In the dynamic world of software applications, DocuSign, Inc. and Perfect Corp. stand out by driving innovation in distinct yet overlapping markets. DocuSign leads in electronic signature and contract management solutions, while Perfect Corp. excels in AI-powered augmented reality for beauty and fashion tech. Comparing these two technology firms offers a unique glimpse into different growth opportunities and innovation strategies. Join me as we explore which company presents the most compelling investment case in 2026.

Table of contents

Companies Overview

I will begin the comparison between DocuSign and Perfect Corp. by providing an overview of these two companies and their main differences.

DocuSign Overview

DocuSign, Inc. provides electronic signature software and related contract lifecycle management solutions globally. Its mission is to enable businesses to digitally prepare, sign, and manage agreements efficiently through AI-enhanced tools and industry-specific cloud offerings. Founded in 2003 and headquartered in San Francisco, DocuSign operates in the software application industry with a market cap of approximately 11.4B USD.

Perfect Corp. Overview

Perfect Corp. specializes in SaaS AI and augmented reality solutions for the beauty and fashion sectors, offering virtual try-on and AI-powered analysis tools. Established in 2015 in New Taipei City, Taiwan, Perfect Corp. focuses on enhancing consumer engagement and personalization via technology. The company trades on the NYSE with a market cap near 179M USD and employs 342 people.

Key similarities and differences

Both companies operate in the software application sector, leveraging AI technology to provide innovative solutions. DocuSign targets digital agreement management primarily for business customers, while Perfect Corp. focuses on consumer-facing AR and AI applications in beauty and fashion. DocuSign’s market cap and employee base are significantly larger, reflecting their broader enterprise reach compared to Perfect Corp.’s niche market orientation.

Income Statement Comparison

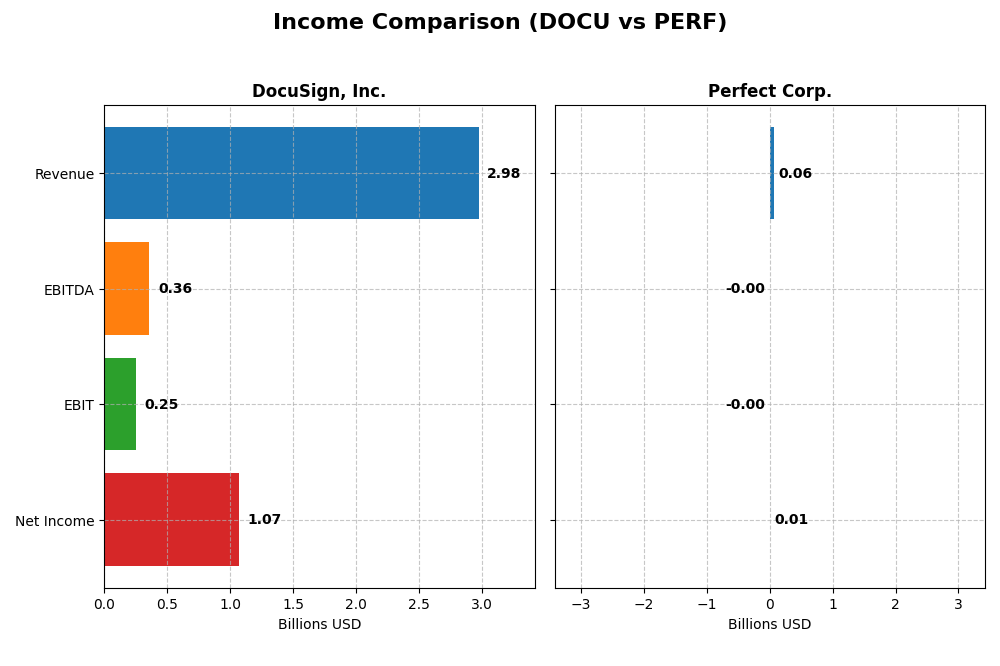

The table below compares the most recent full fiscal year income statement metrics for DocuSign, Inc. and Perfect Corp., highlighting key financial performance figures.

| Metric | DocuSign, Inc. (DOCU) | Perfect Corp. (PERF) |

|---|---|---|

| Market Cap | 11.36B | 179M |

| Revenue | 2.98B | 60.2M |

| EBITDA | 357M | -2.05M |

| EBIT | 249M | -2.84M |

| Net Income | 1.07B | 5.02M |

| EPS | 5.23 | 0.05 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

DocuSign, Inc.

DocuSign’s revenue grew steadily from $1.45B in 2021 to $2.98B in 2025, more than doubling over five years. Net income improved dramatically from a loss of $243M in 2021 to a profit of $1.07B in 2025. Gross margin remained strong at 79.12%, with net margin notably increasing to 35.87%. The 2025 fiscal year saw solid revenue growth of 7.78% and significant margin improvements, reflecting operational efficiency gains.

Perfect Corp.

Perfect Corp.’s revenue increased from $29.9M in 2020 to $60.2M in 2024, more than doubling over this period. Net income showed improvement from a loss of $5.6M in 2020 to a profit of $5.0M in 2024, though margins remain thin. Gross margin was favorable at 77.98%, but EBIT margin was negative at -4.72% in 2024. The latest year showed revenue growth of 12.52%, but EBIT and net margin deteriorated, indicating rising operating costs relative to income.

Which one has the stronger fundamentals?

DocuSign demonstrates stronger fundamentals with consistent revenue and net income growth, coupled with high and improving margins. Its EBIT and net margin improvements highlight operational resilience. Perfect Corp. shows revenue growth but suffers from negative EBIT margins and recent margin contractions, signaling challenges in profitability despite top-line gains. Overall, DocuSign’s income statement indicates more robust financial health.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for DocuSign, Inc. and Perfect Corp. based on their most recent fiscal year data, providing insights into profitability, liquidity, leverage, and market valuation.

| Ratios | DocuSign, Inc. (2025) | Perfect Corp. (2024) |

|---|---|---|

| ROE | 53.32% | 3.42% |

| ROIC | 9.09% | -2.10% |

| P/E | 18.51 | 56.60 |

| P/B | 9.87 | 1.93 |

| Current Ratio | 0.81 | 5.52 |

| Quick Ratio | 0.81 | 5.52 |

| D/E | 0.06 | 0.00 |

| Debt-to-Assets | 3.10% | 0.28% |

| Interest Coverage | 129.0 | -449.0 |

| Asset Turnover | 0.74 | 0.33 |

| Fixed Asset Turnover | 7.28 | 57.94 |

| Payout ratio | 0.00% | 0.00% |

| Dividend yield | 0.00% | 0.00% |

Interpretation of the Ratios

DocuSign, Inc.

DocuSign shows a mix of strengths and weaknesses in its 2025 ratios. It benefits from a high net margin (35.87%) and strong return on equity (53.32%), indicating profitability and efficient equity use. However, the current ratio is low at 0.81, suggesting liquidity concerns. The company does not pay dividends, likely reflecting a reinvestment or growth strategy.

Perfect Corp.

Perfect Corp.’s 2024 ratios reveal challenges with unfavorable returns on equity (3.42%) and invested capital (-2.1%). The company maintains a strong quick ratio (5.52) and minimal debt, but low asset turnover (0.33) limits efficiency. It does not pay dividends, consistent with a focus on reinvestment and expansion rather than shareholder payouts.

Which one has the best ratios?

DocuSign presents a slightly favorable overall ratio profile, highlighted by strong profitability and leverage metrics despite liquidity issues. Perfect Corp. has more unfavorable ratios, particularly in profitability and efficiency, despite solid liquidity and low leverage. Therefore, DocuSign’s ratios are generally more favorable compared to Perfect Corp.

Strategic Positioning

This section compares the strategic positioning of DocuSign and Perfect Corp., covering Market position, Key segments, and Exposure to technological disruption:

DocuSign, Inc.

- Leading global e-signature software provider with NASDAQ listing; faces competition in application software.

- Dominates electronic signature and contract lifecycle management; revenue driven by subscription services.

- Incorporates AI in contract analysis and workflow automation; evolving tech but no mention of disruption threats.

Perfect Corp.

- Smaller market cap with NYSE listing; niche focus on AI and AR beauty tech software solutions.

- Focuses on AI and AR virtual try-on technologies in beauty and fashion; product innovation drives growth.

- Relies heavily on AI and AR innovations; potential exposure due to fast-evolving tech in beauty and fashion sectors.

DocuSign vs Perfect Corp. Positioning

DocuSign has a diversified approach in digital agreement management serving multiple industries with subscription revenues, while Perfect Corp. is concentrated on AI-driven beauty tech solutions, benefiting from specialized innovation but with narrower market exposure.

Which has the best competitive advantage?

DocuSign shows a slightly favorable moat with growing profitability despite shedding value, indicating improving competitive positioning. Perfect Corp. currently destroys value, reflecting a slightly unfavorable moat, though its profitability trend is positive.

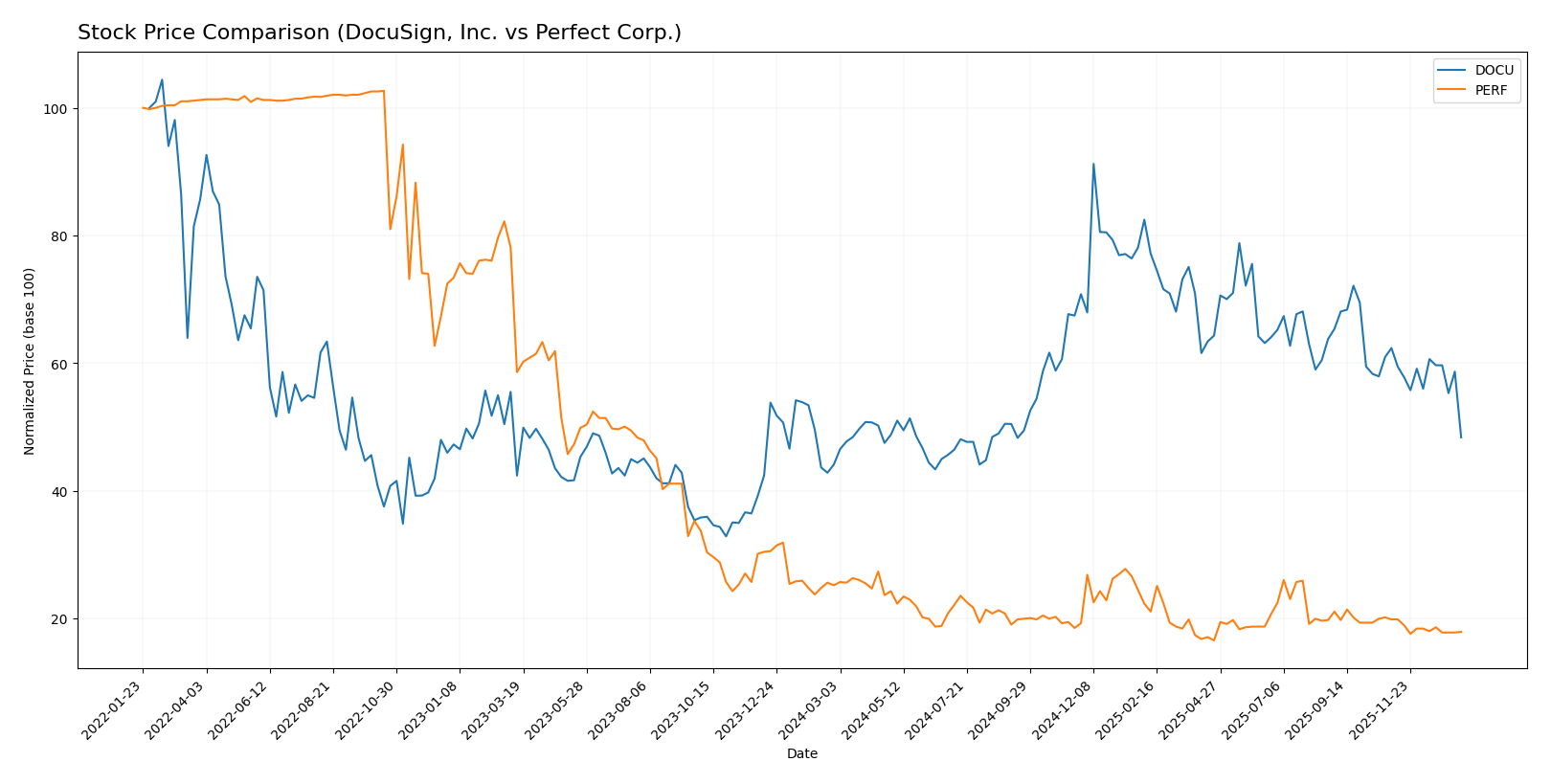

Stock Comparison

The stock prices of DocuSign, Inc. and Perfect Corp. have shown distinctive movements over the past year, with DocuSign experiencing moderate gains amid decelerating momentum, while Perfect Corp. faced a marked decline with steady deceleration in its bearish trend.

Trend Analysis

DocuSign, Inc. recorded a 9.63% price increase over the past 12 months, indicating a bullish trend with deceleration. The stock ranged between 50.84 and 106.99, with a recent downward trend of -22.46% from November 2025 to January 2026.

Perfect Corp. showed a -28.98% price change over the same period, reflecting a bearish trend with deceleration. The stock fluctuated between 1.61 and 2.7, continuing a recent decline of -9.84% in the last months of 2025 and early 2026.

Comparing the two, DocuSign delivered the highest market performance over the past year, demonstrating positive growth, while Perfect Corp. experienced significant losses.

Target Prices

The current analyst consensus on target prices indicates a positive outlook for both DocuSign, Inc. and Perfect Corp.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| DocuSign, Inc. | 88 | 70 | 76.86 |

| Perfect Corp. | 7 | 7 | 7 |

Analysts expect DocuSign’s price to appreciate significantly from its current 56.71 USD, while Perfect Corp.’s consensus target of 7 USD is well above its current price of 1.74 USD, indicating strong growth potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for DocuSign, Inc. and Perfect Corp.:

Rating Comparison

DocuSign, Inc. Rating

- Rating: B+, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 5, considered Very Favorable.

- ROE Score: 4, indicating a Favorable return on equity.

- ROA Score: 4, indicating a Favorable return on assets.

- Debt To Equity Score: 3, indicating Moderate financial risk.

- Overall Score: 3, classified as Moderate overall performance.

Perfect Corp. Rating

- Rating: A-, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 5, considered Very Favorable.

- ROE Score: 2, indicating a Moderate return on equity.

- ROA Score: 3, indicating a Moderate return on assets.

- Debt To Equity Score: 4, indicating a Favorable financial risk.

- Overall Score: 4, classified as Favorable overall performance.

Which one is the best rated?

Based strictly on the provided data, Perfect Corp. holds a higher overall rating (A- versus B+) and a better overall score (4 versus 3) compared to DocuSign, Inc., though DocuSign scores higher on ROE and ROA.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for DocuSign and Perfect Corp.:

DocuSign Scores

- Altman Z-Score: 4.43, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 5, categorized as average financial strength.

Perfect Corp. Scores

- Altman Z-Score: 1.31, indicating financial distress and high bankruptcy risk.

- Piotroski Score: 6, categorized as average financial strength.

Which company has the best scores?

DocuSign has a significantly higher Altman Z-Score, placing it in the safe zone, while Perfect Corp. remains in financial distress. Both companies show average Piotroski Scores, with Perfect slightly higher. Overall, DocuSign’s scores indicate stronger financial stability.

Grades Comparison

Below is a comparison of the available grades for DocuSign, Inc. and Perfect Corp.:

DocuSign, Inc. Grades

This table summarizes recent grades assigned to DocuSign by reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Evercore ISI Group | Maintain | In Line | 2025-12-05 |

| UBS | Maintain | Neutral | 2025-12-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-05 |

| Piper Sandler | Maintain | Neutral | 2025-12-05 |

| RBC Capital | Maintain | Sector Perform | 2025-12-05 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

| Needham | Maintain | Hold | 2025-12-05 |

| Baird | Maintain | Neutral | 2025-12-05 |

DocuSign’s grades show a consistent trend toward neutral and hold ratings, indicating a cautious stance by analysts.

Perfect Corp. Grades

This table summarizes recent grades assigned to Perfect Corp. by reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2024-02-29 |

| Goldman Sachs | Maintain | Neutral | 2023-10-26 |

| Piper Sandler | Maintain | Neutral | 2023-10-25 |

| Piper Sandler | Maintain | Neutral | 2023-07-26 |

| Piper Sandler | Maintain | Neutral | 2023-07-25 |

| Piper Sandler | Maintain | Neutral | 2023-04-27 |

| Oppenheimer | Downgrade | Perform | 2023-04-20 |

| Oppenheimer | Downgrade | Perform | 2023-04-19 |

| Oppenheimer | Downgrade | Perform | 2023-04-18 |

| Piper Sandler | Maintain | Neutral | 2023-03-08 |

Perfect Corp.’s grades are predominantly neutral, with recent downgrades from outperform to perform, reflecting a cautious outlook.

Which company has the best grades?

DocuSign has received a broader range of neutral to hold grades from multiple firms, while Perfect Corp. mainly holds neutral ratings with some downgrades. DocuSign’s more extensive analyst coverage and slightly stronger consensus suggest a marginally more balanced market perception, which may influence investor confidence accordingly.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for DocuSign, Inc. (DOCU) and Perfect Corp. (PERF) based on their recent financial and operational data.

| Criterion | DocuSign, Inc. (DOCU) | Perfect Corp. (PERF) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from subscription services (~$2.9B in 2025) with limited other services | Limited: No detailed segment data available, suggesting narrow focus |

| Profitability | Strong net margin (35.87%) and ROE (53.32%), slightly favorable ROIC (9.09%) | Low profitability, negative ROIC (-2.1%), low ROE (3.42%) |

| Innovation | Growing ROIC trend (+168%) indicates improving efficiency and potential for innovation | Growing ROIC trend (+46%) but still negative absolute values, indicating challenges |

| Global presence | Significant global footprint as a leader in e-signature and digital transaction management | Smaller or niche market presence, limited data on global operations |

| Market Share | Leading position in digital signature market with steady revenue growth | Market share unclear, likely smaller with less diversification |

Key takeaways: DocuSign exhibits strong profitability and improving efficiency, underpinned by a focused subscription business, making it a slightly favorable investment. Perfect Corp. shows growth in profitability metrics but remains unprofitable and less diversified, posing higher risk for investors.

Risk Analysis

Below is a comparative table outlining key risk metrics for DocuSign, Inc. (DOCU) and Perfect Corp. (PERF) as of the most recent fiscal years:

| Metric | DocuSign, Inc. (DOCU) | Perfect Corp. (PERF) |

|---|---|---|

| Market Risk | Beta 0.994 (moderate) | Beta 0.454 (low) |

| Debt Level | Debt-to-Equity 0.06 (low) | Debt-to-Equity 0.0 (none) |

| Regulatory Risk | Moderate (US & international compliance) | Moderate (Taiwan & global SaaS regulations) |

| Operational Risk | Moderate (complex SaaS platform with AI) | Moderate (AR/AI tech in beauty industry) |

| Environmental Risk | Low (software sector) | Low (software sector) |

| Geopolitical Risk | Moderate (US-based, global operations) | Elevated (Taiwan-based, geopolitical tensions region) |

DocuSign’s primary risks involve moderate market volatility and exposure to evolving regulatory standards in multiple jurisdictions. Perfect Corp. faces higher geopolitical risk given its Taiwan base amid regional uncertainties, and operational challenges as a younger company with negative profitability metrics and some financial distress signals. Investors should weigh these factors carefully in their risk management strategies.

Which Stock to Choose?

DocuSign, Inc. (DOCU) shows a favorable income evolution with a 7.78% revenue growth in the last year and strong profitability metrics, including a 35.87% net margin and 53.32% ROE. Its debt levels are low with a 0.06 debt-to-equity ratio, and it holds a very favorable B+ rating. The company’s financial ratios are slightly favorable overall, though the current ratio is below 1, indicating some liquidity concerns.

Perfect Corp. (PERF) exhibits favorable revenue growth of 12.52% recently, but profitability is weaker with an 8.34% net margin and a low 3.42% ROE. The company has minimal debt, reflected in a zero debt-to-equity ratio and a strong current ratio above 5.5. Its rating is A- and financial ratios are slightly unfavorable overall, with some concerns in asset turnover and interest coverage.

For investors focused on growth and higher profitability, DocuSign might appear more favorable due to its strong margins and improving returns, despite liquidity risks. Conversely, those prioritizing financial stability and low leverage might view Perfect Corp. as more suitable, given its strong liquidity and conservative debt profile but more modest profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of DocuSign, Inc. and Perfect Corp. to enhance your investment decisions: