Edwards Lifesciences Corporation and Insulet Corporation are two prominent players in the medical devices sector, each driving innovation in critical healthcare areas. Edwards focuses on advanced heart valve technologies and critical care monitoring, while Insulet specializes in insulin delivery systems for diabetes management. Their overlapping commitment to transformative medical solutions makes them compelling investment candidates. In this article, I will analyze both companies to help you decide which offers the most promising opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Edwards Lifesciences Corporation and Insulet Corporation by providing an overview of these two companies and their main differences.

Edwards Lifesciences Corporation Overview

Edwards Lifesciences Corporation focuses on products and technologies for structural heart disease and critical care monitoring. It offers transcatheter heart valve replacements and repairs, surgical heart solutions, and advanced hemodynamic monitoring systems. Founded in 1958 and headquartered in Irvine, California, Edwards operates globally, distributing through direct sales and independent distributors in the medical devices industry.

Insulet Corporation Overview

Insulet Corporation develops and markets insulin delivery systems for insulin-dependent diabetes patients. Its flagship product is the Omnipod System, a tubeless, self-adhesive insulin pump worn for up to three days, paired with a wireless personal diabetes manager. Incorporated in 2000 and based in Acton, Massachusetts, Insulet sells primarily through independent distributors and pharmacy channels across the US, Canada, Europe, the Middle East, and Australia.

Key similarities and differences

Both Edwards and Insulet operate within the healthcare sector, specializing in medical devices aimed at improving patient outcomes. Edwards concentrates on structural heart and critical care technologies, while Insulet targets diabetes management through insulin delivery systems. Edwards has a larger workforce and market cap, reflecting its broader product portfolio and global reach, whereas Insulet maintains a more focused product line with higher beta volatility.

Income Statement Comparison

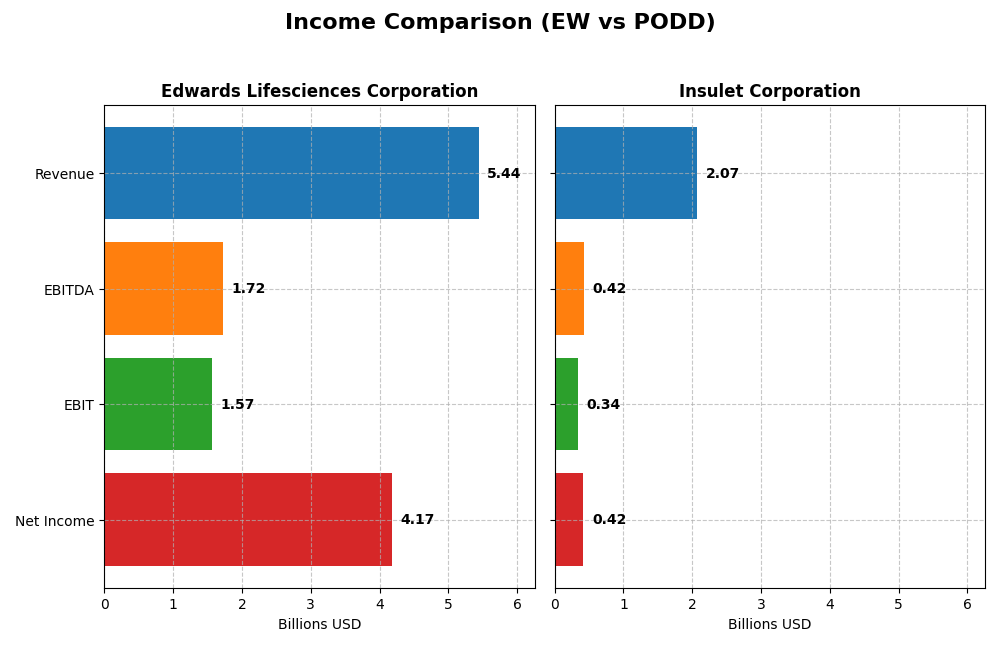

Below is the income statement comparison for Edwards Lifesciences Corporation and Insulet Corporation for the fiscal year 2024, highlighting key financial metrics.

| Metric | Edwards Lifesciences Corporation (EW) | Insulet Corporation (PODD) |

|---|---|---|

| Market Cap | 50B | 20.3B |

| Revenue | 5.44B | 2.07B |

| EBITDA | 1.72B | 424M |

| EBIT | 1.57B | 343M |

| Net Income | 4.17B | 418M |

| EPS | 6.98 | 5.97 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Edwards Lifesciences Corporation

Edwards Lifesciences has shown consistent revenue growth over 2020-2024, increasing from $4.39B to $5.44B. Net income surged notably in 2024 to $4.17B from $1.40B in 2023, driven by a significant rise in discontinued operations. Margins remained strong, with gross margin stable around 79% and net margin improving sharply in 2024, indicating enhanced profitability despite slightly unfavorable operating expense growth.

Insulet Corporation

Insulet’s revenue climbed robustly from $904M in 2020 to $2.07B in 2024, with net income rising from $6.8M to $418M. Margins improved steadily, with gross margin near 70% and net margin at 20.2% in 2024. The latest year saw accelerated growth, including a 22% revenue increase and a near doubling of net margin, reflecting operational efficiency and strong demand for its insulin delivery systems.

Which one has the stronger fundamentals?

Both companies exhibit favorable income statement evaluations, but Insulet’s growth rates outpace Edwards with exceptional net income and EPS growth over the period. Edwards holds higher absolute profitability and margins, benefiting from discontinued operations. Insulet’s purely favorable growth and margin improvements suggest dynamic expansion, but Edwards’ scale and margin strength reflect solid fundamentals.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for Edwards Lifesciences Corporation (EW) and Insulet Corporation (PODD) based on their most recent fiscal year data (2024).

| Ratios | Edwards Lifesciences (EW) | Insulet Corporation (PODD) |

|---|---|---|

| ROE | 41.75% | 34.52% |

| ROIC | 10.72% | 16.27% |

| P/E | 10.60 | 43.74 |

| P/B | 4.43 | 15.10 |

| Current Ratio | 4.18 | 3.54 |

| Quick Ratio | 3.45 | 2.73 |

| D/E (Debt to Equity) | 0.07 | 1.17 |

| Debt-to-Assets | 5.36% | 46.05% |

| Interest Coverage | 69.63 | 7.23 |

| Asset Turnover | 0.42 | 0.67 |

| Fixed Asset Turnover | 3.05 | 2.73 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Edwards Lifesciences Corporation

Edwards Lifesciences shows a strong set of financial ratios, with favorable net margin at 76.75% and a high return on equity of 41.75%. However, the current ratio of 4.18 and price-to-book ratio of 4.43 are less favorable, suggesting some liquidity and valuation concerns. The company does not pay dividends, likely reinvesting earnings to sustain growth, with no recent payout or buyback programs.

Insulet Corporation

Insulet’s ratios present a mixed picture: net margin is positive at 20.19%, with a solid return on equity of 34.52%, but a very high price-to-earnings ratio of 43.74 and price-to-book of 15.1 are unfavorable. Its debt-to-equity ratio of 1.17 signals higher leverage risks. Insulet also does not pay dividends, probably focusing on reinvestment and innovation instead of shareholder payouts.

Which one has the best ratios?

Edwards Lifesciences has a more favorable overall ratio profile, with 64.29% favorable ratios compared to Insulet’s 35.71%, and stronger profitability and leverage metrics. Insulet’s higher valuation multiples and leverage reduce its attractiveness on a purely ratio-based evaluation. Thus, Edwards demonstrates better financial stability and efficiency in this comparison.

Strategic Positioning

This section compares the strategic positioning of Edwards Lifesciences Corporation and Insulet Corporation, including Market position, Key segments, and exposure to disruption:

Edwards Lifesciences Corporation

- Leading medical devices firm in structural heart disease with strong competitive positioning.

- Key segments include transcatheter heart valves, surgical heart valve therapy, and critical care.

- Faces technological disruption primarily in minimally invasive heart valve and monitoring systems.

Insulet Corporation

- Specialized in insulin delivery systems with increasing market presence and competitive pressure.

- Focused on drug delivery and international Omnipod insulin systems as main business drivers.

- Operates in diabetes care with innovation in tubeless, wearable insulin delivery devices.

Edwards Lifesciences Corporation vs Insulet Corporation Positioning

Edwards has a diversified portfolio across structural heart and critical care segments, offering multiple revenue streams. Insulet concentrates on insulin delivery systems, focusing on innovation in a niche diabetes market. Diversification offers Edwards broader exposure but potential complexity.

Which has the best competitive advantage?

Insulet shows a very favorable MOAT with growing ROIC, indicating durable competitive advantage and increasing profitability. Edwards also creates value but with declining ROIC, suggesting a slightly favorable position with some profitability challenges.

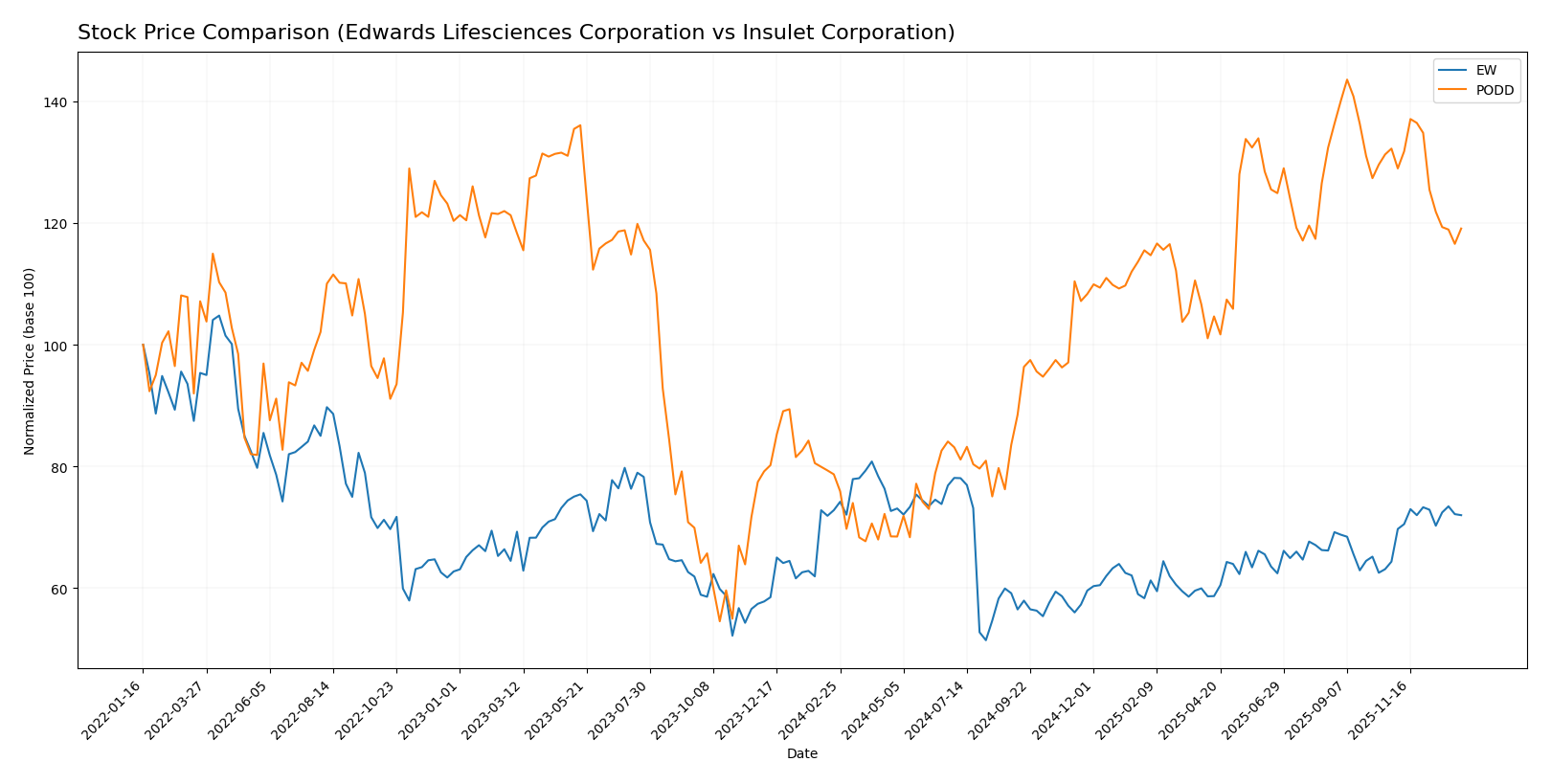

Stock Comparison

The stock price movements of Edwards Lifesciences Corporation (EW) and Insulet Corporation (PODD) over the past year reveal contrasting market dynamics, with EW showing mild overall decline but recent gains, while PODD exhibits strong overall growth with recent pullbacks.

Trend Analysis

Edwards Lifesciences Corporation’s stock experienced a slight bearish trend over the past 12 months with a -1.13% price change, showing acceleration despite this decline and a high volatility level (std deviation 8.32). Recent months indicate a bullish reversal with an 11.87% gain.

Insulet Corporation’s stock showed a strong bullish trend over the past year with a 51.32% increase, though the trend is decelerating. Volatility is high (std deviation 54.06), and recent performance declined by 9.93%, reflecting short-term bearish pressure.

Comparing both, Insulet Corporation delivered the highest market performance over the past 12 months with a significant 51.32% gain, while Edwards Lifesciences showed marginal overall decline but recent upward momentum.

Target Prices

The consensus target prices indicate a generally positive outlook from analysts for both Edwards Lifesciences Corporation and Insulet Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Edwards Lifesciences Corporation | 108 | 87 | 96.47 |

| Insulet Corporation | 450 | 301 | 381.6 |

Analysts expect Edwards Lifesciences shares to appreciate moderately from the current price of $85.13, while Insulet’s consensus target suggests significant upside potential versus its current $289.04 share price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Edwards Lifesciences Corporation (EW) and Insulet Corporation (PODD):

Rating Comparison

EW Rating

- Rating: A- indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 4, favorable, suggesting reasonable valuation.

- ROE Score: 4, favorable, showing efficient profit generation from equity.

- ROA Score: 5, very favorable, demonstrating excellent asset utilization.

- Debt To Equity Score: 3, moderate, reflecting balanced financial risk.

- Overall Score: 4, favorable, indicating strong financial standing.

PODD Rating

- Rating: B- indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 1, very unfavorable, indicating possible overvaluation.

- ROE Score: 4, favorable, showing efficient profit generation from equity.

- ROA Score: 4, favorable, demonstrating good asset utilization.

- Debt To Equity Score: 3, moderate, reflecting balanced financial risk.

- Overall Score: 2, moderate, indicating average financial standing.

Which one is the best rated?

Based strictly on the provided data, EW holds a superior overall rating and stronger scores in discounted cash flow and return on assets, while PODD scores lower particularly in valuation metrics. Thus, EW is the better rated company between the two.

Scores Comparison

The following table presents a comparison of the Altman Z-Score and Piotroski Score for Edwards Lifesciences Corporation (EW) and Insulet Corporation (PODD):

EW Scores

- Altman Z-Score: 12.28, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength and value potential.

PODD Scores

- Altman Z-Score: 9.99, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial strength and value potential.

Which company has the best scores?

Based strictly on the data, EW has a higher Altman Z-Score, suggesting stronger bankruptcy safety, while PODD has a better Piotroski Score, indicating stronger overall financial health. Each excels in a different financial metric.

Grades Comparison

Here is a comparison of the recent and reliable grades issued by recognized grading companies for the two companies:

Edwards Lifesciences Corporation Grades

The following table summarizes recent grades from major financial firms for Edwards Lifesciences Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Buy | Buy | 2026-01-09 |

| Stifel | Maintain | Buy | 2026-01-07 |

| JP Morgan | Upgrade | Overweight | 2025-12-18 |

| Canaccord Genuity | Maintain | Hold | 2025-12-17 |

| Baird | Maintain | Neutral | 2025-12-16 |

| Citigroup | Maintain | Buy | 2025-12-11 |

| Barclays | Maintain | Overweight | 2025-12-08 |

| Truist Securities | Maintain | Hold | 2025-12-05 |

| Canaccord Genuity | Maintain | Hold | 2025-12-05 |

| UBS | Maintain | Neutral | 2025-12-05 |

Edwards Lifesciences exhibits a generally positive trend with multiple buy and overweight ratings, accompanied by several hold and neutral positions.

Insulet Corporation Grades

Here are recent grades from well-known grading companies for Insulet Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2026-01-09 |

| Truist Securities | Maintain | Buy | 2025-12-18 |

| Canaccord Genuity | Maintain | Buy | 2025-12-17 |

| Canaccord Genuity | Maintain | Buy | 2025-11-24 |

| Truist Securities | Maintain | Buy | 2025-11-21 |

| BTIG | Maintain | Buy | 2025-11-21 |

| RBC Capital | Maintain | Outperform | 2025-11-21 |

| UBS | Upgrade | Buy | 2025-11-19 |

| BTIG | Maintain | Buy | 2025-11-13 |

| UBS | Maintain | Neutral | 2025-11-07 |

Insulet Corporation shows a strong consensus around buy and outperform ratings, with no recent downgrades.

Which company has the best grades?

Both companies have a consensus “Buy” rating with numerous buy recommendations. However, Insulet Corporation displays a more consistent pattern of buy and outperform grades, indicating stronger analyst confidence, which could influence investor sentiment positively compared to Edwards Lifesciences’ mix of buy, hold, and neutral ratings.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Edwards Lifesciences Corporation (EW) and Insulet Corporation (PODD) based on their recent financial and strategic data.

| Criterion | Edwards Lifesciences Corporation (EW) | Insulet Corporation (PODD) |

|---|---|---|

| Diversification | Moderate: Focus on heart valve and critical care segments with growing transcatheter therapies. | Limited: Primarily focused on drug delivery and Omnipod products. |

| Profitability | High profitability: Net margin 76.75%, ROIC 10.72%, declining but positive ROIC trend. | Moderate profitability: Net margin 20.19%, ROIC 16.27%, strong ROIC growth trend. |

| Innovation | Strong in heart valve technology with expanding transcatheter therapies. | High innovation in insulin delivery systems and product expansion internationally. |

| Global presence | Strong global footprint in cardiovascular markets. | Expanding international sales, with significant growth outside the US. |

| Market Share | Leading market position in heart valve therapies. | Growing market share in drug delivery devices but more niche. |

In summary, Edwards Lifesciences displays strong profitability and a diversified product line within cardiovascular therapies but faces a declining profitability trend. Insulet shows impressive innovation and ROIC growth, mainly driven by its focused product line and international expansion, though it has less diversification and mixed financial ratios. Investors should weigh EW’s stability against PODD’s growth potential and risk profile.

Risk Analysis

Below is a comparison of key risks for Edwards Lifesciences Corporation (EW) and Insulet Corporation (PODD) in 2026:

| Metric | Edwards Lifesciences Corporation (EW) | Insulet Corporation (PODD) |

|---|---|---|

| Market Risk | Moderate (Beta 0.955, stable healthcare demand) | Higher (Beta 1.4, more volatile NASDAQ listing) |

| Debt level | Low (Debt-to-Equity 0.07, favorable) | Moderate to high (Debt-to-Equity 1.17, unfavorable) |

| Regulatory Risk | Moderate (medical devices heavily regulated worldwide) | Moderate (insulin delivery devices face strict approvals) |

| Operational Risk | Low (large scale with 15.8K employees, diverse products) | Moderate (smaller scale at 3.9K employees, reliance on key products) |

| Environmental Risk | Low (medical device manufacturing, limited direct impact) | Low (similar industry profile) |

| Geopolitical Risk | Moderate (global presence, sensitive to trade policies) | Moderate (international sales, exposed to currency and trade risks) |

The most impactful and likely risks are market volatility for Insulet due to its higher beta, and regulatory hurdles for both companies given the strict oversight in healthcare. Edwards benefits from a stronger balance sheet with minimal debt, reducing financial risk, while Insulet’s higher leverage warrants caution. Both face ongoing regulatory and geopolitical uncertainties that could affect international operations.

Which Stock to Choose?

Edwards Lifesciences Corporation (EW) shows a favorable income evolution with 8.57% revenue growth in 2024, strong profitability including a 76.75% net margin, low debt levels, and a very favorable rating of A-. Its financial ratios are mostly positive, highlighting solid returns on equity (41.75%) and invested capital (10.72%), despite some unfavorable liquidity ratios.

Insulet Corporation (PODD) presents robust income growth with 22.07% revenue increase in 2024, decent profitability at a 20.19% net margin, but carries higher debt and mixed financial ratios. Its overall rating is B-, reflecting moderate financial strength and some challenges with valuation and leverage metrics.

For investors, the choice might depend on risk tolerance and investment focus: risk-averse or quality-focused investors may find EW’s stable profitability and strong overall rating more reassuring, while those seeking growth potential with acceptance of higher financial risk might see PODD’s rapid income growth and very favorable moat as attractive signals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Edwards Lifesciences Corporation and Insulet Corporation to enhance your investment decisions: