Entergy Corporation (ETR) and Edison International (EIX) are two prominent players in the regulated electric utility industry, serving millions of customers across different U.S. regions. Both companies focus on delivering reliable electricity while pursuing innovative strategies in energy generation and distribution. Given their market overlap and shared commitment to sustainable power, this article will help you decide which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Entergy Corporation and Edison International by providing an overview of these two companies and their main differences.

Entergy Corporation Overview

Entergy Corporation operates in the regulated electric industry, focusing on production and retail distribution of electricity in parts of Arkansas, Louisiana, Mississippi, and Texas. Founded in 1913 and headquartered in New Orleans, Entergy runs utility and wholesale commodities segments, generating power from gas, nuclear, coal, hydro, and solar sources. It serves 3M utility customers with approximately 26,000 MW of generating capacity.

Edison International Overview

Edison International is a regulated electric utility company delivering power across Southern, Central, and Coastal California to 15M customers, including residential and commercial users. Established in 1886 and based in Rosemead, California, it operates extensive transmission and distribution systems, offering energy solutions mainly through its subsidiaries. The company focuses on serving a diverse customer base with reliable electricity.

Key similarities and differences

Both Entergy and Edison International operate in the regulated electric utility sector in the US, providing electricity distribution and generation services. Entergy’s operations span multiple states with a diverse fuel mix including nuclear, whereas Edison International serves a larger customer base concentrated in California with significant transmission infrastructure. Each company differs in geographic focus, scale of operations, and generation portfolio.

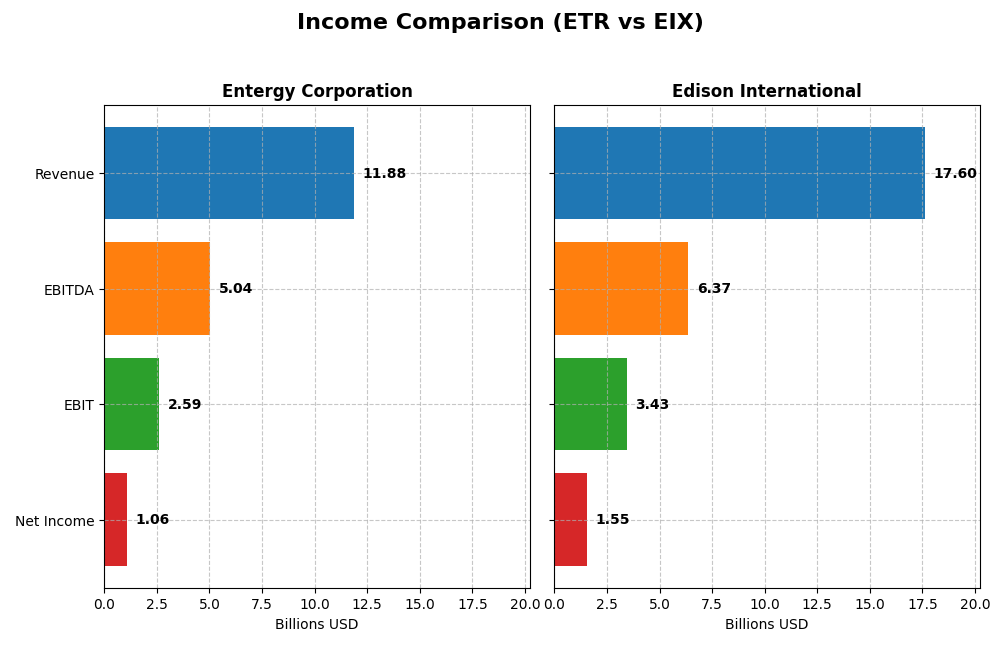

Income Statement Comparison

The table below compares key income statement metrics for Entergy Corporation and Edison International for the fiscal year 2024, providing a snapshot of their financial performance.

| Metric | Entergy Corporation | Edison International |

|---|---|---|

| Market Cap | 41.8B | 23.5B |

| Revenue | 11.9B | 17.6B |

| EBITDA | 5.04B | 6.37B |

| EBIT | 2.59B | 3.43B |

| Net Income | 1.06B | 1.55B |

| EPS | 2.47 | 3.33 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Entergy Corporation

Entergy’s revenue showed a moderate increase over the 2020-2024 period, rising 17.46%, though net income declined by 24.56%. Gross and EBIT margins remained favorable at 48.3% and 21.83%, respectively, but net margin contracted by 35.77%. In 2024, revenue declined slightly by 2.2%, with net income and EPS dropping sharply, reflecting margin pressures and lower profitability.

Edison International

Edison International experienced solid revenue growth of 29.61% from 2020 to 2024, with net income surging 77.5%. Gross margin remained favorable at 41.01%, and EBIT margin improved to 19.5%. The 2024 fiscal year saw a 7.72% revenue increase, alongside a 9.75% EBIT growth and moderate net margin expansion, indicating improving operational efficiency and profitability.

Which one has the stronger fundamentals?

Edison International displays stronger fundamentals with consistent revenue and net income growth, alongside overall favorable margin trends and earnings expansion. Entergy, while maintaining favorable gross and EBIT margins, faces declining net income and EPS over the period, with recent unfavorable growth metrics. Edison’s superior financial momentum suggests a more robust income statement profile.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Entergy Corporation (ETR) and Edison International (EIX) based on their latest reported fiscal year 2024 data.

| Ratios | Entergy Corporation (ETR) | Edison International (EIX) |

|---|---|---|

| ROE | 7.0% | 9.9% |

| ROIC | 3.2% | 3.6% |

| P/E | 30.6 | 19.9 |

| P/B | 2.14 | 1.98 |

| Current Ratio | 0.72 | 0.85 |

| Quick Ratio | 0.43 | 0.78 |

| D/E (Debt/Equity) | 1.91 | 2.43 |

| Debt-to-Assets | 44.6% | 44.1% |

| Interest Coverage | 2.30 | 1.57 |

| Asset Turnover | 0.18 | 0.21 |

| Fixed Asset Turnover | 0.25 | 0.29 |

| Payout Ratio | 94.2% | 83.2% |

| Dividend Yield | 3.08% | 4.17% |

Interpretation of the Ratios

Entergy Corporation

Entergy’s ratios reveal several weaknesses, including low return on equity (7.02%) and return on invested capital (3.2%), both rated unfavorable. The company’s current and quick ratios signal liquidity concerns. Its price-to-earnings ratio at 30.56 is also unfavorable, though the dividend yield of 3.08% is favorable, suggesting a stable income stream supported by dividends.

Edison International

Edison International shows similar ratio challenges with an unfavorable return on equity of 9.93% and return on invested capital of 3.61%. Liquidity ratios remain below optimal levels, and interest coverage is weak at 1.84. The dividend yield is relatively higher at 4.17%, indicating a potentially attractive income return despite the overall unfavorable ratio profile.

Which one has the best ratios?

Both companies share a predominance of unfavorable ratios, including low returns and liquidity issues. While Edison International offers a higher dividend yield, Entergy presents a slightly better interest coverage ratio and a lower price-to-earnings multiple. Overall, neither company demonstrates a strongly favorable ratio set, reflecting caution in financial health.

Strategic Positioning

This section compares the strategic positioning of Entergy Corporation and Edison International, including market position, key segments, and exposure to technological disruption:

Entergy Corporation

- Strong regional presence in Arkansas, Louisiana, Mississippi, and Texas facing regulated electric market pressure.

- Operates Utility and Wholesale Commodities segments; diverse energy sources including gas, nuclear, coal, hydro, and solar.

- Exposure to traditional and nuclear power with some renewable mix; limited explicit disruption noted.

Edison International

- Large customer base in California with significant scale in utility delivery and regulated electric sector.

- Focused on electric utility with competitive power generation and extensive transmission and distribution infrastructure.

- Primarily regulated electric utility with competitive generation; no explicit mention of disruptive technologies.

Entergy Corporation vs Edison International Positioning

Entergy has a diversified energy generation portfolio including wholesale commodities and multiple power sources, while Edison is concentrated mainly on electric utility and competitive power generation in California. Entergy’s broader geography contrasts with Edison’s large, focused customer base.

Which has the best competitive advantage?

Both companies are shedding value with ROIC below WACC; however, Edison shows a growing ROIC trend, indicating improving profitability, whereas Entergy’s profitability is declining, suggesting a weaker competitive advantage currently.

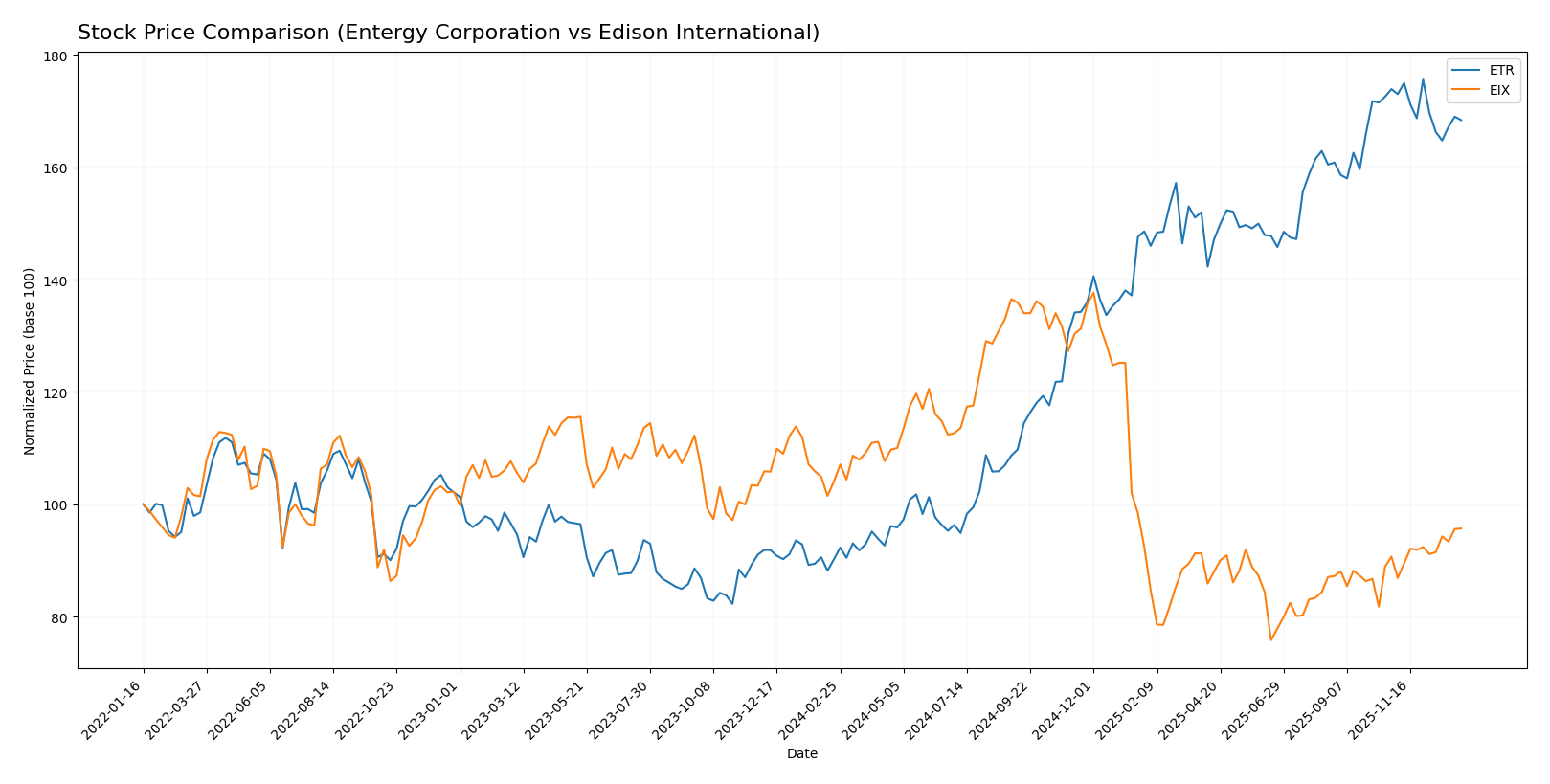

Stock Comparison

The stock price movements of Entergy Corporation (ETR) and Edison International (EIX) over the past year reveal contrasting trends, with notable volatility and shifts in recent months impacting their trading dynamics.

Trend Analysis

Entergy Corporation (ETR) experienced a strong bullish trend over the past 12 months with an 86.74% price increase, though the trend shows deceleration and a recent 3.17% decline, indicating a shift to a mild bearish move in the last quarter.

Edison International (EIX) displayed an overall bearish trend with an 8.02% decrease over the year, but a recent acceleration in momentum yielded a 5.5% price gain since late 2025, suggesting a short-term recovery.

Comparing the two, Entergy Corporation delivered the highest market performance with a significant annual gain, while Edison International lagged but showed positive recent momentum.

Target Prices

The target price consensus for Entergy Corporation and Edison International indicates moderate upside potential for both utilities.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Entergy Corporation | 115 | 91 | 103.17 |

| Edison International | 70 | 56 | 62 |

Analysts see Entergy’s price rising above its current $93.52, with a consensus target around $103. Edison International’s consensus target of $62 suggests a modest increase from its $60.99 trading price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Entergy Corporation and Edison International:

Rating Comparison

ETR Rating

- Rating: B- rated as Very Favorable

- Discounted Cash Flow Score: 1, Very Unfavorable

- ROE Score: 4, Favorable

- ROA Score: 3, Moderate

- Debt To Equity Score: 2, Moderate

- Overall Score: 2, Moderate

EIX Rating

- Rating: B+ rated as Very Favorable

- Discounted Cash Flow Score: 1, Very Unfavorable

- ROE Score: 5, Very Favorable

- ROA Score: 4, Favorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 3, Moderate

Which one is the best rated?

Based strictly on the provided data, Edison International (EIX) holds a higher overall rating (B+) with better ROE and ROA scores, despite a less favorable debt-to-equity score, compared to Entergy (ETR).

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Entergy Corporation and Edison International:

Entergy Corporation Scores

- Altman Z-Score: 1.04, indicating financial distress zone with high bankruptcy risk

- Piotroski Score: 4, categorized as average financial strength

Edison International Scores

- Altman Z-Score: 0.72, also in distress zone indicating high bankruptcy risk

- Piotroski Score: 6, categorized as average financial strength

Which company has the best scores?

Edison International has a slightly higher Piotroski Score of 6 compared to Entergy’s 4, suggesting relatively better financial strength. Both companies have Altman Z-Scores in the distress zone, indicating high bankruptcy risk.

Grades Comparison

The following analysis presents the latest reliable grades for Entergy Corporation and Edison International:

Entergy Corporation Grades

This table summarizes recent grades assigned by established grading firms for Entergy Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Maintain | Buy | 2026-01-06 |

| UBS | Maintain | Buy | 2025-12-17 |

| Keybanc | Maintain | Overweight | 2025-12-12 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| Citigroup | Maintain | Neutral | 2025-11-18 |

| Evercore ISI Group | Maintain | In Line | 2025-10-30 |

| Mizuho | Maintain | Outperform | 2025-10-27 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-22 |

| B of A Securities | Maintain | Neutral | 2025-10-16 |

| Keybanc | Maintain | Overweight | 2025-10-15 |

Overall, Entergy Corporation’s grades show a consistent pattern of buy and overweight ratings from several reputable firms, with no recent downgrades or sell recommendations.

Edison International Grades

This table compiles recent grades for Edison International provided by recognized grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Underweight | 2025-12-17 |

| JP Morgan | Maintain | Neutral | 2025-12-12 |

| UBS | Maintain | Buy | 2025-12-02 |

| Ladenburg Thalmann | Maintain | Neutral | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-10-29 |

| Jefferies | Maintain | Hold | 2025-10-22 |

| Morgan Stanley | Maintain | Underweight | 2025-10-22 |

| Barclays | Maintain | Overweight | 2025-10-21 |

| Jefferies | Downgrade | Hold | 2025-10-02 |

| JP Morgan | Maintain | Neutral | 2025-09-25 |

Edison International’s grades reveal a more mixed outlook with a range of neutral, hold, overweight, and underweight ratings, including a recent downgrade from buy to hold.

Which company has the best grades?

Entergy Corporation has received predominantly buy and overweight ratings without downgrades, indicating stronger analyst confidence compared to Edison International’s mixed ratings and some downgrades. This difference may influence investor perceptions of risk and potential performance.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Entergy Corporation (ETR) and Edison International (EIX) based on the latest available data:

| Criterion | Entergy Corporation (ETR) | Edison International (EIX) |

|---|---|---|

| Diversification | Moderate: Revenue spread across Commercial (3B), Industrial (3.2B), Residential (4.5B), and other segments | Moderate: Primarily Electric Utility with Competitive Power Generation exposure |

| Profitability | Unfavorable: ROIC 3.2% below WACC 5.49%, declining trend, net margin 8.93% neutral | Slightly Unfavorable: ROIC 3.61% below WACC 5.94%, but ROIC improving, net margin 8.78% neutral |

| Innovation | Limited visible innovation initiatives, traditional utility model | Moderate innovation focus with improving ROIC trend |

| Global presence | Primarily US-regulated markets, limited global footprint | Focused on US markets, limited global operations |

| Market Share | Strong presence in US regulated utility markets | Significant share in California electric utility market |

Key takeaways: Both companies face profitability challenges with ROIC below WACC, indicating value destruction. However, Edison International shows improving profitability trends. Diversification is moderate for both, focused mainly on regulated utilities in the US. Investors should weigh risk carefully given ongoing profitability pressures.

Risk Analysis

Below is a comparison of key risks associated with Entergy Corporation (ETR) and Edison International (EIX) based on the most recent 2024 financial data and market conditions:

| Metric | Entergy Corporation (ETR) | Edison International (EIX) |

|---|---|---|

| Market Risk | Beta 0.65 – Moderate volatility; sensitive to energy market and regulatory changes | Beta 0.83 – Higher volatility; exposed to California energy market fluctuations |

| Debt level | D/E 1.91 – High leverage; interest coverage 2.25 (neutral) | D/E 2.43 – Very high leverage; interest coverage 1.84 (unfavorable) |

| Regulatory Risk | High – Operates in multiple states with complex energy regulations | High – Heavy regulation in California; wildfire liabilities increase risk |

| Operational Risk | Moderate – Diverse generation mix including nuclear; aging infrastructure | Moderate to High – Large grid with underground/overhead lines; wildfire risk |

| Environmental Risk | Moderate – Nuclear and fossil fuel plants subject to environmental scrutiny | High – California wildfire risk and renewable energy transition pressures |

| Geopolitical Risk | Low – Primarily US domestic operations | Low – Primarily US domestic operations |

In synthesis, both utilities face significant regulatory and environmental risks inherent to the energy sector. Edison International’s higher debt load combined with California-specific wildfire liabilities represents the most impactful risk. Entergy’s leverage is high but with a slightly stronger interest coverage. Investors should closely monitor regulatory developments and environmental liabilities when considering these stocks.

Which Stock to Choose?

Entergy Corporation (ETR) shows mixed income trends with a favorable gross and EBIT margin but declining net margin and EPS over five years. Its financial ratios are mostly unfavorable, including high debt and weak liquidity, though it has a favorable dividend yield. The company’s rating is very favorable overall, with moderate scores on key metrics.

Edison International (EIX) demonstrates stronger income growth, with favorable revenue and net income increases and solid profitability metrics. Its financial ratios also lean unfavorable, particularly in leverage and interest coverage, yet it offers a higher dividend yield. The company holds a very favorable rating with some moderate and unfavorable metric scores.

For investors, EIX may appear more suitable for those seeking growth and improving profitability given its favorable income growth and ROIC trend. ETR might be seen as more fitting for income-focused investors due to its dividend yield despite weaker profitability and value destruction signals. The ultimate choice could depend on individual risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Entergy Corporation and Edison International to enhance your investment decisions: