountain View, California, Elastic serves diverse data-related use cases including app search, logging, metrics, and application performance management.

Perfect Corp. Overview

Perfect Corp. offers SaaS artificial intelligence and augmented reality solutions focused on the beauty and fashion technology sectors. Its product suite includes virtual try-on apps and AI tools for makeup, hair styling, skin analysis, and accessories, supporting both consumer apps and business services. Founded in 2015 and based in New Taipei City, Taiwan, Perfect Corp. integrates AR and AI to enhance retail and personal beauty experiences through its YouCam apps and customized solutions.

Key similarities and differences

Both Elastic N.V. and Perfect Corp. operate in the technology sector under the software application industry, leveraging advanced software to deliver innovative solutions. Elastic focuses on data search, analytics, and cloud-based infrastructure, while Perfect Corp. specializes in AI and AR applications tailored to beauty and fashion. Elastic is a significantly larger company by market capitalization and employee count, whereas Perfect Corp. is more niche with a smaller workforce and market presence, reflecting their different market positions and product focuses.

Income Statement Comparison

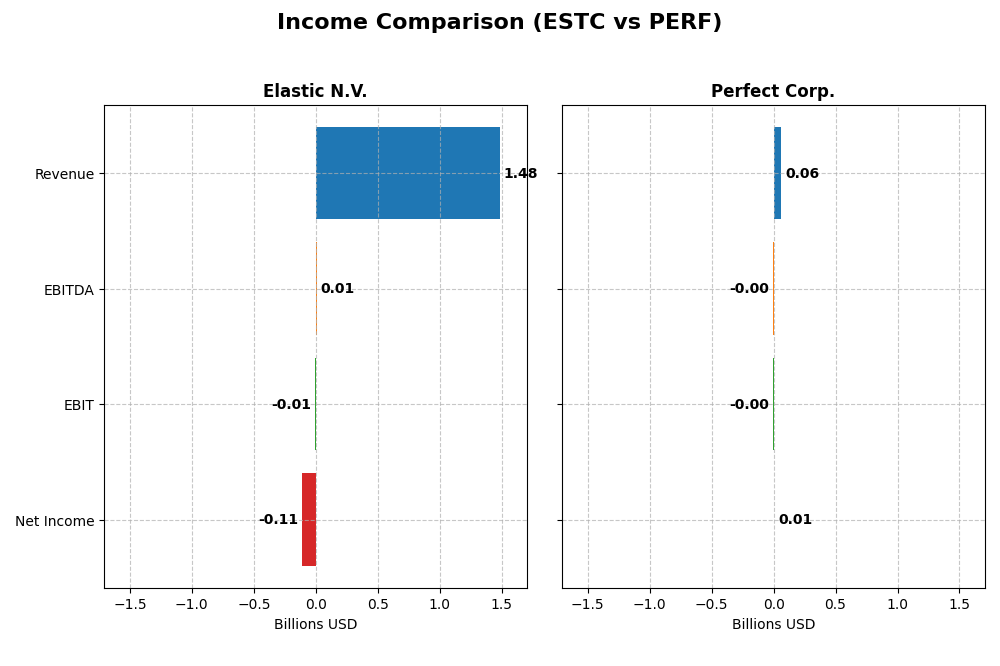

This table presents a side-by-side comparison of key income statement metrics for Elastic N.V. and Perfect Corp. for their most recent fiscal years, providing a snapshot of their financial performance.

| Metric | Elastic N.V. (ESTC) | Perfect Corp. (PERF) |

|---|---|---|

| Market Cap | 7.52B | 179M |

| Revenue | 1.48B | 60.2M |

| EBITDA | 6.1M | -2.0M |

| EBIT | -6.3M | -2.8M |

| Net Income | -108.1M | 5.0M |

| EPS | -1.04 | 0.05 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Elastic N.V.

Elastic N.V. showed strong revenue growth from $608M in 2021 to $1.48B in 2025, with gross margins stable around 74%. Despite an unfavorable net margin of -7.29% in 2025, the company improved EBIT margin significantly, indicating operational progress. The latest year saw revenue grow 17%, yet net income turned negative at -$108M, signaling margin pressure.

Perfect Corp.

Perfect Corp. grew revenue from $29.9M in 2020 to $60.2M in 2024, maintaining favorable gross margins near 78%. Net income improved to $5M in 2024 with a positive net margin of 8.34%. While EBIT margin remained negative at -4.72%, the company showed consistent revenue and net income growth, although EBIT declined sharply in the last year.

Which one has the stronger fundamentals?

Both companies demonstrate favorable revenue growth and strong gross margins, yet Elastic’s larger scale and improving EBIT contrast with Perfect’s smaller size but positive net margin and EPS growth. Elastic faces recent net losses despite growth, while Perfect maintains profitability but with weaker EBIT. Elastic’s fundamentals show more operational scale, Perfect’s reflect healthier profitability.

Financial Ratios Comparison

The table below presents the most recent key financial ratios for Elastic N.V. and Perfect Corp., reflecting their fiscal year 2025 and 2024 performances respectively.

| Ratios | Elastic N.V. (ESTC) FY 2025 | Perfect Corp. (PERF) FY 2024 |

|---|---|---|

| ROE | -11.66% | 3.42% |

| ROIC | -3.45% | -2.10% |

| P/E | -82.7 | 56.6 |

| P/B | 9.64 | 1.93 |

| Current Ratio | 1.92 | 5.52 |

| Quick Ratio | 1.92 | 5.52 |

| D/E (Debt-to-Equity) | 0.64 | 0.0035 |

| Debt-to-Assets | 23% | 0.28% |

| Interest Coverage | -2.17 | -449 |

| Asset Turnover | 0.57 | 0.33 |

| Fixed Asset Turnover | 51.3 | 57.9 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Elastic N.V.

Elastic N.V. shows a mixed financial profile with favorable liquidity ratios (current and quick ratio at 1.92) and a low debt-to-assets ratio (22.95%), indicating solid short-term financial health. However, profitability metrics like net margin (-7.29%), return on equity (-11.66%), and interest coverage (-0.25) are unfavorable, signaling operational challenges. The company does not pay dividends, likely reflecting reinvestment in growth and R&D priorities.

Perfect Corp.

Perfect Corp. exhibits a slightly unfavorable overall ratio profile, with positive net margin (8.34%) but weak returns such as ROE (3.42%) and ROIC (-2.1%). Despite a strong quick ratio (5.52) and minimal debt (debt-to-assets 0.28%), the interest coverage ratio is deeply negative (-406.29), raising concerns about financial leverage. The company does not distribute dividends, consistent with its growth and reinvestment strategy.

Which one has the best ratios?

Elastic N.V. presents a more balanced ratio distribution, with a higher proportion of favorable liquidity and leverage metrics, despite profitability weaknesses. Perfect Corp. faces more pronounced unfavorable ratios, particularly in interest coverage and asset turnover. Overall, Elastic N.V.’s ratios appear more stable, while Perfect Corp.’s ratios suggest greater financial risk and operational inefficiency.

Strategic Positioning

This section compares the strategic positioning of Elastic N.V. and Perfect Corp. regarding market position, key segments, and exposure to technological disruption:

Elastic N.V.

- Market leader in multi-cloud search software, facing competition in application software.

- Key segments: subscription software and professional services driving revenue growth.

- Exposed to disruption via cloud computing and real-time analytics technology.

Perfect Corp.

- Smaller market cap, focused on AI and AR beauty and fashion tech, with niche competitive pressures.

- Focused on SaaS AI and AR solutions for beauty and fashion, with multiple virtual try-on applications.

- Faces disruption risk from rapid AI and AR innovation in consumer beauty tech applications.

Elastic N.V. vs Perfect Corp. Positioning

Elastic N.V. has a diversified business model with strong subscription revenue and professional services, while Perfect Corp. is more concentrated on AI-driven beauty and fashion tech solutions. Elastic’s broad platform contrasts with Perfect’s specialized niche focus.

Which has the best competitive advantage?

Both companies are slightly unfavorable in MOAT evaluation, shedding value but showing improving ROIC trends. Neither currently demonstrates a strong sustainable competitive advantage based on ROIC versus WACC.

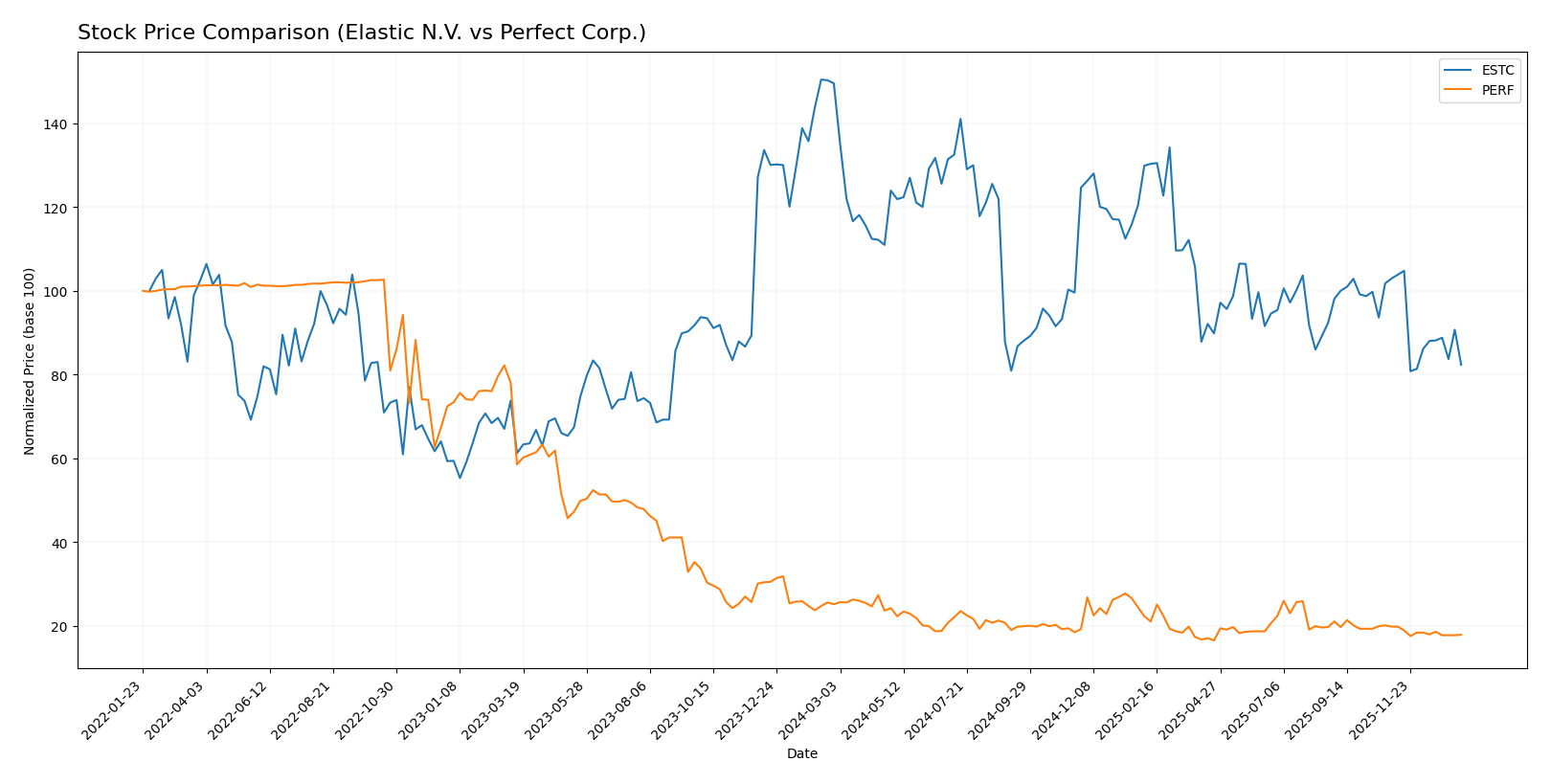

Stock Comparison

The past year has seen significant price declines for both Elastic N.V. and Perfect Corp., with Elastic experiencing a sharper drop and higher volatility, while trading volumes for both stocks have shown an increasing trend amid shifting buyer-seller dynamics.

Trend Analysis

Elastic N.V. (ESTC) displayed a bearish trend over the past 12 months with a -44.93% price change and decelerating decline. It reached a high of 129.62 and a low of 70.04, showing elevated volatility at 14.08 std deviation.

Perfect Corp. (PERF) also experienced a bearish trend with a -28.98% price change and deceleration. The stock showed low volatility at 0.27 std deviation, with a highest price of 2.7 and lowest of 1.61 over the year.

Comparing both, Elastic N.V. had the larger price decrease and greater volatility, resulting in a lower market performance than Perfect Corp. during the analyzed period.

Target Prices

Analyst consensus target prices suggest potential upside for these technology companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Elastic N.V. | 134 | 76 | 108 |

| Perfect Corp. | 7 | 7 | 7 |

Elastic N.V.’s consensus target of 108 USD is significantly above its current price of 71.38 USD, indicating bullish analyst expectations. Perfect Corp.’s target at 7 USD also suggests considerable upside from its current 1.74 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Elastic N.V. and Perfect Corp.:

Rating Comparison

Elastic N.V. Rating

- Rating: C- with a very favorable status.

- Discounted Cash Flow Score: 3, moderate status.

- ROE Score: 1, very unfavorable status.

- ROA Score: 1, very unfavorable status.

- Debt To Equity Score: 1, very unfavorable status.

- Overall Score: 1, very unfavorable status.

Perfect Corp. Rating

- Rating: A- with a very favorable status.

- Discounted Cash Flow Score: 5, very favorable status.

- ROE Score: 2, moderate status.

- ROA Score: 3, moderate status.

- Debt To Equity Score: 4, favorable status.

- Overall Score: 4, favorable status.

Which one is the best rated?

Based strictly on the provided data, Perfect Corp. is better rated than Elastic N.V., with higher scores across all financial metrics and a superior overall rating. Elastic N.V. shows consistently low scores and less favorable ratings.

Scores Comparison

Here is a comparison of Elastic N.V. and Perfect Corp. based on their Altman Z-Score and Piotroski Score:

Elastic N.V. Scores

- Altman Z-Score of 3.51 indicates a safe zone status, low bankruptcy risk.

- Piotroski Score of 4 reflects average financial strength and value.

Perfect Corp. Scores

- Altman Z-Score of 1.31 places it in distress zone, high bankruptcy risk.

- Piotroski Score of 6 reflects average but stronger financial health.

Which company has the best scores?

Elastic N.V. shows a safer financial position with a high Altman Z-Score in the safe zone, while Perfect Corp. scores better on the Piotroski scale but is in financial distress by Altman standards.

Grades Comparison

The following presents a comparison of the available grades for Elastic N.V. and Perfect Corp.:

Elastic N.V. Grades

This table summarizes recent grades from reputable financial institutions for Elastic N.V.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-11-24 |

| Wedbush | Maintain | Outperform | 2025-11-21 |

| B of A Securities | Maintain | Neutral | 2025-11-21 |

| Guggenheim | Maintain | Buy | 2025-11-21 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-21 |

| RBC Capital | Maintain | Outperform | 2025-11-21 |

| Canaccord Genuity | Maintain | Buy | 2025-11-21 |

Elastic N.V.’s grades predominantly reflect positive sentiment, with a consensus of “Buy” supported by multiple “Buy” and “Outperform” ratings from leading analysts.

Perfect Corp. Grades

This table summarizes recent grades from reputable financial institutions for Perfect Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2024-02-29 |

| Goldman Sachs | Maintain | Neutral | 2023-10-26 |

| Piper Sandler | Maintain | Neutral | 2023-10-25 |

| Piper Sandler | Maintain | Neutral | 2023-07-26 |

| Piper Sandler | Maintain | Neutral | 2023-07-25 |

| Piper Sandler | Maintain | Neutral | 2023-04-27 |

| Oppenheimer | Downgrade | Perform | 2023-04-20 |

| Oppenheimer | Downgrade | Perform | 2023-04-19 |

| Oppenheimer | Downgrade | Perform | 2023-04-18 |

| Piper Sandler | Maintain | Neutral | 2023-03-08 |

Perfect Corp.’s grades show a consistent “Neutral” or “Perform” consensus, indicating a more cautious analyst stance compared to Elastic N.V.

Which company has the best grades?

Elastic N.V. has received significantly more favorable grades, with a strong majority of “Buy” and “Outperform” ratings, while Perfect Corp. holds mainly “Neutral” and downgraded “Perform” grades. This difference implies higher analyst confidence in Elastic N.V.’s outlook, potentially affecting investor sentiment and portfolio positioning accordingly.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Elastic N.V. (ESTC) and Perfect Corp. (PERF) based on their latest financial and operational data.

| Criterion | Elastic N.V. (ESTC) | Perfect Corp. (PERF) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from Subscription (1.38B USD) with some Professional Services (98.8M USD) | Limited: No detailed revenue segmentation available |

| Profitability | Weak: Negative net margin (-7.29%), ROIC (-3.45%), and ROE (-11.66%) | Weak: Positive net margin (8.34%) but negative ROIC (-2.1%) and low ROE (3.42%) |

| Innovation | Growing ROIC trend (+85.8%) shows improving profitability potential despite current losses | Growing ROIC trend (+45.8%) indicates improving profitability but still value destructive |

| Global presence | Strong: Subscription business likely global, supported by steady revenue growth | Moderate: No explicit data, but company shows some operational scale |

| Market Share | Significant in its niche, supported by growing subscription revenue from 392M USD in 2020 to 1.38B USD in 2025 | Not clearly defined, but financial ratios suggest smaller scale and higher volatility |

Key takeaways: Both companies are currently shedding value with negative returns on invested capital compared to their cost of capital. However, they show improving profitability trends. Elastic N.V. demonstrates stronger revenue growth and global reach, while Perfect Corp. faces more financial challenges and lacks diversification data. Investors should exercise caution and consider these trends alongside market conditions.

Risk Analysis

Below is a comparative table highlighting key risks for Elastic N.V. (ESTC) and Perfect Corp. (PERF) based on the most recent data available:

| Metric | Elastic N.V. (ESTC) | Perfect Corp. (PERF) |

|---|---|---|

| Market Risk | Moderate (Beta 0.93) | Low (Beta 0.45) |

| Debt level | Moderate (Debt/Equity 0.64) | Low (Debt/Equity 0.0) |

| Regulatory Risk | Moderate (US tech sector) | Moderate (Taiwan tech sector) |

| Operational Risk | Moderate (3,403 employees, multi-cloud ops) | Moderate (342 employees, AI/AR focus) |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate (US-based, global operations) | High (Taiwan-based, geopolitical tensions) |

Elastic N.V. faces moderate market and operational risks with a balanced but non-negligible debt level, while Perfect Corp. has low debt but higher geopolitical risk due to its Taiwan base amid regional tensions. Both companies operate in regulated tech environments where compliance is critical.

Which Stock to Choose?

Elastic N.V. (ESTC) shows a favorable income statement with 17% revenue growth in 2025 but suffers from negative profitability and return ratios, including a -11.66% ROE. Its debt levels are moderate, and the overall rating is very favorable despite some unfavorable financial ratios.

Perfect Corp. (PERF) presents a favorable income evolution with 12.5% revenue growth and positive net margin of 8.34% in 2024. Profitability ratios are mixed, with a modest 3.42% ROE and low debt. The company holds a very favorable rating but exhibits some unfavorable financial ratios as well.

Investors focused on growth might find Elastic’s improving income and profitability trends appealing, whereas those prioritizing financial stability and moderate risk might see Perfect’s consistent income growth and stronger rating as more suitable. Both companies show signs of value destruction but with improving profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Elastic N.V. and Perfect Corp. to enhance your investment decisions: