Unity Software Inc. and DocuSign, Inc. are two leading players in the application software industry, each driving innovation in distinct yet overlapping markets. Unity excels in real-time 3D content creation for gaming and virtual experiences, while DocuSign specializes in digital transaction management and e-signature solutions. This comparison explores their market positions and innovation strategies to help you identify which company offers the most compelling investment opportunity. Let’s dive into their strengths and potential.

Table of contents

Companies Overview

I will begin the comparison between Unity Software Inc. and DocuSign, Inc. by providing an overview of these two companies and their main differences.

Unity Software Inc. Overview

Unity Software Inc. operates a platform for creating and managing interactive real-time 2D and 3D content across multiple devices, including mobile, PC, consoles, and AR/VR. Its mission focuses on enabling developers, artists, and designers to build and monetize immersive experiences. Unity is positioned as a leading player in application software, with a market cap of $17.5B and global reach spanning multiple countries.

DocuSign, Inc. Overview

DocuSign, Inc. provides electronic signature and agreement cloud solutions that streamline digital transaction management. Its offerings include AI-driven contract lifecycle management and industry-specific cloud services for sectors like real estate and government. DocuSign serves enterprises, commercial, and small businesses globally, with a market cap of $11.4B and a strong presence in software applications.

Key similarities and differences

Both companies operate within the technology sector specializing in software applications and are headquartered in San Francisco. Unity focuses on interactive content creation tools, while DocuSign emphasizes digital agreement workflows and contract management. Unity’s market cap exceeds DocuSign’s, reflecting differences in scale and product scope. Additionally, Unity serves creative developers, whereas DocuSign targets business process automation across various industries.

Income Statement Comparison

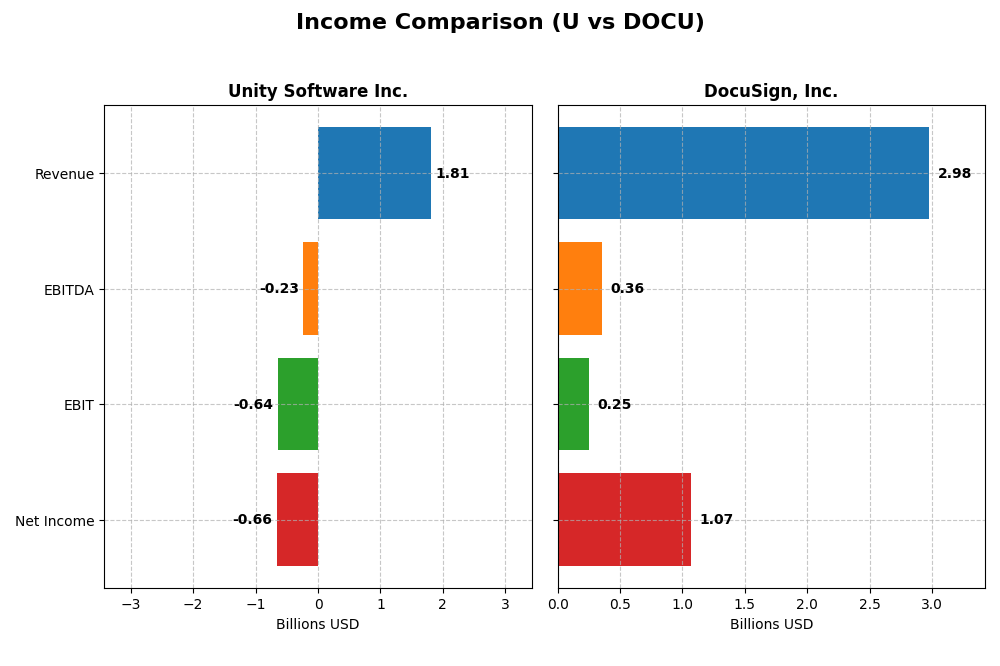

Below is the income statement comparison for Unity Software Inc. and DocuSign, Inc. for their most recent fiscal year, highlighting key financial metrics.

| Metric | Unity Software Inc. | DocuSign, Inc. |

|---|---|---|

| Market Cap | 17.5B | 11.4B |

| Revenue | 1.81B | 2.98B |

| EBITDA | -235M | 357M |

| EBIT | -644M | 249M |

| Net Income | -664M | 1.07B |

| EPS | -1.68 | 5.23 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Unity Software Inc.

Unity Software’s revenue increased significantly from 2020 to 2023 but declined by 17.1% in 2024, with net income consistently negative throughout the period. Gross margins remained strong at 73.48%, yet EBIT and net margins stayed unfavorable, reflecting ongoing operating losses. The 2024 results show some EBIT improvement but continued net income losses, indicating persistent profitability challenges.

DocuSign, Inc.

DocuSign demonstrated steady revenue growth over 2021-2025, with a moderate 7.78% increase in 2025. Gross margin was high at 79.12%, with EBIT margin neutral and net margin favorable at 35.87%. The latest year saw strong growth in EBIT, net margin, and EPS, highlighting improving profitability and operational efficiency after previous losses.

Which one has the stronger fundamentals?

DocuSign exhibits stronger fundamentals, with consistent revenue growth, positive net income, and favorable margin trends, particularly in the most recent year. Unity Software shows top-line growth over the longer term but persistent net losses and unfavorable margins. DocuSign’s financial health and profitability metrics suggest a more robust income statement profile.

Financial Ratios Comparison

The table below compares key financial ratios for Unity Software Inc. and DocuSign, Inc. based on their most recent fiscal year data, providing insight into profitability, liquidity, leverage, and efficiency.

| Ratios | Unity Software Inc. (2024) | DocuSign, Inc. (2025) |

|---|---|---|

| ROE | -20.8% | 53.3% |

| ROIC | -12.8% | 9.1% |

| P/E | -13.4 | 18.5 |

| P/B | 2.79 | 9.87 |

| Current Ratio | 2.50 | 0.81 |

| Quick Ratio | 2.50 | 0.81 |

| D/E | 0.74 | 0.06 |

| Debt-to-Assets | 34.9% | 3.1% |

| Interest Coverage | -32.1 | 129.0 |

| Asset Turnover | 0.27 | 0.74 |

| Fixed Asset Turnover | 18.3 | 7.28 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Unity Software Inc.

Unity Software shows several unfavorable ratios including a negative net margin of -36.63% and a return on equity at -20.81%, indicating profitability and efficiency challenges. The company has a strong current ratio of 2.5, reflecting good short-term liquidity. Unity does not pay dividends, likely due to negative earnings and a focus on reinvestment, with no share buyback programs noted.

DocuSign, Inc.

DocuSign presents mostly favorable ratios, including a positive net margin of 35.87% and a high return on equity of 53.32%, signaling strong profitability. The company maintains low debt levels with a debt-to-assets ratio of 3.1%. DocuSign also does not pay dividends, which may reflect reinvestment priorities or growth strategy, as no dividend yield or buybacks are reported.

Which one has the best ratios?

DocuSign exhibits a stronger overall financial profile with more favorable profitability and leverage ratios compared to Unity Software. Unity faces significant profitability and efficiency weaknesses despite solid liquidity, while DocuSign maintains healthy margins and low leverage, pointing to a slightly favorable ratio evaluation overall.

Strategic Positioning

This section compares the strategic positioning of Unity Software Inc. and DocuSign, Inc. regarding Market position, Key segments, and Exposure to technological disruption:

Unity Software Inc.

- Operates in real-time 3D content platform, facing competitive pressure in software applications.

- Key segments include Create Solutions and Operate Solutions driving revenues from interactive content.

- Exposure to disruption via evolving 3D content technology and real-time interactive platforms.

DocuSign, Inc.

- Provides electronic signature software with competitive pressure in digital agreement management.

- Key segments are Subscription and Circulation, plus Professional Services driving contract management.

- Exposure to disruption through AI-driven contract lifecycle management and digital signature innovations.

Unity Software Inc. vs DocuSign, Inc. Positioning

Unity focuses on diversified real-time 3D content creation and operation solutions, while DocuSign concentrates on digital agreement and contract management. Unity’s broad platform contrasts with DocuSign’s specialized cloud-based e-signature services.

Which has the best competitive advantage?

DocuSign exhibits a slightly favorable moat with growing ROIC, indicating improving profitability, whereas Unity shows a very unfavorable moat with declining ROIC, signaling value destruction and weaker competitive positioning.

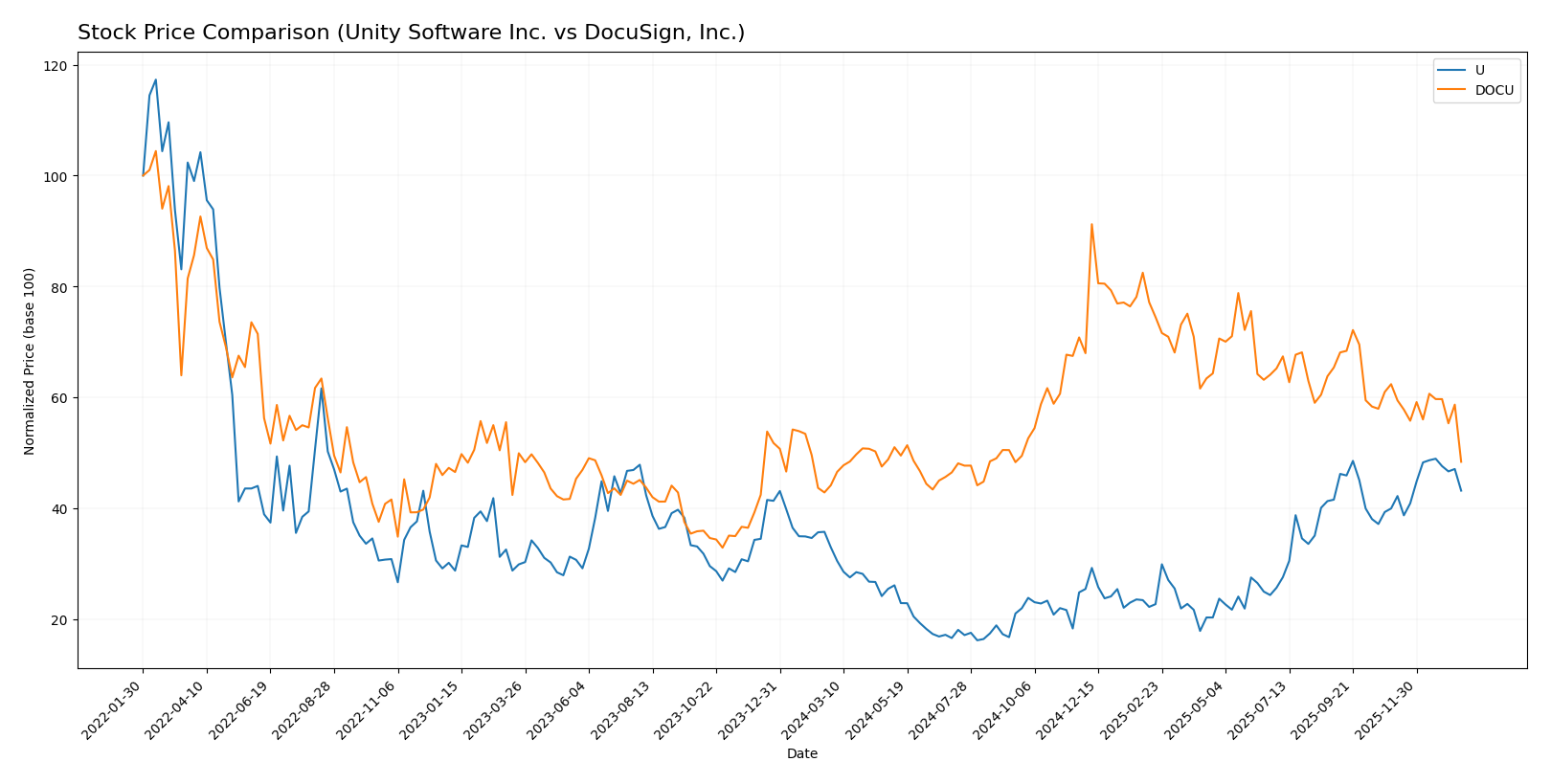

Stock Comparison

The past year has seen Unity Software Inc. (U) exhibit a strong bullish trend with notable acceleration, while DocuSign, Inc. (DOCU) experienced a milder bullish trajectory overall but recent deceleration and a sharp decline in the last months.

Trend Analysis

Unity Software Inc. displayed a 31.0% price increase over the past 12 months, marking a bullish trend with acceleration. The stock fluctuated between 15.32 and 46.42, showing moderate volatility with a standard deviation of 9.04.

DocuSign, Inc. recorded a 9.63% price rise over the same period, indicating a bullish trend but with deceleration. The price ranged from 50.84 to 106.99, accompanied by higher volatility at a 12.98 standard deviation.

Comparing the two, Unity Software has delivered the highest market performance over the year, outperforming DocuSign both in price appreciation and recent buyer dominance.

Target Prices

The current analyst consensus provides a clear outlook on target prices for Unity Software Inc. and DocuSign, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Unity Software Inc. | 60 | 39 | 50.98 |

| DocuSign, Inc. | 88 | 70 | 76.86 |

Analysts expect Unity’s stock to appreciate from its current price of $40.95 toward the consensus target of $50.98, while DocuSign’s consensus target of $76.86 is significantly above its current price of $56.71, indicating potential upside.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Unity Software Inc. and DocuSign, Inc.:

Rating Comparison

Unity Software Inc. Rating

- Rating: D+ indicating a very favorable overall rating status.

- Discounted Cash Flow Score: 1, very unfavorable, suggesting low valuation.

- ROE Score: 1, very unfavorable, showing weak equity profitability.

- ROA Score: 1, very unfavorable, indicating poor asset utilization.

- Debt To Equity Score: 1, very unfavorable, implying high financial risk.

- Overall Score: 1, very unfavorable, representing weak overall financials.

DocuSign, Inc. Rating

- Rating: B+ reflecting a very favorable overall rating status.

- Discounted Cash Flow Score: 5, very favorable, indicating strong value.

- ROE Score: 4, favorable, reflecting efficient profit generation.

- ROA Score: 4, favorable, showing effective asset use.

- Debt To Equity Score: 3, moderate, suggesting balanced financial risk.

- Overall Score: 3, moderate, reflecting fairly solid financial standing.

Which one is the best rated?

Based on the provided data, DocuSign holds a better rating with a B+ and higher scores in discounted cash flow, ROE, ROA, debt-to-equity, and overall score. Unity’s ratings and scores are uniformly very unfavorable, placing DocuSign as the stronger rated company.

Scores Comparison

The comparison of the Altman Z-Score and Piotroski Score for Unity Software Inc. and DocuSign, Inc. is as follows:

Unity Software Inc. Scores

- Altman Z-Score: 2.93, placing it in the grey zone, indicating moderate bankruptcy risk.

- Piotroski Score: 4, categorized as average financial strength.

DocuSign, Inc. Scores

- Altman Z-Score: 4.43, placing it in the safe zone, indicating low bankruptcy risk.

- Piotroski Score: 5, also categorized as average financial strength.

Which company has the best scores?

DocuSign has a higher Altman Z-Score, indicating stronger financial stability with low bankruptcy risk. Both companies have average Piotroski Scores, with DocuSign slightly ahead. Thus, DocuSign shows somewhat better scores based on this data.

Grades Comparison

Here is a detailed comparison of the most recent grades assigned to Unity Software Inc. and DocuSign, Inc.:

Unity Software Inc. Grades

The following table shows recent grades from reputable financial institutions for Unity Software Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-01-13 |

| Goldman Sachs | Maintain | Neutral | 2026-01-13 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Piper Sandler | Upgrade | Overweight | 2025-12-11 |

| BTIG | Upgrade | Buy | 2025-12-11 |

| Wells Fargo | Upgrade | Overweight | 2025-12-05 |

| Arete Research | Upgrade | Buy | 2025-12-01 |

| Citigroup | Maintain | Buy | 2025-11-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

Unity Software Inc. has seen mostly upgrades and maintains a strong buy/overweight consensus, reflecting positive analyst sentiment.

DocuSign, Inc. Grades

The following table shows the most recent grades from major grading firms for DocuSign, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Evercore ISI Group | Maintain | In Line | 2025-12-05 |

| UBS | Maintain | Neutral | 2025-12-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-05 |

| Piper Sandler | Maintain | Neutral | 2025-12-05 |

| RBC Capital | Maintain | Sector Perform | 2025-12-05 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

| Needham | Maintain | Hold | 2025-12-05 |

| Baird | Maintain | Neutral | 2025-12-05 |

DocuSign, Inc. maintains a neutral to hold consensus, indicating a generally cautious or balanced outlook from analysts.

Which company has the best grades?

Unity Software Inc. has received predominantly buy and overweight grades, suggesting stronger analyst confidence compared to DocuSign, Inc., which holds mainly neutral and hold ratings. This divergence could influence investor expectations regarding growth and risk profiles.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of Unity Software Inc. (U) and DocuSign, Inc. (DOCU) based on the latest financial and strategic data from 2024-2025.

| Criterion | Unity Software Inc. (U) | DocuSign, Inc. (DOCU) |

|---|---|---|

| Diversification | Moderate diversification with Create and Operate Solutions revenue streams, but reliance on Operate Solutions (USD 1.2B in 2024) | Highly focused on Subscription and Circulation (USD 2.9B in 2025) with minor Professional Services |

| Profitability | Negative net margin (-36.63%) and ROIC (-12.78%), value destroying with declining profitability | Strong profitability with 35.87% net margin and positive ROIC (9.09%), growing profitability trend |

| Innovation | High fixed asset turnover (18.35) indicating efficient asset use, but overall declining economic moat | Continued innovation driving growing ROIC and competitive positioning, though PB ratio is elevated (9.87) |

| Global presence | Solid presence in gaming and software markets, but financials under pressure and ROIC below WACC | Established global SaaS footprint with steady subscription growth and improving financial health |

| Market Share | Market share challenged by financial struggles and declining ROIC | Growing market share supported by strong subscription revenue and operational efficiency |

Key takeaways: DocuSign shows stronger profitability, a growing economic moat, and operational efficiency, making it a slightly favorable investment. Unity Software faces profitability challenges and a declining ROIC, indicating caution despite its diversified product lines.

Risk Analysis

Below is a comparative risk assessment table for Unity Software Inc. (U) and DocuSign, Inc. (DOCU) based on the most recent fiscal data.

| Metric | Unity Software Inc. (U) | DocuSign, Inc. (DOCU) |

|---|---|---|

| Market Risk | High beta (2.05) indicates high volatility | Moderate beta (0.99) indicates average market sensitivity |

| Debt level | Moderate debt-to-equity (0.74), debt to assets 34.94% | Low debt-to-equity (0.06), debt to assets 3.1% |

| Regulatory Risk | Moderate, operating in multiple countries with evolving software regulations | Moderate, global presence with compliance demands in digital signatures |

| Operational Risk | Negative margins and returns suggest operational inefficiency | Strong profitability and returns indicate lower operational risk |

| Environmental Risk | Low, standard for software industry | Low, standard for software industry |

| Geopolitical Risk | Exposure to global markets but limited hardware reliance | Exposure to global markets, especially US federal contracts |

Unity’s most pressing risks are its operational inefficiencies and market volatility, reflected in its negative profitability and high beta. DocuSign benefits from strong financial health and lower debt, but its valuation metrics suggest caution. Both face moderate regulatory and geopolitical risks inherent in their global technology operations.

Which Stock to Choose?

Unity Software Inc. (U) shows a mixed income evolution with significant revenue growth over 2020-2024 but declining net income and profitability. Its financial ratios are slightly unfavorable overall, with strong liquidity but weak returns and asset efficiency. Debt levels are moderate, and the rating is very unfavorable despite a favorable letter grade.

DocuSign, Inc. (DOCU) presents a favorable income statement with steady revenue and net income growth, and strong profitability metrics. Its financial ratios are slightly favorable, highlighting solid returns and low debt, though liquidity ratios are below one. The company holds a very favorable rating with a moderate overall score.

Investors focused on growth and improving profitability may see DocuSign’s financial and income strengths as favorable, while those valuing liquidity and cautious leverage might find Unity’s higher current ratios appealing despite weaker profitability. The choice could thus depend on the investor’s risk tolerance and preference for growth versus liquidity stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Unity Software Inc. and DocuSign, Inc. to enhance your investment decisions: