In the fast-evolving technology sector, Shopify Inc. and Domo, Inc. stand out as influential players in software applications, each driving innovation in commerce and business intelligence. Shopify empowers merchants globally with a versatile e-commerce platform, while Domo focuses on real-time data insights for organizational decision-making. Given their overlapping markets and growth potential, this article will help you determine which company presents the more compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Shopify Inc. and Domo, Inc. by providing an overview of these two companies and their main differences.

Shopify Inc. Overview

Shopify Inc. is a Canadian commerce company offering a comprehensive platform that supports merchants in managing sales through multiple channels, including web, mobile, physical stores, and social media. The company’s services cover product management, order processing, payment solutions, and customer engagement. Headquartered in Ottawa, Shopify operates globally with a strong focus on enabling seamless commerce experiences.

Domo, Inc. Overview

Domo, Inc. is a U.S.-based technology firm specializing in cloud-based business intelligence platforms. Its solution connects all organizational levels with real-time data and insights, accessible via smartphones, helping businesses manage operations effectively. Headquartered in American Fork, Utah, Domo serves domestic and international markets with a focus on data-driven business management.

Key similarities and differences

Both companies operate in the software application industry and provide technology-driven platforms to improve business operations. Shopify emphasizes commerce and merchant services across diverse sales channels, while Domo focuses on business intelligence and data connectivity within organizations. Shopify’s market cap is substantially larger at $205B compared to Domo’s $257M, reflecting different scales and market positions.

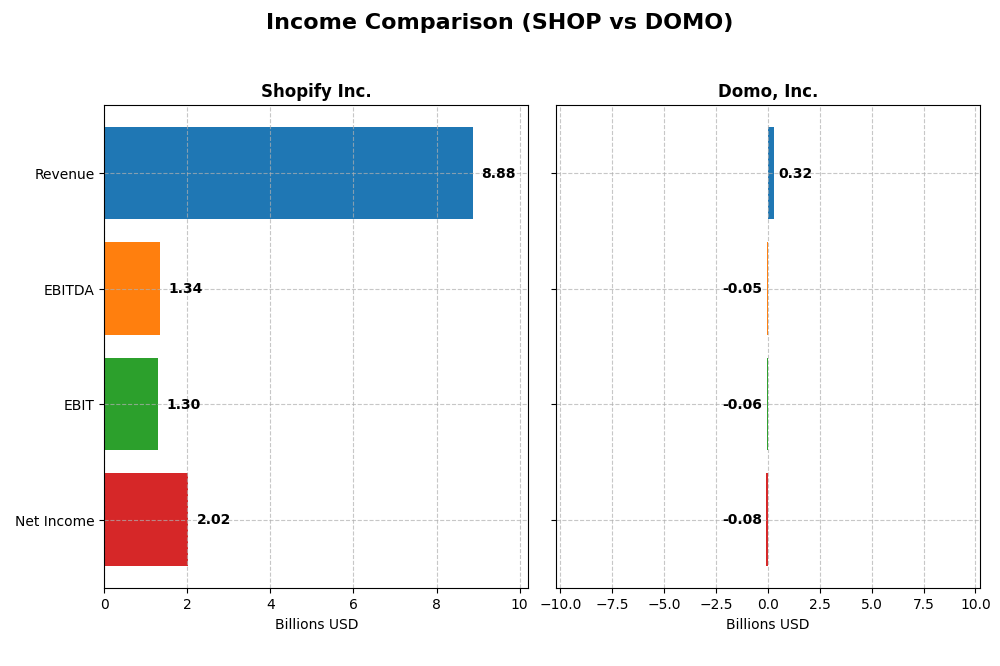

Income Statement Comparison

This table presents the latest fiscal year income statement figures for Shopify Inc. and Domo, Inc., providing a clear comparison of key financial metrics for 2024 and 2025 respectively.

| Metric | Shopify Inc. (2024) | Domo, Inc. (2025) |

|---|---|---|

| Market Cap | 205B | 257M |

| Revenue | 8.88B | 317M |

| EBITDA | 1.34B | -50M |

| EBIT | 1.30B | -59M |

| Net Income | 2.02B | -82M |

| EPS | 1.56 | -2.13 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Shopify Inc.

Shopify showed strong revenue growth from 2020 to 2024, increasing from $2.9B to $8.9B, with net income recovering from a loss of $3.46B in 2022 to a profit of $2.02B in 2024. Margins improved significantly, with a gross margin of 50.36% and net margin of 22.74% in 2024. The latest year marked a robust turnaround with favorable growth across revenue, net income, and margins.

Domo, Inc.

Domo’s revenue rose from $210M in 2021 to around $317M in 2025, but net income remained negative, recording a loss of $82M in the latest year. Gross margin is healthy at 74.45%, yet EBIT and net margins are negative at -18.7% and -25.84%, respectively. The most recent year showed a slight revenue decline and worsening profitability, reflecting ongoing operational challenges.

Which one has the stronger fundamentals?

Shopify exhibits stronger fundamentals, driven by substantial revenue and profit growth, improving margins, and a positive net income trend. In contrast, Domo, despite solid gross margins, struggles with consistent losses and negative EBIT and net margins. Shopify’s overall favorable income statement contrasts with Domo’s predominantly unfavorable evaluation, indicating a more robust financial position.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for Shopify Inc. (SHOP) and Domo, Inc. (DOMO) based on the most recent available fiscal year data.

| Ratios | Shopify Inc. (2024) | Domo, Inc. (2025) |

|---|---|---|

| ROE | 17.5% | 46.2% |

| ROIC | 7.5% | 195% |

| P/E | 68.2 | -3.98 |

| P/B | 11.9 | -1.84 |

| Current Ratio | 3.71 | 0.56 |

| Quick Ratio | 3.70 | 0.56 |

| D/E (Debt-to-Equity) | 0.097 | -0.76 |

| Debt-to-Assets | 8.1% | 63.2% |

| Interest Coverage | 0 | -3.0 |

| Asset Turnover | 0.64 | 1.48 |

| Fixed Asset Turnover | 63.4 | 8.17 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Shopify Inc.

Shopify presents a mixed ratio profile with strong net margin (22.74%) and ROE (17.47%), but unfavorable P/E (68.18) and P/B (11.91), indicating high valuation. The current ratio is strong at 3.71 but marked unfavorable due to potential liquidity concerns. Shopify does not pay dividends, likely reinvesting in growth and R&D, as suggested by its solid quick ratio and low debt levels.

Domo, Inc.

Domo shows favorable ROE (46.23%) and ROIC (194.73%), though the net margin is deeply negative (-25.84%), reflecting profitability challenges. Its liquidity ratios are weak, with a current ratio of 0.56 and interest coverage negative, signaling financial strain. Domo also does not pay dividends, probably focusing on reinvestment and managing losses amid its high asset turnover.

Which one has the best ratios?

Shopify exhibits a more balanced and slightly favorable ratio set, with solid profitability and manageable debt, despite high valuation multiples. Domo’s ratios are more polarized, with strong returns but significant liquidity and profitability weaknesses. Overall, Shopify’s profile suggests greater financial stability compared to Domo’s mixed signals.

Strategic Positioning

This section compares the strategic positioning of Shopify Inc. and Domo, Inc., including Market position, Key segments, and Exposure to technological disruption:

Shopify Inc.

- Market leader in commerce platform with large market cap of 205B, facing high competitive pressure

- Key segments include Merchant Solutions and Subscription, driven by e-commerce and payments

- Exposed to disruption through evolving commerce technologies and digital payment integrations

Domo, Inc.

- Smaller market cap of 257M, focused on cloud-based business intelligence, moderate competitive pressure

- Revenue mainly from Subscription and Professional Services, driven by real-time data insights

- Exposed to disruption in cloud BI platforms and real-time data management technological advances

Shopify Inc. vs Domo, Inc. Positioning

Shopify adopts a diversified commerce platform strategy across multiple sales channels and merchant solutions, offering scale advantages. Domo concentrates on cloud BI with fewer employees and smaller revenue scale, focusing on real-time data connectivity. Shopify’s size may bring scale benefits but also higher competitive challenges.

Which has the best competitive advantage?

Domo shows a very favorable MOAT with growing ROIC above WACC, indicating durable competitive advantage and increasing profitability. Shopify’s MOAT is slightly unfavorable due to value shedding despite growing ROIC, suggesting weaker capital efficiency.

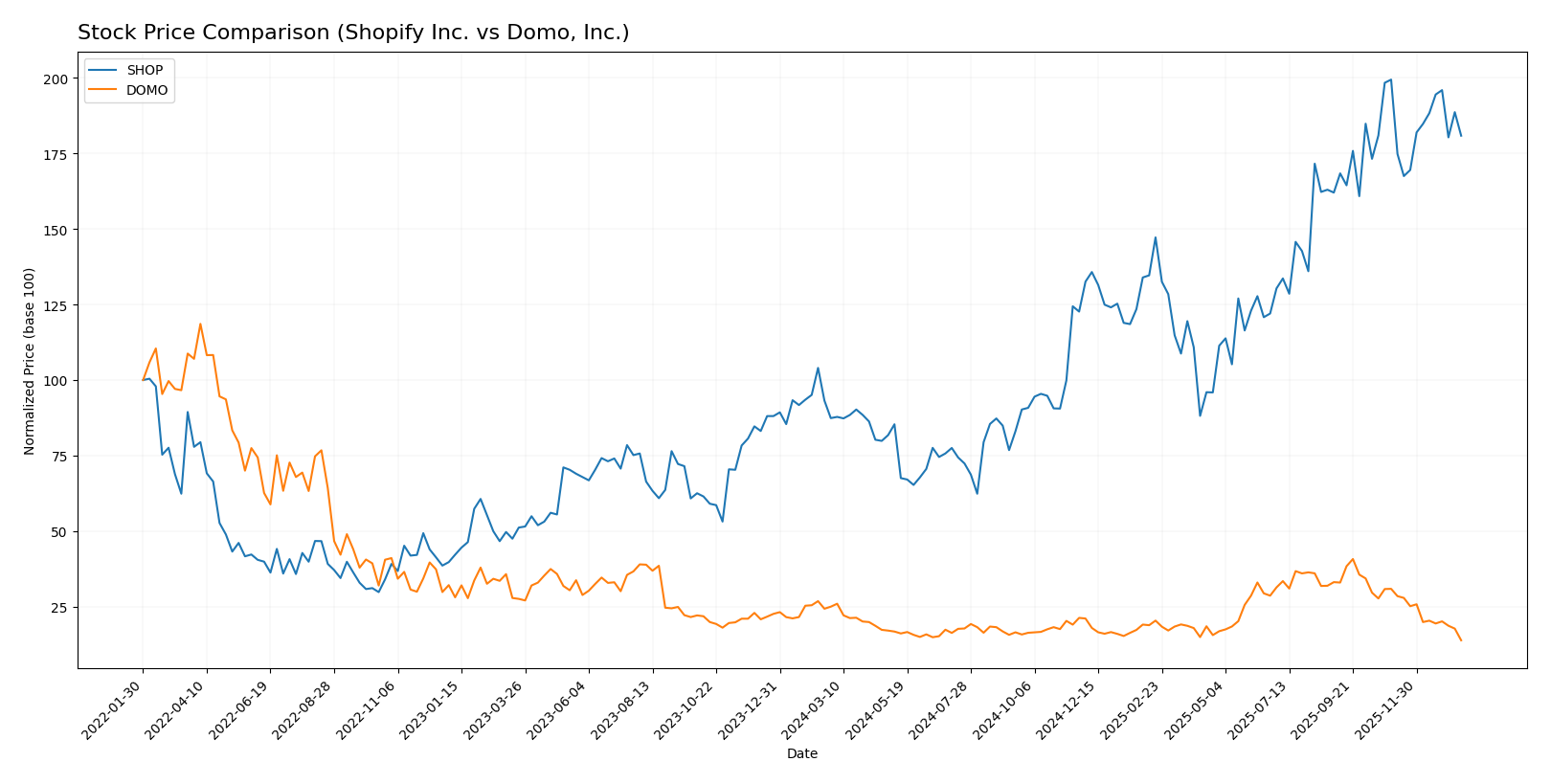

Stock Comparison

The stock price chart highlights significant divergent movements over the past year, with Shopify Inc. showing a strong bullish gain contrasted by Domo, Inc.’s marked bearish decline.

Trend Analysis

Shopify Inc. experienced a 106.83% price increase over the past 12 months, indicating a bullish trend with decelerating momentum and notable volatility (33.71 std deviation). The stock reached a high of 173.86 and a low of 54.43.

Domo, Inc.’s stock price fell by 44.36% over the same period, reflecting a bearish trend with deceleration and low volatility (3.01 std deviation). The highest price recorded was 18.06, and the lowest was 6.17.

Comparatively, Shopify delivered the highest market performance with its significant price appreciation and buyer dominance, while Domo’s stock showed a persistent decline and seller dominance.

Target Prices

The current analyst consensus reveals promising upside potential for both Shopify Inc. and Domo, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Shopify Inc. | 200 | 140 | 186.24 |

| Domo, Inc. | 13 | 10 | 11.5 |

Analysts expect Shopify’s stock to appreciate from its current price of 157.51 USD to near 186.24 USD on average. Domo’s consensus target of 11.5 USD suggests significant upside from its present 6.16 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Shopify Inc. and Domo, Inc.:

Rating Comparison

Shopify Inc. Rating

- Rating: B, evaluated as Very Favorable

- Discounted Cash Flow Score: 3 (Moderate)

- ROE Score: 4 (Favorable)

- ROA Score: 5 (Very Favorable)

- Debt To Equity Score: 3 (Moderate)

- Overall Score: 3 (Moderate)

Domo, Inc. Rating

- Rating: C, evaluated as Very Favorable

- Discounted Cash Flow Score: 1 (Very Unfavorable)

- ROE Score: 5 (Very Favorable)

- ROA Score: 1 (Very Unfavorable)

- Debt To Equity Score: 1 (Very Unfavorable)

- Overall Score: 2 (Moderate)

Which one is the best rated?

Shopify Inc. has a higher overall rating (B) and better scores in discounted cash flow, ROA, and debt to equity, while Domo, Inc. excels only in ROE score. Overall, Shopify shows stronger financial metrics.

Scores Comparison

Here is a comparison of the financial scores for Shopify Inc. and Domo, Inc.:

Shopify Scores

- Altman Z-Score: 50.42, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 6, representing average financial strength.

Domo Scores

- Altman Z-Score: -10.10, indicating distress zone with high bankruptcy risk.

- Piotroski Score: 3, representing very weak financial strength.

Which company has the best scores?

Shopify has notably stronger financial scores, with a very high Altman Z-Score in the safe zone and an average Piotroski Score. Domo’s scores indicate financial distress and very weak strength, based on the provided data.

Grades Comparison

Here is a comparison of the latest reliable grades issued by recognized grading companies for Shopify Inc. and Domo, Inc.:

Shopify Inc. Grades

This table summarizes recent grade changes and maintenance actions from reputable grading firms for Shopify Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Scotiabank | Upgrade | Sector Outperform | 2026-01-08 |

| Wolfe Research | Downgrade | Peer Perform | 2026-01-06 |

| Wells Fargo | Maintain | Overweight | 2025-12-17 |

| Truist Securities | Maintain | Hold | 2025-11-05 |

| CIBC | Maintain | Outperform | 2025-11-05 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-11-05 |

| DA Davidson | Maintain | Buy | 2025-11-05 |

| Scotiabank | Maintain | Sector Perform | 2025-11-05 |

| Needham | Maintain | Buy | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

Shopify’s grades show a mixed but generally positive trend with several buy and outperform ratings maintained, despite a recent downgrade by Wolfe Research.

Domo, Inc. Grades

Below is a summary of recent grading actions from established firms for Domo, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Neutral | 2025-12-05 |

| TD Cowen | Maintain | Buy | 2025-12-05 |

| Lake Street | Maintain | Hold | 2025-12-05 |

| DA Davidson | Maintain | Neutral | 2025-12-01 |

| JMP Securities | Maintain | Market Outperform | 2025-09-10 |

| DA Davidson | Maintain | Neutral | 2025-08-28 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-08-28 |

| TD Cowen | Upgrade | Buy | 2025-08-26 |

| JMP Securities | Maintain | Market Outperform | 2025-06-25 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-06-25 |

Domo maintains a steady profile with multiple neutral to buy ratings and several market outperform and overweight ratings sustained.

Which company has the best grades?

Both Shopify Inc. and Domo, Inc. hold a consensus “Buy” rating, but Shopify has a higher number of buy and outperform grades from top-tier firms, indicating stronger analyst confidence. This could suggest relatively greater optimism about Shopify’s prospects, which might influence investor sentiment and portfolio allocations accordingly.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of Shopify Inc. (SHOP) and Domo, Inc. (DOMO) based on recent financial performance, market position, and strategic attributes.

| Criterion | Shopify Inc. (SHOP) | Domo, Inc. (DOMO) |

|---|---|---|

| Diversification | Strong product mix with Merchant Solutions and Subscriptions generating $8.88B in 2024 | Primarily subscription-based with $286M in 2025; limited diversification |

| Profitability | Positive net margin (22.74%) and ROE (17.47%), but ROIC below WACC indicating value destruction | Negative net margin (-25.84%) but very high ROE (46.23) and ROIC (194.73%), showing growth potential |

| Innovation | Moderate innovation with growing ROIC trend but slightly unfavorable moat status | High innovation with very favorable moat status and strong ROIC growth |

| Global presence | Large global footprint with expanding services | Smaller global presence, more niche market focus |

| Market Share | Significant market share in e-commerce platforms | Smaller market share but rapidly growing in BI software |

Key takeaways: Shopify shows solid profitability and diversification but struggles with efficient capital use, while Domo impresses with strong value creation and innovation despite current profitability challenges. Both have growth potential, but risk profiles differ significantly.

Risk Analysis

Below is a comparative overview of key risk factors affecting Shopify Inc. and Domo, Inc. as of the most recent fiscal years.

| Metric | Shopify Inc. (SHOP) | Domo, Inc. (DOMO) |

|---|---|---|

| Market Risk | High beta at 2.84, indicating significant volatility. | Moderate beta at 1.65, less volatile but still sensitive to market swings. |

| Debt level | Low debt-to-equity ratio (0.1), favorable debt profile. | High debt-to-assets ratio (63.23%), unfavorable, indicating heavy leverage. |

| Regulatory Risk | Moderate, due to global operations across multiple regions. | Moderate, mainly US-focused but with international presence. |

| Operational Risk | Large scale with 8,100 employees; complexity may cause operational inefficiencies. | Smaller scale with 888 employees; risk from scaling challenges. |

| Environmental Risk | Standard industry risks; no significant exposure reported. | Standard industry risks; no significant exposure reported. |

| Geopolitical Risk | Global presence exposes Shopify to geopolitical tensions affecting trade. | Primarily US-based but some international exposure; moderate geopolitical risk. |

The most impactful risks for Shopify are market volatility and geopolitical tensions due to its global footprint. For Domo, the most likely and critical risks stem from its high leverage and financial distress indicators, including a negative Altman Z-score and weak liquidity ratios, raising concerns over solvency and operational sustainability.

Which Stock to Choose?

Shopify Inc. (SHOP) shows strong income growth with a 25.78% revenue increase in 2024 and favorable net margin of 22.74%. Its financial ratios are slightly favorable overall, supported by a solid return on equity of 17.47% and low debt levels, although valuation multiples appear stretched. The company’s debt is well managed, and it holds a very favorable overall rating of B.

Domo, Inc. (DOMO) experiences a challenging income profile with a negative net margin of -25.84% and declining revenue recently. Financial ratios present a mixed picture with favorable returns on equity and invested capital but concerns on liquidity and debt ratios. The company’s financial health is weaker, reflected in a very favorable rating of C but with notable risks and a distressed Altman Z-Score.

For investors, Shopify’s consistent income growth and balanced financial ratios could appear more suitable for those prioritizing quality and moderate risk, while Domo’s high returns on equity but weaker fundamentals might appeal to risk-tolerant investors focused on potential turnaround or growth opportunities. The choice might depend on the investor’s appetite for stability versus speculative exposure.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Shopify Inc. and Domo, Inc. to enhance your investment decisions: