In the dynamic specialty chemicals sector, International Flavors & Fragrances Inc. (IFF) and DuPont de Nemours, Inc. (DD) stand out for their innovation and market reach. Both companies serve diverse industries with advanced materials and solutions, competing in overlapping markets such as consumer goods and industrial applications. This comparison will help investors understand which company offers the most compelling opportunity for a balanced, forward-looking portfolio. Let’s explore their strengths and investment potential.

Table of contents

Companies Overview

I will begin the comparison between International Flavors & Fragrances Inc. and DuPont de Nemours, Inc. by providing an overview of these two companies and their main differences.

International Flavors & Fragrances Inc. Overview

IFF operates in the specialty chemicals industry, focusing on manufacturing and selling cosmetic active and natural health ingredients globally. Its product segments include Nourish, Scent, Health & Biosciences, and Pharma Solutions, serving markets such as personal care, food, beverages, and pharmaceuticals. Founded in 1833 and headquartered in New York, IFF employs around 22,400 people and holds a market cap of approximately 17.6B USD.

DuPont de Nemours, Inc. Overview

DuPont de Nemours, also in the specialty chemicals sector, offers technology-based materials and solutions across multiple regions. It operates through Electronics & Industrial, Mobility & Materials, and Water & Protection segments, catering to advanced printing, semiconductor fabrication, transportation, and water purification markets. Headquartered in Wilmington, Delaware, DuPont employs about 24,000 staff with a market cap near 18.3B USD.

Key similarities and differences

Both companies are major players in the specialty chemicals industry with global footprints and diversified product lines addressing various industrial and consumer needs. IFF emphasizes natural ingredients and fragrances for personal care and food sectors, while DuPont focuses more on technology-driven materials for electronics, mobility, and water protection. Their employee counts and market capitalizations are similar, but their business segment focuses distinguish their market approaches.

Income Statement Comparison

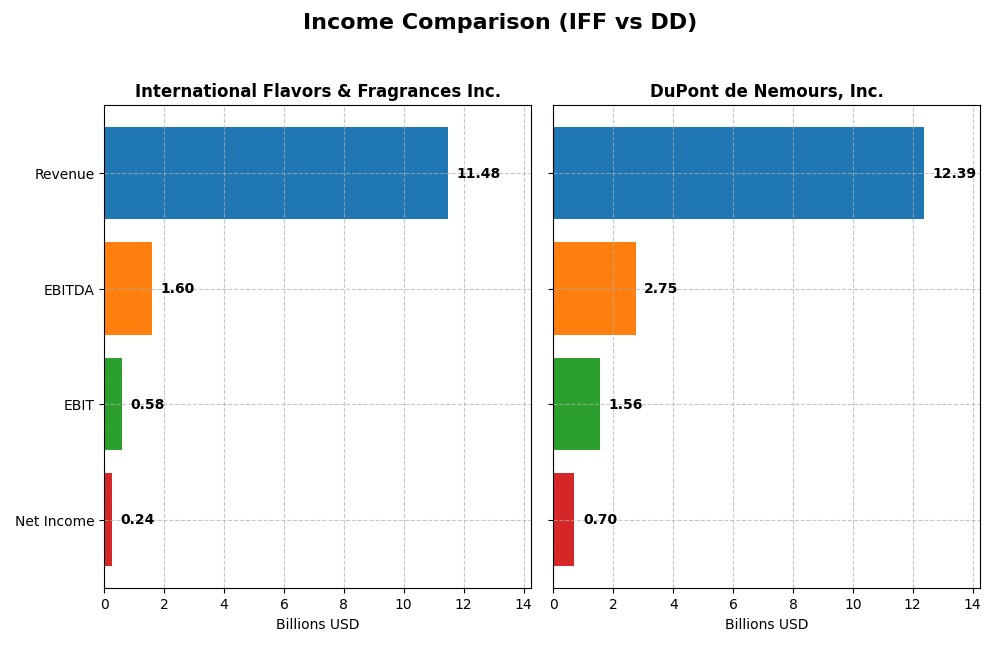

The table below presents a side-by-side comparison of key income statement metrics for International Flavors & Fragrances Inc. (IFF) and DuPont de Nemours, Inc. (DD) for the fiscal year 2024.

| Metric | International Flavors & Fragrances Inc. (IFF) | DuPont de Nemours, Inc. (DD) |

|---|---|---|

| Market Cap | 17.6B | 18.3B |

| Revenue | 11.5B | 12.4B |

| EBITDA | 1.60B | 2.75B |

| EBIT | 583M | 1.56B |

| Net Income | 243M | 703M |

| EPS | 0.95 | 1.68 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

International Flavors & Fragrances Inc.

IFF’s revenue grew substantially by 126% over 2020-2024 but net income declined by 33%. Gross margins remained favorable at 35.9%, while EBIT and net margins stayed neutral. In 2024, revenue stabilized with only 0.04% growth, but gross profit and EBIT surged by 12% and 127%, respectively, driving a notable net margin and EPS improvement.

DuPont de Nemours, Inc.

DD experienced a 14% revenue decline overall but net income more than doubled by 124% from 2020 to 2024. Margins improved favorably with gross margin at 31.6%, EBIT margin 12.6%, and net margin 5.7%. In the latest year, revenue increased modestly by 2.6%, supported by 7.7% gross profit growth and 73% EBIT growth, lifting net margins and EPS significantly.

Which one has the stronger fundamentals?

Both firms show favorable global income statement evaluations, yet DD demonstrates stronger margin improvements and net income growth over the period, while IFF shows stronger revenue expansion but weaker net income trends. DD’s consistent margin gains and EPS growth contrast with IFF’s recent recovery after prior losses, indicating differing fundamental strengths in profitability and growth dynamics.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for International Flavors & Fragrances Inc. (IFF) and DuPont de Nemours, Inc. (DD) based on their most recent fiscal year 2024 data.

| Ratios | International Flavors & Fragrances Inc. (IFF) | DuPont de Nemours, Inc. (DD) |

|---|---|---|

| ROE | 1.75% | 3.01% |

| ROIC | 2.63% | 3.54% |

| P/E | 89.1 | 19.0 |

| P/B | 1.56 | 0.57 |

| Current Ratio | 1.84 | 1.33 |

| Quick Ratio | 1.32 | 0.88 |

| D/E | 0.69 | 0.31 |

| Debt-to-Assets | 33.6% | 19.6% |

| Interest Coverage | 2.51 | 5.00 |

| Asset Turnover | 0.40 | 0.34 |

| Fixed Asset Turnover | 2.65 | 2.15 |

| Payout ratio | 211.5% | 90.3% |

| Dividend yield | 2.37% | 4.75% |

Interpretation of the Ratios

International Flavors & Fragrances Inc. (IFF)

IFF shows a mixed ratio profile with several unfavorable metrics such as low net margin (2.12%), ROE (1.75%), and ROIC (2.63%), indicating profitability challenges. The current and quick ratios are favorable at 1.84 and 1.32 respectively, signaling good liquidity. Dividend yield is solid at 2.37%, but coverage concerns exist as free cash flow to equity remains negative, suggesting cautious dividend sustainability.

DuPont de Nemours, Inc. (DD)

DD presents a more balanced ratio set with neutral to favorable readings. Net margin is neutral at 5.68%, while ROE and ROIC are unfavorable but slightly higher than IFF, showing moderate profitability. The company’s dividend yield is attractive at 4.75%, supported by a lower debt-to-equity ratio of 0.31 and reasonable interest coverage. Liquidity ratios are neutral, implying manageable short-term obligations.

Which one has the best ratios?

Based on the evaluations, DD exhibits a stronger overall ratio profile with a higher proportion of favorable metrics (35.71%) and fewer unfavorable ones (21.43%) compared to IFF, which shows a slightly unfavorable stance with 42.86% unfavorable ratios. DD’s better dividend yield and debt management contribute to its relatively more positive financial health.

Strategic Positioning

This section compares the strategic positioning of International Flavors & Fragrances Inc. and DuPont de Nemours, Inc., including market position, key segments, and exposure to technological disruption:

International Flavors & Fragrances Inc.

- Operates in specialty chemicals with moderate market cap and competitive pressure in flavor and fragrance sectors.

- Key segments include Nourish (food ingredients), Scent (fragrances), Health & Biosciences, and Pharma Solutions.

- Exposure to disruption is limited to evolving consumer preferences and biotech ingredients in cosmetics and food.

DuPont de Nemours, Inc.

- Competes in specialty chemicals with a similar market cap, facing pressure in diversified industrial and materials markets.

- Key segments are Electronics & Industrial, Mobility & Materials, and Water & Protection, focusing on technology-based materials and systems.

- Faces technological disruption in advanced materials, semiconductor fabrication, and water purification technologies.

International Flavors & Fragrances Inc. vs DuPont de Nemours, Inc. Positioning

IFF shows a diversified focus on natural ingredients and consumer product sectors, while DD concentrates on advanced materials and industrial solutions. IFF’s segments target consumer markets, whereas DD emphasizes technology-driven industrial applications, shaping their strategic risks and opportunities.

Which has the best competitive advantage?

Both companies have a very unfavorable moat status with declining ROIC trends, indicating value destruction and limited competitive advantage based on efficient capital use and profitability over 2020-2024.

Stock Comparison

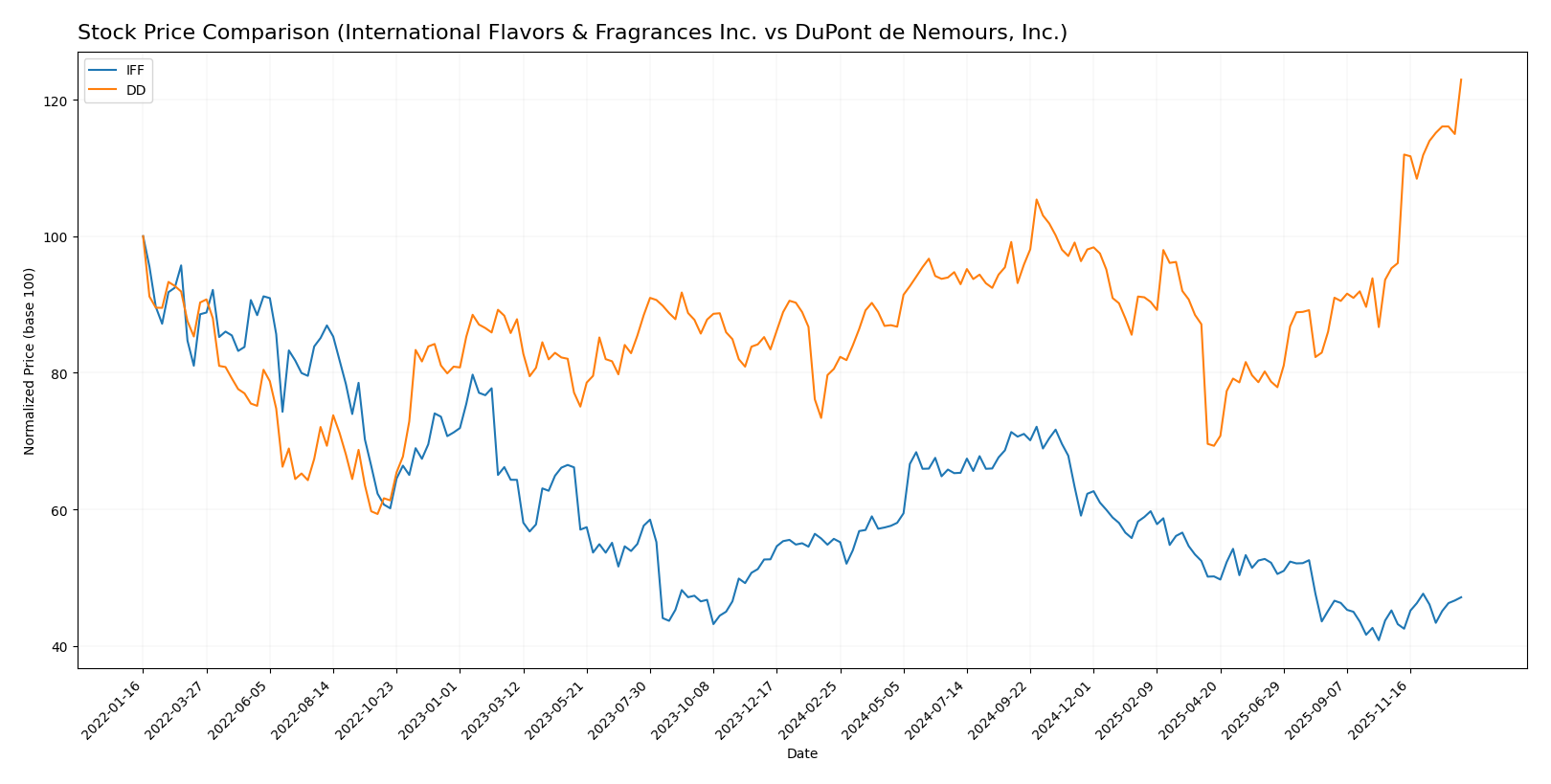

The stock price chart highlights contrasting dynamics between International Flavors & Fragrances Inc. and DuPont de Nemours, Inc. over the past year, with IFF exhibiting a bearish trend and DD showing strong bullish momentum marked by accelerating price changes.

Trend Analysis

International Flavors & Fragrances Inc. (IFF) experienced a 15.36% price decline over the past 12 months, indicating a bearish trend with accelerating downward movement and notable volatility (std deviation 12.69). The stock hit a high of 105.12 and a low of 59.55.

DuPont de Nemours, Inc. (DD) posted a 52.58% price increase over the same period, reflecting a bullish trend with acceleration and moderate volatility (std deviation 3.58). The stock’s price ranged between 24.64 and 43.7.

Comparing both stocks reveals DD delivered the highest market performance with a significant bullish trend, while IFF showed a pronounced bearish trend over the past year.

Target Prices

The consensus target prices for International Flavors & Fragrances Inc. and DuPont de Nemours, Inc. reflect analysts’ expectations for moderate growth potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| International Flavors & Fragrances Inc. | 89 | 66 | 76.67 |

| DuPont de Nemours, Inc. | 107 | 44 | 55.57 |

Analysts expect IFF’s price to rise moderately above its current 68.74 USD, while DD’s consensus target is modestly above its current 43.73 USD, indicating cautious optimism.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for International Flavors & Fragrances Inc. (IFF) and DuPont de Nemours, Inc. (DD):

Rating Comparison

IFF Rating

- Rating: C+ with a status marked as Very Favorable

- Discounted Cash Flow Score: 5, indicating a Very Favorable valuation outlook

- ROE Score: 1, assessed as Very Unfavorable

- ROA Score: 1, assessed as Very Unfavorable

- Debt To Equity Score: 1, considered Very Unfavorable for financial stability

- Overall Score: 2, classified as Moderate

DD Rating

- Rating: C+ with a status marked as Very Favorable

- Discounted Cash Flow Score: 4, indicating a Favorable valuation outlook

- ROE Score: 1, assessed as Very Unfavorable

- ROA Score: 1, assessed as Very Unfavorable

- Debt To Equity Score: 2, considered Moderate for financial stability

- Overall Score: 2, classified as Moderate

Which one is the best rated?

Both IFF and DD share the same overall rating of C+ and an overall score of 2, indicating moderate performance. IFF has a higher discounted cash flow score, while DD scores better on debt to equity and price-to-book metrics, reflecting nuanced differences in financial risk and valuation.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for International Flavors & Fragrances Inc. (IFF) and DuPont de Nemours, Inc. (DD):

IFF Scores

- Altman Z-Score: 1.20, indicating financial distress risk.

- Piotroski Score: 5, reflecting average financial strength.

DD Scores

- Altman Z-Score: 1.31, indicating financial distress risk.

- Piotroski Score: 5, reflecting average financial strength.

Which company has the best scores?

Both IFF and DD show Altman Z-Scores placing them in the distress zone, with DD slightly higher. Their Piotroski Scores are equal at 5, indicating average financial health for both companies based on the provided data.

Grades Comparison

Here is the comparative analysis of the grades assigned to International Flavors & Fragrances Inc. and DuPont de Nemours, Inc.:

International Flavors & Fragrances Inc. Grades

The following table summarizes recent grades from established financial institutions for IFF:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-07 |

| UBS | Maintain | Neutral | 2025-11-06 |

| B of A Securities | Maintain | Buy | 2025-10-14 |

| Argus Research | Maintain | Buy | 2025-10-07 |

| UBS | Maintain | Neutral | 2025-10-06 |

| Citigroup | Maintain | Buy | 2025-10-06 |

| Mizuho | Maintain | Outperform | 2025-10-03 |

| Morgan Stanley | Maintain | Overweight | 2025-09-22 |

| Wolfe Research | Upgrade | Peer Perform | 2025-09-08 |

| Tigress Financial | Maintain | Buy | 2025-08-26 |

Overall, IFF’s grades predominantly indicate a positive outlook, with most firms maintaining Buy, Overweight, or Outperform ratings.

DuPont de Nemours, Inc. Grades

The table below shows recent grades from recognized analysts for DD:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-07 |

| Mizuho | Maintain | Outperform | 2025-12-18 |

| RBC Capital | Maintain | Outperform | 2025-11-18 |

| Wells Fargo | Maintain | Overweight | 2025-11-07 |

| UBS | Maintain | Buy | 2025-11-07 |

| Keybanc | Maintain | Overweight | 2025-11-07 |

| Keybanc | Maintain | Overweight | 2025-11-05 |

| UBS | Maintain | Buy | 2025-11-05 |

| BMO Capital | Maintain | Outperform | 2025-11-03 |

| JP Morgan | Maintain | Overweight | 2025-10-15 |

DD shows consistently positive grades, with multiple Outperform and Overweight ratings maintained over recent months.

Which company has the best grades?

Both companies have predominantly Buy or better ratings from reputable grading firms, but DD features more Outperform and Overweight grades compared to IFF’s mix of Buy and Neutral ratings. This suggests a slightly stronger consensus favoring DD, which may influence investor sentiment towards greater confidence in DD’s growth prospects.

Strengths and Weaknesses

Below is a comparative table highlighting the strengths and weaknesses of International Flavors & Fragrances Inc. (IFF) and DuPont de Nemours, Inc. (DD) based on recent financial and operational data.

| Criterion | International Flavors & Fragrances Inc. (IFF) | DuPont de Nemours, Inc. (DD) |

|---|---|---|

| Diversification | Moderate; revenue spread across Nourish (5.87B), Scent (2.44B), Health & Biosciences (2.11B), Pharma Solutions (961M) | High; multiple segments including Electronics & Industrial (5.93B), Water & Protection (5.42B), Corporate (1.03B) |

| Profitability | Low net margin at 2.12%, ROIC 2.63% below WACC, indicating value destruction | Moderate net margin 5.68%, ROIC 3.54% but still below WACC, slight value erosion |

| Innovation | Moderate innovation focus in Health & Biosciences and Pharma Solutions | Innovation-driven segments in Electronics and Water Protection, strong R&D focus |

| Global presence | Established global footprint but limited scale compared to peers | Extensive global operations with broad industrial exposure |

| Market Share | Niche leader in flavors and fragrances markets | Significant market share in industrial materials and specialty sectors |

Key takeaways: Both companies face challenges in profitability with ROIC below WACC, signaling value destruction. DuPont offers more diversification and a slightly better profitability profile, while IFF’s strengths lie in specialized product segments. Investors should weigh diversification and profitability cautiously.

Risk Analysis

Below is a comparison of key risks for International Flavors & Fragrances Inc. (IFF) and DuPont de Nemours, Inc. (DD) based on the latest 2024 data:

| Metric | International Flavors & Fragrances Inc. (IFF) | DuPont de Nemours, Inc. (DD) |

|---|---|---|

| Market Risk | Beta 1.056, moderate volatility | Beta 1.113, slightly higher volatility |

| Debt level | Debt/Equity 0.69 (neutral), Debt to Assets 33.56% | Debt/Equity 0.31 (favorable), Debt to Assets 19.57% (favorable) |

| Regulatory Risk | Moderate, operates in global specialty chemicals and fragrances | Moderate, operates in chemicals with exposure to environmental and safety regulations |

| Operational Risk | Supply chain complexity in natural ingredients and biosciences | Diverse segments; industrial and electronics materials expose to technological shifts |

| Environmental Risk | Exposure to sustainability pressures in natural and synthetic ingredients | Higher scrutiny due to chemical manufacturing and water protection solutions |

| Geopolitical Risk | Global presence including emerging markets, sensitive to trade policies | Global operations with exposure to geopolitical tensions affecting supply chains |

Synthesizing these risks, both companies face operational and regulatory challenges inherent in the specialty chemicals sector. IFF’s higher debt level and lower profitability metrics increase financial risk, while DD’s lower leverage and diversified segments present relatively lower financial risk. Market volatility is moderate for both. Environmental regulations and geopolitical tensions remain significant, especially for DD’s industrial focus. Investors should weigh these factors carefully, prioritizing robust risk management given the sector’s complexity and global exposure.

Which Stock to Choose?

International Flavors & Fragrances Inc. (IFF) shows mixed income evolution with favorable recent gross profit growth but overall declining net income and profitability. Its financial ratios are slightly unfavorable, with moderate debt and a very favorable rating of C+.

DuPont de Nemours, Inc. (DD) demonstrates a favorable income statement with positive net margin and strong net income growth. Its financial ratios are slightly favorable, featuring lower debt levels and a similarly very favorable C+ rating.

For investors, DD might appear more attractive for those prioritizing growth and improving profitability, while IFF could be interpreted as more suitable for those seeking exposure to a company with a stable rating but facing profitability challenges. Both companies show value destruction in MOAT terms, indicating caution.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of International Flavors & Fragrances Inc. and DuPont de Nemours, Inc. to enhance your investment decisions: