In the competitive world of household and personal products, Inter Parfums, Inc. (IPAR) and Edgewell Personal Care Company (EPC) stand out with distinct yet overlapping market footprints. Both companies innovate within the consumer defensive sector, offering a diverse range of fragrances and personal care essentials. This article will guide you through their strengths and challenges, helping you determine which company could be the smarter addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Inter Parfums, Inc. and Edgewell Personal Care Company by providing an overview of these two companies and their main differences.

Inter Parfums, Inc. Overview

Inter Parfums, Inc. operates in the household and personal products industry, manufacturing and distributing fragrances and related products worldwide. The company markets a diverse portfolio of luxury brands, including Coach, Jimmy Choo, and Boucheron. Headquartered in New York City, Inter Parfums serves department stores, specialty retailers, and e-commerce channels, emphasizing premium fragrance offerings.

Edgewell Personal Care Company Overview

Edgewell Personal Care Company is a global manufacturer and marketer of personal care products, operating through wet shave, sun and skin care, and feminine care segments. Its brand portfolio includes Schick, Banana Boat, and Playtex. Founded in 1772 and based in Shelton, Connecticut, Edgewell focuses on mass-market personal care solutions with a broad consumer base and diverse product lines.

Key similarities and differences

Both companies operate within the consumer defensive sector focused on personal care products, yet their business models differ in market positioning and product range. Inter Parfums targets the luxury fragrance segment with selective distribution, while Edgewell offers a wider variety of mass-market personal care products across multiple categories. Their geographic reach and brand strategies also reflect distinct market approaches within the same industry.

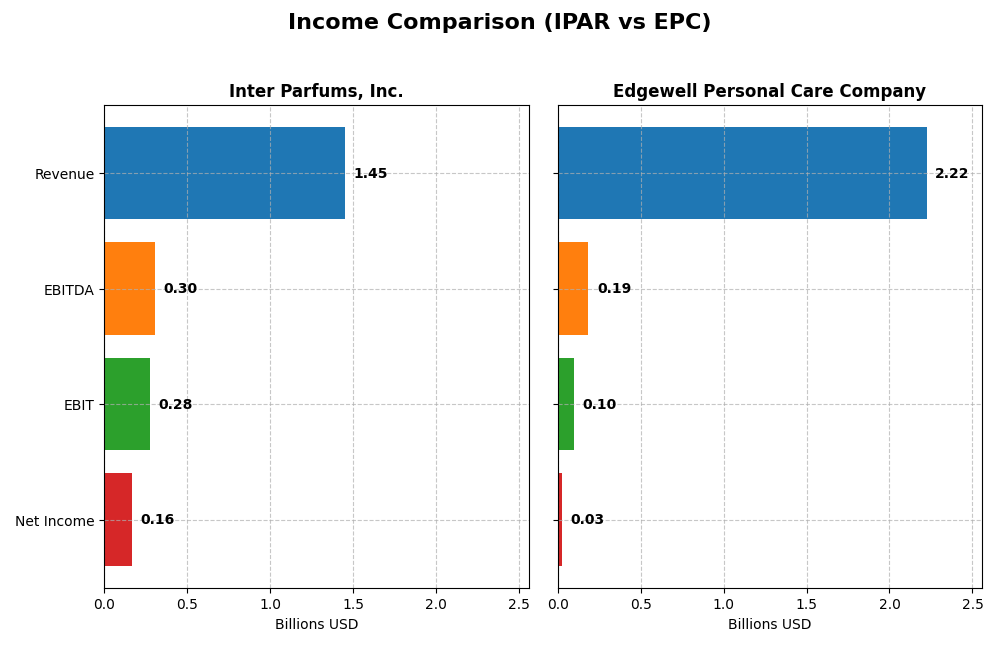

Income Statement Comparison

The table below compares the most recent fiscal year income statement figures for Inter Parfums, Inc. and Edgewell Personal Care Company, highlighting their key financial metrics.

| Metric | Inter Parfums, Inc. (IPAR) | Edgewell Personal Care Company (EPC) |

|---|---|---|

| Market Cap | 2.87B | 847M |

| Revenue | 1.45B | 2.22B |

| EBITDA | 305M | 186M |

| EBIT | 276M | 97M |

| Net Income | 164M | 25M |

| EPS | 5.13 | 0.53 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Inter Parfums, Inc.

Inter Parfums showed strong revenue growth from $539M in 2020 to $1.45B in 2024, with net income rising from $38M to $164M. Margins remained robust, with a gross margin of 63.85% and net margin near 11.32%. The 2024 year saw a 10.2% revenue increase and a slight dip in net margin growth, indicating solid but slightly pressured profitability.

Edgewell Personal Care Company

Edgewell’s revenue grew modestly from $2.09B in 2021 to $2.22B in 2025 but declined slightly in the latest year. Net income fell sharply from $118M to $25M over five years, with net margin at a low 1.14%. The 2025 results reflect a 1.3% revenue decrease and significant margin compression, signaling weakening profitability and operational challenges.

Which one has the stronger fundamentals?

Inter Parfums demonstrates stronger fundamentals with sustained revenue and net income growth, favorable margins, and efficient interest expense management. Edgewell faces declining net income and margins, with unfavorable recent growth trends. Overall, Inter Parfums’ income statement shows more consistent profitability and margin stability compared to Edgewell’s deteriorating financial metrics.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Inter Parfums, Inc. (IPAR) and Edgewell Personal Care Company (EPC) based on their most recent fiscal year data.

| Ratios | Inter Parfums, Inc. (IPAR) FY 2024 | Edgewell Personal Care Company (EPC) FY 2025 |

|---|---|---|

| ROE | 22.1% | 1.64% |

| ROIC | 18.6% | 3.00% |

| P/E | 25.6 | 38.1 |

| P/B | 5.66 | 0.62 |

| Current Ratio | 2.75 | 1.76 |

| Quick Ratio | 1.63 | 0.90 |

| D/E (Debt to Equity) | 0.26 | 0.91 |

| Debt-to-Assets | 13.6% | 37.6% |

| Interest Coverage | 35.6x | 1.32x |

| Asset Turnover | 1.03 | 0.59 |

| Fixed Asset Turnover | 8.14 | 6.02 |

| Payout Ratio | 58.4% | 115.4% |

| Dividend Yield | 2.28% | 3.03% |

Interpretation of the Ratios

Inter Parfums, Inc.

Inter Parfums demonstrates strong financial health with favorable net margin at 11.32%, ROE at 22.07%, and ROIC at 18.62%, indicating efficient profitability and capital use. Its liquidity ratios, including a current ratio of 2.75, and low debt levels are also favorable. Dividend yield is stable at 2.28%, with distributions well covered by free cash flow, posing limited risk of unsustainable payouts.

Edgewell Personal Care Company

Edgewell’s ratios reveal weaknesses, notably low net margin of 1.14%, ROE at 1.64%, and ROIC of 3.0%, reflecting limited profitability and capital efficiency. While its debt to equity and current ratio show moderate strength, interest coverage at 1.32 is unfavorable, indicating potential stress servicing debt. It pays dividends with a 3.03% yield, but profitability constraints may affect sustainability.

Which one has the best ratios?

Inter Parfums clearly holds the advantage with predominantly favorable ratios demonstrating solid profitability, efficient asset use, and strong liquidity. Edgewell presents a mixed profile with several unfavorable metrics, especially profitability and interest coverage, tempering its dividend yield benefit. Overall, Inter Parfums exhibits a more robust financial position based on the current ratio evaluation.

Strategic Positioning

This section compares the strategic positioning of Inter Parfums, Inc. (IPAR) and Edgewell Personal Care Company (EPC), focusing on market position, key segments, and exposure to technological disruption:

Inter Parfums, Inc. (IPAR)

- Mid-sized player with $2.87B market cap and moderate competitive pressure.

- Operates in fragrances across Europe and the US, selling multiple luxury and fashion brands.

- No explicit mention of technological disruption exposure or innovation focus.

Edgewell Personal Care Company (EPC)

- Smaller market cap at $847M, with notable competitive pressure in personal care.

- Diversified personal care segments: wet shave, sun and skin care, feminine care.

- No explicit exposure to technological disruption indicated in data.

IPAR vs EPC Positioning

IPAR focuses on a concentrated portfolio of branded fragrances across two geographic segments, offering luxury appeal. EPC has a more diversified product base across personal care categories but operates with lower market capitalization and higher employee count, indicating a broader operational scope but potential complexity.

Which has the best competitive advantage?

IPAR demonstrates a very favorable moat with growing ROIC surpassing WACC, indicating durable competitive advantage and efficient capital use. EPC shows a very unfavorable moat with declining ROIC below WACC, signaling value destruction and weakening profitability.

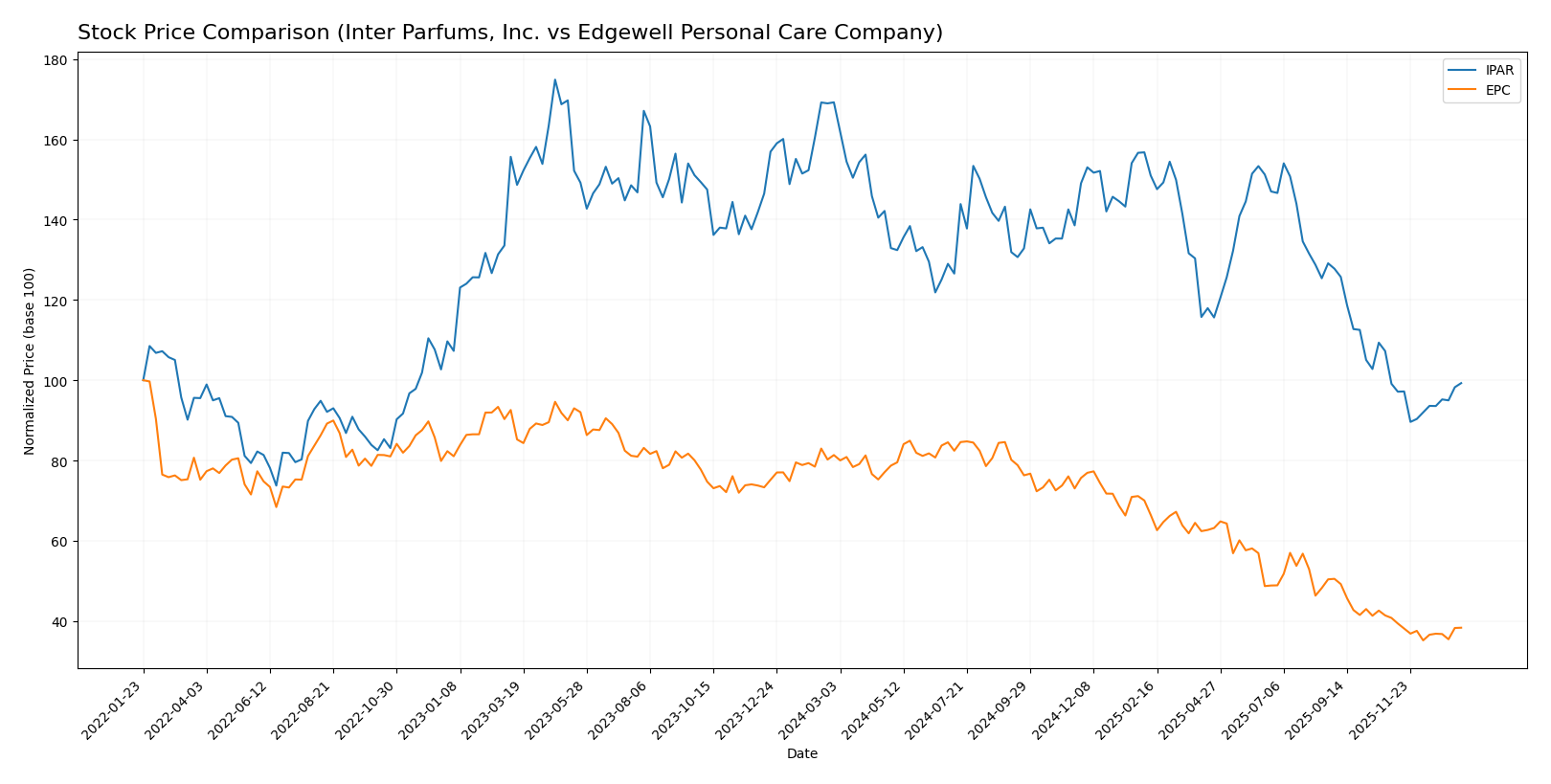

Stock Comparison

The past year has seen a pronounced bearish trend for both Inter Parfums, Inc. (IPAR) and Edgewell Personal Care Company (EPC), with significant price declines and accelerating downward momentum, contrasting with a recent stabilization phase for IPAR.

Trend Analysis

Inter Parfums, Inc. experienced a -41.33% price decline over the past year, indicating a bearish trend with acceleration. Its price ranged between 80.61 and 152.22, showing high volatility with a 17.11 standard deviation. Recently, its trend stabilized with a slight 0.17% increase.

Edgewell Personal Care Company’s stock fell by -52.87% over the past year, consistent with a bearish trend and accelerating decline. The price fluctuated from 16.73 to 40.38, with a lower volatility (7.54 std deviation). In the recent period, the decline continued with a -5.98% drop.

Comparing both, IPAR’s stock has outperformed EPC’s over the past year, delivering a smaller percentage decline and showing recent signs of stabilization, whereas EPC continues to face a steeper and sustained downward trend.

Target Prices

The current analyst consensus provides clear target price ranges for both Inter Parfums, Inc. and Edgewell Personal Care Company.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Inter Parfums, Inc. | 125 | 103 | 114 |

| Edgewell Personal Care Company | 23 | 20 | 21.5 |

Analysts expect Inter Parfums’ stock to appreciate significantly from its current price of $89.3, suggesting strong upside potential. Edgewell’s consensus target also indicates a moderate increase compared to its current price of $18.23.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Inter Parfums, Inc. and Edgewell Personal Care Company:

Rating Comparison

Inter Parfums, Inc. Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate, scored 3 out of 5.

- ROE Score: Very favorable, highest at 5 out of 5.

- ROA Score: Very favorable, top score of 5 out of 5.

- Debt To Equity Score: Moderate, scored 3 out of 5.

- Overall Score: Moderate, scored 3 out of 5.

Edgewell Personal Care Company Rating

- Rating: B, also rated very favorable by analysts.

- Discounted Cash Flow Score: Very favorable, scored 5 out of 5.

- ROE Score: Moderate, scored 2 out of 5.

- ROA Score: Moderate, scored 2 out of 5.

- Debt To Equity Score: Moderate, scored 2 out of 5.

- Overall Score: Moderate, scored 3 out of 5.

Which one is the best rated?

Inter Parfums has a higher overall rating (B+) and stronger profitability metrics (ROE and ROA scores of 5) than Edgewell, which scores better in discounted cash flow but lags in return ratios. Both have moderate overall scores.

Scores Comparison

The comparison of scores for Inter Parfums, Inc. (IPAR) and Edgewell Personal Care Company (EPC) is as follows:

IPAR Scores

- Altman Z-Score: 6.12, indicating a safe zone.

- Piotroski Score: 5, reflecting average financial strength.

EPC Scores

- Altman Z-Score: 1.44, indicating a distress zone.

- Piotroski Score: 6, reflecting average financial strength.

Which company has the best scores?

IPAR’s Altman Z-Score places it clearly in the safe zone, unlike EPC, which is in distress. Both companies have average Piotroski Scores, with EPC slightly higher. Overall, IPAR shows stronger financial stability based on these scores.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Inter Parfums, Inc. and Edgewell Personal Care Company:

Inter Parfums, Inc. Grades

The following table summarizes recent grades and rating actions from verified grading companies for Inter Parfums, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BWS Financial | Downgrade | Neutral | 2025-11-21 |

| Canaccord Genuity | Maintain | Buy | 2025-11-19 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Jefferies | Maintain | Buy | 2025-10-28 |

| BWS Financial | Maintain | Buy | 2025-10-22 |

| Canaccord Genuity | Maintain | Buy | 2025-10-21 |

| BWS Financial | Maintain | Buy | 2025-05-07 |

| Piper Sandler | Maintain | Overweight | 2025-04-24 |

| DA Davidson | Maintain | Buy | 2025-03-25 |

| BWS Financial | Maintain | Buy | 2025-03-17 |

Inter Parfums, Inc. predominantly holds a “Buy” consensus with a recent downgrade to “Neutral” by BWS Financial, indicating mostly positive but slightly cautious sentiment.

Edgewell Personal Care Company Grades

Below is a summary of recent verified grades for Edgewell Personal Care Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-18 |

| Barclays | Maintain | Equal Weight | 2025-11-14 |

| RBC Capital | Maintain | Outperform | 2025-11-14 |

| Wells Fargo | Maintain | Overweight | 2025-11-14 |

| Wells Fargo | Maintain | Overweight | 2025-09-25 |

| Morgan Stanley | Upgrade | Equal Weight | 2025-08-06 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Barclays | Maintain | Equal Weight | 2025-08-06 |

| Canaccord Genuity | Maintain | Buy | 2025-08-06 |

Edgewell Personal Care Company shows a range of “Equal Weight” to “Overweight” ratings, with no recent downgrades and a stable outlook.

Which company has the best grades?

Inter Parfums, Inc. holds a stronger overall consensus with mostly “Buy” ratings compared to Edgewell’s “Hold” consensus and more moderate grades. This suggests Inter Parfums currently enjoys more bullish analyst sentiment, which could affect investor confidence and portfolio positioning differently.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Inter Parfums, Inc. (IPAR) and Edgewell Personal Care Company (EPC) based on recent financial and strategic data.

| Criterion | Inter Parfums, Inc. (IPAR) | Edgewell Personal Care Company (EPC) |

|---|---|---|

| Diversification | Moderate product range focused on fragrances; limited geographic diversification (notably strong in France, $37.6M in 2020) | Broad product portfolio across personal care segments including razors, sun care, feminine products; global footprint |

| Profitability | Strong profitability: net margin 11.3%, ROIC 18.6%, ROE 22.1% (2024) | Weak profitability: net margin 1.1%, ROIC 3.0%, ROE 1.6% (2025) |

| Innovation | Demonstrates increasing profitability and efficient capital use indicating effective innovation | Declining profitability and value destruction suggest innovation challenges |

| Global presence | Limited but focused international presence, primarily in Europe | Extensive global presence across multiple product categories |

| Market Share | Niche player in fragrance segment with durable competitive advantage | Large player in personal care but facing market share pressure and declining returns |

Key takeaways: Inter Parfums shows a very favorable economic moat with growing returns and strong profitability, suggesting effective capital deployment and competitive positioning. In contrast, Edgewell struggles with profitability and value creation despite broad product diversification and global reach, indicating caution for investors due to declining financial performance and competitive challenges.

Risk Analysis

Below is a comparative risk table for Inter Parfums, Inc. (IPAR) and Edgewell Personal Care Company (EPC) based on the latest financial and operational data from 2025-2026:

| Metric | Inter Parfums, Inc. (IPAR) | Edgewell Personal Care Company (EPC) |

|---|---|---|

| Market Risk | Beta 1.24 – moderately volatile | Beta 0.62 – lower volatility |

| Debt level | Low debt-to-assets 13.6% – favorable | Moderate debt-to-assets 37.6% – neutral |

| Regulatory Risk | Moderate (cosmetics industry regulations) | Moderate (personal care and hygiene regulations) |

| Operational Risk | Low – stable operations, 647 employees | Moderate – larger scale with 6,700 employees, more complexity |

| Environmental Risk | Moderate – consumer products impact | Moderate – personal care products impact |

| Geopolitical Risk | Moderate – global distribution exposure | Moderate – global markets exposure |

The most impactful and likely risk for IPAR is market volatility combined with premium valuation concerns, despite strong financial health and low debt. EPC faces higher financial risk due to elevated debt and weaker profitability, amplified by operational complexity and a distress-level Altman Z-Score, signaling caution for investors.

Which Stock to Choose?

Inter Parfums, Inc. (IPAR) shows a favorable income evolution with strong revenue and net income growth over 2020-2024. Its financial ratios are mostly very favorable, indicating high profitability, low debt, and solid liquidity. The company maintains a very favorable rating and demonstrates a very favorable moat with growing ROIC above WACC.

Edgewell Personal Care Company (EPC) presents an unfavorable income evolution marked by declining net income and margins over 2021-2025. Its financial ratios are mixed, with several unfavorable metrics including low profitability and high debt levels. Despite a very favorable overall rating, EPC’s moat is very unfavorable due to a declining ROIC below WACC, signaling value destruction.

For investors prioritizing durable profitability and financial strength, IPAR may appear more favorable given its strong income growth, robust ratios, and very favorable moat. Conversely, EPC might appeal to those with a tolerance for risk seeking potential value in a company with a very favorable rating but weaker income and profitability trends.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Inter Parfums, Inc. and Edgewell Personal Care Company to enhance your investment decisions: