In the evolving energy sector, Dominion Energy, Inc. and Oklo Inc. stand out as key players shaping the future of regulated electric utilities. Dominion, a well-established giant, operates a vast network delivering traditional and renewable energy, while Oklo pioneers innovative fission power technology with a focus on sustainability. Comparing these companies highlights contrasting strategies in energy production and innovation. This article will help you decide which company aligns best with your investment goals.

Table of contents

Companies Overview

I will begin the comparison between Dominion Energy, Inc. and Oklo Inc. by providing an overview of these two companies and their main differences.

Dominion Energy Overview

Dominion Energy, Inc. operates as a major energy producer and distributor in the US, serving millions of customers through regulated electricity and natural gas operations. Its extensive infrastructure includes 30.2GW of electric capacity, 10,700 miles of transmission lines, and 95,700 miles of gas distribution mains. Headquartered in Richmond, Virginia, Dominion focuses on regulated electric and gas markets across multiple states with a diversified asset portfolio.

Oklo Overview

Oklo Inc. is a smaller, innovative player specializing in fission power plant design and nuclear fuel recycling in the US. Founded in 2013 and based in Santa Clara, California, Oklo aims to deliver reliable, commercial-scale nuclear energy. With a lean workforce of 120 employees, the company is positioned in the regulated electric sector with a focus on advanced nuclear technology and sustainable energy solutions.

Key similarities and differences

Both companies operate within the US utilities sector and focus on regulated electric power generation. Dominion Energy is a large, diversified utility with broad geographic coverage and extensive infrastructure in traditional and renewable energy. In contrast, Oklo is a niche player specializing in nuclear fission technology with a smaller scale and innovative approach. The contrast lies in Dominion’s established presence and wide asset base versus Oklo’s tech-driven, specialized market focus.

Income Statement Comparison

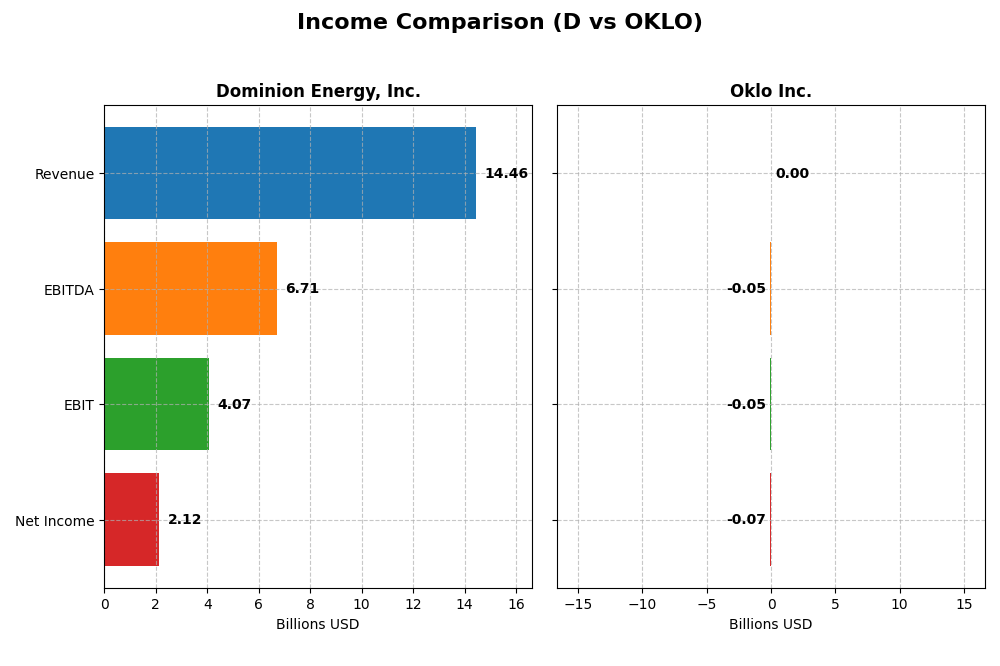

The table below presents a side-by-side comparison of key income statement metrics for Dominion Energy, Inc. and Oklo Inc. for the fiscal year 2024.

| Metric | Dominion Energy, Inc. | Oklo Inc. |

|---|---|---|

| Market Cap | 49.5B | 16.5B |

| Revenue | 14.5B | 0 |

| EBITDA | 6.7B | -52.5M |

| EBIT | 4.1B | -52.8M |

| Net Income | 2.1B | -73.6M |

| EPS | 2.44 | -0.74 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Dominion Energy, Inc.

Dominion Energy’s revenue exhibited modest growth from 2020 to 2024, reaching $14.46B in 2024 with a slight 0.46% increase year-over-year. Net income surged significantly over the period, hitting $2.12B in 2024, supported by improving net margins at 14.69%. The latest year showed EBIT growth of 10.15% and EPS growth of 6.55%, reflecting enhanced profitability despite stable revenue.

Oklo Inc.

Oklo Inc. recorded zero revenue throughout 2021-2024, resulting in persistent net losses, with net income dropping to -$73.6M in 2024. Margins remain unfavorable due to lack of sales and ongoing research and administrative expenses. The company’s EBIT declined 183.33% in 2024, and EPS fell by 59.38%, underscoring continued operating challenges and absence of profitability.

Which one has the stronger fundamentals?

Dominion Energy demonstrates stronger fundamentals overall, with favorable gross, EBIT, and net margins alongside steady revenue and significant net income growth. Conversely, Oklo struggles with zero revenue, consistent net losses, and deteriorating margins. Dominion’s positive income trends contrast with Oklo’s unfavorable financial performance, indicating a more robust earnings profile for Dominion Energy.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Dominion Energy, Inc. (D) and Oklo Inc. (OKLO) based on their most recent fiscal year data, 2024.

| Ratios | Dominion Energy, Inc. (D) | Oklo Inc. (OKLO) |

|---|---|---|

| ROE | 7.79% | -29.35% |

| ROIC | 2.86% | -19.23% |

| P/E | 21.28 | -28.52 |

| P/B | 1.66 | 8.37 |

| Current Ratio | 0.71 | 43.47 |

| Quick Ratio | 0.52 | 43.47 |

| D/E | 1.53 | 0.0051 |

| Debt-to-Assets | 40.77% | 0.46% |

| Interest Coverage | 1.72 | 0 |

| Asset Turnover | 0.14 | 0 |

| Fixed Asset Turnover | 0.21 | 0 |

| Payout Ratio | 105.41% | 0 |

| Dividend Yield | 4.95% | 0 |

Interpretation of the Ratios

Dominion Energy, Inc.

Dominion Energy shows a mixed ratio profile with a favorable net margin of 14.69% but unfavorable returns on equity (7.79%) and invested capital (2.86%). Its liquidity ratios are weak, with a current ratio of 0.71 and a quick ratio of 0.52, raising potential short-term solvency concerns. The company delivers a solid dividend yield of 4.95%, supported by a balanced payout, though some financial leverage ratios remain unfavorable.

Oklo Inc.

Oklo Inc. exhibits predominantly unfavorable ratios, including a net margin of 0% and deeply negative returns on equity (-29.35%) and invested capital (-19.23%), reflecting operational challenges. Liquidity appears strong with a very high current and quick ratio of 43.47, while debt levels are minimal with a debt to equity of 0.01. Oklo does not pay dividends, likely due to its high-growth phase and reinvestment focus.

Which one has the best ratios?

Dominion Energy presents a slightly unfavorable overall ratio profile but benefits from positive profitability and dividend yield metrics. Oklo Inc. has a more unfavorable ratio set, with significant losses and no dividends, though it holds a strong liquidity and low debt position. Based solely on these ratios, Dominion Energy’s financials appear comparatively more stable.

Strategic Positioning

This section compares the strategic positioning of Dominion Energy, Inc. and Oklo Inc., including Market position, Key segments, and disruption:

Dominion Energy, Inc.

- Large regulated electric utility with 49.5B market cap and diverse competitive pressures

- Operates multiple segments: Virginia and South Carolina electricity, gas distribution, contracted renewable energy

- Exposure to regulated energy infrastructure; limited info on technological disruption

Oklo Inc.

- Smaller regulated electric company with 16.5B market cap, focused on niche nuclear power

- Designs and develops fission power plants and used nuclear fuel recycling services

- Focused on innovative nuclear technology, facing risks from emerging nuclear innovations

Dominion Energy, Inc. vs Oklo Inc. Positioning

Dominion Energy has a diversified portfolio across regulated electricity and gas distribution, providing stable revenues from multiple regions. Oklo is concentrated on advanced fission power plants and recycling, involving higher technological risk and niche market exposure.

Which has the best competitive advantage?

Dominion Energy’s moat is slightly unfavorable but improving with growing ROIC, indicating some value creation potential. Oklo faces a very unfavorable moat with declining ROIC, signaling ongoing value destruction and weaker competitive advantage.

Stock Comparison

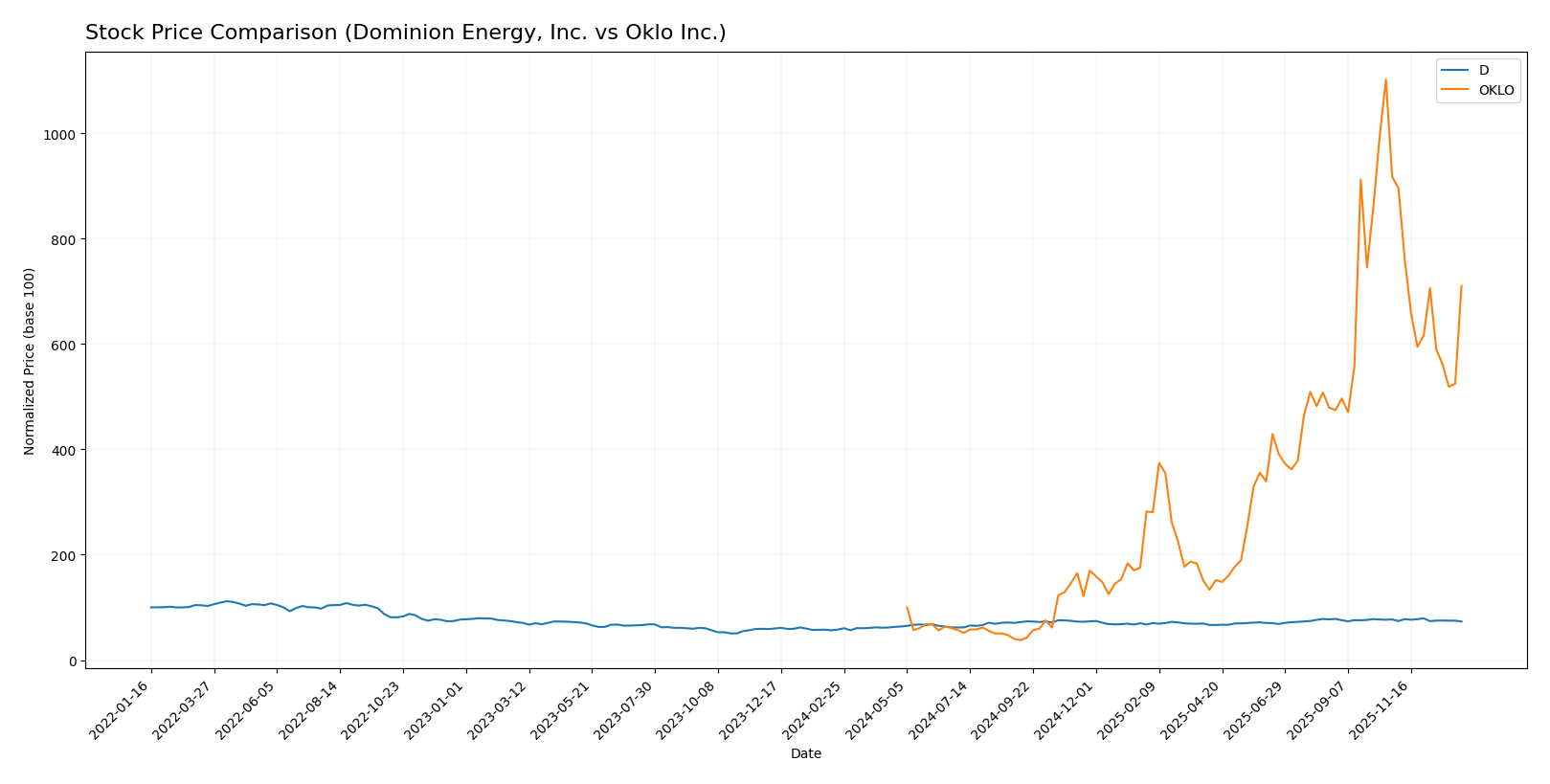

The stock price movements of Dominion Energy, Inc. and Oklo Inc. over the past 12 months reveal contrasting dynamics, with both experiencing notable gains followed by recent downward pressure in trading activity.

Trend Analysis

Dominion Energy, Inc. showed a bullish trend over the past year with a 26.43% price increase, accompanied by decelerating momentum and moderate volatility (4.03 std deviation). Recent months indicate a slight bearish correction of -5.04%.

Oklo Inc. demonstrated a strong bullish trend over the year, surging 610.11% with high volatility (39.02 std deviation) and decelerating acceleration. However, recent trading saw a sharper decline of -22.59%, reflecting increased selling pressure.

Comparing the two, Oklo Inc. delivered substantially higher market performance over the year despite recent losses, outperforming Dominion Energy by a wide margin in total price appreciation.

Target Prices

The current analyst consensus suggests a positive outlook for both Dominion Energy, Inc. and Oklo Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Dominion Energy, Inc. | 70 | 63 | 66 |

| Oklo Inc. | 150 | 95 | 125.67 |

Analysts expect Dominion Energy’s stock to rise moderately from its current $57.98 price, while Oklo’s consensus target implies significant upside from $105.31, reflecting growth potential in nuclear energy.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Dominion Energy, Inc. and Oklo Inc.:

Rating Comparison

D Rating

- Rating: Both companies hold a C+ rating classified as Very Favorable.

- Discounted Cash Flow Score: D scores 4, indicating a favorable valuation.

- ROE Score: D scores 3, showing moderate efficiency in generating equity profit.

- ROA Score: Both D and OKLO score 1, showing very unfavorable asset utilization.

- Debt To Equity Score: D scores 3, reflecting moderate financial risk.

- Overall Score: Both companies have an overall score of 2, rated moderate.

OKLO Rating

- Rating: Both companies hold a C+ rating classified as Very Favorable.

- Discounted Cash Flow Score: OKLO scores 3, indicating a moderate valuation.

- ROE Score: OKLO scores 1, reflecting very unfavorable efficiency in equity use.

- ROA Score: Both D and OKLO score 1, showing very unfavorable asset utilization.

- Debt To Equity Score: OKLO scores 5, indicating very favorable financial risk.

- Overall Score: Both companies have an overall score of 2, rated moderate.

Which one is the best rated?

Both Dominion Energy and Oklo share the same overall rating of C+ and an identical overall score of 2. Dominion Energy scores higher in discounted cash flow and return on equity, while Oklo has a superior debt-to-equity score. Thus, neither company is clearly better rated across all metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

Dominion Energy, Inc. Scores

- Altman Z-Score: Unavailable, no data provided.

- Piotroski Score: 7, classified as strong.

Oklo Inc. Scores

- Altman Z-Score: 339.4, indicating a safe zone.

- Piotroski Score: 2, classified as very weak.

Which company has the best scores?

Based strictly on the provided data, Dominion Energy shows a strong Piotroski Score of 7, while Oklo has a very weak Piotroski Score of 2 but a very high Altman Z-Score indicating safety. Dominion Energy’s Altman Z-Score is unavailable, limiting full comparison.

Grades Comparison

Here is the grades comparison for Dominion Energy, Inc. and Oklo Inc.:

Dominion Energy, Inc. Grades

The following table shows recent grades from reputable financial institutions for Dominion Energy, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-12-17 |

| JP Morgan | Maintain | Underweight | 2025-12-11 |

| BMO Capital | Maintain | Market Perform | 2025-11-03 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-22 |

| Barclays | Maintain | Overweight | 2025-10-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-09-25 |

| JP Morgan | Maintain | Underweight | 2025-08-21 |

| JP Morgan | Maintain | Underweight | 2025-07-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-06-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-05-22 |

Dominion Energy’s ratings generally cluster around “Equal Weight” to “Overweight,” with some divergence including “Underweight” from JP Morgan, indicating a mixed but mostly neutral to moderately positive outlook.

Oklo Inc. Grades

The following table shows recent grades from reputable financial institutions for Oklo Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Seaport Global | Upgrade | Buy | 2025-12-08 |

| UBS | Maintain | Neutral | 2025-12-03 |

| B of A Securities | Maintain | Neutral | 2025-11-12 |

| B. Riley Securities | Maintain | Buy | 2025-11-12 |

| Wedbush | Maintain | Outperform | 2025-11-12 |

| B of A Securities | Downgrade | Neutral | 2025-09-30 |

| Seaport Global | Downgrade | Neutral | 2025-09-23 |

| Wedbush | Maintain | Outperform | 2025-09-22 |

| Wedbush | Maintain | Outperform | 2025-08-14 |

| Wedbush | Maintain | Outperform | 2025-08-12 |

Oklo’s grades skew more positively, with multiple “Outperform” and “Buy” ratings, despite some recent neutral downgrades, indicating a generally bullish assessment from analysts.

Which company has the best grades?

Oklo Inc. has received generally more favorable grades than Dominion Energy, with several “Buy” and “Outperform” ratings, while Dominion Energy’s consensus and grades are mostly “Hold” or “Equal Weight.” This distinction may influence investor sentiment and risk appetite differently between the two companies.

Strengths and Weaknesses

The table below compares key strengths and weaknesses of Dominion Energy, Inc. (D) and Oklo Inc. (OKLO) based on the latest financial and operational data.

| Criterion | Dominion Energy, Inc. (D) | Oklo Inc. (OKLO) |

|---|---|---|

| Diversification | Strong revenue streams across energy generation, distribution, and contracted energy (~$15B total in 2024) | Limited diversification, early-stage with no significant revenue streams |

| Profitability | Moderate net margin (14.7%) but ROIC below WACC indicating slight value destruction | Negative profitability metrics; ROIC and net margin sharply negative |

| Innovation | Stable but traditional energy player, moderate innovation in renewables | High innovation potential in advanced nuclear technology but unproven profitability |

| Global presence | Primarily U.S. focused with strong regional market share | Emerging company, limited geographic footprint |

| Market Share | Significant market share in Virginia and South Carolina energy markets | Negligible market share due to early development stage |

Key takeaways: Dominion Energy shows stable revenue diversification and moderate profitability with improving ROIC trends despite some value destruction. Oklo, while innovative with potential in nuclear energy, faces significant financial challenges and negative profitability, making it a higher risk investment at this stage.

Risk Analysis

Below is a risk comparison table for Dominion Energy, Inc. and Oklo Inc. based on the most recent 2024 data:

| Metric | Dominion Energy, Inc. (D) | Oklo Inc. (OKLO) |

|---|---|---|

| Market Risk | Moderate (Beta 0.699) | Moderate (Beta 0.773) |

| Debt Level | High (Debt-to-Equity 1.53, neutral) | Very Low (Debt-to-Equity 0.01, favorable) |

| Regulatory Risk | Elevated due to energy regulations | High, nuclear industry sensitive |

| Operational Risk | Moderate, large infrastructure | High, early-stage nuclear tech |

| Environmental Risk | Significant, fossil fuel and gas operations | Moderate, nuclear waste concerns |

| Geopolitical Risk | Low to moderate, US-focused | Low to moderate, US-focused |

Dominion Energy carries substantial debt and faces significant environmental and regulatory risks typical of utilities reliant on fossil fuels and gas. Oklo, while low on debt, operates in the highly regulated and technically complex nuclear sector, posing high operational and regulatory risk. Investors should weigh Dominion’s financial stability against Oklo’s technology and regulatory uncertainties.

Which Stock to Choose?

Dominion Energy, Inc. (D) shows a slightly unfavorable financial profile with a growing income and profitability trend. Its net margin stands favorable at 14.69%, though return on equity and invested capital are less strong. Debt levels and liquidity ratios appear challenging, while the overall rating is very favorable.

Oklo Inc. (OKLO) presents an unfavorable income evolution with negative profitability and declining returns on assets and equity. Despite a very favorable rating on debt management, its current ratio is unusually high, signaling potential liquidity concerns. The global financial ratios and income statement evaluations are mostly unfavorable.

Investors focused on stability and income might find Dominion Energy’s improving profitability and moderate rating more aligned with their profile. Conversely, those with a tolerance for higher risk and seeking growth opportunities could interpret Oklo’s high stock price appreciation and debt position as potential, though caution is warranted given its unfavorable profitability and value metrics.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Dominion Energy, Inc. and Oklo Inc. to enhance your investment decisions: