In the competitive realm of household and personal products, Spectrum Brands Holdings, Inc. (SPB) and Edgewell Personal Care Company (EPC) stand out as key players with overlapping markets and innovative strategies. Both companies leverage strong brand portfolios across personal care and consumer essentials, making their performance and growth prospects worthy of comparison. This article will guide you through their strengths and risks to identify the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Spectrum Brands Holdings, Inc. and Edgewell Personal Care Company by providing an overview of these two companies and their main differences.

Spectrum Brands Holdings, Inc. Overview

Spectrum Brands Holdings, Inc. is a global branded consumer products company operating through Home and Personal Care, Global Pet Care, and Home and Garden segments. It offers a wide range of products including home appliances, pet care items, and pest control solutions under various well-known brands. The company is headquartered in Middleton, Wisconsin, and employs around 3,100 people.

Edgewell Personal Care Company Overview

Edgewell Personal Care Company manufactures and markets personal care products worldwide, operating through Wet Shave, Sun and Skin Care, and Feminine Care segments. Its portfolio includes razors, sun protection, skincare, and feminine hygiene products under established brands like Schick and Banana Boat. Founded in 1772, Edgewell is based in Shelton, Connecticut, with a workforce of approximately 6,700 employees.

Key similarities and differences

Both companies operate in the Household & Personal Products industry and serve global markets with diversified product lines. Spectrum Brands emphasizes a broader portfolio including pet care and home garden products, while Edgewell focuses specifically on personal care categories such as shaving and feminine hygiene. Both trade on the NYSE and have similar beta values indicating moderate stock volatility.

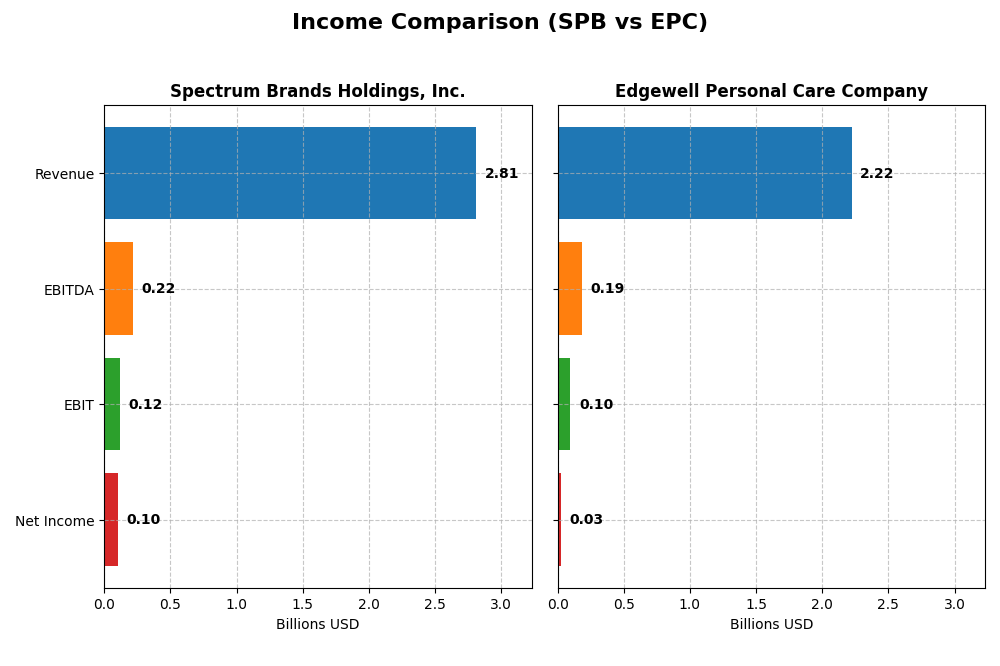

Income Statement Comparison

Below is a comparison of the key income statement metrics for Spectrum Brands Holdings, Inc. and Edgewell Personal Care Company for their most recent fiscal year.

| Metric | Spectrum Brands Holdings, Inc. (SPB) | Edgewell Personal Care Company (EPC) |

|---|---|---|

| Market Cap | 1.53B | 847M |

| Revenue | 2.81B | 2.22B |

| EBITDA | 215M | 186M |

| EBIT | 117M | 97M |

| Net Income | 99.9M | 25.4M |

| EPS | 3.88 | 0.53 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Spectrum Brands Holdings, Inc.

Spectrum Brands experienced a general decline in revenue and net income over 2021-2025, with revenue falling from $3.13B to $2.81B and net income dropping significantly. Margins showed mixed signals; the gross margin remained favorable at 36.74%, while EBIT and net margins were neutral but deteriorated recently. In 2025, revenue and profitability contracted, with a 5.23% revenue decline and net margin shrinking by 15.54%.

Edgewell Personal Care Company

Edgewell’s revenue showed modest overall growth of 6.53% during 2021-2025, though net income sharply decreased by 78.44%. Gross margin was favorable at 41.6%, while EBIT and net margins were neutral but weakening. The latest year reflected a 1.34% drop in revenue and a steep 73.89% fall in net margin, indicating significant margin pressure and earnings decline despite stable top-line figures.

Which one has the stronger fundamentals?

Both companies face unfavorable income statement trends, with declining net incomes and shrinking margins. Spectrum Brands shows a sharper overall revenue decline but maintains a relatively stronger gross margin. Edgewell reports slight revenue growth but suffers more severe earnings and margin contractions. Both firms present risks, with neither demonstrating clearly stronger fundamentals based on recent income statement performance.

Financial Ratios Comparison

The table below summarizes the latest financial ratios for Spectrum Brands Holdings, Inc. (SPB) and Edgewell Personal Care Company (EPC), providing a clear side-by-side view for fiscal year 2025.

| Ratios | Spectrum Brands Holdings, Inc. (SPB) | Edgewell Personal Care Company (EPC) |

|---|---|---|

| ROE | 5.23% | 1.64% |

| ROIC | 4.95% | 3.00% |

| P/E | 13.51 | 38.07 |

| P/B | 0.71 | 0.62 |

| Current Ratio | 2.26 | 1.76 |

| Quick Ratio | 1.41 | 0.90 |

| D/E (Debt-to-Equity) | 0.34 | 0.91 |

| Debt-to-Assets | 19.4% | 37.6% |

| Interest Coverage | 4.16 | 1.32 |

| Asset Turnover | 0.83 | 0.59 |

| Fixed Asset Turnover | 8.55 | 6.02 |

| Payout Ratio | 48.2% | 115.4% |

| Dividend Yield | 3.57% | 3.03% |

Interpretation of the Ratios

Spectrum Brands Holdings, Inc.

Spectrum Brands exhibits mostly favorable financial ratios, with a strong current ratio of 2.26 and a low debt-to-equity ratio of 0.34, indicating solid liquidity and manageable leverage. However, net margin at 3.56% and return on equity at 5.23% are considered unfavorable, suggesting limited profitability. The company pays dividends with a 3.57% yield, supported by a reasonable payout ratio, but risks may arise if cash flow coverage weakens.

Edgewell Personal Care Company

Edgewell shows a mixed ratio profile, with favorable liquidity indicated by a current ratio of 1.76 but a high debt-to-equity ratio near 0.91, which may raise leverage concerns. Profitability ratios like net margin (1.14%) and return on equity (1.64%) are weak, and interest coverage is unfavorable at 1.32. The company pays a 3.03% dividend yield, though the high payout relative to earnings could pose sustainability issues.

Which one has the best ratios?

Spectrum Brands holds a more favorable overall ratio stance, with 64.29% of its ratios rated positively versus Edgewell’s 35.71%. Spectrum’s stronger liquidity, lower leverage, and better valuation multiples contrast with Edgewell’s weaker profitability and higher debt. However, both companies face profitability challenges, and investors should consider these nuances carefully.

Strategic Positioning

This section compares the strategic positioning of Spectrum Brands Holdings, Inc. (SPB) and Edgewell Personal Care Company (EPC), including market position, key segments, and exposure to disruption:

Spectrum Brands Holdings, Inc. (SPB)

- Operates globally in household & personal products with moderate market cap and diversified competition.

- Key segments include Home and Personal Care, Global Pet Care, and Home and Garden, driving broad revenue streams.

- Exposure to technological disruption appears moderate, centered on branded consumer products without noted innovation shifts.

Edgewell Personal Care Company (EPC)

- Operates globally in personal care with smaller market cap and competitive pressure in shaving and skin care.

- Focused on Wet Shave, Sun and Skin Care, and Feminine Care segments, relying heavily on razors and blades.

- Faces technological disruption risks mainly in personal care product innovation and consumer preferences.

SPB vs EPC Positioning

SPB adopts a diversified approach across multiple consumer product segments, providing revenue stability but requiring broad management focus. EPC concentrates on personal care niches, potentially enhancing specialization but increasing dependency on fewer categories.

Which has the best competitive advantage?

Based on MOAT evaluation, SPB has a slightly unfavorable position with growing profitability, while EPC faces a very unfavorable position with declining returns, indicating SPB currently maintains a stronger competitive advantage.

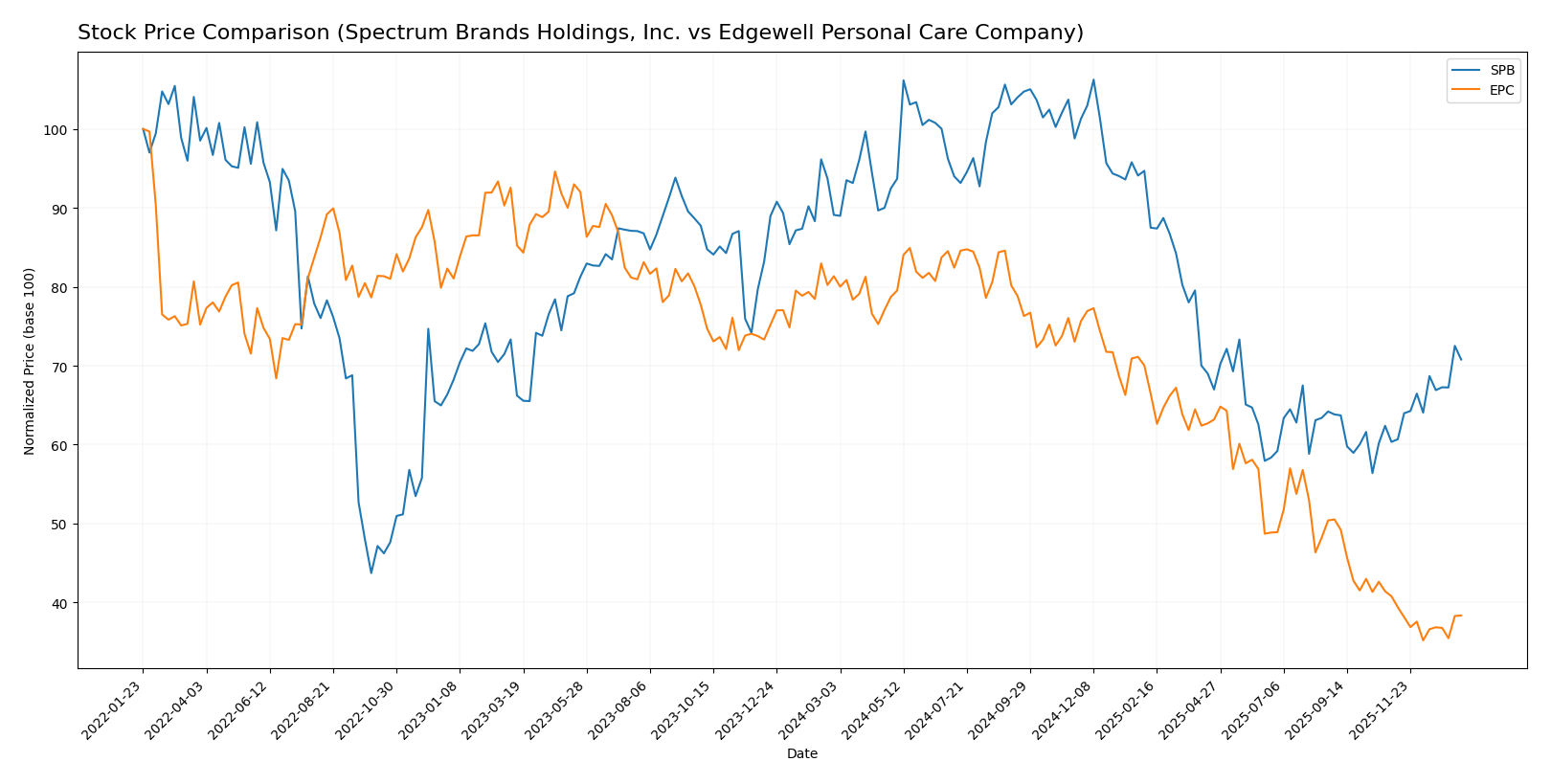

Stock Comparison

The stock price chart over the past 12 months highlights divergent trading dynamics and significant price movements for Spectrum Brands Holdings, Inc. (SPB) and Edgewell Personal Care Company (EPC), reflecting contrasting market performances and investor sentiment.

Trend Analysis

Spectrum Brands Holdings, Inc. (SPB) exhibited a bearish trend over the past 12 months with a price decline of 20.57%. The trend showed acceleration, with high volatility (std deviation 15.02), hitting a high of 94.88 and a low of 50.35. Recent months revealed a bullish rebound of 17.3%.

Edgewell Personal Care Company (EPC) experienced a stronger bearish trend, declining 52.87% over the last year with accelerating downward momentum and moderate volatility (std deviation 7.54). The stock fell from a high of 40.38 to a low of 16.73, with recent periods continuing a bearish trend (-5.98%).

Comparing the two, SPB outperformed EPC in market performance over the past year, showing a smaller overall decline and a recent positive recovery, whereas EPC sustained a sharper and ongoing bearish trend.

Target Prices

The target price consensus for these companies reflects cautious optimism among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Spectrum Brands Holdings, Inc. | 75 | 75 | 75 |

| Edgewell Personal Care Company | 23 | 20 | 21.5 |

Spectrum Brands’ consensus target of 75 suggests a potential upside from its current price of 63.2, while Edgewell’s target range indicates moderate growth potential relative to its 18.23 market price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Spectrum Brands Holdings, Inc. (SPB) and Edgewell Personal Care Company (EPC):

Rating Comparison

SPB Rating

- Rating: B, status Very Favorable

- Discounted Cash Flow Score: 1, status Very Unfavorable, indicating undervaluation concerns

- ROE Score: 2, status Moderate, moderate efficiency in generating equity returns

- ROA Score: 3, status Moderate, better utilization of assets

- Debt To Equity Score: 3, status Moderate, moderate financial risk

- Overall Score: 3, status Moderate, average financial standing

EPC Rating

- Rating: B, status Very Favorable

- Discounted Cash Flow Score: 5, status Very Favorable, suggesting strong cash flow projections

- ROE Score: 2, status Moderate, similar moderate efficiency in equity returns

- ROA Score: 2, status Moderate, slightly less effective asset utilization

- Debt To Equity Score: 2, status Moderate, somewhat stronger balance sheet

- Overall Score: 3, status Moderate, average financial standing

Which one is the best rated?

Both SPB and EPC share the same overall rating of B and an overall score of 3, indicating moderate standing. EPC outperforms SPB in discounted cash flow and has a slightly stronger balance sheet, while SPB shows better asset utilization. The choice depends on which metric investors prioritize.

Scores Comparison

Here is the comparison of the Altman Z-Score and Piotroski Score for Spectrum Brands Holdings, Inc. and Edgewell Personal Care Company:

SPB Scores

- Altman Z-Score: 1.77, in distress zone indicating high bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength.

EPC Scores

- Altman Z-Score: 1.44, in distress zone indicating high bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength.

Which company has the best scores?

Both SPB and EPC have Altman Z-Scores in the distress zone, signaling high bankruptcy risk. Their Piotroski Scores are equal at 6, indicating similar average financial strength. Neither company shows a clear advantage based on these scores.

Grades Comparison

Here is the grades comparison for Spectrum Brands Holdings, Inc. and Edgewell Personal Care Company:

Spectrum Brands Holdings, Inc. Grades

The table below shows recent grades from reputable financial institutions for Spectrum Brands Holdings, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Canaccord Genuity | Maintain | Buy | 2025-11-17 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-14 |

| Wells Fargo | Maintain | Equal Weight | 2025-09-25 |

| Canaccord Genuity | Maintain | Buy | 2025-08-08 |

| Wells Fargo | Maintain | Equal Weight | 2025-07-09 |

| Canaccord Genuity | Maintain | Buy | 2025-06-25 |

| UBS | Maintain | Buy | 2025-05-09 |

| UBS | Maintain | Buy | 2025-04-17 |

| Wells Fargo | Maintain | Equal Weight | 2025-04-16 |

| Wells Fargo | Maintain | Equal Weight | 2025-04-02 |

Spectrum Brands Holdings, Inc. shows a consistent pattern of “Buy” and “Equal Weight” ratings, indicating stable confidence among analysts.

Edgewell Personal Care Company Grades

The table below shows recent grades from reputable financial institutions for Edgewell Personal Care Company.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-18 |

| Barclays | Maintain | Equal Weight | 2025-11-14 |

| RBC Capital | Maintain | Outperform | 2025-11-14 |

| Wells Fargo | Maintain | Overweight | 2025-11-14 |

| Wells Fargo | Maintain | Overweight | 2025-09-25 |

| Morgan Stanley | Upgrade | Equal Weight | 2025-08-06 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Barclays | Maintain | Equal Weight | 2025-08-06 |

| Canaccord Genuity | Maintain | Buy | 2025-08-06 |

Edgewell Personal Care Company’s ratings range from “Buy” to “Outperform” and “Overweight,” showing moderately positive analyst sentiment with some variance.

Which company has the best grades?

Spectrum Brands Holdings, Inc. has received predominantly “Buy” and “Equal Weight” grades, while Edgewell Personal Care Company’s ratings include “Overweight,” “Outperform,” and several “Equal Weight” assessments. Spectrum Brands’ more consistent “Buy” consensus suggests steadier analyst confidence, potentially implying a clearer outlook for investors compared to Edgewell’s wider range of opinions.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of Spectrum Brands Holdings, Inc. (SPB) and Edgewell Personal Care Company (EPC) based on their latest financial and strategic data.

| Criterion | Spectrum Brands Holdings, Inc. (SPB) | Edgewell Personal Care Company (EPC) |

|---|---|---|

| Diversification | Highly diversified across Global Pet Supplies (1.08B), Home and Personal Care (1.15B), and Home and Garden (573M) segments | Less diversified, focused on Razors and Blades (1.1B) and Sun Care (459M), with smaller segments such as Infant Care (201M) |

| Profitability | Low but improving profitability; 2025 ROIC 4.95% below WACC 5.45%; net margin 3.56% unfavorable | Weak profitability; 2025 ROIC 3.0%, below WACC 5.23%; net margin 1.14% unfavorable, declining ROIC |

| Innovation | Moderate innovation indicated by stable fixed asset turnover (8.55 favorable) and growing ROIC trend | Innovation challenges with declining ROIC and unfavorable interest coverage (1.32) reflecting financial pressure |

| Global presence | Strong global presence with multiple consumer product segments generating over 2.8B combined revenue | Global reach centered on personal care products but less diversified geographically and by segment |

| Market Share | Stable presence in pet supplies and home care markets, supported by solid asset turnover and dividend yield | Market share concentrated in razors and skin care but pressured by declining profitability and high P/E ratio (38.07 unfavorable) |

In summary, SPB shows better diversification and financial stability with a favorable ratio profile and a growing return on invested capital despite currently shedding value. EPC faces profitability and efficiency challenges with a declining ROIC and higher financial risk, suggesting caution for investors seeking stable value creation.

Risk Analysis

Below is a comparison of key risks for Spectrum Brands Holdings, Inc. (SPB) and Edgewell Personal Care Company (EPC) based on the most recent data from 2025.

| Metric | Spectrum Brands Holdings, Inc. (SPB) | Edgewell Personal Care Company (EPC) |

|---|---|---|

| Market Risk | Moderate (Beta 0.68, stable consumer sector) | Moderate (Beta 0.62, niche personal care) |

| Debt level | Low (Debt/Equity 0.34, Debt/Assets 19.36%) | Moderate (Debt/Equity 0.91, Debt/Assets 37.61%) |

| Regulatory Risk | Moderate (Consumer products, environmental compliance) | Moderate (Personal care product regulations) |

| Operational Risk | Moderate (Diverse product segments, supply chain exposure) | Moderate (Concentrated product categories, potential supply disruptions) |

| Environmental Risk | Moderate (Pesticides and chemical products in portfolio) | Low to Moderate (Focus on skin care, less chemical exposure) |

| Geopolitical Risk | Low to Moderate (Global supply chain exposure) | Low to Moderate (Global sourcing but less diversified) |

The most impactful and likely risks are the moderate debt level and operational challenges faced by Edgewell due to its higher leverage and concentrated product focus. Spectrum Brands shows lower financial leverage and a diversified product range, but its exposure to environmental regulatory risks, especially in pest control products, requires attention. Both firms operate in stable consumer sectors but face ongoing regulatory and supply chain risks that investors must monitor closely.

Which Stock to Choose?

Spectrum Brands Holdings, Inc. (SPB) shows declining income with a 5.23% revenue drop in 2025 and unfavorable profitability trends, though it maintains a favorable financial ratio profile and moderate debt levels. Its rating is very favorable, supported by a B grade and a slightly unfavorable moat due to value destruction but growing ROIC.

Edgewell Personal Care Company (EPC) experienced a milder 1.34% revenue decline in 2025 with low profitability and a neutral financial ratio evaluation. It carries higher debt and a moderate rating also graded B, but its moat status is very unfavorable, reflecting declining ROIC and consistent value erosion.

Investors focused on financial stability and stronger ratio metrics may find SPB’s profile more favorable, while those with tolerance for higher risk and a preference for companies with less favorable moats might see EPC as an alternative. The choice could depend on the investor’s risk appetite and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Spectrum Brands Holdings, Inc. and Edgewell Personal Care Company to enhance your investment decisions: