In the fast-evolving software application sector, Shopify Inc. and DocuSign, Inc. stand out as leaders driving innovation in commerce and digital agreements. Shopify empowers merchants with comprehensive e-commerce solutions worldwide, while DocuSign revolutionizes how businesses handle electronic signatures and contract management. Both companies overlap in their technology-driven approach to streamline business processes, making this comparison crucial. Let’s explore which stock presents the most compelling investment opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Shopify Inc. and DocuSign, Inc. by providing an overview of these two companies and their main differences.

Shopify Inc. Overview

Shopify Inc. is a Canadian commerce company providing a comprehensive platform that enables merchants to manage and sell products across multiple sales channels, including online storefronts and physical locations. Its services include inventory management, payment processing, shipping, and financing solutions. Established in 2004 and headquartered in Ottawa, Shopify operates globally, serving a broad range of merchants with a mission to simplify commerce.

DocuSign, Inc. Overview

DocuSign, Inc., based in San Francisco, provides electronic signature software and digital agreement management solutions worldwide. Founded in 2003, the company focuses on automating and securing agreement workflows using AI-driven tools and cloud offerings tailored for various industries. DocuSign’s platform supports electronic signatures, contract lifecycle management, and remote notarization, aiming to streamline and digitize business agreements.

Key similarities and differences

Both Shopify and DocuSign operate in the technology sector within application software, offering cloud-based solutions that enhance business processes. While Shopify focuses on enabling commerce through multi-channel sales and merchant services, DocuSign centers on digital agreement and signature workflows. Their business models share a SaaS approach, but Shopify targets retail merchants broadly, whereas DocuSign serves enterprises with contract management and legal compliance tools.

Income Statement Comparison

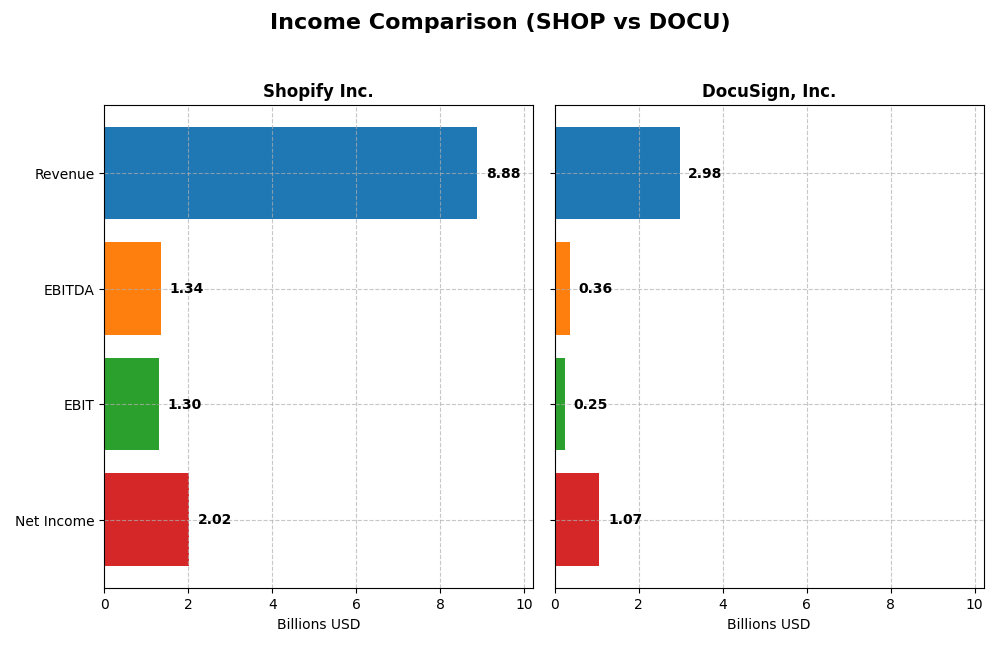

This table presents the most recent fiscal year income statement metrics for Shopify Inc. and DocuSign, Inc., offering a direct financial comparison for investors.

| Metric | Shopify Inc. (SHOP) | DocuSign, Inc. (DOCU) |

|---|---|---|

| Market Cap | 205B | 11.5B |

| Revenue | 8.88B | 2.98B |

| EBITDA | 1.34B | 357M |

| EBIT | 1.30B | 249M |

| Net Income | 2.02B | 1.07B |

| EPS | 1.56 | 5.23 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Shopify Inc.

Shopify Inc. demonstrated strong revenue growth from 2020 to 2024, increasing from $2.9B to $8.9B, with net income turning sharply positive in 2024 at $2.0B after prior volatility. Margins improved significantly, with a gross margin of 50.36% and net margin of 22.74% in 2024. The latest year showed robust growth, including a 25.78% revenue increase and a substantial rise in EBIT and EPS.

DocuSign, Inc.

DocuSign’s revenue grew steadily from $1.5B in 2021 to $3.0B in 2025, with net income turning positive in 2024 and reaching $1.07B in 2025. The company maintains a high gross margin of 79.12%, though its EBIT margin is moderate at 8.38%. Recent growth has been more moderate, with a 7.78% revenue increase in 2025, alongside strong improvements in net margin and EPS.

Which one has the stronger fundamentals?

Both companies show favorable income statement trends with significant net income growth and improving margins. Shopify exhibits higher revenue growth and margin improvements, while DocuSign maintains stronger gross margins and a higher net margin. Shopify’s rapid turnaround and margin expansion contrast with DocuSign’s steadier, more moderate growth and profitability, highlighting different fundamental strengths.

Financial Ratios Comparison

The table below presents a side-by-side comparison of the key financial ratios for Shopify Inc. (SHOP) and DocuSign, Inc. (DOCU) based on their most recent fiscal year data.

| Ratios | Shopify Inc. (2024) | DocuSign, Inc. (2025) |

|---|---|---|

| ROE | 17.5% | 53.3% |

| ROIC | 7.5% | 9.1% |

| P/E | 68.2 | 18.5 |

| P/B | 11.9 | 9.9 |

| Current Ratio | 3.71 | 0.81 |

| Quick Ratio | 3.70 | 0.81 |

| D/E (Debt to Equity) | 0.10 | 0.06 |

| Debt-to-Assets | 8.1% | 3.1% |

| Interest Coverage | 0 | 129 |

| Asset Turnover | 0.64 | 0.74 |

| Fixed Asset Turnover | 63.4 | 7.28 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Shopify Inc.

Shopify exhibits a mix of strong and weak ratios. Its net margin (22.74%) and return on equity (17.47%) are favorable, indicating solid profitability and shareholder value creation. However, high valuation multiples like a PE of 68.18 and a PB of 11.91 raise concerns. The current ratio of 3.71 is unfavorable, but debt metrics and interest coverage are strong. Shopify does not pay dividends, likely reinvesting earnings into growth and R&D.

DocuSign, Inc.

DocuSign shows robust profitability with a net margin of 35.87% and an impressive return on equity of 53.32%, both favorable. Its valuation is more moderate with a PE of 18.51, though the price-to-book ratio of 9.87 is unfavorable. Liquidity ratios like current ratio (0.81) are weak, but debt levels and interest coverage are solid. DocuSign also does not pay dividends, focusing on reinvestment and growth initiatives.

Which one has the best ratios?

Both companies have a slightly favorable overall ratio profile, but Shopify holds a higher proportion of favorable ratios (50%) despite some valuation concerns. DocuSign’s profitability ratios are stronger, yet weaker liquidity and a higher proportion of neutral ratios limit its edge. Neither company pays dividends, reflecting growth-oriented strategies.

Strategic Positioning

This section compares the strategic positioning of Shopify Inc. and DocuSign, Inc., including market position, key segments, and exposure to disruption:

Shopify Inc.

- Leading commerce platform with $205B market cap, facing high competition in software applications.

- Key segments: Merchant Solutions and Subscription, driving revenue through commerce services and tools.

- Exposure to ecommerce platform evolution and payment processing technologies.

DocuSign, Inc.

- E-signature software provider with $11.5B market cap, competing in digital agreement management.

- Key segments: Subscription services and professional services, focused on digital signature and CLM solutions.

- Exposure to AI-driven contract lifecycle management and digital signature innovations.

Shopify Inc. vs DocuSign, Inc. Positioning

Shopify has a diversified commerce platform business with significant merchant solutions and subscription revenue, while DocuSign concentrates on e-signature and contract management software. Shopify’s broader ecosystem contrasts with DocuSign’s specialized digital agreement focus.

Which has the best competitive advantage?

DocuSign shows a slightly favorable moat with growing ROIC, indicating improving profitability, while Shopify has a slightly unfavorable moat despite growing ROIC, signaling value destruction but improving efficiency.

Stock Comparison

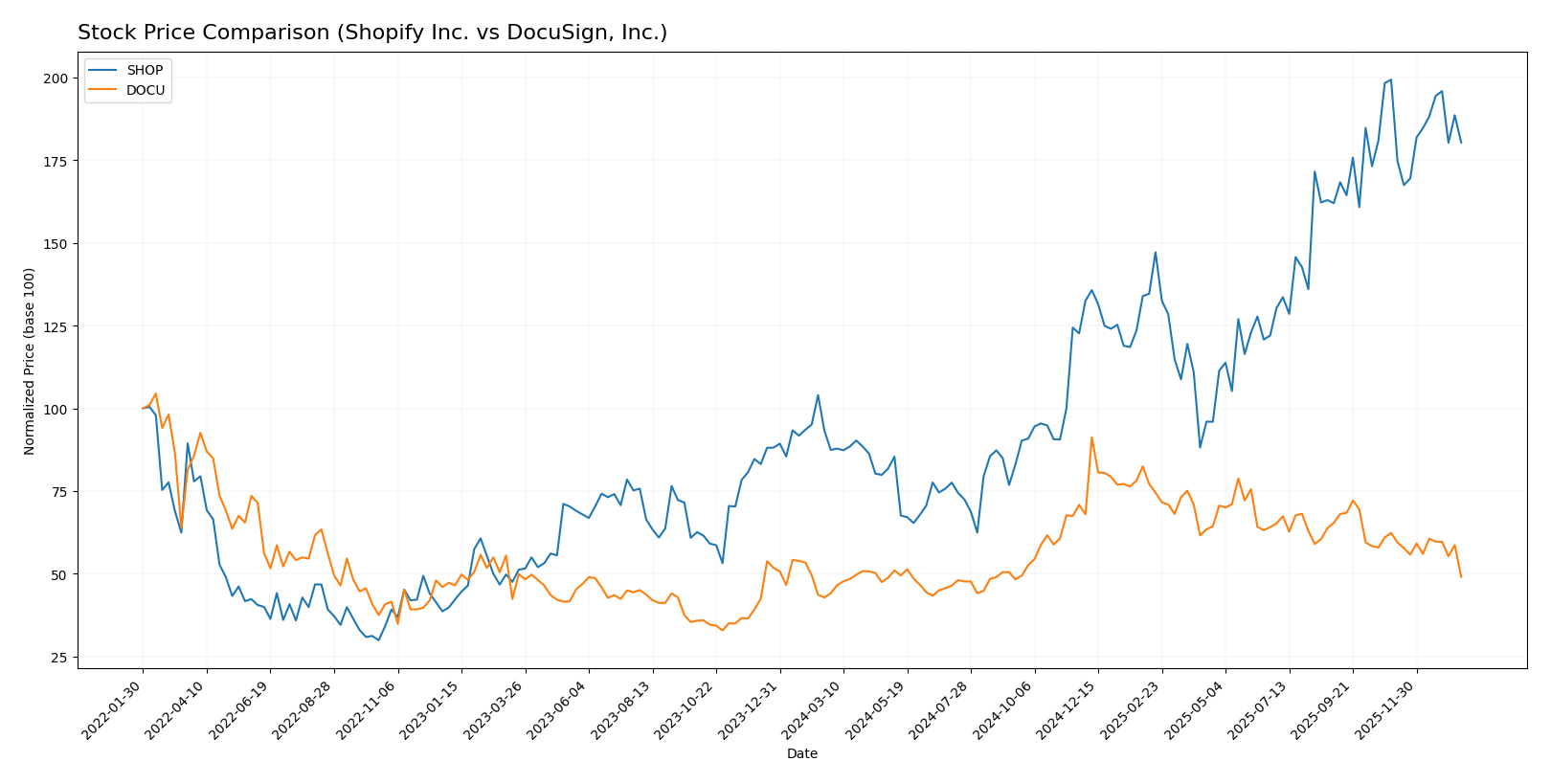

The stock price chart over the past 12 months reveals divergent trajectories between Shopify Inc. and DocuSign, Inc., with Shopify showing a strong overall gain despite recent pullbacks, and DocuSign exhibiting modest growth followed by sharper declines.

Trend Analysis

Shopify Inc. experienced a bullish trend over the past year with a 106.34% price increase, though momentum decelerated. The stock hit a high of 173.86 and a low of 54.43, displaying significant volatility with a standard deviation of 33.7.

DocuSign, Inc.’s stock also showed a bullish trend over the past 12 months with an 11.21% gain but similarly faced deceleration. Its price ranged between 50.84 and 106.99, with lower volatility compared to Shopify at a 12.97 standard deviation.

Comparing the two, Shopify delivered the highest market performance with a substantially larger price appreciation than DocuSign throughout the analyzed period.

Target Prices

Analysts present a clear target price consensus for Shopify Inc. and DocuSign, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Shopify Inc. | 200 | 140 | 186.24 |

| DocuSign, Inc. | 88 | 70 | 76.86 |

Shopify’s consensus target price of 186.24 suggests upside potential from its current price of 157.21. DocuSign’s consensus target of 76.86 also indicates expected appreciation from its 57.49 market price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Shopify Inc. and DocuSign, Inc.:

Rating Comparison

Shopify Inc. Rating

- Rating: B, assessed as Very Favorable

- Discounted Cash Flow Score: Moderate at 3

- ROE Score: Favorable at 4

- ROA Score: Very Favorable at 5

- Debt To Equity Score: Moderate at 3

- Overall Score: Moderate at 3

DocuSign, Inc. Rating

- Rating: B+, assessed as Very Favorable

- Discounted Cash Flow Score: Very Favorable at 5

- ROE Score: Favorable at 4

- ROA Score: Favorable at 4

- Debt To Equity Score: Moderate at 3

- Overall Score: Moderate at 3

Which one is the best rated?

Based strictly on provided data, DocuSign holds a slightly better rating (B+) versus Shopify’s B, driven mainly by a stronger discounted cash flow score, while overall and other scores remain comparable.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Shopify and DocuSign:

Shopify Scores

- Altman Z-Score: 50.4, indicating a safe zone from bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength.

DocuSign Scores

- Altman Z-Score: 4.43, indicating a safe zone from bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength.

Which company has the best scores?

Shopify shows a significantly higher Altman Z-Score, indicating stronger financial stability compared to DocuSign. Both companies have average Piotroski Scores, with Shopify slightly ahead. Overall, Shopify holds better scores based on the provided data.

Grades Comparison

Here is a comparison of recent grades given to Shopify Inc. and DocuSign, Inc.:

Shopify Inc. Grades

The table below summarizes recent grades from various reputable grading companies for Shopify Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Scotiabank | Upgrade | Sector Outperform | 2026-01-08 |

| Wolfe Research | Downgrade | Peer Perform | 2026-01-06 |

| Wells Fargo | Maintain | Overweight | 2025-12-17 |

| Truist Securities | Maintain | Hold | 2025-11-05 |

| CIBC | Maintain | Outperform | 2025-11-05 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-11-05 |

| DA Davidson | Maintain | Buy | 2025-11-05 |

| Scotiabank | Maintain | Sector Perform | 2025-11-05 |

| Needham | Maintain | Buy | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

Shopify’s grades generally trend positive, with several “Buy” and “Outperform” ratings, although there is some recent downgrade activity.

DocuSign, Inc. Grades

The table below summarizes recent grades from various reputable grading companies for DocuSign, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Evercore ISI Group | Maintain | In Line | 2025-12-05 |

| UBS | Maintain | Neutral | 2025-12-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-05 |

| Piper Sandler | Maintain | Neutral | 2025-12-05 |

| RBC Capital | Maintain | Sector Perform | 2025-12-05 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

| Needham | Maintain | Hold | 2025-12-05 |

| Baird | Maintain | Neutral | 2025-12-05 |

DocuSign’s grades are consistently neutral or hold, showing a cautious and stable outlook with no upgrades or downgrades recently.

Which company has the best grades?

Shopify Inc. has received stronger grades overall, with multiple “Buy” and “Outperform” ratings, compared to DocuSign’s predominantly “Neutral” and “Hold” grades. This difference may influence investors seeking higher conviction in analyst sentiment.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Shopify Inc. (SHOP) and DocuSign, Inc. (DOCU) based on their recent financial and operational data.

| Criterion | Shopify Inc. (SHOP) | DocuSign, Inc. (DOCU) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from Merchant Solutions and Subscriptions | Moderate: Revenue mainly from Subscriptions and Professional Services |

| Profitability | Improving net margin at 22.7%, but ROIC below WACC, indicating value destruction | Strong net margin at 35.9% and ROIC slightly above WACC, showing slight value creation |

| Innovation | High: Rapidly growing ROIC trend (514%), strong fixed asset turnover | High: Growing ROIC trend (168%), strong interest coverage ratio |

| Global presence | Broad e-commerce platform with global merchants | Global leader in e-signature and digital agreement solutions |

| Market Share | Significant in e-commerce platform market | Leading in e-signature market with expanding subscription base |

Key takeaways: Shopify shows strong growth potential with improving profitability but currently struggles to generate returns above its capital cost. DocuSign maintains better profitability and a slight competitive advantage, supported by steady revenue growth and efficient capital use. Both companies have strengths in innovation and market presence but require careful monitoring of profitability trends.

Risk Analysis

Below is a risk comparison table for Shopify Inc. (SHOP) and DocuSign, Inc. (DOCU) based on the most recent data from 2025-2026:

| Metric | Shopify Inc. (SHOP) | DocuSign, Inc. (DOCU) |

|---|---|---|

| Market Risk | High beta 2.84, volatile price range (69.84-182.19) | Moderate beta 0.99, narrower range (57.45-99.3) |

| Debt Level | Low debt-to-equity 0.1, debt-to-assets 8.09% | Very low debt-to-equity 0.06, debt-to-assets 3.1% |

| Regulatory Risk | Moderate, operates globally with diverse regulations | Moderate, mainly US-based but expanding globally |

| Operational Risk | Moderate, relies on e-commerce platform stability and innovation | Moderate, dependent on SaaS platform performance and security |

| Environmental Risk | Low, technology sector with limited direct impact | Low, primarily digital services with minimal environmental footprint |

| Geopolitical Risk | Moderate, exposure across multiple regions including emerging markets | Moderate, primarily US-focused but some international exposure |

Shopify faces higher market risk due to greater stock price volatility and a high beta, indicating sensitivity to market swings. Both companies maintain low debt levels, minimizing financial risk. Regulatory and operational risks are moderate given their tech nature and global footprints. Geopolitical risks exist but are not currently critical. The most impactful risk likely remains Shopify’s market volatility, which investors should monitor closely.

Which Stock to Choose?

Shopify Inc. (SHOP) shows strong income growth with a 203% revenue increase over five years and a favorable net margin of 22.74%. Its financial ratios are slightly favorable, balancing high profitability with some valuation concerns. The company carries low debt, a robust current ratio, and holds a very favorable rating of B with solid Altman Z-Score and average Piotroski Score. However, its MOAT evaluation is slightly unfavorable as it currently destroys value despite growing profitability.

DocuSign, Inc. (DOCU) exhibits steady income growth of 105% over five years and a higher net margin of 35.87%. Its financial ratios are also slightly favorable, with strong profitability and moderate debt levels but weaker liquidity ratios. DOCU’s rating is very favorable at B+ with a safe-zone Altman Z-Score and average Piotroski Score. The company’s MOAT is slightly favorable, indicating improving profitability but no clear competitive advantage yet.

For investors, DOCU may appear suitable for those prioritizing profitability and improving competitive positioning, while SHOP could be more appealing for those valuing rapid income growth and strong asset returns despite some value erosion. The choice might depend on whether an investor favors growth dynamics or improving economic moat characteristics.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Shopify Inc. and DocuSign, Inc. to enhance your investment decisions: