Home > Comparison > Technology > META vs DASH

The strategic rivalry between Meta Platforms, Inc. and DoorDash, Inc. shapes the evolution of digital consumer services. Meta, a technology powerhouse, focuses on social connectivity and immersive realities. DoorDash operates a communication services platform, specializing in logistics and on-demand delivery. This clash highlights growth dynamics versus platform scalability. This analysis will reveal which corporate strategy provides a superior risk-adjusted return for diversified portfolios in today’s volatile market environment.

Table of contents

Companies Overview

Meta Platforms and DoorDash stand as pivotal players in their respective digital ecosystems, shaping consumer engagement and logistics.

Meta Platforms, Inc.: Digital Social Ecosystem Leader

Meta dominates the social media and virtual reality landscape. It generates revenue primarily through advertising across its Family of Apps, including Facebook, Instagram, Messenger, and WhatsApp. In 2026, Meta sharpens its focus on expanding its Reality Labs division, aiming to lead in augmented and virtual reality experiences, enhancing long-term user engagement.

DoorDash, Inc.: On-Demand Delivery and Logistics Innovator

DoorDash operates a logistics platform connecting merchants, consumers, and dashers. Its core revenue comes from marketplace transactions and subscription services like DashPass and Wolt+. In 2026, DoorDash prioritizes expanding its white-label delivery solutions and digital ordering platforms, targeting merchant acquisition and seamless e-commerce integration.

Strategic Collision: Similarities & Divergences

Meta and DoorDash pursue distinct ecosystems—Meta builds a closed social and virtual reality environment, while DoorDash offers an open logistics infrastructure. Their primary battleground lies in consumer engagement and convenience, though across different verticals. Meta’s broad digital social moat contrasts with DoorDash’s niche in last-mile delivery, shaping unique risk and growth profiles for investors.

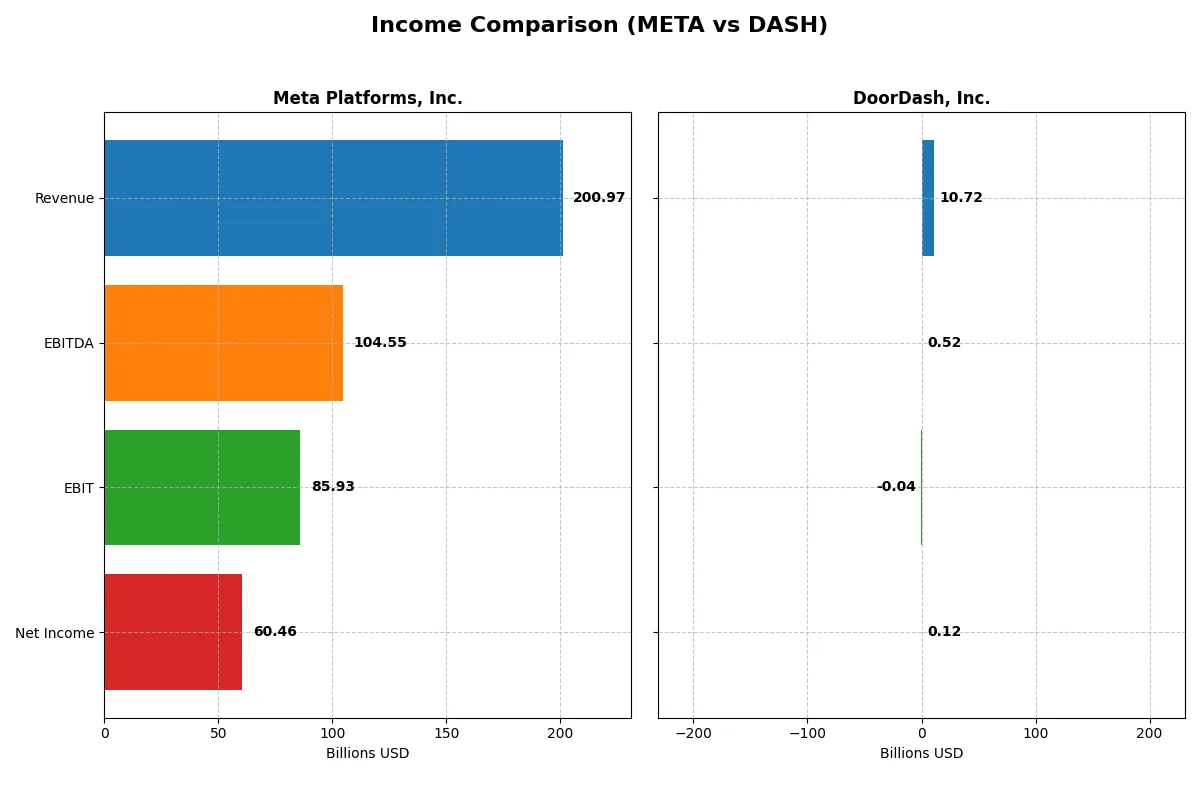

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Meta Platforms, Inc. (META) | DoorDash, Inc. (DASH) |

|---|---|---|

| Revenue | 201B | 10.7B |

| Cost of Revenue | 36.2B | 5.54B |

| Operating Expenses | 81.5B | 5.22B |

| Gross Profit | 164.8B | 5.18B |

| EBITDA | 104.5B | 523M |

| EBIT | 85.9B | -38M |

| Interest Expense | 0 | 0 |

| Net Income | 60.5B | 123M |

| EPS | 23.98 | 0.3 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals how efficiently Meta Platforms and DoorDash convert revenues into profits and sustain growth momentum.

Meta Platforms, Inc. Analysis

Meta’s revenue surged from 135B in 2023 to 201B in 2025, showing strong top-line growth. Net income rose from 39B in 2023 to 60B in 2025, but dipped slightly from 2024’s peak of 62B. Gross margin remains robust at 82%, and net margin holds above 30%, reflecting excellent profitability. Despite increasing operating expenses, Meta sustains high EBIT margin momentum near 43%.

DoorDash, Inc. Analysis

DoorDash grew revenue impressively from 8.6B in 2023 to 10.7B in 2024, with net income flipping from a loss of -558M in 2023 to a modest profit of 123M in 2024. Its gross margin at 48% is solid for the sector, but the EBIT margin remains negative, indicating ongoing challenges in controlling operating costs. However, DoorDash’s rapid margin improvements and positive net income growth signal accelerating operational efficiency.

Profitability Strength vs. Growth Recovery

Meta dominates with superior scale, profitability, and consistent margin strength, delivering a 30% net margin and 70% revenue growth over five years. DoorDash impresses with rapid revenue expansion and a return to profitability but still lags in operating efficiency. For investors prioritizing proven profit power, Meta’s profile is more compelling, while DoorDash appeals to those betting on a high-growth turnaround.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Meta Platforms, Inc. (META) | DoorDash, Inc. (DASH) |

|---|---|---|

| ROE | 27.8% | 1.6% |

| ROIC | 17.9% | -0.3% |

| P/E | 27.5 | 561.3 |

| P/B | 7.7 | 8.8 |

| Current Ratio | 2.60 | 1.66 |

| Quick Ratio | 2.60 | 1.66 |

| D/E | 0.39 | 0.07 |

| Debt-to-Assets | 22.9% | 4.2% |

| Interest Coverage | 0 (not reported) | 0 (not reported) |

| Asset Turnover | 0.55 | 0.83 |

| Fixed Asset Turnover | 1.02 | 9.19 |

| Payout ratio | 8.8% | 0% |

| Dividend yield | 0.32% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, revealing hidden risks and operational excellence beyond surface-level numbers.

Meta Platforms, Inc.

Meta displays strong profitability with a 27.8% ROE and a robust 30.1% net margin, signaling operational efficiency. However, its valuation appears stretched, with a P/E of 27.5 and P/B of 7.7, above sector norms. Meta returns value modestly through a 0.32% dividend yield, focusing heavily on reinvestment in R&D for sustainable growth.

DoorDash, Inc.

DoorDash struggles with profitability, posting a low 1.6% ROE and a thin 1.15% net margin, reflecting operational challenges. Its valuation is highly stretched, marked by an extreme P/E of 561 and a P/B of 8.9. While it pays no dividend, DoorDash reinvests aggressively in growth initiatives but remains burdened by unfavorable returns on capital and interest coverage.

Premium Valuation vs. Operational Safety

Meta offers a superior balance of profitability and operational strength despite a premium valuation. DoorDash’s stretched multiples and weak returns heighten risk without clear reward. Investors seeking operational safety and consistent returns may prefer Meta’s profile, while those targeting speculative growth face higher uncertainty with DoorDash.

Which one offers the Superior Shareholder Reward?

Meta Platforms, Inc. (META) pays a modest dividend yield of 0.34% with a low payout ratio near 8%, supported by strong free cash flow of $21B in 2025. It also aggressively repurchases shares, enhancing total shareholder returns sustainably. DoorDash, Inc. (DASH) pays no dividend and reinvests heavily in growth, reflected in negative or minimal net margins and volatile operating cash flow. Its buyback activity is minimal compared to META. Historically, META’s combination of disciplined dividends and significant buybacks offers a more balanced and sustainable shareholder reward. I conclude META delivers the superior total return profile in 2026.

Comparative Score Analysis: The Strategic Profile

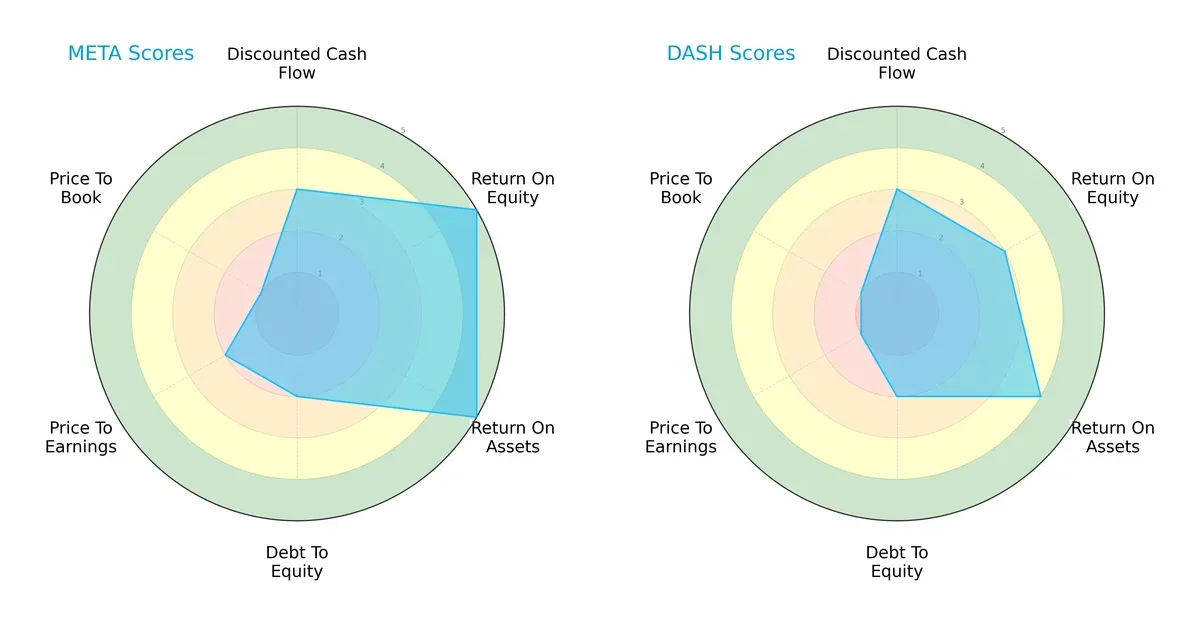

The radar chart reveals the fundamental DNA and trade-offs of Meta Platforms and DoorDash, highlighting their distinct strategic strengths and weaknesses:

Meta excels in profitability with top ROE and ROA scores of 5 each, reflecting exceptional capital efficiency. DoorDash shows solid asset utilization (ROA 4) but lags in equity returns (ROE 3). Both share moderate debt profiles (Debt/Equity 2), signaling balanced leverage. Meta’s valuation metrics (PE 2, PB 1) indicate potential overvaluation risks, while DoorDash faces even steeper valuation challenges with weaker PE and PB scores (1 each). Meta offers a more balanced profile, leveraging profitability and growth, whereas DoorDash relies heavily on asset efficiency amid valuation pressure.

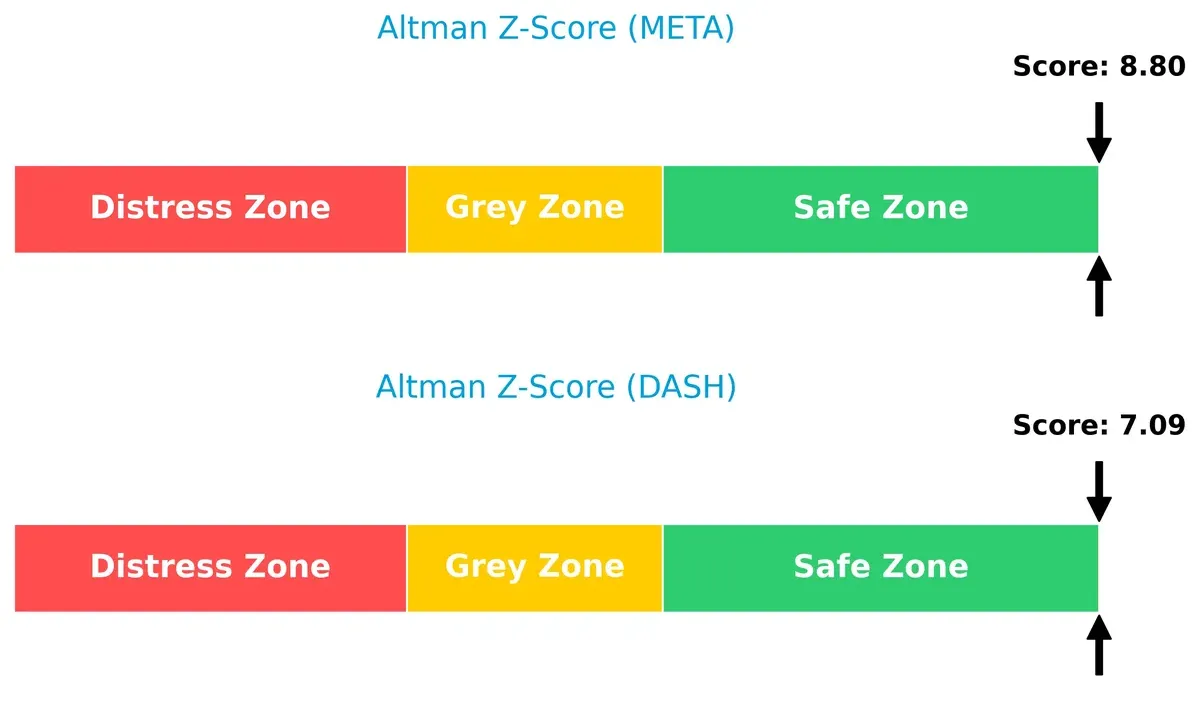

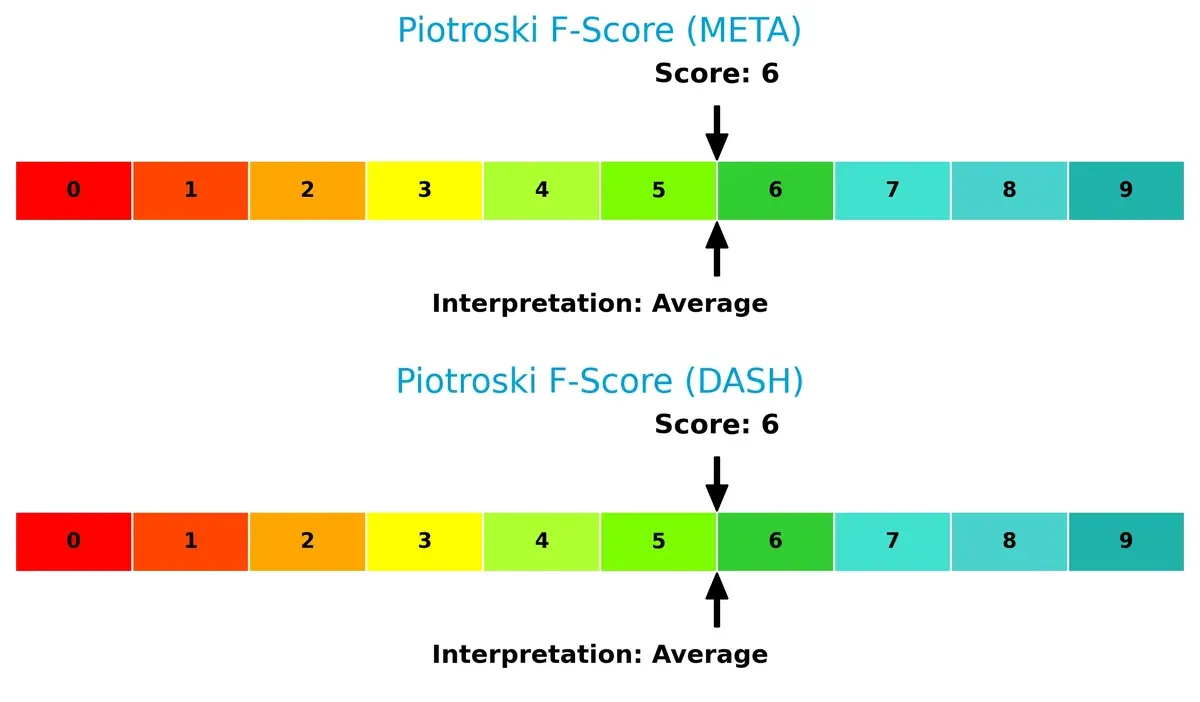

Bankruptcy Risk: Solvency Showdown

Meta’s Altman Z-Score of 8.8 versus DoorDash’s 7.1 places both comfortably in the safe zone, implying robust long-term survival prospects in this cycle:

Financial Health: Quality of Operations

Both Meta and DoorDash share identical Piotroski F-Scores of 6, indicating average financial health without glaring red flags in operational metrics:

How are the two companies positioned?

This section dissects META and DASH’s operational DNA by comparing revenue distribution and internal dynamics. The goal: confront their economic moats to reveal which model offers the most resilient competitive advantage today.

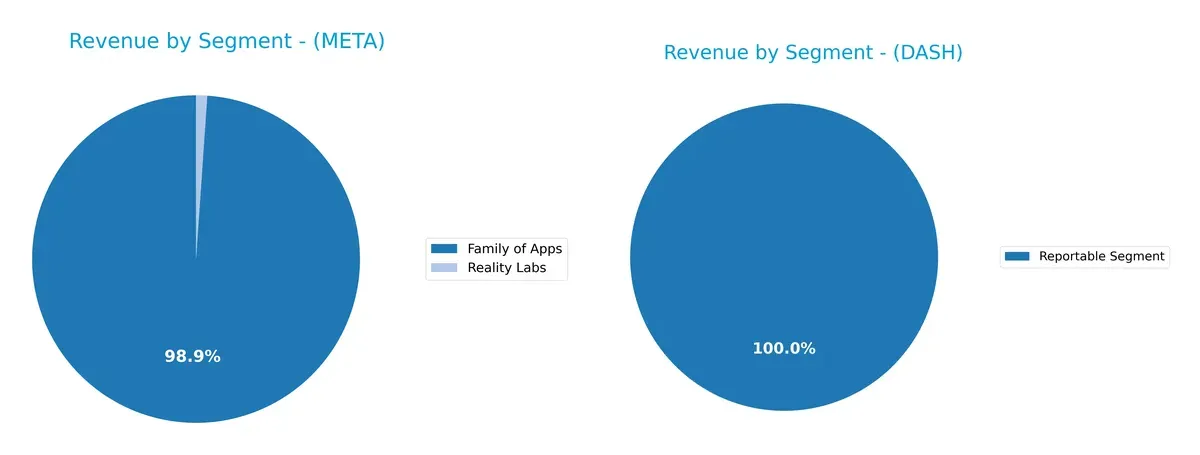

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Meta Platforms, Inc. and DoorDash, Inc. diversify their income streams and reveals where their primary sector bets lie:

Meta Platforms dwarfs DoorDash with $199B from its Family of Apps in 2025, anchoring its revenue heavily in advertising and social ecosystems. Reality Labs lags at $2.2B, showing early-stage diversification. DoorDash, by contrast, pivots almost entirely on Marketplaces and Platform Services with $10.7B in 2024, exposing it to concentration risk but also infrastructure dominance in food delivery. Meta’s mix signals ecosystem lock-in; DoorDash relies on a single segment’s growth.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Meta Platforms, Inc. and DoorDash, Inc.:

Meta Strengths

- Strong profitability with 30% net margin

- High ROE at 27.8%

- Favorable liquidity ratios (current and quick ratio 2.6)

- Significant global presence with $79B US & Canada revenue

- Diverse product segmentation including Family of Apps

- Moderate debt levels with strong interest coverage

DoorDash Strengths

- Favorable liquidity ratios (current and quick ratio 1.66)

- Very low debt levels (debt-to-assets 4.17%)

- High fixed asset turnover (9.19) indicating efficient asset use

- Growing US market revenue of $9.4B

- Focused product segment with $10.7B total revenue

Meta Weaknesses

- Unfavorable valuation multiples (PE 27.5, PB 7.7)

- Low dividend yield (0.32%)

- Neutral asset turnover and fixed asset turnover

- Heavy reliance on US & Canada for revenue

- Limited diversification outside Family of Apps

DoorDash Weaknesses

- Low profitability with net margin 1.15% and negative ROIC

- Unfavorable WACC at 11.8%

- Poor interest coverage (0) indicating financial risk

- Very high PE ratio (561) and PB ratio (8.85)

- No dividend yield and high unfavorable ratios overall

Meta shows robust profitability and global scale, but faces valuation and diversification challenges. DoorDash exhibits operational efficiency and low leverage but struggles with profitability and financial stability. These contrasts highlight different strategic priorities in market positioning and capital structure management.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield protecting long-term profits from the relentless erosion of competition. Let’s dissect the moats of two industry leaders:

Meta Platforms, Inc.: Network Effects Powerhouse

Meta’s dominant network effects create huge switching costs, locking in users across Facebook, Instagram, and WhatsApp. This translates into a strong 30% net margin and a high ROIC that still outpaces its WACC by 8.4%. However, its ROIC has declined by 33% recently, signaling margin pressure from emerging competitors and regulatory risks in 2026.

DoorDash, Inc.: Expanding Logistics Ecosystem

DoorDash’s moat stems from its integrated delivery platform and merchant partnerships. Unlike Meta’s user lock-in, DoorDash leverages operational scale and data-driven logistics to improve efficiency. Despite currently shedding value (ROIC below WACC by 12%), its ROIC is rapidly growing nearly 96%, fueled by international expansion and new service offerings in 2026.

Network Effects vs. Logistics Scale: The Moat Clash

Meta’s wider moat derives from entrenched network effects driving stable high margins and capital returns. DoorDash shows promise with a fast-improving ROIC and scalable logistics, but it remains less defensible. Meta is better positioned to defend market share amid intensifying competition.

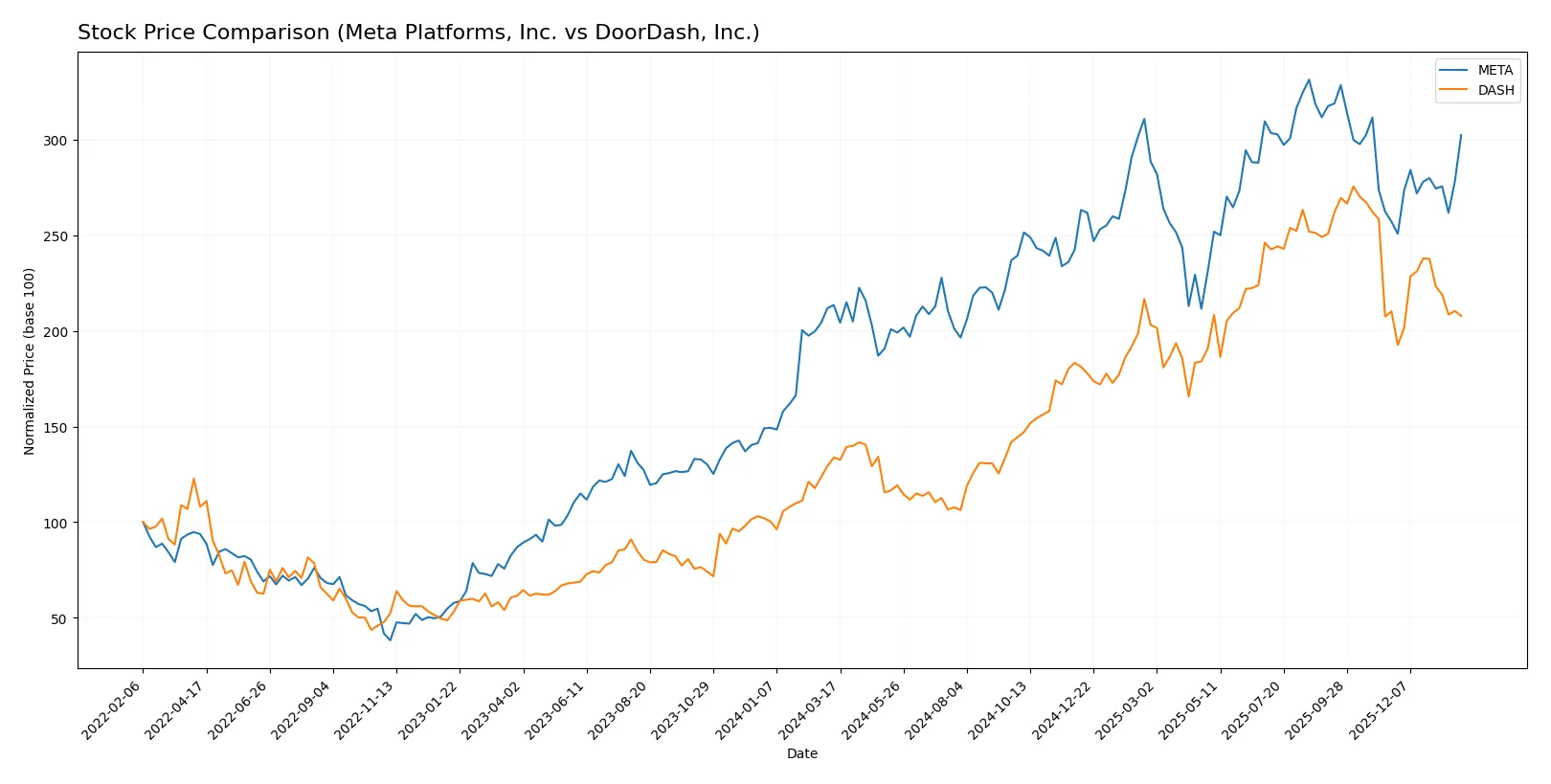

Which stock offers better returns?

Over the past 12 months, both Meta Platforms, Inc. and DoorDash, Inc. exhibited strong price gains, with distinct acceleration patterns and trading volume dynamics shaping their trajectories.

Trend Comparison

Meta Platforms, Inc. shows a 41.61% price increase over the last year, confirming a bullish trend with acceleration. The stock’s volatility is high, with prices ranging between 443.29 and 785.23.

DoorDash, Inc. delivered a 55.25% price rise over the same period, also bullish but with deceleration. Its price fluctuated between 104.74 and 271.22, reflecting moderate volatility.

DoorDash outperformed Meta in total returns despite slowing momentum. Meta’s accelerating trend contrasts with DoorDash’s deceleration, indicating differing investor sentiment momentum.

Target Prices

The analyst consensus reveals a positive outlook for both Meta Platforms, Inc. and DoorDash, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Meta Platforms, Inc. | 700 | 1,117 | 853 |

| DoorDash, Inc. | 224 | 350 | 286.33 |

Meta’s consensus target of 853 implies roughly 19% upside from the current 716.5 price, reflecting confidence in its growth and innovation. DoorDash’s target price of 286.33 suggests a 40% potential rise from 204.62, indicating strong market expectations despite recent volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Institutional grading provides insights into the market consensus for these two companies:

Meta Platforms, Inc. Grades

Below is a summary of recent grades awarded by prominent institutions for Meta Platforms, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Maintain | Overweight | 2024-09-30 |

| Monness, Crespi, Hardt | Maintain | Buy | 2024-09-30 |

| Baird | Maintain | Outperform | 2024-09-26 |

| JMP Securities | Maintain | Market Outperform | 2024-09-26 |

| B of A Securities | Maintain | Buy | 2024-09-26 |

| Rosenblatt | Maintain | Buy | 2024-09-26 |

| Wedbush | Maintain | Outperform | 2024-09-26 |

| JP Morgan | Maintain | Overweight | 2024-09-26 |

| Cantor Fitzgerald | Maintain | Overweight | 2024-09-23 |

| Citigroup | Maintain | Buy | 2024-09-23 |

DoorDash, Inc. Grades

The table below lists the latest grades assigned to DoorDash, Inc. by reputable grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Maintain | Buy | 2026-01-29 |

| Stifel | Maintain | Hold | 2026-01-27 |

| Keybanc | Maintain | Overweight | 2026-01-20 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-08 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-08 |

| Wedbush | Maintain | Outperform | 2025-12-19 |

| Argus Research | Maintain | Buy | 2025-12-12 |

| Jefferies | Maintain | Buy | 2025-12-11 |

| Guggenheim | Maintain | Buy | 2025-11-19 |

| Jefferies | Upgrade | Buy | 2025-11-19 |

Which company has the best grades?

Meta Platforms consistently receives high marks with multiple “Buy,” “Outperform,” and “Overweight” ratings from top-tier firms. DoorDash shows a broader range from “Hold” to “Buy,” indicating more mixed sentiment. Investors may interpret Meta’s stronger consensus grades as higher institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Meta Platforms, Inc.

- Dominates social media but faces fierce competition in emerging metaverse and AI markets.

DoorDash, Inc.

- Operates in a highly competitive delivery logistics space with low barriers to entry and price pressure.

2. Capital Structure & Debt

Meta Platforms, Inc.

- Maintains moderate leverage (D/E 0.39) with strong interest coverage and liquidity.

DoorDash, Inc.

- Very low debt levels (D/E 0.07) but zero interest coverage signals weak earnings to service debt if needed.

3. Stock Volatility

Meta Platforms, Inc.

- Beta 1.29 shows moderate stock volatility, typical for large tech companies.

DoorDash, Inc.

- Beta 1.70 indicates higher volatility, reflecting growth-stage risk and market sensitivity.

4. Regulatory & Legal

Meta Platforms, Inc.

- Faces intense scrutiny on data privacy, antitrust, and content regulation globally.

DoorDash, Inc.

- Subject to regulatory risks in gig economy labor laws and food safety regulations.

5. Supply Chain & Operations

Meta Platforms, Inc.

- Relies on complex hardware supply chains for Reality Labs; software operations are scalable.

DoorDash, Inc.

- Dependent on third-party delivery partners and merchant network stability, vulnerable to operational disruptions.

6. ESG & Climate Transition

Meta Platforms, Inc.

- Invests in sustainability but faces pressure on energy use in data centers and hardware production.

DoorDash, Inc.

- Faces ESG risks related to gig worker treatment and carbon footprint of delivery logistics.

7. Geopolitical Exposure

Meta Platforms, Inc.

- Global presence exposes it to geopolitical risks including censorship and trade restrictions.

DoorDash, Inc.

- Primarily US-focused but expanding internationally, exposed to geopolitical trade and regulatory risks.

Which company shows a better risk-adjusted profile?

Meta faces its greatest risk from regulatory and competitive pressures in a rapidly evolving tech landscape. DoorDash’s key risk lies in operational fragility and poor earnings coverage amid intense competition. Meta’s superior capital structure, profitability (ROIC 17.95%), and liquidity provide a more resilient risk-adjusted profile. DoorDash’s high valuation multiples (PE 561x) and negative ROIC highlight financial vulnerability. Meta’s Altman Z-score of 8.8 confirms strong financial health, while DoorDash, though also in a safe zone (7.1), has weaker profitability metrics. These factors justify greater caution with DoorDash despite its growth potential.

Final Verdict: Which stock to choose?

Meta Platforms, Inc. wields unmatched efficiency as a cash-generating powerhouse, consistently delivering high returns on invested capital. Its key point of vigilance is the recent decline in profitability trends, which could pressure margins. Meta suits investors targeting aggressive growth with solid financial backing and scale advantages.

DoorDash, Inc. commands a strategic moat rooted in rapid revenue expansion and operational scalability within the on-demand delivery niche. Though it carries a more cautious safety profile than Meta, its improving profitability signals potential. DoorDash fits well for GARP investors seeking growth tempered by improving fundamentals.

If you prioritize durable cash flow generation and proven value creation, Meta outshines due to its entrenched market position and scale. However, if you seek higher growth potential with a tolerance for operational risk, DoorDash offers a compelling scenario given its accelerating profitability and market penetration. Each appeals to distinct investor profiles balancing growth and risk.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Meta Platforms, Inc. and DoorDash, Inc. to enhance your investment decisions: