In the dynamic world of software applications, DocuSign, Inc. and Pegasystems Inc. stand out as pioneering forces shaping digital business processes. Both companies operate in the software application industry, focusing on innovation through automation and AI-driven solutions that streamline workflows and enhance customer engagement. This comparison aims to uncover which company presents the most compelling investment opportunity for savvy investors seeking growth in technology-driven markets. Join me as we explore their strengths and risks to find the best fit for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between DocuSign and Pegasystems by providing an overview of these two companies and their main differences.

DocuSign Overview

DocuSign, Inc. specializes in electronic signature software, offering solutions that enable businesses to digitally prepare, sign, and manage agreements worldwide. It provides advanced tools such as AI-driven contract lifecycle management and industry-specific cloud offerings. Founded in 2003 and headquartered in San Francisco, DocuSign serves enterprises, commercial, and small businesses through direct, partner-assisted, and web-based sales channels.

Pegasystems Overview

Pegasystems Inc. develops enterprise software applications focused on customer engagement and digital process automation. Its platforms include Pega Platform and Pega Infinity, which unify customer experience and automate processes across industries. Established in 1983 and based in Waltham, Massachusetts, Pegasystems markets its products globally, targeting sectors like financial services, healthcare, and government, primarily through a direct sales force and technology partnerships.

Key similarities and differences

Both DocuSign and Pegasystems operate in the software application industry, providing technology solutions that enhance business operations. While DocuSign focuses on digital agreement management and e-signatures, Pegasystems emphasizes customer engagement and process automation platforms. Each company employs a direct sales approach but differs in their product scope and industry specialization, with DocuSign centered on contract workflows and Pegasystems on broader enterprise software applications.

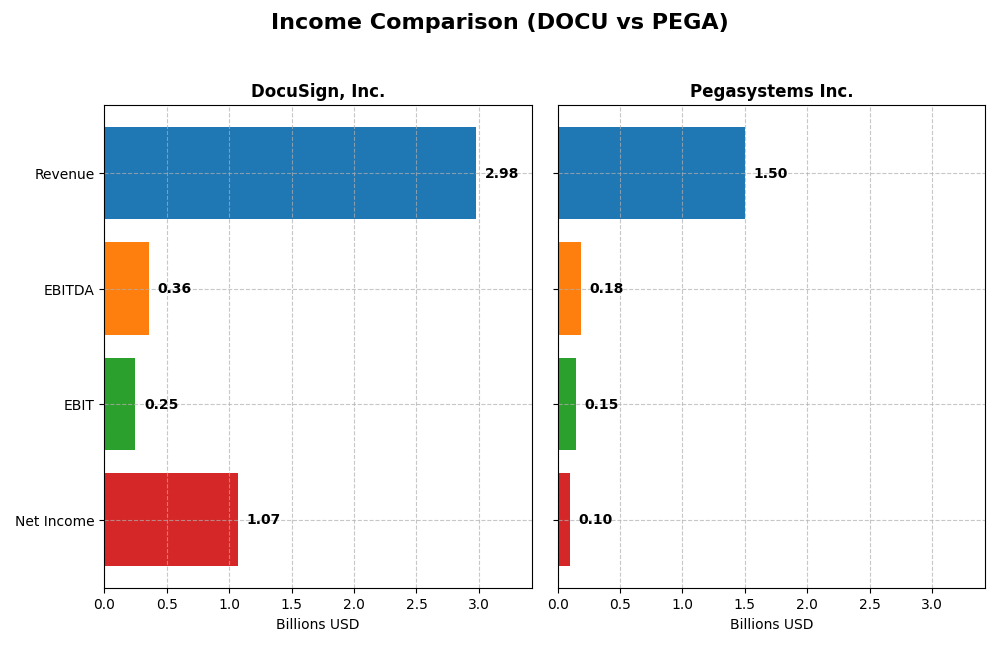

Income Statement Comparison

Below is a comparison of key income statement metrics for DocuSign, Inc. and Pegasystems Inc. for their most recent fiscal years, offering a snapshot of their financial performance.

| Metric | DocuSign, Inc. (DOCU) | Pegasystems Inc. (PEGA) |

|---|---|---|

| Market Cap | 11.36B | 8.89B |

| Revenue | 2.98B | 1.50B |

| EBITDA | 357M | 185M |

| EBIT | 249M | 149M |

| Net Income | 1.07B | 99M |

| EPS | 5.23 | 0.58 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

DocuSign, Inc.

DocuSign’s revenue nearly doubled from 2021 to 2025, reaching $2.98B with a net income surge to $1.07B in 2025. Gross margin was strong at 79.12%, while net margin showed significant improvement, expanding to 35.87%. The latest fiscal year highlights a 7.78% revenue growth with a remarkable 1239% net margin increase, signaling robust profitability gains.

Pegasystems Inc.

Pegasystems reported steady revenue growth from $1.02B in 2020 to $1.50B in 2024, with net income improving from losses to $99M. Gross margin remained favorable at 73.91%, and net margin rose to 6.63%. The most recent year showed a 4.51% revenue increase alongside a 40% net margin growth, reflecting consistent operational improvement despite more moderate scale.

Which one has the stronger fundamentals?

DocuSign demonstrates stronger fundamentals with higher gross and net margins, along with more pronounced profitability and EPS growth over the period. Pegasystems shows steady progress and positive trends but with lower margin levels and net income scale. Both companies exhibit favorable income statement evaluations, yet DocuSign’s larger margin expansion and net income gains suggest comparatively stronger financial health.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for DocuSign, Inc. and Pegasystems Inc. based on their most recent fiscal year data, offering insight into their operational efficiency, profitability, liquidity, and leverage.

| Ratios | DocuSign, Inc. (2025) | Pegasystems Inc. (2024) |

|---|---|---|

| ROE | 53.3% | 16.9% |

| ROIC | 9.1% | 7.4% |

| P/E | 18.5 | 80.1 |

| P/B | 9.87 | 13.57 |

| Current Ratio | 0.81 | 1.23 |

| Quick Ratio | 0.81 | 1.23 |

| D/E (Debt-to-Equity) | 0.06 | 0.94 |

| Debt-to-Assets | 3.1% | 31.1% |

| Interest Coverage | 129.0 | 18.1 |

| Asset Turnover | 0.74 | 0.85 |

| Fixed Asset Turnover | 7.28 | 14.36 |

| Payout Ratio | 0 | 10.3% |

| Dividend Yield | 0 | 0.13% |

Interpretation of the Ratios

DocuSign, Inc.

DocuSign shows a mix of strong and weak ratios in 2025. Its net margin and return on equity are favorable at 35.87% and 53.32%, respectively, but the price-to-book ratio and current ratio are unfavorable, indicating potential valuation concerns and liquidity risks. The company does not pay dividends, likely prioritizing reinvestment and growth over shareholder payouts.

Pegasystems Inc.

Pegasystems presents mostly neutral to favorable ratios. Its return on equity is a positive 16.94%, with a solid interest coverage ratio of 21.87, but the price-to-earnings and price-to-book ratios are unfavorable at 80.12 and 13.57, hinting at high market expectations. It pays a modest dividend of 0.13% yield, reflecting some shareholder return while maintaining operational flexibility.

Which one has the best ratios?

Both companies have a slightly favorable global ratios opinion. DocuSign excels in profitability metrics but struggles with liquidity and valuation, whereas Pegasystems shows better liquidity and coverage ratios but suffers from high valuation multiples. The overall ratio profiles suggest differing strengths and risks without a clear superiority.

Strategic Positioning

This section compares the strategic positioning of DocuSign and Pegasystems, focusing on market position, key segments, and exposure to technological disruption:

DocuSign, Inc.

- Leading electronic signature software with NASDAQ presence, facing moderate competitive pressure in application software.

- Revenue mainly from subscription services (~$2.9B in 2025) and professional services; focuses on agreement management and AI-driven contract lifecycle solutions.

- Moderate exposure through AI-enhanced contract analysis and cloud-based offerings; continuously innovates in digital agreement workflows.

Pegasystems Inc.

- Provides enterprise software across multiple regions; faces competition in digital process automation and customer engagement.

- Diverse revenue from Pega Cloud ($1.1B in 2024), consulting, maintenance, and subscription licenses; targets multiple industries including financial services.

- Exposure via cloud platform and automation software; integrates customer service and sales automation with intelligent automation technologies.

DocuSign vs Pegasystems Positioning

DocuSign concentrates on digital agreement management with a subscription-based model, while Pegasystems pursues a diversified enterprise software approach across cloud, consulting, and licenses. DocuSign’s focus offers specialization advantages; Pegasystems’ breadth targets multiple industries and software needs.

Which has the best competitive advantage?

Both companies are currently shedding value but show growing ROIC trends. DocuSign’s slightly favorable moat contrasts with Pegasystems’ slightly unfavorable rating, indicating DocuSign holds a marginally stronger competitive advantage based on recent profitability improvements.

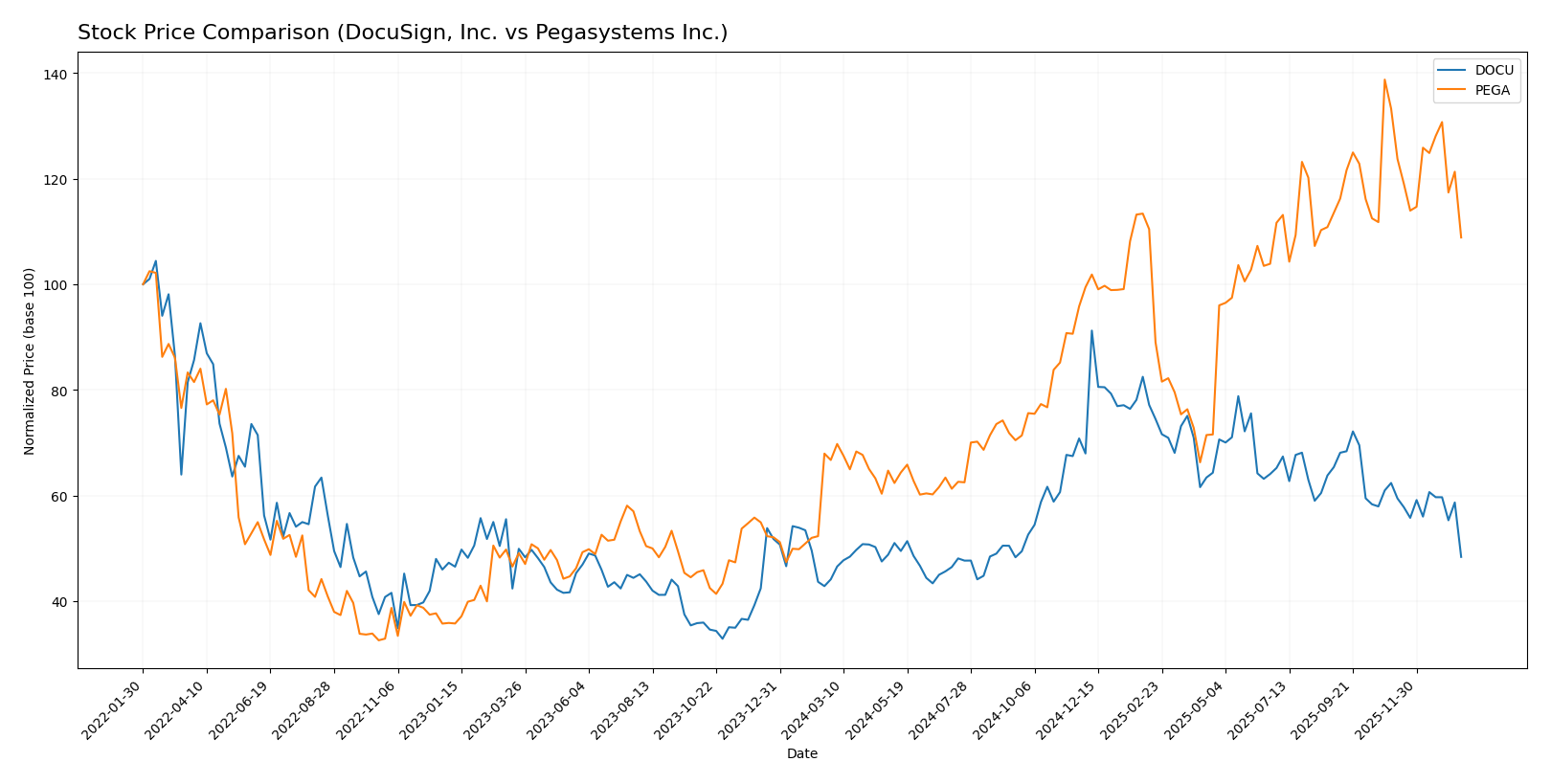

Stock Comparison

The stock price movements of DocuSign, Inc. and Pegasystems Inc. over the past 12 months reveal distinct bullish trends with notable deceleration phases and recent downward corrections impacting both securities.

Trend Analysis

DocuSign, Inc. exhibited a bullish trend with a 9.63% price appreciation over the past year, accompanied by decelerating momentum and a high volatility level of 12.98%, ranging from $50.84 to $106.99. Recent months show a sharp negative correction of -22.46%.

Pegasystems Inc. delivered a stronger bullish trend with a 63.18% gain over the last 12 months, also with decelerating acceleration and volatility at 10.77%, moving between $28.73 and $66.27. It faced a recent decline of -18.32%, less steep compared to DocuSign.

Comparing both, Pegasystems outperformed DocuSign in market performance over the past year, achieving a significantly higher total price increase despite both experiencing recent price drops.

Target Prices

The consensus target prices for DocuSign, Inc. and Pegasystems Inc. indicate moderate upside potential from current levels.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| DocuSign, Inc. | 88 | 70 | 76.86 |

| Pegasystems Inc. | 80 | 67 | 74 |

Analysts expect DocuSign’s stock to trade significantly higher than the current price of 56.71 USD, while Pegasystems shows a similar potential upside from 51.99 USD. This suggests generally positive market sentiment with room for price appreciation.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for DocuSign, Inc. and Pegasystems Inc.:

Rating Comparison

DocuSign, Inc. Rating

- Rating: B+ indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 5, very favorable, suggesting undervaluation.

- ROE Score: 4, favorable, showing efficient profit generation from equity.

- ROA Score: 4, favorable, reflecting effective asset utilization.

- Debt To Equity Score: 3, moderate, indicating average financial risk.

- Overall Score: 3, moderate, representing a balanced financial standing.

Pegasystems Inc. Rating

- Rating: B+ indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 3, moderate, indicating fair valuation.

- ROE Score: 5, very favorable, indicating excellent profit generation efficiency.

- ROA Score: 5, very favorable, showing highly effective use of assets.

- Debt To Equity Score: 3, moderate, similarly indicating average financial risk.

- Overall Score: 3, moderate, representing a balanced financial standing.

Which one is the best rated?

Both companies share the same B+ rating and an overall score of 3, indicating moderate standing. Pegasystems leads with stronger ROE and ROA scores, while DocuSign scores higher on discounted cash flow, reflecting differing strengths in key financial metrics.

Scores Comparison

Here is a comparison of DocuSign and Pegasystems scores based on the Altman Z-Score and Piotroski Score:

DocuSign Scores

- Altman Z-Score: 4.43, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 5, classified as average financial strength.

Pegasystems Scores

- Altman Z-Score: 10.31, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial strength.

Which company has the best scores?

Pegasystems has the higher Altman Z-Score and a very strong Piotroski Score, suggesting stronger financial health compared to DocuSign, which has a safe zone Altman Z-Score but only an average Piotroski Score.

Grades Comparison

Here is a comparison of the recent grades and ratings for DocuSign, Inc. and Pegasystems Inc.:

DocuSign, Inc. Grades

The table below summarizes DocuSign’s latest grades from major financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Evercore ISI Group | Maintain | In Line | 2025-12-05 |

| UBS | Maintain | Neutral | 2025-12-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-05 |

| Piper Sandler | Maintain | Neutral | 2025-12-05 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

| Needham | Maintain | Hold | 2025-12-05 |

| Baird | Maintain | Neutral | 2025-12-05 |

DocuSign’s grades predominantly indicate a neutral to hold stance, reflecting a consensus of caution or balanced risk.

Pegasystems Inc. Grades

The table below presents Pegasystems’ recent grades from well-known grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-10-23 |

| RBC Capital | Maintain | Outperform | 2025-10-23 |

| Barclays | Maintain | Equal Weight | 2025-10-23 |

| Rosenblatt | Maintain | Buy | 2025-10-23 |

| DA Davidson | Upgrade | Buy | 2025-10-22 |

Pegasystems’ grades show a generally positive outlook with multiple buy and outperform recommendations, indicating stronger market confidence.

Which company has the best grades?

Pegasystems has received more favorable grades overall, with several buy and outperform ratings versus DocuSign’s mostly neutral and hold evaluations. This could suggest higher expected growth or lower perceived risk for Pegasystems among analysts.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for DocuSign, Inc. (DOCU) and Pegasystems Inc. (PEGA) based on the latest financial and operational data.

| Criterion | DocuSign, Inc. (DOCU) | Pegasystems Inc. (PEGA) |

|---|---|---|

| Diversification | Primarily subscription-based (~$2.9B in 2025), focused on e-signature and digital agreement solutions | More diversified revenue streams: Pega Cloud ($1.13B), Subscription License ($398M), Consulting ($213M), Maintenance ($341M) |

| Profitability | Strong net margin (35.87%), high ROE (53.32%), neutral ROIC (9.09%) with growing profitability trend | Moderate net margin (6.63%), decent ROE (16.94%), neutral ROIC (7.4%) but improving profitability |

| Innovation | High fixed asset turnover (7.28) indicating efficient asset use; strong growth in ROIC | Very high fixed asset turnover (14.36), indicating excellent operational efficiency and innovation focus |

| Global presence | Large global footprint supported by cloud subscription services | Global presence with strong cloud platform and consulting services worldwide |

| Market Share | Leading position in digital signature market, growing subscription base | Strong position in BPM and CRM software markets with diversified product suite |

Key takeaways: DocuSign excels in profitability and subscription revenue stability but shows limited diversification. Pegasystems offers a more diversified revenue model and operational efficiency, though with lower current profitability. Both companies demonstrate growing profitability trends, signaling improving competitive positions.

Risk Analysis

Below is a comparison table of key risks for DocuSign, Inc. (DOCU) and Pegasystems Inc. (PEGA) based on their latest financial and market data from 2025-2026:

| Metric | DocuSign, Inc. (DOCU) | Pegasystems Inc. (PEGA) |

|---|---|---|

| Market Risk | Beta 0.994 (moderate) | Beta 1.084 (slightly higher) |

| Debt level | Low debt-to-equity 0.06 (favorable) | Moderate debt-to-equity 0.94 (neutral) |

| Regulatory Risk | Moderate, software industry compliance | Moderate, global enterprise software |

| Operational Risk | Moderate, innovation-driven | Moderate, diverse product lines |

| Environmental Risk | Low, limited direct impact | Low, limited direct impact |

| Geopolitical Risk | Moderate, US-centric but global sales | Moderate, global exposure including Europe, Asia |

DocuSign’s low debt and strong interest coverage reduce financial risk, but its lower liquidity ratios warrant caution. Pegasystems carries more debt, elevating financial risk, though it has strong operational efficiency and a very strong Piotroski score. Market volatility is moderate for both, with Pegasystems slightly more sensitive. Overall, financial leverage and market sensitivity are the most impactful risks to monitor.

Which Stock to Choose?

DocuSign, Inc. (DOCU) shows a favorable income evolution with strong growth in net margin and EPS over the 2021-2025 period. Its financial ratios reveal high profitability and low debt levels, supported by a very favorable rating and a slightly favorable moat status reflecting growing ROIC.

Pegasystems Inc. (PEGA) presents a favorable income statement with steady revenue and net margin growth through 2020-2024. Financial ratios are slightly less favorable with moderate debt and valuation concerns, but scores indicate strong financial health and a slightly unfavorable moat due to ROIC below WACC despite growth.

For investors prioritizing growth and profitability, DOCU’s strong income statement growth and favorable financial ratios might appear more attractive, while those valuing financial stability and strong balance sheet metrics could view PEGA as a suitable choice given its solid scores and moderate ratios. The final assessment may depend on the investor’s risk tolerance and strategy focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of DocuSign, Inc. and Pegasystems Inc. to enhance your investment decisions: