In the fast-evolving software industry, Pegasystems Inc. and Domo, Inc. stand out as innovative players delivering cutting-edge enterprise applications and cloud-based business intelligence platforms. Both companies target the digital transformation needs of businesses, leveraging data and automation to drive efficiency. This comparison will explore their market positions, growth strategies, and innovation to help you decide which stock could be a more compelling addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Pegasystems Inc. and Domo, Inc. by providing an overview of these two companies and their main differences.

Pegasystems Inc. Overview

Pegasystems Inc. develops and markets enterprise software applications, focusing on customer engagement and digital process automation. The company provides platforms like Pega Platform and Pega Infinity, serving industries such as financial services, healthcare, government, and manufacturing. Founded in 1983, Pegasystems is headquartered in Waltham, Massachusetts, with a market capitalization of approximately 8.9B USD.

Domo, Inc. Overview

Domo, Inc. operates a cloud-based business intelligence platform that connects all levels of an organization with real-time data and insights. Founded in 2010 and based in American Fork, Utah, Domo targets users globally with its mobile-enabled platform. The company’s market cap stands near 257M USD, reflecting its smaller scale compared to more established peers in the software application sector.

Key similarities and differences

Both Pegasystems and Domo operate in the software application industry, focusing on enterprise solutions that enhance business processes through technology. Pegasystems emphasizes customer engagement and automation with a broad industry reach, while Domo concentrates on real-time business intelligence and data connectivity. Their market capitalizations and employee counts differ significantly, highlighting Pegasystems’ larger size and longer market presence compared to Domo’s more specialized, cloud-centric approach.

Income Statement Comparison

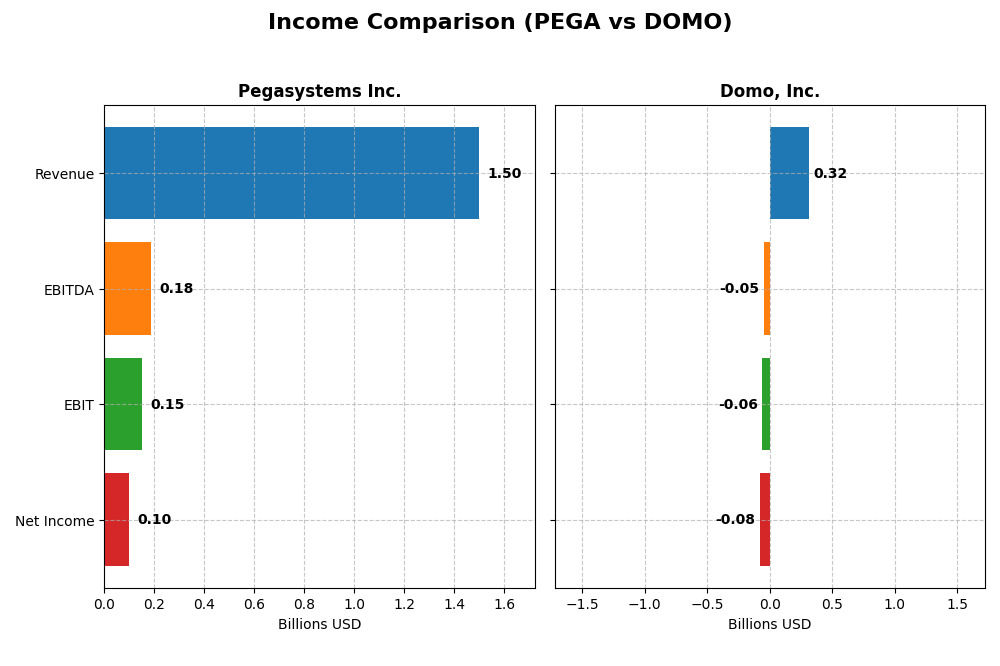

The table below summarizes the key income statement metrics for Pegasystems Inc. and Domo, Inc. for their most recent fiscal years, illustrating their financial performance side by side.

| Metric | Pegasystems Inc. (PEGA) | Domo, Inc. (DOMO) |

|---|---|---|

| Market Cap | 8.9B | 257M |

| Revenue | 1.50B | 317M |

| EBITDA | 185M | -50M |

| EBIT | 149M | -59M |

| Net Income | 99M | -82M |

| EPS | 0.58 | -2.13 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Pegasystems Inc.

Pegasystems shows a clear upward trend in revenue, growing 47.14% from 2020 to 2024, with net income increasing sharply by 261.62%. Gross margin has remained favorable at 73.91%, while net margin improved to 6.63% in 2024. The latest year saw a moderate revenue growth of 4.51%, supported by a strong 46.09% rise in EBIT and a 39.97% net margin improvement, signaling enhanced profitability.

Domo, Inc.

Domo experienced revenue growth of 50.84% over 2021-2025 but posted a net income growth of only 3.19%, with its net margin deeply negative at -25.84%. The gross margin is favorable at 74.45%, but EBIT margin remains unfavorable at -18.7%. The latest fiscal year showed a slight revenue decline of -0.61%, with net margin and EPS worsening, reflecting ongoing operational challenges.

Which one has the stronger fundamentals?

Pegasystems displays stronger fundamentals with consistent revenue and net income growth, favorable margins, and improving profitability metrics. Domo, despite revenue growth over the longer term, struggles with sustained negative net margins and EBIT, showing operational losses and deteriorating profitability in the most recent year. Pegasystems’ income statement presents a more favorable overall financial health.

Financial Ratios Comparison

The table below presents the most recent fiscal year-end financial ratios for Pegasystems Inc. and Domo, Inc., offering a side-by-side view of key performance, liquidity, leverage, and valuation metrics.

| Ratios | Pegasystems Inc. (2024) | Domo, Inc. (2025) |

|---|---|---|

| ROE | 16.94% | 46.23% |

| ROIC | 7.40% | 194.73% |

| P/E | 80.12 | -3.98 |

| P/B | 13.57 | -1.84 |

| Current Ratio | 1.23 | 0.56 |

| Quick Ratio | 1.23 | 0.56 |

| D/E (Debt-to-Equity) | 0.94 | -0.76 |

| Debt-to-Assets | 31.09% | 63.23% |

| Interest Coverage | 18.12 | -2.99 |

| Asset Turnover | 0.85 | 1.48 |

| Fixed Asset Turnover | 14.36 | 8.17 |

| Payout Ratio | 10.28% | 0% |

| Dividend Yield | 0.13% | 0% |

Interpretation of the Ratios

Pegasystems Inc.

Pegasystems shows a generally balanced financial profile with a slightly favorable global ratios opinion. Key strengths include a favorable return on equity (16.94%) and strong interest coverage (21.87), indicating solid profitability and manageable debt costs. However, high price-to-earnings (80.12) and price-to-book (13.57) ratios reflect potentially overvalued stock metrics. The company pays a modest dividend, with a low yield of 0.13%, suggesting limited shareholder returns but consistent payouts supported by free cash flow.

Domo, Inc.

Domo presents a mixed financial picture with a neutral global ratios opinion. It boasts favorable returns on equity (46.23%) and invested capital (194.73%), but suffers from a significant negative net margin (-25.84%) and unfavorable liquidity ratios, including a current ratio of 0.56. The company does not pay dividends, likely prioritizing reinvestment and growth, as indicated by negative free cash flow and high research and development expenses, which aligns with its early phase in business development.

Which one has the best ratios?

Pegasystems offers a more stable financial profile with balanced liquidity, profitability, and moderate valuation concerns, while Domo shows stronger returns but faces serious liquidity and profitability challenges. Given these contrasts, Pegasystems’ ratios indicate a more consistent operational foundation, whereas Domo’s metrics reflect higher risk and growth-oriented characteristics.

Strategic Positioning

This section compares the strategic positioning of Pegasystems Inc. and Domo, Inc. across Market position, Key segments, and Exposure to technological disruption:

Pegasystems Inc.

- Larger market cap of 8.9B; operates globally with diverse competitive pressures.

- Broad product mix including cloud, consulting, subscription licenses, and maintenance services driving revenues.

- Provides enterprise software platforms integrating customer engagement and automation; moderate exposure to disruption.

Domo, Inc.

- Smaller market cap of 257M; active in US, Japan, and international markets.

- Focused mainly on subscription services and professional services as business drivers.

- Cloud-based business intelligence platform centered on real-time data access and mobile management; exposure focused on cloud tech evolution.

Pegasystems Inc. vs Domo, Inc. Positioning

Pegasystems has a diversified product portfolio spanning multiple enterprise software segments, offering broader market reach. Domo concentrates on cloud BI subscriptions, reflecting a narrower but specialized focus. Pegasystems’ global presence contrasts with Domo’s more limited footprint.

Which has the best competitive advantage?

Domo shows a very favorable MOAT with strong value creation and growing ROIC, indicating durable competitive advantage. Pegasystems, while growing in profitability, has a slightly unfavorable MOAT, signaling value destruction despite improving ROIC trends.

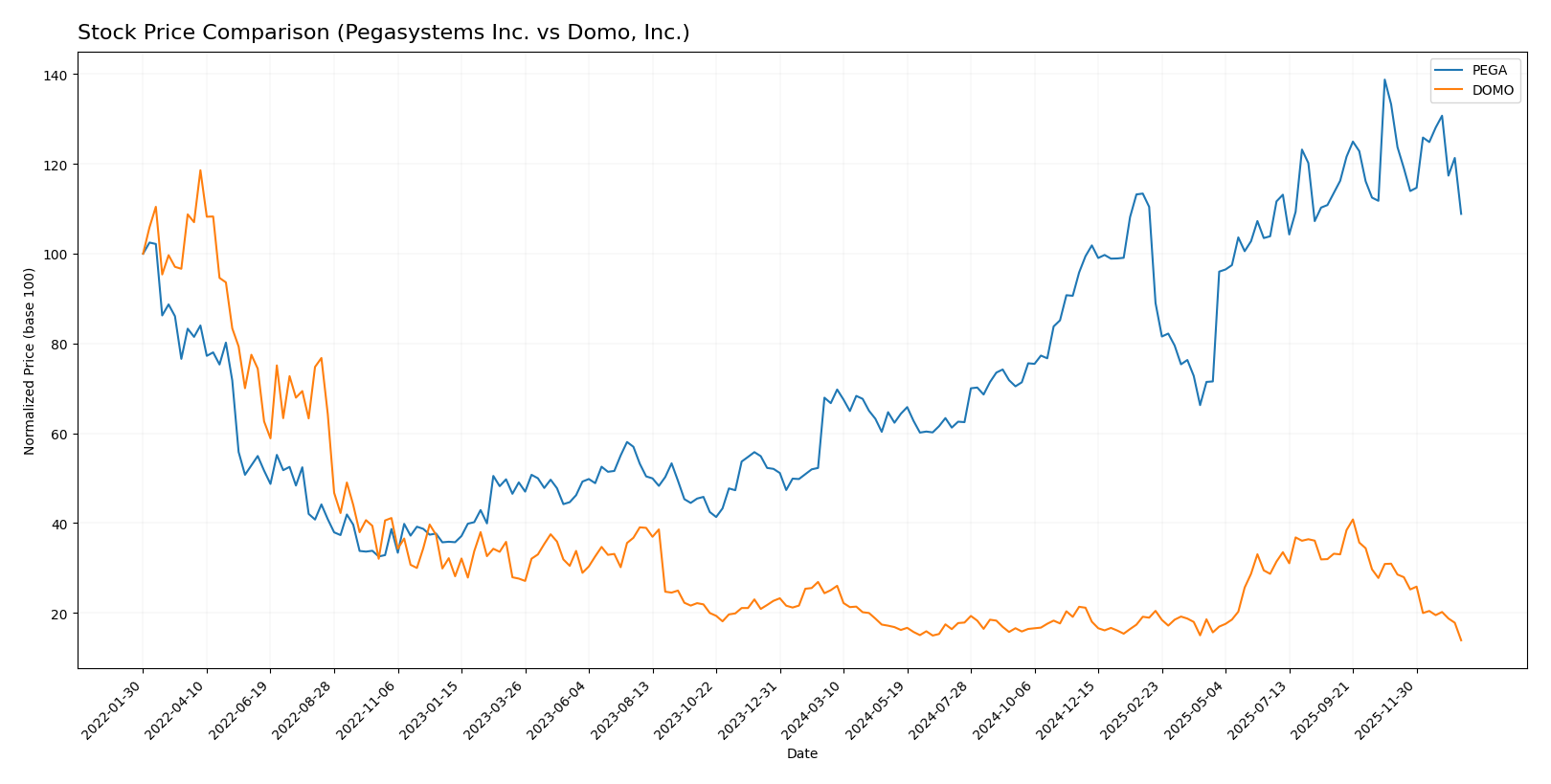

Stock Comparison

The stock price movements over the past 12 months reveal a strong bullish trend for Pegasystems Inc., contrasted by a significant bearish trend for Domo, Inc., with both showing deceleration in momentum recently.

Trend Analysis

Pegasystems Inc. (PEGA) experienced a 63.18% price increase over the past year, indicating a bullish trend with decelerating momentum and a notable price range from 28.73 to 66.27. Recent months show a slight bearish correction.

Domo, Inc. (DOMO) faced a 44.54% price decline over the same period, reflecting a bearish trend with decelerating momentum. Prices ranged between 6.15 and 18.06, with recent months showing accelerated decline.

Comparing both, PEGA outperformed DOMO significantly, delivering the highest market performance over the past 12 months despite recent downward pressure.

Target Prices

Here is the current consensus on target prices from verified analysts for Pegasystems Inc. and Domo, Inc.:

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Pegasystems Inc. | 80 | 67 | 74 |

| Domo, Inc. | 13 | 10 | 11.5 |

Analysts expect Pegasystems’ stock price to rise significantly from its current $51.99, while Domo’s consensus target of $11.5 also suggests upside from the current $6.15 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Pegasystems Inc. and Domo, Inc.:

Rating Comparison

PEGA Rating

- Rating: B+, indicating a very favorable status.

- Discounted Cash Flow Score: 3, moderate valuation.

- ROE Score: 5, very favorable return on equity.

- ROA Score: 5, very favorable asset utilization.

- Debt To Equity Score: 3, moderate financial risk.

- Overall Score: 3, moderate overall financial health.

DOMO Rating

- Rating: C, indicating a very favorable status.

- Discounted Cash Flow Score: 1, very unfavorable valuation.

- ROE Score: 5, very favorable return on equity.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 1, very unfavorable financial risk.

- Overall Score: 2, moderate overall financial health.

Which one is the best rated?

Pegasystems holds a higher rating (B+ vs. C) and scores better on discounted cash flow, ROA, and debt to equity, indicating stronger financial health compared to Domo, which has more unfavorable financial risk and valuation scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Pegasystems Inc. and Domo, Inc.:

PEGA Scores

- Altman Z-Score: 10.31, classified in safe zone, indicating very low bankruptcy risk.

- Piotroski Score: 8, considered very strong financial health and value potential.

DOMO Scores

- Altman Z-Score: -10.10, classified in distress zone, indicating high bankruptcy risk.

- Piotroski Score: 3, considered very weak financial health and value potential.

Which company has the best scores?

Pegasystems Inc. has significantly better scores, with a safe zone Altman Z-Score and a very strong Piotroski Score, compared to Domo, Inc.’s distress zone and very weak Piotroski Score. This indicates stronger financial stability and health for Pegasystems.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Pegasystems Inc. and Domo, Inc.:

Pegasystems Inc. Grades

The table below summarizes recent grades from recognized financial institutions for Pegasystems Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-10-23 |

| RBC Capital | Maintain | Outperform | 2025-10-23 |

| Barclays | Maintain | Equal Weight | 2025-10-23 |

| Rosenblatt | Maintain | Buy | 2025-10-23 |

| DA Davidson | Upgrade | Buy | 2025-10-22 |

| Rosenblatt | Maintain | Buy | 2025-10-15 |

| Rosenblatt | Maintain | Buy | 2025-07-24 |

| DA Davidson | Maintain | Neutral | 2025-07-24 |

| Wedbush | Maintain | Outperform | 2025-07-24 |

Overall, Pegasystems shows a predominantly positive grading trend with multiple “Buy” and “Outperform” ratings, indicating sustained confidence from analysts.

Domo, Inc. Grades

The table below lists recent grades from verified grading companies for Domo, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Neutral | 2025-12-05 |

| TD Cowen | Maintain | Buy | 2025-12-05 |

| Lake Street | Maintain | Hold | 2025-12-05 |

| DA Davidson | Maintain | Neutral | 2025-12-01 |

| JMP Securities | Maintain | Market Outperform | 2025-09-10 |

| DA Davidson | Maintain | Neutral | 2025-08-28 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-08-28 |

| TD Cowen | Upgrade | Buy | 2025-08-26 |

| JMP Securities | Maintain | Market Outperform | 2025-06-25 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-06-25 |

Domo’s grades indicate a mix of “Neutral,” “Hold,” and positive ratings like “Buy” and “Market Outperform,” pointing to moderate analyst support with some recent upgrades.

Which company has the best grades?

Pegasystems Inc. has received more consistent “Buy” and “Outperform” grades compared to Domo, Inc., which has a wider range including “Neutral” and “Hold” ratings. This pattern may suggest stronger analyst conviction in Pegasystems, potentially influencing investor sentiment toward greater confidence and perceived upside.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses of Pegasystems Inc. (PEGA) and Domo, Inc. (DOMO), based on the most recent financial and operational data.

| Criterion | Pegasystems Inc. (PEGA) | Domo, Inc. (DOMO) |

|---|---|---|

| Diversification | Moderate diversification with Consulting, Maintenance, Cloud, and License revenues, Pega Cloud leading at $1.13B in 2024 | Less diversified, mainly Subscription ($286M) and Professional Services ($31M) |

| Profitability | Neutral net margin (6.63%), moderate ROIC (7.4%), slightly unfavorable valuation ratios (PE 80.12) | Negative net margin (-25.84%), but very high ROIC (194.73%), mixed valuation signals |

| Innovation | Consistent growth in Pega Cloud segment, steady innovation in SaaS offerings | Strong innovation reflected in high ROIC growth, focused on subscription services |

| Global presence | Established global footprint with steady consulting and maintenance revenues | Smaller scale, less global reach, focus on cloud-based subscription market |

| Market Share | Stable with increasing cloud adoption, diverse client base | Growing market share in data platform space, but limited scale compared to PEGA |

Key takeaways: Pegasystems shows steady profitability and diversification with growing cloud revenues but faces valuation pressure. Domo demonstrates a strong competitive advantage with rapid ROIC growth and innovation, though profitability and liquidity remain concerns. Investors should weigh the balance between growth potential and financial stability.

Risk Analysis

Below is a comparison of key risks facing Pegasystems Inc. (PEGA) and Domo, Inc. (DOMO) based on the most recent data available:

| Metric | Pegasystems Inc. (PEGA) | Domo, Inc. (DOMO) |

|---|---|---|

| Market Risk | Moderate (Beta 1.08) | High (Beta 1.65) |

| Debt level | Moderate (Debt/Equity ~0.94) | High leverage concerns (Debt/Equity negative, Debt-to-Assets 63%) |

| Regulatory Risk | Moderate (US and global software markets) | Moderate (US and international presence with cloud services) |

| Operational Risk | Moderate (Established platform with steady operations) | Elevated (Smaller scale, rapid growth challenges) |

| Environmental Risk | Low (Software industry, minimal direct impact) | Low (Cloud-based software, minimal direct impact) |

| Geopolitical Risk | Moderate (Global operations, currency & trade exposure) | Moderate (International markets exposure) |

Pegasystems shows moderate market and debt risks but benefits from strong operational stability and healthy financial scores. Domo faces higher market volatility, significant leverage concerns, and financial distress indicators, increasing its investment risk. The most impactful risks are Domo’s financial instability and Pegasystems’ valuation premium.

Which Stock to Choose?

Pegasystems Inc. (PEGA) shows a favorable income statement with steady revenue growth and improving profitability, reflected in a 6.63% net margin and 16.94% ROE. Its financial ratios are slightly favorable overall, with moderate debt levels and a very favorable rating of B+. The company’s ROIC is growing but still below WACC, indicating slight value destruction despite improving profitability.

Domo, Inc. (DOMO) presents an unfavorable income profile with negative net margin (-25.84%) and declining revenues recently, though it exhibits very favorable ROE and ROIC ratios with strong value creation. However, DOMO’s financial ratios are mixed, with half unfavorable, significant debt concerns, and a very favorable rating of C but weak scores in solvency and valuation metrics.

Investors with a tolerance for risk and focus on value creation might see DOMO’s strong ROIC growth as promising, while those prioritizing stable income growth and financial health may view PEGA’s slightly favorable ratios and improving profitability as more appropriate. The choice could depend on preference for growth versus stability in portfolio composition.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Pegasystems Inc. and Domo, Inc. to enhance your investment decisions: