In the competitive world of household and personal products, Edgewell Personal Care Company (EPC) and Helen of Troy Limited (HELE) stand out as two influential players. Both companies operate globally, offering diverse consumer products with strong innovation strategies and market presence. This comparison highlights their strengths and challenges, helping you decide which company holds greater potential for your investment portfolio in 2026. Let’s explore which stock is the smarter choice for your wallet.

Table of contents

Companies Overview

I will begin the comparison between Edgewell Personal Care Company and Helen of Troy Limited by providing an overview of these two companies and their main differences.

Edgewell Personal Care Company Overview

Edgewell Personal Care Company is dedicated to manufacturing and marketing personal care products worldwide. It operates through three segments: Wet shave, Sun and Skin care, and Feminine care, offering a range of products under brands like Schick, Banana Boat, and Playtex. Founded in 1772 and headquartered in Shelton, Connecticut, Edgewell focuses on household and personal products within the consumer defensive sector.

Helen of Troy Limited Overview

Helen of Troy Limited offers a diverse portfolio of consumer products in markets across multiple continents. Its three segments include Home & Outdoor, Health & Wellness, and Beauty, featuring brands such as OXO, Hydro Flask, Braun, and Revlon. The company, incorporated in 1968 and based in El Paso, Texas, sells through various retail channels, targeting household and personal products within the consumer defensive sector.

Key similarities and differences

Both companies operate in the household and personal products industry within the consumer defensive sector, serving global markets with diversified product lines. Edgewell concentrates on personal care with segments focused on shaving, skin, and feminine care, while Helen of Troy has a broader product range spanning home goods, health devices, and beauty products. Employee count and market capitalization also differ, with Edgewell larger in both aspects.

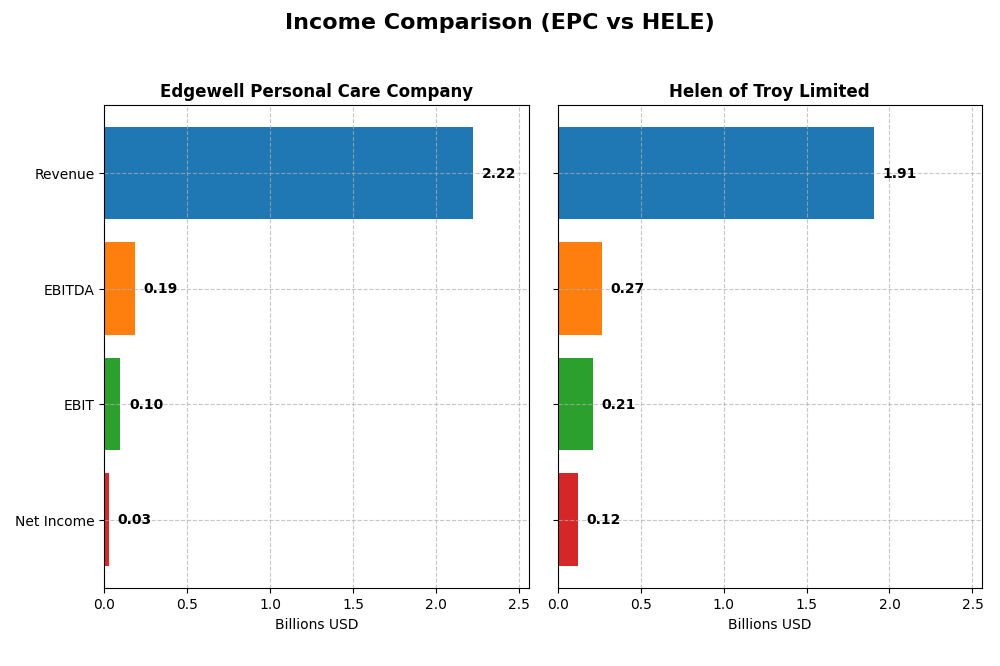

Income Statement Comparison

The following table compares key income statement metrics for Edgewell Personal Care Company and Helen of Troy Limited based on their most recent fiscal year results.

| Metric | Edgewell Personal Care Company (EPC) | Helen of Troy Limited (HELE) |

|---|---|---|

| Market Cap | 847M | 431M |

| Revenue | 2.22B | 1.91B |

| EBITDA | 186M | 269M |

| EBIT | 97M | 214M |

| Net Income | 25M | 124M |

| EPS | 0.53 | 5.38 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Edgewell Personal Care Company

Edgewell’s revenue showed modest growth of 6.53% over 2021-2025 but declined slightly by 1.34% in 2025, reflecting a slowdown. Net income dropped significantly by 78.44% over the period and 73.89% in the last year, with net margins contracting similarly. The 2025 fiscal year saw underperformance in profitability with a net margin of 1.14%, indicating margin pressure despite a stable gross margin near 41.6%.

Helen of Troy Limited

Helen of Troy’s revenue declined by 9.11% over the five years, accelerating to a 4.86% decrease in 2025. Net income also fell sharply by 51.27% across the period and 22.85% last year, compressing net margins to 6.49%. Despite top-line and bottom-line weaknesses, the company maintained favorable gross and EBIT margins of 47.93% and 11.19% respectively, showing operational efficiency even amid declining sales.

Which one has the stronger fundamentals?

Both companies faced revenue and net income declines recently, with unfavorable margin trends. However, Helen of Troy sustains higher gross and EBIT margins, indicating better operational profitability. Edgewell’s margins and earnings suffered more steeply, despite slight revenue growth over the period. Overall, Helen of Troy’s stronger margin profile contrasts with Edgewell’s weakening profitability, presenting mixed fundamental strengths.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Edgewell Personal Care Company (EPC) and Helen of Troy Limited (HELE) based on their most recent fiscal year data.

| Ratios | Edgewell Personal Care Company (EPC) | Helen of Troy Limited (HELE) |

|---|---|---|

| ROE | 1.64% | 7.35% |

| ROIC | 3.00% | 5.32% |

| P/E | 38.07 | 10.25 |

| P/B | 0.62 | 0.75 |

| Current Ratio | 1.76 | 2.00 |

| Quick Ratio | 0.90 | 1.03 |

| D/E | 0.91 | 0.57 |

| Debt-to-Assets | 37.61% | 30.74% |

| Interest Coverage | 1.32 | 2.75 |

| Asset Turnover | 0.59 | 0.61 |

| Fixed Asset Turnover | 6.02 | 5.23 |

| Payout Ratio | 115.35% | 0% |

| Dividend Yield | 3.03% | 0% |

Interpretation of the Ratios

Edgewell Personal Care Company

Edgewell’s ratios show a balanced profile with 35.71% favorable and 35.71% unfavorable indicators, reflecting a neutral overall stance. Strengths include a solid current ratio of 1.76 and a low price-to-book ratio of 0.62, while concerns arise from weak profitability metrics such as a 1.14% net margin and 1.64% ROE. The company pays dividends with a 3.03% yield, supported by moderate payout sustainability but risks remain due to limited free cash flow coverage.

Helen of Troy Limited

Helen of Troy displays a slightly favorable ratio profile, with 42.86% favorable and only 14.29% unfavorable ratios. The company benefits from a low P/E of 10.25, good liquidity ratios, and a reasonable debt level, though its ROE at 7.35% is considered weak. Helen of Troy does not pay dividends, likely prioritizing reinvestment and growth, which aligns with its higher retained earnings and shareholder value focus.

Which one has the best ratios?

Helen of Troy holds a slight advantage with a higher proportion of favorable ratios and fewer unfavorable metrics, particularly in valuation and liquidity. Edgewell presents a more neutral picture, with mixed profitability and coverage concerns. Both companies exhibit some weaknesses, but Helen of Troy’s balance sheet and valuation metrics offer a marginally better risk-reward profile based on the 2025 data.

Strategic Positioning

This section compares the strategic positioning of Edgewell Personal Care Company and Helen of Troy Limited, including their market position, key segments, and exposure to technological disruption:

Edgewell Personal Care Company

- Operates in personal care with strong presence in razors; faces competitive pressure in consumer defensive sector.

- Key segments are Wet Shave, Sun and Skin Care, and Feminine Care, driven by established brands like Schick and Banana Boat.

- Exposure to technological disruption is not explicitly detailed; operates in traditional personal care and consumer goods markets.

Helen of Troy Limited

- Competes in consumer products with broad geographic reach; moderate competitive pressure in household personal products.

- Focuses on Home & Outdoor, Health & Wellness, and Beauty segments with diverse product lines and multiple brands.

- No specific information on technological disruption; operates in consumer products with diverse wellness and home categories.

Edgewell Personal Care Company vs Helen of Troy Limited Positioning

Edgewell adopts a concentrated strategy focusing on personal care segments such as razors and feminine care, benefiting from strong brand recognition. Helen of Troy pursues a more diversified approach across home, wellness, and beauty, broadening its market exposure but with fewer details on its technological adaptation.

Which has the best competitive advantage?

Both companies demonstrate declining ROIC trends below their WACC, indicating value destruction and weak economic moats. Neither currently shows a sustainable competitive advantage based on their financial efficiency from 2021 to 2025.

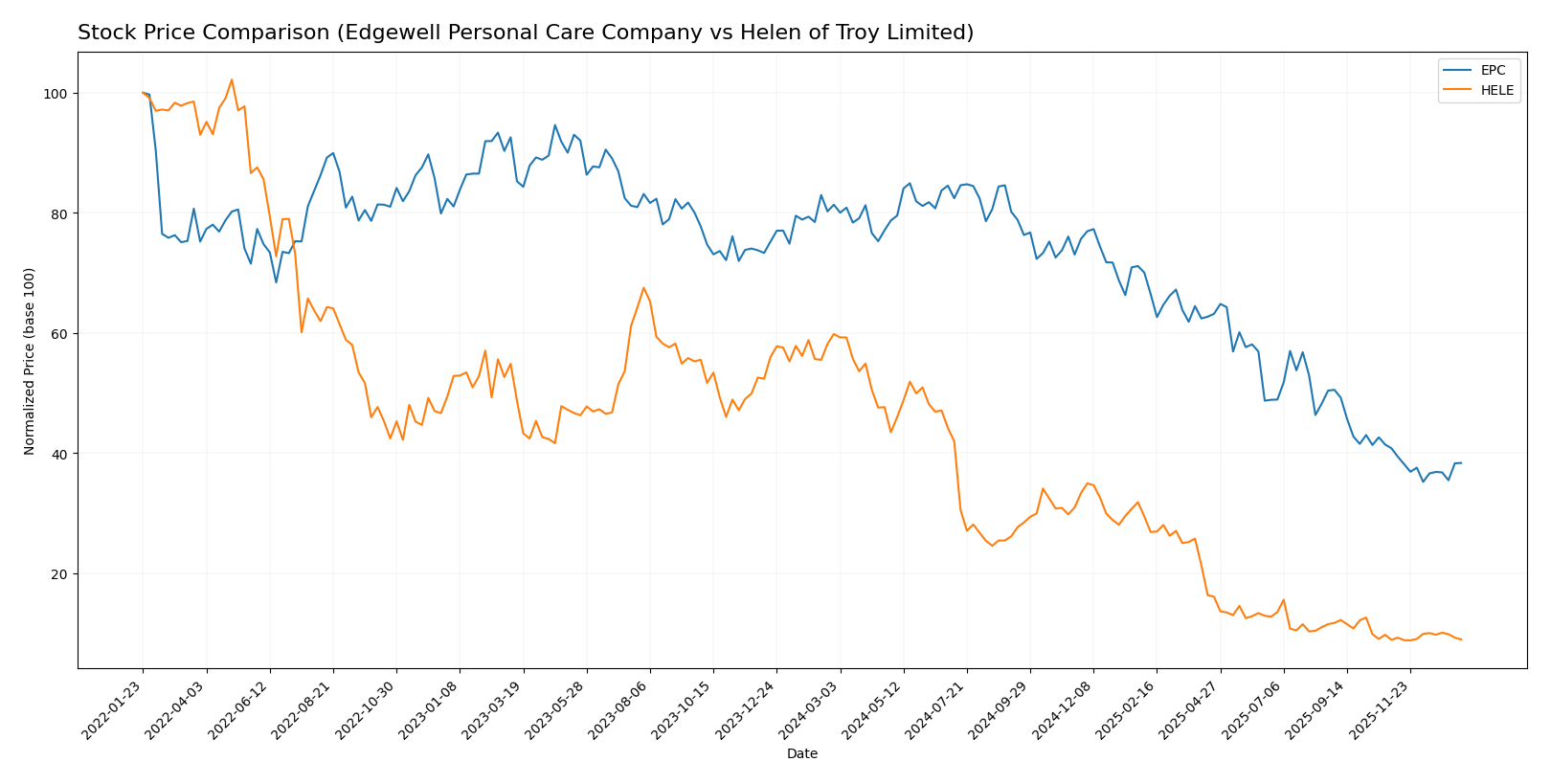

Stock Comparison

The stock prices of Edgewell Personal Care Company (EPC) and Helen of Troy Limited (HELE) have experienced significant declines over the past 12 months, with both showing accelerating bearish trends despite recent minor fluctuations.

Trend Analysis

Edgewell Personal Care Company (EPC) shows a bearish trend with a -52.87% price change over the past year, marked by accelerating decline and a standard deviation of 7.54, ranging from 40.38 to 16.73.

Helen of Troy Limited (HELE) also displays a bearish trend with an -85.04% price change over the same period, featuring acceleration and higher volatility with a standard deviation of 31.1, and prices fluctuating between 125.57 and 18.45.

Comparing both, HELE delivered the lowest market performance over the past year, with a more pronounced price decline than EPC, despite minor recent positive movement in HELE’s stock.

Target Prices

Analysts provide a clear consensus on target prices for both Edgewell Personal Care Company and Helen of Troy Limited.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Edgewell Personal Care Company | 23 | 20 | 21.5 |

| Helen of Troy Limited | 22 | 22 | 22 |

The consensus target prices indicate moderate upside potential for both stocks compared to current prices: Edgewell at $18.23 and Helen of Troy at $18.78. Analysts expect these consumer defensive companies to appreciate steadily within their respective target ranges.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Edgewell Personal Care Company and Helen of Troy Limited:

Rating Comparison

EPC Rating

- Rating: Both companies have a “B” rating, indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: EPC has a very favorable DCF score of 5, suggesting undervaluation potential.

- ROE Score: EPC shows a moderate ROE score of 2, reflecting average efficiency in generating profit from equity.

- ROA Score: EPC’s ROA score is 2, representing moderate asset utilization.

- Debt To Equity Score: EPC’s score is 2, a moderate debt level implying moderate financial risk.

- Overall Score: Both companies share an overall score of 3, which is moderate.

HELE Rating

- Rating: Both companies have a “B” rating, indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: HELE also scores 5, indicating similar undervaluation potential.

- ROE Score: HELE has a very unfavorable ROE score of 1, indicating low efficiency in profit generation from equity.

- ROA Score: HELE scores 1, showing very unfavorable asset utilization compared to EPC.

- Debt To Equity Score: HELE scores 4, favorable and indicating lower financial risk from debt.

- Overall Score: Both companies share an overall score of 3, which is moderate.

Which one is the best rated?

Both EPC and HELE share the same overall score and rating of “B” with very favorable DCF scores. EPC performs better in ROE and ROA, while HELE has a stronger debt-to-equity score. Overall, both ratings reflect moderate strength with differing financial risk profiles.

Scores Comparison

Here is a comparison of the financial scores for Edgewell Personal Care Company (EPC) and Helen of Troy Limited (HELE):

EPC Scores

- Altman Z-Score: 1.44, indicating financial distress.

- Piotroski Score: 6, reflecting average financial strength.

HELE Scores

- Altman Z-Score: 1.10, indicating financial distress.

- Piotroski Score: 3, reflecting very weak financial strength.

Which company has the best scores?

EPC has a higher Piotroski Score of 6 compared to HELE’s 3, suggesting stronger financial health. Both companies fall into the distress zone by Altman Z-Score, but EPC’s score is slightly higher.

Grades Comparison

Here is the comparison of recent grades and ratings for Edgewell Personal Care Company and Helen of Troy Limited:

Edgewell Personal Care Company Grades

The following table summarizes recent grades assigned to Edgewell Personal Care Company by reputable grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-18 |

| Barclays | Maintain | Equal Weight | 2025-11-14 |

| RBC Capital | Maintain | Outperform | 2025-11-14 |

| Wells Fargo | Maintain | Overweight | 2025-11-14 |

| Wells Fargo | Maintain | Overweight | 2025-09-25 |

| Morgan Stanley | Upgrade | Equal Weight | 2025-08-06 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Barclays | Maintain | Equal Weight | 2025-08-06 |

| Canaccord Genuity | Maintain | Buy | 2025-08-06 |

Edgewell’s grades generally range from Neutral to Outperform, with multiple Overweight and Buy ratings indicating moderately positive sentiment.

Helen of Troy Limited Grades

Below is a summary of recent grades for Helen of Troy Limited from credible grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-09 |

| Canaccord Genuity | Maintain | Hold | 2026-01-09 |

| Canaccord Genuity | Maintain | Hold | 2026-01-06 |

| UBS | Maintain | Neutral | 2025-10-10 |

| Canaccord Genuity | Maintain | Hold | 2025-10-10 |

| UBS | Maintain | Neutral | 2025-10-02 |

| Canaccord Genuity | Downgrade | Hold | 2025-07-11 |

| UBS | Maintain | Neutral | 2025-07-11 |

| Canaccord Genuity | Maintain | Buy | 2025-07-07 |

| Canaccord Genuity | Maintain | Buy | 2025-04-25 |

Helen of Troy’s grades mainly range between Hold and Neutral, with occasional Buy ratings, reflecting a cautious to neutral market outlook.

Which company has the best grades?

Edgewell Personal Care Company has received comparatively stronger grades, including Outperform and Overweight ratings, versus Helen of Troy Limited’s predominantly Neutral and Hold grades. This could imply a more favorable analyst outlook for Edgewell, potentially impacting investor confidence differently.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Edgewell Personal Care Company (EPC) and Helen of Troy Limited (HELE) based on the most recent data.

| Criterion | Edgewell Personal Care Company (EPC) | Helen of Troy Limited (HELE) |

|---|---|---|

| Diversification | Moderate product range focused on razors, sun care, feminine care, and skin care. Reliant on razors and blades (~$1.1B revenue in 2025). | More diversified with major segments in Beauty & Wellness ($1.0B) and Home & Outdoor ($906M). |

| Profitability | Low net margin (1.14%), low ROIC (3.0%), declining profitability; company is value-destroying. | Better net margin (6.49%) and ROIC (5.32%) but still declining; slightly favorable overall ratios. |

| Innovation | Limited recent innovation indicated; declining ROIC trend suggests challenges in sustaining competitive edge. | Moderate innovation with stable product categories and slightly favorable financial health. |

| Global presence | Established presence in personal care with recognizable brands; somewhat concentrated markets. | Stronger global footprint across diverse wellness and household products. |

| Market Share | Leading in razors and blades segment; steady revenue in core products but growth challenges. | Growing share in beauty and home sectors with rising revenues in key segments. |

Key takeaways: Helen of Troy exhibits stronger diversification and slightly better profitability metrics, indicating a more resilient business model. Edgewell struggles with declining profitability and concentrated revenue streams, signaling higher risk for investors. Both companies face challenges with declining ROIC trends, underscoring the need for cautious investment consideration.

Risk Analysis

The following table summarizes the key risk factors for Edgewell Personal Care Company (EPC) and Helen of Troy Limited (HELE) based on the most recent 2025 data:

| Metric | Edgewell Personal Care (EPC) | Helen of Troy Limited (HELE) |

|---|---|---|

| Market Risk | Moderate (Beta 0.62) | Moderate (Beta 0.78) |

| Debt Level | Neutral (D/E 0.91, Debt/Assets 37.6%) | Neutral (D/E 0.57, Debt/Assets 30.7%) |

| Regulatory Risk | Moderate (Consumer product regulations) | Moderate (Consumer product regulations) |

| Operational Risk | Moderate (Net margin 1.14%, Interest coverage 1.32) | Moderate (Net margin 6.49%, Interest coverage 4.11) |

| Environmental Risk | Moderate (Industry exposure to sustainability pressures) | Moderate (Industry exposure to sustainability pressures) |

| Geopolitical Risk | Low (Primarily US market exposure) | Moderate (Global operations across multiple regions) |

In summary, both companies face moderate market and operational risks typical of the consumer products sector. EPC’s financial distress signals, including a low Altman Z-Score (1.44) and weak profitability ratios, suggest a higher risk of financial instability. HELE also shows distress-zone Altman Z-Score (1.10) and very weak Piotroski score (3), with somewhat better debt metrics but concerns on profitability and valuation. The most impactful risks are financial distress and operational margin pressures, requiring cautious risk management before investing.

Which Stock to Choose?

Edgewell Personal Care Company (EPC) shows a generally unfavorable income evolution with declining net margin and EPS over 2021-2025. Its financial ratios are balanced with a neutral global assessment, moderate profitability, moderate debt levels, and a very favorable rating.

Helen of Troy Limited (HELE) presents an income statement with favorable margins but negative growth trends overall. Its financial ratios are slightly favorable, demonstrating moderate profitability, manageable debt, but mixed rating scores with some unfavorable profitability measures.

Considering ratings and financial ratios, EPC might appear more balanced with a very favorable rating despite weaker income growth, while HELE’s slightly favorable ratios and stronger margins could appeal differently. Investors focused on stability may find EPC’s financial profile more reassuring, whereas those seeking higher margin potential might lean toward HELE, mindful of its mixed rating signals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Edgewell Personal Care Company and Helen of Troy Limited to enhance your investment decisions: