Ecolab Inc. (ECL) and International Flavors & Fragrances Inc. (IFF) are two prominent players in the specialty chemicals industry, each with distinct market focuses yet overlapping innovation strategies. Ecolab excels in water, hygiene, and infection prevention solutions, while IFF specializes in flavors, fragrances, and biosciences. This article will dissect their strengths and risks to help you identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Ecolab Inc. and International Flavors & Fragrances Inc. by providing an overview of these two companies and their main differences.

Ecolab Inc. Overview

Ecolab Inc. specializes in water, hygiene, and infection prevention solutions globally, serving industries such as manufacturing, food processing, healthcare, and hospitality. Established in 1923 and headquartered in Saint Paul, Minnesota, Ecolab operates through three main segments: Global Industrial, Global Institutional & Specialty, and Global Healthcare & Life Sciences. The company emphasizes customized services, pest control, and water and energy management.

International Flavors & Fragrances Inc. Overview

International Flavors & Fragrances Inc. manufactures cosmetic actives and natural health ingredients for consumer products worldwide. Founded in 1833 and based in New York City, it operates through Nourish, Scent, Health & Biosciences, and Pharma Solutions segments. IFF focuses on flavor compounds, fragrances, enzymes, probiotics, and pharmaceutical excipients, serving diverse markets from cosmetics to food and pharmaceuticals.

Key similarities and differences

Both companies belong to the specialty chemicals industry and serve global markets with a focus on innovative ingredients and solutions. Ecolab’s model centers on hygiene, water treatment, and infection prevention services, while IFF emphasizes flavors, fragrances, and health-related bioingredients. The workforce size differs significantly, with Ecolab employing 48K and IFF 22.4K staff, reflecting their distinct operational scopes and product focus.

Income Statement Comparison

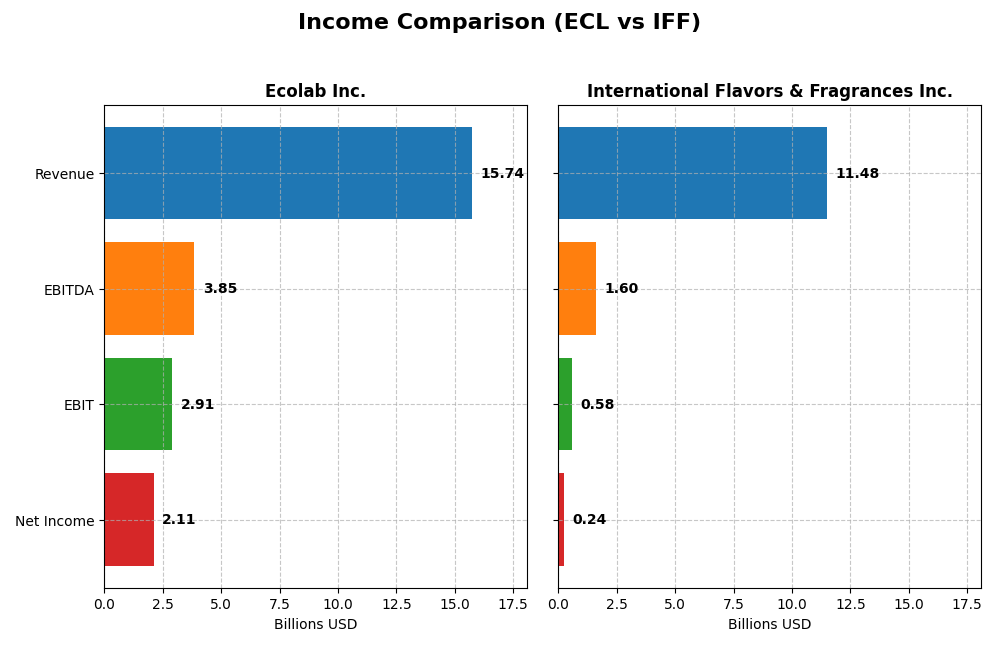

The table below presents a side-by-side comparison of key income statement metrics for Ecolab Inc. and International Flavors & Fragrances Inc. for the fiscal year 2024.

| Metric | Ecolab Inc. (ECL) | International Flavors & Fragrances Inc. (IFF) |

|---|---|---|

| Market Cap | 77B | 17.6B |

| Revenue | 15.7B | 11.5B |

| EBITDA | 3.85B | 1.60B |

| EBIT | 2.91B | 583M |

| Net Income | 2.11B | 243M |

| EPS | 7.43 | 0.95 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Ecolab Inc.

Ecolab’s revenue showed a steady increase from 12.8B in 2021 to 15.7B in 2024, with net income rising sharply from 1.13B to 2.11B over the same period. Margins improved notably, with a gross margin of 43.47% and net margin of 13.42% in 2024. The latest year showed slower revenue growth (2.75%) but strong margin expansion and a 54% rise in earnings per share.

International Flavors & Fragrances Inc.

IFF’s revenue grew significantly from 5.1B in 2020 to 11.5B in 2024, but net income declined from 365M to 243M. Margins remain moderate, with a gross margin of 35.91% and net margin at 2.12% in 2024. The most recent year saw flat revenue growth (0.04%) but a strong recovery in profitability metrics, including a 109% increase in net margin and EPS.

Which one has the stronger fundamentals?

Ecolab demonstrates stronger fundamentals with consistent revenue and net income growth, robust margin improvement, and favorable profitability metrics. In contrast, IFF’s revenues expanded sharply but with declining net income and weaker margins overall, despite recent margin improvements. Ecolab’s stable and growing profitability presents a more favorable income statement profile.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Ecolab Inc. (ECL) and International Flavors & Fragrances Inc. (IFF) for the fiscal year 2024, providing insights into profitability, liquidity, leverage, and market valuation.

| Ratios | Ecolab Inc. (ECL) | International Flavors & Fragrances Inc. (IFF) |

|---|---|---|

| ROE | 24.12% | 1.75% |

| ROIC | 11.80% | 2.63% |

| P/E | 31.54 | 89.07 |

| P/B | 7.61 | 1.56 |

| Current Ratio | 1.26 | 1.84 |

| Quick Ratio | 0.95 | 1.32 |

| D/E (Debt-to-Equity) | 0.95 | 0.69 |

| Debt-to-Assets | 37.00% | 33.56% |

| Interest Coverage | 7.72 | 2.51 |

| Asset Turnover | 0.70 | 0.40 |

| Fixed Asset Turnover | 3.52 | 2.65 |

| Payout ratio | 31.45% | 211.52% |

| Dividend yield | 1.00% | 2.37% |

Interpretation of the Ratios

Ecolab Inc.

Ecolab’s financial ratios show strength in profitability and capital efficiency, with favorable net margin (13.42%), ROE (24.12%), and ROIC (11.8%). However, valuation metrics like P/E (31.54) and P/B (7.61) appear stretched, suggesting elevated stock price levels. The dividend yield is modest at 1.0%, supported by consistent payouts, but the high payout ratio could pose sustainability concerns amid cash flow fluctuations.

International Flavors & Fragrances Inc.

IFF exhibits weaker profitability ratios, with net margin (2.12%), ROE (1.75%), and ROIC (2.63%) all flagged as unfavorable, indicating limited earnings generation. Liquidity ratios are favorable, and the dividend yield at 2.37% is attractive, suggesting a shareholder return focus despite operational challenges. The high P/E ratio (89.07) reflects elevated valuation relative to earnings, raising concerns about growth expectations.

Which one has the best ratios?

Ecolab presents a more favorable ratio profile overall, combining solid profitability and capital returns despite some valuation stretch. In contrast, IFF struggles with profitability and coverage ratios, offset only partially by better liquidity and dividend yield. Ecolab’s ratios lean toward strength, while IFF’s indicate more operational and financial challenges.

Strategic Positioning

This section compares the strategic positioning of Ecolab Inc. and International Flavors & Fragrances Inc., including market position, key segments, and exposure to technological disruption:

Ecolab Inc.

- Leading specialty chemicals provider with diverse industrial and institutional markets, facing moderate competitive pressure.

- Diverse segments including water treatment, hygiene, healthcare, pest elimination, driving revenue across multiple industries.

- Exposure to disruption limited; emphasis on water, hygiene, and infection prevention with incremental innovation.

International Flavors & Fragrances Inc.

- Specialty chemicals firm focused on flavor, fragrance, and biosciences with competitive pressures in consumer goods sectors.

- Concentrated in Nourish, Scent, Health & Biosciences, and Pharma Solutions, focused on natural ingredients and cosmetics.

- Faces disruption risks in natural ingredient trends and biotech advances in health and biosciences segments.

Ecolab Inc. vs International Flavors & Fragrances Inc. Positioning

Ecolab’s diversified approach spans industrial, institutional, and healthcare markets, providing broad revenue streams. IFF’s focused segments target consumer and health-related products, offering specialization but narrower diversification and exposure.

Which has the best competitive advantage?

Ecolab demonstrates a very favorable moat with growing ROIC above WACC, indicating durable competitive advantage and value creation. IFF shows a very unfavorable moat with declining ROIC below WACC, reflecting value destruction and weaker competitive positioning.

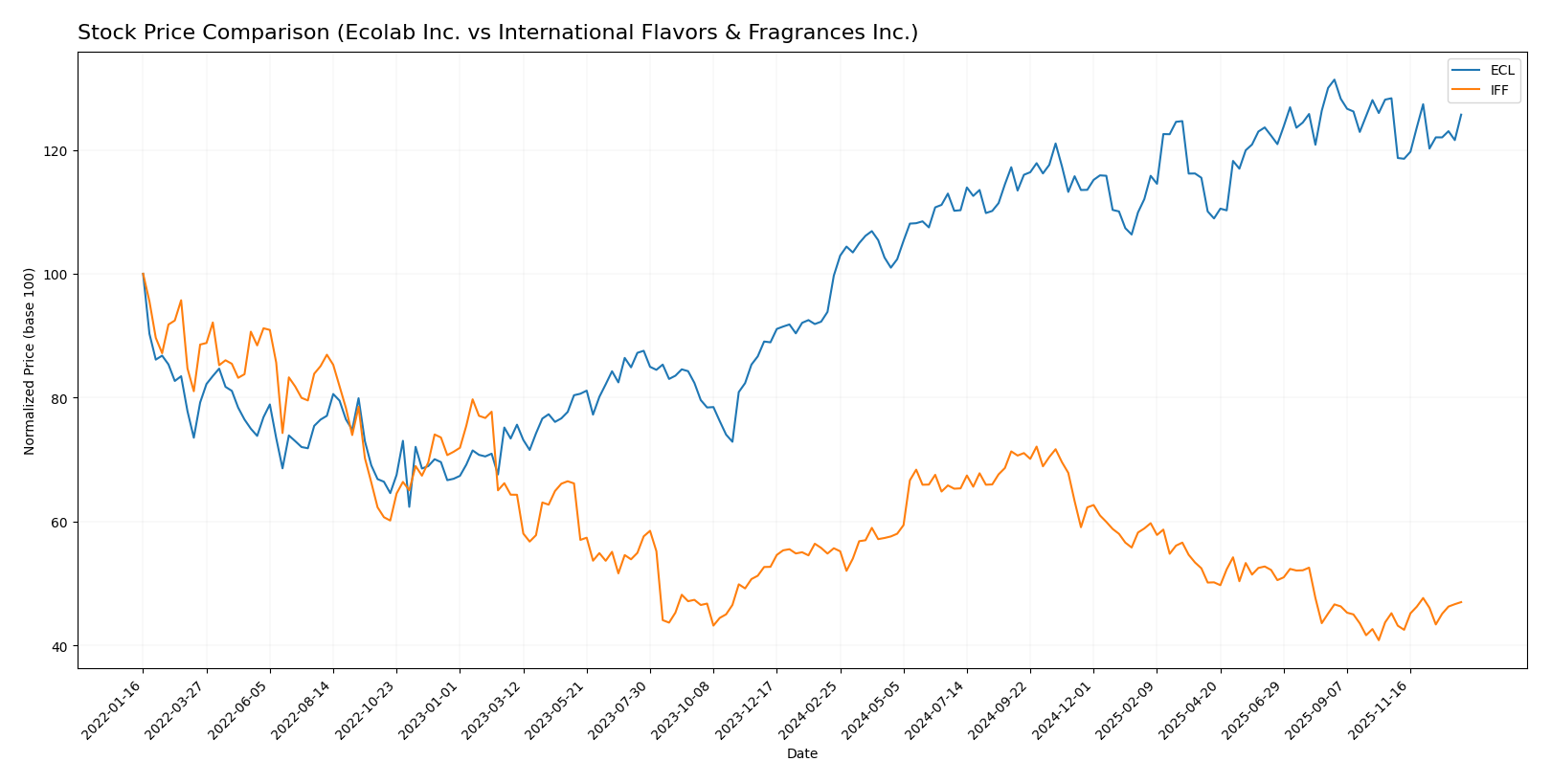

Stock Comparison

The stock price movements of Ecolab Inc. and International Flavors & Fragrances Inc. over the past year reveal distinct trading dynamics, with Ecolab showing a strong overall rise and IFF experiencing a notable decline followed by recent recovery.

Trend Analysis

Ecolab Inc. exhibited a bullish trend over the past 12 months, with a 26.07% price increase, though the upward momentum showed deceleration. The stock ranged between 215.38 and 283.73, with a high volatility indicated by a 16.43 std deviation.

International Flavors & Fragrances Inc. faced a bearish trend for the year, declining by 15.61%, but recent months show a slight bullish reversal with a 3.95% gain and accelerating price movement. Its volatility measured 12.7 std deviation.

Comparing both stocks, Ecolab delivered the highest market performance over the past year, outperforming IFF’s overall decline despite IFF’s recent positive price movement.

Target Prices

The current analyst consensus target prices for Ecolab Inc. and International Flavors & Fragrances Inc. indicate moderate upside potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Ecolab Inc. | 426 | 295 | 318.75 |

| International Flavors & Fragrances Inc. | 89 | 66 | 76.67 |

Analysts expect Ecolab’s stock to trade above its current price of 271.64 USD, suggesting upside to the consensus target of 318.75 USD. Similarly, IFF’s current price of 68.55 USD is below the consensus target of 76.67 USD, indicating potential appreciation.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Ecolab Inc. and International Flavors & Fragrances Inc.:

Rating Comparison

Ecolab Inc. Rating

- Rating: B, categorized as Very Favorable

- Discounted Cash Flow Score: 4, Favorable

- ROE Score: 5, Very Favorable

- ROA Score: 5, Very Favorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 3, Moderate

International Flavors & Fragrances Inc. Rating

- Rating: C+, categorized as Very Favorable

- Discounted Cash Flow Score: 5, Very Favorable

- ROE Score: 1, Very Unfavorable

- ROA Score: 1, Very Unfavorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 2, Moderate

Which one is the best rated?

Based strictly on the provided data, Ecolab Inc. holds a better overall rating (B vs. C+) with stronger ROE and ROA scores, despite sharing a very unfavorable debt-to-equity score with International Flavors & Fragrances.

Scores Comparison

Here is a comparison of the financial health scores for Ecolab Inc. and International Flavors & Fragrances Inc.:

ECL Scores

- Altman Z-Score: 5.08, indicating a safe zone status.

- Piotroski Score: 7, reflecting strong financial health.

IFF Scores

- Altman Z-Score: 1.20, indicating distress zone status.

- Piotroski Score: 5, reflecting average financial health.

Which company has the best scores?

Ecolab Inc. demonstrates stronger financial stability with a safe-zone Altman Z-Score and a strong Piotroski Score. In contrast, IFF’s scores indicate higher bankruptcy risk and only average financial strength.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to Ecolab Inc. and International Flavors & Fragrances Inc.:

Ecolab Inc. Grades

This table summarizes the recent grades provided by major financial institutions for Ecolab Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-07 |

| Citigroup | Maintain | Buy | 2025-12-18 |

| Evercore ISI Group | Upgrade | Outperform | 2025-11-03 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Barclays | Maintain | Overweight | 2025-10-29 |

| Stifel | Maintain | Buy | 2025-10-29 |

| Citigroup | Maintain | Buy | 2025-10-29 |

| JP Morgan | Maintain | Neutral | 2025-10-29 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-27 |

| UBS | Maintain | Neutral | 2025-10-06 |

Overall, Ecolab’s grades mostly reflect a stable to positive outlook, with several “Buy” and “Outperform” ratings balanced by multiple “Neutral” assessments.

International Flavors & Fragrances Inc. Grades

The following table shows the latest grades from recognized financial analysts for International Flavors & Fragrances Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-07 |

| UBS | Maintain | Neutral | 2025-11-06 |

| B of A Securities | Maintain | Buy | 2025-10-14 |

| Argus Research | Maintain | Buy | 2025-10-07 |

| UBS | Maintain | Neutral | 2025-10-06 |

| Citigroup | Maintain | Buy | 2025-10-06 |

| Mizuho | Maintain | Outperform | 2025-10-03 |

| Morgan Stanley | Maintain | Overweight | 2025-09-22 |

| Wolfe Research | Upgrade | Peer Perform | 2025-09-08 |

| Tigress Financial | Maintain | Buy | 2025-08-26 |

International Flavors & Fragrances shows a predominantly positive trend with multiple “Buy,” “Overweight,” and “Outperform” ratings, along with an upgrade from “Underperform” to “Peer Perform.”

Which company has the best grades?

Both Ecolab Inc. and International Flavors & Fragrances Inc. have received predominantly positive grades, with strong consensus on “Buy” ratings. However, International Flavors & Fragrances exhibits a slightly higher frequency of “Buy” and “Overweight” ratings, potentially indicating a more bullish analyst sentiment that could influence investor confidence.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of Ecolab Inc. (ECL) and International Flavors & Fragrances Inc. (IFF) based on recent financial and strategic data.

| Criterion | Ecolab Inc. (ECL) | International Flavors & Fragrances Inc. (IFF) |

|---|---|---|

| Diversification | Highly diversified across institutional, industrial, pest elimination, healthcare segments with $15B+ revenue | Diversified product portfolio: Nourish, Pharma, Scent, Health & Biosciences segments totaling ~$11B revenue |

| Profitability | Strong profitability: net margin 13.4%, ROIC 11.8%, ROE 24.1% (favorable) | Weak profitability: net margin 2.1%, ROIC 2.6%, ROE 1.8% (unfavorable) |

| Innovation | Demonstrates durable competitive advantage with growing ROIC (+24.9%) | Declining ROIC (-31%), value destruction indicating innovation or operational challenges |

| Global presence | Extensive global footprint across multiple industries and geographies | Global reach in flavors and biosciences, but less industrial diversification |

| Market Share | Strong market position supported by favorable ROIC > WACC (+3.94%) | Losing value with ROIC < WACC (-4.15%), suggesting shrinking competitive edge |

Ecolab shows robust diversification, profitability, and a durable moat with increasing returns on capital, making it a stable value creator. In contrast, IFF faces challenges with declining profitability and value destruction, signaling caution despite a solid product range.

Risk Analysis

Below is a comparative overview of key risks affecting Ecolab Inc. and International Flavors & Fragrances Inc. as of 2024, highlighting their financial and operational vulnerabilities.

| Metric | Ecolab Inc. (ECL) | International Flavors & Fragrances Inc. (IFF) |

|---|---|---|

| Market Risk | Moderate (Beta 0.999) | Moderate-High (Beta 1.056) |

| Debt Level | Neutral (D/E 0.95, 37%) | Neutral (D/E 0.69, 33.6%) |

| Regulatory Risk | Moderate (Water & chemical regulations) | Moderate (Cosmetics & food safety regulations) |

| Operational Risk | Moderate (Complex service operations globally) | Moderate (Supply chain and ingredient sourcing) |

| Environmental Risk | Moderate (Water use, chemical waste) | Moderate (Sustainability in natural ingredients) |

| Geopolitical Risk | Moderate (Global industrial exposure) | Moderate (International markets, raw materials) |

Ecolab’s risk profile is slightly more stable with a strong Altman Z-Score (5.08, safe zone) and solid profitability, but it faces operational complexities and environmental regulations. IFF shows higher financial distress risk (Altman Z-Score 1.20, distress zone) and weaker profitability, making its market and operational risks more impactful. Investors should weigh Ecolab’s steadier financial health against IFF’s higher vulnerability and growth challenges.

Which Stock to Choose?

Ecolab Inc. (ECL) shows a favorable income evolution with strong profitability, including a 13.42% net margin and growing net income over 2020-2024. Its financial ratios are slightly favorable, supported by a very favorable rating and moderate debt levels (net debt to EBITDA 1.83). The company demonstrates a durable competitive advantage with a very favorable MOAT and strong financial scores.

International Flavors & Fragrances Inc. (IFF) has a mixed income evolution with favorable recent revenue growth but an overall decline in net income and margins. Its financial ratios are slightly unfavorable, reflecting weaker profitability and higher leverage (net debt to EBITDA 5.73). The rating is very favorable overall but highlights concerns in returns and debt. The MOAT is very unfavorable, indicating declining profitability and value destruction.

For investors prioritizing growth and stable profitability, Ecolab’s strong income statement, financial ratios, and durable competitive advantage might appear more aligned with such profiles. Conversely, investors focused on potential turnaround opportunities or higher risk tolerance may interpret IFF’s recent improvements and valuation differently, although its financial challenges suggest caution.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Ecolab Inc. and International Flavors & Fragrances Inc. to enhance your investment decisions: