In the dynamic world of personal care, e.l.f. Beauty, Inc. (ELF) and Edgewell Personal Care Company (EPC) stand out as key players with distinct approaches to innovation and market reach. Both operate in the household and personal products industry, offering a diverse range of skincare and grooming products. This comparison explores their strategies, market positions, and growth potential to help you identify which company might be the smarter choice for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between e.l.f. Beauty, Inc. and Edgewell Personal Care Company by providing an overview of these two companies and their main differences.

e.l.f. Beauty, Inc. Overview

e.l.f. Beauty, Inc. operates in the Household & Personal Products industry, offering cosmetic and skin care products globally under brands like e.l.f. Cosmetics and Keys Soulcare. Founded in 2004 and headquartered in Oakland, California, the company markets its products through retailers and e-commerce platforms. It focuses on affordable beauty solutions and has a market cap of approximately 4.9B USD.

Edgewell Personal Care Company Overview

Edgewell Personal Care Company is a long-established player in personal care, manufacturing and marketing products across Wet shave, Sun and Skin care, and Feminine care segments. Founded in 1772 and based in Shelton, Connecticut, its portfolio includes brands such as Schick, Banana Boat, and Playtex. With about 6,700 employees, Edgewell has a market cap near 847M USD and distributes products worldwide.

Key similarities and differences

Both companies operate in the Consumer Defensive sector with a focus on personal care products and global distribution. However, e.l.f. Beauty emphasizes cosmetics and skincare with a direct-to-consumer approach, while Edgewell targets broader personal care categories including shaving and feminine care, supported by a larger workforce. Market capitalization and brand diversity also distinguish their business models significantly.

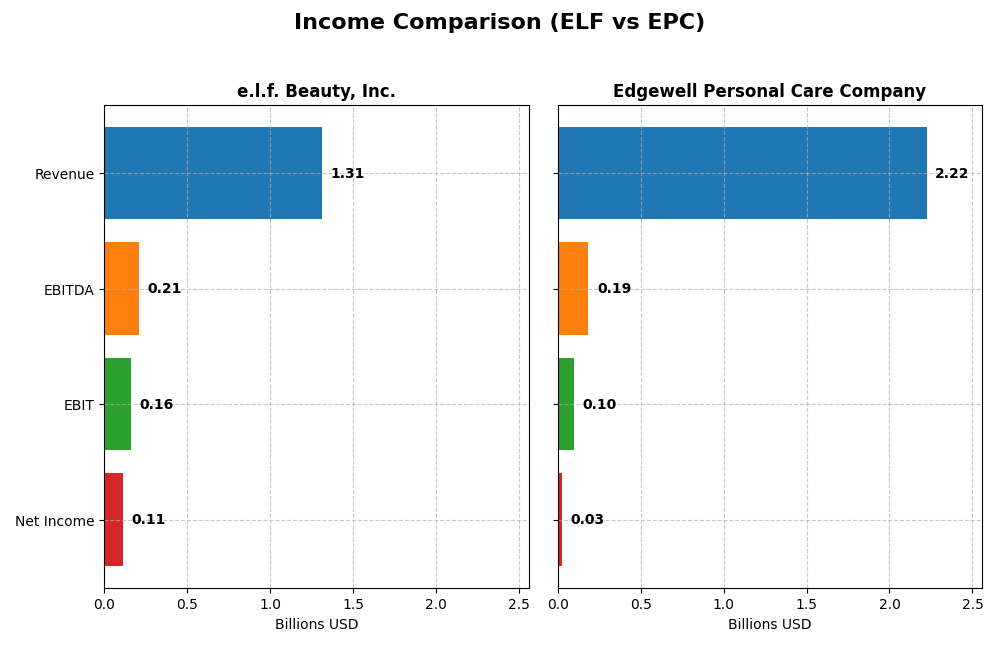

Income Statement Comparison

The table below summarizes the key income statement metrics for e.l.f. Beauty, Inc. and Edgewell Personal Care Company for their most recent fiscal years, providing a clear basis for financial comparison.

| Metric | e.l.f. Beauty, Inc. (ELF) | Edgewell Personal Care Company (EPC) |

|---|---|---|

| Market Cap | 4.9B | 847M |

| Revenue | 1.31B | 2.22B |

| EBITDA | 206M | 186M |

| EBIT | 162M | 97M |

| Net Income | 112M | 25M |

| EPS | 1.99 | 0.53 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

e.l.f. Beauty, Inc.

e.l.f. Beauty showed strong revenue growth from $318M in 2021 to $1.31B in 2025, with net income rising from $6.2M to $112M over the same period. Margins improved notably, with a gross margin of 71.24% and an EBIT margin of 12.34% in 2025. Despite a 31.56% decline in net margin growth in 2025, overall profitability trends remain favorable.

Edgewell Personal Care Company

Edgewell’s revenue was relatively stable, slightly declining from $2.09B in 2021 to $2.22B in 2025. Net income, however, decreased substantially from $118M to $25.4M during this time. Margins reflect this pressure, with a gross margin of 41.6% but a low net margin of 1.14% in 2025. Recent declines in EBIT and EPS highlight challenges in margin sustainability.

Which one has the stronger fundamentals?

e.l.f. Beauty exhibits stronger fundamentals, with consistent revenue and net income growth, superior margins, and a favorable overall income statement evaluation at 78.57%. In contrast, Edgewell faces declining profitability and margins, with an unfavorable score of 64.29% on income statement factors. The data suggest e.l.f. Beauty demonstrates more robust financial health over the period analyzed.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for e.l.f. Beauty, Inc. (ELF) and Edgewell Personal Care Company (EPC) based on their most recent fiscal year data.

| Ratios | e.l.f. Beauty, Inc. (2025) | Edgewell Personal Care Company (2025) |

|---|---|---|

| ROE | 14.7% | 1.6% |

| ROIC | 11.2% | 3.0% |

| P/E | 31.5 | 38.1 |

| P/B | 4.6 | 0.62 |

| Current Ratio | 3.05 | 1.76 |

| Quick Ratio | 2.00 | 0.90 |

| D/E (Debt-to-Equity) | 0.41 | 0.91 |

| Debt-to-Assets | 25.1% | 37.6% |

| Interest Coverage | 9.20 | 1.32 |

| Asset Turnover | 1.05 | 0.59 |

| Fixed Asset Turnover | 45.6 | 6.0 |

| Payout Ratio | 0 | 115% |

| Dividend Yield | 0% | 3.0% |

Interpretation of the Ratios

e.l.f. Beauty, Inc.

e.l.f. Beauty shows a balanced mix of favorable and unfavorable ratios, with strong quick ratio (2.0) and low debt-to-equity (0.41), indicating good liquidity and moderate leverage. However, a high P/E of 31.49 and elevated price-to-book ratio (4.64) suggest valuation concerns. The company does not pay dividends, consistent with a possible reinvestment or growth strategy.

Edgewell Personal Care Company

Edgewell exhibits several unfavorable profitability ratios, such as low net margin (1.14%) and ROE (1.64%), and weak interest coverage (1.32), raising financial risk concerns. Yet, it benefits from a low P/B of 0.62 and a solid current ratio (1.76). Edgewell pays a dividend with a 3.03% yield, supporting shareholder returns despite modest earnings.

Which one has the best ratios?

Both companies present a neutral overall ratio profile with distinct strengths and weaknesses. e.l.f. Beauty excels in liquidity and leverage metrics but shows valuation challenges and no dividend. Edgewell offers dividend income and better asset valuation but struggles with profitability and interest coverage. The choice depends on investor priorities between growth and income.

Strategic Positioning

This section compares the strategic positioning of e.l.f. Beauty, Inc. (ELF) and Edgewell Personal Care Company (EPC), focusing on market position, key segments, and exposure to technological disruption:

e.l.f. Beauty, Inc.

- Mid-cap cosmetic company facing competitive pressure within personal products sector.

- Focuses on cosmetics and skin care sold via retailers and direct-to-consumer channels.

- No explicit data on disruption exposure from provided information.

Edgewell Personal Care Company

- Smaller market cap personal care firm with established legacy and competitive niche.

- Operates through wet shave, sun and skin care, and feminine care segments.

- No explicit data on disruption exposure from provided information.

e.l.f. Beauty, Inc. vs Edgewell Personal Care Company Positioning

ELF maintains a more concentrated focus on cosmetics and skin care with a digital sales emphasis, while EPC has diversified segments including wet shave and feminine care. EPC’s broader product range contrasts with ELF’s more niche market approach.

Which has the best competitive advantage?

Both companies are shedding value as ROIC is below WACC; however, ELF shows a growing ROIC trend, indicating improving profitability, whereas EPC experiences declining profitability and a very unfavorable moat status.

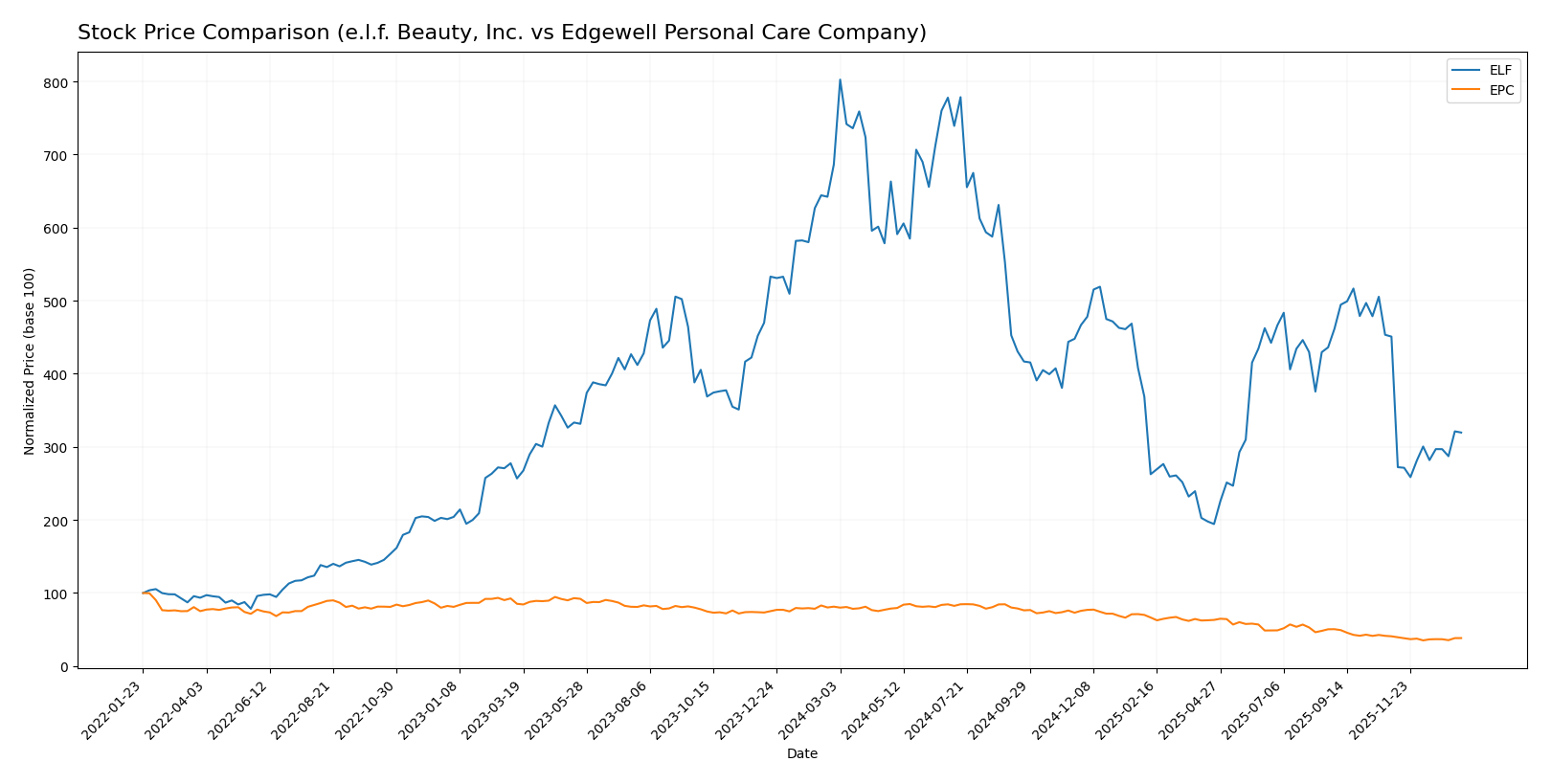

Stock Comparison

The stock prices of e.l.f. Beauty, Inc. (ELF) and Edgewell Personal Care Company (EPC) have both exhibited significant bearish trends with accelerating declines and notable volatility over the past 12 months.

Trend Analysis

e.l.f. Beauty, Inc. (ELF) experienced a 53.44% price decrease over the past year, confirming a bearish trend with acceleration. The stock showed high volatility, ranging from a high of 217.4 to a low of 52.65, with recent decline continuing at -29.11%.

Edgewell Personal Care Company (EPC) also recorded a bearish trend with a 52.87% price drop over 12 months. The acceleration of the downward trend was accompanied by lower volatility compared to ELF, with prices between 40.38 and 16.73 and a recent decline of -5.98%.

Comparatively, both stocks showed similar negative performance over the year, with ELF having a slightly larger percentage decrease and greater volatility, indicating a more pronounced decline in market value.

Target Prices

The current analyst consensus presents a measured outlook for both e.l.f. Beauty, Inc. and Edgewell Personal Care Company.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| e.l.f. Beauty, Inc. | 165 | 85 | 128.17 |

| Edgewell Personal Care Company | 23 | 20 | 21.5 |

Analysts expect e.l.f. Beauty’s stock to appreciate from its current price of $86.58 toward a consensus target of $128.17, indicating significant upside potential. Edgewell Personal Care’s consensus target of $21.5 also suggests a moderate increase over its current price of $18.23.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial grades for e.l.f. Beauty, Inc. and Edgewell Personal Care Company:

Rating Comparison

ELF Rating

- Rating: C+, considered very favorable overall.

- Discounted Cash Flow Score: Moderate at 3 out of 5.

- ROE Score: Moderate efficiency at 3 out of 5.

- ROA Score: Moderate asset utilization at 3 out of 5.

- Debt To Equity Score: Moderate financial risk at 2 out of 5.

- Overall Score: Moderate at 2 out of 5.

EPC Rating

- Rating: B, considered very favorable overall.

- Discounted Cash Flow Score: Very favorable at 5 out of 5.

- ROE Score: Moderate efficiency at 2 out of 5.

- ROA Score: Moderate asset utilization at 2 out of 5.

- Debt To Equity Score: Moderate financial risk at 2 out of 5.

- Overall Score: Moderate at 3 out of 5.

Which one is the best rated?

Edgewell Personal Care (EPC) holds a higher overall rating (B) and a stronger discounted cash flow score than e.l.f. Beauty (ELF), which has a C+ rating. EPC’s overall score is also higher, indicating a comparatively better analyst evaluation.

Scores Comparison

Here is the comparison of the Altman Z-Score and Piotroski Score for the two companies:

e.l.f. Beauty Scores

- Altman Z-Score: 3.44, indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 5, showing average financial strength.

Edgewell Personal Care Scores

- Altman Z-Score: 1.44, indicating a distress zone, higher bankruptcy risk.

- Piotroski Score: 6, showing average financial strength.

Which company has the best scores?

e.l.f. Beauty has a significantly better Altman Z-Score, placing it in the safe zone, while Edgewell is in distress. Edgewell’s Piotroski Score is slightly higher, but both are average. Overall, e.l.f. Beauty shows stronger financial stability.

Grades Comparison

The following is a comparison of recent grades assigned to e.l.f. Beauty, Inc. and Edgewell Personal Care Company by reputable grading firms:

e.l.f. Beauty, Inc. Grades

This table summarizes the latest grades from established financial institutions for e.l.f. Beauty, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2025-12-22 |

| JP Morgan | Maintain | Overweight | 2025-12-18 |

| Goldman Sachs | Maintain | Buy | 2025-11-07 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Jefferies | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Downgrade | Neutral | 2025-11-06 |

| UBS | Maintain | Neutral | 2025-11-06 |

| Canaccord Genuity | Maintain | Buy | 2025-11-06 |

| JP Morgan | Maintain | Overweight | 2025-11-06 |

| Jefferies | Maintain | Buy | 2025-10-28 |

Overall, e.l.f. Beauty, Inc. shows a consistent pattern of “Buy” and “Overweight” ratings with occasional “Neutral” assessments, indicating generally positive analyst sentiment.

Edgewell Personal Care Company Grades

This table presents recent analyst grades for Edgewell Personal Care Company from recognized financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-18 |

| Barclays | Maintain | Equal Weight | 2025-11-14 |

| RBC Capital | Maintain | Outperform | 2025-11-14 |

| Wells Fargo | Maintain | Overweight | 2025-11-14 |

| Wells Fargo | Maintain | Overweight | 2025-09-25 |

| Morgan Stanley | Upgrade | Equal Weight | 2025-08-06 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Barclays | Maintain | Equal Weight | 2025-08-06 |

| Canaccord Genuity | Maintain | Buy | 2025-08-06 |

Edgewell Personal Care’s ratings are more mixed, ranging from “Buy” and “Overweight” to “Equal Weight” and “Neutral,” suggesting a moderate consensus with some cautious positioning.

Which company has the best grades?

e.l.f. Beauty, Inc. has received predominantly higher grades, including multiple “Buy” and “Overweight” recommendations, compared to Edgewell Personal Care’s more balanced “Equal Weight” and “Neutral” ratings. This may reflect stronger analyst confidence in e.l.f. Beauty, potentially impacting investor sentiment toward growth prospects.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses between e.l.f. Beauty, Inc. (ELF) and Edgewell Personal Care Company (EPC) based on the most recent data:

| Criterion | e.l.f. Beauty, Inc. (ELF) | Edgewell Personal Care Company (EPC) |

|---|---|---|

| Diversification | Limited product range focused on cosmetics | Broad product portfolio across personal care segments including razors, sun care, and feminine products |

| Profitability | Neutral net margin (8.53%) and ROE (14.73%); ROIC slightly below WACC, indicating slight value destruction but improving trend | Low net margin (1.14%) and ROE (1.64%); ROIC below WACC with declining profitability, indicating significant value destruction |

| Innovation | Growing ROIC trend signals improving efficiency and potential for innovation | Declining ROIC trend suggests challenges in maintaining competitive edge |

| Global presence | Moderate, primarily in beauty sector | Strong global presence in multiple personal care markets |

| Market Share | Niche in cosmetics with competitive pressures | Leading market positions in razors and sun care segments |

Key takeaways: ELF shows improving profitability despite current slight value destruction, with a focused cosmetics portfolio and solid financial structure. EPC benefits from broad diversification and strong market presence but faces profitability and efficiency challenges, reflected in declining ROIC and value destruction. Investors should weigh ELF’s growth potential against EPC’s diversification but caution regarding EPC’s financial health.

Risk Analysis

The table below summarizes key risk metrics for e.l.f. Beauty, Inc. (ELF) and Edgewell Personal Care Company (EPC) as of 2025.

| Metric | e.l.f. Beauty, Inc. (ELF) | Edgewell Personal Care Co. (EPC) |

|---|---|---|

| Market Risk | High beta 1.72 indicates higher volatility | Low beta 0.62 suggests lower volatility |

| Debt level | Moderate debt/equity 0.41, debt/assets 25.08% (favorable) | Higher debt/equity 0.91, debt/assets 37.61% (neutral) |

| Regulatory Risk | Moderate, typical for cosmetics industry | Moderate, exposure in personal care regulations |

| Operational Risk | Moderate, smaller scale with 633 employees | Higher operational complexity with 6,700 employees |

| Environmental Risk | Increasing focus on sustainability in cosmetics | Moderate, personal care products face scrutiny on ingredients |

| Geopolitical Risk | Limited, mostly US and distributor markets | Moderate, global supply chain exposure |

In synthesis, ELF’s higher market volatility and less favorable valuation ratios present notable market risk, though its lower debt and strong liquidity mitigate financial risk. EPC faces significant bankruptcy risk (Altman Z-score in distress zone) due to weaker profitability and interest coverage, despite favorable debt management. The most impactful risks are EPC’s financial distress potential and ELF’s market volatility, warranting cautious portfolio weighting and close monitoring of operational execution and regulatory developments.

Which Stock to Choose?

e.l.f. Beauty, Inc. (ELF) shows strong income growth with favorable gross and EBIT margins, though recent net margin and EPS declines raise caution. Financial ratios are mixed: profitability and liquidity are solid, debt is well-managed, and the rating is very favorable but with some valuation concerns.

Edgewell Personal Care Company (EPC) exhibits a declining income trend with mostly unfavorable growth metrics and modest profitability. Its financial ratios present a neutral overall view, with some strengths in liquidity and valuation, but high debt and weak interest coverage temper the outlook. The rating remains very favorable.

For investors prioritizing growth and improving profitability, ELF’s expanding income and favorable margins might appear more attractive despite some valuation and margin risks. Conversely, those seeking moderate valuation and stable metrics could find EPC’s profile more aligned with cautious strategies, given its financial stability signals despite weaker profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of e.l.f. Beauty, Inc. and Edgewell Personal Care Company to enhance your investment decisions: