In today’s fast-evolving tech landscape, DoorDash, Inc. (DASH) and Twilio Inc. (TWLO) stand out as innovative leaders within the Communication Services sector. Both companies serve crucial roles in digital connectivity—DoorDash through logistics and delivery solutions, and Twilio by powering customer engagement via cloud communications. Their overlapping focus on technology-driven services makes this comparison essential. Join me as we explore which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between DoorDash and Twilio by providing an overview of these two companies and their main differences.

DoorDash Overview

DoorDash, Inc. operates a logistics platform connecting merchants, consumers, and dashers primarily in the US and internationally. Its services include marketplaces like DoorDash and Wolt, membership products, white-label delivery fulfillment, and digital ordering solutions. Founded in 2013 and headquartered in San Francisco, DoorDash focuses on solving merchant challenges in customer acquisition, delivery, and payment processing, positioning itself as a leader in on-demand logistics.

Twilio Overview

Twilio Inc. provides a cloud communications platform that empowers developers to build, scale, and operate customer engagement within software applications globally. Its platform offers APIs that support voice, messaging, video, and email integration. Incorporated in 2008 and based in San Francisco, Twilio targets software developers and businesses aiming to embed communication capabilities into applications, establishing itself as a key player in programmable communications.

Key similarities and differences

Both DoorDash and Twilio operate within the Communication Services sector and are headquartered in San Francisco, serving global markets with technology-driven platforms. DoorDash focuses on logistics and e-commerce solutions connecting merchants and consumers, while Twilio specializes in cloud communication APIs for developers to enhance customer engagement. Their business models differ: DoorDash emphasizes delivery and fulfillment services, whereas Twilio centers on programmable communications software.

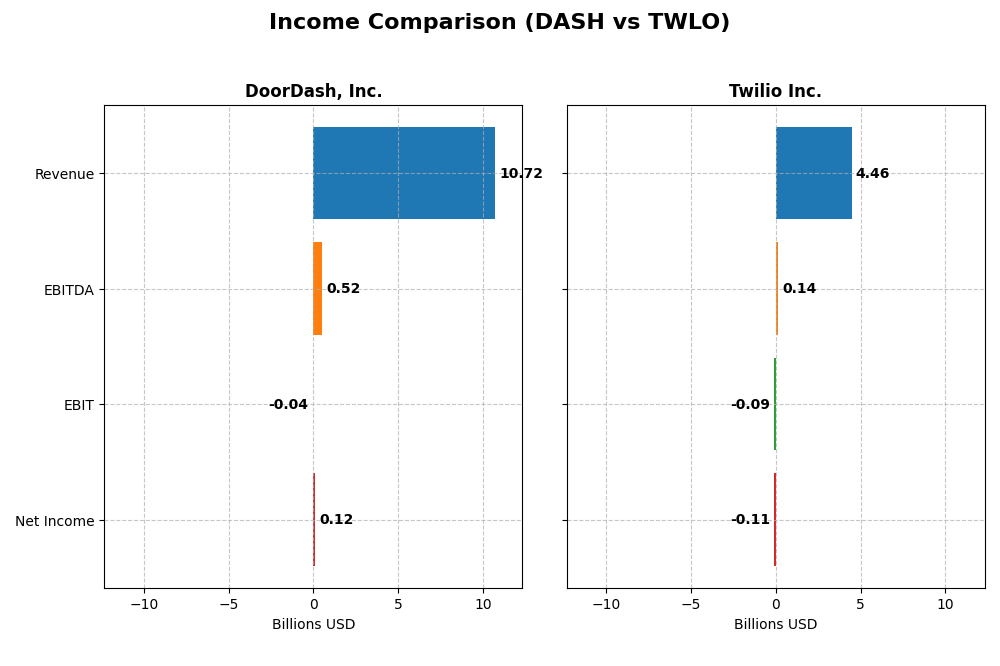

Income Statement Comparison

The table below presents the key income statement figures for DoorDash, Inc. and Twilio Inc. for the fiscal year 2024, highlighting revenue, profitability, and earnings per share metrics.

| Metric | DoorDash, Inc. (DASH) | Twilio Inc. (TWLO) |

|---|---|---|

| Market Cap | 92.6B | 20.2B |

| Revenue | 10.7B | 4.46B |

| EBITDA | 523M | 136M |

| EBIT | -38M | -89M |

| Net Income | 123M | -109M |

| EPS | 0.30 | -0.66 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

DoorDash, Inc.

DoorDash’s revenue showed strong growth from 2020 to 2024, rising from 2.9B to 10.7B, with net income turning positive in 2024 at 123M after consistent losses. Gross margins remained favorable near 48%, while EBIT margins stayed slightly negative. The latest year showed significant margin improvement and a 24.2% revenue increase, reflecting operational progress.

Twilio Inc.

Twilio’s revenue increased steadily to 4.5B in 2024 from 1.8B in 2020, with net losses shrinking to -109M in 2024 from much larger deficits earlier. Gross margins held strong around 50%, but EBIT and net margins were negative, though improving. Growth slowed to 7.3% revenue gain in 2024, but profitability metrics showed marked improvement.

Which one has the stronger fundamentals?

DoorDash exhibits stronger fundamentals with higher revenue growth (271.5% over five years) and a positive net income turnaround. It maintains solid gross margins and improving EBIT margins. Twilio, while also improving, shows slower revenue growth (153%) and persistent net losses. Both have favorable gross margins, but DoorDash’s margin and profitability progress is more pronounced.

Financial Ratios Comparison

The following table presents key financial ratios for DoorDash, Inc. and Twilio Inc. based on their most recent fiscal year data, facilitating a direct comparison of their financial performance and structure.

| Ratios | DoorDash, Inc. (DASH) | Twilio Inc. (TWLO) |

|---|---|---|

| ROE | 1.58% | -1.38% |

| ROIC | -0.34% | -0.45% |

| P/E | 561.28 | -163.92 |

| P/B | 8.85 | 2.25 |

| Current Ratio | 1.66 | 4.20 |

| Quick Ratio | 1.66 | 4.20 |

| D/E (Debt to Equity) | 0.07 | 0.14 |

| Debt-to-Assets | 4.17% | 11.25% |

| Interest Coverage | 0 | 0 |

| Asset Turnover | 0.83 | 0.45 |

| Fixed Asset Turnover | 9.19 | 18.24 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

DoorDash, Inc.

DoorDash shows a mixed ratio profile with strong liquidity indicated by a current ratio of 1.66 and low leverage (debt to equity 0.07), which are favorable. However, profitability ratios such as net margin (1.15%) and return on equity (1.58%) remain weak, alongside a high PE ratio of 561.28, signaling potential valuation concerns. DoorDash does not pay dividends, aligning with its growth and reinvestment strategy.

Twilio Inc.

Twilio displays several weak profitability metrics, including a negative net margin (-2.45%) and return on equity (-1.38%), though it benefits from a favorable PE ratio at -163.92 and moderate leverage (debt to equity 0.14). The company’s current ratio is high at 4.20 but considered unfavorable due to possible capital inefficiency. Twilio also does not pay dividends, likely reflecting focus on growth and R&D.

Which one has the best ratios?

Both companies exhibit challenges in profitability and shareholder returns, but DoorDash’s liquidity and low leverage provide a more balanced financial position despite weak earnings. Twilio’s stronger valuation metrics contrast with weaker asset turnover and profitability. Overall, DoorDash holds a slightly more favorable ratio profile compared to Twilio’s slightly unfavorable one.

Strategic Positioning

This section compares the strategic positioning of DoorDash and Twilio, covering Market position, Key segments, and Exposure to technological disruption:

DoorDash, Inc.

- Leading logistics platform connecting merchants, consumers, and dashers amid competitive delivery markets.

- Revenue driven by marketplaces, platform services, and delivery solutions with significant scale.

- Exposure to technological disruption via evolving e-commerce logistics and digital ordering innovations.

Twilio Inc.

- Cloud communications platform enabling developers to embed engagement tools within applications.

- Revenue mainly from communications APIs supporting voice, messaging, video, and email services.

- Faces disruption risk from rapidly evolving communication technologies and developer platform demands.

DoorDash vs Twilio Positioning

DoorDash has a diversified approach focused on logistics and marketplace services, while Twilio concentrates on cloud communication APIs. DoorDash benefits from scale in delivery services, whereas Twilio’s strength lies in developer-centric communication tools, each with distinct market dynamics and risks.

Which has the best competitive advantage?

Both companies have slightly unfavorable MOAT evaluations, shedding value despite growing ROIC trends. Their competitive advantages are challenged, but improving profitability suggests potential for future value creation.

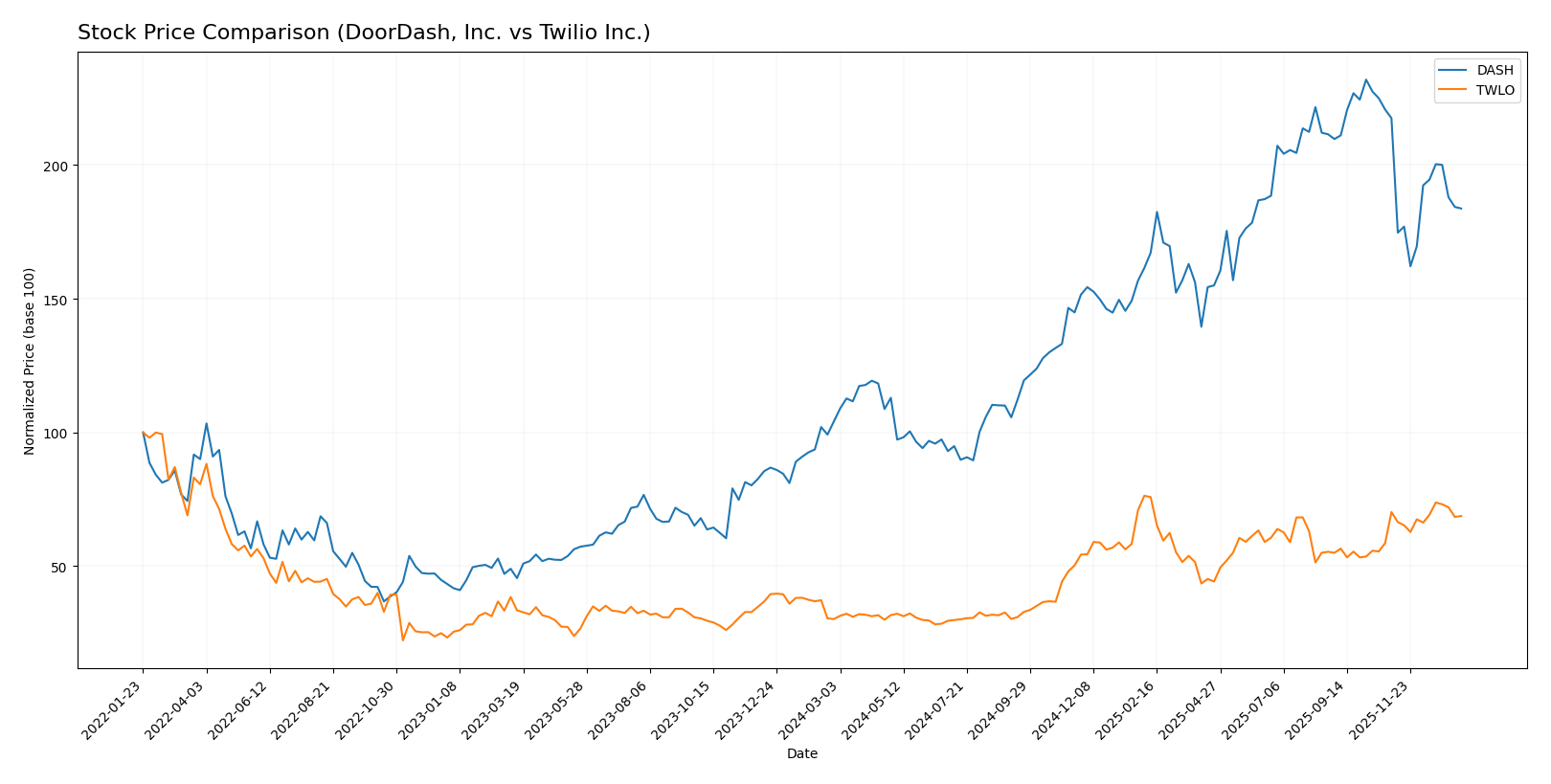

Stock Comparison

The past year reveals significant bullish trends for both DoorDash, Inc. and Twilio Inc., with notable price gains and distinct trading volume patterns shaping their market dynamics.

Trend Analysis

DoorDash, Inc. experienced a strong bullish trend over the past 12 months with a 76.47% price increase, marked by high volatility (std deviation 49.17) and a deceleration in upward momentum. Recent months show a mild downward correction of -15.53%.

Twilio Inc. posted a larger bullish gain of 127.56% over the same period, also with decelerating momentum and lower volatility (std deviation 28.32). Its recent price change is nearly neutral at -2.13%, indicating relative stability.

Comparing the two, Twilio delivered the highest market performance with a more pronounced price increase, although both stocks have shown recent slight declines and a shift toward seller dominance in trading volumes.

Target Prices

The current analyst consensus presents optimistic target prices for both DoorDash, Inc. and Twilio Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| DoorDash, Inc. | 350 | 239 | 292.45 |

| Twilio Inc. | 170 | 100 | 145.91 |

Analysts expect DoorDash’s stock to appreciate significantly from its current price of $214.87, with consensus targets well above. Twilio’s consensus target of $145.91 also suggests upside potential from its current $132.01 trading price.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for DoorDash, Inc. and Twilio Inc.:

Rating Comparison

DoorDash Rating

- Rating: B-, considered very favorable by analysts.

- Discounted Cash Flow Score: 3, indicating a moderate valuation based on future cash flow.

- ROE Score: 3, showing moderate efficiency in generating profit from shareholders’ equity.

- ROA Score: 4, favorable use of assets to generate earnings.

- Debt To Equity Score: 2, moderate financial risk with some reliance on debt.

- Overall Score: 2, indicating a moderate overall financial standing.

Twilio Rating

- Rating: B-, also considered very favorable by analysts.

- Discounted Cash Flow Score: 3, also moderate valuation based on future cash flow.

- ROE Score: 2, reflecting moderate but lower efficiency compared to DoorDash.

- ROA Score: 3, moderate effectiveness in asset utilization.

- Debt To Equity Score: 3, moderate financial risk but better balance sheet strength than DoorDash.

- Overall Score: 2, also indicating a moderate overall financial standing.

Which one is the best rated?

Both DoorDash and Twilio share the same overall rating of B- and a moderate overall score of 2. DoorDash shows stronger asset utilization (ROA 4 vs. 3), while Twilio has a more favorable debt-to-equity score (3 vs. 2). Neither company clearly outperforms the other based on these metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

DASH Scores

- Altman Z-Score: 7.42, indicating a safe zone status.

- Piotroski Score: 6, classified as average financial strength.

TWLO Scores

- Altman Z-Score: 6.62, indicating a safe zone status.

- Piotroski Score: 6, classified as average financial strength.

Which company has the best scores?

Both DoorDash and Twilio show Altman Z-Scores in the safe zone, with DoorDash slightly higher. Their Piotroski Scores are identical at 6, reflecting average financial strength for both.

Grades Comparison

Here is the grades comparison for DoorDash, Inc. and Twilio Inc. from several reputable grading companies:

DoorDash, Inc. Grades

The following table shows recent grades and actions from well-known grading companies for DoorDash, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-08 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-08 |

| Wedbush | Maintain | Outperform | 2025-12-19 |

| Argus Research | Maintain | Buy | 2025-12-12 |

| Jefferies | Maintain | Buy | 2025-12-11 |

| Jefferies | Upgrade | Buy | 2025-11-19 |

| Guggenheim | Maintain | Buy | 2025-11-19 |

| Needham | Maintain | Buy | 2025-11-14 |

| Wedbush | Upgrade | Outperform | 2025-11-13 |

| Mizuho | Maintain | Outperform | 2025-11-12 |

Overall, DoorDash grades show a strong buy consensus and several recent upgrades, indicating positive analyst sentiment.

Twilio Inc. Grades

Below is the recent grading data and analyst actions for Twilio Inc. from established firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Buy | 2026-01-07 |

| RBC Capital | Maintain | Underperform | 2026-01-05 |

| Piper Sandler | Downgrade | Neutral | 2026-01-05 |

| Citizens | Maintain | Market Outperform | 2025-12-30 |

| Wells Fargo | Maintain | Overweight | 2025-10-31 |

| Piper Sandler | Maintain | Overweight | 2025-10-31 |

| Needham | Maintain | Buy | 2025-10-31 |

| B of A Securities | Maintain | Underperform | 2025-10-31 |

| Mizuho | Maintain | Outperform | 2025-10-31 |

| TD Cowen | Maintain | Hold | 2025-10-31 |

Twilio’s grades display a mixed trend with some downgrades and underperform ratings, despite a general buy consensus.

Which company has the best grades?

DoorDash, Inc. has received consistently positive grades with multiple buy and outperform ratings, reflecting stronger analyst confidence compared to Twilio Inc., which shows more varied opinions including underperform and neutral grades. This disparity may influence investor perceptions of risk and growth potential.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for DoorDash, Inc. (DASH) and Twilio Inc. (TWLO) based on the most recent financial and operational data.

| Criterion | DoorDash, Inc. (DASH) | Twilio Inc. (TWLO) |

|---|---|---|

| Diversification | Moderate; primarily focused on marketplaces and platform services with $10.7B revenue in 2024 | Moderate; mainly communications segment with $4.16B revenue in 2024, some software and other products |

| Profitability | Low profitability; net margin 1.15%, ROIC -0.34%, shedding value but improving ROIC | Unprofitable; net margin -2.45%, ROIC -0.45%, also shedding value but showing ROIC growth |

| Innovation | Strong platform innovations supporting growth | Strong innovation in cloud communications APIs and software |

| Global presence | Primarily US-focused with some international exposure | Global reach with cloud-based communication services |

| Market Share | Leading in food delivery in the US market | Significant player in cloud communication APIs, but competitive market |

Key takeaways: Both companies are currently shedding value with negative ROIC compared to their cost of capital, although both show improving profitability trends. DoorDash has a larger revenue base and market share in its niche, while Twilio benefits from innovation and global cloud service reach. Investors should weigh growth potential against current profitability challenges.

Risk Analysis

Below is a comparison of key risks for DoorDash, Inc. (DASH) and Twilio Inc. (TWLO) based on the most recent data available for 2024-2026.

| Metric | DoorDash, Inc. (DASH) | Twilio Inc. (TWLO) |

|---|---|---|

| Market Risk | High beta (1.7) indicates higher volatility | Moderate beta (1.3) implies moderate volatility |

| Debt level | Low debt-to-equity (0.07), low debt-to-assets (4.17%) | Moderate debt-to-equity (0.14), debt-to-assets (11.25%) |

| Regulatory Risk | Moderate – operates in highly regulated delivery and e-commerce sectors | Moderate – cloud communications face evolving data privacy laws |

| Operational Risk | Large workforce (~23.7K) with complex logistics operations | Smaller workforce (~5.5K), but reliant on scalable cloud infrastructure |

| Environmental Risk | Moderate – delivery logistics contribute to carbon footprint | Low to moderate – data centers have energy demands but less direct impact |

| Geopolitical Risk | Exposure to international markets, sensitive to trade policies and global disruptions | Exposure to global cloud markets, sensitive to geopolitical tensions affecting tech infrastructure |

The most impactful risks for both companies are market volatility and operational challenges inherent to their business models. DoorDash faces higher market risk due to greater volatility and complex logistics, while Twilio’s risks stem from moderate debt and dependence on cloud technology amid regulatory shifts. Both companies maintain a safe zone for bankruptcy risk but show moderate financial strength, warranting cautious risk management.

Which Stock to Choose?

DoorDash, Inc. (DASH) has shown strong income growth over 2020-2024 with favorable revenue and profit expansions. Despite mostly unfavorable profitability and valuation ratios, it maintains a low debt level and a solid current ratio, earning a very favorable B- rating overall.

Twilio Inc. (TWLO) displays moderate income growth and a higher gross margin but suffers from negative net margin and profitability ratios. It carries slightly more debt than DASH but shows favorable leverage ratios and a similar very favorable B- rating, though its financial ratios are slightly less favorable overall.

Investors prioritizing growth and improving profitability might find DASH’s stronger income momentum and efficient asset use appealing, while those seeking a company with moderate leverage and stable rating could consider TWLO. Both companies exhibit value destruction but improving profitability, suggesting different risk tolerances and investment approaches could influence preference.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of DoorDash, Inc. and Twilio Inc. to enhance your investment decisions: