Home > Comparison > Technology > FICO vs DOMO

The strategic rivalry between Fair Isaac Corporation and Domo, Inc. shapes the evolving landscape of the software application sector. Fair Isaac, a mature analytics and decision management provider, contrasts with Domo’s agile, cloud-based business intelligence platform. This head-to-head highlights a clash between established scale and innovative growth models. This analysis will identify which company’s trajectory offers superior risk-adjusted potential for a diversified portfolio amid technology’s dynamic evolution.

Table of contents

Companies Overview

Fair Isaac Corporation and Domo, Inc. stand as pivotal players shaping the software application market landscape.

Fair Isaac Corporation: Analytics Pioneer in Decision Management

Fair Isaac Corporation dominates as a leader in analytic software and data management, generating revenue through advanced scoring solutions and decision management software. Its core strength lies in automating decisions across marketing, fraud detection, and financial compliance. In 2026, the company emphasizes expanding its modular FICO Platform to support versatile analytic use cases globally.

Domo, Inc.: Real-Time Business Intelligence Innovator

Domo, Inc. operates a cloud-based business intelligence platform that connects all organizational levels with real-time data. Its revenue stems from providing dynamic insights accessible via smartphones, enhancing decision-making across enterprises. The firm focuses on scaling its platform’s reach internationally while improving user engagement and system integration in 2026.

Strategic Collision: Similarities & Divergences

Both companies prioritize software solutions that enhance business decision-making but diverge in approach—Fair Isaac offers a modular, analytics-driven ecosystem, while Domo champions real-time data connectivity via the cloud. Their primary battleground is enterprise customer adoption of decision-support tools. Fair Isaac leverages established analytic rigor; Domo bets on agility and user-centric data access, defining distinct investment profiles in this sector.

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Fair Isaac Corporation (FICO) | Domo, Inc. (DOMO) |

|---|---|---|

| Revenue | 1.99B | 317M |

| Cost of Revenue | 354M | 81M |

| Operating Expenses | 712M | 295M |

| Gross Profit | 1.64B | 236M |

| EBITDA | 951M | -50M |

| EBIT | 936M | -59M |

| Interest Expense | 134M | 20M |

| Net Income | 652M | -82M |

| EPS | 26.9 | -2.13 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates with superior efficiency and sustained profitability over varying market conditions.

Fair Isaac Corporation Analysis

Fair Isaac Corporation (FICO) displays a robust revenue climb, reaching $1.99B in 2025, up 16% from the prior year. Net income surged 27% to $652M, reflecting strong operational execution. Its gross margin remains high at 82.2%, while the net margin at 32.8% signals exceptional cost control and pricing power. FICO’s EBIT margin of 47% underscores scalable profitability and momentum.

Domo, Inc. Analysis

Domo, Inc. (DOMO) posted flat revenue near $317M in 2025, down slightly from 2024. It continues to report net losses, with a negative net margin of -25.8% and EBIT margin of -18.7%, indicating ongoing challenges in managing expenses relative to sales. Although its gross margin holds at a respectable 74.4%, the company struggles to convert revenue growth into profits, showing weakening operational efficiency.

Margin Dominance vs. Growth Struggles

FICO clearly outperforms DOMO with vastly superior margins and consistent net income growth, demonstrating a durable economic moat. DOMO’s narrow top-line and persistent losses highlight structural profitability issues. For investors prioritizing stable earnings and margin strength, FICO’s profile offers a more compelling and lower-risk opportunity.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | Fair Isaac Corporation (FICO) | Domo, Inc. (DOMO) |

|---|---|---|

| ROE | -37.3% | 46.2% |

| ROIC | 52.96% | 194.7% |

| P/E | 55.6 | -4.0 |

| P/B | -20.8 | -1.8 |

| Current Ratio | 0.83 | 0.56 |

| Quick Ratio | 0.83 | 0.56 |

| D/E | -176.1% | -76.5% |

| Debt-to-Assets | 164.6% | 63.2% |

| Interest Coverage | 6.92 | -2.99 |

| Asset Turnover | 1.07 | 1.48 |

| Fixed Asset Turnover | 21.2 | 8.17 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and signaling operational efficiency and valuation strength.

Fair Isaac Corporation

FICO posts a strong net margin of 32.75% and a robust ROIC at 52.96%, indicating operational efficiency. However, a negative ROE at -37.34% and a high P/E of 55.64 suggest stretched valuation. With no dividend yield, FICO appears to reinvest heavily in R&D, supporting growth despite a weak current ratio of 0.83.

Domo, Inc.

DOMO shows a positive ROE of 46.23% and an exceptionally high ROIC of 194.73%, reflecting effective capital use. The negative net margin at -25.84% signals ongoing losses. The P/E is negative, indicating lack of earnings, and the current ratio at 0.56 flags liquidity concerns. DOMO reinvests aggressively in R&D to fuel expansion, with zero dividends.

Premium Valuation vs. Growth Risk

FICO balances operational efficiency with a premium valuation but carries profitability and liquidity challenges. DOMO’s metrics highlight high returns on invested capital despite losses and liquidity strain. Investors seeking growth at the cost of risk may lean toward DOMO, while those valuing operational safety and scale might prefer FICO’s profile.

Which one offers the Superior Shareholder Reward?

I compare Fair Isaac Corporation (FICO) and Domo, Inc. (DOMO) on shareholder distributions and buyback intensity. FICO pays zero dividends but boasts strong free cash flow (31.8/share in 2025) and a robust buyback capacity implied by healthy cash flow coverage ratios. DOMO also pays no dividends and suffers negative free cash flow (-0.48/share in 2025) with weak operating cash flow, signaling no room for buybacks. FICO’s zero payout ratio and 0% dividend yield reflect a reinvestment strategy fueling growth and shareholder value. DOMO’s losses and negative margins raise sustainability concerns. Historically, in software and data analytics, firms like FICO with strong cash flow and buyback potential offer superior total shareholder returns. I conclude FICO presents the more attractive shareholder reward in 2026, balancing capital preservation and disciplined reinvestment.

Comparative Score Analysis: The Strategic Profile

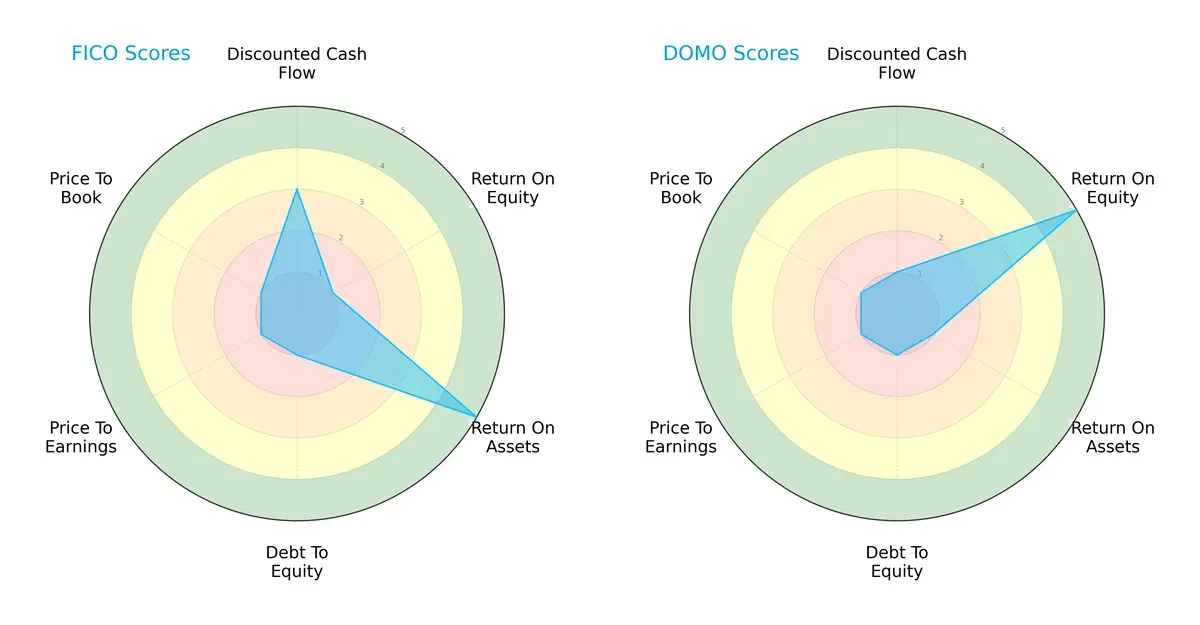

The radar chart reveals the fundamental DNA and trade-offs of Fair Isaac Corporation and Domo, Inc., highlighting their distinct financial strengths and weaknesses:

Fair Isaac excels in asset efficiency (ROA 5) and discounted cash flow (DCF 3) but struggles with equity returns (ROE 1) and carries heavy debt risks (Debt/Equity 1). Domo shines in ROE (5) but lags in asset utilization (ROA 1) and also faces debt concerns (Debt/Equity 1). Both firms suffer from weak valuation metrics (PE/PB 1). Fair Isaac shows a more balanced profile, while Domo relies heavily on its equity return strength.

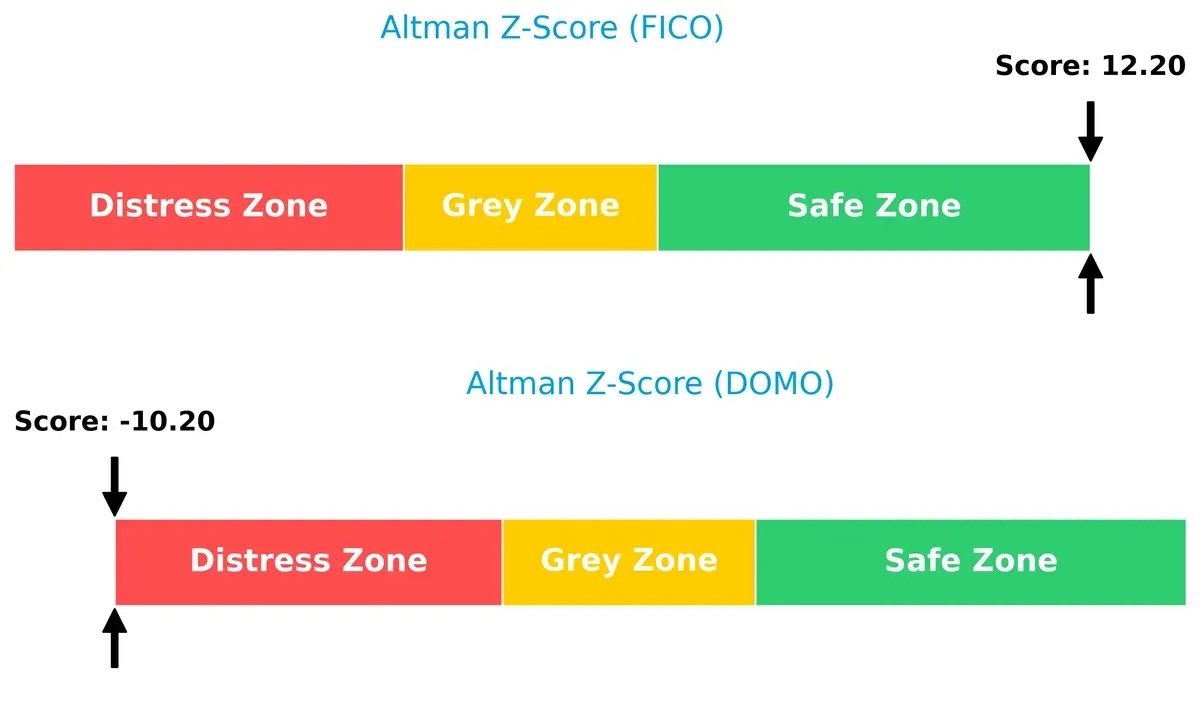

Bankruptcy Risk: Solvency Showdown

Fair Isaac’s Altman Z-Score of 12.2 signals a very safe zone, indicating strong long-term survival prospects. In stark contrast, Domo’s -10.2 places it deep in the distress zone, warning of substantial bankruptcy risk in this cycle:

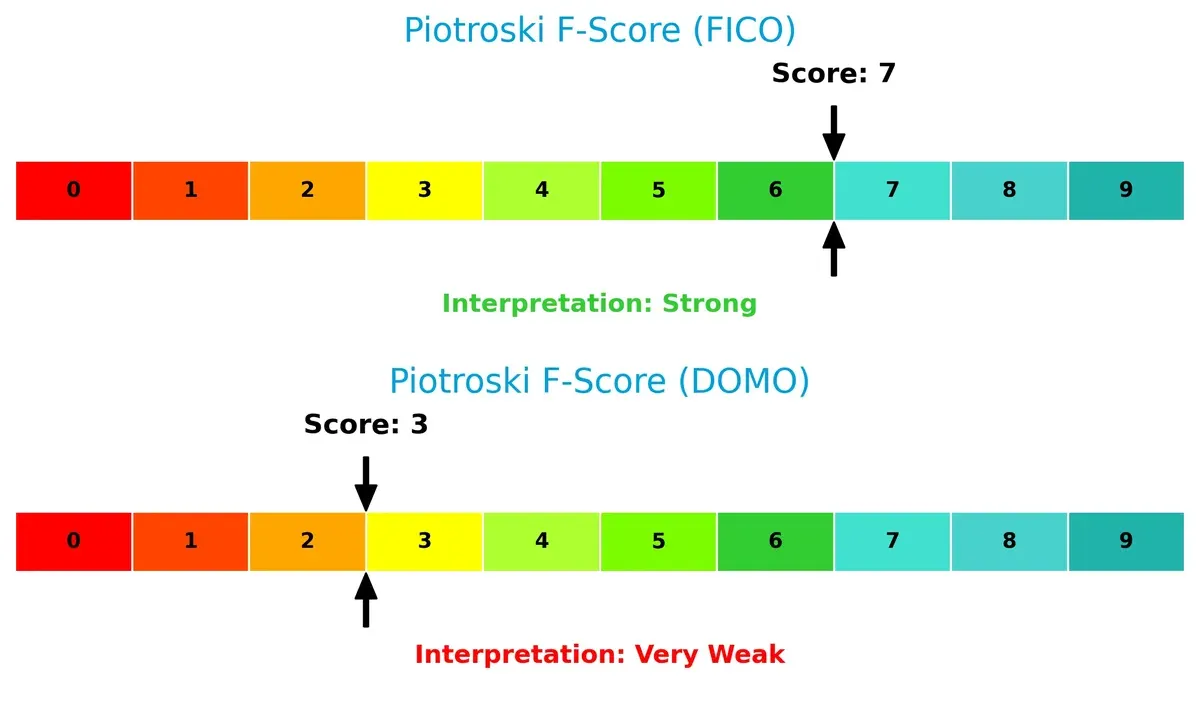

Financial Health: Quality of Operations

Fair Isaac’s Piotroski F-Score of 7 reflects a strong financial position with solid operational metrics. Domo’s score of 3 flags significant red flags, suggesting weak internal financial health and operational challenges:

How are the two companies positioned?

This section dissects the operational DNA of FICO and DOMO by comparing their revenue distribution and internal dynamics of strengths and weaknesses. The goal is to confront their economic moats and reveal which business model delivers the most resilient, sustainable competitive advantage today.

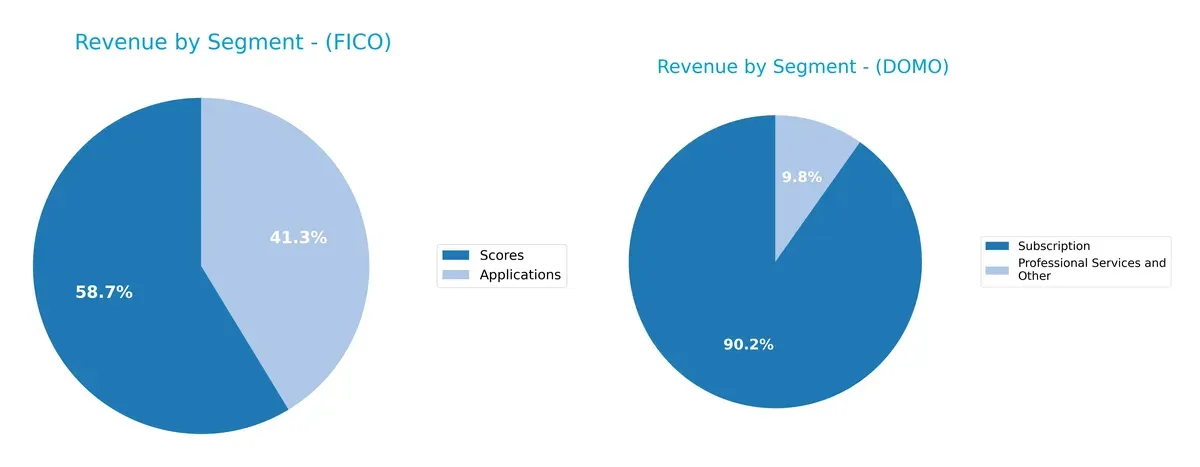

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Fair Isaac Corporation and Domo, Inc. diversify their income streams and reveals where each firm places its primary sector bets:

Fair Isaac Corporation pivots on two key segments: Scores at $1.17B and Applications/Software near $822M, showing moderate diversification. Domo, Inc. relies heavily on Subscription revenue, $286M, dwarfing its $31M Professional Services. FICO’s more balanced revenue mix suggests resilience and ecosystem lock-in, while Domo’s concentration in subscriptions signals potential growth but also concentration risk if market shifts occur.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Fair Isaac Corporation (FICO) and Domo, Inc. (DOMO):

FICO Strengths

- Strong profitability with 32.75% net margin

- High ROIC at 52.96% exceeds WACC

- Favorable asset and fixed asset turnover

- Diversified revenue streams from Scores and Applications

- Solid market presence in Americas and EMEA

DOMO Strengths

- Exceptional ROIC at 194.73%, signaling capital efficiency

- Favorable PE and PB ratios indicate valuation strength

- Higher asset turnover than FICO

- Revenue growth in Subscription services

- Strong US market focus with expanding international presence

FICO Weaknesses

- Negative ROE at -37.34%, indicating shareholder return issues

- High debt-to-assets ratio at 165% is a red flag

- Current ratio below 1 signals liquidity risk

- No dividend yield limits income for investors

- Elevated PE ratio at 55.64 suggests expensive valuation

DOMO Weaknesses

- Negative net margin of -25.84% shows profitability challenges

- Unfavorable WACC at 12.71%, increasing capital costs

- Weak liquidity with current and quick ratios at 0.56

- Negative interest coverage indicates financial stress

- High debt-to-assets ratio at 63% poses leverage risk

FICO demonstrates solid profitability and operational efficiency but faces liquidity and leverage concerns. DOMO excels in capital returns yet struggles with profitability and financial stability. Both companies must address these weaknesses to strengthen their competitive positions.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from relentless competitive erosion. Without it, sustainable advantage vanishes quickly:

Fair Isaac Corporation: Data-Driven Decision Moat

Fair Isaac dominates with high switching costs embedded in its credit scoring and decision analytics. Its 47% EBIT margin and 33% net margin prove deep profitability. Expanding AI-driven solutions in 2026 should strengthen this moat further.

Domo, Inc.: Platform Network Effects Moat

Domo leverages real-time data connectivity to lock in clients, contrasting Fair Isaac’s scoring focus. Despite negative EBIT margin, Domo’s growing ROIC signals improving capital efficiency. Scaling platform adoption and international expansion remain key growth levers.

Moat Depth Battle: Switching Costs vs. Network Effects

Fair Isaac’s entrenched switching costs yield higher margin stability and value creation, offering a wider moat. While Domo’s platform shows promise, its profitability struggles suggest a narrower moat. Fair Isaac stands better equipped to defend and expand market share in 2026.

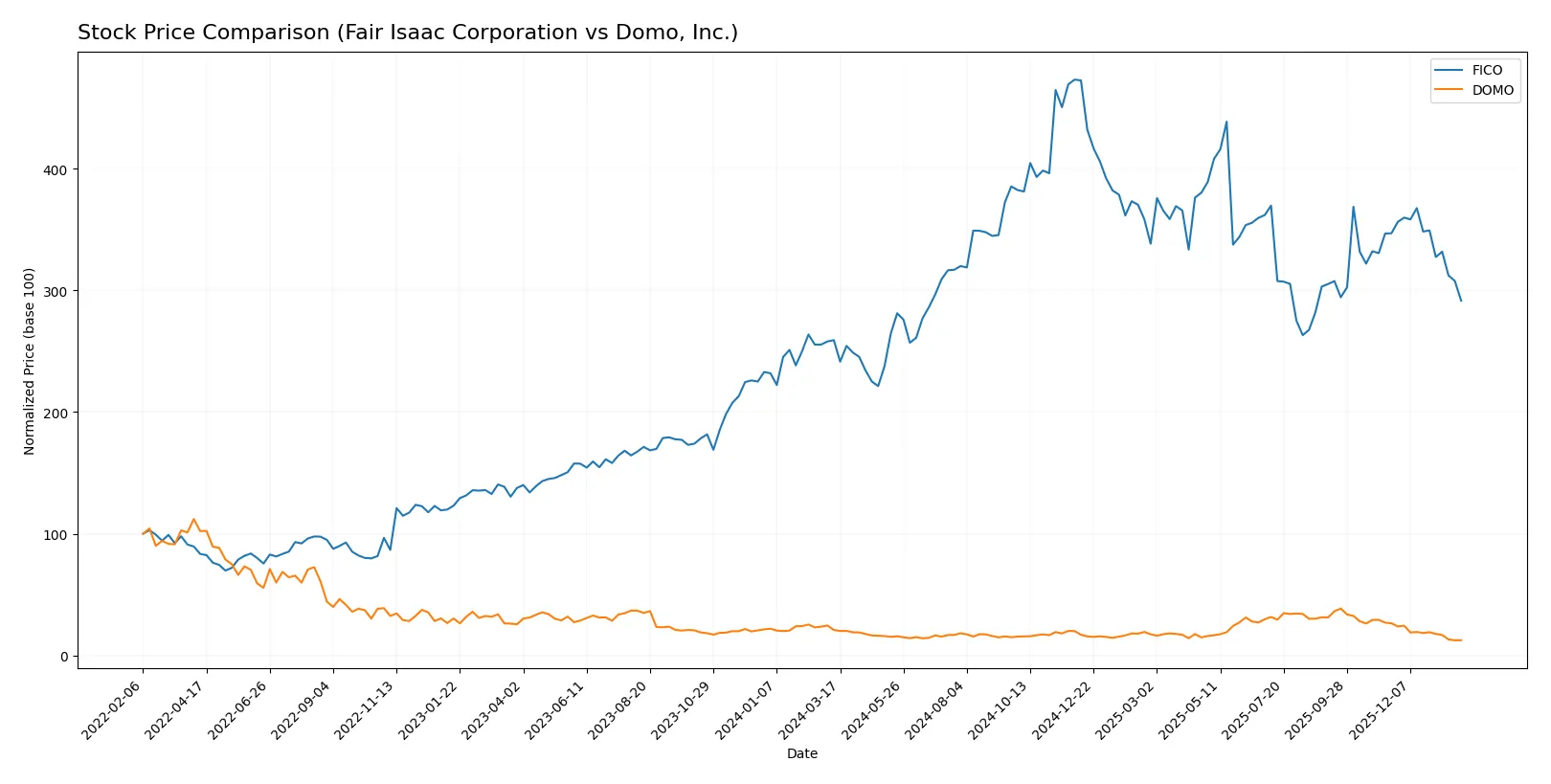

Which stock offers better returns?

Fair Isaac Corporation’s stock showed a 12.5% gain over the past year, despite recent deceleration and a short-term decline. In contrast, Domo, Inc. declined sharply by over 40%, reflecting persistent bearish pressure.

Trend Comparison

FICO’s stock rose 12.5% over the past 12 months, marking a bullish trend with decelerating momentum. It peaked near 2375 but faced a recent 16% drop from November 2025 to February 2026.

DOMO’s stock fell 40.2% across the same period, confirming a bearish trend with deceleration. Its recent decline accelerated to 52.6%, with prices bottoming near 5.8 and limited volatility.

FICO outperformed DOMO significantly, delivering the highest market returns despite recent weakness, while DOMO endured sustained and steep losses.

Target Prices

Analysts project a bullish outlook for both Fair Isaac Corporation and Domo, Inc., with target prices well above current trading levels.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Fair Isaac Corporation | 1,640 | 2,400 | 2,115 |

| Domo, Inc. | 10 | 13 | 11.5 |

Fair Isaac’s target consensus of 2,115 implies a 44% upside from its 1,463 price, signaling strong growth expectations. Domo’s 11.5 target consensus suggests nearly double its current 5.87 price, reflecting high anticipated expansion despite a smaller market cap.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Fair Isaac Corporation Grades

The table below shows recent grades from major financial institutions for Fair Isaac Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-29 |

| Jefferies | Maintain | Buy | 2026-01-16 |

| Wells Fargo | Maintain | Overweight | 2026-01-14 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Jefferies | Maintain | Buy | 2025-11-06 |

| BMO Capital | Maintain | Outperform | 2025-11-06 |

| Wells Fargo | Maintain | Overweight | 2025-10-14 |

| Barclays | Maintain | Overweight | 2025-10-02 |

| Needham | Maintain | Buy | 2025-10-02 |

Domo, Inc. Grades

The following table lists recent institutional grades for Domo, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Lake Street | Maintain | Hold | 2025-12-05 |

| DA Davidson | Maintain | Neutral | 2025-12-05 |

| TD Cowen | Maintain | Buy | 2025-12-05 |

| DA Davidson | Maintain | Neutral | 2025-12-01 |

| JMP Securities | Maintain | Market Outperform | 2025-09-10 |

| DA Davidson | Maintain | Neutral | 2025-08-28 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-08-28 |

| TD Cowen | Upgrade | Buy | 2025-08-26 |

| JMP Securities | Maintain | Market Outperform | 2025-06-25 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-06-25 |

Which company has the best grades?

Fair Isaac Corporation consistently receives strong buy and outperform ratings, showing widespread institutional confidence. Domo, Inc. has a mix including hold and neutral grades, with fewer top-tier endorsements. Investors may view Fair Isaac’s higher grades as reflecting better consensus on growth and risk.

Risks specific to each company

In the volatile 2026 market environment, these categories pinpoint the critical pressure points and systemic threats facing Fair Isaac Corporation and Domo, Inc.:

1. Market & Competition

Fair Isaac Corporation

- Established leader with strong market cap and mature product lines; faces fierce competition from larger analytics firms.

Domo, Inc.

- Smaller market cap and newer platform; struggles to scale against entrenched competitors in cloud BI space.

2. Capital Structure & Debt

Fair Isaac Corporation

- High debt-to-assets ratio (165%) signals leverage risk despite favorable interest coverage.

Domo, Inc.

- Moderate debt-to-assets (63%) but negative interest coverage signals financial stress and repayment difficulty.

3. Stock Volatility

Fair Isaac Corporation

- Beta of 1.29 indicates moderate volatility typical for tech application firms.

Domo, Inc.

- Higher beta at 1.65 shows elevated stock price swings and investor uncertainty.

4. Regulatory & Legal

Fair Isaac Corporation

- Operates globally, exposed to data privacy and financial compliance regulations.

Domo, Inc.

- International presence with cloud services exposes it to evolving cybersecurity and data sovereignty laws.

5. Supply Chain & Operations

Fair Isaac Corporation

- Software delivery relies on stable cloud infrastructure and talent retention; risks from tech disruptions.

Domo, Inc.

- Dependent on cloud service providers and continuous innovation; smaller scale limits operational resilience.

6. ESG & Climate Transition

Fair Isaac Corporation

- Larger firm under greater scrutiny to meet ESG targets; faces pressure on energy-efficient data centers.

Domo, Inc.

- Emerging company with less formal ESG reporting; potential risk if unable to meet investor ESG expectations.

7. Geopolitical Exposure

Fair Isaac Corporation

- Broad geographic footprint increases exposure to trade tensions and regulatory shifts.

Domo, Inc.

- Primarily US-focused but expanding internationally with risks from geopolitical instability affecting cloud adoption.

Which company shows a better risk-adjusted profile?

Fair Isaac’s highest risk is its heavy leverage despite strong operational metrics, while Domo’s critical risk lies in its financial distress signaled by poor liquidity and negative interest coverage. Fair Isaac’s robust Altman Z-Score (12.2, safe zone) versus Domo’s distress zone (-10.2) clearly shows a superior risk-adjusted profile. The recent data reveal Domo’s liquidity and solvency challenges as the dominant concern, underscoring Fair Isaac’s relative resilience amid competitive pressures.

Final Verdict: Which stock to choose?

Fair Isaac Corporation’s superpower lies in its durable competitive moat, demonstrated by robust ROIC well above its WACC and consistent value creation. Its operational efficiency and strong income growth stand out. The point of vigilance: a current ratio below 1 signals liquidity risks. It suits portfolios aiming for aggressive growth with tolerance for short-term balance sheet quirks.

Domo, Inc. boasts a strategic moat anchored in its impressive ROIC trajectory and high return on equity, reflecting operational leverage in a challenging environment. Its recurring revenue potential supports growth, though its financial health and liquidity ratios raise caution versus Fair Isaac. Domo fits best within GARP portfolios seeking growth balanced with risk awareness.

If you prioritize durable profitability and operational efficiency, Fair Isaac emerges as the compelling choice due to its sustained value creation and income strength. However, if you seek growth potential with a strategic moat underpinned by equity returns, Domo offers superior upside but with elevated financial risk. Both demand prudent risk management aligned with your investment horizon and risk tolerance.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Fair Isaac Corporation and Domo, Inc. to enhance your investment decisions: