In the competitive landscape of household and personal products, The Clorox Company (CLX) and Edgewell Personal Care Company (EPC) stand out as established players with distinct yet overlapping market footprints. Both firms focus on consumer essentials, blending innovation with trusted brands to capture market share. This comparison explores their strategies and growth potential to help you identify which stock may be the smarter addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between The Clorox Company and Edgewell Personal Care Company by providing an overview of these two companies and their main differences.

The Clorox Company Overview

The Clorox Company operates globally in the household and personal products sector, focusing on four segments: Health and Wellness, Household, Lifestyle, and International. It markets cleaning, personal care, food, and water-filtration products under well-known brands like Clorox, Glad, Brita, and Burt’s Bees. Headquartered in Oakland, California, Clorox has a market capitalization of approximately 13B USD and employs around 7,400 people.

Edgewell Personal Care Company Overview

Edgewell Personal Care Company manufactures and markets personal care products worldwide through three segments: Wet shave, Sun and Skin care, and Feminine care. Its portfolio includes brands such as Schick, Banana Boat, Playtex, and Wet Ones. Based in Shelton, Connecticut, Edgewell has a market cap near 850M USD and employs roughly 6,700 staff members, emphasizing grooming and skin protection products.

Key similarities and differences

Both companies operate in the consumer defensive sector, producing personal and household care products, but their product focuses differ. Clorox has a broader range including cleaning and food-related products, while Edgewell concentrates more on personal grooming and skin care. Clorox’s market cap and employee count are significantly higher, reflecting its larger global scale and diversified segments compared to Edgewell’s more specialized portfolio.

Income Statement Comparison

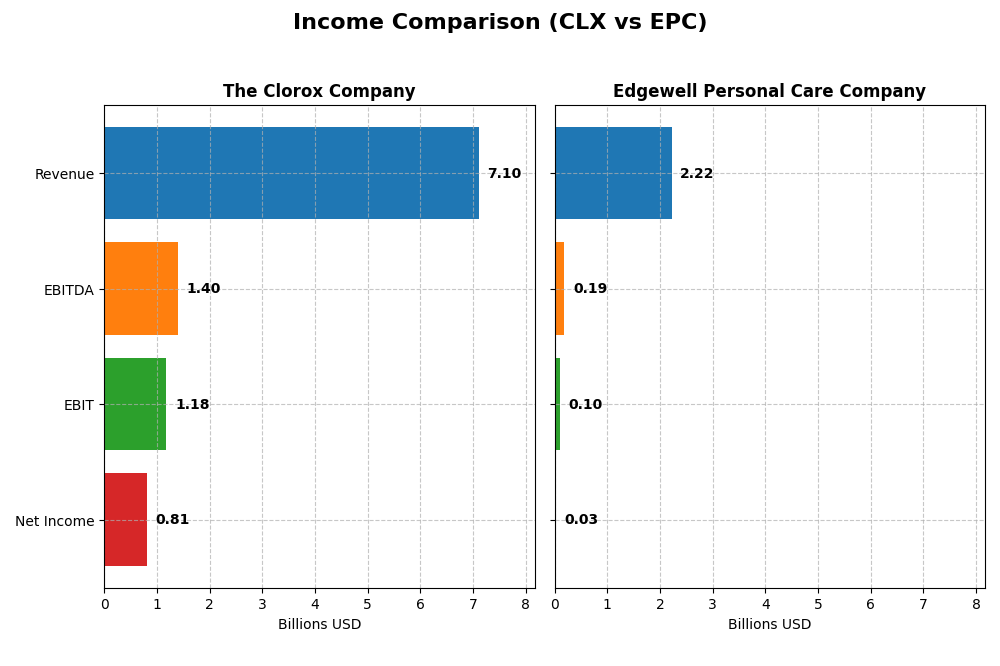

This table presents a side-by-side comparison of key income statement metrics for The Clorox Company (CLX) and Edgewell Personal Care Company (EPC) for the most recent fiscal year available.

| Metric | The Clorox Company (CLX) | Edgewell Personal Care Company (EPC) |

|---|---|---|

| Market Cap | 13B | 847M |

| Revenue | 7.1B | 2.22B |

| EBITDA | 1.40B | 186M |

| EBIT | 1.18B | 97M |

| Net Income | 810M | 25.4M |

| EPS | 6.56 | 0.53 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

The Clorox Company

From 2021 to 2025, The Clorox Company’s revenue showed a slight overall decline of 3.23%, but net income grew by 14.08%, reflecting improved profitability. Margins remained favorable, with a gross margin near 45% and net margin at 11.4%. In 2025, revenue growth slowed to 0.16%, yet net margin and EPS saw strong improvements, indicating enhanced operational efficiency.

Edgewell Personal Care Company

Edgewell’s revenue grew modestly by 6.53% over the 2021-2025 period, but net income declined sharply by 78.44%, signaling profitability challenges. Gross margin stayed favorable at 41.6%, though EBIT and net margins were neutral to weak. The latest year saw a 1.34% revenue decrease and significant drops in EBIT and net margin, highlighting weakening earnings capacity.

Which one has the stronger fundamentals?

The Clorox Company demonstrates stronger fundamentals with mostly favorable income statement metrics, including solid margins and improving profitability despite stagnant revenue. Edgewell’s weaker net income trends and unfavorable margin developments raise concerns. Overall, Clorox’s income statement shows better margin stability and earnings growth, while Edgewell struggles with profitability declines.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for The Clorox Company (CLX) and Edgewell Personal Care Company (EPC) based on the most recent fiscal year data available.

| Ratios | The Clorox Company (CLX) FY 2025 | Edgewell Personal Care Company (EPC) FY 2025 |

|---|---|---|

| ROE | 2.52% | 1.64% |

| ROIC | 24.14% | 3.00% |

| P/E | 18.31 | 38.07 |

| P/B | 46.20 | 0.62 |

| Current Ratio | 0.84 | 1.76 |

| Quick Ratio | 0.57 | 0.90 |

| D/E (Debt-to-Equity) | 8.97 | 0.91 |

| Debt-to-Assets | 51.79% | 37.61% |

| Interest Coverage | 11.67 | 1.32 |

| Asset Turnover | 1.28 | 0.59 |

| Fixed Asset Turnover | 4.44 | 6.02 |

| Payout Ratio | 74.32% | 115.35% |

| Dividend Yield | 4.06% | 3.03% |

Interpretation of the Ratios

The Clorox Company

The Clorox Company shows a favorable overall ratio profile, with strong net margin at 11.4%, a robust return on equity of 252.34%, and solid return on invested capital of 24.14%. However, concerns arise from an unfavorable current ratio of 0.84 and a high debt-to-equity ratio of 8.97, indicating liquidity and leverage risks. The company pays a dividend with a healthy yield of 4.06%, supported by consistent free cash flow coverage, though elevated debt levels may pressure payout sustainability.

Edgewell Personal Care Company

Edgewell presents a mixed ratio picture, with weak profitability metrics including a net margin of 1.14% and return on equity of 1.64%, signaling operational inefficiency. The company maintains a strong current ratio of 1.76, reflecting good short-term liquidity, but interest coverage is low at 1.32, suggesting vulnerability to debt costs. Edgewell also pays dividends with a 3.03% yield, supported by moderate payout capacity amid a cautious financial stance.

Which one has the best ratios?

Comparing both, The Clorox Company exhibits stronger profitability and efficiency ratios, though with some liquidity and leverage concerns. Edgewell displays better liquidity metrics but struggles with profitability and interest coverage. Clorox’s overall favorable ratio assessment contrasts with Edgewell’s neutral stance, indicating Clorox currently holds the more robust financial ratio profile.

Strategic Positioning

This section compares the strategic positioning of The Clorox Company and Edgewell Personal Care Company, including market position, key segments, and exposure to technological disruption:

The Clorox Company

- Large market cap of 13B USD with moderate beta, facing typical consumer defensive competitive pressure

- Diversified segments: Health and Wellness, Household, Lifestyle, and International drive revenues

- Exposure to disruption not explicitly stated, operates in established consumer product categories

Edgewell Personal Care Company

- Smaller market cap of 847M USD, operating in competitive personal care segments with moderate beta

- Concentrated in Wet Shave, Sun and Skin Care, and Feminine Care segments

- Exposure to disruption not detailed, focused on traditional personal care products

The Clorox Company vs Edgewell Personal Care Company Positioning

The Clorox Company adopts a diversified approach across multiple consumer product categories and geographies, providing broader revenue streams. Edgewell is more concentrated in personal care product niches, which may limit diversification but focus on specialized markets.

Which has the best competitive advantage?

The Clorox Company demonstrates a very favorable moat with strong and growing ROIC above WACC, indicating durable competitive advantage. Edgewell shows a very unfavorable moat with declining ROIC below WACC, suggesting value destruction and weaker competitive positioning.

Stock Comparison

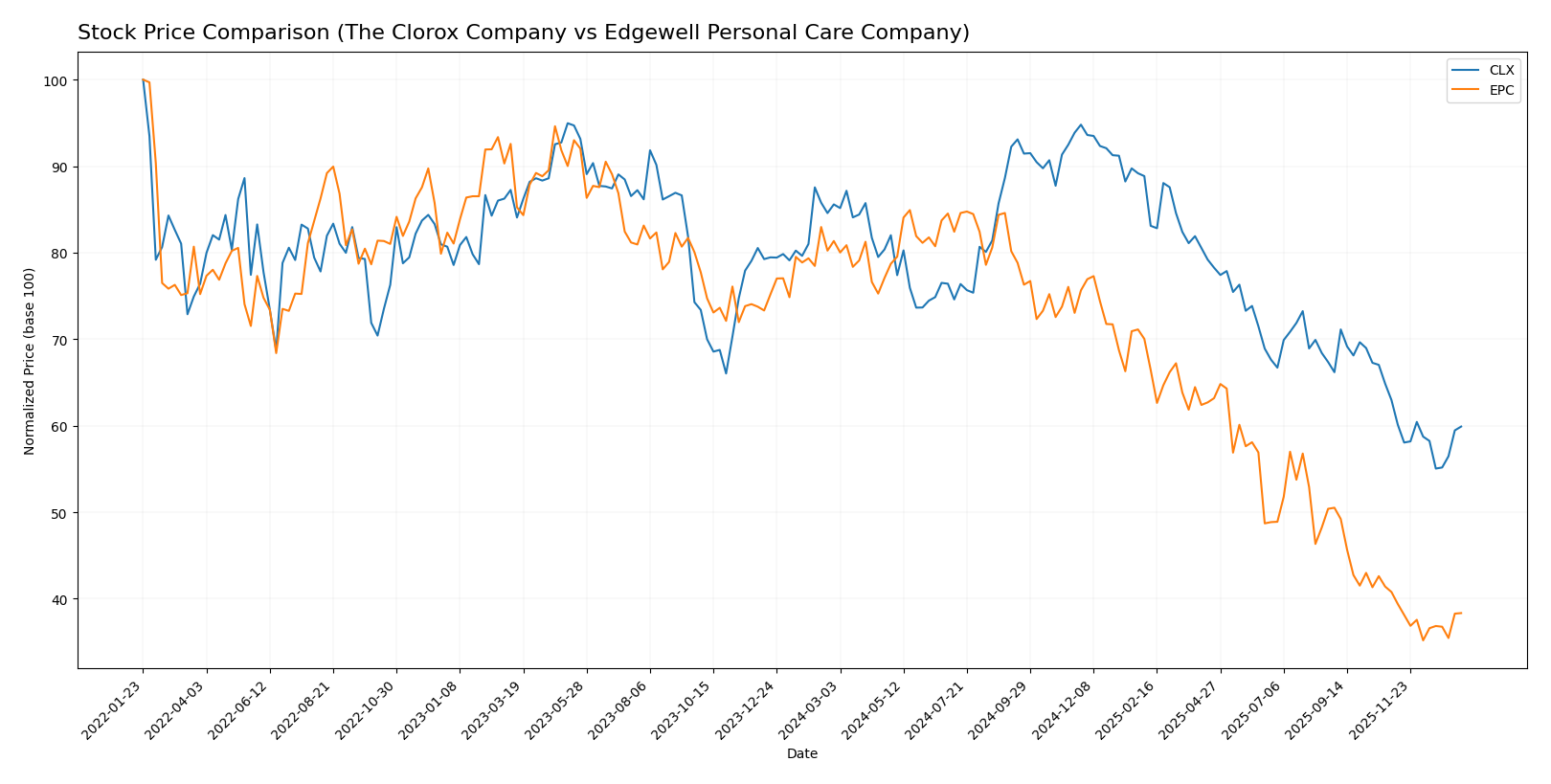

The stock price movements of The Clorox Company (CLX) and Edgewell Personal Care Company (EPC) over the past year reveal pronounced bearish trends, with both exhibiting significant declines and distinct trading volume dynamics.

Trend Analysis

The Clorox Company’s stock price declined by 30.01% over the past 12 months, indicating a bearish trend with deceleration. Price volatility was high, with a standard deviation of 19.09, and the stock ranged between 98.31 and 169.3.

Edgewell Personal Care’s stock fell by 52.87% in the same period, also bearish but with accelerating decline. Volatility was moderate, with a standard deviation of 7.54, and prices fluctuated between 16.73 and 40.38.

Comparing both, CLX delivered higher market performance with a smaller loss, while EPC experienced a steeper decline and greater acceleration in downward momentum.

Target Prices

Analysts provide a clear consensus on target prices for The Clorox Company and Edgewell Personal Care Company.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Clorox Company | 152 | 94 | 118.33 |

| Edgewell Personal Care Company | 23 | 20 | 21.5 |

For The Clorox Company, the consensus target price of 118.33 suggests upside potential from the current price of 106.98. Edgewell Personal Care Company’s target consensus at 21.5 also indicates expected growth above its current price of 18.23.

Analyst Opinions Comparison

This section compares the analysts’ ratings and financial scores for The Clorox Company and Edgewell Personal Care Company:

Rating Comparison

The Clorox Company Rating

- Rating: B- with a Very Favorable status

- Discounted Cash Flow Score: 5, Very Favorable

- Return on Equity Score: 1, Very Unfavorable

- Return on Assets Score: 5, Very Favorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 3, Moderate

Edgewell Personal Care Company Rating

- Rating: B with a Very Favorable status

- Discounted Cash Flow Score: 5, Very Favorable

- Return on Equity Score: 2, Moderate

- Return on Assets Score: 2, Moderate

- Debt To Equity Score: 2, Moderate

- Overall Score: 3, Moderate

Which one is the best rated?

Edgewell Personal Care holds a higher rating of B compared to The Clorox Company’s B-. Both have equal overall and discounted cash flow scores, but Edgewell shows moderate scores on ROE, ROA, and debt to equity, outperforming Clorox’s very unfavorable scores in these areas.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

CLX Scores

- Altman Z-Score: 3.27, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 5, categorized as average financial strength.

EPC Scores

- Altman Z-Score: 1.44, indicating a distress zone with high bankruptcy risk.

- Piotroski Score: 6, categorized as average financial strength.

Which company has the best scores?

Based on the provided data, CLX has a clearly better Altman Z-Score, placing it in the safe zone, while EPC is in the distress zone. Both have average Piotroski Scores, with EPC slightly higher at 6 versus 5 for CLX.

Grades Comparison

The following presents the latest official grades assigned by verified grading companies for The Clorox Company and Edgewell Personal Care Company:

The Clorox Company Grades

Here are the recent grades issued by well-known financial institutions for The Clorox Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Hold | 2026-01-08 |

| Goldman Sachs | Maintain | Sell | 2026-01-07 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-05 |

| Citigroup | Maintain | Neutral | 2025-12-17 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-04 |

| JP Morgan | Maintain | Neutral | 2025-11-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-04 |

| Citigroup | Maintain | Neutral | 2025-11-04 |

| JP Morgan | Maintain | Neutral | 2025-10-10 |

| Citigroup | Maintain | Neutral | 2025-10-09 |

The grades for The Clorox Company predominantly indicate a hold or neutral stance, reflecting a cautious outlook with no recent upgrades or downgrades.

Edgewell Personal Care Company Grades

Below are the latest grades from reputable firms for Edgewell Personal Care Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-18 |

| Barclays | Maintain | Equal Weight | 2025-11-14 |

| RBC Capital | Maintain | Outperform | 2025-11-14 |

| Wells Fargo | Maintain | Overweight | 2025-11-14 |

| Wells Fargo | Maintain | Overweight | 2025-09-25 |

| Morgan Stanley | Upgrade | Equal Weight | 2025-08-06 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Barclays | Maintain | Equal Weight | 2025-08-06 |

| Canaccord Genuity | Maintain | Buy | 2025-08-06 |

The grades for Edgewell Personal Care Company show a generally positive trend with multiple overweight and outperform ratings, indicating favorable sentiment from analysts.

Which company has the best grades?

Edgewell Personal Care Company has received more positive grades, including overweight and outperform ratings, whereas The Clorox Company’s grades are mostly neutral or hold. This suggests investors may perceive Edgewell as having greater growth potential or favorable outlooks compared to Clorox’s more cautious stance.

Strengths and Weaknesses

Below is a comparative overview of The Clorox Company (CLX) and Edgewell Personal Care Company (EPC) based on key business and financial criteria as of 2026.

| Criterion | The Clorox Company (CLX) | Edgewell Personal Care Company (EPC) |

|---|---|---|

| Diversification | Broad product portfolio: Health & Wellness, Household, International, Lifestyle segments with balanced revenue streams around $2.7B to $1.0B per segment in 2025. | Concentrated in personal care: Razors/blades dominant ($1.1B), plus sun care, feminine care, and infant products with less balanced revenue. |

| Profitability | High profitability with net margin at 11.4%, ROIC 24.14%, and a favorable ROIC vs WACC spread (+18.3%), indicating strong value creation. | Low profitability: net margin 1.14%, ROIC 3.0%, ROIC below WACC (-2.2%), signaling value destruction and declining returns. |

| Innovation | Demonstrates durable competitive advantage with growing ROIC trend (+13.7%), implying ongoing innovation and operational effectiveness. | Declining ROIC trend (-50.4%) suggests challenges in sustaining innovation and competitive edge. |

| Global presence | Significant international revenues (~$1.06B in 2025), supporting diversified geographic exposure. | Primarily focused on North American markets with limited international diversification. |

| Market Share | Strong market position in household and health products with consistent revenue growth and a favorable financial ratio profile. | Struggles with market share growth, reflected in neutral to unfavorable financial ratios and profitability metrics. |

In summary, Clorox shows robust diversification, strong profitability, and a durable competitive moat, making it a favorable choice for investors prioritizing stability and value creation. Edgewell faces profitability and growth challenges, warranting cautious consideration due to its declining returns and narrower product focus.

Risk Analysis

Below is a comparative table of key risks for The Clorox Company (CLX) and Edgewell Personal Care Company (EPC) based on the most recent 2025 data:

| Metric | The Clorox Company (CLX) | Edgewell Personal Care Company (EPC) |

|---|---|---|

| Market Risk | Moderate (beta 0.575) | Moderate (beta 0.616) |

| Debt Level | High (Debt/Equity 8.97; Debt to Assets 51.79%) | Moderate (Debt/Equity 0.91; Debt to Assets 37.61%) |

| Regulatory Risk | Moderate (Consumer product regulations) | Moderate (Personal care product regulations) |

| Operational Risk | Moderate (Diverse product segments) | Moderate (Multiple segments with supply chain complexity) |

| Environmental Risk | Moderate (Sustainability pressures) | Moderate (Environmental concerns in manufacturing) |

| Geopolitical Risk | Low (Primarily US-based, global presence) | Low (Primarily US-based) |

In synthesis, The Clorox Company faces its most significant risk in its high debt level, with debt-to-equity near 9 and over half of its assets financed by debt, increasing financial vulnerability despite strong operational metrics. Edgewell shows a distressing Altman Z-Score indicating potential financial strain, coupled with low interest coverage, making debt servicing riskier. Market and regulatory risks remain moderate for both due to stable consumer essentials sectors, but investors should monitor Clorox’s leverage and Edgewell’s financial stability closely.

Which Stock to Choose?

The Clorox Company (CLX) shows a generally favorable income evolution with strong profitability metrics, including a net margin of 11.4% and a growing ROIC well above WACC, indicating value creation. However, its debt levels and liquidity ratios are unfavorable, and the rating is very favorable overall despite some weaknesses.

Edgewell Personal Care Company (EPC) exhibits an unfavorable income trend with low profitability, including a net margin near 1.14% and a declining ROIC below WACC, signaling value destruction. While debt and liquidity ratios are mostly neutral or favorable, the rating remains very favorable overall but with mixed financial health signals.

For investors prioritizing durable profitability and value creation, CLX might appear more favorable due to its strong moat and income statement performance. Conversely, those focusing on balance sheet strength and lower leverage could find EPC’s profile more suitable, despite its weaker income and profitability trends.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Clorox Company and Edgewell Personal Care Company to enhance your investment decisions: